- Financial education: Before investing, understand basic concepts such as liquidity, volatility, and diversification.

- Choosing a broker: A common mistake among beginners is selecting the first broker they find on Google without evaluating crucial aspects, such as hidden fees, available analysis tools, Portuguese support, or access to the US market.

- Company analysis: Evaluate indicators such as P/E (Price/Earnings), dividend yield, and company debt.

- Diversification: How does successful stock investment work? Distribute your resources among different sectors to reduce risks.

- Monitoring: Regularly monitor the performance of the company and the market with analytical tools.

How stock investing works

Understanding how investing in stocks in the Brazilian market works can transform your financial situation and create opportunities for wealth growth. This comprehensive article will explain the process, present practical strategies and show you how to start your investment journey with confidence and knowledge.

Article navigation

The basics: how stock investing works

Investing in stocks means acquiring a small part (fraction) of companies traded on the stock exchange. By buying stocks, you effectively become one of the owners of the company, being entitled to a portion of the distributed profits (dividends) and benefiting from the appreciation of the stock price.

How does stock investment work in practice?

When a company grows, increases its revenue, or expands its operations, the value of its shares tends to rise, generating capital gains for investors. Additionally, profitable companies generally distribute part of their profits in the form of dividends, offering passive income to shareholders.

How does stock investment work for beginners?

For those who are starting, the process can be simplified into practical steps:

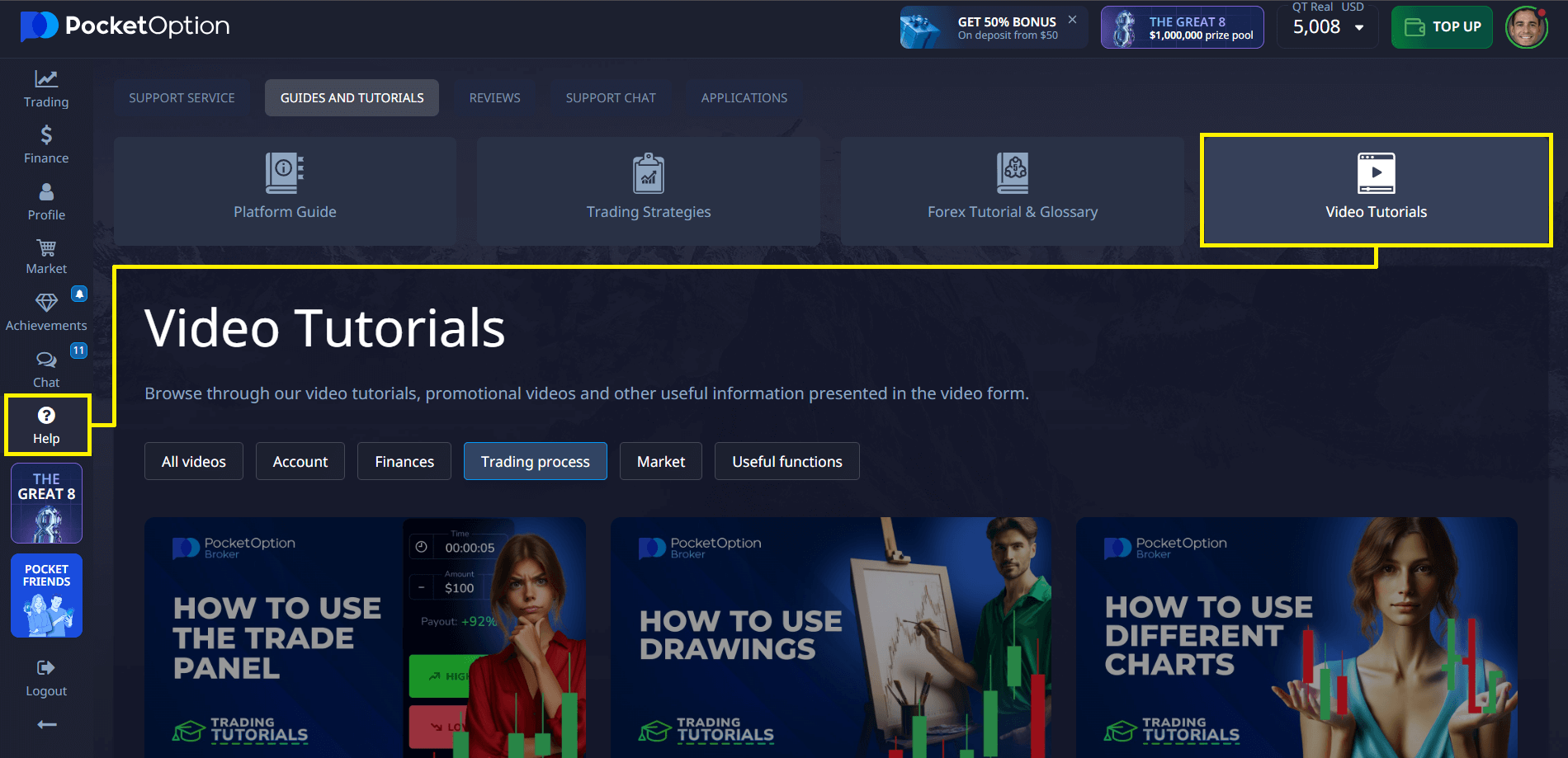

Pocket Option provides comprehensive tools and a free training section to help you prepare for trading stocks. All materials will be available right after registration!

Real examples of how buying stocks works

Imagine that you invested R$5,000 in stocks of companies in the financial sector in 2020. With the post-pandemic market recovery, this investment could have generated a return of approximately 30% by 2022, resulting in R$6,500. However, if you had invested in the technology sector, the return could have exceeded 45% in the same period.

The importance of understanding risks

How does stock investment work in relation to risks? The stock market presents volatility, and there may be periods of significant decline. Factors such as economic crises, regulatory changes, and specific company problems can negatively impact the value of stocks.

What to consider before starting to invest?

Before starting your investments in stocks, establish:

- Clear and measurable financial goals

- Time horizon (short, medium, or long term)

- Risk profile and tolerance to volatility

- Percentage of assets to be allocated to stocks

- Strategy for diversification between sectors and regions

How to trade stocks on Pocket Option?

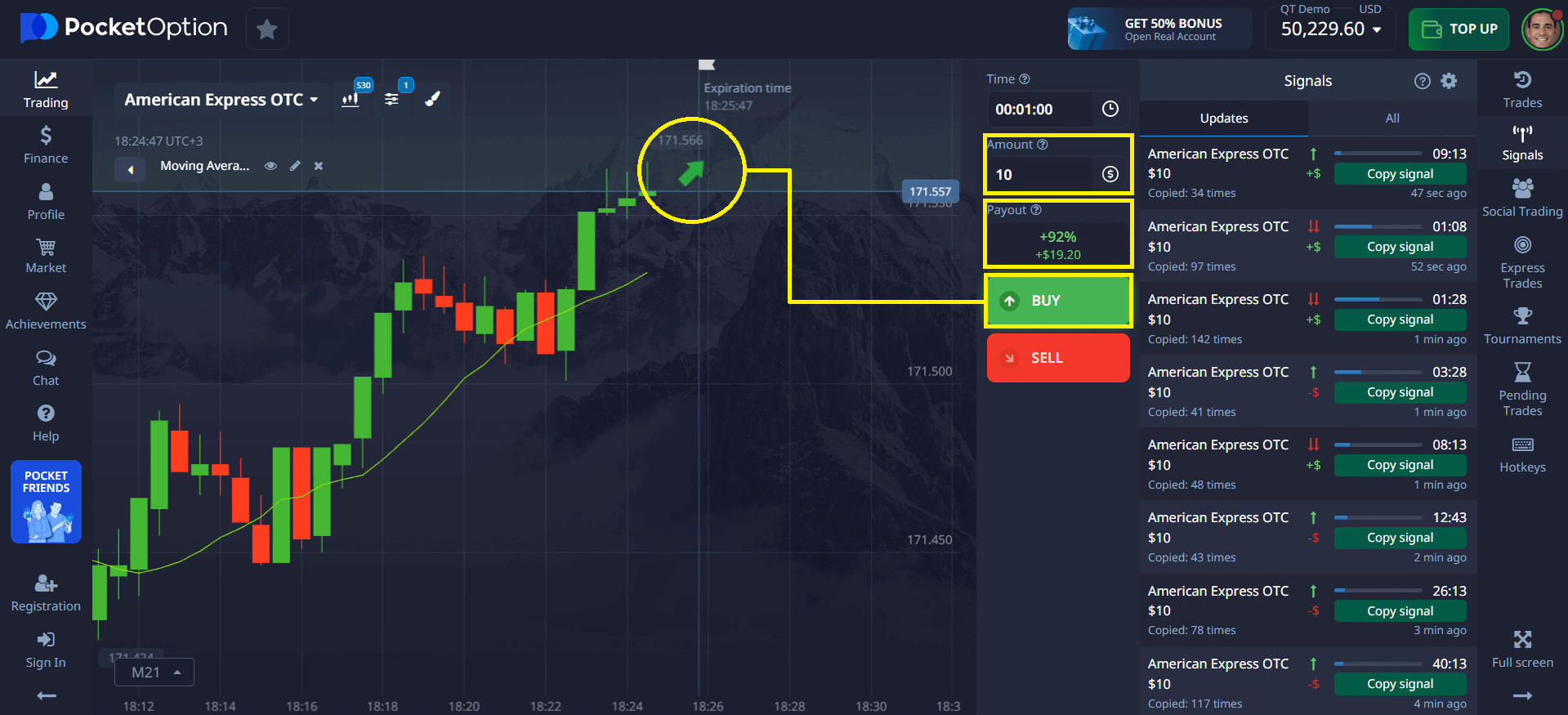

Through quick trades, the Pocket Option platform simplifies the stock investment process in five steps:

1. Sign up: 100% digital process that takes less than 10 minutes.

2. Deposit funds: 50+ payment options with instant processing.

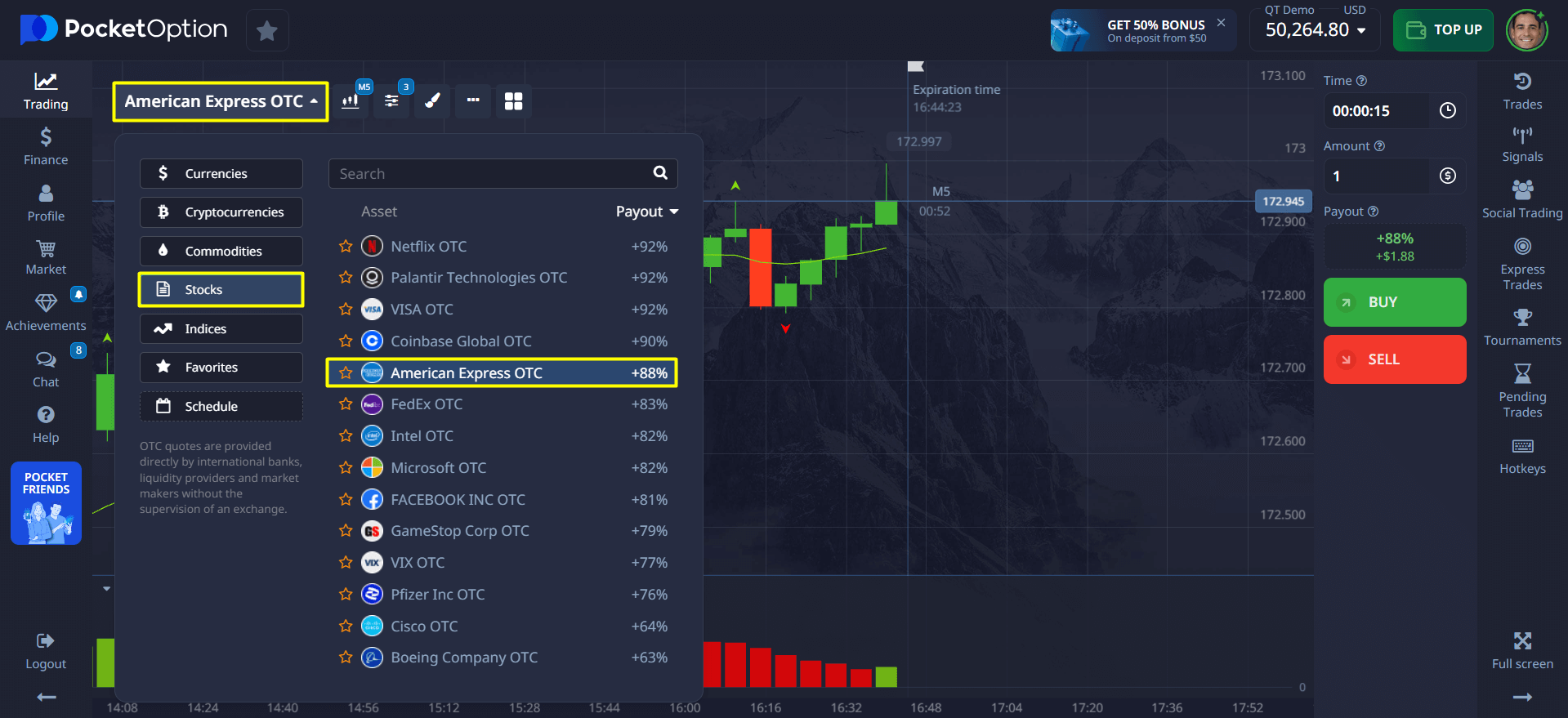

3. Select stocks: Intuitive interface with more than 100 assets from different sectors and countries, 30+ stocks of global companies.

4. Make a forecast: if the price will go up or down, choose the forecast time.

5. Wait for the forecast expiration time: if your forecast is correct, get up to 92% profit!

Quick trading will allow you to trade even with small capital, starting from $5 (the exact minimum deposit amount depends on the payment method).

Conclusion

Understanding how stock investing works is the first step to building solid wealth in the long term. With Pocket Option, you have access to all the necessary tools to start this journey safely and efficiently. The platform combines advanced technology with ease of use, making the stock market accessible to both beginners and experienced investors.

FAQ

How does stock investing work for beginners?

For beginners, the process consists of opening an account on Pocket Option, studying market fundamentals through available educational resources, starting with small amounts in well-established companies, and gradually expanding their knowledge and portfolio. Pocket Option offers simulators that allow you to practice without risking real capital.

What are the risks of investing in stocks?

The main risks include market volatility, company-specific risk, liquidity, and systematic risk (economic crises).

How does stock investment work in the short and long term?

Taxation on stocks in Brazil works as follows: capital gains on stock sales are taxed at 15% when the total value of monthly sales exceeds R$20,000. Day trading operations are taxed at 20% regardless of the amount. Dividends are exempt from income tax, which represents a significant advantage. Taxes must be collected by the investor through a DARF form by the last business day of the month following the calculation.

What are the benefits of using Pocket Option to invest in stocks?

Pocket Option stands out for its simplified interface, competitive commissions (starting at 0.1%), free educational tools, 24/7 support in Portuguese, and fast execution technology. Additionally, the platform offers bonuses for new investors and loyalty programs that can reduce operational costs by up to 30%.

Is it possible to live off stock dividends in Brazil?

Yes, it is possible to live off dividends in Brazil, but this requires a considerable amount of assets invested in shares with a good distribution history. The Brazilian advantage is the tax exemption on dividends, which makes this strategy attractive. For a monthly income of R$5,000, for example, considering an average dividend yield of 5% per year, you would need a portfolio of approximately R$1.2 million. Companies in the utilities, banking and some consumer sectors have a tradition of paying consistent dividends in the Brazilian market.