- Explore over 100 assets including forex, stocks, cryptocurrencies, and commodities. This wide variety allows traders to diversify their learning and find the asset classes that best fit their strategies and trading styles.

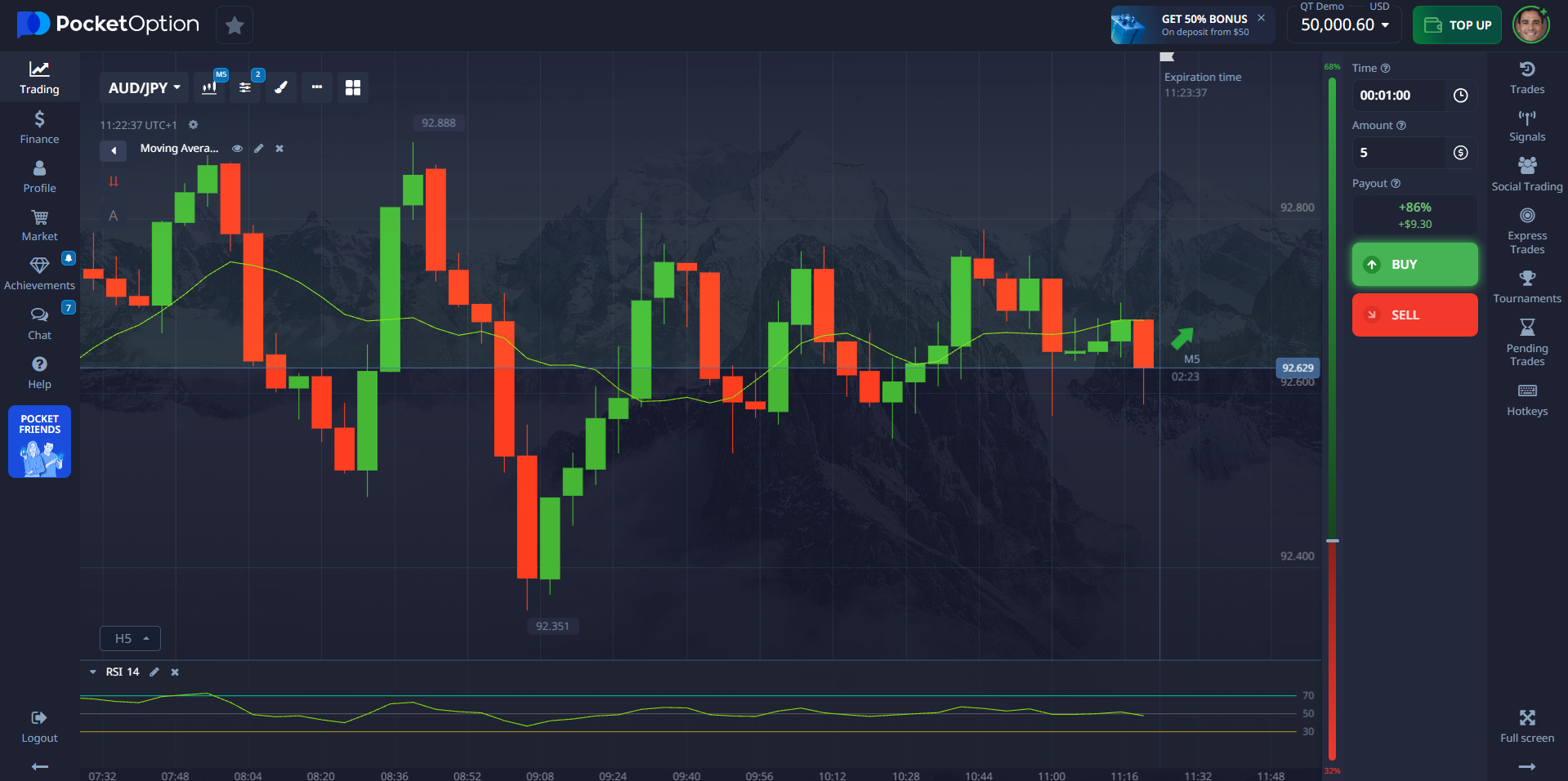

- Use real-time charts with technical indicators such as RSI, MACD, and moving averages. These tools help traders analyze price movements effectively and make informed decisions during strategy testing.

- Practice trade execution, timing, and risk management without financial pressure. This eliminates the fear factor that often plagues new traders and encourages thoughtful, consistent actions.

- Build emotional control and trading discipline essential for long-term success. By repeating trades on demo accounts, traders familiarize themselves with market fluctuations and learn to manage emotions like fear and greed.

Boost Your Trading Success: How to Test Trading Strategies on Pocket Option Demo

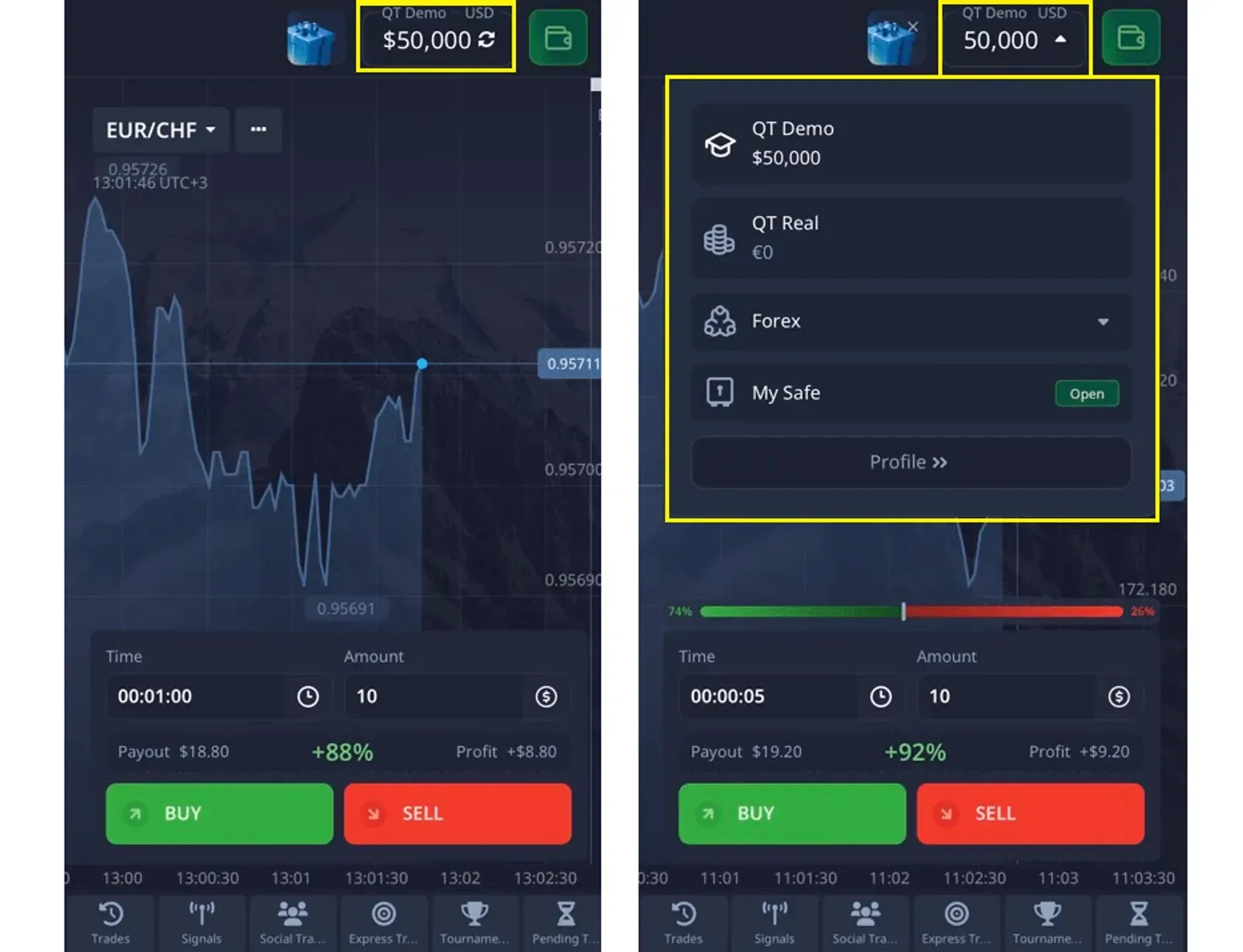

Testing trading on Pocket Option trading allows you to build real trading skills without risking your money. With a $50,000 demo balance, you can practice different strategies and gain confidence before entering live markets. This risk-free environment closely mimics real trading, helping you prepare for success.

Article navigation

Why Testing Trading on Pocket Option Trading Is Crucial

Jumping directly into live trading without thorough preparation often leads to losses due to untested strategies and emotional decision-making. Testing trading on Pocket Option trading offers a risk-free environment that simulates real market conditions closely, enabling traders to:

Linda Bradford, Senior Trading Analyst at MarketPulse, states, “Demo trading is the laboratory of financial markets — without it, you’re essentially flying blind.” Her insight underlines the fundamental importance of testing trading on Pocket Option trading before risking real capital.

Pocket Option Help Center: Tutorials and Strategy Education

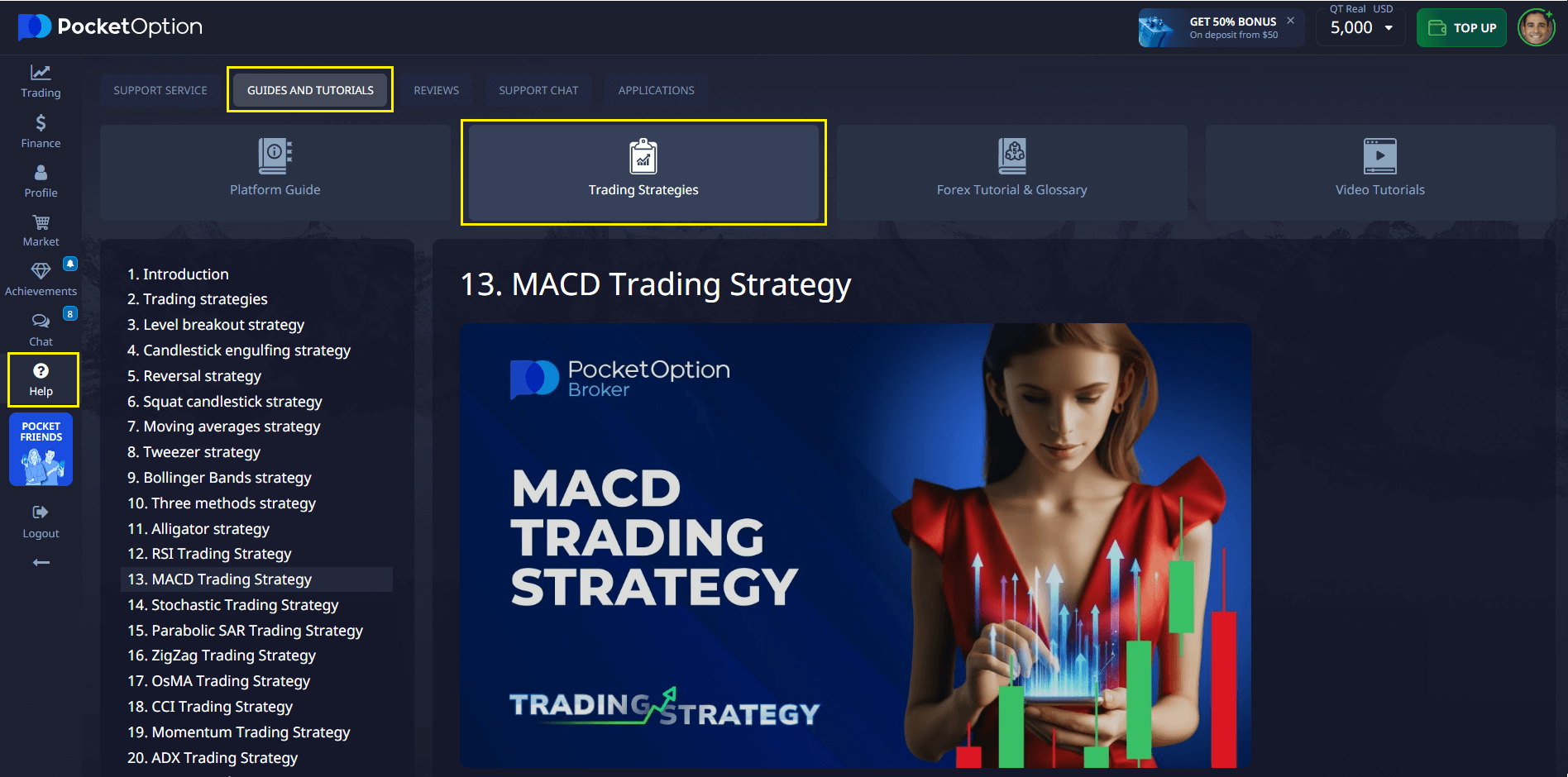

An often overlooked but incredibly valuable resource on Pocket Option is its comprehensive Help Center, which includes detailed tutorials, video lessons, and step-by-step instructions covering various trading strategies and platform functionalities.

Whether you are a beginner or looking to polish your approach, these materials offer:

| Educational Section | Description |

|---|---|

| Basic Education on How Financial Markets Operate | Explains concepts like candlestick charts, trend analysis, and common technical indicators. |

| Strategy-Specific Tutorials | Covers popular methods such as trend following, breakout trading, and counter-trend strategies. |

| Practical Demonstrations and Walkthroughs | Shows exactly how to set up charts, apply indicators, and execute trades on Pocket Option. |

What makes this section so powerful is the ability to learn and practice simultaneously: after watching or reading a tutorial, you can immediately test the strategy on your demo account. This hands-on approach accelerates learning and cements understanding, enabling faster mastery of effective trading.

The integration of education with risk-free practice ensures that traders do not just learn theory but also develop practical skills crucial for live trading success.

Five Steps to Apply a Trade Strategy for Test on Pocket Option

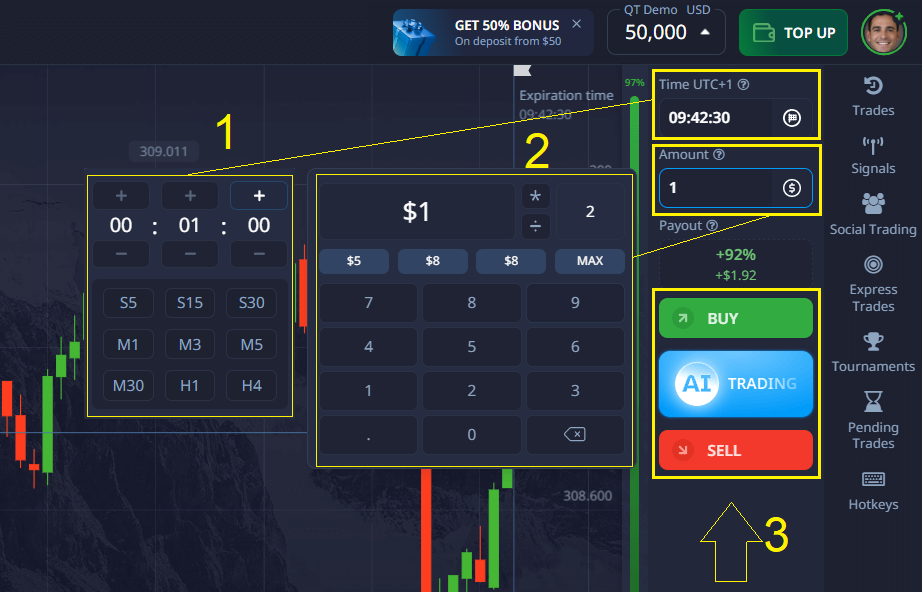

- Choose a Simple Strategy

Start with easy-to-understand strategies like Moving Averages crossover or RSI to identify trends and reversals. Use Pocket Option’s tutorials to learn basics. - Set Up Indicators

Configure the necessary indicators in Pocket Option’s platform, adjusting settings based on asset and timeframe. - Test on Multiple Assets and Timeframes

Apply your strategy on different markets (forex, crypto, stocks) and timeframes (1-minute, 15-minute, daily) to evaluate performance. - Keep a Trading Journal

Record your trades with entry, exit, and outcomes to track performance and mistakes. - Review and Optimize

Analyze your journal regularly to adjust settings and improve your strategy.

Sophia Nguyen, Founder of SmartTrader Academy, emphasizes, “Consistent demo testing with disciplined journaling increases profitability by up to 30%, as traders learn to avoid common mistakes and adjust strategies dynamically.”

Common Mistakes to Avoid During Testing Trading on Pocket Option Trading

- Treating the demo account as a game — It’s easy to become casual when no money is at stake, but treating demo trading seriously is essential to developing transferable skills.

- Ignoring stop-loss and risk controls — Practice setting realistic stop-loss levels and managing position sizes, even on demo, to build good habits for live trading.

- Delaying the transition to live trading — Spending too long on demo can lead to overconfidence or complacency. Know when your strategy and skills are ready for real markets.

- Overtrading or chasing unrealistic profits — Focus on quality trades based on your strategy, rather than high-frequency or emotionally driven trades.

By avoiding these pitfalls, your demo experience will better prepare you for the challenges of live trading.

The Psychological Edge: How Demo Testing Builds Emotional Control

Many traders underestimate how much emotions influence decision-making in live trading. The pressure of risking real money can lead to impulsive actions, panic selling, or greed-driven overtrading.

👉 Testing trading on Pocket Option trading offers a safe space to confront these emotional challenges without financial damage. Repeated exposure to market volatility on demo builds mental toughness and confidence.

James O’Connell, author of Trading Psychology Essentials, explains, “Effective strategy testing differentiates successful traders from amateurs. Using risk-free environments to practice sharpens decision-making and improves risk management skills.”

This psychological preparation is often the difference between consistent profitability and repeated losses.

Pocket Option Demo Account vs Live Account: What You Need to Know

| Feature | Demo Account | Live Account |

|---|---|---|

| Funds | $50,000 virtual, unlimited refill | Real money, minimum deposit $5 |

| Market Conditions | Simulated real-time prices | Actual market prices |

| Emotional Impact | Low, due to virtual funds | High, real financial risk |

| Feature Access | Most features except social trading and tournaments | Full platform features |

The demo account closely mimics live trading, except for social trading and tournament participation, ensuring you get realistic practice.

When Should You Transition From Demo to Live Trading?

Consider moving to live trading on Pocket Option once you:

- ✅ Achieve consistent profitability across multiple demo sessions spanning different market conditions.

- ✅ Demonstrate emotional control during demo trades, avoiding impulsive decisions and sticking to your plan.

- ✅ Develop and implement a tested risk management approach that protects capital and limits losses.

Pocket Option enables a seamless switch from demo to live with a single click, starting from as little as a $5 deposit. This ease of transition supports gradual confidence building.

Final Thoughts

Testing trading on Pocket Option trading using the demo account is a vital process that equips you with practical skills, emotional resilience, and strategy confidence. By following the steps outlined here, leveraging Pocket Option’s educational resources, and learning from expert insights, you will be better prepared to navigate live markets and improve your trading outcomes.

FAQ

How can I start testing trading on Pocket Option trading?

Register on Pocket Option to get immediate access to a demo account with $50,000 virtual funds, allowing you to practice trade strategies risk-free.

What is the difference between testing trading on Pocket Option demo and live trading?

Demo trading uses virtual funds and simulates real-time prices, while live trading involves actual money and real market conditions.

How do I apply a trade strategy for test on Pocket Option effectively?

Choose a strategy, set up technical indicators, test it across different assets and timeframes on the demo, keep a trading journal, and analyze results.

Can I test multiple trade strategies on Pocket Option trading simultaneously?

What is the minimum deposit required to move from demo to live on Pocket Option trading?

What is the minimum deposit required to move from demo to live on Pocket Option trading?

You can start live trading with a minimum deposit of $5 after completing your testing on the demo account.