- Accessibility: Eliminates the 3-5 year learning curve typically needed to develop trading expertise

- Time efficiency: Reduces trading management time by up to 85% for active investors

- Emotion management: Studies show 72% of mirror traders stick to strategies during market volatility versus 31% of manual traders

- Diversification: Easily follow multiple uncorrelated strategies simultaneously

- Transparency: Access complete performance metrics before committing capital

Mirror trading: Unleashing the Power of Following Top Traders

Mirror trading allows investors to automatically replicate strategies of market-leading traders. With over 3 million users worldwide adopting this approach, mirror trading effectively bridges the expertise gap, giving newcomers immediate access to proven techniques while offering experienced traders a time-efficient way to diversify their portfolios.

Article navigation

What Is Mirror Trading and How Does It Work?

Mirror trading automatically copies the positions of successful traders into your account. This revolutionary approach emerged in the early 2000s in forex markets but has expanded across all major asset classes. When your selected expert executes a trade, the mirror trading software instantly replicates that exact position in your account.

Benefits and Limitations of Mirror Trading

Key Advantages

Mirror trading delivers compelling benefits that explain its 47% annual growth rate:

Potential Drawbacks

Despite its advantages, mirror trading has limitations you must understand:

- Execution delays: Even on top mirror trading platforms, execution gaps can impact profitability

- Strategy mismatch: A successful strategy may not align with your risk tolerance

- Over-reliance risk: Depending solely on others’ expertise limits your trading development

- Changing market conditions: Previously successful strategies can underperform in new environments

Mirror Trading vs. Copy Trading: How Pocket Option Enhances Control

While many platforms refer to “mirror trading” as the automated duplication of trades without user discretion, Pocket Option takes a more refined approach.

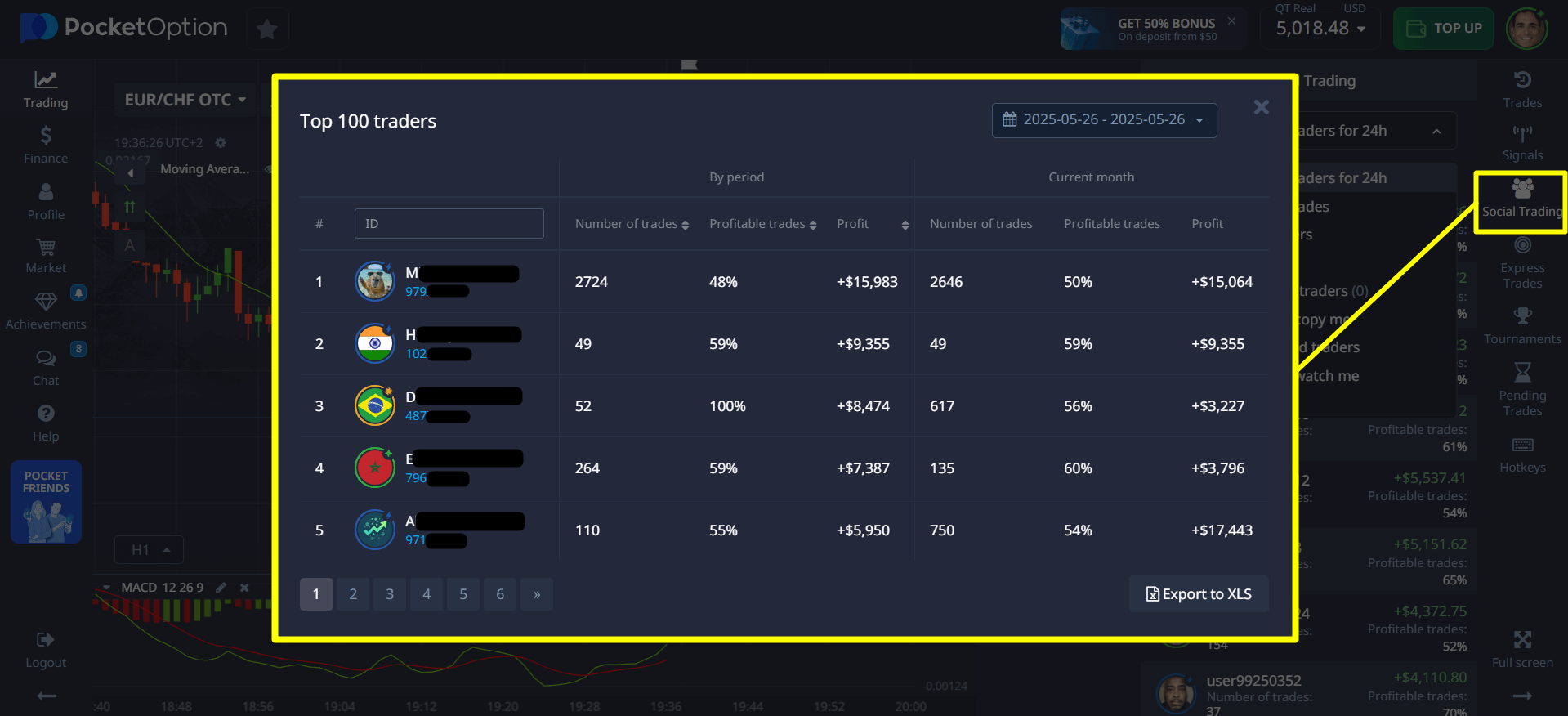

The Social Trading feature empowers users to selectively copy experienced traders based on transparent data. Before replicating any strategy, you can assess a trader’s performance history, risk level, and trading behavior. A Top100 list is renewed daily:

This ensures a more personalized and strategic experience — giving you the freedom to build a portfolio that aligns with your own goals, rather than blindly following predefined moves.

| Mirror Trading | Copy Trading (Pocket Option Social Trading) |

|---|---|

| Fully automated trade replication without user input | Manual selection of traders to follow with customizable risk parameters |

| Limited control over individual trades or strategies | Full transparency and control: view performance, adjust lot sizes, disconnect anytime |

| Often predefined strategies chosen by the platform | Choose from real traders with verified performance histories |

| May lack adaptability to changing market conditions | Freedom to switch traders or strategies based on market behavior |

| Risk of passive dependency on one strategy | Diversify across multiple traders, timeframes, and assets |

| Execution delays may occur on bulk signal replication | Optimized trade mirroring with high-speed execution (0.4s avg. on Pocket Option) |

| Minimal performance analytics for users | Advanced metrics: ROI, drawdown, Sharpe ratio, win rate per trader |

Getting Started with Copy Trading on Pocket Option

✅ Create an account on Pocket Option and fund it with at least $5 (note that the minimum deposit may vary based on your chosen payment method).

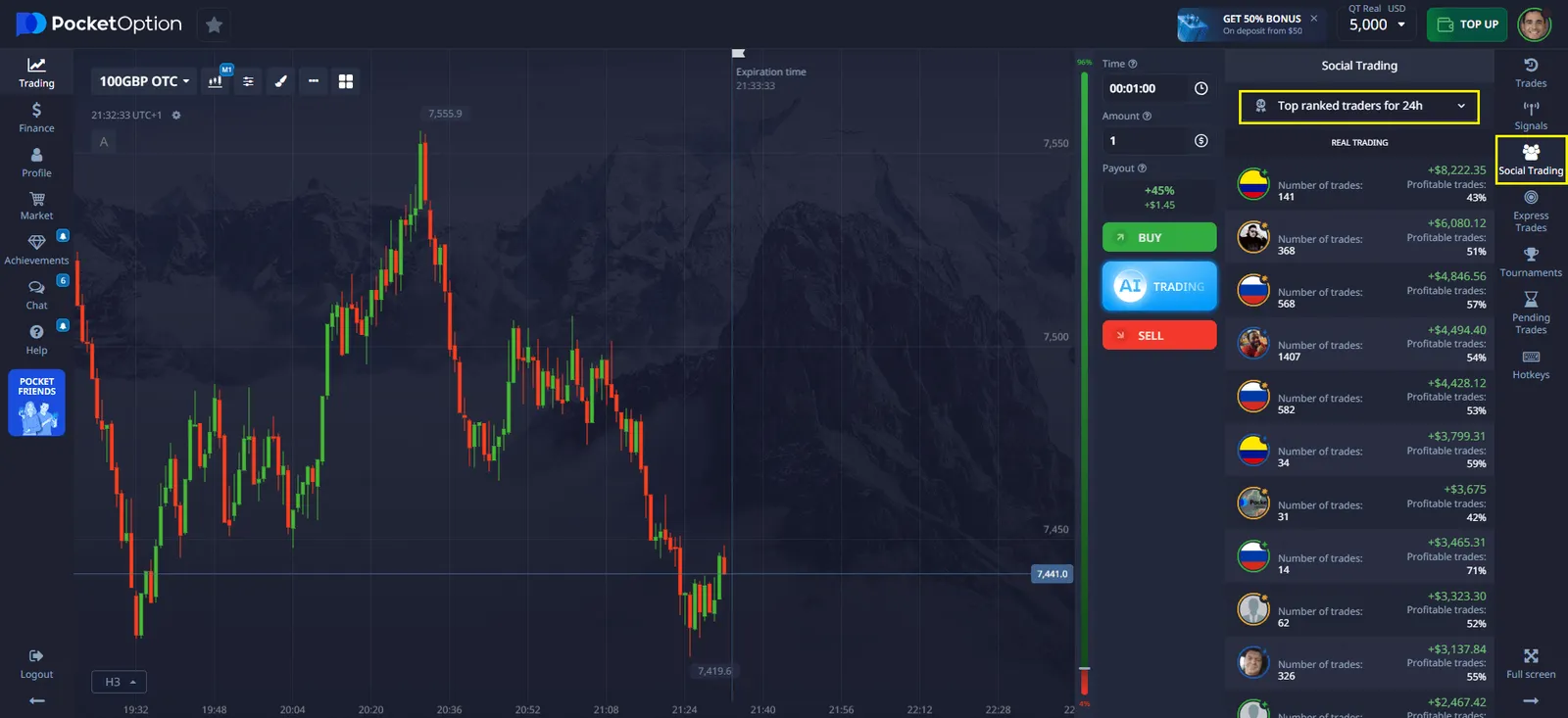

✅ Go to the “Social Trading” section from the main navigation menu.

✅ Explore the “Top ranked traders” — a real-time list of the most profitable traders, updated every minute.

✅ Choose 2–3 traders with varying strategies. Select those whose approach aligns best with your trading goals.

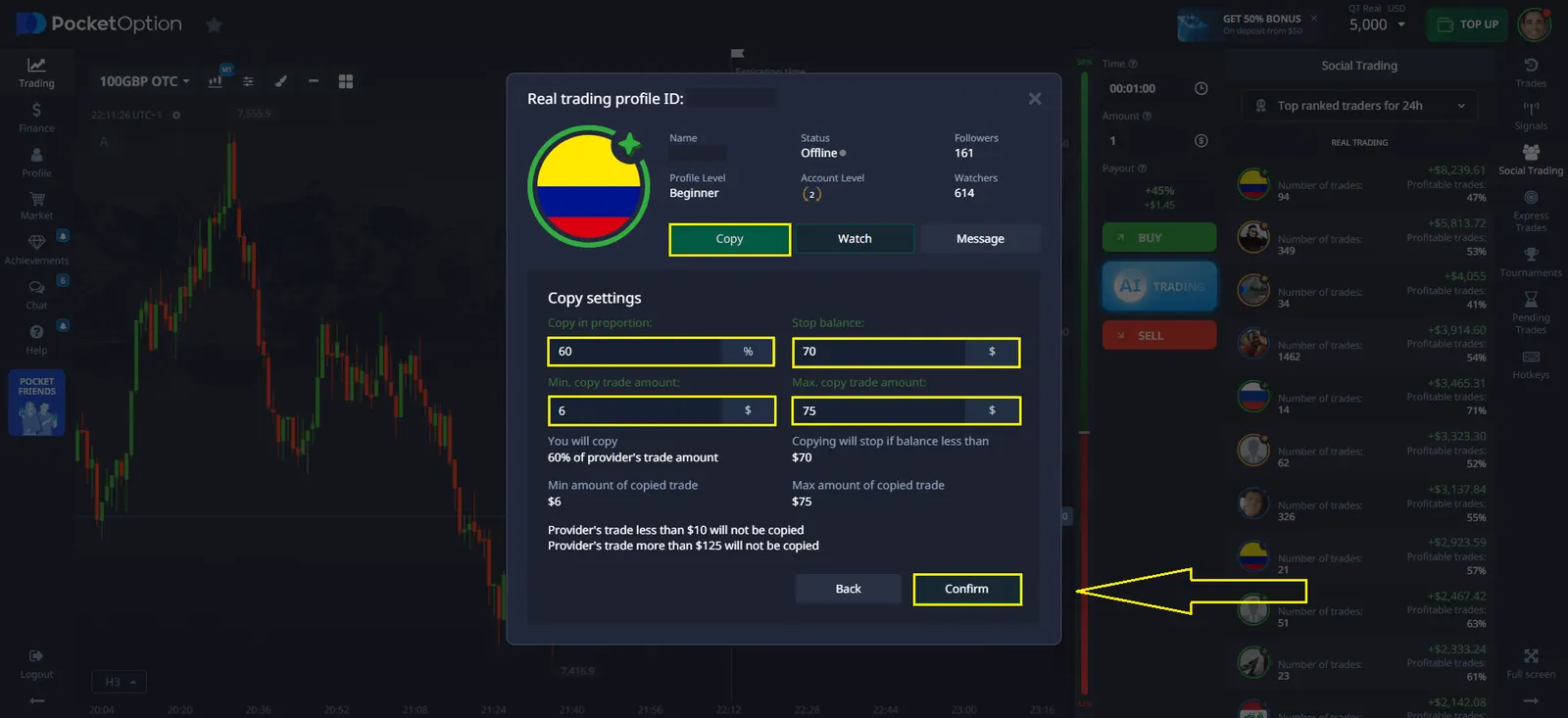

✅ Adjust Copy Settings. Set the percentage of each trade to be copied, along with your minimum and maximum trade limits.

✅ Hit “Copy“. After confirming your setup, the system will begin duplicating the trades of your selected traders automatically.

✅ Track your results weekly and consider rebalancing your portfolio each month.

When selecting traders to follow, focus on those with:

- A stable return of 5% or more per month for over 6 months

- Drawdowns capped at 30%

- A trading volume of 15–40 trades per month (avoiding excessive activity)

- A clear focus on specific markets

- A transparent trading record that includes both bullish and bearish market periods

If you have any further questions, you can discuss them with experienced platform users in our community!

Implementing Effective Trading Strategies

Create your diversified portfolio: Combine 3-5 strategies with different approaches:

- Market specialists (e.g., forex pairs, commodities)

- Trading styles (trend-following, counter-trend, breakout)

- Timeframes (day traders, swing traders, position traders)

Implement proper position sizing: Never allocate more than 20% of your capital to any single strategy, regardless of past performance.

Set performance thresholds: Establish clear criteria for when to stop following underperforming strategies. On Pocket Option, you can create automatic disconnection rules based on drawdown or consecutive losses.

Risk Management Essentials

Even with copy trading, you remain responsible for risk management. Implement these protective measures:

- Start with 10-15% of your trading capital to test strategies

- Use Pocket Option’s custom risk controls to override a strategy’s position sizing

- Monitor correlation between your chosen strategies to ensure true diversification

- Review performance weekly, focusing on risk-adjusted metrics rather than raw returns

Conclusion

Mirror trading offers a powerful solution for investors seeking market expertise without the learning curve. By carefully selecting strategies, managing risk, and utilizing advanced platform features, you can potentially achieve consistent returns regardless of your experience level, though this trading style carries risks.

Unlike mirror trading platforms, Pocket Option provides the ideal combination of strategy selection, performance transparency, and customization tools to implement this approach successfully. Whether you’re just beginning your investment journey or seeking to diversify your existing approach, copy trading deserves serious consideration as part of your financial toolkit.

FAQ

What exactly is mirror trading?

Mirror trading automatically replicates expert traders' positions in your account. When you select a strategy on a trading platform, the system executes identical trades whenever your chosen expert makes moves, eliminating manual trading entirely.

How does mirror trading differ from copy trading?

Mirror trading typically replicates algorithm-based strategies rather than individual traders. Copy trading follows specific traders directly, including their discretionary decisions, and often includes social interaction. Pocket Option offers Copy Trading for better risk control.

What percentage of my portfolio should I allocate to mirror trading?

Start with 10-20% of your trading capital for mirror trading strategies. This conservative approach lets you evaluate performance while limiting potential drawdowns if strategies underperform.

What is mirror trading forex and how does it work?

Mirror trading forex refers to automatically copying the trades of professional currency traders into your own account. When a selected trader opens or closes a position on a forex pair (like EUR/USD or GBP/JPY), the same action is mirrored in the follower’s account. While efficient, this style often lacks flexibility — unlike Pocket Option’s Social Trading feature, which lets you evaluate and customize forex strategies before copying them, offering a more tailored trading experience.

How long should I follow a strategy before evaluating its performance?

Evaluate a mirror trading or copy trading strategy for at least 6-12 months, covering different market conditions. Pocket Option provides detailed historical performance data, allowing you to assess how strategies performed during periods similar to current market environments.