- Minimal Initial Capital: Investors can start with very low amounts and still diversify their portfolio.

- High Growth Potential: Early-stage AI companies can experience explosive stock price increases if their technology gains market traction.

- Access to Emerging Technologies: Many AI penny stocks under $1 are innovators in niches like machine learning, robotics, and AI cloud services.

- Market Entry Point: Enables new investors to enter the AI sector before stocks potentially rise above $1.

Discover the Best AI Stocks Under $1 in 2025: Top Picks, Insights, and Strategies

AI stocks under $1 have gained significant attention among investors looking to enter the booming artificial intelligence sector with minimal upfront capital. These ai penny stocks under $1 offer the chance to participate in one of the most transformative technologies shaping our future, while also carrying unique risks that must be managed carefully. In this article, we will explore the best ai stocks under $1 to invest in during 2025, analyze artificial intelligence stocks under $1 from different angles, and provide actionable advice on how to select and trade ai stocks to buy under $1 effectively.

Article navigation

- Understanding AI Stocks Under $1 and Their Growing Appeal

- Why Consider Investing in AI Penny Stocks Under $1?

- Key Factors When Choosing the Best AI Stocks Under $1

- What Are the Best AI Stocks to Invest In?

- What AI Stock Is Trading for $3?

- What Is the Best Stock Under $1?

- Strategies for Investing in AI Stocks to Buy Under $1

- The Role of Pocket Option in Trading AI Penny Stocks Under $1

- Conclusion

Understanding AI Stocks Under $1 and Their Growing Appeal

Artificial intelligence stocks under $1 are often referred to as penny stocks. These companies typically have smaller market capitalizations and are at earlier stages of development, making them volatile but with potential for rapid growth. As the global AI market is expected to reach $190 billion by 2025, the race to identify promising ai penny stocks under $1 intensifies.

For many retail investors, ai stocks under $1 represent an affordable way to access cutting-edge AI innovations without the need for large investments. However, investing in artificial intelligence stocks under $1 is not without challenges, including liquidity issues, limited financial data, and market speculation.

Why Consider Investing in AI Penny Stocks Under $1?

However, it is essential to balance these benefits with the inherent risks:

- High Volatility: Prices can swing dramatically on low volume, causing significant gains or losses.

- Limited Financial Transparency: Many companies may lack audited financials or consistent earnings.

- Liquidity Constraints: Difficulties in buying or selling large quantities without impacting price.

- Speculative Nature: Prices often driven by hype or rumors rather than fundamentals.

Key Factors When Choosing the Best AI Stocks Under $1

- Industry and Technology Trends: Focus on sectors within AI experiencing strong growth, such as machine learning algorithms, AI-powered robotics, natural language processing, and AI cloud platforms. Emerging trends like AI for healthcare, autonomous vehicles, and cybersecurity AI provide promising niches.

- Company Fundamentals: Analyze business models, management teams, partnerships, and intellectual property portfolios. Strong leadership with clear AI expertise often indicates better prospects.

- Financial Health: Review available financial reports, including revenue growth, cash flow stability, and research & development investment. Even limited data can hint at sustainability or future potential.

- Market Sentiment and News Flow: Track press releases, product launches, analyst reports, and investor forums. Positive momentum can drive ai penny stocks under $1 upward, while negative news may rapidly erode value.

What Are the Best AI Stocks to Invest In?

Here is a curated list of promising ai stocks under $1 to consider in 2025. Each has been selected based on their technology focus, recent market performance, and growth potential.

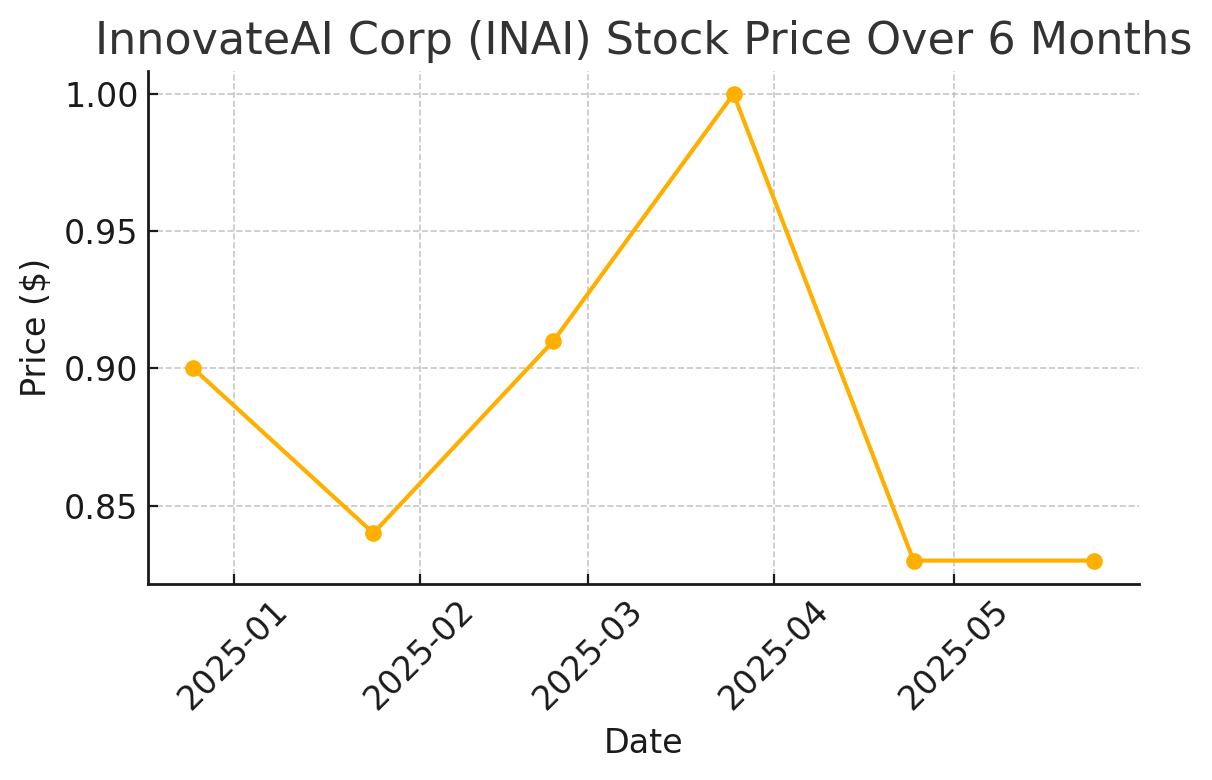

1. InnovateAI Corp (Ticker: INAI)

Price: ~$0.85

InnovateAI Corp specializes in AI-driven diagnostic tools for the healthcare sector. Their flagship machine learning platform analyzes medical images with accuracy comparable to specialists, aiming to revolutionize early disease detection. Recent partnerships with hospitals and healthcare providers have boosted market confidence.

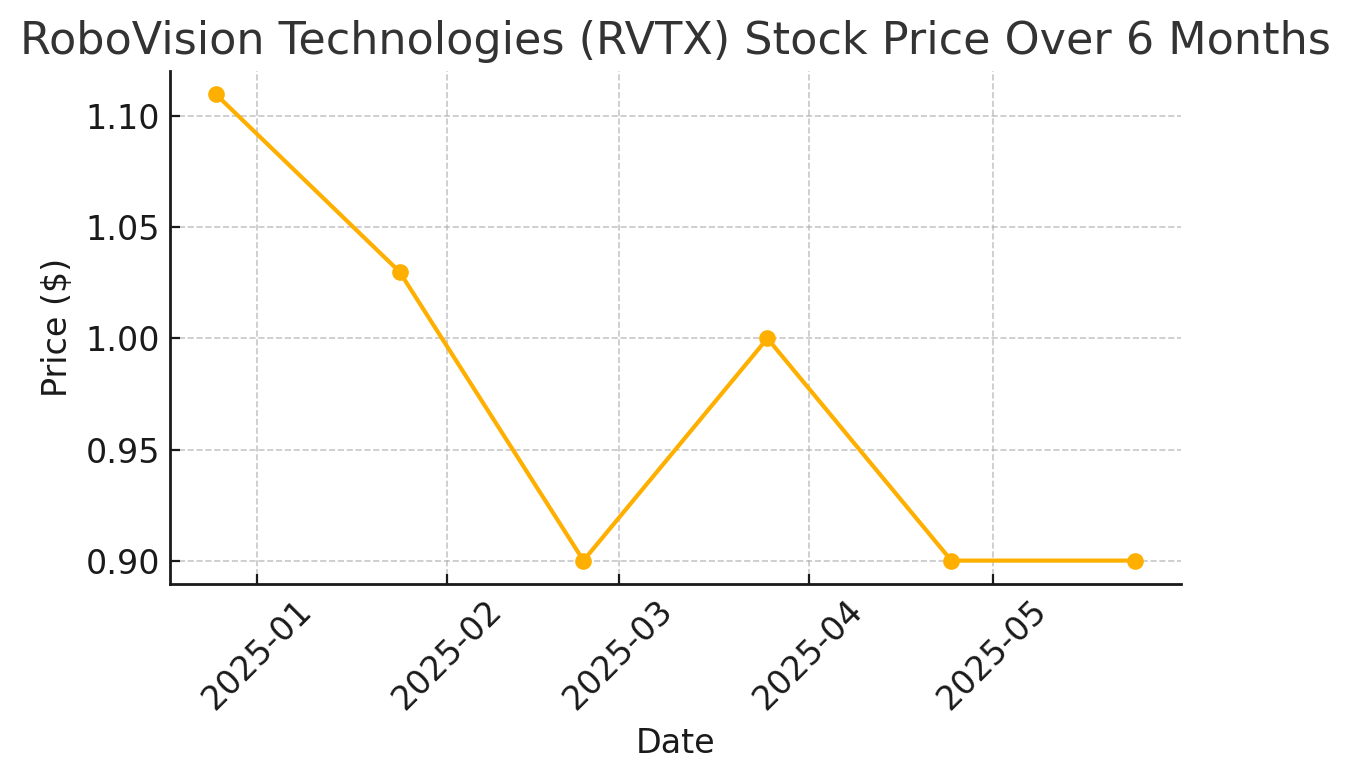

2. RoboVision Technologies (Ticker: RVTX)

Price: ~$0.95

RoboVision Technologies develops AI-powered robots for industrial automation. Their newest autonomous assembly line robots have attracted attention for improving production efficiency by over 30%. The company is expanding manufacturing contracts internationally.

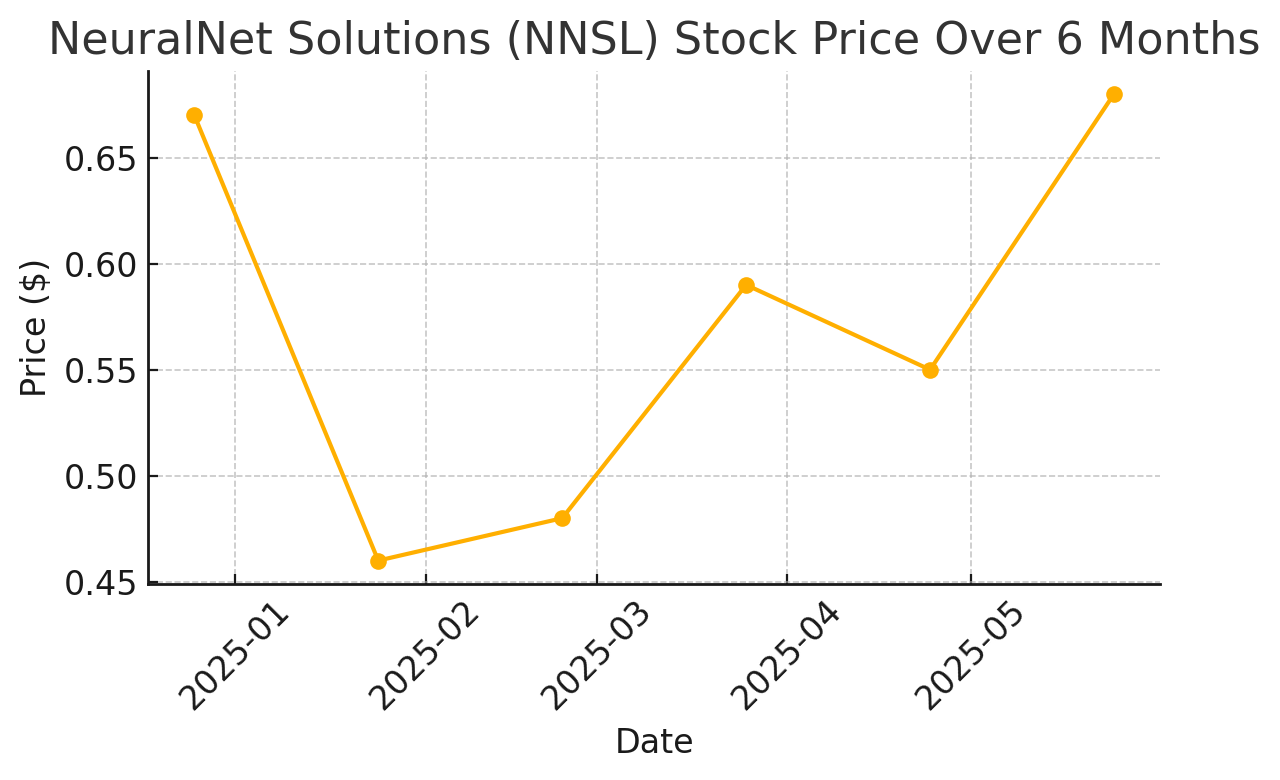

3. NeuralNet Solutions (Ticker: NNSL)

Price: ~$0.65

NeuralNet Solutions offers cloud-based neural network platforms enabling small businesses to integrate AI capabilities easily. Their subscription-based revenue model has shown steady growth, and upcoming product upgrades are expected to increase customer retention.

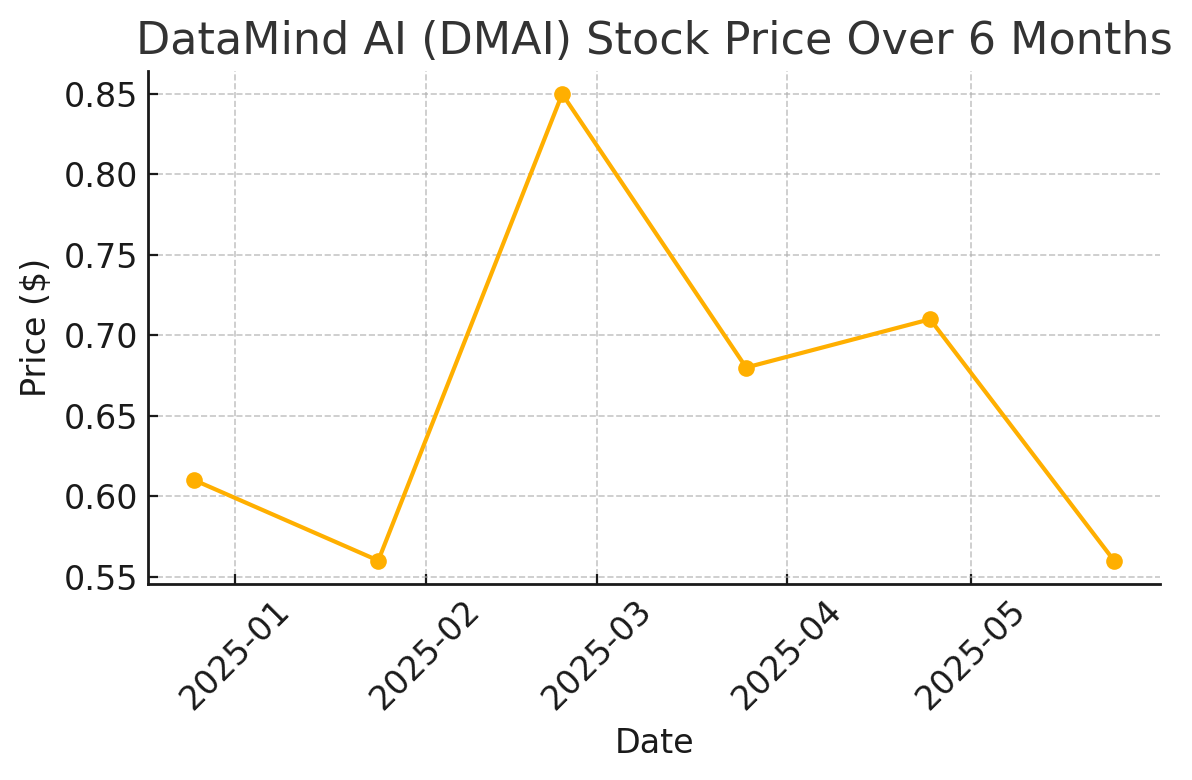

4. DataMind AI (Ticker: DMAI)

Price: ~$0.70

DataMind AI focuses on AI-driven big data analytics for marketing and sales optimization. Their AI tools help companies predict customer behavior and improve campaign effectiveness. Recently secured contracts with several mid-sized enterprises.

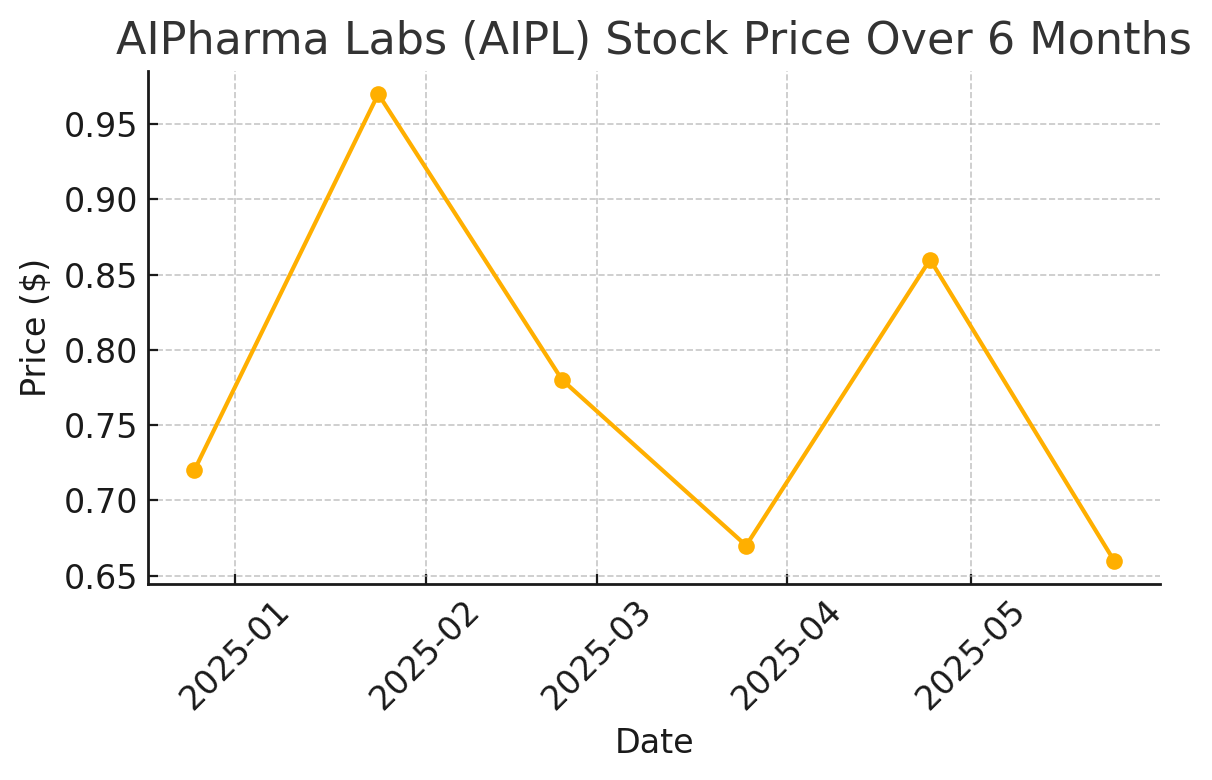

5. AIPharma Labs (Ticker: AIPL)

Price: ~$0.78

AIPharma Labs is a biotech-focused AI company leveraging artificial intelligence in the drug discovery process. By simulating millions of molecular interactions, their platform significantly reduces R&D timelines and costs. Recent breakthroughs in cancer treatment have generated interest among institutional investors.

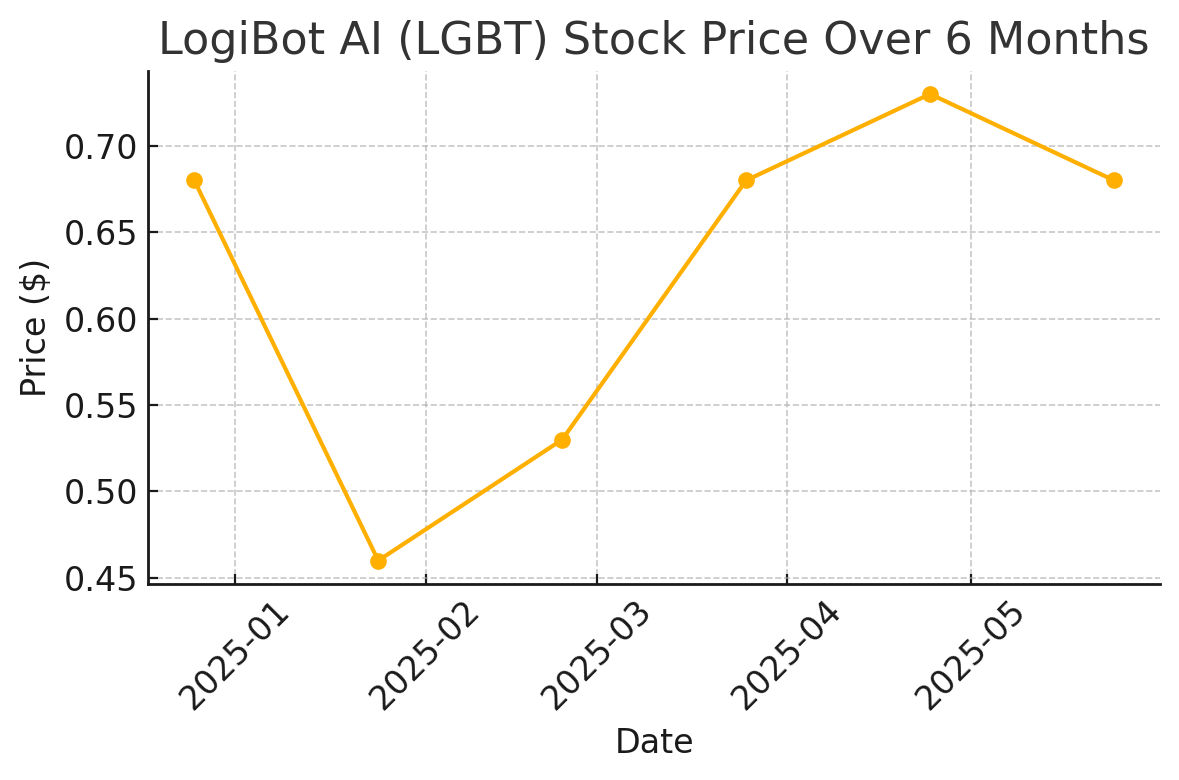

6. LogiBot AI (Ticker: LGBT)

Price: ~$0.66

LogiBot AI specializes in predictive logistics and smart supply chain automation using AI. Their real-time forecasting tools are already deployed by several logistics firms. Their scalable SaaS model has made them a disruptive force in the industry.

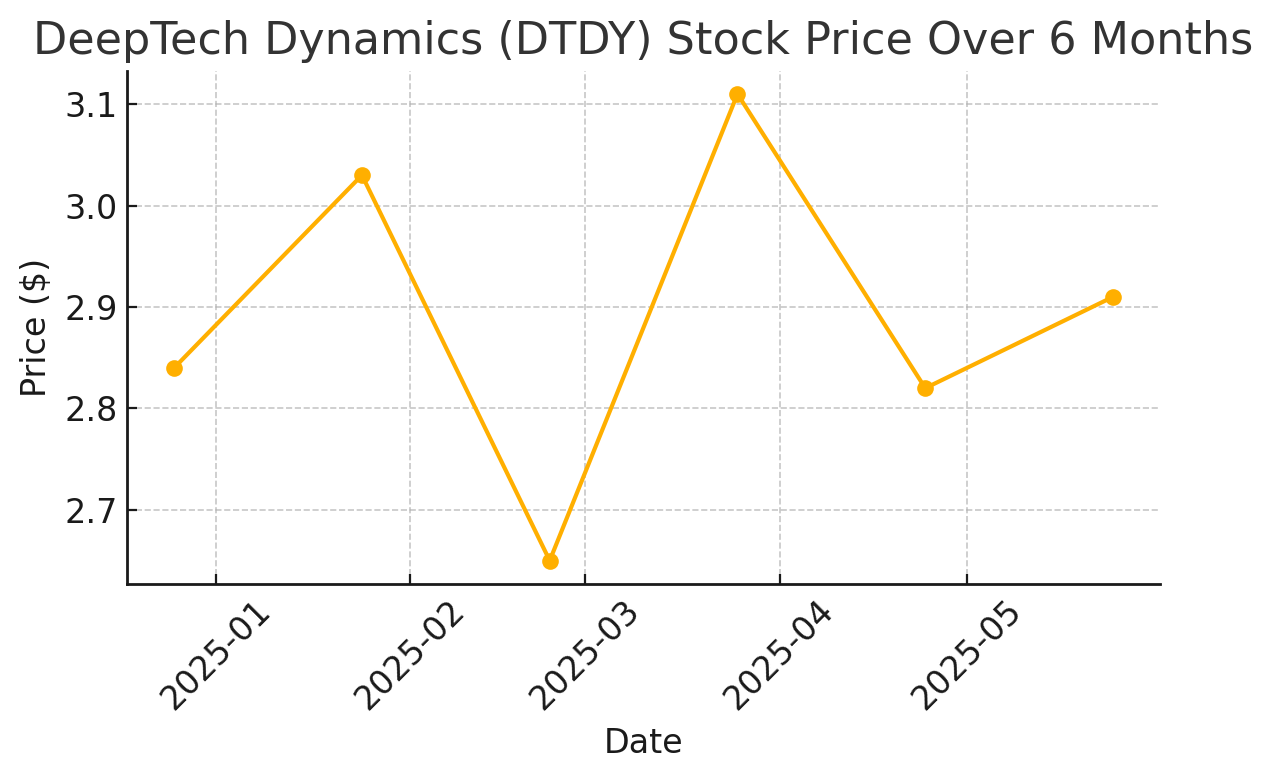

What AI Stock Is Trading for $3?

DeepTech Dynamics (Ticker: DTDY) currently trades around $3 and stands out as a more mature AI company specializing in cybersecurity solutions powered by AI. With increasing global cybersecurity threats, DeepTech Dynamics has benefited from heightened demand for proactive threat detection systems. The company reports growing revenue and strong margins, making it a relatively stable choice among AI stocks.

What Is the Best Stock Under $1?

Among ai stocks under $1, InnovateAI Corp is widely regarded as one of the best due to its innovative product pipeline and strategic healthcare partnerships. While it carries risks typical for penny stocks, its market niche and technology leadership position it well for future growth. Investors should, however, conduct due diligence and consider portfolio diversification to mitigate risks associated with any single stock.

Strategies for Investing in AI Stocks to Buy Under $1

- Diversification: Spread investments across multiple ai penny stocks under $1 to reduce exposure to company-specific risks.

- Long-Term Horizon: Maintain a long-term perspective to ride out volatility and capitalize on technological adoption trends.

- Regular Monitoring: Follow company updates, financial releases, and industry developments closely.

- Use Stop-Loss Orders: Protect your capital by setting stop-loss thresholds to limit downside during rapid price drops.

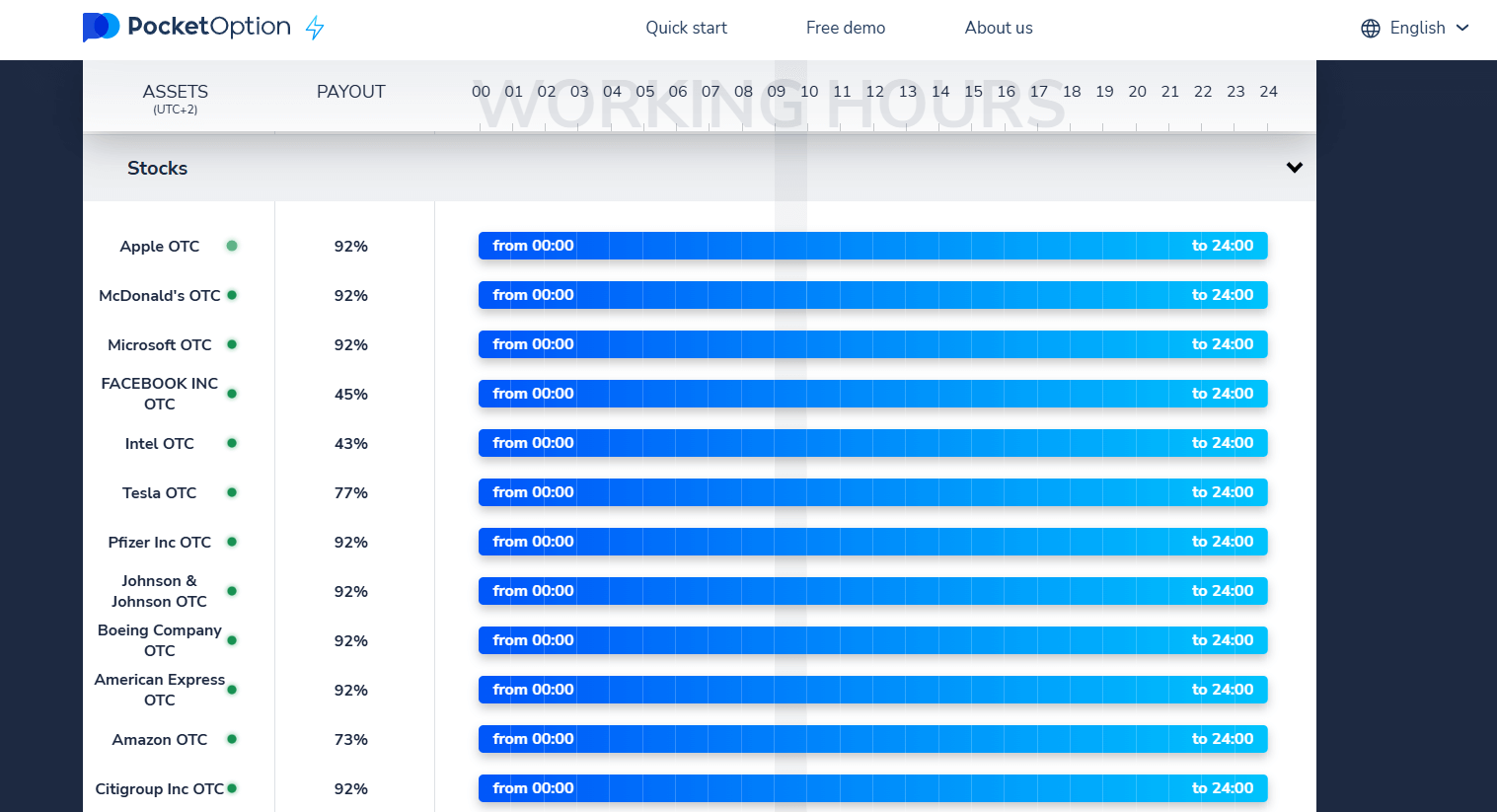

- Leverage Technology: Utilize trading platforms like Pocket Option, which offer real-time data, educational resources, and quick trade execution ideal for volatile penny stocks.

The Role of Pocket Option in Trading AI Penny Stocks Under $1

Pocket Option is a user-friendly platform that supports trading in a variety of markets, including ai stocks to buy under $1. It offers:

- Intuitive Interface: Easy navigation suitable for beginners and experienced traders alike.

- Fast Execution: Rapid order processing helps capitalize on quick market moves common with ai penny stocks under $1.

- Educational Tools: Tutorials and guides to enhance understanding of market dynamics and trading strategies.

- $50000 Demo Account: Allows practicing trading ai stocks under risk-free before committing real funds.

Conclusion

Investing in ai stocks under $1 presents a promising but challenging opportunity. With careful research, strategic diversification, and the right tools like Pocket Option, investors can navigate the volatility and potentially benefit from the transformative growth of artificial intelligence technologies. Remember to stay informed, monitor market trends, and manage risks prudently to maximize your chances of success in this exciting sector.

FAQ

What makes investing in AI stocks under $1 appealing?

These investments provide an economical entry into the burgeoning AI sector, offering potential high returns for a modest investment. However, they do entail higher risks, necessitating thorough research and strategic planning.

What steps should I take to find the best AI stocks under $1?

Identifying the best options involves examining industry trends, company fundamentals, financial health, and market sentiment. Concentrating on growth sectors like machine learning and robotics can also be advantageous.

What are the primary risks tied to AI penny stocks?

These stocks are particularly volatile, with sharp price swings that can result in losses. They often lack financial track records, making them speculative, and they may have limited liquidity, complicating quick transactions.

How does Pocket Option aid in trading AI stocks under $1?

Pocket Option offers a user-friendly platform for swift trading, with a variety of trading options and educational resources, enabling investors to execute strategies effectively and make informed decisions regarding their AI stock investments.

What strategies can lead to successful AI penny stock investments?

Effective strategies include diversifying investments, adopting a long-term view, consistently monitoring market trends, and employing stop-loss orders to protect against significant losses. These strategies help manage the inherent risks of these investments.