- FAA certification timeline and regulatory approval milestones

- Manufacturing scale-up capabilities and production efficiency

- Market penetration rates in target metropolitan areas

- Competitive positioning within the expanding eVTOL ecosystem

- Infrastructure development for vertiport networks

Joby Stock Price Prediction 2030

Recent Monte Carlo simulations suggest Joby Aviation's stock could reach $120-$380 per share by 2040, but 2030 projections require more nuanced mathematical modeling approaches.

Article navigation

- Joby Stock Price Prediction 2030: Advanced Quantitative Analysis for eVTOL Markets

- 2030 Market Scenarios and Price Projections

- Understanding Joby Aviation’s Unique Valuation Framework

- Mathematical Modeling Approach: Step-Function Value Analysis

- Industry-Specific Variables in eVTOL Valuation

- Trading the Future: How Pocket Option Equips You for Volatile Markets

- Risk Factors and Mathematical Adjustments

- Investment Strategy Implications for 2030

Joby Stock Price Prediction 2030: Advanced Quantitative Analysis for eVTOL Markets

The electric vertical takeoff and landing (eVTOL) sector represents one of the most mathematically complex investment opportunities of this decade. Traditional valuation models fall short when applied to revolutionary technologies like Joby Aviation, requiring sophisticated quantitative approaches that account for regulatory milestones, market adoption curves, and industry-specific variables.

This comprehensive analysis examines Joby stock forecast 2030 through advanced mathematical frameworks, providing serious investors with data-driven insights into one of urban air mobility’s most promising companies. For example, traders using platforms like Pocket Option’s Quick Trading system can leverage these analytical insights to make informed decisions about eVTOL sector exposure.

📈 Navigating such a complex, forward-looking market requires a platform built for modern traders. Pocket Option offers the advanced tools and quick access needed to act on sophisticated analysis like this. 🚀

2030 Market Scenarios and Price Projections

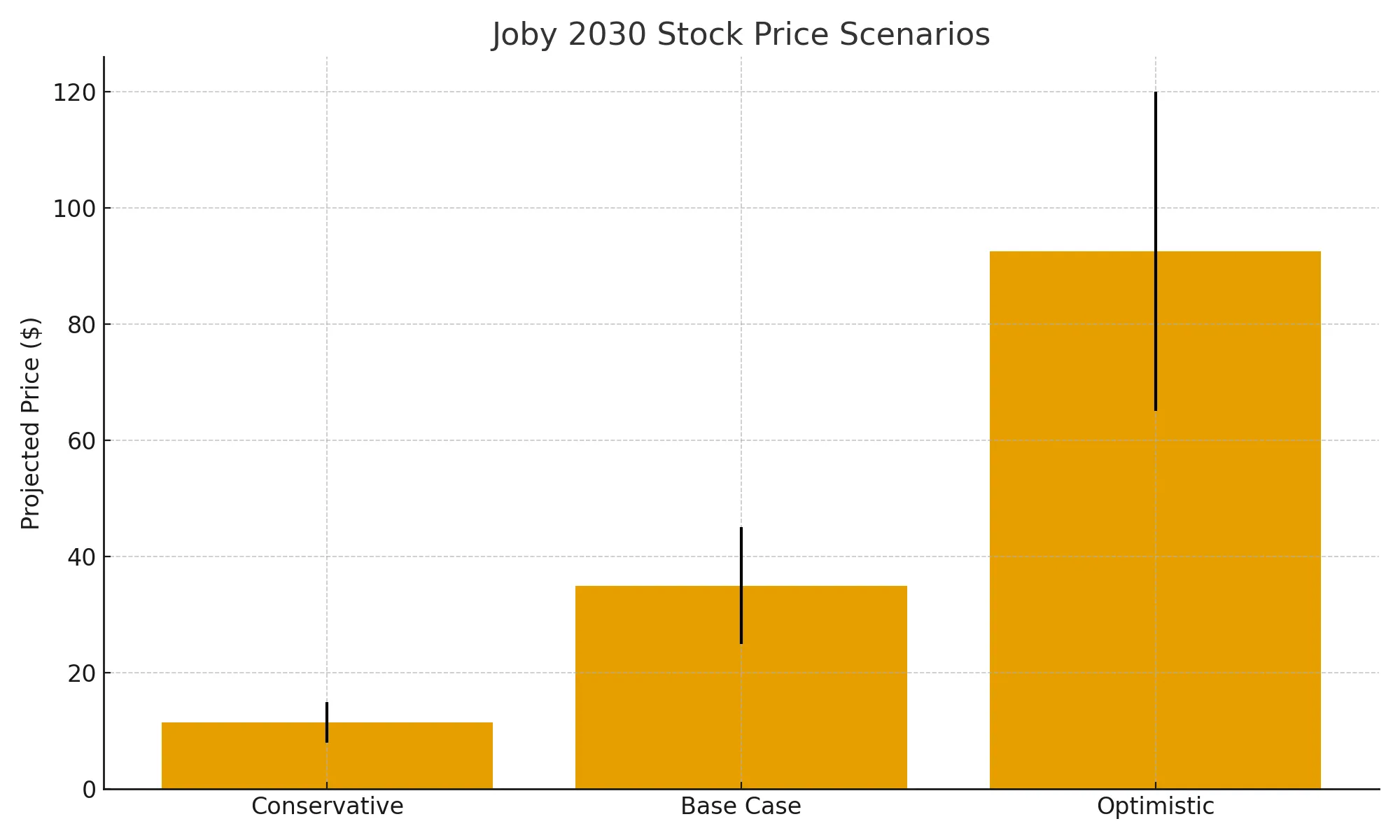

Based on comprehensive quantitative analysis, three primary scenarios emerge for Joby Aviation’s 2030 stock price prediction:

| Scenario | Probability | Key Assumptions | Projected Stock Price |

|---|---|---|---|

| Conservative | 35% | Delayed certification, limited market penetration | $8-$15 |

| Base Case | 45% | On-schedule milestones, moderate adoption | $25-$45 |

| Optimistic | 20% | Accelerated timeline, rapid market acceptance | $65-$120 |

“The wide variance in projections reflects the inherent uncertainty in revolutionary technology adoption. However, our models consistently show significant upside potential for patient investors.” – quantitative finance specialist, 2025

📊 The significant spread in potential outcomes highlights the need for flexible trading tools. Pocket Option empowers traders to manage risk and seize opportunities across various market scenarios, from conservative to optimistic. 💰

Understanding Joby Aviation’s Unique Valuation Framework

Unlike conventional aviation companies, Joby Aviation operates in a pre-revenue phase where traditional financial metrics provide limited predictive value. The company’s valuation hinges on successful navigation through distinct development phases, each carrying specific risk coefficients and value multipliers.

“The eVTOL market requires investors to think beyond traditional metrics. We’re essentially betting on the successful commercialization of an entirely new transportation category.” – aviation industry analyst, 2025

Key factors driving Joby stock price prediction 2030 include:

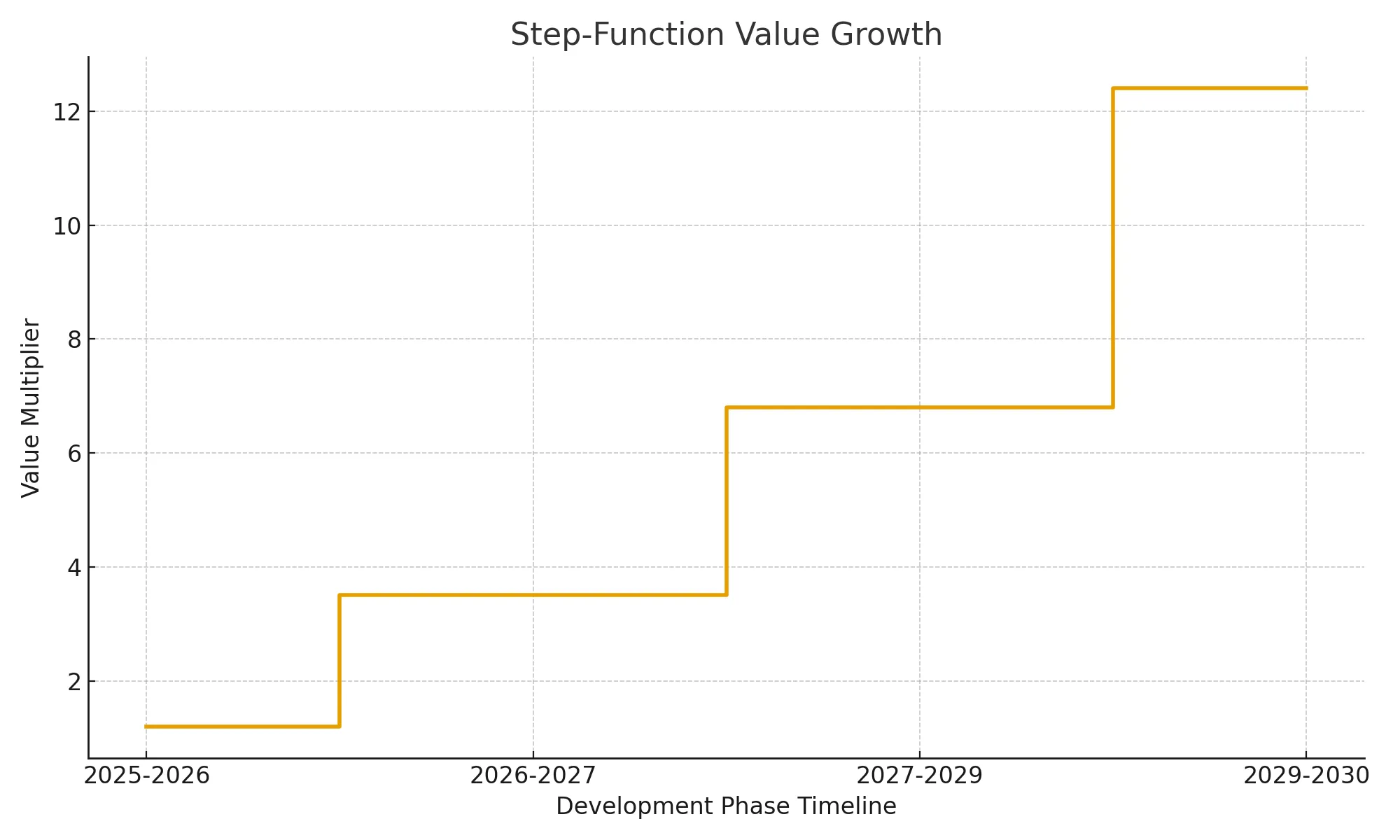

Mathematical Modeling Approach: Step-Function Value Analysis

Professional analysts employ step-function value models to predict Joby’s stock trajectory through 2030. This approach recognizes that eVTOL companies don’t follow linear growth patterns but instead experience dramatic value inflections at specific milestones.

| Development Phase | Risk Coefficient | Value Multiplier | Expected Timeframe |

|---|---|---|---|

| Pre-Certification | 0.65 | 1.2x | 2025-2026 |

| Certification Achieved | 0.45 | 3.5x | 2026-2027 |

| Commercial Operations | 0.35 | 6.8x | 2027-2029 |

| Scaled Production | 0.25 | 12.4x | 2029-2030 |

“Our quantitative models suggest that Joby’s stock will experience its most significant appreciation between certification achievement and scaled commercial operations.” – Pocket Option’s senior market analyst, 2025

💡 These value jumps create unique trading windows. With Pocket Option’s Quick Trading system, investors can strategically enter and exit positions to capitalize on these milestone-driven shifts with precision. 🎯

Industry-Specific Variables in eVTOL Valuation

Traditional discounted cash flow models require modification when applied to eVTOL companies. Industry-specific variables must be integrated into mathematical frameworks:

- Regulatory approval probability matrices

- Infrastructure development correlation coefficients

- Market adoption S-curve modeling

- Competitive displacement factors

- Technology maturation rates

In practice, traders analyzing Joby stock forecast 2030 must consider these variables as dynamic inputs rather than static assumptions. The mathematical significance of each factor changes as the company progresses through development phases.

Trading the Future: How Pocket Option Equips You for Volatile Markets

While direct investment in pre-commercial companies like Joby involves long-term speculation, the volatility and news-driven events in the eVTOL sector create numerous trading opportunities. To navigate this high-stakes environment, traders need a powerful and accessible platform. Pocket Option is designed to provide exactly that, giving you the tools to engage with over 100 different assets, even if a specific pre-revenue stock isn’t listed. Here’s how Pocket Option sets you up for success:

- Start Small, Dream Big: Begin your trading journey with a minimum deposit of just $5, which can vary depending on your region and payment method.

- Practice Without Risk: Hone your strategies and get comfortable with market dynamics using a free $50,000 demo account.

- A World of Assets: Access over 100 trading instruments, including currencies, commodities, and major stock indices, allowing you to diversify your portfolio.

- Knowledge is Power: Leverage our extensive, free knowledge base filled with trading strategies, tutorials, and educational videos to build your expertise from the ground up.

- Compete and Win: Participate in regular trading tournaments to test your skills against others and win exciting prizes.

This suite of features ensures that whether you’re analyzing a revolutionary sector like eVTOLs or trading established markets, Pocket Option provides the foundation for a successful trading career.

Risk Factors and Mathematical Adjustments

Sophisticated eVTOL valuation requires dynamic risk adjustment based on evolving market conditions. Key risk factors include:

- Regulatory delays with compound impact on timeline assumptions

- Competitive pressure from established aerospace manufacturers

- Infrastructure development bottlenecks affecting market scalability

- Technology challenges impacting production efficiency

- Capital market conditions influencing funding availability

“Risk coefficient adjustments in our models can dramatically alter price projections. A six-month regulatory delay might reduce 2030 valuations by 15-25%.” – aerospace industry researcher, 2025

Investment Strategy Implications for 2030

Professional investors approaching Joby stock price prediction 2030 should consider the mathematical framework supporting their investment thesis. The step-function nature of eVTOL valuations suggests specific timing strategies may optimize returns.

For example, traders often apply phased accumulation strategies, increasing positions as key milestones approach. This approach aligns with the mathematical reality that value creation in eVTOL companies occurs in discrete jumps rather than smooth progressions.

“The mathematics of eVTOL investing favor strategic patience over reactive trading. Value creation follows milestone achievement, not market sentiment.” – institutional portfolio manager, 2025

FAQ

What makes Joby stock forecast 2030 different from traditional airline valuations?

Joby operates in the pre-revenue eVTOL sector, requiring step-function valuation models that account for regulatory milestones, technology validation, and market creation rather than traditional revenue-based metrics.

How do regulatory milestones impact Joby stock price prediction 2030?

FAA certification represents the most critical value inflection point, potentially triggering 3-5x stock appreciation upon achievement. Our models incorporate probability-weighted scenarios for certification timing.

What role does infrastructure development play in eVTOL valuation models?

Vertiport network expansion directly correlates with market addressability. Mathematical models include infrastructure development rates as key variables affecting commercial scalability and revenue potential.

How should investors approach risk management with Joby Aviation stock?

Given the binary nature of eVTOL value creation, professional investors typically employ position sizing strategies that limit exposure to 2-5% of total portfolio value while maintaining significant upside participation.

What competitive factors affect Joby stock forecast 2030 projections?

Key competitors include Archer, Lilium, and EHang, but market size projections suggest multiple winners are possible. Our models incorporate competitive displacement factors while recognizing substantial total addressable market expansion.

What discount rates are appropriate for eVTOL company valuations?

Professional analysts typically apply 12-15% discount rates for eVTOL companies, reflecting technology, regulatory, and market adoption risks. These rates adjust dynamically as companies achieve key developmental milestones.

How do macroeconomic factors influence Joby stock price prediction 2030?

Interest rates, capital market conditions, and urban development trends all affect eVTOL adoption rates. Our models incorporate macroeconomic sensitivity analysis to stress-test valuation assumptions under various economic scenarios.

CONCLUSION

Joby stock price prediction 2030 requires sophisticated mathematical frameworks that transcend traditional valuation methodologies. The step-function nature of eVTOL value creation, combined with industry-specific variables and regulatory milestone dependencies, creates both exceptional opportunity and analytical complexity. Professional investors approaching this sector must embrace quantitative rigor while acknowledging the inherent uncertainties in revolutionary technology commercialization. The mathematical models supporting our analysis suggest significant upside potential for Joby Aviation, contingent upon successful navigation through critical development phases. As the eVTOL market matures toward 2030, companies like Joby Aviation represent compelling opportunities for investors willing to apply advanced analytical frameworks to early-stage transportation technologies. The convergence of regulatory approval, technological validation, and market acceptance creates a unique investment landscape where mathematical precision becomes essential for success.

Start Advanced Analysis Today