- Most stock exchanges operate Monday through Friday.

- Standard trading hours for NYSE and NASDAQ are 9:30 AM to 4:00 PM Eastern Time.

- After-hours trading allows some transactions outside of regular hours.

- Understanding these trading hours helps traders optimize their strategies.

How Many Trading Days in a Month? Understanding Market Sessions Throughout the Year

The concept of trading days is crucial for everyone from novice traders to seasoned investors. Whether you're developing a strategy or analyzing performance, understanding how many trading days are in a month or a year directly influences planning and execution. In this comprehensive guide, we explore what constitutes a trading day, how many trading days typically occur in a month and a year, and how this knowledge can shape your trading approach.

What is a Trading Day?

A trading day is any day on which a financial market–such as the New York Stock Exchange (NYSE) or NASDAQ–is open for business. These markets operate according to set schedules and close on weekends and recognized holidays, reducing the total number of trading sessions from the 365 days in a calendar year.

Key features:

According to CNBC, over 70% of U.S. stock market activity occurs in the first and last hour of regular trading. Timing matters.

Why Trading Days Matter

The number of trading days influences portfolio management, strategy development, and trade execution. Traders and investors rely on this metric to:

- Schedule entries and exits.

- Track market trends.

- Evaluate the performance of trades or portfolios.

Both day traders and swing traders benefit from this knowledge:

- Day traders rely on daily price fluctuations and must account for each available trading session.

- Swing traders benefit from analyzing broader trends over multiple trading days.

How Many Trading Days in a Year?

The number of trading days per year is not fixed but typically falls between 250 and 252. Here’s why:

- A standard year has 365 days.

- Subtract 104 weekend days (52 Saturdays + 52 Sundays).

- Subtract 9 to 11 market holidays (e.g., Independence Day, Thanksgiving Day).

| Year | Total Trading Days |

|---|---|

| 2023 | 252 |

| 2024 | 251 |

| 2025 (forecast) | 251–252 |

According to Investopedia, the number of trading days can impact earnings calendars and portfolio rebalancing windows.

Most Common U.S. Market Holidays

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents’ Day

- Good Friday

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

How Many Trading Days in a Month?

On average, there are 20 to 22 trading days in a month. However, the number can vary depending on weekends and market holidays.

| Month | Average Trading Days | Notes |

|---|---|---|

| January | 20–21 | New Year’s Day |

| February | 19–20 | Presidents’ Day, fewer total days |

| March | 21–22 | |

| April | 20–21 | Good Friday |

| May | 20–21 | Memorial Day |

| June | 21–22 | Juneteenth, sometimes observed |

| July | 20–21 | Independence Day |

| August | 22 | Typically no holidays |

| September | 20–21 | Labor Day |

| October | 21–22 | |

| November | 19–20 | Thanksgiving |

| December | 20–21 | Christmas |

Factors That Affect Trading Days

- Market-specific holidays.

- Unscheduled closures due to geopolitical or economic events.

Impact on Trading Strategies

Understanding how many trading days are in a month can help fine-tune various trading strategies:

For Day Traders:

- Focus on intraday movements.

- Use high-frequency setups across all active trading sessions.

- May leverage after-hours trading to capture additional opportunities.

For Swing Traders:

- Analyze multi-day market trends.

- Assess broader momentum that spans several sessions.

- Plan trades based on average trading days in a month.

Risk Management During Red Days

Red days–days when stock prices fall–can disrupt strategies. It’s crucial to:

- Use stop-loss and trailing-stop mechanisms.

- Avoid overtrading in highly volatile sessions.

- Diversify across uncorrelated assets.

Pocket Option: Trade 24/7 with Over 100 Assets

Unlike traditional stock exchanges, Pocket Option offers unique flexibility:

- Trade stocks, cryptocurrencies, indices, and more 24/7.

- Quick Trading lets you speculate whether an asset’s price will rise (Buy) or fall (Sell).

- Start trading from just $1.

This availability means that even on non-standard or non-market days, you can still execute trades and refine strategies using tools like copy trading, bots, and AI trading.

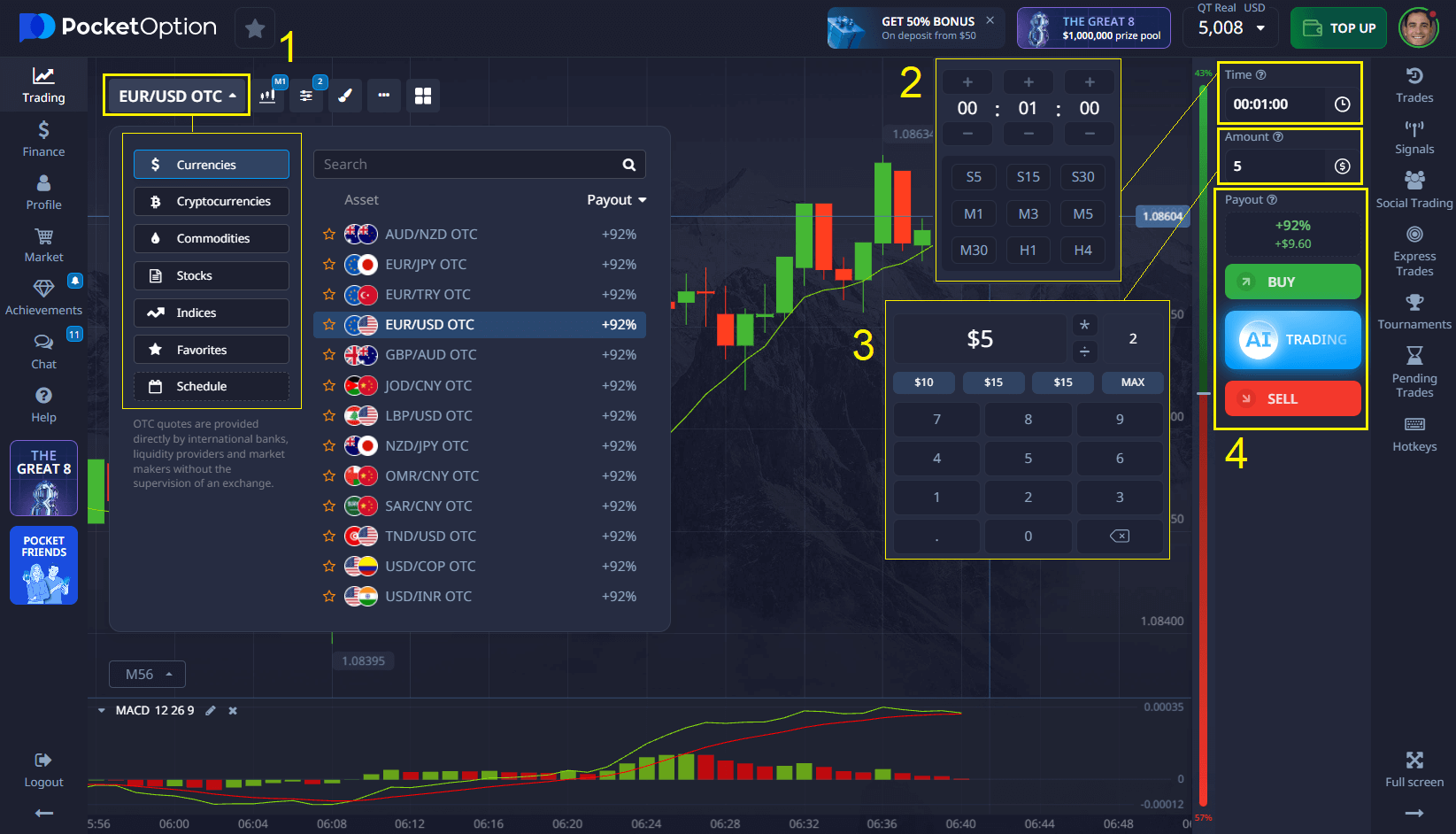

Example: How to Open a Trade on Pocket Option

- Choose an asset from over 100 available on the platform.

- Analyze the chart using technical tools or the trader sentiment indicator.

- Enter the trade amount — starting from just $1.

- Set the trade duration, from as low as 5 seconds on OTC assets.

- Make a forecast: if you believe the price will go up — press Buy; if down — press Sell.

If your forecast is correct, you can earn up to 92% profit. This percentage is visible before entering a trade.

With a real account starting from just $5, you unlock features like copy trading, cashback, and more advanced tools.

“Pocket Option’s flexibility helped me trade global indices on weekends and nights. That’s a game-changer.”Marco D.

“I started with $20, copied trades from experts, and turned a profit within two weeks. Very intuitive platform.” Elina T.

“Being able to trade 24/7 with $1 trades made it easy to experiment and grow without stress.” Jonas M.

Tools for Calculating Trading Days

To calculate the number of trading days, consider using:

- Stock market calendars (NYSE, NASDAQ official sites).

- Financial news portals with updated market schedules.

- Custom scripts or Excel templates for monthly planning.

Simple Formula

Trading Days = Total Days in Month - (Weekend Days + Market Holidays)

Visual Snapshot: Trading Days vs Calendar Days

| Month | Calendar Days | Trading Days | Holidays Impact |

|---|---|---|---|

| Feb | 28/29 | ~19 | Presidents’ Day |

| Nov | 30 | ~19–20 | Thanksgiving |

| Aug | 31 | ~22 | None |

Final Thoughts

So, how many trading days are in a month? The number typically ranges from 19 to 22, depending on holidays and weekends. Throughout the year, you can expect about 250 to 252 trading days in the stock market. However, platforms like Pocket Option extend these possibilities with round-the-clock access to markets.

By tracking trading days and tailoring strategies accordingly, you enhance not only planning but also performance. Whether you’re day trading or swing trading, this calendar-driven awareness is a strategic edge.

FAQ

What is the typical range of trading days in a month?

The typical range of trading days in a month is between 19 and 23 days, with an average of about 21 trading days per month.

How do holidays affect the number of trading days?

Holidays reduce the number of trading days in a month as markets are usually closed on these days. The impact varies depending on the specific holidays and their dates each year.

Why is it important to know how many trading days are in a month?

Knowing the number of trading days is crucial for accurate performance calculations, strategy planning, risk management, and liquidity management in financial markets.

Do all global markets have the same number of trading days?

No, the number of trading days can vary across different global markets due to regional holidays, market-specific closures, and other local factors.

How can I calculate the exact number of trading days for a specific month?

To calculate trading days, start with the total days in the month, subtract weekends and public holidays falling on weekdays, and account for any special market closures or half-days.