- 5G Monetization Pressure: Operators globally are racing to turn 5G investments into revenue. Watch for B2B solutions and enterprise segments.

- Infrastructure Sharing: Tower and fiber infrastructure sharing is rising to lower CapEx and improve ROI.

- AI and Automation: Telecoms increasingly adopt AI for network optimization, cost control, and customer service efficiency.

- Regulatory Shifts: Government controls over spectrum, data privacy, and foreign investment continue to evolve, especially in India, the EU, and the US.

BSNL Stock Investment Guide: Availability, Alternatives & Opportunities

Interest in BSNL stock continues to surge as investors explore India's evolving telecommunications sector. While BSNL remains a state-owned giant without a stock market listing, understanding its position — and the broader telecom landscape — can help investors make informed decisions. This guide not only addresses whether BSNL stock is available but also explores viable telecom investment alternatives, platform options, and sector dynamics in 2025.

Article navigation

- 2025 Telecom Sector Analysis: Trends Shaping Investment

- Understanding BSNL: The PSU Behemoth Behind the “BSNL Stock” Question

- The Core Misconception: Is BSNL Listed on Any Stock Exchange?

- 📡 Broader Telecom Sector Alternatives in 2025

- The Ghost of BSNL Privatization: A History of Speculation

- The Investor’s Pivot: Finding Telecom Opportunities Beyond BSNL

- 💼 Comparing Platforms to Access Telecom Stocks

- How to Analyze Telecom Sector Stocks: A Pro’s Framework 📊

- The Pocket Option Advantage: Modern Tools for Telecom Investment

- Future Scenarios: Could BSNL Stock Ever Become a Reality?

- Expert Insights & Risk Management in Telecom Investing

BSNL Stock: An Investor’s 2025 Guide to a Non-Listed Telecom Giant

For years, investors have been intrigued by the prospect of BSNL stock. The sheer scale of Bharat Sanchar Nigam Limited (BSNL), a household name in India, makes it a tantalizing subject for anyone interested in telecom stock investment. Frequent searches for “BSNL stock availability” and “is BSNL listed” highlight a significant information gap in the market. This definitive guide will not only clarify BSNL’s current market status but also provide a professional framework for evaluating the broader telecommunications sector, revealing how investors can strategically engage with this dynamic industry even without direct access to BSNL shares.

BSNL, a state-owned enterprise (PSU), has been a cornerstone of India’s communication network since its inception in 2000. Its vast infrastructure and legacy presence are undeniable. However, its corporate structure is fundamentally different from the publicly traded companies that investors typically analyze and trade on platforms. Understanding this distinction is the first step toward making informed telecommunications investment decisions.

2025 Telecom Sector Analysis: Trends Shaping Investment

These trends affect stock performance across telecom subsectors and help shape long-term investment potential.

Understanding BSNL: The PSU Behemoth Behind the “BSNL Stock” Question

Bharat Sanchar Nigam Limited operates as a Public Sector Undertaking (PSU) wholly owned by the Government of India. This is the single most critical fact for any potential investor. Unlike private-sector counterparts like Bharti Airtel or Vodafone Idea, which are listed on stock exchanges and have their shares traded daily, BSNL’s equity is not available to the public.

This makes the category of Indian PSU stocks interesting; while many PSUs like State Bank of India or Life Insurance Corporation (LIC) are listed and actively traded, BSNL remains an exception. Its role has historically been viewed as a strategic national asset for providing connectivity across the length and breadth of India, including in regions where private operators might find it unprofitable.

According to a report by the Department of Investment and Public Asset Management (DIPAM), the government’s strategy for PSUs varies, with some slated for strategic disinvestment and others retained for national interest. BSNL has, so far, remained firmly in the latter category.

The Core Misconception: Is BSNL Listed on Any Stock Exchange?

Let’s address the central question directly: BSNL is not listed on any stock exchange, neither the National Stock Exchange (NSE) of India nor the Bombay Stock Exchange (BSE). Therefore, you cannot find a “BSNL stock name” or ticker symbol to trade it on any brokerage platform, including Pocket Option.

This reality often surprises investors. To clarify the difference, here’s a structural comparison:

| Company Aspect | BSNL (Bharat Sanchar Nigam Limited) | Publicly Listed Telecom Company (e.g., Bharti Airtel) |

|---|---|---|

| Ownership Structure | 100% owned by the Government of India. | Owned by public shareholders, promoters, and institutional investors. |

| Stock Exchange Listing | Not listed on any stock exchange. | Listed on major exchanges (e.g., NSE, BSE). |

| Investment Access | No direct public equity investment possible. | Shares can be bought and sold freely via brokerage platforms. |

| Primary Goal | Providing nationwide telecom services as a strategic asset. | Maximizing shareholder value and profitability. |

| Financial Reporting | Publishes reports, but not driven by quarterly market expectations. | Must adhere to strict quarterly reporting standards set by regulators. |

This table clearly illustrates why searches for BSNL stock end in a dead end. Its function as a government entity supersedes the commercial objectives that necessitate a public listing.

📡 Broader Telecom Sector Alternatives in 2025

In addition to stocks and ETFs, investors can explore these telecom-related opportunities:

- Telecom REITs (e.g., American Tower, Brookfield India Real Estate Trust) — Focused on passive income via infrastructure ownership.

- Tech-Telecom Convergence Stocks — Companies like Cisco, Ericsson, or Nvidia that support network modernization and 5G rollout.

- Regional Growth Players — Smaller telecom firms in emerging markets (e.g., Indonesia, Brazil) showing strong subscriber growth and digital expansion.

The Ghost of BSNL Privatization: A History of Speculation

The persistent interest in BSNL stock is largely fueled by recurring discussions about BSNL privatization. Over the past two decades, various government panels and officials have floated the idea of a partial stake sale or an Initial Public Offering (IPO).

Revival Packages: In 2019 and again in 2022, the Indian government announced significant revival packages for BSNL, amounting to billions of dollars. These packages included measures for network modernization, 4G spectrum allocation, and debt restructuring. While these discussions sometimes mentioned future disinvestment, no concrete timeline for an IPO has ever been confirmed.

As a leading telecom analyst noted in The Economic Times, “Privatizing BSNL is a Herculean task. It involves untangling decades of legacy systems, managing a massive workforce, and valuing its extensive but aging infrastructure. While the potential is there, the political and operational will required is immense.” This expert opinion underscores the speculative nature of any potential listing.

The Investor’s Pivot: Finding Telecom Opportunities Beyond BSNL

Since direct investment in BSNL is impossible, the savvy investor must pivot. The global telecommunications market is vast and filled with opportunities. This is where a versatile platform like Pocket Option becomes an invaluable tool. While you can’t buy BSNL, you can access a wide array of other assets to build a robust portfolio.

Here are the primary alternatives for investors seeking exposure to the telecom sector stocks:

- Major Listed Telecom Companies: Invest directly in the equity of established players in India (like Reliance Industries/Jio, Bharti Airtel) or global giants (like AT&T, Verizon, Deutsche Telekom).

- Telecommunications ETFs: Exchange-Traded Funds (ETFs) like the iShares Global Comm Services ETF (IXP) provide diversified exposure to dozens of telecom and communication companies in a single trade, reducing company-specific risk.

- Infrastructure Companies: Consider companies that own the physical infrastructure, like tower companies (e.g., Indus Towers) or fiber optic network providers. These often operate like real estate and can offer stable, dividend-paying returns.

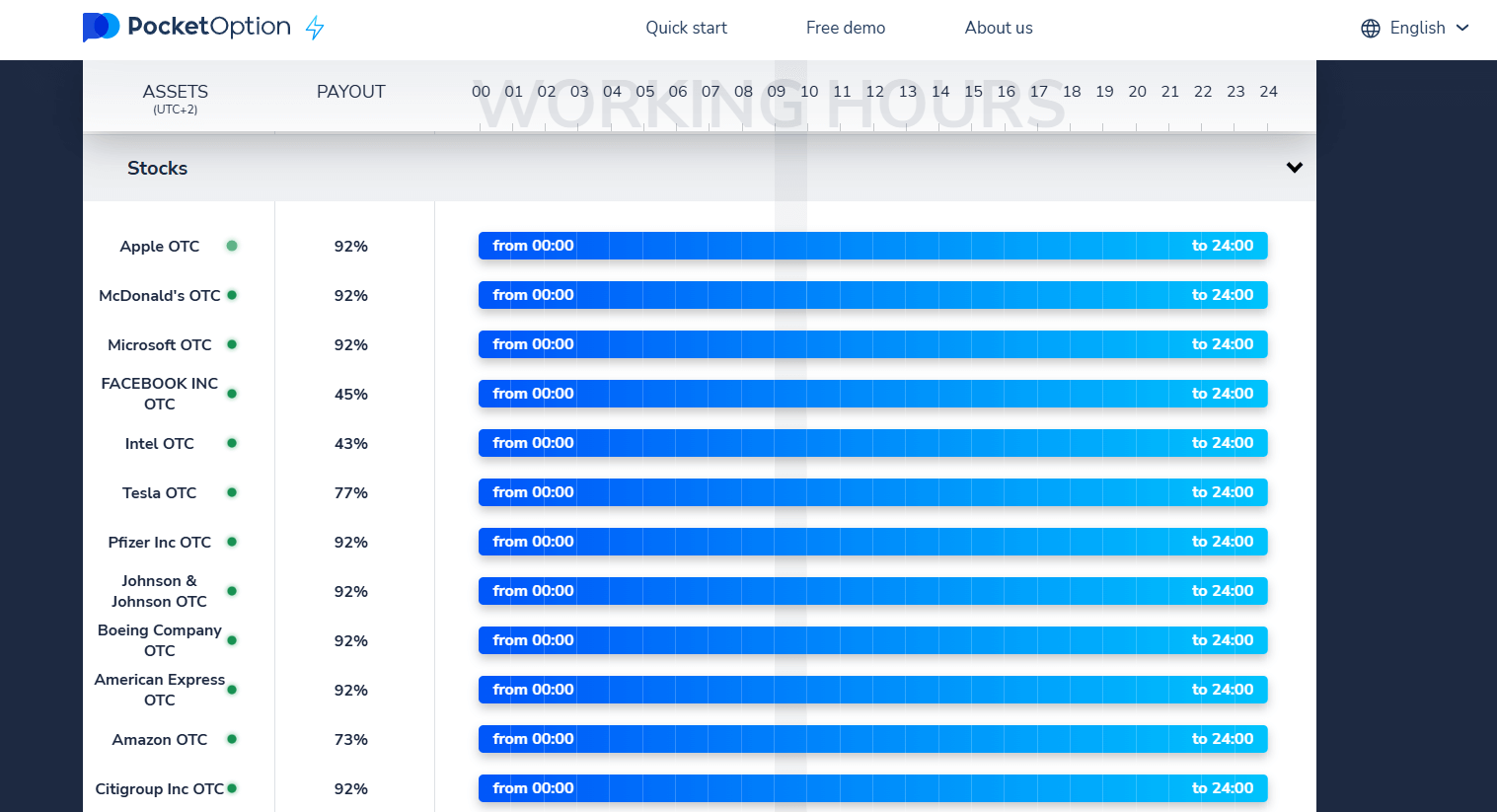

With Pocket Option, you can explore many of these avenues. Even if a specific stock isn’t listed, the platform’s access to over 100+ assets, including OTC (Over-The-Counter) stocks, allows you to trade a diverse range of companies 24/7. This flexibility is key to capitalizing on market movements whenever they happen.

💼 Comparing Platforms to Access Telecom Stocks

| Platform | Strengths | Ideal For |

|---|---|---|

| Pocket Option | 100+ assets, 24/7 OTC trading, demo account, AI tools | Short-term trading strategies |

| Zerodha (India) | Direct access to Indian listed telecoms via NSE/BSE | Long-term equity investments |

| eToro | Global telecom ETFs and copy trading | Beginners wanting global diversification |

| Interactive Brokers | Access to telecom stocks, ETFs, REITs worldwide | Advanced investors, institutional style |

Pocket Option stands out for flexible short-term trading, while other platforms are better suited for long-term equity positions or ETF diversification.

How to Analyze Telecom Sector Stocks: A Pro’s Framework 📊

Shifting your focus from the unavailable BSNL stock to tradable telecom sector stocks requires a solid analytical framework. This sector has unique Key Performance Indicators (KPIs) that every investor must understand.

| Key Performance Metric | Why It’s Important | How to Analyze It |

|---|---|---|

| Average Revenue Per User (ARPU) | The primary measure of a telecom’s ability to monetize its user base. Higher ARPU is better. | Track the quarterly trend. Compare it against direct competitors. According to TRAI data, Indian ARPU has been rising post-consolidation, a positive sign for the sector. |

| Subscriber Growth Rate | Indicates market share expansion and customer acquisition success, especially in high-value segments like postpaid and 5G. | Look at both the net additions per quarter and the quality of subscribers being added (e.g., 4G/5G users vs. 2G). |

| Debt-to-EBITDA Ratio | The telecom sector is capital-intensive. This ratio shows how well a company can service its debt. A ratio below 3x is generally considered healthy. | Compare the current ratio to the company’s historical levels and industry averages. High debt can be a major red flag. 🚩 |

| Capital Expenditure (CapEx) | Shows how much the company is investing in its future, particularly in network modernization and 5G rollout. | Analyze the CapEx-to-revenue ratio. High investment is necessary, but it must lead to future revenue growth to be effective. |

Mastering these metrics is crucial for any serious telecommunications investment strategy.

The Pocket Option Advantage: Modern Tools for Telecom Investment

Navigating the complexities of telecom stock investment is easier with the right tools. While the search for BSNL stock may be fruitless, your journey into the markets can be highly empowered. Pocket Option is designed for both novice and experienced traders, offering a suite of features that provide a distinct edge.

- Low Barrier to Entry: Start your trading journey with a minimal deposit of just $5 and practice risk-free with an unlimited demo account.

- Automated & Social Trading: Leverage technology with AI Trading algorithms or use Social Trading to copy the strategies of proven, successful traders. It’s a fantastic way to learn and potentially profit simultaneously. 🤝

- Constant Engagement: Compete in Tournaments to test your skills and win prizes, and boost your trading capital with generous Bonuses and Promo Codes.

- Trade On Your Terms: The Mobile App ensures you never miss an opportunity. Whether you have a minute in a taxi or a break at work, you can execute a trade anytime, anywhere. 📱

- Expert Support: Get guidance from a Signal Telegram Bot and rely on extensive Learning Materials and 24/7 Customer Support to build your confidence and expertise.

These features transform trading from a passive activity into an interactive, supported, and highly accessible experience.

Future Scenarios: Could BSNL Stock Ever Become a Reality?

For long-term watchers, the question remains: what could change BSNL’s status? While purely speculative, here are a few potential scenarios:

- Strategic Disinvestment: The government could sell a minority stake (e.g., 25%) to a strategic partner to inject capital and private-sector efficiency.

- Initial Public Offering (IPO): A full-fledged IPO could be launched as part of a broader government disinvestment strategy to raise funds and unlock value.

- Merger or Consolidation: BSNL could be merged with another state-owned telecom entity, MTNL, and the combined entity could be restructured for a future listing.

- Continued PSU Status: The most likely scenario in the short-to-medium term is that BSNL will remain 100% government-owned, focusing on its national strategic role, especially in expanding 5G to rural areas.

Investors should monitor official announcements from the Department of Telecommunications (DoT) and DIPAM rather than relying on market rumors.

Expert Insights & Risk Management in Telecom Investing

Investing in telecommunications is not without risk. A senior market strategist at a global investment firm recently commented, “The global telecom landscape is defined by a fierce battle for 5G dominance, regulatory headwinds, and immense capital requirements. Investors should prioritize companies with strong balance sheets, clear monetization strategies for their 5G investments, and growing enterprise business segments.”

Here are key risks to manage in your telecom stock investment portfolio:

- Regulatory Risk: Government policies on spectrum auctions, pricing caps, and competition can change, impacting profitability.

- Technological Risk: The constant need to upgrade from 4G to 5G and beyond means that companies who fail to invest wisely can quickly become obsolete.

- Competition Risk: Price wars are common in the telecom sector and can severely erode margins and ARPU.

A diversified approach, easily managed on a platform like Pocket Option, is a sound risk mitigation strategy. By not putting all your capital into a single stock, you can better weather sector-specific volatility.

FAQ

Is BSNL stock available for trading?

No, BSNL stock is not available for trading. As of 2025, BSNL is a fully government-owned public sector enterprise and is not listed on any stock exchange.

Why isn't BSNL listed on stock exchanges?

BSNL is a strategic state-owned enterprise (PSU) under the Department of Telecommunications. Its role in national infrastructure, especially in underserved regions, has kept it outside of privatization plans. Therefore, it has no ticker symbol and is not publicly traded.

What are alternatives to BSNL stock investment?

Investors can consider listed telecom companies like Bharti Airtel, Reliance Jio (via Reliance Industries), or global giants like AT&T and Verizon. Other options include telecom ETFs, infrastructure REITs, and 5G-related tech firms.

Can I invest in BSNL through other companies?

Not directly. However, companies involved in BSNL’s infrastructure projects, such as fiber providers or tower operators (e.g., ITI Limited, Indus Towers), may offer indirect exposure to BSNL’s operational ecosystem.

What telecom stocks are available for trading?

You can trade telecom stocks such as Bharti Airtel, Reliance Industries (which owns Jio), and Vodafone Idea in India, as well as international companies like AT&T, Verizon, and Deutsche Telekom. These stocks are available on major trading platforms and some OTC services, including Pocket Option.

Will BSNL ever go public?

Possibly — but there's no confirmed plan or timeline. The Indian government has occasionally discussed strategic disinvestment or IPO, but BSNL’s status as a national service provider makes this a long-term and uncertain scenario.

Conclusion: A Strategic Approach to a Dynamic Sector

The quest for BSNL stock ultimately leads to a more important discovery: the vast and accessible world of telecom sector stocks. While BSNL remains a non-listed, government-owned entity, the principles of sound investment--thorough analysis, strategic diversification, and risk management--are universal. By understanding the key metrics that drive the telecom industry and leveraging the powerful, user-friendly tools offered by platforms like Pocket Option, any investor can build a well-informed strategy. From a low-cost entry point to advanced AI and social trading features, the resources are available to turn market analysis into decisive action. The telecommunications sector is at the heart of the modern digital economy. By focusing on fundamentally strong, publicly traded companies, investors can effectively participate in its long-term growth story.

Open Your Demo Account