- AWS offers machine learning tools to enterprise clients.

- Its e-commerce division uses AI for product recommendations and demand forecasting.

- AI is also being deployed in logistics and warehouse automation.

Meta vs Amazon Stock: Comprehensive Analysis for Tech Investors

META AMZN comparison is a central theme for investors seeking clarity in Meta vs Amazon stock decisions in 2025. Let’s dive in.

Article navigation

- Key Business Models: Social vs E-Commerce Dynamics

- Financial Performance Indicators

- AI Strategies and Competitive Edge

- Risk Assessment and Volatility

- FAANG Stocks Comparison: Meta vs Amazon Stock Breakdown

- Growth Stocks Analysis: Performance Metrics & Earnings Trends

- Technology Investment Comparison: Which Tech Titan Leads in 2025?

- Portfolio Allocation Strategies

- Long-Term Outlook: Strategic Paths Beyond 2025

- Real Trader Feedback on Pocket Option

Key Business Models: Social vs E-Commerce Dynamics

Understanding the underlying business models is the first step in any tech stocks comparison.

| Aspect | Meta | Amazon |

|---|---|---|

| Primary Revenue Source | Digital advertising | E-commerce, AWS |

| User Base | 3+ billion monthly active users | 200+ million Prime subscribers |

| Business Focus | Social networking, metaverse | Retail, cloud computing |

| Market Cap (2025) | ~$900 billion | ~$1.9 trillion |

Meta (formerly Facebook) leverages its digital platforms like Facebook, Instagram, and WhatsApp for targeted advertising. Amazon dominates the physical and digital retail space while leading in cloud computing through Amazon Web Services (AWS). The market cap comparison highlights their differing scales and sector dominance.

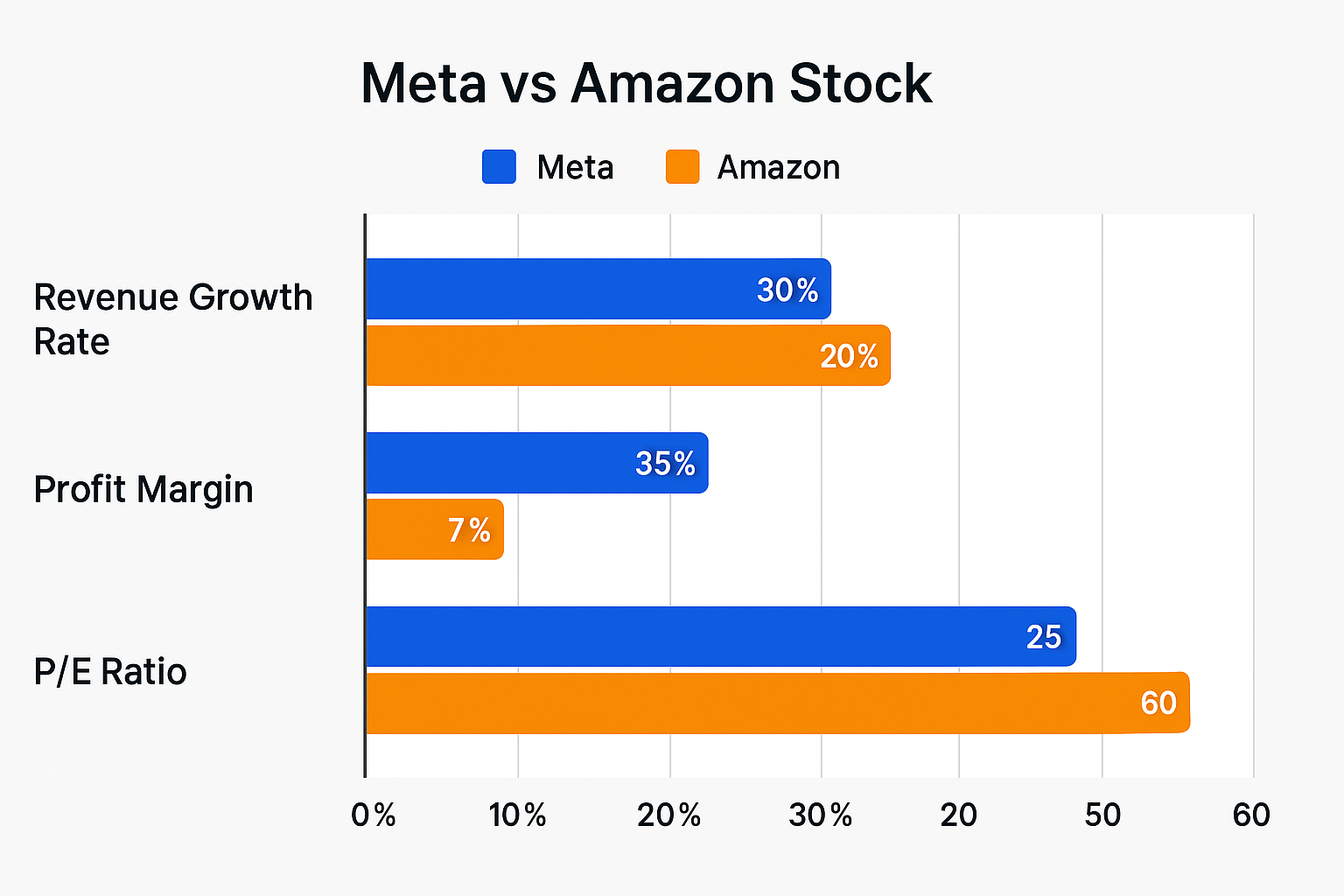

Financial Performance Indicators

A close look at the numbers reveals how Meta and Amazon differ in financial fundamentals–key for any growth stocks analysis.

| Financial Metric | Meta | Amazon |

|---|---|---|

| Revenue Growth Rate | 25–30% annually | 15–20% annually |

| Profit Margin | Higher (25–35%) | Lower (4–7%) |

| P/E Ratio | 20–25 | 50–60 |

| Operating Income (2024) | $53B | $54B |

Meta’s higher margins come from its lean, digital-only model. Amazon, though lower-margin, compensates with scale and revenue diversity. Analysts at JPMorgan and Bank of America have both raised price targets for Meta and Amazon in 2025, citing strong earnings momentum and AI integration.

AI Strategies and Competitive Edge

Artificial intelligence is rapidly transforming both companies.

Meta’s AI Innovations

Meta is enhancing digital advertising efficiency and platform engagement through AI-driven content personalization. It’s also developing LLMs (large language models) to power chatbots and AI assistants across Facebook, Instagram, and WhatsApp. Meta’s AI strategy fuels both revenue growth and user retention.

Amazon’s AI Ecosystem

Amazon integrates AI across all core verticals:

AI is central to both firms’ futures, and any investor evaluating Facebook Amazon stock must consider how each leverages this technology.

Risk Assessment and Volatility

Each company faces different challenges that affect investment risk.

Meta:

- Regulatory scrutiny over privacy and ad targeting.

- High CAPEX in metaverse/AI projects.

- Execution risk if metaverse fails to gain traction.

Amazon:

- Supply chain cost pressures.

- AWS growth normalization.

- Competition in e-commerce and cloud markets.

AI exposure introduces unique volatility as well. Meta’s future hinges on monetizing innovation; Amazon must scale AI profitably within AWS.

FAANG Stocks Comparison: Meta vs Amazon Stock Breakdown

Within the FAANG stocks comparison framework, Meta and Amazon offer two distinct investment profiles:

- Meta aligns with high-margin, high-volatility profiles.

- Amazon remains a safer, diversified compounder.

The shift in 2025 of both companies toward a blended growth/value classification in Russell indices reflects their evolving maturity. This matters for style-based portfolio strategies.

Growth Stocks Analysis: Performance Metrics & Earnings Trends

Meta’s growth is powered by global ad demand, Reels monetization, and AI innovation.

Amazon’s drivers include:

- Expanding AWS client base.

- Subscription ecosystem growth.

- Retail sales recovery.

Analysts forecast Meta reaching $750 and Amazon $248 in the next 12 months, depending on AI impact and macro conditions.

Technology Investment Comparison: Which Tech Titan Leads in 2025?

When conducting a technology investment comparison, here’s a breakdown:

| Factor | Meta | Amazon |

|---|---|---|

| Innovation Focus | Metaverse, AR/VR, AI Ads | AI logistics, cloud AI, personalization |

| Revenue Mix | 97% ads | 60% retail, 30% AWS |

| International Expansion | Steady | Aggressive |

| Analyst Sentiment | Mixed to positive | Broadly positive |

Meta’s innovation is bolder but riskier. Amazon’s focus on utility-driven AI makes its business more resilient.

Portfolio Allocation Strategies

| Investor Type | Strategy |

|---|---|

| Conservative | Higher Amazon weight for stability |

| Balanced | Equal weight Meta and Amazon |

| Growth-Oriented | Overweight Meta, tactical Amazon |

Both are integral to tech-heavy portfolios. Use Pocket Option’s demo account or dashboard tools to simulate allocations and market reactions.

Long-Term Outlook: Strategic Paths Beyond 2025

- Meta could lead the next social/advertising revolution if AI/AR/VR strategies succeed.

- Amazon is poised to remain essential infrastructure, especially via AWS and AI‑powered commerce.

Your decision in the Meta vs Amazon stock debate hinges on balancing innovation exposure with financial predictability.

Real Trader Feedback on Pocket Option

Isabella R., trader: “I use Pocket Option to follow both Meta and Amazon. The charts and tools help me decide entry points based on earnings and news.”

Derek L., investor: “Pocket Option gives me the flexibility to test strategies without risking real capital. Perfect for comparing FAANG stocks.”

Mikael T., day trader: “Meta’s volatility gives me more short-term action. Amazon is my safe play. I track them both with Pocket Option’s trading signal bot.”

FAQ

Which performed better historically: Meta or Amazon stock?

Historical performance varies by timeframe. Over the past decade, Amazon has generally outperformed Meta, but there have been periods where Meta showed stronger returns. Recent years have seen more volatility in both stocks with changing market conditions.

Are dividends offered by either Meta or Amazon?

Neither Meta nor Amazon currently offers regular dividends to shareholders. Both companies reinvest profits into business growth, research, and development rather than distributing earnings as dividends.

Which stock is more affected by interest rate changes?

Meta stock tends to be more sensitive to interest rate changes than Amazon. As a growth-oriented tech company with higher valuations, Meta often experiences more significant price movements when interest rate expectations shift.

Is Meta or Amazon stock more suitable for beginning investors?

Amazon stock is often considered more suitable for beginning investors due to its diversified business model across multiple sectors, which typically results in less volatility. However, individual investment goals and risk tolerance should guide this decision.

What are the minimum amounts needed to invest in Meta or Amazon stocks?

The minimum investment depends on current share prices and whether your broker offers fractional shares. Without fractional shares, you'll need enough to purchase at least one complete share. Many platforms like Pocket Option now offer fractional investing, allowing you to start with smaller amounts.

What are Meta vs Amazon stock differences?

Meta focuses on social media and digital advertising, while Amazon dominates e-commerce and cloud computing. Their revenue sources, growth models, and risk profiles differ significantly.

Which is better META or AMZN investment?

Meta offers higher margins and innovation potential; Amazon delivers steady performance and revenue diversity. The best pick depends on your risk tolerance and strategy.

How do social media and e-commerce stocks compare?

Social media stocks (like Meta) tend to have higher margins and more volatility, while e-commerce stocks (like Amazon) often provide steadier revenue and broad utility.

Should I diversify between Meta and Amazon?

Yes. Diversifying between Meta and Amazon balances innovation and stability, especially in tech-heavy portfolios.

CONCLUSION

When it comes to Meta vs Amazon stock, there’s no one-size-fits-all answer—only the right choice for your investment goals. Meta offers bold innovation through AI, the metaverse, and high-margin digital advertising. Amazon delivers unmatched business diversification, long-term resilience through AWS, and consistent performance in e-commerce and cloud services. 👉 Whether you're just starting out or optimizing your tech portfolio, now's a great time to explore both stocks and make your move with confidence.

Try Pocket Option today!