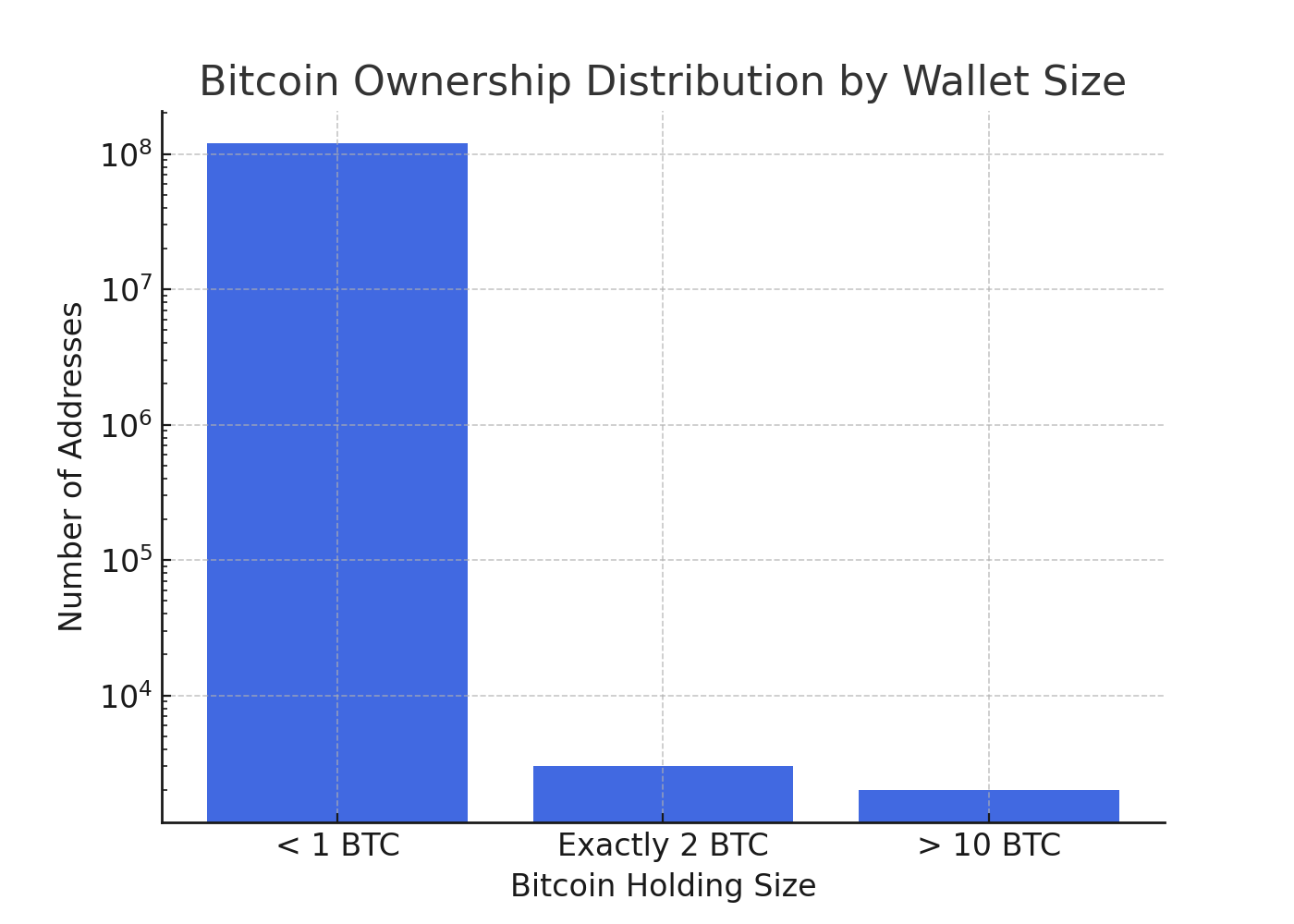

- Majority of wallets hold less than 1 BTC

- About a few thousand addresses own exactly 2 BTC

- Even fewer wallets hold more than 10 BTC

- An elite group of whales holds hundreds or thousands of BTC, greatly influencing market dynamics

How Much Bitcoin Does the Average Person Have?

“How much Bitcoin does the average person have?” This shows the global spread of digital assets and helps you see where you stand in today’s fast-changing crypto market.

Article navigation

- Understanding the Average Bitcoin Holding: Key Metrics in 2025

- Pocket Option: Your Gateway to Crypto Trading 🚀

- How to Open Trading Account: Step-by-Step with Pocket Option

- Expert Insights on Bitcoin Ownership and Wealth Distribution

- Pros and Cons of Bitcoin Ownership

- Trading Strategies Tailored to Ownership Insights

Understanding the Average Bitcoin Holding: Key Metrics in 2025

To properly answer how much Bitcoin does the average person have, we need to look at the key on-chain metrics and wallet distribution data.

| Metric | Value |

|---|---|

| Total Bitcoins in Circulation | Approximately 19 million |

| Estimated Total Bitcoin Holders | Around 150 million |

| Average Bitcoin Holding per Person | Approximately 0.126 BTC |

Despite the average holding of about 0.126 BTC per person, this figure masks significant inequality in ownership. The reality is that Bitcoin ownership is highly concentrated among a small group of large holders — often called “whales” — while most holders own much smaller fractions.

Bitcoin Ownership Distribution: A Deep Dive 📊

How much Bitcoin does average person own? The distribution of Bitcoin across wallets reveals stark contrasts:

| Holding Amount | Approximate Number of Addresses | Ownership Characteristic |

|---|---|---|

| Less than 1 BTC | Majority | Small retail investors, casual users |

| Exactly 2 BTC | Few thousand | Mid-level holders |

| More than 10 BTC | Thousands | Whales and institutional investors |

This uneven distribution explains why the average Bitcoin holding does not fully capture wealth concentration — a critical insight for traders and investors alike.

Bitcoin ownership chart:

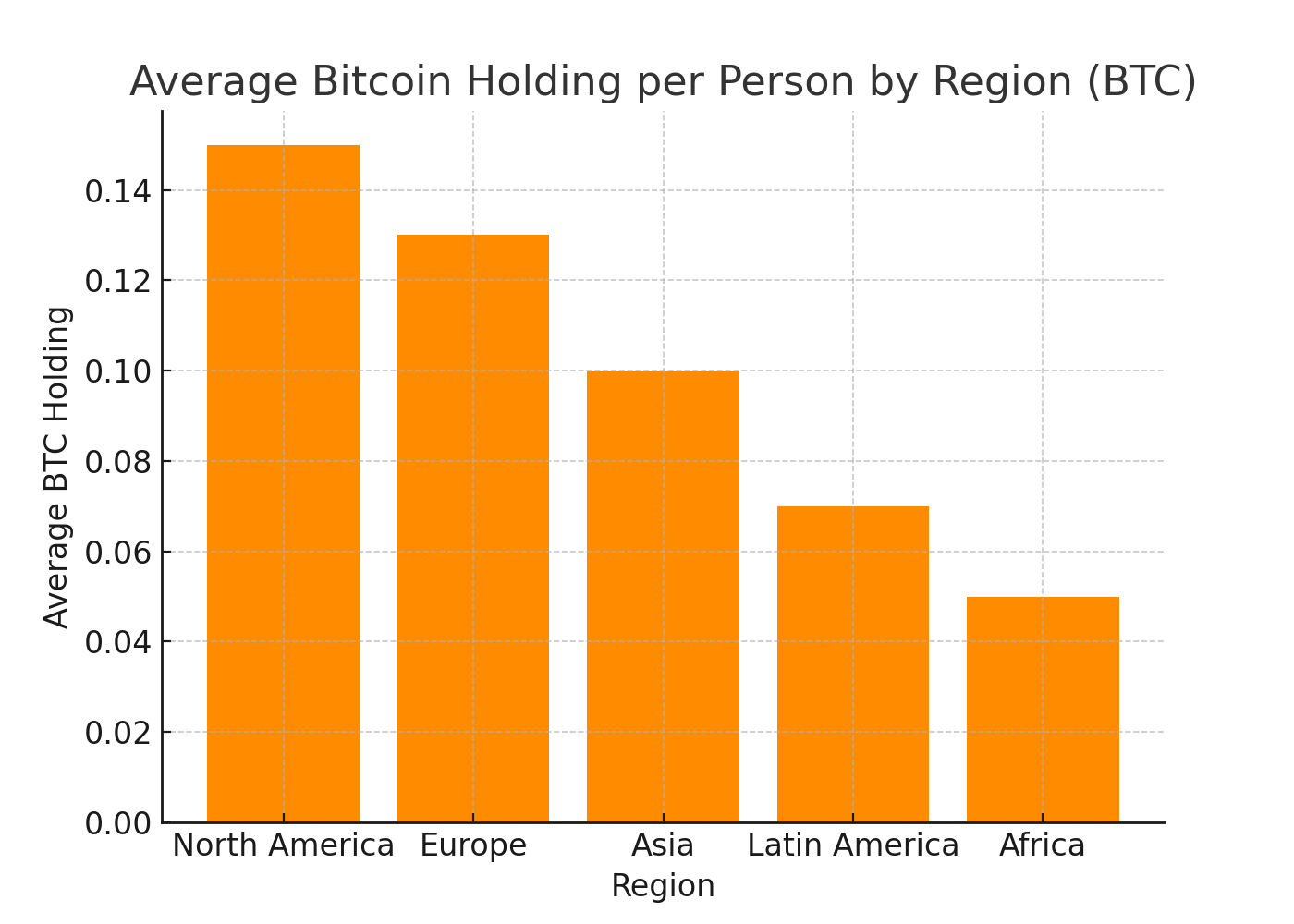

Regional Variations: Where Are the Largest Bitcoin Holders?

Bitcoin adoption varies worldwide. Here are some geographical trends influencing the average Bitcoin holding per person:

- North America and Europe: Highest adoption rates, with average holdings closer to or above global average.

- Asia: Rapidly growing markets, especially in countries like South Korea, Japan, and increasingly India.

- Latin America and Africa: Growing interest but generally lower average holdings due to economic factors.

These regional differences affect market liquidity and trading patterns and should inform your trading strategy.

How Many People Own 2 Bitcoin?

Owning 2 BTC places an individual in an exclusive tier of holders. While precise numbers vary, it is estimated that only a few thousand wallets contain exactly 2 Bitcoins. This milestone signifies a significant investment, as 2 BTC today equate to a substantial dollar value, making these holders important market participants.

Bitcoin vs. Other Cryptocurrencies: Average Holdings Comparison

| Cryptocurrency | Average Holding Per Person | Distribution Characteristic |

|---|---|---|

| Bitcoin | 0.126 BTC | High concentration among whales |

| Ethereum | Higher average | More evenly distributed |

| Litecoin | Lower average | Mostly transactional use |

Bitcoin’s unique status as the original and most valuable cryptocurrency leads to different ownership patterns than altcoins, which are often more distributed due to their use cases and community size.

Implications of Cryptocurrency Ownership Distribution for Traders and Investors

Understanding how much Bitcoin the average person owns is more than trivia — it’s vital for:

- Portfolio management: Assess risk when ownership is concentrated and price volatility is high.

- Market timing: Whale movements can cause sharp price swings.

- Regulatory impact: Policymakers respond differently depending on ownership spread.

- Trading strategies: Tailor your approach based on who controls supply.

Practical Strategies for Diversifying Crypto Holdings

| Strategy | Description |

|---|---|

| Dollar-Cost Averaging | Investing fixed amounts regularly to reduce the impact of price volatility |

| Crypto Index Funds | Diversifying across a basket of cryptocurrencies to spread risk |

| Long-Term Holding | Buying and holding coins for extended periods to ride out market fluctuations |

Each strategy helps balance exposure to the volatile crypto market while accounting for concentrated ownership risks.

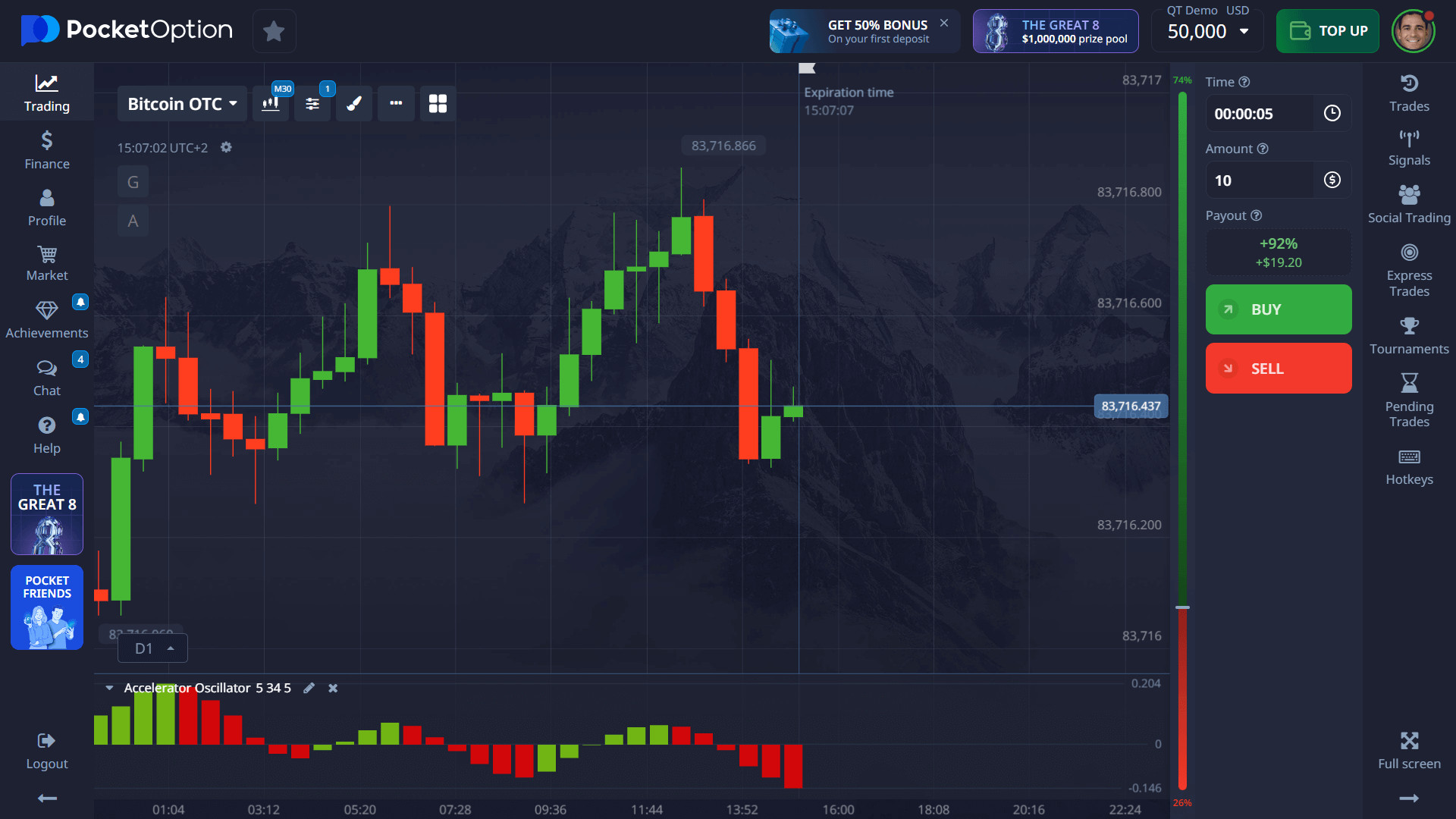

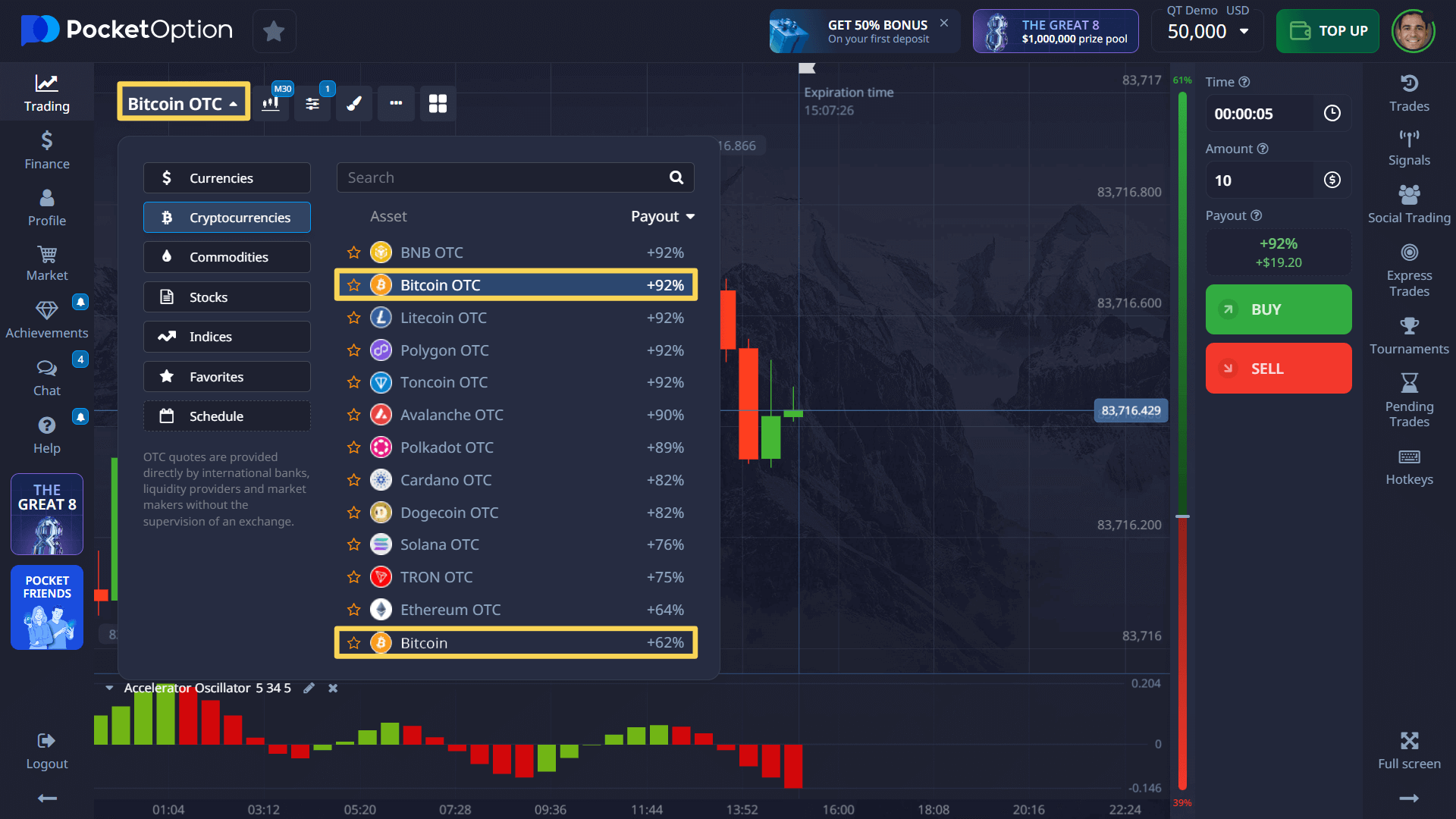

Understanding the distribution of Bitcoin ownership and related market factors helps to formulate successful strategies. The Pocket Option platform provides convenient tools for trading cryptocurrencies and forex, providing flexible conditions for traders with different levels of experience.

Pocket Option: Your Gateway to Crypto Trading 🚀

Trading Bitcoin on Pocket Option has several key advantages:

- Leverage: Amplify potential returns on your trades.

- Flexibility: Choose short-term or long-term trading strategies.

- Mobile Trading: Access the market anytime, anywhere with the Pocket Option app.

- Active Community: Join chats to discuss market trends and ownership insights.

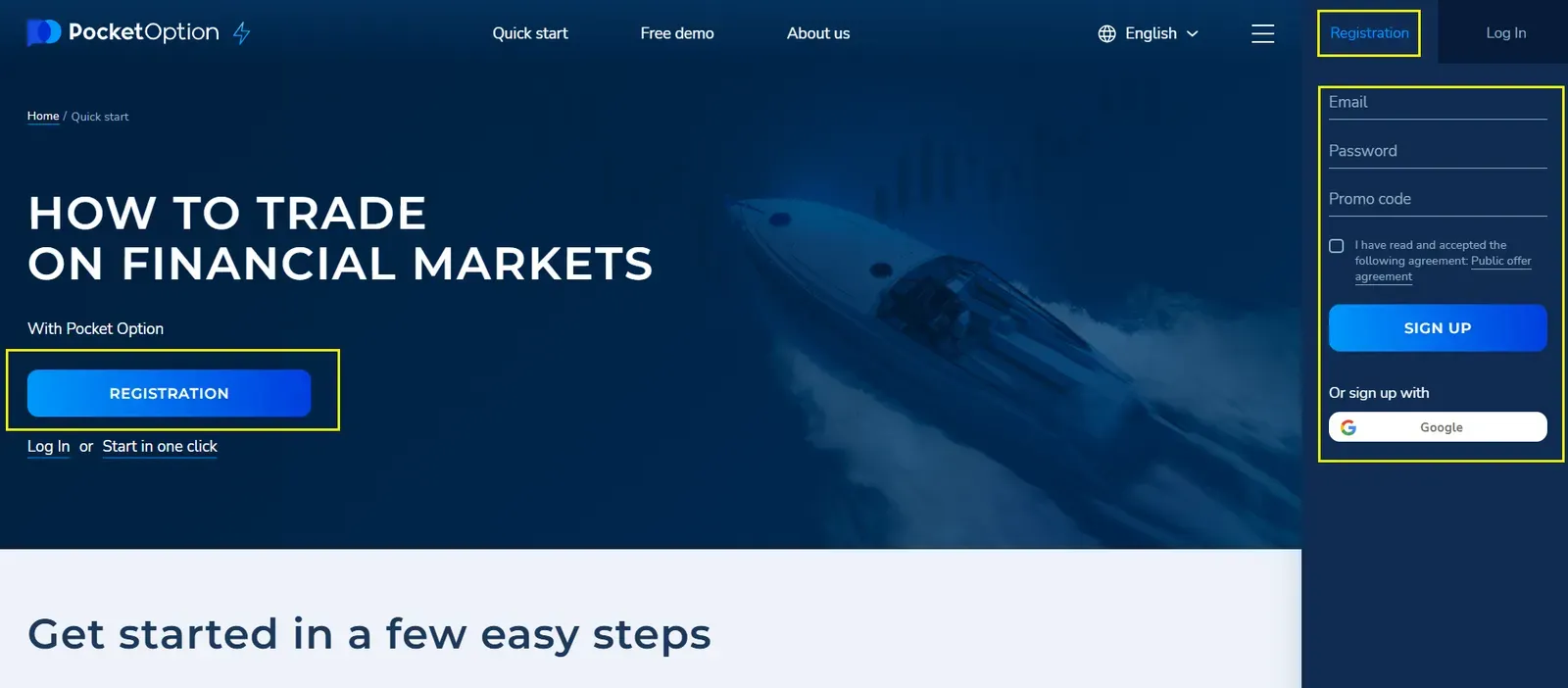

How to Open Trading Account: Step-by-Step with Pocket Option

Pocket Option offers an intuitive platform suitable for all traders, with easy access to BTC trading, forex, and more. Starting to trade or invest without risk is essential for beginners. Here’s how to open a demo account and explore Bitcoin or forex trading on Pocket Option:

- Register on Pocket Option via email or social media.

- Log in and navigate to your account dashboard.

- Select the Demo Account option — you’ll receive $50,000 in virtual funds instantly.

- Use demo mode to explore trading tools, test your strategies, and trade risk-free.

- Once comfortable, open a real account with deposits starting from just $5.

Expert Insights on Bitcoin Ownership and Wealth Distribution

“The early adoption of this pioneering cryptocurrency shaped its wealth distribution, making it both an opportunity and challenge for newcomers. Awareness of ownership patterns helps investors avoid pitfalls and align strategies.” — Dr. Anna Li, Crypto Economist

This highlights the importance of understanding distribution not just for investment but for anticipating market behavior.

Pros and Cons of Bitcoin Ownership

| Pros | Cons |

|---|---|

| Potential for High Returns | High Volatility |

| Decentralization | Security Risks |

| Inflation Hedge | Regulatory Uncertainty |

| Accessibility via Platforms | Unequal Distribution |

Trading Strategies Tailored to Ownership Insights

- Follow Whale Movements: Monitor large wallet transactions to anticipate market shifts.

- Use Leverage Carefully: Because of volatility and concentration risks.

- Diversify: Combine BTC trades with other assets or cryptocurrencies.

- Leverage Pocket Option Features:

- Copy Trading: Follow experienced traders who understand ownership dynamics.

- AI Bots: Automate trades based on market data.

FAQ

What is the average Bitcoin holding per person globally?

As of 2025, the average Bitcoin holding per person stands at around 0.126 BTC. This figure results from dividing the total bitcoins in circulation by the estimated global number of holders. It highlights the relatively modest amount of bitcoin the average individual owns, emphasizing the unequal distribution of this digital asset.

How does geographical location affect Bitcoin ownership?

Geographical location significantly shapes Bitcoin ownership. Regions like North America and Europe boast higher concentrations of bitcoin holders due to superior access to technology and greater disposable income. Conversely, in areas with less developed economic and technological infrastructures, bitcoin adoption rates and average holdings are generally lower.

Why is there an uneven distribution of Bitcoin holdings?

The primary reason for Bitcoin's uneven distribution is the "whale" phenomenon, where a limited number of individuals or entities hold large bitcoin amounts. Early adopters and institutional investors acquired substantial quantities in bitcoin's early years when prices were lower, leading to concentrated wealth. This mirrors traditional financial markets where wealth commonly clusters among a small group.

What strategies can individuals use to increase their Bitcoin holdings?

Individuals aiming to boost their Bitcoin holdings can utilize various strategies. Dollar-cost averaging, which involves regular investment of a fixed amount, helps mitigate volatility impacts. Diversifying via crypto index funds offers exposure to multiple cryptocurrencies, reducing risk. Long-term holding strategies, where bitcoin is retained for extended periods regardless of market fluctuations, can also be effective.

How does Pocket Option facilitate engagement in the Bitcoin market?

Pocket Option enables Bitcoin market engagement by offering a platform for quick trading, allowing users to participate in bitcoin's price movements without directly owning the asset. It provides leverage, enabling traders to maximize potential returns on market positions. This approach is particularly advantageous for individuals keen to explore bitcoin's market dynamics without sizable initial investments.

What is a good amount of Bitcoin to own?

It depends on your risk tolerance, investment goals, and strategy. Many start small and increase holdings via dollar-cost averaging.

How much does the average person have in crypto?

Bitcoin average is about 0.126 BTC per person globally; total crypto holdings vary widely by region and individual.

How much Bitcoin does the average person have in the US?

US holders typically own between 0.1 and 0.5 BTC, with strong institutional ownership influencing the market.

How many people own 10 Bitcoin?

Only a small fraction of holders (whales) own 10 or more BTC. Their trades significantly impact market trends.

How does Bitcoin ownership affect price volatility?

High concentration among whales can lead to large price swings when they move coins.

What percentage of Bitcoins is lost forever?

Estimates suggest about 3-4 million BTC are lost, reducing circulating supply and impacting price.

CONCLUSION

Knowing how much Bitcoin the average person has is essential for both casual investors and professional traders. It reveals market structure, risk factors, and trading opportunities. Platforms like Pocket Option lower entry barriers by providing easy access to BTC trading with demo accounts and flexible real accounts starting at $5, making it ideal for traders of all levels. Start your crypto journey informed — analyze ownership patterns, apply strategic trading, and use reliable platforms to maximize your potential.

Start trading