- Pros: Potential for large price appreciation.

- Cons: Often higher volatility and less predictable income.

How to Buy Stocks: Complete Beginner’s Guide 2025

Buying stocks has never been more accessible — and in 2025, with modern trading platforms like Pocket Option, you can start with as little as $5, trade 100+ assets 24/7 (including OTC stocks), and even use social trading to learn from pros 📈. This investment guide is designed for stock investing beginners who want to understand how to buy stocks step-by-step and actually apply that knowledge today.

Understanding Stocks and Investment

What is a Stock?

A stock represents a share of ownership in a company. When you buy stocks online, you’re essentially purchasing a slice of that company, entitling you to a portion of profits (dividends) and voting rights (if it’s common stock).

💡 Expert Insight — Bloomberg Markets:

“Over the past century, equities have provided the highest returns of any major asset class, but with corresponding volatility — making diversification and disciplined entry strategies essential.”

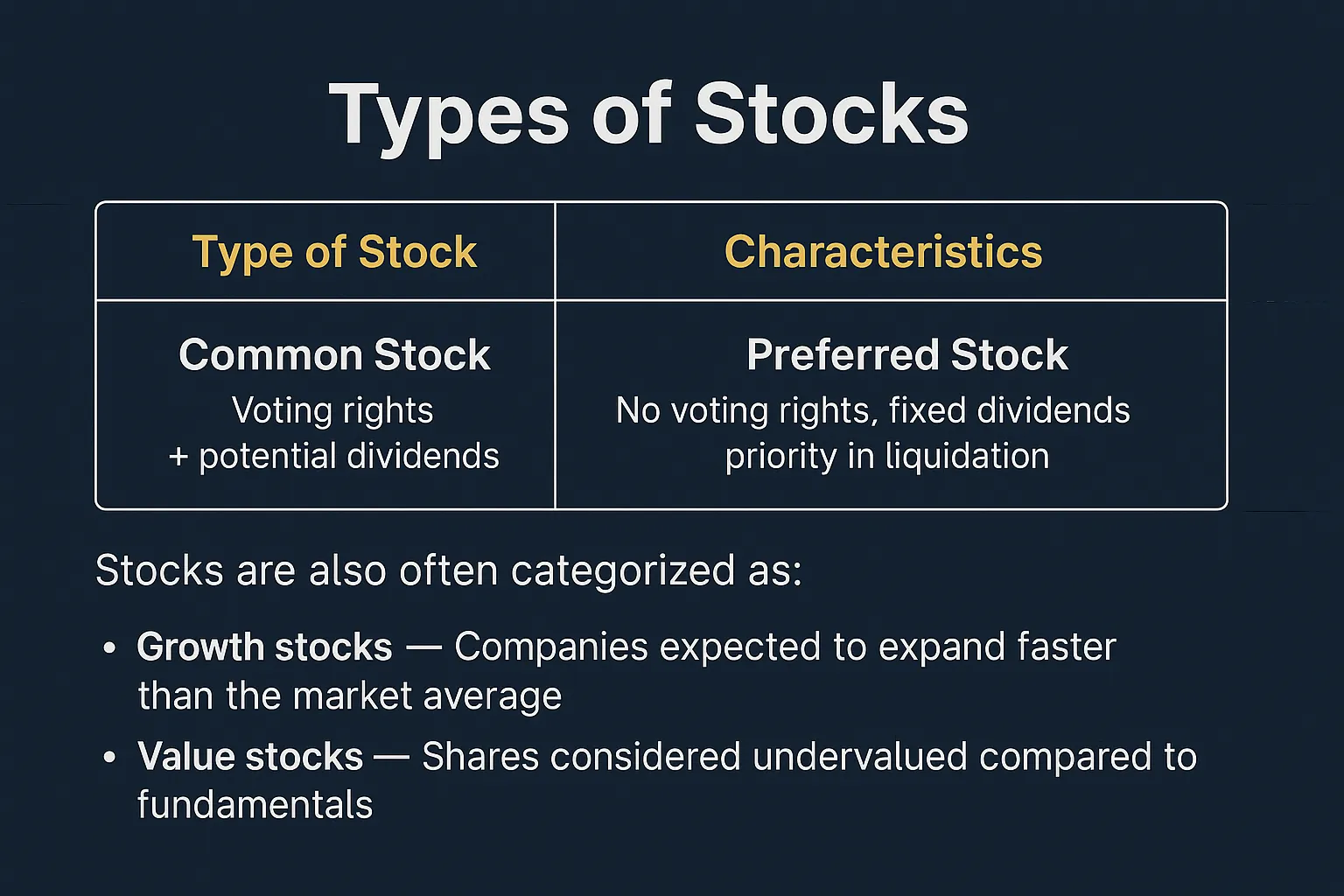

Types of Stocks

| Type of Stock | Characteristics |

|---|---|

| Common Stock | Offers voting rights at shareholder meetings and potential dividends. Often provides higher growth potential but with greater price volatility. |

| Preferred Stock | No voting rights in most cases, but offers fixed dividends and priority over common stock in asset distribution if the company is liquidated. More stable but less potential for capital appreciation. |

Common Stock — Ownership with Growth Potential

When you hold common stock, you’re essentially a part-owner of the company. You can vote on major decisions, such as electing board members or approving mergers.

Pros: Potential for significant capital gains, ability to influence corporate governance, may receive dividends.

Cons: Greater volatility and last in line for payouts in case of bankruptcy.

📌 Example: Buying common stock in Apple gives you both the chance to benefit from its growth and a vote at shareholder meetings.

Preferred Stock — Stability and Predictable Income

Preferred stockholders get paid dividends before common stockholders and have a fixed income stream, making them attractive to conservative investors. However, they generally cannot vote on corporate matters.

Pros: Fixed dividends, priority in payouts during liquidation, lower volatility.

Cons: Limited capital appreciation, usually no voting rights.

📌 Example: A bank may issue preferred shares paying a 5% annual dividend — suitable for income-focused investors seeking stability.

Other Ways Stocks Are Categorized

Beyond ownership type, stocks are also grouped by growth characteristics and valuation:

Growth Stocks — Companies expected to expand faster than the overall market, often reinvesting profits into the business instead of paying high dividends. These tend to be in sectors like technology or biotech.

📊 Morningstar Data: Over the past 20 years, U.S. growth stocks returned an average of 10.6% annually.

Value Stocks — Shares considered undervalued based on fundamentals such as earnings, revenue, or book value. Often found in mature industries.

- Pros: Potential for price rebound + often pay steady dividends.

- Cons: May take longer to realize gains if the market undervaluation persists.

📊 Morningstar Data: Historically, value stocks averaged 8.4% annual returns over 20 years.

💡 Investopedia: “A balanced portfolio often blends growth and value stocks, allowing investors to benefit from different market cycles.”

Benefits of Investing in Stocks

- High Return Potential — Historically, stocks outperform bonds and savings accounts.

- Portfolio Diversification — Exposure to different sectors reduces risk.

- Dividend Income — Regular payouts even in volatile markets.

- Fractional Shares — Start with as little as $1.

📈 CNBC Reports:

“An investor who stayed fully invested in the S&P 500 from 1993 to 2023 saw their money grow over 10×, despite multiple market downturns.”

Getting Started with Stock Investing

Beginning your journey in the stock market can be exciting, but preparation is key to long-term success. Before you make your first trade, you need to lay a solid financial and educational foundation.

Step 1 — Assess Your Financial Readiness

Before you even think about how to buy stocks, you should ensure that investing fits into your overall financial picture.

Build an Emergency Fund

- Keep 3–6 months’ worth of living expenses in a savings account.

- This buffer protects you from selling investments at a loss during emergencies.

Define Your Investment Strategy

- Growth Strategy — Focus on companies expected to expand quickly (e.g., tech startups).

- Income Strategy — Prioritize dividend-paying stocks and steady cash flow.

- Balanced Strategy — Combine growth and income stocks for stability and upside potential.

📌 Example: A young professional with a steady income might choose 70% growth stocks and 30% dividend stocks, while a retiree may flip those ratios for income stability.

Decide Your Risk Tolerance

- Consider your investment horizon (how long you can keep your money invested).

- Use online risk tolerance questionnaires or portfolio simulators to see how you’d react to market drops.

💡 Expert Tip — Kiplinger:

“Your ability to stick with an investment plan during downturns is more important than chasing the highest returns.”

Step 2 — Learn the Stock Market Basics

Understanding fundamental concepts will make you a smarter investor from day one:

- Market Orders — Buy or sell immediately at the current price.

- Limit Orders — Set a specific price at which you want to buy or sell.

- Dividend Yield — Annual dividends per share divided by the share price — shows income potential.

- P/E Ratio (Price-to-Earnings) — Measures a stock’s valuation relative to its earnings.

📌 Example: If a stock has a P/E ratio of 15, it means investors are willing to pay $15 for every $1 of the company’s earnings.

Broker Comparison Table (2025)

| Broker | Minimum Deposit | Key Features | Best For |

|---|---|---|---|

| Pocket Option | $5 | 100+ assets, OTC trading, social trading, AI signals | Beginners & active traders |

| Fidelity | $0 | Extensive research tools, retirement accounts | Long-term investors |

| Charles Schwab | $0 | Commission-free stocks, global ETFs | Value investors |

| Vanguard | $0 | Low-cost index funds, ETFs | Passive investors |

💡 Important Distinction:

Fidelity, Charles Schwab, and Vanguard are traditional, regulated stock brokerages — when you buy shares through them, you become the legal owner of those stocks.

Pocket Option, on the other hand, offers trading via contracts on stock price movements (including OTC markets), allowing you to profit from price changes without actually owning the underlying shares. This approach is often faster and more flexible for short-term strategies but is different from long-term stock ownership.

📌 Expert Insight — Investopedia:

“CFD and derivatives trading platforms give traders access to stock price movements with lower entry requirements, but they don’t confer shareholder rights.”

💡 Expert Tip — Investopedia:

“Choose a broker not only for low fees, but also for platform usability and the quality of educational resources.”

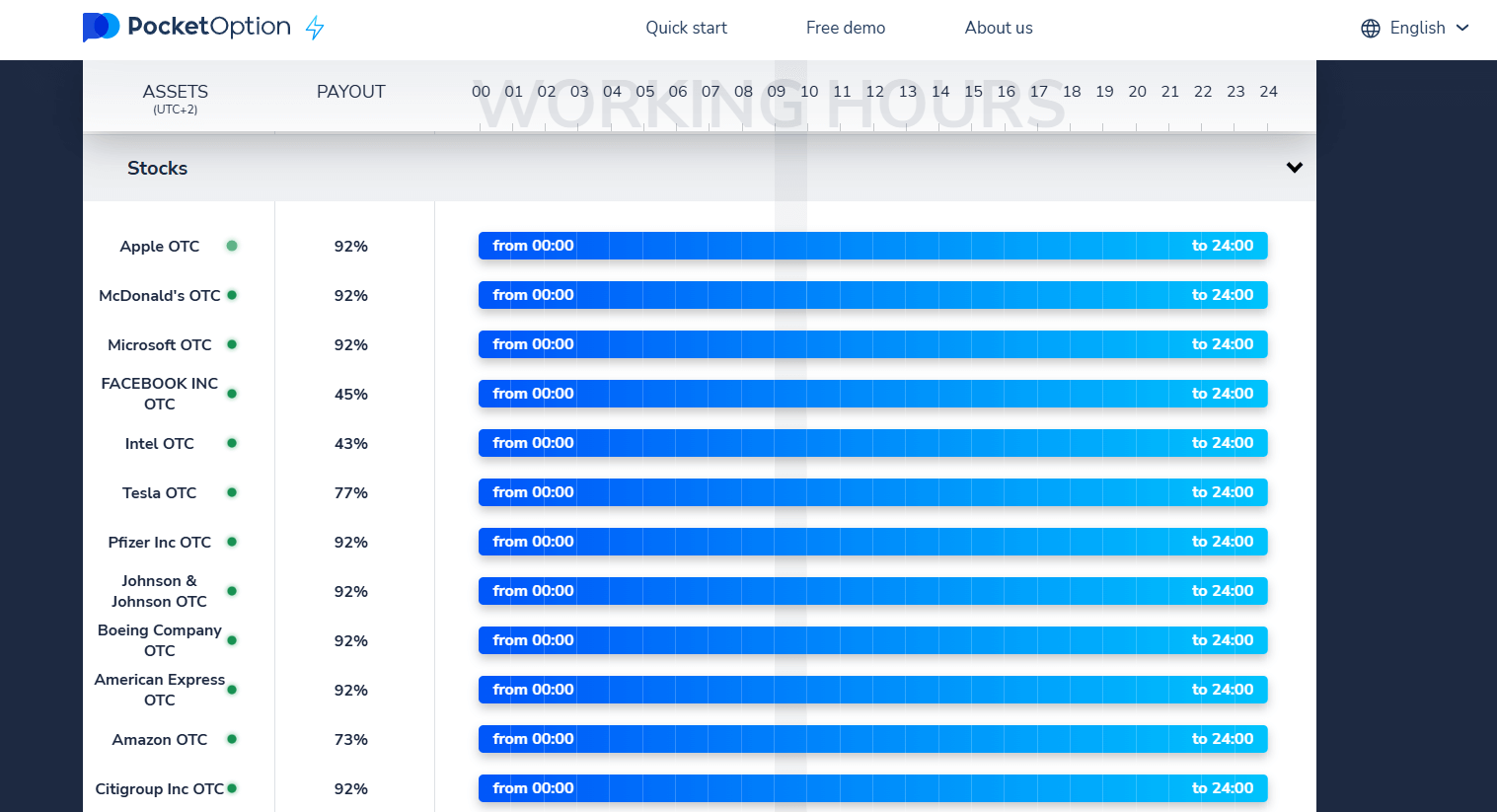

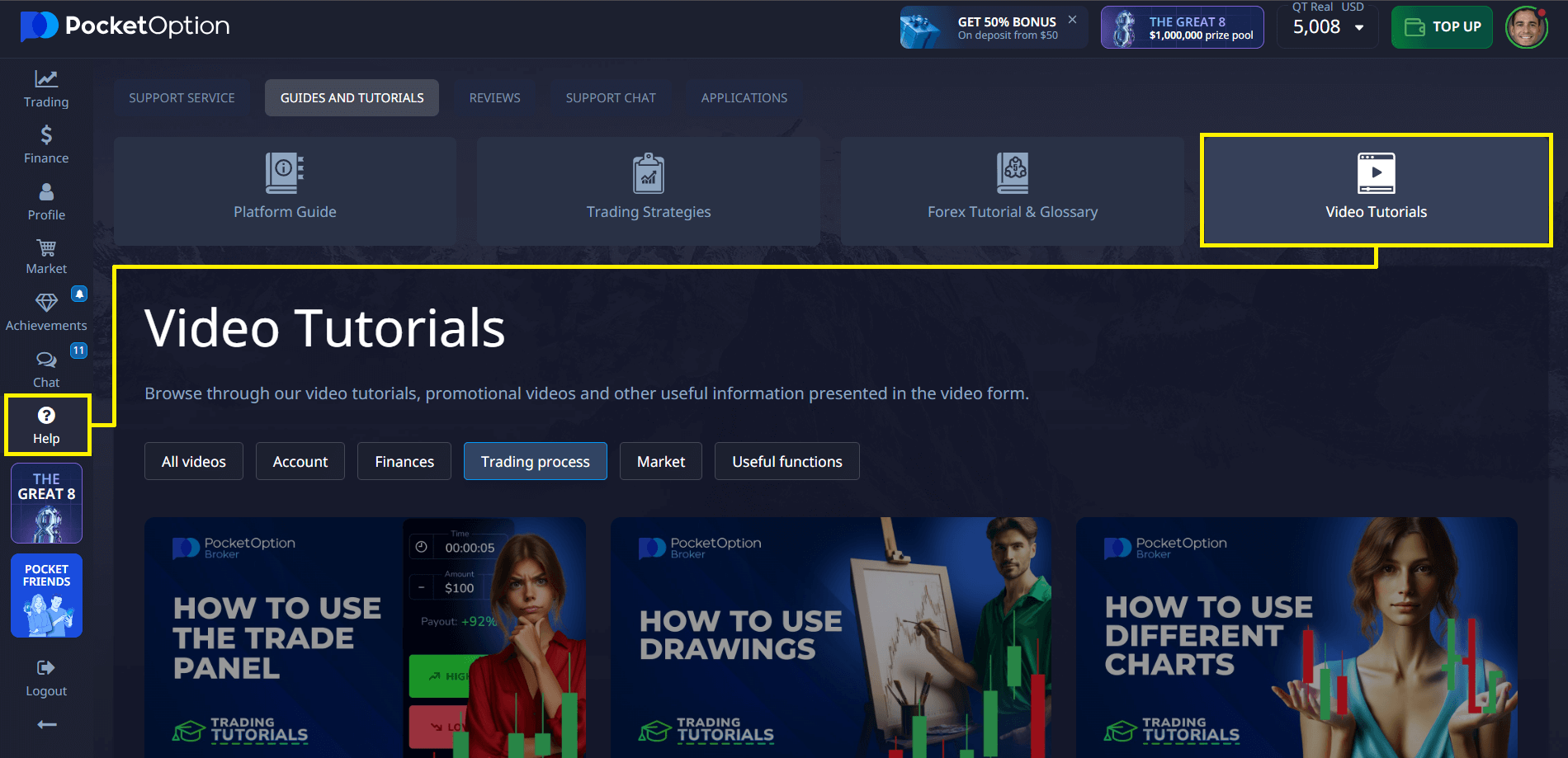

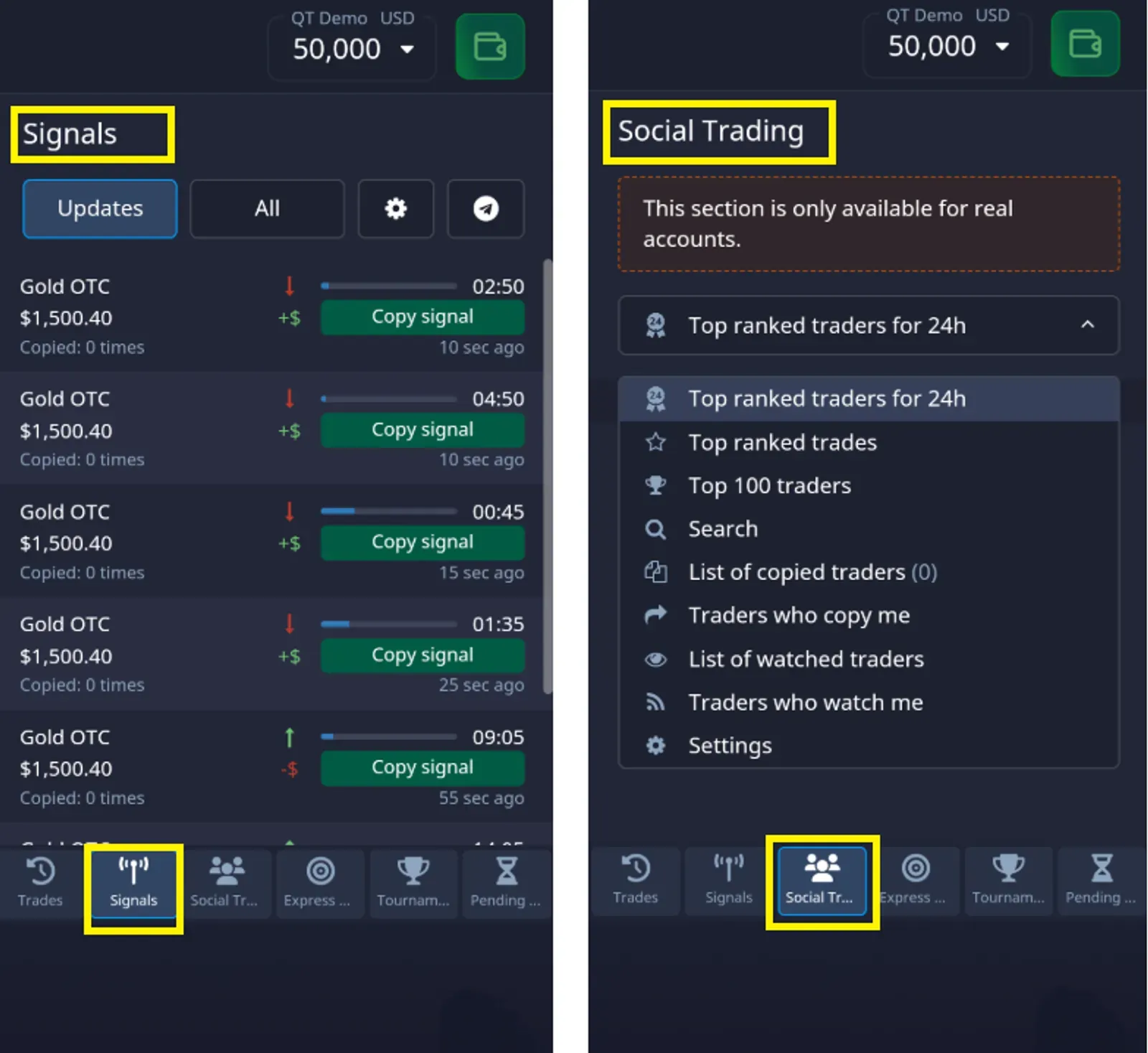

If you’re just starting, Pocket Option offers a fast-track into trading:

- Start with only $5 real account or unlimited demo mode.

- Access 100+ assets, including major U.S. stocks and OTC markets 24/7.

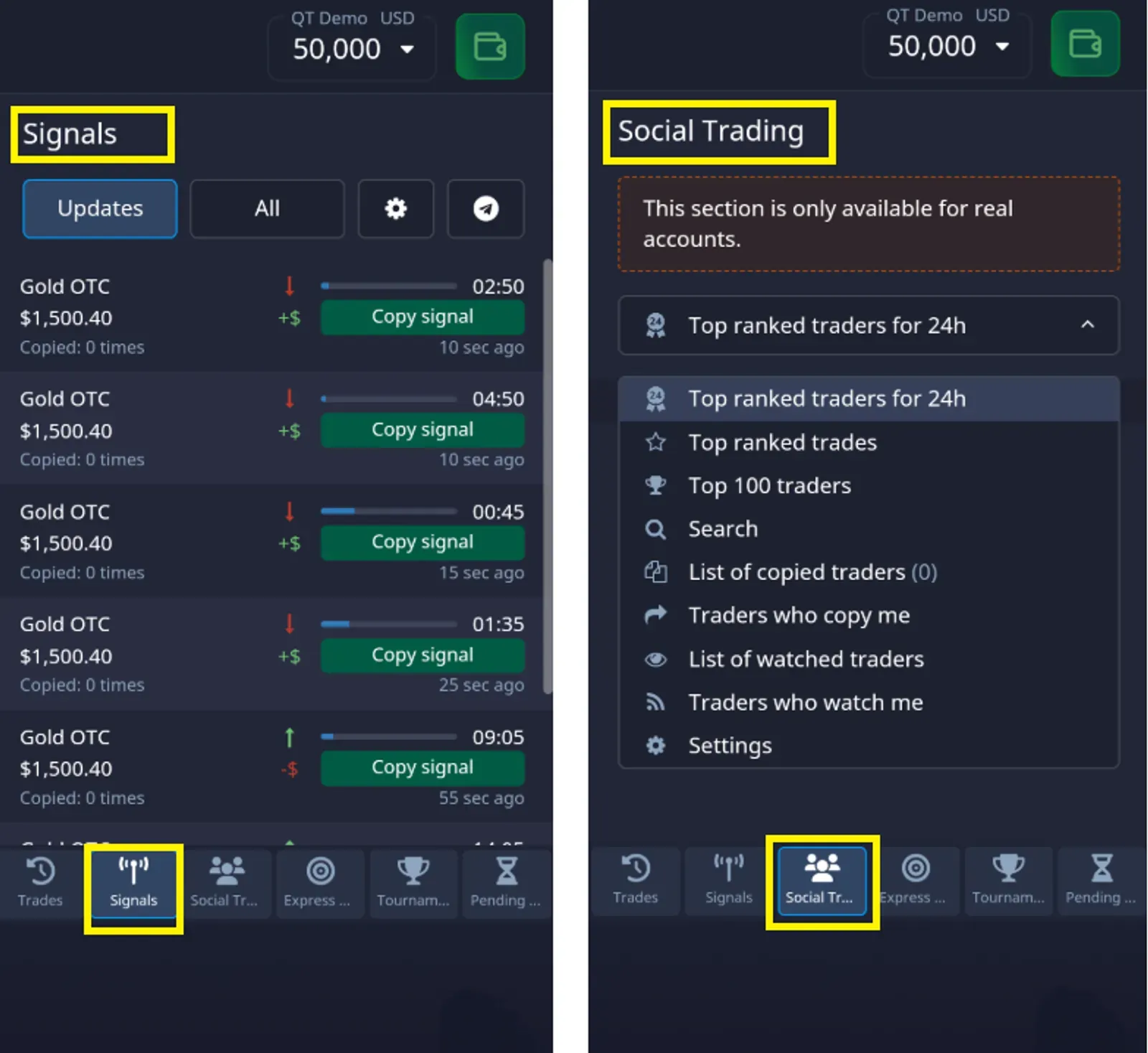

- Use AI Trading, social copy trades, and Telegram signals.

✔️ Open your account with Pocket Option today and trade 100+ assets from just $5

✔️ Example Trade on Pocket Option

✔️ Example Trade on Pocket Option

- Choose an Asset — e.g., Tesla stock.

- Analyze the Chart — Use the built-in Trader Sentiment tool + technical indicators.

- Enter Trade Amount — From $1 upwards.

- Set Trade Time — From 5 seconds (on OTC) to hours.

- Forecast Direction — Tap BUY if you expect the price to rise, SELL if you expect it to drop.

If your prediction is correct, you can earn up to 92% profit — displayed before you place the trade.

📌 Pro Insight — Financial Times: “Short-term OTC trades can offer flexibility for active traders, but should be balanced with longer-term positions for stability.”

Setting Up Your Brokerage Account

Opening a brokerage account is your official entry point into the world of stock investing. While the process is straightforward, paying attention to details will save you from delays and mistakes later on.

Step-by-Step Account Setup

Complete Personal Information

- Provide your name, address, date of birth, and government-issued ID (such as SSN in the U.S. or relevant national ID).

- Brokerages are legally required to verify your identity (KYC process) to comply with anti-money laundering laws.

Assess Your Experience Level

- Many brokers will ask about your investment experience, income range, and financial goals to determine your suitability for certain products.

Link Your Bank Account

- Connect a checking or savings account for deposits and withdrawals.

- Consider using a bank with fast transfer times to avoid delays when funding trades.

Fund Your Account

- Start small to test the platform — for example, $100–$200 to practice executing trades.

- With Pocket Option, you can start a real account from just $5 or use an unlimited demo to practice risk-free.

💡 Expert Tip – NerdWallet: “Fund your brokerage with an amount you can afford to lose initially — treat it as tuition for learning the markets.”

Investment Checklist for Beginners 📝

This checklist ensures you have the essentials covered before making your first trade:

| Step | Task | Why It Matters |

|---|---|---|

| 1 | Build an emergency fund | Protects you from forced selling if unexpected expenses arise |

| 2 | Set investment goals | Clarifies your stock selection and time horizon |

| 3 | Learn order types | Prevents costly execution mistakes |

| 4 | Start with small trades | Lets you gain confidence without significant risk |

| 5 | Diversify holdings | Reduces portfolio volatility and spreads risk |

📌 Example: A beginner starting with $500 might put $200 into a large-cap ETF, $150 into a dividend stock, $100 into a growth stock, and keep $50 as cash for future opportunities.

💡 Pro Insight — Kiplinger: “Even small, well-planned portfolios can compound into significant wealth if you keep costs low and stay invested through market cycles.”

Executing Stock Trades

Placing a trade is more than just clicking “buy” — it’s about choosing the right order type that aligns with your investment strategy and market conditions. The three most common order types are:

Market Orders — Buy instantly at the current price

A market order tells your broker to buy or sell a stock immediately at the best available price. It’s best used when:

- The stock is highly liquid.

- You need instant execution.

- Price movement is minimal.

📌 Example: You want to buy 10 shares of Apple at $175. The market order executes instantly, possibly at $175.02 or $174.98, depending on bid/ask spreads.

💡 Tip — Investopedia: “Market orders are ideal for large-cap, high-volume stocks but can be risky for thinly traded or volatile stocks.”

Limit Orders — Set your own entry price

A limit order executes only if the stock reaches your specified price or better. This helps avoid overpaying but carries the risk of the order not being filled at all.

📌 Example: You place a limit order to buy Microsoft at $325. The trade will only happen if the stock drops to $325 or lower.

Best for:

- Entering at specific technical levels.

- Protecting against sudden price spikes.

Stop Orders — Automate exits to limit loss or lock profit

A stop order triggers a market order once the stock reaches a set price. It’s a risk management tool to protect your capital.

📌 Example: You own Tesla at $250. You set a stop loss at $230 to limit your loss to $20 per share if the market turns against you.

Variants:

- Stop-Loss Order — Protects from large losses.

- Stop-Limit Order — Triggers a limit order instead of a market order when activated.

📊 JP Morgan Research:

“Investors using predefined limit and stop levels tend to outperform discretionary traders by 12% annually on average.”

Understanding Shares of Stock

When you invest in the stock market, you’re buying shares — units of ownership in a company. Understanding the difference between share types helps match investments to your goals.

Common Stock — Voting rights + potential higher returns

- Shareholders vote on corporate matters.

- Potential for capital appreciation and dividends.

- Higher risk compared to preferred stock.

📈 Example: Owning common stock in Amazon means you can attend shareholder meetings and vote on major company decisions.

Preferred Stock — Fixed dividends, less volatility

- No voting rights (usually).

- Priority over common stock for dividend payments and during liquidation.

- Lower price volatility, but less potential for rapid growth.

📌 Example: A bank might issue preferred shares paying a 5% annual dividend, attracting income-focused investors.

💡 Expert Tip — Motley Fool: “Preferred stock acts more like a bond than a stock — it’s a hybrid security offering predictable income but limited upside.”

Portfolio Management & Long-Term Success

Managing your portfolio is not just about picking the right stocks — it’s about balancing risk, maximizing potential returns, and adapting as markets change. A well-managed portfolio can weather downturns and take full advantage of growth opportunities 📊.

Diversification Strategies

Diversification spreads your investments across different assets so no single event can significantly damage your portfolio. This includes:

- By Stock Type — Mix growth, value, and dividend-paying stocks.

- By Sector — Balance between technology, healthcare, finance, consumer goods, energy, and others.

- By Geography — Include domestic and international markets to reduce country-specific risk.

- By Asset Class — Add ETFs, bonds, or REITs for stability and passive income.

📌 Example: A beginner portfolio might hold 40% U.S. large-cap stocks, 20% international stocks, 20% dividend ETFs, 10% bonds, and 10% cash or short-term instruments.

💡 Insight — Morningstar: “Portfolios diversified across multiple sectors and asset classes have historically delivered more stable long-term returns, even during market corrections.”

Role of Dividends

Dividends can be a steady income source and a powerful growth driver if reinvested. Over decades, reinvested dividends can account for up to 40% of total market returns.

| Factor | Importance |

|---|---|

| Dividend Yield | Indicates the income potential from an investment. Higher isn’t always better — very high yields can be a red flag. |

| Payout Ratio | Shows what percentage of earnings is paid as dividends; sustainable payout ratios are typically under 60%. |

📈 Example: Investing $10,000 in a stock with a 4% yield and reinvesting dividends could grow to over $21,900 in 20 years, assuming no capital gains — purely from compounding payouts.

💡 Quote — Warren Buffett: “Never invest in a business you cannot understand.”

Monitoring Your Investments

Regular monitoring ensures your portfolio stays aligned with your goals:

- Frequency — Review monthly for tactical changes, quarterly for performance analysis, annually for full strategy evaluation.

- Rebalancing — If any allocation drifts more than 5% from your target, adjust by buying underweighted assets and trimming overweighted ones.

- Tools — Use broker dashboards, mobile apps, and alerts for price moves, dividend announcements, and earnings reports.

💡 Expert Tip — Vanguard Research: “Investors who rebalance annually tend to achieve better risk-adjusted returns than those who let portfolios drift indefinitely.”

Final Expert Recommendations:

- Start small, learn fast, and avoid emotional decisions.

- Use demo trading to refine strategies before going live.

- Follow market news from reliable sources.

📈 CNBC Pro Analysis: “The most consistent performers are those who invest steadily, reinvest dividends, and avoid the temptation to time the market.”

FAQ

How much money needed start investing?

You can start with as little as $5 on Pocket Option or $50–$100 with many brokers.

What's best broker for beginners?

Choose one with low fees, easy interface, and good education tools — e.g., Pocket Option, Fidelity, or Charles Schwab.

How choose stocks to buy?

Look for companies with strong fundamentals, growth potential, and fair valuation.

When best time buy stocks?

Long-term investors often use dollar-cost averaging instead of timing the market.

How avoid investment mistakes?

Diversify, set a strategy, control emotions, and avoid chasing hype.

What are stock market fees?

Broker commissions, spreads, and sometimes account maintenance or withdrawal fees.

Final thoughts

If you follow this how to buy stocks guide, you’ll not only understand stock market basics but also be able to execute trades with confidence, manage your portfolio effectively, and take advantage of modern platforms like Pocket Option to accelerate your learning and potential returns.

Start trading