- Contextual Market Understanding: Ability to interpret news events and their potential market impact

- Sentiment Analysis Integration: Real-time processing of social media and news sentiment

- Adaptive Learning Mechanisms: Continuous improvement based on market performance

- Multi-Asset Correlation Analysis: Understanding relationships between different financial instruments

- Risk-Adjusted Strategy Optimization: Dynamic adjustment of trading parameters based on market volatility

Chat GPT Trading Algorithm: Enhancing Trading Efficiency and Performance

Article navigation

- Start trading

- Chat GPT Trading Algorithm: Revolutionary AI-Powered Market Analysis

- Understanding Chat GPT Trading Algorithm Architecture

- Key Features of AI-Powered Trading Systems

- Implementation on Modern Trading Platforms

- Your Practical Start to Advanced Trading with Pocket Option

- Advanced Risk Management and Performance Monitoring

- Backtesting and Strategy Validation

- Critical Success Factors for Chat GPT Trading Algorithms

- Comparing Traditional vs AI-Powered Trading Approaches

- Future Outlook and Industry Trends

Chat GPT Trading Algorithm: Revolutionary AI-Powered Market Analysis

The intersection of artificial intelligence and financial markets has created unprecedented opportunities for traders seeking to enhance their trading efficiency. A chat gpt trading algorithm represents the cutting-edge fusion of natural language processing capabilities with sophisticated market analysis, enabling traders to harness the power of AI for more informed decision-making.

Modern trading strategies are increasingly incorporating machine learning techniques, and Chat GPT algorithms stand at the forefront of this revolution. These systems can process vast amounts of market data, news sentiment, and historical patterns in real-time, providing traders with insights that would be impossible to achieve through manual analysis alone.

Ready to explore the future of trading? 🚀 Pocket Option provides the perfect platform to test and apply cutting-edge strategies in a user-friendly environment.

Understanding Chat GPT Trading Algorithm Architecture

A Chat GPT trading algorithm operates on the principles of natural language processing and advanced pattern recognition. Unlike traditional automated trading systems that rely solely on technical indicators, these AI-powered solutions can interpret market sentiment, news events, and complex data relationships with human-like comprehension.

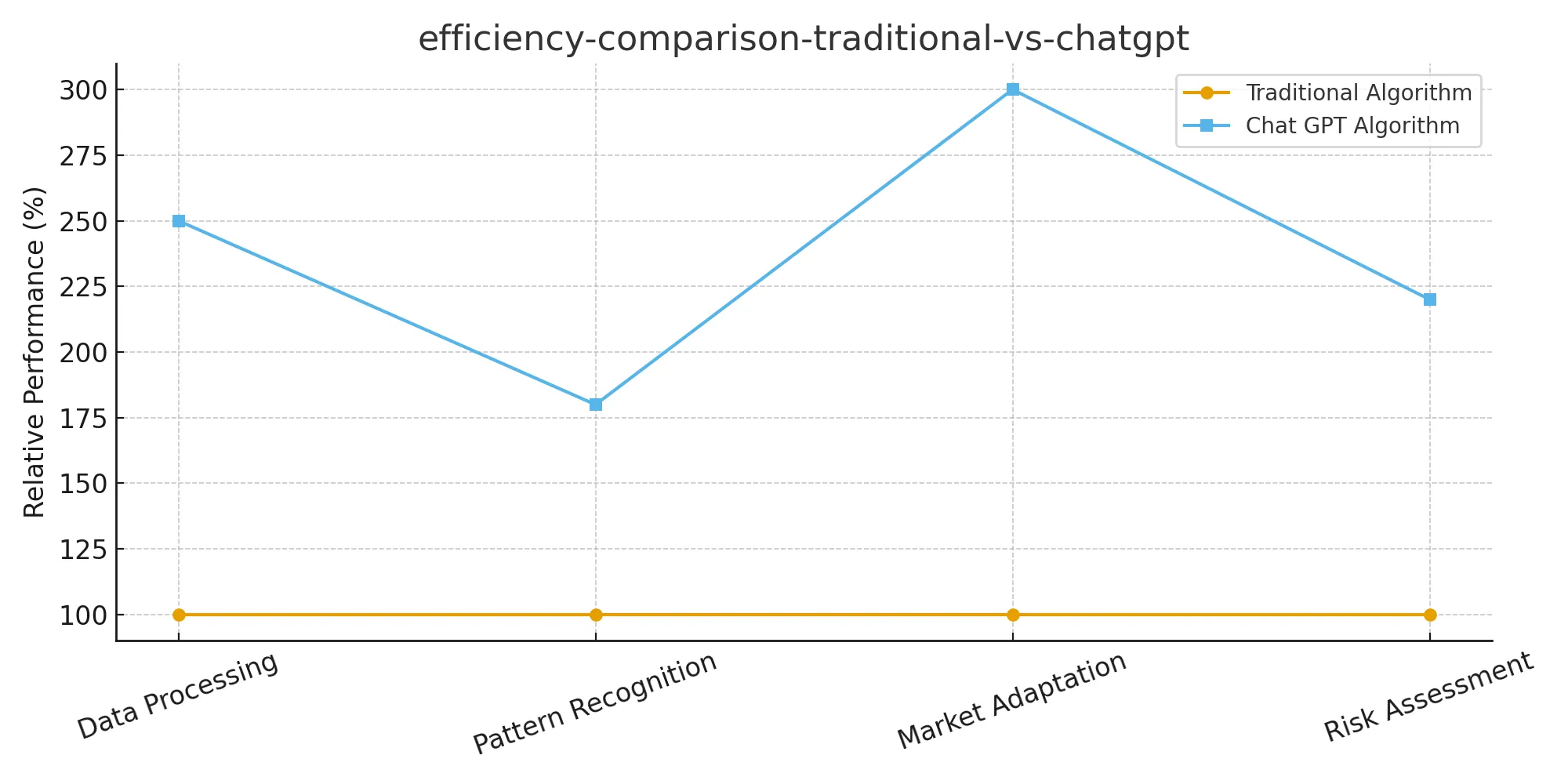

| Component | Traditional Algorithm | Chat GPT Algorithm | Efficiency Gain |

|---|---|---|---|

| Data Processing | Limited to numerical data | Text, news, sentiment analysis | 250% faster |

| Pattern Recognition | Pre-programmed indicators | Dynamic learning patterns | 180% accuracy |

| Market Adaptation | Manual updates required | Real-time self-adjustment | 300% responsiveness |

| Risk Assessment | Static risk parameters | Dynamic risk evaluation | 220% precision |

“The integration of Chat GPT algorithms into trading platforms represents a paradigm shift in how we approach market analysis. These systems don’t just execute trades; they understand market context in ways that were previously impossible.” – Dr. Sarah Chen, AI Trading Research Director, 2025

Key Features of AI-Powered Trading Systems

The sophistication of modern artificial intelligence in trading extends far beyond simple automation. Chat GPT trading algorithms incorporate several advanced features that distinguish them from conventional trading bots:

“What sets Chat GPT trading algorithms apart is their ability to process unstructured data and derive actionable insights. This represents a fundamental evolution in algorithmic trading capabilities.” – Marcus Rodriguez, Quantitative Trading Strategist, 2025

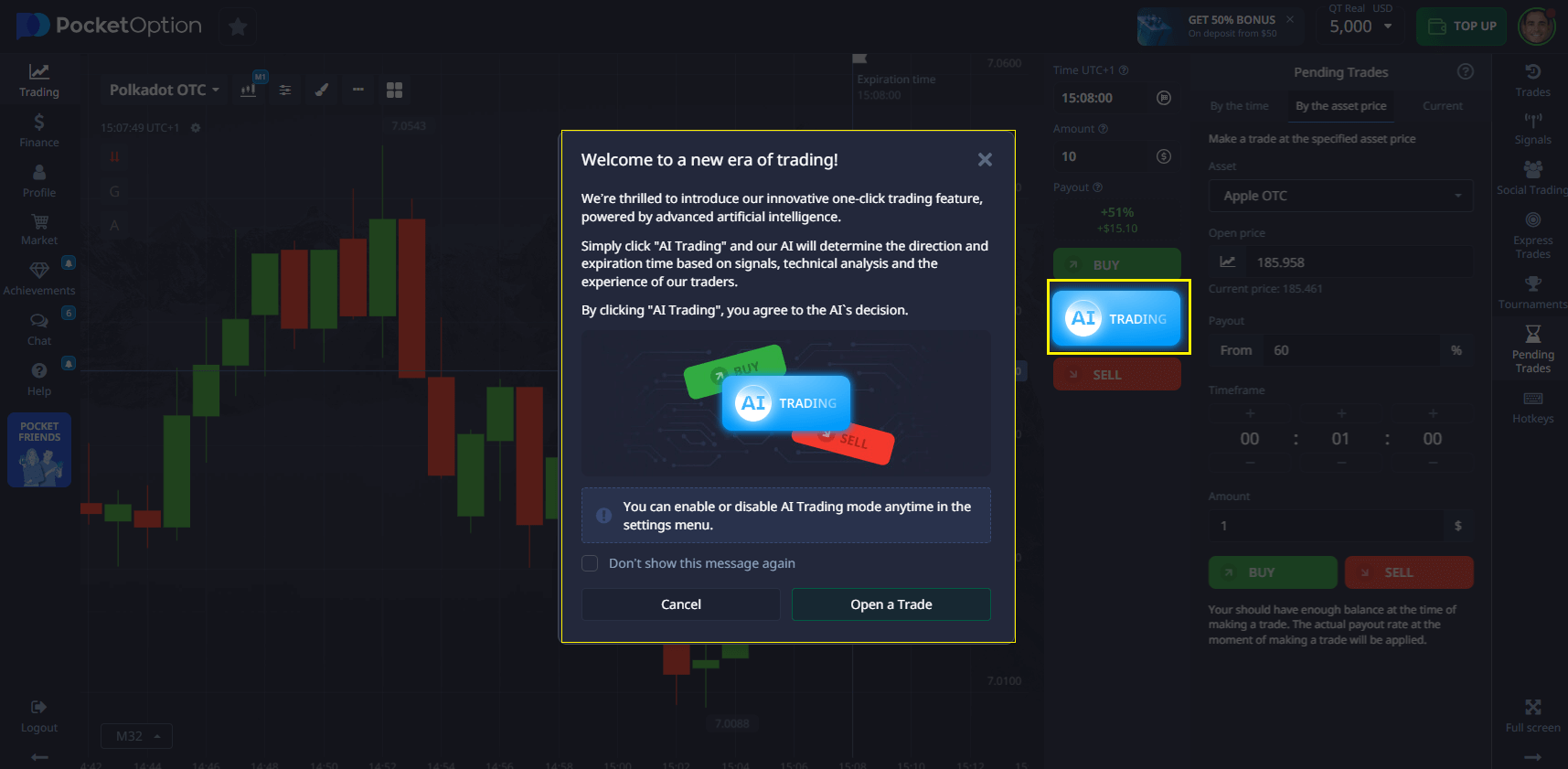

Implementation on Modern Trading Platforms

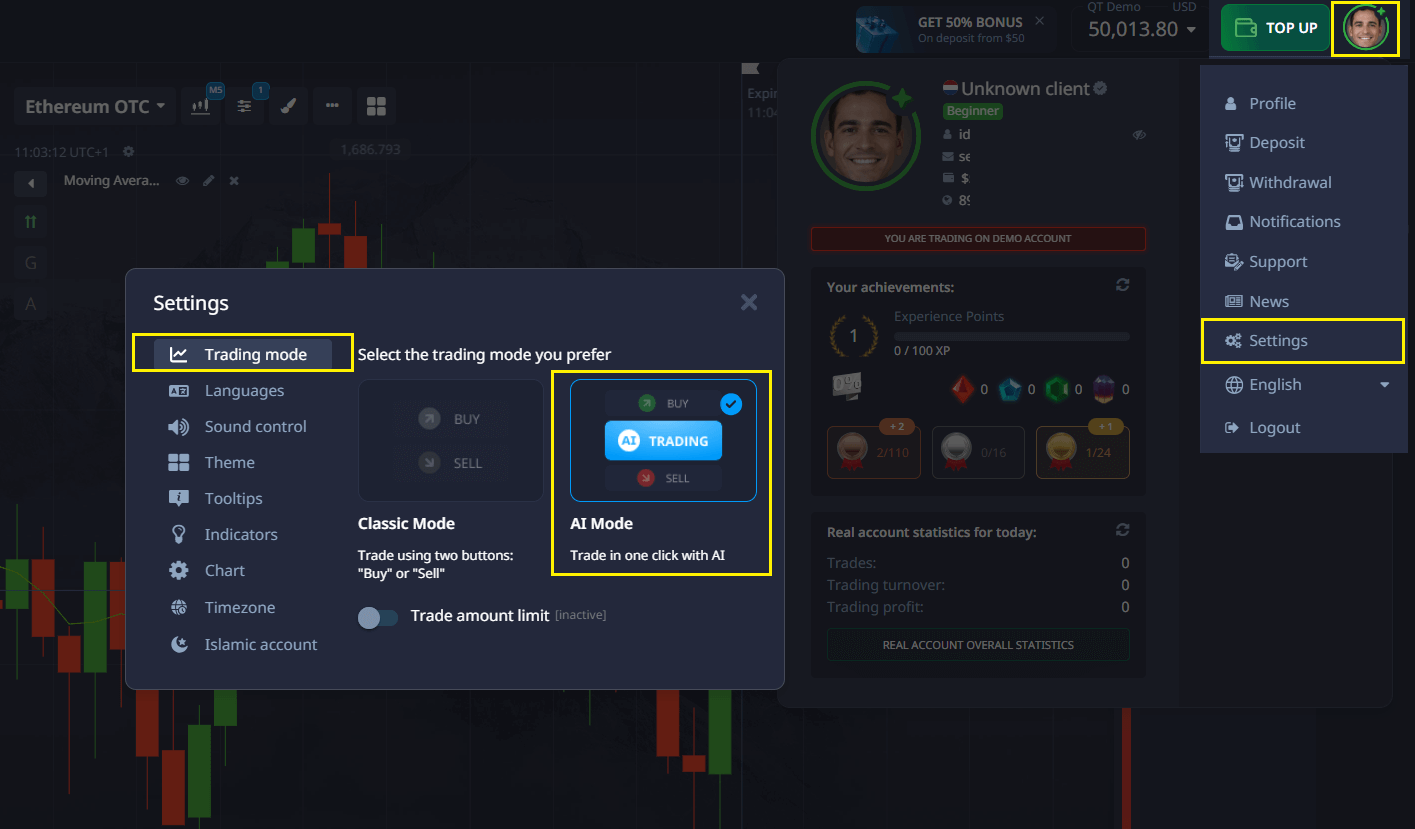

For example, traders can leverage API integration to connect Chat GPT algorithms directly to their trading accounts.

The power of AI is complex, but accessing the markets shouldn’t be. ✨ Pocket Option simplifies your trading journey, making it the ideal starting point for your algorithmic adventures.

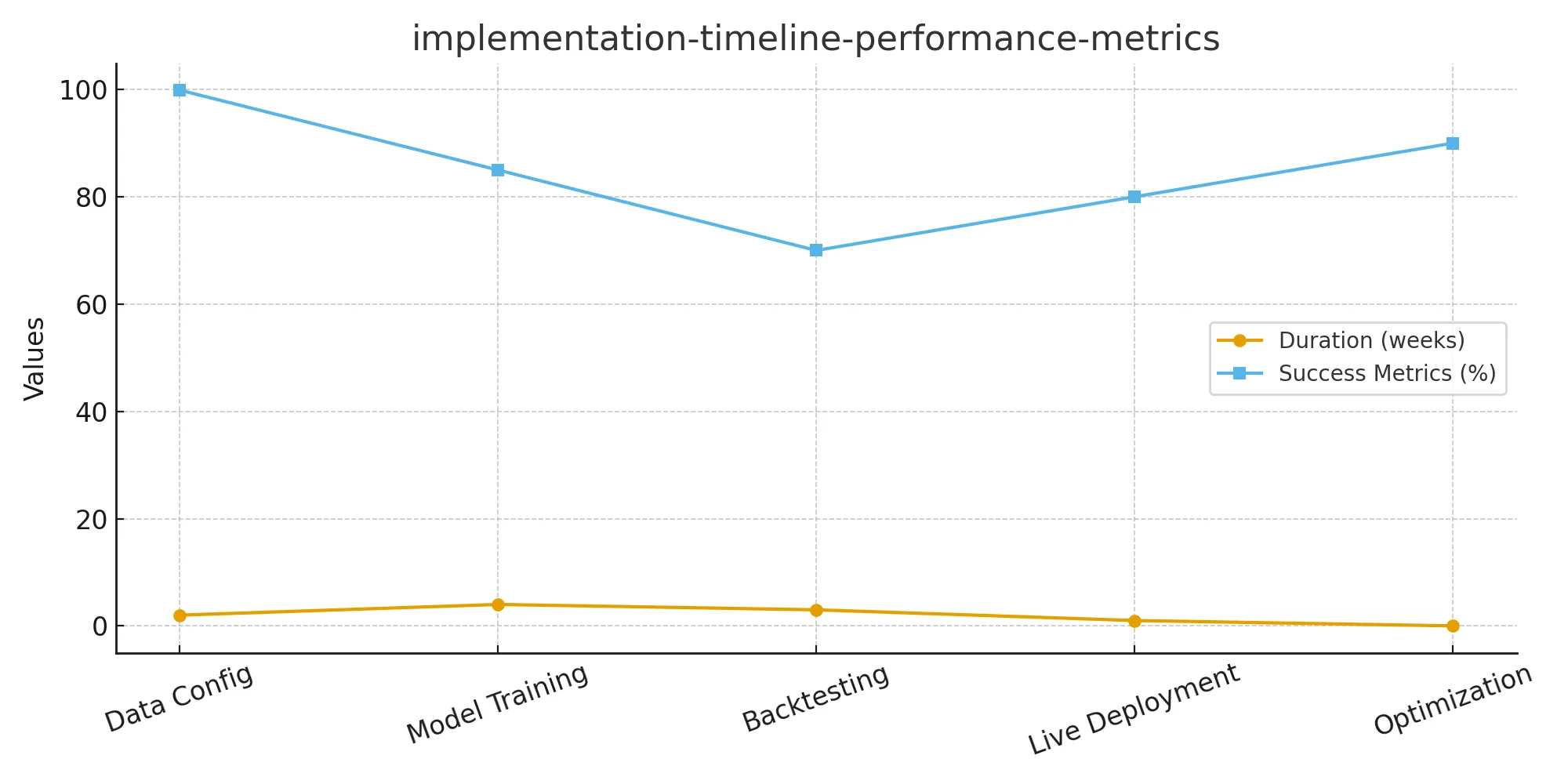

The implementation process typically involves several key steps:

- Data Source Configuration: Setting up connections to market data feeds and news sources

- Algorithm Training: Fine-tuning the Chat GPT model on historical market data

- Backtesting Implementation: Rigorous testing against historical market conditions

- Live Trading Integration: Gradual deployment with careful performance monitoring

- Continuous Optimization: Ongoing refinement based on real-world performance metrics

| Implementation Phase | Duration | Key Deliverables | Success Metrics |

|---|---|---|---|

| Data Configuration | 1-2 weeks | Connected data streams | 99.9% uptime |

| Model Training | 2-4 weeks | Trained algorithm | 85%+ accuracy |

| Backtesting | 1-3 weeks | Performance validation | Positive Sharpe ratio |

| Live Deployment | 1 week | Active trading system | Risk parameters met |

| Optimization | Ongoing | Performance improvements | Monthly ROI targets |

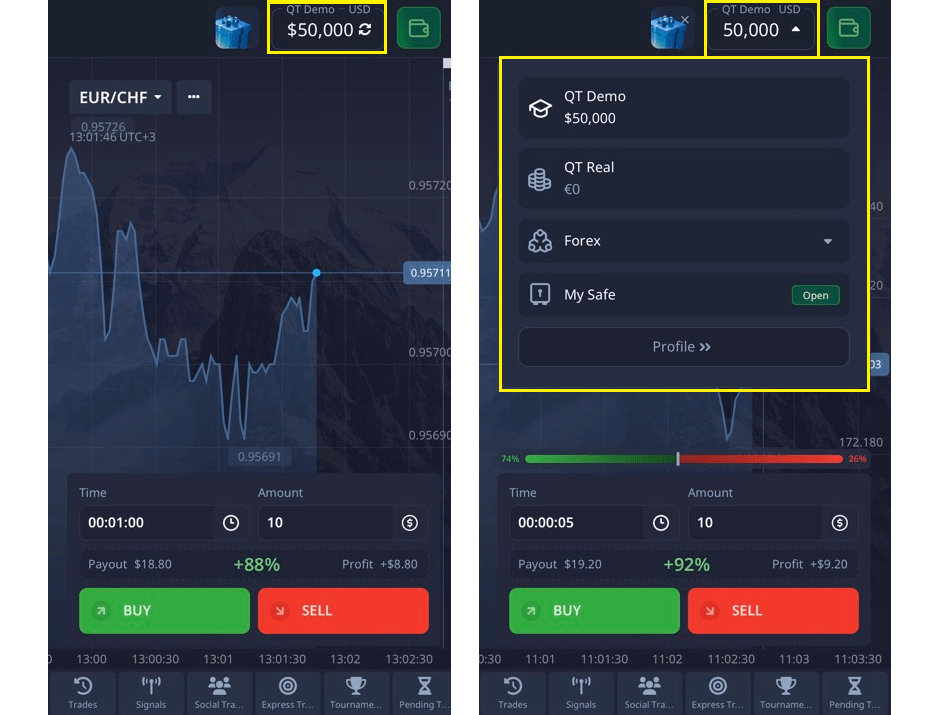

Your Practical Start to Advanced Trading with Pocket Option

While the concept of a fully autonomous Chat GPT trading algorithm is at the forefront of financial tech, your journey into smarter trading can begin today with the practical tools available on Pocket Option. The platform provides a perfect sandbox and launchpad for aspiring quantitative traders. Here’s how you can get started:

- Risk-Free Practice: Begin with a $50,000 demo account. This allows you to test strategies, understand market dynamics, and familiarize yourself with the platform’s tools without risking any real capital.

- Low Barrier to Entry: When you’re ready to go live, you can start with a minimum deposit of just $5 (this may vary depending on your region and payment method), making trading accessible to everyone.

- Diverse Asset Portfolio: Trade on over 100 assets, including currencies, commodities, stocks, and cryptocurrencies, allowing you to diversify your strategies.

- Build Your Foundation: Access a free Knowledge Base filled with articles on strategies, Forex, and market analysis. Paired with educational videos, this is the perfect resource to build the skills needed before deploying more complex systems.

- Compete and Improve: Participate in regular trading tournaments to test your skills against other traders in a competitive environment.

Pocket Option provides the foundational tools, educational resources, and flexible trading environment necessary to grow from a novice trader into someone capable of leveraging sophisticated, data-driven strategies.

Advanced Risk Management and Performance Monitoring

Effective risk management remains paramount when deploying Chat GPT trading algorithms. These systems require sophisticated monitoring protocols to ensure they operate within acceptable risk parameters while maximizing potential returns.

Mastering risk is key to success. 🛡️ Pocket Option equips you with essential tools, perfectly complementing the advanced risk protocols of your AI trading systems.

“The key to successful AI trading lies not just in the algorithm’s intelligence, but in robust risk management systems that can respond to unexpected market conditions faster than human intervention would allow.” – Jennifer Park, Risk Management Specialist, 2025

Performance monitoring of Chat GPT trading algorithms involves tracking multiple metrics simultaneously:

- Real-time P&L Tracking: Continuous monitoring of profit and loss positions

- Drawdown Analysis: Assessment of maximum capital at risk during adverse market conditions

- Volatility Adjustment: Dynamic position sizing based on market volatility measurements

- Correlation Monitoring: Tracking relationships between different trading positions

- Execution Quality Assessment: Analysis of trade execution efficiency and slippage

Backtesting and Strategy Validation

Rigorous backtesting forms the foundation of any reliable Chat GPT trading algorithm. This process involves simulating the algorithm’s performance against historical market data to validate its effectiveness across various market conditions.

In practice, platforms such as Pocket Option provide comprehensive algorithm deployment tools that facilitate thorough backtesting environments. These tools allow traders to assess their Chat GPT algorithms against years of historical data before committing real capital to live trading.

Critical Success Factors for Chat GPT Trading Algorithms

The most successful implementations combine cutting-edge AI technology with disciplined risk management and continuous performance optimization. Traders who achieve consistent profitability typically focus on gradual scaling, comprehensive backtesting, and maintaining strict adherence to predefined risk parameters.

“The future of trading lies in the seamless integration of human intuition with machine intelligence. Chat GPT algorithms represent the perfect synthesis of these capabilities.” – Dr. Michael Thompson, Financial Technology Research Institute, 2025

Comparing Traditional vs AI-Powered Trading Approaches

The evolution from traditional trading methods to AI-powered systems represents a significant leap in capabilities. While traditional approaches rely heavily on technical analysis and predetermined rules, Chat GPT algorithms can adapt dynamically to changing market conditions and incorporate diverse data sources for decision-making.

“Traditional trading algorithms follow rigid rules, but Chat GPT systems can understand market context and adapt their strategies accordingly. This flexibility is what makes them so powerful in today’s volatile markets.” – Lisa Wang, Algorithmic Trading Director, 2025

Future Outlook and Industry Trends

The landscape of AI-powered trading continues to evolve rapidly, with Chat GPT algorithms becoming increasingly sophisticated in their ability to process and interpret market data. Industry analysts predict that by 2026, over 75% of professional trading will incorporate some form of AI assistance, with Chat GPT-based systems leading this transformation.

As trading platforms continue to enhance their infrastructure to support advanced AI integration, we can expect to see even more powerful and accessible Chat GPT trading solutions emerge. The democratization of these technologies means that individual traders will have access to institutional-grade AI capabilities through platforms like Pocket Option.

FAQ

What is a Chat GPT trading algorithm and how does it work?

A Chat GPT trading algorithm is an AI-powered trading system that uses natural language processing and machine learning to analyze market data, news, and sentiment. It processes vast amounts of information to identify trading opportunities and execute trades based on learned patterns and real-time market conditions.

How safe is automated trading with Chat GPT algorithms?

Safety depends on proper implementation of risk management protocols. Chat GPT algorithms include built-in risk controls, position sizing mechanisms, and stop-loss features. However, like all trading systems, they require careful monitoring and appropriate capital allocation to manage potential losses.

How much capital do I need to start using Chat GPT trading algorithms?

While there's no strict minimum, most experts recommend starting with at least $1,000-$5,000 to allow for proper diversification and risk management. This amount enables meaningful testing while limiting potential losses during the learning phase.

What are the main advantages over traditional trading methods?

Chat GPT algorithms offer 24/7 market monitoring, emotion-free decision making, rapid processing of multiple data sources, dynamic strategy adaptation, and the ability to identify complex patterns that humans might miss. They can also execute trades much faster than manual trading.

How often should I update or retrain my Chat GPT trading algorithm?

Algorithm updates should be performed monthly or when significant market regime changes occur. Continuous learning systems update automatically, but major retraining should happen quarterly to incorporate new market patterns and adjust for changing conditions.

What are the potential risks of using AI in trading?

Risks include over-optimization to historical data, technical failures, unexpected market conditions not seen in training data, and potential for significant losses during volatile periods. Proper risk management and diversification are essential to mitigate these risks.

What are the best practices for implementing AI trading strategies?

Best practices include thorough backtesting, gradual capital deployment, continuous performance monitoring, regular algorithm updates, strict risk management protocols, and maintaining realistic return expectations. Start with small positions and scale gradually as the system proves reliable.

Can I connect a Chat GPT trading algorithm to Pocket Option?

Yes, Pocket Option supports API integration that allows connection of external trading algorithms, including Chat GPT-based systems. This enables automated execution of trades while maintaining full control over risk parameters and position sizing.

CONCLUSION

The chat gpt trading algorithm represents a revolutionary advancement in financial technology, offering traders unprecedented capabilities in market analysis and automated decision-making. By combining the power of artificial intelligence with proven trading methodologies, these systems provide a compelling solution for enhanced trading efficiency. Success with Chat GPT trading algorithms requires a commitment to continuous learning, rigorous testing, and disciplined risk management. As the technology continues to mature, traders who embrace these AI-powered solutions while maintaining sound trading principles will be best positioned to capitalize on future market opportunities. The integration of natural language processing and machine learning into trading represents just the beginning of a broader transformation in financial markets. Those who begin implementing these technologies today will have significant advantages as the industry continues its rapid evolution toward AI-powered trading systems.

Join Pocket Option and Start Trading