- Portfolio Analysis: Comprehensive assessment of your current holdings, risk tolerance, and investment objectives

- Strategy Development: Creation of customized trading strategies aligned with your financial goals

- Risk Management: Implementation of sophisticated risk control measures to protect capital

- Performance Reporting: Regular detailed reports on portfolio performance and market activities

- Market Monitoring: Continuous surveillance of market conditions and adjustment of strategies accordingly

Trading Account Management Services: Optimizing Your Trading Performance

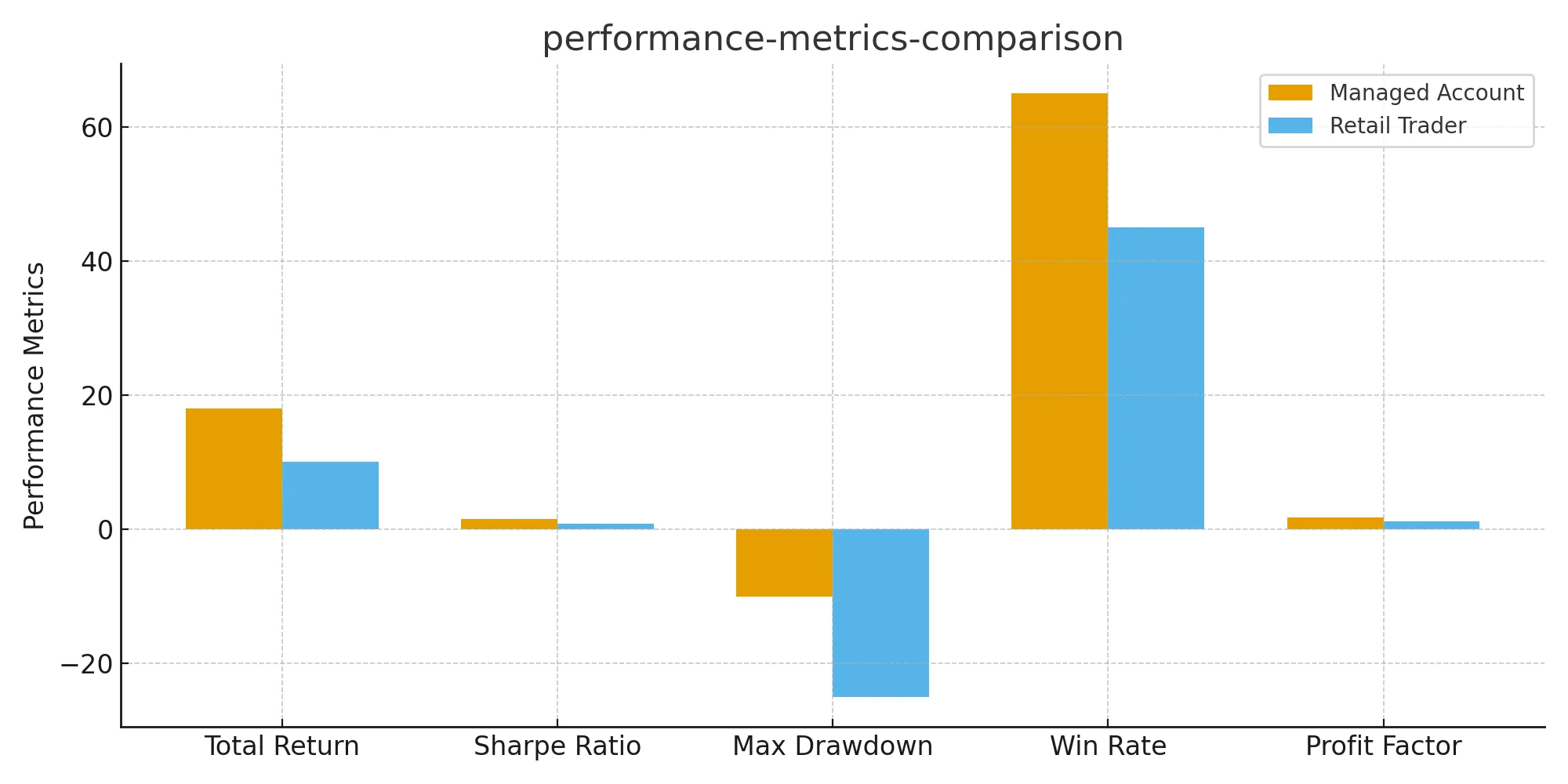

Recent data shows that 78% of retail traders lose money, while professionally managed accounts demonstrate significantly higher success rates through systematic risk management and disciplined strategy execution.

Article navigation

- Trading Account Management Services: Your Gateway to Professional Investment Success

- Understanding Trading Account Management Services

- Types of Trading Account Management Models

- Key Benefits of Professional Trading Account Management

- Selecting the Right Trading Account Manager

- Empower Your Trading Journey with Pocket Option

- Risk Management in Professional Account Management

- Performance Measurement and Reporting

Trading Account Management Services: Your Gateway to Professional Investment Success

The financial markets present both tremendous opportunities and significant risks. For many investors, navigating these waters successfully requires expertise, time, and emotional discipline that can be challenging to maintain consistently. This is where trading account management services come into play, offering professional solutions that can transform your investment approach.

Trading account management services represent a comprehensive approach to portfolio oversight, where experienced professionals handle the day-to-day operations of your trading account. These services combine market expertise, risk management protocols, and systematic strategies to help optimize your investment performance while potentially reducing the stress and time commitment required for active trading.

Understanding Trading Account Management Services

Trading account management services encompass a range of professional solutions designed to handle various aspects of your investment portfolio. At their core, these services involve delegating trading decisions and portfolio management to qualified professionals who possess the expertise, tools, and time necessary to navigate complex financial markets effectively.

“The key advantage of professional account management lies in removing emotional decision-making from trading. Most retail traders fail because they let fear and greed drive their decisions, while professional managers stick to proven strategies regardless of market sentiment.” – Sarah Chen, Portfolio Manager at Global Trading Solutions (2025)

These services typically include several key components that work together to create a comprehensive management approach:

🚀 Ready to see what professional-grade tools feel like? Pocket Option puts the power of advanced trading right at your fingertips! 💻

Types of Trading Account Management Models

The world of account management offers several distinct models, each designed to meet different investor needs and preferences. Understanding these options is crucial for selecting the approach that best aligns with your investment goals.

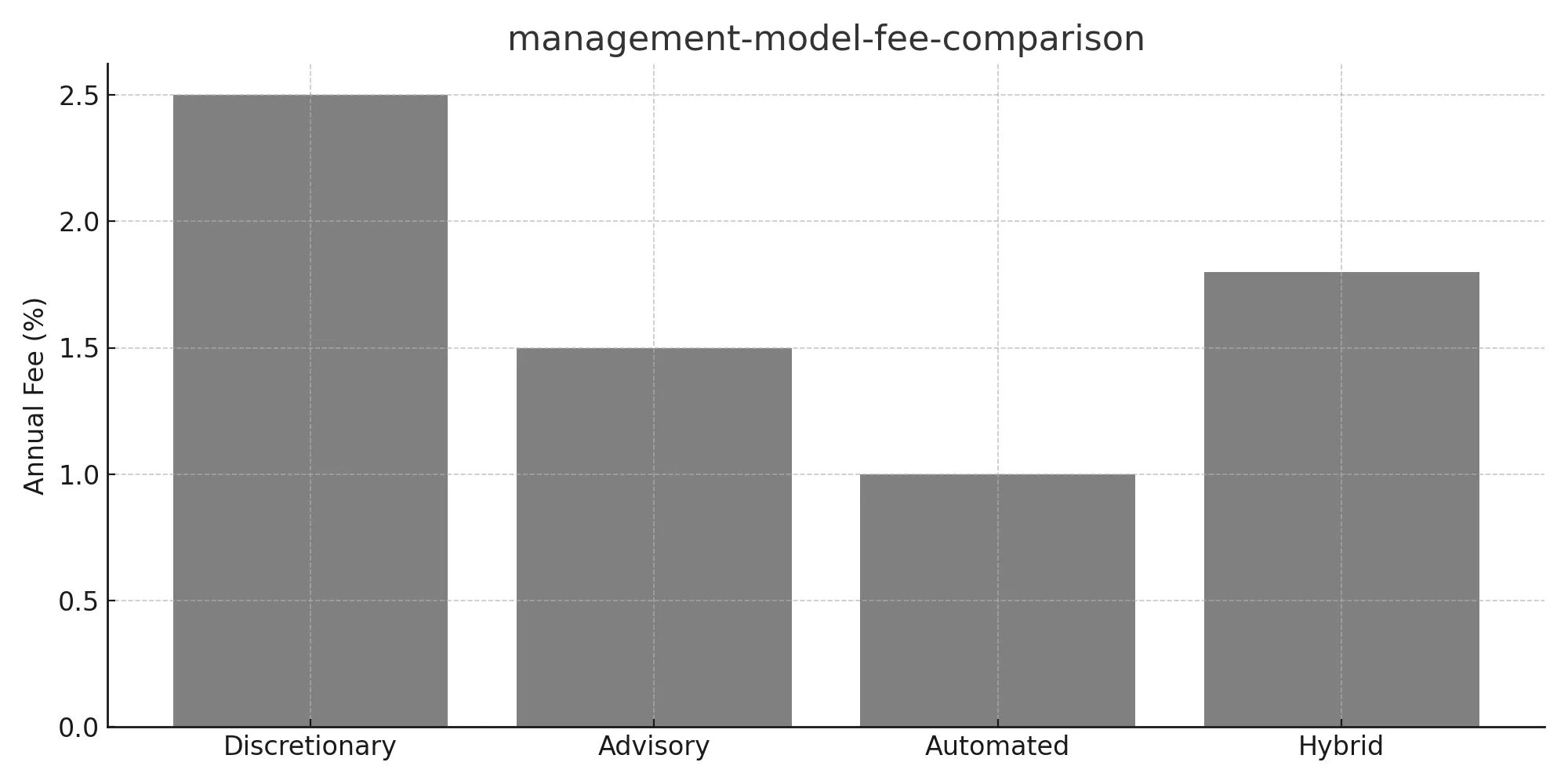

| Management Type | Control Level | Best For | Typical Fee Structure |

|---|---|---|---|

| Discretionary | Full Manager Control | Busy professionals, hands-off investors | 2-3% annual + performance fees |

| Advisory | Client Final Decision | Active learners, partial involvement | 1-2% annual fee |

| Automated | Algorithm-Based | Tech-savvy, systematic approach | 0.5-1.5% annual fee |

| Hybrid | Combined Approach | Flexible, customized needs | Variable based on services |

Discretionary Management

In discretionary management, you grant full trading authority to your account manager. This model provides the highest level of professional oversight, as managers can execute trades immediately based on market conditions without waiting for your approval. This approach is particularly valuable in fast-moving markets where timing is critical.

For example, Pocket Option’s Quick Trading platform facilitates rapid execution that discretionary managers leverage to capitalize on market opportunities that might be missed with delayed decision-making processes.

Advisory Management

Advisory services provide professional guidance while keeping the final decision-making authority with you. Managers analyze markets, identify opportunities, and make recommendations, but all trades require your explicit approval before execution.

“Advisory management strikes an excellent balance for investors who want professional insights but prefer to maintain control over their trading decisions. It’s educational and empowering.” – Michael Rodriguez, Senior Trading Consultant (2025)

Automated Management Solutions

Automated trading management utilizes sophisticated algorithms and artificial intelligence to manage portfolios. These systems can process vast amounts of market data, identify patterns, and execute trades based on predetermined criteria, often with minimal human intervention.

- Algorithm Development: Custom trading algorithms based on proven strategies

- Backtesting: Historical validation of strategy performance

- Risk Parameters: Automated risk controls and position sizing

- Performance Optimization: Continuous refinement of trading parameters

💡 With Pocket Option, you’re not just trading; you’re building a smarter investment future with an intuitive and powerful platform. 🤝

Key Benefits of Professional Trading Account Management

The advantages of professional account management extend far beyond simple trade execution. These services offer a comprehensive approach to wealth building that addresses many of the challenges individual traders face.

| Benefit Category | Specific Advantages | Impact on Performance |

|---|---|---|

| Expertise Access | Professional market knowledge, advanced strategies | Higher probability of profitable trades |

| Time Efficiency | No need for constant market monitoring | Consistent strategy execution |

| Emotional Control | Removes fear and greed from decisions | Better adherence to trading plans |

| Risk Management | Professional risk assessment and control | Reduced drawdowns, capital preservation |

| Diversification | Access to multiple markets and strategies | Improved risk-adjusted returns |

“Professional management isn’t just about making more money–it’s about making money more consistently and with better risk control. The compound effect of avoiding major losses often outweighs the benefits of hitting occasional home runs.” – Dr. Jennifer Walsh, Quantitative Finance Researcher (2025)

Selecting the Right Trading Account Manager

Choosing an appropriate account manager is one of the most critical decisions you’ll make in your investment journey. The selection process requires careful evaluation of multiple factors to ensure alignment with your goals and risk tolerance.

When evaluating potential managers, consider these essential criteria:

- Track Record: Verified performance history across different market conditions

- Risk Management Approach: Clear protocols for capital preservation and drawdown control

- Strategy Transparency: Detailed explanation of trading methodologies and decision-making processes

- Communication Standards: Regular reporting and accessibility for client questions

- Regulatory Compliance: Proper licensing and adherence to financial regulations

- Fee Structure: Transparent and reasonable compensation arrangements

In practice, traders often apply these evaluation criteria when exploring managed account options on platforms like Pocket Option, where the integration of professional management services with user-friendly trading interfaces creates an optimal environment for both novice and experienced investors.

Empower Your Trading Journey with Pocket Option

While managed accounts offer a hands-off approach, many modern traders prefer to take control of their financial destiny. Pocket Option is designed to empower you with the tools, knowledge, and flexibility to become your own successful portfolio manager. Here’s how the platform sets you up for success:

- Start Small, Dream Big: You can begin your trading journey with a minimum deposit of just $5, making the financial markets accessible to everyone. (Note: minimum deposit may vary based on your region and payment method).

- Practice Makes Perfect: Before risking real capital, you can master your strategies on a free demo account loaded with a virtual $50,000. It’s the perfect sandbox to test your skills.

- A World of Opportunity: Diversify your portfolio with access to over 100 trading assets, including currencies, commodities, stocks, and cryptocurrencies.

- Knowledge is Power: Kickstart your career with Pocket Option’s free, extensive knowledge base. Dive into ready-made strategies, watch educational video tutorials, and learn the ins and outs of Forex trading.

- Compete and Win: Sharpen your skills and earn rewards by participating in exciting trading tournaments against other traders on the platform.

With Pocket Option, you get more than just a platform; you get a complete ecosystem designed to support your growth from a beginner to a confident trader.

📈 Unlock your full potential! The diverse asset range and powerful educational tools on Pocket Option mean you never have to miss a market opportunity. 🌍

Risk Management in Professional Account Management

Risk management forms the foundation of successful trading account management services. Professional managers employ sophisticated risk control measures that go far beyond basic stop-loss orders, implementing comprehensive frameworks designed to protect capital under various market scenarios.

Effective risk management in account management typically involves:

- Position Sizing: Calculating appropriate trade sizes based on account equity and risk tolerance

- Diversification Strategies: Spreading risk across multiple assets, timeframes, and strategies

- Drawdown Controls: Implementing maximum loss thresholds and recovery protocols

- Market Correlation Analysis: Understanding how different positions interact during market stress

- Scenario Planning: Preparing for various market conditions and having contingency plans

“Risk management isn’t about avoiding risk entirely–it’s about taking calculated risks with predetermined exit strategies. The goal is to stay in the game long enough for successful strategies to compound returns.” – Amanda Foster, Risk Management Specialist (2025)

Performance Measurement and Reporting

Comprehensive performance reporting distinguishes professional trading account management services from casual trading approaches. These reports provide transparency, accountability, and valuable insights into portfolio performance that help both managers and clients make informed decisions about strategy adjustments.

Professional performance reports typically include detailed analysis of multiple metrics that paint a complete picture of account performance beyond simple profit and loss figures.

| Performance Metric | Description | Importance |

|---|---|---|

| Total Return | Overall portfolio performance over specified period | Primary measure of success |

| Sharpe Ratio | Risk-adjusted return measurement | Evaluates efficiency of risk-taking |

| Maximum Drawdown | Largest peak-to-trough decline | Assesses capital preservation |

| Win Rate | Percentage of profitable trades | Strategy consistency indicator |

| Profit Factor | Ratio of gross profits to gross losses | Overall strategy effectiveness |

Whether you choose a managed service or decide to steer your own ship with the powerful tools available on Pocket Option, understanding these metrics is key to long-term success.

FAQ

How much should I expect to pay for professional trading account management?

Management fees typically range from 1-3% annually, plus potential performance fees of 10-20% of profits. Automated solutions may cost 0.5-1.5% annually. The fee structure should align with the level of service and expected returns.

Is my money safe with a trading account management service?

Reputable services use segregated accounts, meaning your funds remain separate from the management company's assets. However, trading risk remains, and you should verify regulatory oversight and insurance coverage before selecting a manager.

What's the minimum account size for professional management?

This varies significantly by provider, ranging from $1,000 for basic automated services to $100,000+ for high-end discretionary management. Many platforms now offer tiered services to accommodate different account sizes.

How do I monitor my managed account's performance?

Professional services provide regular reports (monthly or quarterly) with detailed performance metrics, trade summaries, and strategy updates. Many also offer online portals for real-time account monitoring.

Can I withdraw my money anytime from a managed account?

Most managed accounts allow withdrawals, though there may be notice periods (typically 30-90 days) to avoid disrupting trading strategies. Emergency withdrawal provisions should be clearly outlined in your agreement.

What happens if my account manager underperforms?

You typically have the right to terminate the management agreement, though specific procedures vary. Some services include performance guarantees or reduced fees during underperformance periods.

Should I choose discretionary or advisory management?

Discretionary management suits busy investors who prefer hands-off approaches, while advisory services work better for those wanting to learn while receiving professional guidance. Consider your time availability and involvement preferences.

How do managed accounts differ from mutual funds or ETFs?

Managed accounts offer personalized strategies, direct ownership of assets, and customizable risk parameters, while mutual funds pool investor money into standardized strategies. Managed accounts typically provide more control and transparency.

CONCLUSION

The landscape of trading account management continues to evolve rapidly, driven by technological advances, regulatory changes, and shifting investor preferences. Artificial intelligence and machine learning are increasingly being integrated into management strategies, while blockchain technology promises to enhance transparency and reduce costs. For example, modern Quick Trading platforms are incorporating advanced analytics and automation tools that enable more sophisticated management approaches while maintaining the accessibility that individual investors require. "The future belongs to hybrid management models that combine human expertise with technological efficiency. We're seeing the emergence of AI-assisted managers who can process information faster while maintaining the strategic thinking that only human experience can provide." - Dr. Thomas Liu, Financial Technology Analyst (2025) Trading account management services represent a powerful tool for investors seeking to optimize their market participation while managing risk and time commitments effectively. Whether through discretionary management, advisory services, or automated solutions, these professional services can significantly enhance your investment outcomes when properly selected and implemented. The key to success lies in thoroughly researching potential managers, understanding their strategies and risk management approaches, and selecting services that align with your financial goals and risk tolerance. As markets continue to evolve and become more complex, professional account management services are likely to become increasingly valuable for investors at all levels. Remember that while professional management can significantly improve your chances of success, no strategy guarantees profits, and all trading involves risk. The goal is to work with qualified professionals who can help you navigate these risks more effectively than you might manage on your own.

Start Your Managed Account Journey