Samsung stock vs Apple stock: Technology Impact Analysis 2025-2030

Advanced Technology Analysis: Samsung stock vs Apple stock Performance

Article navigation

Samsung Stock vs Apple Stock: Technology Impact Analysis 2025–2030

Want to compare tech giants? Find out whether Samsung stock vs Apple stock is the better investment for 2025 and beyond — and how Pocket Option helps you trade tech stocks 24/7 with a demo and low minimum deposit.

Banner: contrasting Samsung and Apple with an upward stock trendline

Market Overview 📊

Current Market Share Analysis

As of 2025, Samsung Electronics (KRX Samsung) and Apple Inc. (NASDAQ AAPL) continue to dominate the smartphone market. In this section, we analyze their market share and growth trends in detail. Samsung leads globally thanks to its diverse product portfolio and strong Galaxy S and Z Fold shipments. Apple maintains premium segment dominance with over 15% global share and a strong U.S. presence.

| Company | 2025 Global Smartphone Market Share | Strength |

|---|---|---|

| Samsung | 19.7% | Product diversity, foldables |

| Apple | 15.7% | Brand loyalty, U.S. dominance |

Source: IDC Q2 2025

Historical Stock Price Trends (Updated 2025)

When you compare AAPL vs Samsung, historical data shows:

| Year | AAPL Avg. Price | Samsung Avg. Price (KRW) |

|---|---|---|

| 2015 | $28 | ₩1,287,000 |

| 2020 | $133 | ₩1,400,000 |

| 2023 | $175 | ₩1,640,000 |

| 2024 | $190 | ₩1,720,000 |

| 2025 | $160 | ₩1,880,000 |

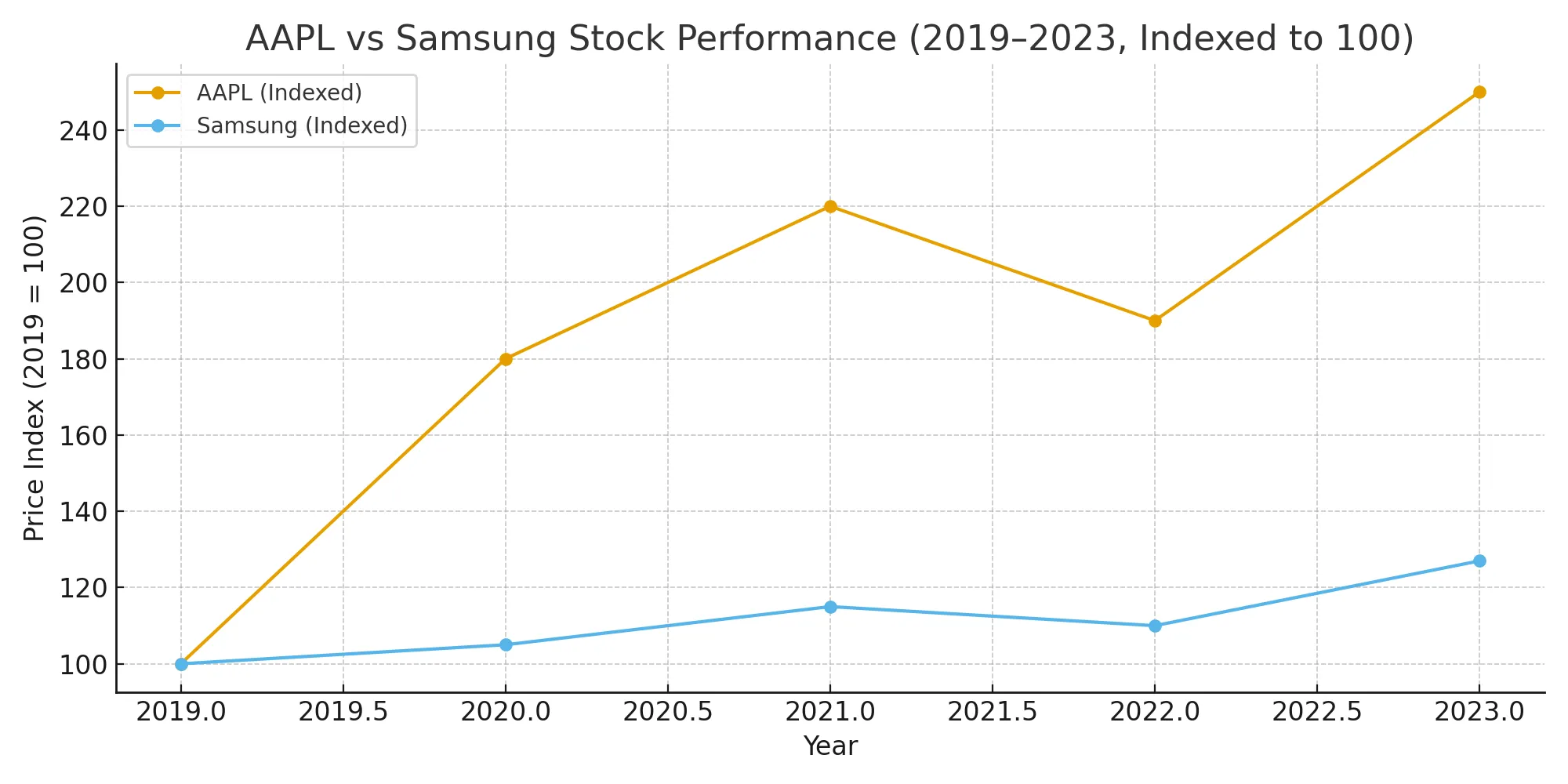

Chart: Indexed growth of AAPL and Samsung 2019–2023

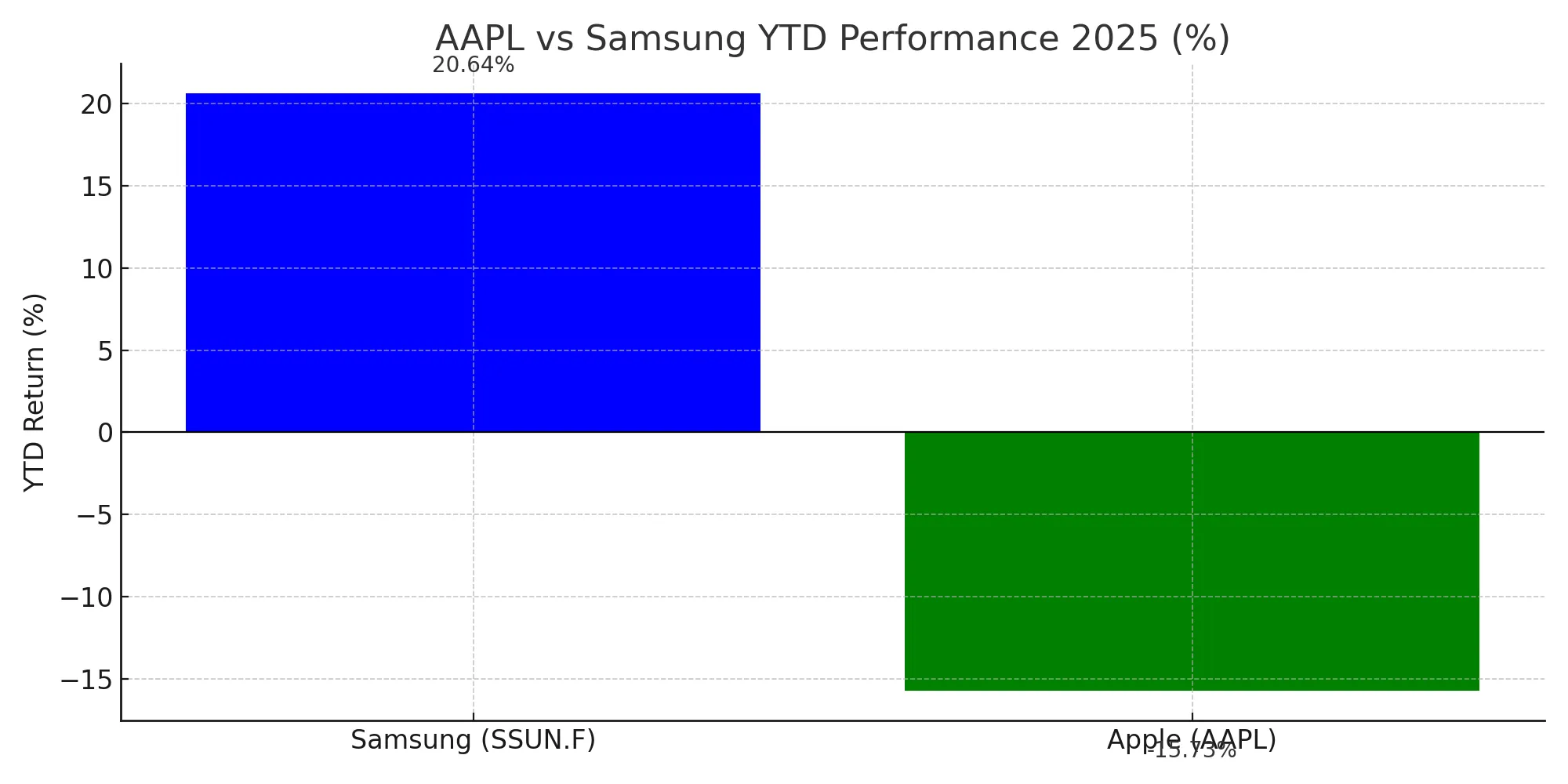

Chart: YTD 2025 performance — Samsung +20.6%, Apple −15.7%

Insight: Samsung shows strong recovery and short-term upside potential, while Apple faces headwinds in 2025.

Future Projections for 2025 and Beyond 🔮

Both companies invest heavily in innovation: Samsung in foldables and semiconductors, Apple in AR/VR and ecosystem development. Bloomberg projects Apple to ship 10M Vision Pro units by 2027.

Apple vs Samsung: Stock Comparison

Valuation Metrics

| Metric | Apple (AAPL) | Samsung Electronics |

|---|---|---|

| P/E | ~29 | ~14 |

| Market Cap (2025) | $2.8T | $360B |

| Revenue (2025) | $394B | $227B |

| Dividend Yield | 0.5% | 2.3% |

Volatility and Risk Assessment ⚠️

AAPL: Lower volatility supported by services revenue.

Samsung: More cyclical, exposed to memory price swings.

📉 Goldman Sachs: Samsung earnings volatility is 1.6x Apple.

Moving Averages

| Company | 50-Day MA (Aug 2025) | 200-Day MA | Trend |

|---|---|---|---|

| AAPL | $182 | $171 | Bullish |

| Samsung | ₩1,670,000 | ₩1,620,000 | Neutral–Bullish |

📈 JP Morgan notes Apple shows a “textbook breakout.”

Smartphone Market Dynamics 📱

Impact of Foldable Phones

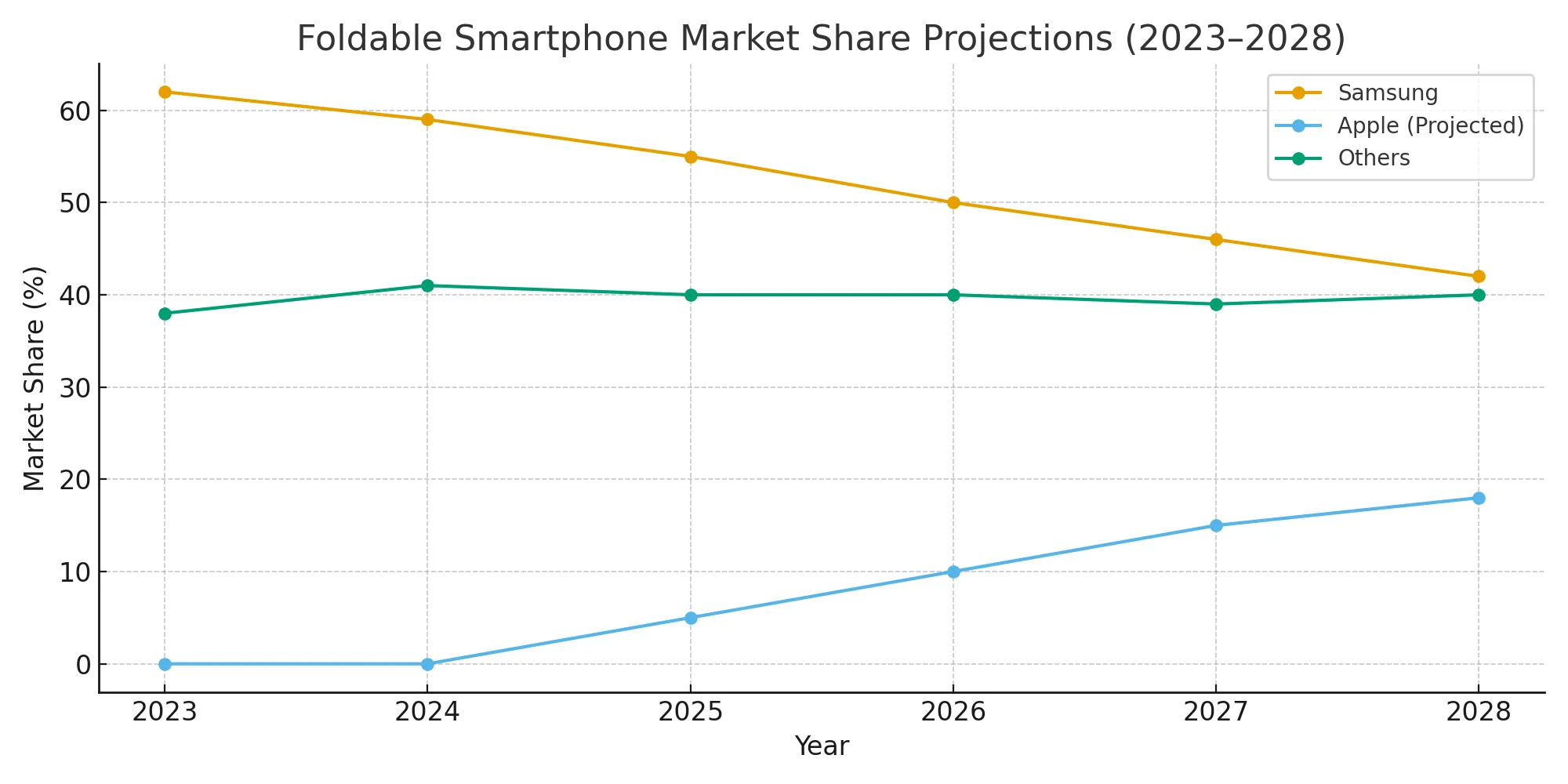

Samsung captured over 60% of foldable shipments in 2024 but dropped to 9% share in Q2 2025, losing ground to Huawei and Motorola.

| Year | Global Foldable Share | Samsung Foldable Share |

|---|---|---|

| 2024 | ~1.5% | 62% |

| Q2 2025 | — | 9% |

Chart: Global foldable share growth projection 2023–2028

Market Strategies and Earnings Growth

| Strategy | Apple | Samsung |

|---|---|---|

| Focus Markets | U.S., China, EU | Asia, EU, LATAM |

| Growth Drivers | Services, AR/VR | Foldables, Chips |

| Earnings YoY | +7.2% | +11.5% |

Apple vs Samsung Revenue 2025–2030

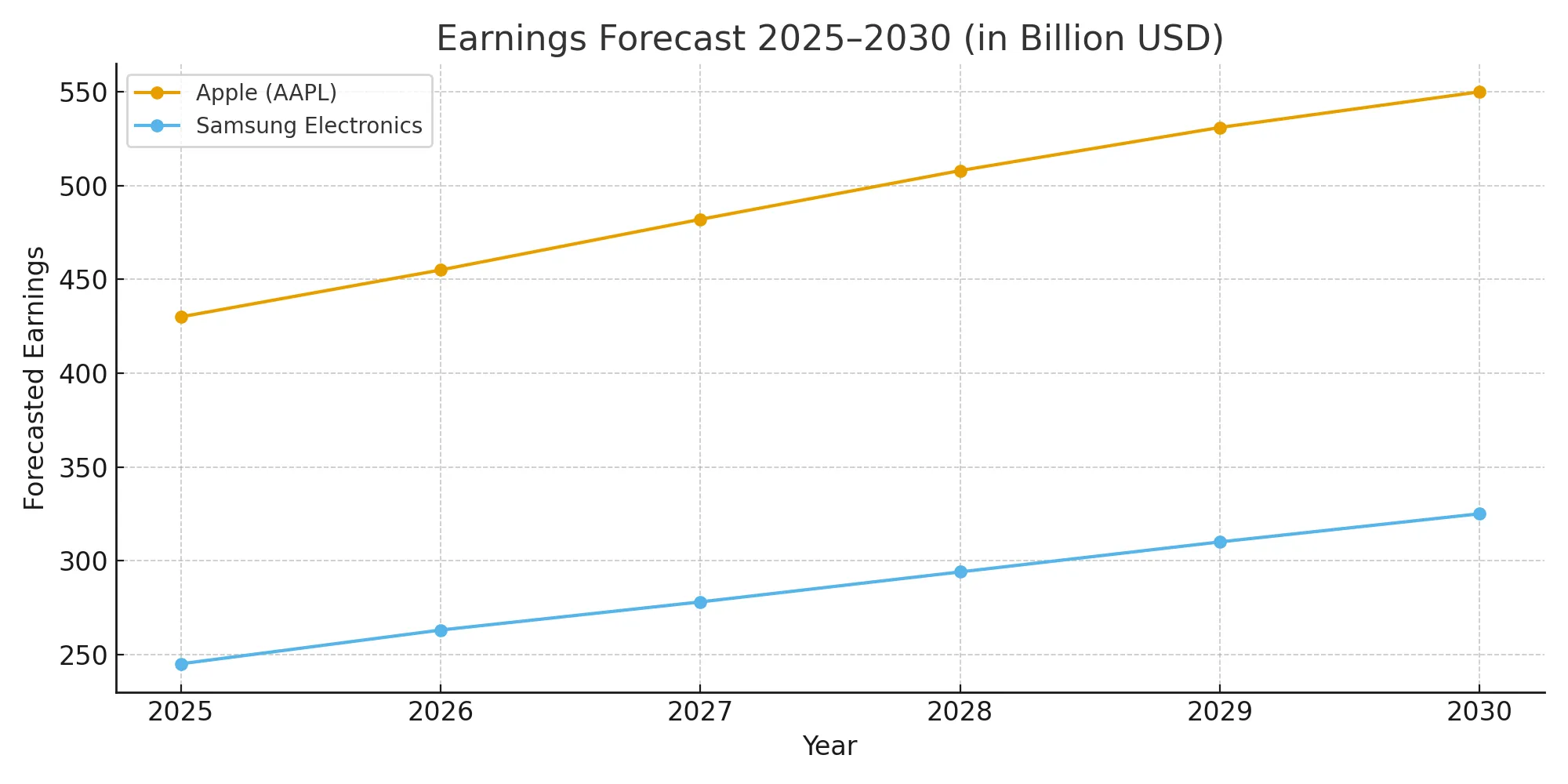

| Year | Apple Revenue | Samsung Revenue |

|---|---|---|

| 2025 | $394 | $227 |

| 2026 | $410 | $238 |

| 2027 | $425 | $250 |

| 2028 | $440 | $265 |

| 2029 | $460 | $280 |

| 2030 | $478 | $295 |

Chart: Apple vs Samsung revenue trend through 2030

Comparing Investment Potential: Apple vs Samsung

When comparing Samsung vs Apple shares, Apple provides stability and predictable earnings growth, while Samsung offers diversification and stronger upside in semiconductor and foldable cycles. Active traders may find Samsung more volatile and potentially profitable in the short term.

Pocket Option allows you to trade Apple (OTC) from $5* with 24/7 access, a free $50k demo account, AI tools, copy trading, and tournaments.

For long-term investors deciding whether to invest in Apple or Samsung, it’s important to consider market share trends and growth drivers.

*Minimum deposit may vary by region and payment method.

Read more: Apple Asset Guide

Real Trader Reviews

“The AI Trading tool helped me improve my timing on Apple trades.” — Lena M.

“Unlimited demo account made learning risk-free.” — Markus L.

“Trading AAPL outside market hours was a game changer.” — Jia H.

“Telegram bot sends signals I trust.” — Diego R.

FAQ

Which is better investment Apple or Samsung?

Apple is seen as a safer long-term bet; Samsung has more short-term upside.

Does Samsung pay dividends?

Yes, about 2–2.5% yield.

Is Apple stock safer than Samsung?

Generally less volatile, supported by services revenue.

Will Apple release a foldable iPhone by 2025?

Most analysts now suggest Apple could delay the foldable iPhone launch to 2026–2027, focusing on improving durability and reducing costs before mass production.

Can I trade Samsung and Apple stocks on Pocket Option?

Yes, Apple via OTC — Samsung stock trading is not available on Pocket Option as of 2025.