- Direct ownership of a decentralized asset.

- Avoid intermediary or corporate governance risks.

- Greater integration into Web3, DeFi, and crypto-native opportunities.

- Hedging potential against fiat inflation and geopolitical uncertainty.

- Liquidity on global crypto exchanges 24/7.

MSTR vs BTC: Strategic Investment Comparison for 2025

In the ever-evolving financial markets, the debate around MSTR vs BTC continues to attract attention from both retail and institutional investors. Understanding the dynamics between MicroStrategy stock (MSTR) and Bitcoin (BTC) is essential for anyone considering a strategic approach to crypto-aligned investing. This microstrategy vs Bitcoin investment comparison will provide advanced insights, correlation data, and expert opinions to help guide your decisions.

Article navigation

- Understanding MSTR and Bitcoin Fundamentals

- MSTR vs BTC: Price Correlation Insights

- Key Investment Differences: MSTR vs BTC

- Volatility and Risk Assessment

- Long-Term Outlook: Bitcoin vs MicroStrategy

- Pocket Option: Trade Bitcoin and Global Assets Seamlessly

- MSTR vs Bitcoin ETF: Similar Exposure, Different Mechanisms

- Making the Right Choice

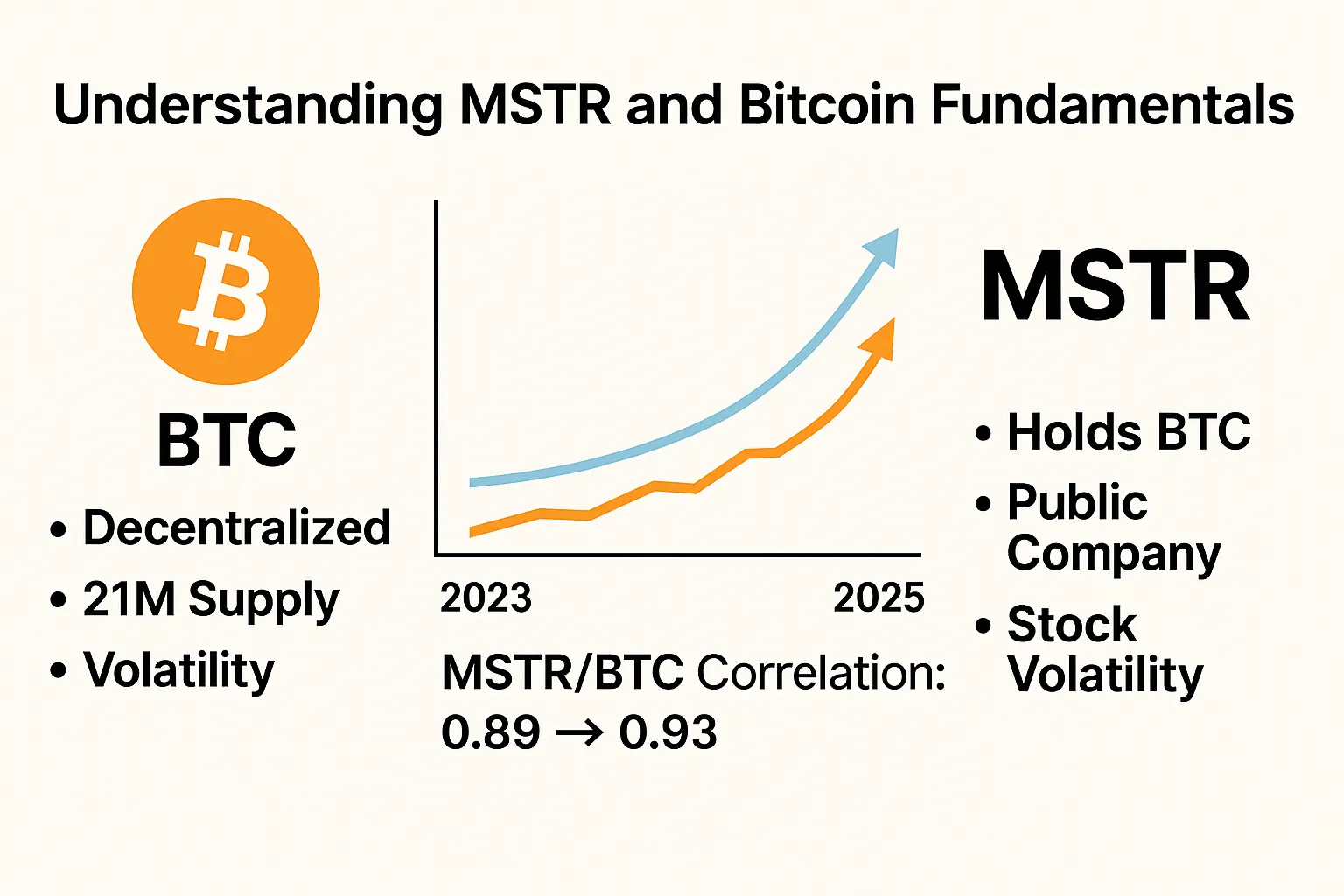

Understanding MSTR and Bitcoin Fundamentals

What is Bitcoin?

Bitcoin (BTC) is a decentralized digital asset, functioning outside traditional financial institutions. It serves as a speculative investment, an inflation hedge, and a store of value. BTC’s price is volatile, often driven by macroeconomic data, technological shifts, and regulatory changes.

“Bitcoin remains the most asymmetric bet of the decade.” — Lyn Alden, macro strategist.

Investors who buy Bitcoin directly benefit from full ownership and have the opportunity to store it in personal wallets. The transparency of the blockchain and the limited supply of BTC (21 million coins) are seen by many as attractive characteristics. This direct exposure avoids third-party risk and allows participation in decentralized finance ecosystems.

What is MicroStrategy (MSTR)?

MicroStrategy is a U.S.-based business intelligence firm that became widely recognized for its aggressive Bitcoin acquisition strategy. Under Michael Saylor’s leadership, it has turned its corporate treasury into a major BTC reserve. As a result, MSTR’s correlation to Bitcoin has surged, leading to the emergence of new trading and investment models.

Michael Saylor’s Influence

Michael Saylor has positioned himself as a major advocate for Bitcoin. His strategic decisions to convert cash reserves into BTC, raise capital via convertible notes, and align MicroStrategy’s identity with Bitcoin have transformed the company’s market image. His vocal presence on social platforms and interviews consistently reinforces MicroStrategy’s role as a de facto Bitcoin proxy.

MSTR vs BTC: Price Correlation Insights

Analyzing MSTR Bitcoin Correlation

Understanding mstr correlation to bitcoin is vital when evaluating MicroStrategy’s role in a Bitcoin-heavy investment portfolio. Empirical studies reveal a high mstr btc correlation, especially during market volatility. The following chart shows a snapshot from TradingView:

| Date Range | MSTR/BTC Correlation Coefficient |

|---|---|

| Jan 2023 – Jan 2024 | 0.89 |

| Feb 2024 – Jun 2025 | 0.93 |

This microstrategy bitcoin correlation chart suggests that while MSTR reflects Bitcoin’s price movement, it introduces additional volatility due to company-specific news.

MSTR vs BTC Price and Ratio Chart — MSTR vs BTC Chart

The following table compares the mstr btc price across two time periods, offering insight into price appreciation and the relative strength of MicroStrategy’s stock against Bitcoin:

| Date | BTC Price (USD) | MSTR Price (USD) | MSTR/BTC Ratio |

|---|---|---|---|

| Jan 2023 | 23,000 | 270 | 0.0117 |

| Jun 2025 | 66,500 | 1,450 | 0.0218 |

The rising mstr/btc ratio confirms increasing investor confidence in MicroStrategy’s Bitcoin-heavy strategy.

Key Investment Differences: MSTR vs BTC

Reasons to Buy BTC

“Our strategy is simple — buy Bitcoin and hold Bitcoin. “— Michael Saylor, Executive Chairman of MicroStrategy.

Investing in MSTR: A Stock Perspective

- Access to Bitcoin through regulated stock markets.

- Easier integration into retirement portfolios (e.g., IRAs).

- Possibility of dividends or future corporate actions.

- Enhanced visibility and analyst coverage compared to cryptocurrencies.

- Exposure to a corporate overlay with potential non-Bitcoin value drivers.

Volatility and Risk Assessment

MSTR Bitcoin Correlation Analysis

A thorough mstr btc correlation analysis reveals key insights into how MicroStrategy stock performs in tandem with Bitcoin. This analysis helps investors evaluate volatility exposure and potential leverage outcomes. The volatility of BTC impacts MSTR in amplified ways. As BTC surges, MSTR often outpaces gains due to leveraged exposure. However, during downturns, MSTR BTC price correlation shows that MSTR may underperform.

Risk Mitigation Strategies

For BTC investors:

- Store assets securely in cold wallets.

- Use dollar-cost averaging to reduce entry risk.

- Diversify into stablecoins or Ethereum-based assets.

For MSTR investors:

- Monitor quarterly financials and debt issuance.

- Hedge exposure using options or inverse ETFs.

- Combine MSTR with tech or infrastructure stocks for balance.

Long-Term Outlook: Bitcoin vs MicroStrategy

MSTR vs BTC Forecast and Price Prediction

Both mstr vs btc price prediction and broader market forecasts indicate that these assets may follow diverging paths influenced by macroeconomic factors, Bitcoin halving cycles, and MicroStrategy’s treasury strategy. Expert analysts offer varied mstr vs btc prediction outlooks: some expect MSTR to outperform BTC in bull markets due to its leveraged nature, while others highlight BTC’s resilience in downturns due to its decentralized structure. Some expect MicroStrategy to outperform BTC in bullish markets due to its leveraged exposure. Others argue that BTC may be more resilient during corrections due to lower counterparty risk.

Future of Bitcoin

Bitcoin continues to gain traction among institutions, sovereign wealth funds, and individual investors. Innovations such as the Lightning Network, Ordinals, and increasing regulatory clarity may support higher adoption.

MicroStrategy’s Strategic Positioning

MicroStrategy has evolved into a quasi-Bitcoin holding company. Its Bitcoin acquisition strategy involves raising capital to purchase BTC, effectively amplifying exposure.

MSTR vs BTC Reddit and TradingView Trends

Online communities like Reddit frequently compare MSTR vs BTC performance. Common threads include:

- Short-term trading signals using mstr vs btc tradingview indicators.

- Sentiment analysis on MSTR vs Bitcoin ETF performance.

- Discussion of Saylor’s public statements.

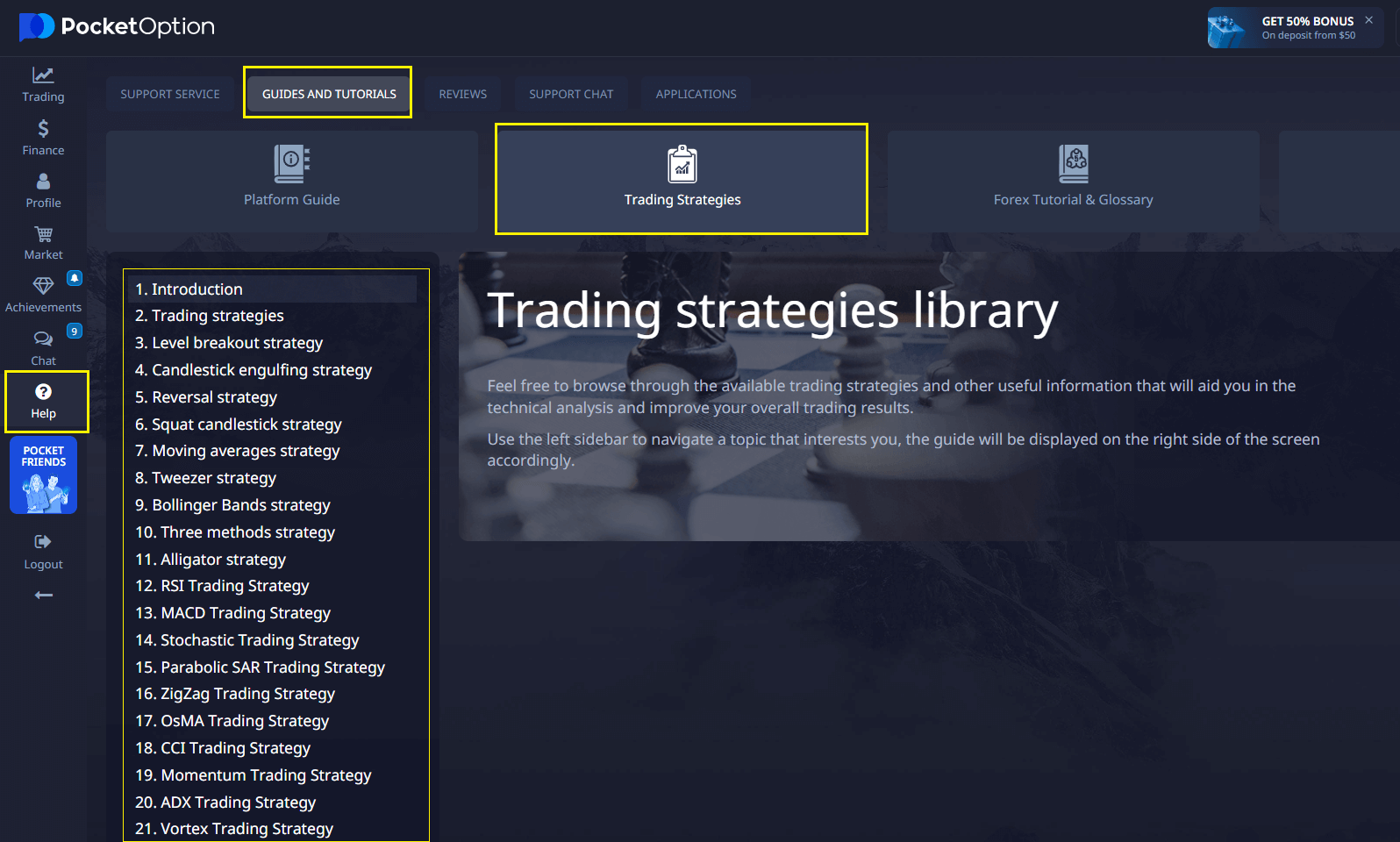

Learn strategies on Pocket Option

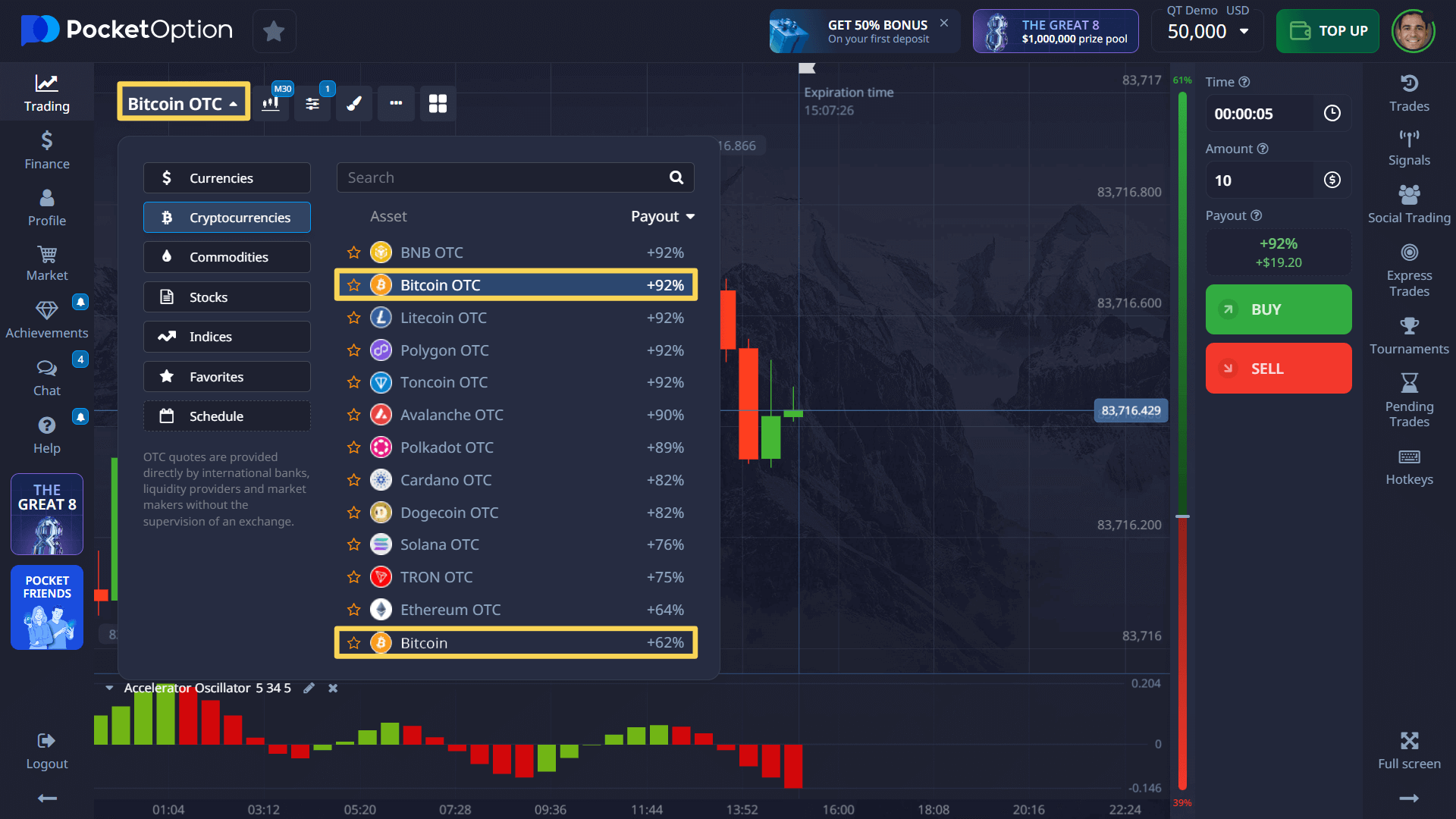

Pocket Option: Trade Bitcoin and Global Assets Seamlessly

With Pocket Option, traders can access over 100 assets, including BTC, tech stocks, forex pairs, and commodities. The Quick Trading interface is intuitive:

- Click Buy if you expect the price to rise.

- Click Sell if you anticipate a decline.

It’s ideal for active traders seeking flexibility without ownership complexities.

Note: On Pocket Option, traders can access Bitcoin and over 100 other global assets through the platform’s Quick Trading feature.

“I use Pocket Option to trade BTC. The simplicity of Quick Trading combined with the speed is unmatched.” — Ethan M., trader

“I appreciate that Pocket Option lets me speculate on Bitcoin with low entry amounts — it’s fast, flexible, and ideal for short-term setups.” — Aiko L., investor

MSTR vs Bitcoin ETF: Similar Exposure, Different Mechanisms

ETFs such as IBIT or GBTC offer passive Bitcoin tracking. MSTR, in contrast, introduces operational leverage, active capital deployment, and company-specific factors.

Anthony Pompliano: “MSTR offers Bitcoin exposure and alpha if you trust Saylor’s strategy — it’s not just passive holding.”

Making the Right Choice

When deciding between MSTR vs BTC, consider:

- Choose BTC if you seek full digital asset ownership.

- Choose MSTR if you prefer stock-based exposure with company potential.

🔍 Stay informed. Monitor the mstr/btc tradingview ratio, compare Reddit insights, and follow expert forecasts to stay ahead.

FAQ

What distinguishes MicroStrategy's Bitcoin investment?

MicroStrategy's Bitcoin investment stands out because it was among the first publicly traded companies to adopt Bitcoin as a primary treasury reserve asset. This strategic move has not only affected the company's stock performance but also established it as a significant player in corporate cryptocurrency adoption.

How does the price correlation between MicroStrategy and Bitcoin influence investors?

The price correlation offers investors a way to anticipate MSTR's stock movements based on Bitcoin's price trends. A strong correlation suggests that MSTR's stock price is significantly affected by Bitcoin, allowing investors to make informed decisions based on cryptocurrency market dynamics.

What risks come with investing in MSTR and BTC?

Investing in MSTR involves risks associated with corporate governance and regulatory oversight, whereas BTC carries risks tied to high volatility and the absence of regulation. Investors should weigh these factors and their risk tolerance when deciding between the two.

Is Pocket Option suitable for trading MSTR and BTC?

Indeed, Pocket Option can be utilized for trading these assets. The platform provides various tools and features that enable traders to speculate on price movements and execute quick trades, making it a practical choice for those interested in both traditional and digital assets.

What investment strategy would be appropriate for a conservative investor interested in these options?

A conservative investor might allocate a smaller portion of their portfolio to MSTR to gain exposure to Bitcoin's potential upside with the reliability of corporate governance. They could also invest in less volatile traditional assets to balance the overall portfolio, ensuring a mix of growth potential and risk management.

Is MSTR a good proxy for Bitcoin?

MSTR provides leveraged Bitcoin exposure but includes corporate risk; it's a partial proxy, not a pure substitute.

Why is MSTR down when Bitcoin is up?

MSTR may underperform BTC during Bitcoin rallies due to stock market sentiment, financial disclosures, or dilution events.

What is the relationship between MSTR and BTC?

MSTR's price is highly correlated with Bitcoin due to MicroStrategy’s large BTC holdings, but it also reflects company-specific risks.