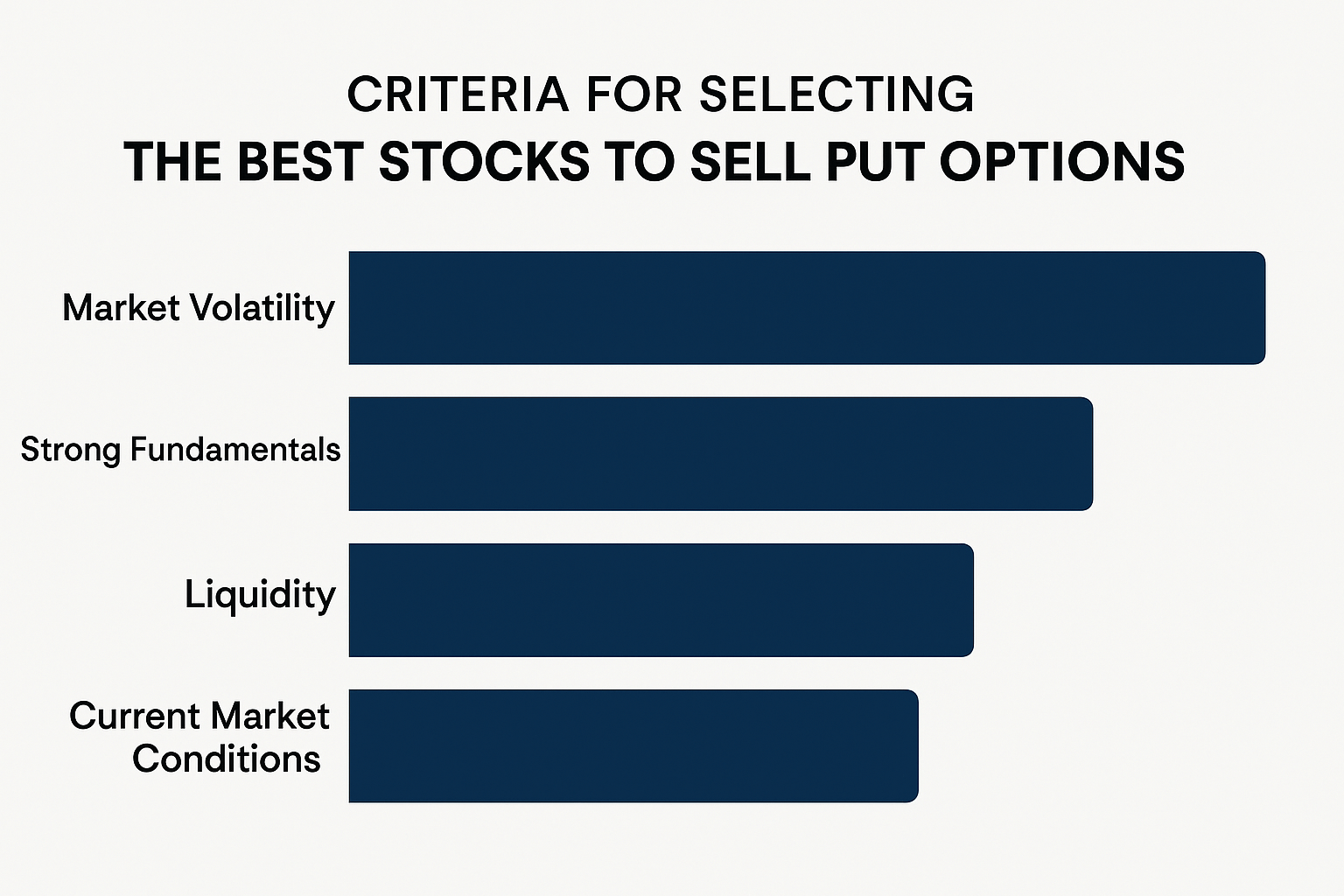

- Market Volatility: Moderate, predictable volatility leads to higher premiums without exposing traders to excessive risk.

- Strong Fundamentals: Choose companies with solid earnings, low debt, and a stable outlook.

- Liquidity: High daily trading volumes ensure better bid-ask spreads for options.

- Sector Stability: Defensive or leading sector stocks can reduce downside risk.

Best Stocks to Sell Puts on 2025 for Steady Premium Income

Selling put options is a powerful way to earn steady income and potentially buy quality stocks at lower prices. This strategy works best in bullish or neutral markets, especially when focused on the best stocks to sell puts. In this article, you'll learn how to apply it effectively in 2025 and beyond.

Article navigation

Understanding the Strategy of Selling Put Options

Selling put options is one of the best income-generating strategies for bullish investors. When done right, it allows traders to collect premium income upfront by obligating themselves to buy a stock at a specific price. This technique works best in stable or rising markets and is widely used by professionals — even Warren Buffett has employed this method. In fact, investors often ask: what are the best stocks to sell puts to maximize income and minimize downside risk? We’ll explore that — and more — in this expert article.

Put selling, especially through cash-secured puts, is a strategic approach for those looking to potentially acquire stocks at lower prices while generating consistent income. The key to success lies in selecting the best stocks to sell puts, analyzing volatility, and understanding strike price positioning.

What Is a Put Option?

A put option is a financial contract that gives the buyer the right (but not the obligation) to sell 100 shares of a stock at a predetermined strike price before expiration. When you sell a put, you agree to potentially buy those shares at the strike price — in exchange for a premium upfront.

Expert Insight:

“When I sell puts, I’m targeting companies I’d love to own anyway. The premium gives me yield, and if I get assigned — I get them at a discount.” — Todd Gordon, Founder of Inside Edge Capital

Criteria for Selecting the Best Stocks to Sell Put Options

When identifying the best stocks for selling put options, consider the following factors:

Cash-Secured Puts Explained

When you sell a cash-secured put, you’re setting aside enough capital to buy 100 shares of the stock at the strike price, should the option be exercised. It’s a conservative way to generate income and potentially buy into stocks you already want — at a discount.

Top Picks: Best Stocks to Sell Puts on 2025

Here are top candidates for selling weekly cash-secured puts in 2025 based on fundamentals and option market behavior:

Apple Inc. (AAPL)

- Pros: Global brand dominance, recurring revenue, strong balance sheet

- Cons: High valuation, macro sensitivity

Microsoft Corp. (MSFT)

- Pros: Cloud leadership, consistent earnings, wide moat business model

- Cons: Increasing regulatory headwinds

Tesla Inc. (TSLA)

- Pros: EV industry leader, technological edge

- Cons: High implied volatility, cyclical production

Johnson & Johnson (JNJ)

- Pros: Diversified healthcare, steady dividends, strong R&D

- Cons: Legal liabilities, slower innovation pace

Amazon.com Inc. (AMZN)

- Pros: E-commerce and cloud dual-engine growth, logistics leadership

- Cons: Low margins, antitrust scrutiny

Interesting Fact

Selling puts can be a win-win. If the stock stays above the strike price, you keep the full premium. If it drops, you buy a quality stock at a lower effective price. That’s why long-term investors often consider this strategy for acquiring shares they already want to hold. In fact, the best stocks to sell put options are often those investors believe in for the next decade.

Cash Secured Put Example

Let’s say AAPL trades at $150. You sell a $145 put expiring in 1 week, collecting a $2.50 premium per share. If AAPL stays above $145, you keep the premium. If it drops to $140, you’re assigned the stock at $145, but your effective cost basis is $142.50.

Choosing the Right Strike and Expiration

For safer outcomes, sell puts 5–10% below the current price (OTM) with expirations of 7 to 30 days. Weekly options offer faster income turnover, while monthly contracts may provide higher premiums with less trading overhead.

Risk Management and Considerations

Even with the best stocks for selling put options, risk control is crucial:

- Macro Trends: Monitor economic indicators and earnings calendars

- Diversification: Don’t sell puts on too many stocks in the same sector

- Strike Distance: Favor OTM (out-of-the-money) strikes for safety margin

Risks of Selling Cash-Secured Puts

While the strategy is safer than naked puts, it still carries risk. If the stock drops significantly below the strike price, you could end up buying it at a loss. Always be ready to own the stock long-term — or set a clear exit plan to manage assignment risk.

Expert Recommendation:

“When volatility spikes, premiums jump. I wait for those moments — especially around macro events — to lock in better yield.” — Chloe Tran, options strategist at MarketGenius

2025 Outlook for Put Sellers

With moderate inflation, rising interest rates, and sector rotation from tech into value, 2025 presents unique opportunities for selling puts. Sectors like healthcare, consumer staples, and AI infrastructure are expected to offer strong support zones and premium potential.

Comparison: Selling Puts vs. Buying Calls

Both are bullish, but selling puts provides upfront cash and controlled risk, while buying calls offers leverage but higher chance of loss. If you prefer consistent income over speculative upside, selling puts is the clear choice.

Options Glossary:

- Premium — the income received from selling the put.

- Strike Price — the price at which you might be obligated to buy the stock.

- Expiration Date — the deadline by which the option can be exercised.

- OTM (Out-of-the-Money) — strike price is below the current stock price.

- Assignment — when you’re required to buy the stock at the strike price.

Unlocking Potential with Strategic Put Selling in 2025

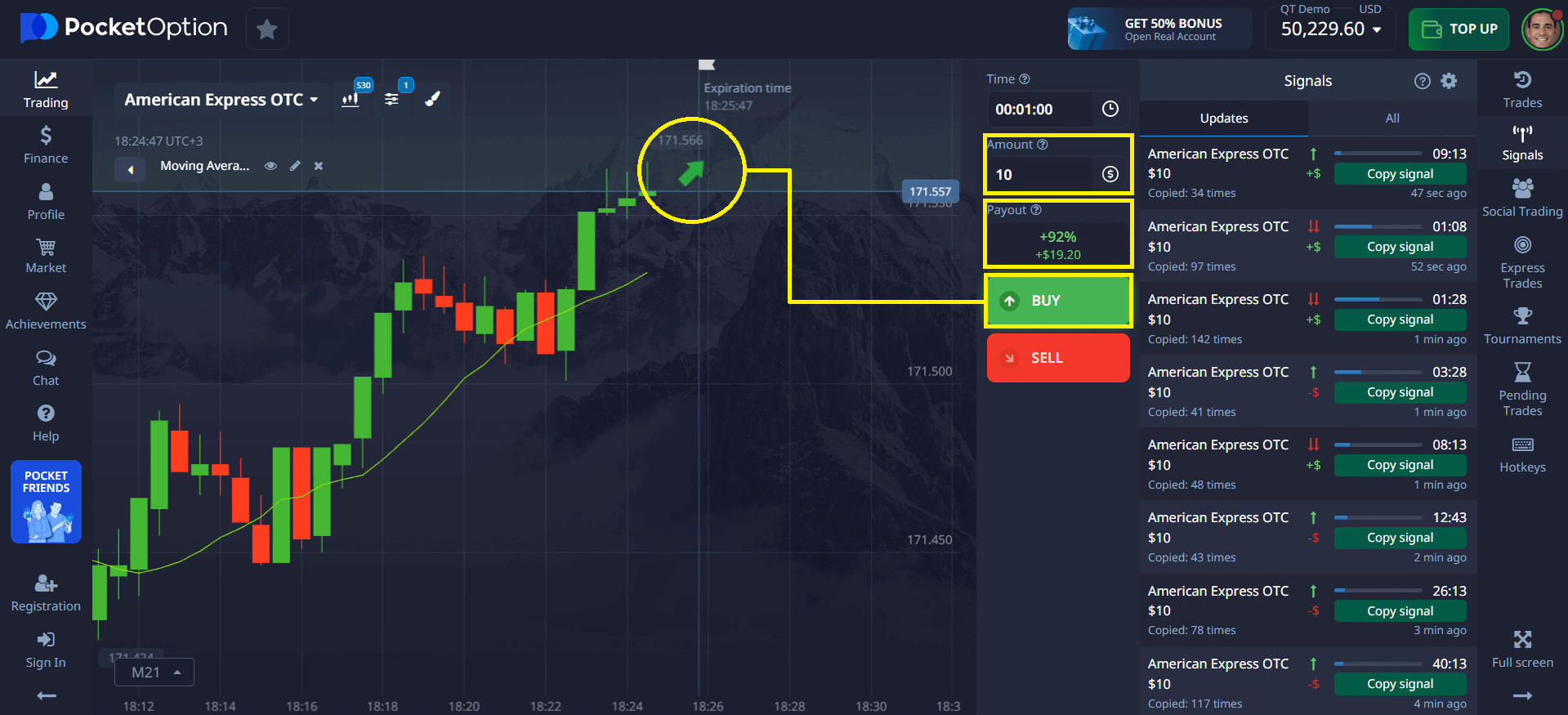

To summarize, the best stocks to sell puts today and beyond are typically large-cap, liquid, and fundamentally strong companies. Investors using this approach can benefit from premium income while building long-term positions more efficiently. Whether you’re selling puts for income or stock acquisition, platforms like Pocket Option can help simulate outcomes and reinforce decision-making — and you can discuss this topic with other users in our сommunity!

While Pocket Option offers a unique and simplified trading experience, it’s important to note that it doesn’t function like a traditional options market. You won’t be selling put options in the conventional sense. Instead, when you choose “Put” on the platform, you’re simply predicting that the asset’s price will go down — it’s a directional trade, not an options contract.

FAQ

Which stock is best for option selling?

Large-cap, low-volatility names like Apple, Microsoft, and Johnson & Johnson are widely considered among the best.

Is selling puts profitable?

Yes, especially when executed on quality stocks with solid fundamentals and managed risk. Premium income can compound returns significantly.

Does Warren Buffett use put options?

Yes. Buffett has sold long-dated puts in the past to acquire shares of companies he wanted to own at discounted prices.

What is the best strategy for selling put options?

Using cash-secured puts with a diversified portfolio, selecting out-of-the-money strikes on strong stocks, and selling during periods of higher implied volatility.

Is selling puts better than buying calls?

Selling puts is generally more suitable for investors with a neutral to bullish outlook, as it generates income with moderate risk. Buying calls offers higher potential returns but requires a strong bullish conviction and carries higher risk.