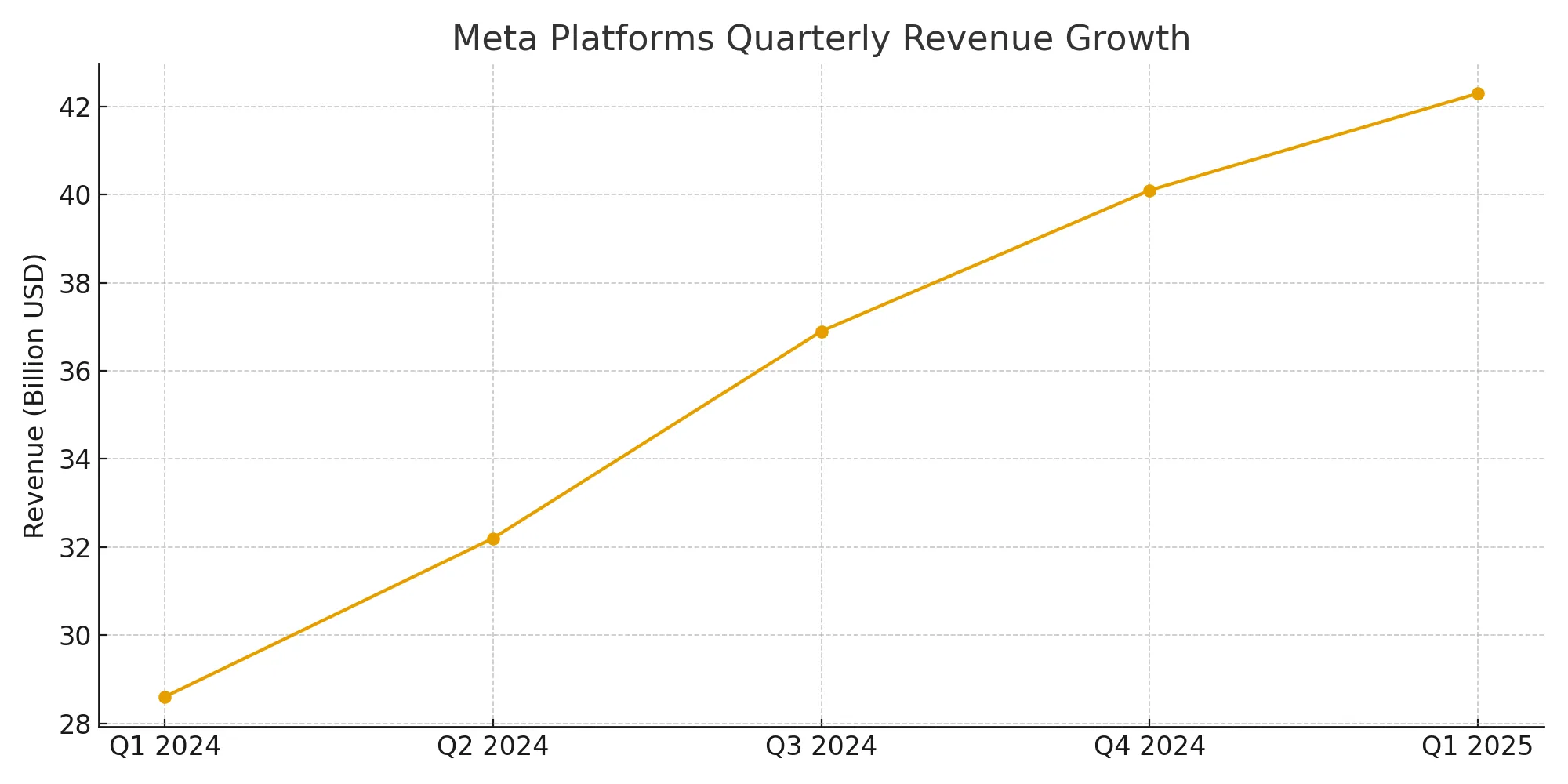

- In Q1 2025, Meta posted a 16% year‑over‑year revenue jump to $42.3 billion.

- Ad revenue surged 22% in 2024, fueling a 60% EPS increase.

- Capital expenditures are forecasted to reach $64–72 billion in 2025.

NASDAQ META: Your Long‑Term Investment in a High‑Growth Social Media Stock

Looking to buy Meta stock with strong long‑term potential? Discover why NASDAQ META stands out in the world of social media stock investments—and how Pocket Option makes trading, affordable, and smart.

Article navigation

Want to test your trading skills before buying real shares like trading?

Pocket Option lets you practice with a free $50,000 demo and trade 100+ top assets 24/7 via OTC markets–even when stock markets are closed.

Why Meta Platforms Might Be Your Next Big Long‑Term Investment

NASDAQ META isn’t just another ticker–it’s your gateway to investing in one of the most influential social media stocks out there. With platforms like Facebook, Instagram, WhatsApp, and Threads under its belt, Meta is redefining AI‑powered advertising, global connectivity, and digital experiences. And if you’re exploring a long‑term investment, this stock demands attention. Some investors still refer to Meta as Facebook shares, especially when using older brokerage platforms.

“Meta’s AI strategy is bold, ambitious, and incredibly expensive–but it’s working. With a projected $53.4 billion in 2025 capital expenditures, Meta is turning from a social media empire into an AI infrastructure powerhouse.”– Dan Ives, Managing Director at Wedbush Securities (CNBC)

According to Bloomberg Intelligence, Meta ranks among the top 3 U.S. tech companies in AI hardware deployment, only behind Amazon and Microsoft.

Strong AI Momentum Driving Value

Analysts continue to underscore Meta’s AI-driven edge:

“Retail investors are becoming more strategic. They now view Meta not as a growth gamble, but as a blue-chip AI infrastructure stock.”

— Cathy Wood, CEO of ARK Invest (Forbes)

You may want to buy Meta stock early in your portfolio strategy to capitalize on this rapid AI transformation. As the company shifts to a long-term growth trajectory, many analysts recommend to buy Meta stock during market dips. For active traders, multiple entry points to buy Meta stock can be explored using technical support zones.

How to Buy Meta Stock: A Practical Guide for Investors

| Step | What to Do |

|---|---|

| 1. Analyze Fundamentals | Review earnings, user growth, AI investments, and competition. |

| 2. Clarify Your Goals | Decide if META suits your long-term investment strategy. |

| 3. Choose a Platform | Use a broker with NASDAQ access. Try Pocket Option to simulate your ideas. |

| 4. Decide Allocation | Cap single stock exposure to 5–10% of your portfolio. |

| 5. Monitor & Rebalance | Follow Meta’s financials, tech trends, and regulatory news to support your long-term investment strategy. |

💡 Use the steps above to explore investing in NASDAQ META through your brokerage account

Example Scenario

You invest $300 of a $1,000 portfolio in META. If it grows 20%, your META position becomes $360. The other $700 goes into ETFs and safer assets. That’s a strategic long-term investment balance.

How Pocket Option Elevates Your Trading Experience

Pocket Option doesn’t offer Meta stock directly–but it’s the perfect platform to learn, test, and practice:

- Minimum deposit from just $5

- Free $50,000 demo account

- Trade 100+ assets 24/7 via OTC

- AI Trading, Signal Telegram Bot, Social Trading

- Tournaments, Bonuses, Flexible Payments, Learning Materials

- Mobile App for quick trades anytime

🚀 Want to experience AI in action–on a platform built for speed and simplicity? Pocket Option offers AI Trading, signal bots, and 24/7 access to tech stocks via OTC assets.

AI Spending Trends Affecting Meta

Meta’s LLaMA model, personalized ad targeting, and AI‑powered moderation tools show how deeply AI is integrated into operations. AI now drives user experience, monetization, and internal cost efficiencies.

“Meta’s Reality Labs posted $4.2 billion in Q1 losses, but Zuckerberg made it clear: ‘We’re not building for today. We’re building the computing platform of the future’.”– Mark Zuckerberg, Q1 2025 Earnings Call

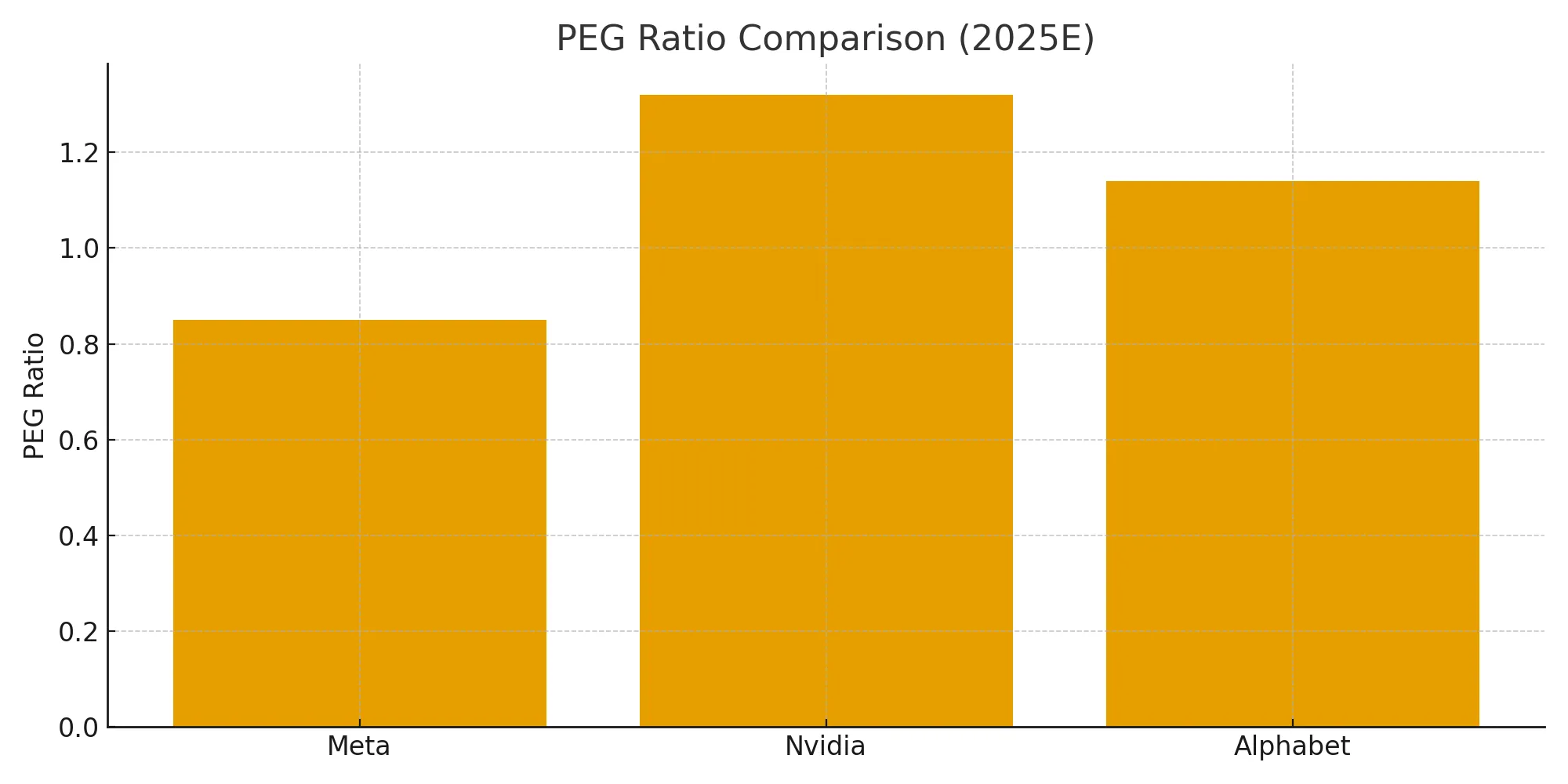

Goldman Sachs: “Among the Magnificent Seven, Meta offers the most attractive PEG ratio at 0.85.”

Bank of America: “Investors should treat Meta as an AI infrastructure play–not just a social media company.”

Comparative Analysis with Magnificent Seven Stocks

Meta Platforms, Inc. stands tall among the Magnificent Seven tech giants:

| Company | Strength | PEG Ratio (2025 est.) |

|---|---|---|

| Meta | AI + Social + Infra | 0.85 |

| Nvidia | Chips + Data Centers | 1.32 |

| Alphabet | Search + Cloud + Ads | 1.14 |

“Meta’s valuation is relatively low despite strong earnings growth, making it a potential re‑rating candidate.” — Bernstein Research

📌 Investors are advised to combine 2–3 of the Magnificent Seven in their portfolio for optimal diversification.

Final Thoughts: META as the Cornerstone of Your Long‑Term Growth Strategy

NASDAQ META is a social media stock deeply rooted in AI innovation and consistent revenue performance. For those seeking to invest in META, the company presents a compelling case for sustainable long-term growth. It’s undervalued versus peers and strategically positioned for future dominance.

✅ Whether you’re planning to invest in long-term stocks like META or just learning how markets work–start with tools that help you grow safely. Pocket Option is the perfect place to begin: use a free demo, trade 100+ assets anytime, and build your strategy.

Glossary

- NASDAQ META: Meta Platforms, Inc. stock ticker

- Social media stock: Equities of platforms like Facebook, Instagram

- Long‑term investment: Buy-and-hold strategy focused on future growth

FAQ

How to buy Meta Platforms stock?

To buy META, create an account with a brokerage that offers access to NASDAQ, search the ticker META, and place a buy order. You can also use platforms like Pocket Option to simulate strategies before investing.

Is Meta a good long-term investment?

Yes, many analysts consider Meta a strong long-term investment due to its AI infrastructure, revenue growth, and position among the Magnificent Seven tech leaders.

Which broker allows buying META?

Most major brokers like Fidelity, Charles Schwab, eToro, and Interactive Brokers offer access to NASDAQ META. Make sure your broker supports U.S. stocks.

Is it risky to buy Meta stock now?

Like any tech stock, META carries risks—especially due to regulatory scrutiny and high R&D spending. However, many experts argue that its strong fundamentals and AI investments make it a compelling long-term investment opportunity.

Can I buy Meta stock outside the U.S.?

Yes. Many international brokers (e.g., eToro, Interactive Brokers) allow investors to buy Meta shares even if they live outside the U.S., as long as they support access to NASDAQ