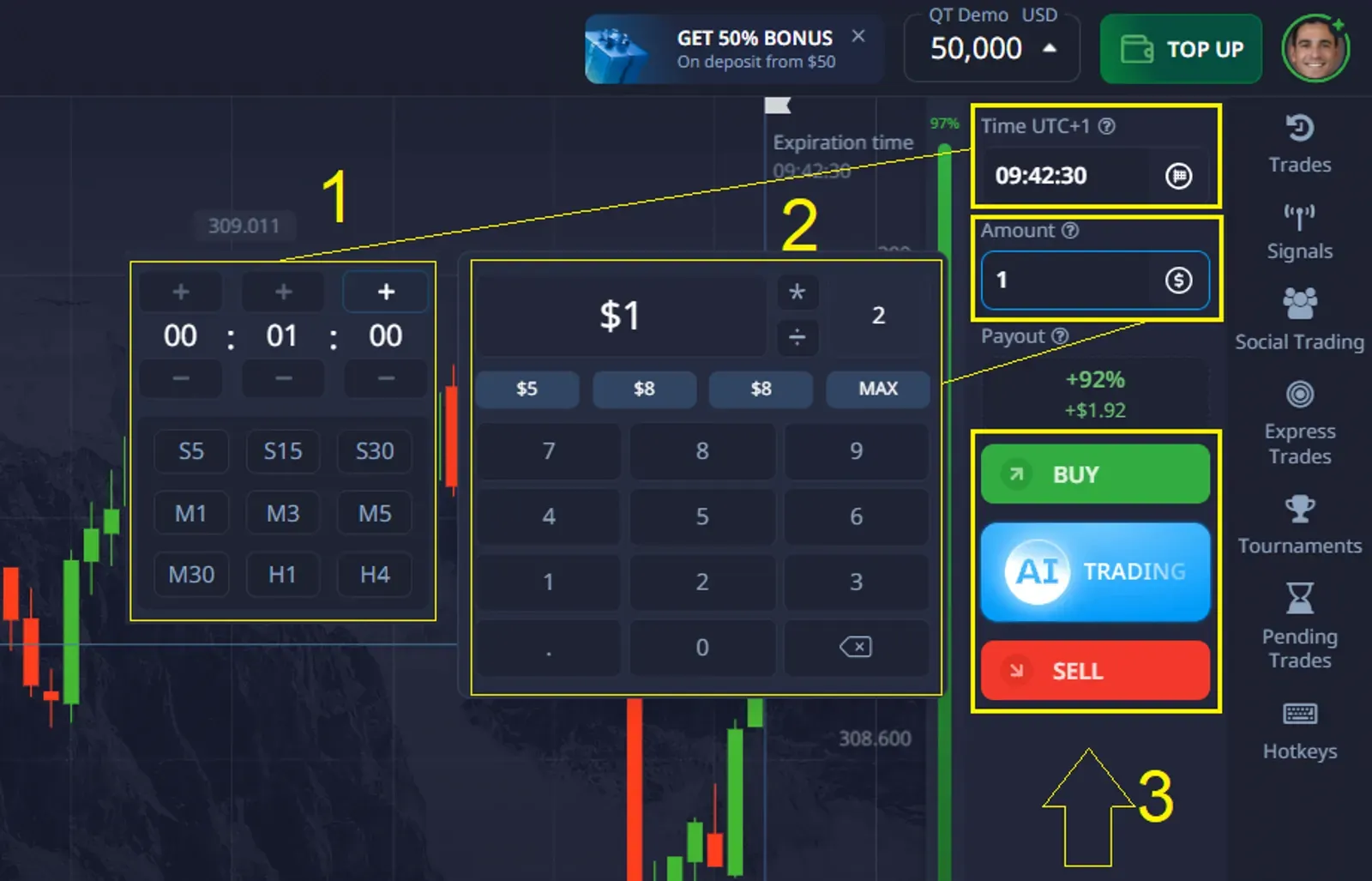

- Choose Your Asset: Log in to your Pocket Option account and select ‘Tesla’ or ‘TSLA’ from the list of over 100 available assets.

- Analyze the Chart: Use the platform’s built-in tools. You could use a technical indicator like the RSI to check if the stock is overbought or oversold, or simply use the “Trader’s Sentiment” indicator to see which direction the majority of traders are betting on.

- Set Your Investment: Choose your trade amount, starting from as little as $1.

- Set Your Timeframe: Select the trade duration. On OTC assets, this can be as short as 5 seconds, allowing for rapid-fire trading opportunities.

- Make Your Forecast: Predict the price direction. If you believe the price will go UP within your chosen time, click the BUY button. If you think it will go DOWN, click the SELL button.

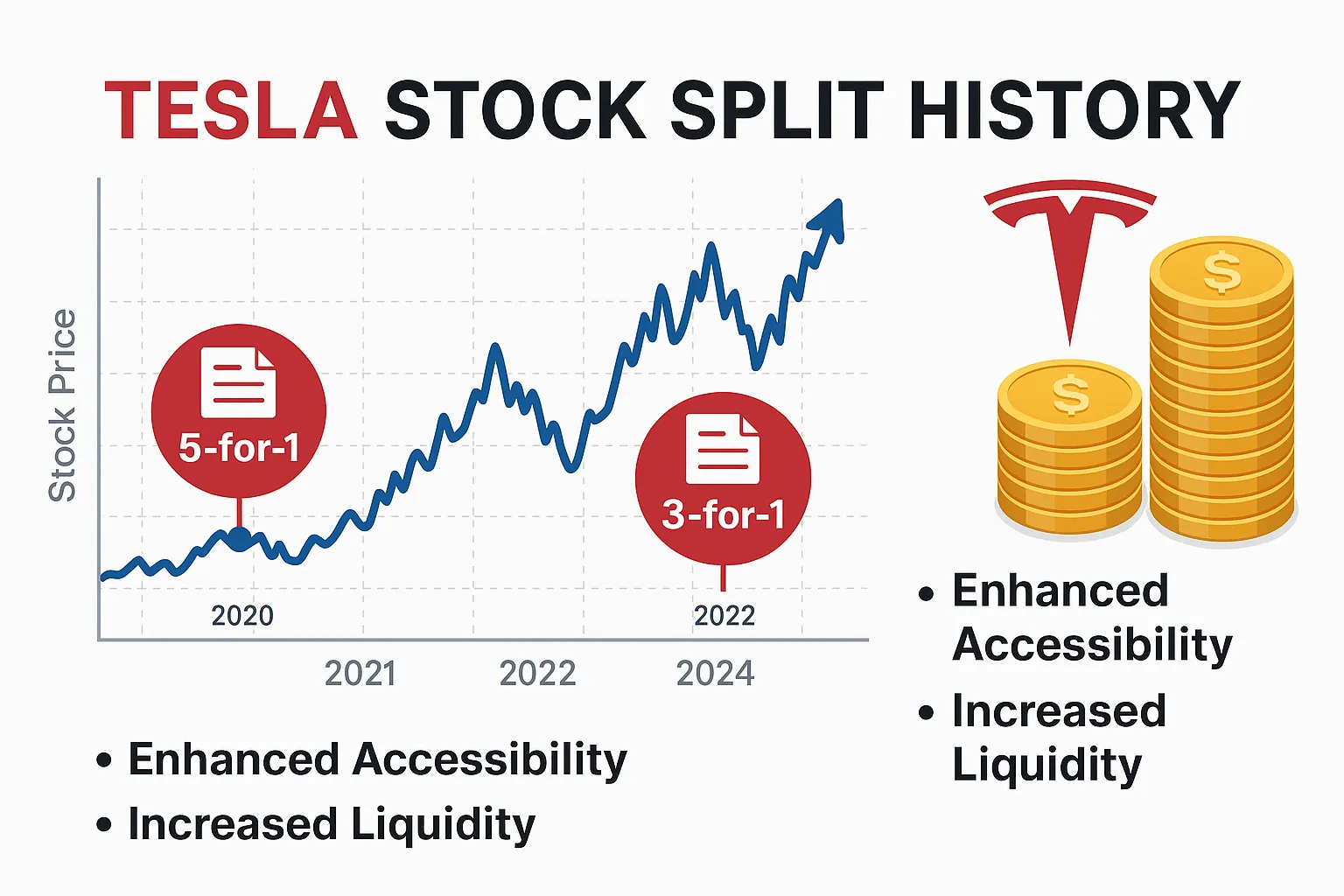

Tesla Stock Split History: Complete Analysis of 2020 and 2022 Splits

In the dynamic and often turbulent world of the stock market, few companies capture the imagination quite like Tesla (TSLA).

Article navigation

- Understanding Tesla Stock Splits: The Strategy Behind the Numbers

- Why Companies Like Tesla Implement Stock Splits

- The Complete Tesla Stock Split History (TSLA Split History)

- Stock Split Impact Analysis: Pre-Split vs. Post-Split Performance

- The Million-Dollar Question: Will Tesla Split Again in 2024-2025? 💡

- Trading Tesla in the Modern Era: A Practical Guide with Pocket Option

Understanding Tesla Stock Splits: The Strategy Behind the Numbers

Tesla journey has been a masterclass in innovation, disruption, and, for investors, a thrilling ride of volatility and growth. A crucial part of this journey, and a topic of immense interest, is the Tesla stock split history. Understanding these strategic financial maneuvers is key to grasping Tesla’s market strategy and its relationship with its ever-growing base of investors. This article provides a comprehensive analysis of all Tesla stock splits from 2020 to the present, examines their impact, and explores the probability of future splits.

At its core, a stock split is a corporate action where a company increases the number of its outstanding shares by dividing existing shares into multiple new ones. Imagine you have one pizza slice that costs $20. A 5-for-1 split means the company cuts that slice into five smaller pieces. You now have five slices, but the total value is still $20, meaning each new, smaller slice is worth $4. The key takeaway is that the company’s total market capitalization (the total value of all its shares) remains unchanged immediately after the split. The primary goal is to lower the price of a single share, making it more psychologically appealing and financially accessible to a broader range of investors, especially retail traders.

Why Companies Like Tesla Implement Stock Splits

Companies, particularly those with high-growth trajectories like Tesla, use stock splits as a powerful tool for several strategic reasons. It’s not just about changing the numbers; it’s about shaping market perception and accessibility.

📊 According to Nasdaq Market Intelligence (2023), after large-cap stock splits such as Tesla and Apple, the average gain in retail investor participation is 38% in the first month.

| Strategic Goal | Explanation | Impact on Tesla |

|---|---|---|

| Enhanced Accessibility | A lower share price removes the psychological barrier for retail investors who might be intimidated by a stock trading for hundreds or thousands of dollars. | Opened the door for millions of new, smaller investors to own a piece of the company, democratizing its shareholder base. |

| Increased Liquidity | More shares in circulation means more trading activity. This higher liquidity makes it easier for investors to buy and sell shares without causing significant price fluctuations. | Smoother trading and tighter bid-ask spreads, which is attractive for both day traders and long-term investors. |

| Investor Confidence Signal | A stock split is often interpreted as a sign of management’s confidence. It implies they believe the stock price will continue to rise from its new, lower base. 🚀 | Generated significant positive buzz and reinforced the narrative of Tesla’s unstoppable growth, fueling investor optimism. |

| Employee Compensation | For companies that offer stock options and equity as part of employee compensation, a lower share price makes these grants more flexible and manageable. | Helps in attracting and retaining top talent in a competitive industry by making stock-based compensation more practical. |

💬 “Splits are a signal of strength. They don’t add real value to a company, but they create a perception of affordability, which is especially important in the retail era,” said Tom Lee, managing partner at Fundstrat Global Advisors.

The Complete Tesla Stock Split History (TSLA Split History)

Tesla’s journey through the stock market has been marked by two major splits that have fundamentally altered its trading landscape. To answer the question, “when did Tesla split?”, we need to look at two key dates. The TSLA split history is a tale of bold, strategic decisions that paid off handsomely.

The Landmark 5-for-1 Stock Split in 2020

In August 2020, Tesla executed its first major stock split, a game-changing Tesla 5 to 1 split. Before the split announcement, TSLA’s stock was soaring, trading at over $2,200 per share. This price point, while reflecting the company’s incredible performance, made it prohibitive for many average investors.

The 5-for-1 split meant that for every one share an investor held, they received four additional shares. The stock began trading on a split-adjusted basis on August 31, 2020. This move was a resounding success. It not only made the stock more accessible but also ignited a massive surge in interest from retail investors, contributing to a powerful rally in the stock’s price both before and after the split date.

The Strategic 3-for-1 Stock Split in 2022

Building on the success of its 2020 split, Tesla announced another split in the summer of 2022. This time, it was a Tesla 3 to 1 split, which took effect on August 25, 2022. By this point, the stock had once again climbed to a formidable price, trading in the $900 range. While not as high as the pre-2020 split price, the board recognized the ongoing benefit of keeping the share price within a more accessible range.

This second split further solidified Tesla’s reputation as a retail-investor-friendly company. It continued the strategy of enhancing liquidity and ensuring a broad and diverse shareholder base, which is a key component of its market strength.

💬 “Tesla uses splits as a marketing tool as much as a financial one,” Manuel Mendoza, a senior analyst at Deutsche Bank, told Bloomberg. “When the price approaches a psychological ceiling, the company gives the market a chance to regroup and accelerate.”

Stock Split Impact Analysis: Pre-Split vs. Post-Split Performance

The true test of a stock split’s success lies in its long-term effects. A detailed stock split impact analysis reveals a clear pattern of positive reinforcement for Tesla’s market standing.

📉 An analysis from J.P. Morgan found that companies that announced splits in 2020–2022 outperformed the S&P 500 by 16% on average in the 12 months following the split date. However, that advantage is lost if the overall stock market enters a correction, as it did in 2022.

Immediate Market Reactions and Long-Term Performance

Both of Tesla’s splits were met with tremendous enthusiasm. The announcements alone were enough to trigger significant rallies as investors rushed to buy shares ahead of the split date.

| Split Event | Pre-Split Price (Approx.) | Post-Split Opening Price (Approx.) | 6-Month Performance Post-Split | 1-Year Performance Post-Split |

|---|---|---|---|---|

| 2020 (5-for-1) | ~$2,213 | ~$442 | +55% | +110% |

| 2022 (3-for-1) | ~$891 | ~$297 | -40%* | +25%* |

*Note: The period following the 2022 split was marked by significant macroeconomic headwinds, including rising interest rates and recession fears, which impacted the entire market, not just Tesla. The stock still outperformed the broader Nasdaq index over the subsequent year.

The long-term effects have been profound. By dramatically increasing the number of shares available, TSLA splits have created a highly liquid and dynamic trading environment. This has made Tesla a favorite among traders on various platforms, including those offering flexible trading options.

For instance, platforms like Pocket Option allow traders to predict Tesla’s price movements without needing to purchase entire shares. With a lower, post-split share price, the asset becomes even more attractive for contracts for difference (CFDs) and options trading, where smaller price movements can still lead to significant outcomes. This accessibility is a direct result of Tesla’s strategic splits.

The Million-Dollar Question: Will Tesla Split Again in 2024-2025? 💡

With the Tesla stock split history as our guide, investors and analysts are constantly speculating about the next potential split. As of mid-2024 and looking into 2025, there have been no official announcements from Tesla’s board. However, we can conduct a probability analysis based on historical triggers and current market conditions.

🔍 Morgan Stanley analysts believe that Tesla’s third split could be preceded by one of two events: the launch of mass production of the Optimus robot or an IPO of its AI subsidiary.

Latest Rumors and Split Probability Analysis

The chatter around a potential third split tends to intensify whenever TSLA’s stock price begins to approach the $500 mark and beyond. While “rumors” are often just market speculation, they are fueled by a clear historical precedent.

💡 “Investors should pay attention not only to the TSLA price, but also to the tone of Elon Musk’s public statements: mentions of expanding the shareholder base, retail investors, or rising share prices almost always foreshadow important corporate actions,” said Christina Hooper, chief global strategist at Invesco.

Here is a probability scorecard for a potential Tesla stock split in the near future:

| Factor | Current Status (2024-2025) | Probability Influence | Analysis |

|---|---|---|---|

| Stock Price | Fluctuating between $180-$300. | Low to Medium | The current price is not yet in the “prohibitive” territory that triggered past splits ($900+). A sustained rally above $500 would significantly increase the probability. |

| Historical Precedent | Two successful splits in two years (2020, 2022). | High | The company has a clear playbook. Management knows that splits are a popular and effective tool for engaging their investor base. |

| Market Sentiment | Generally positive, focused on AI, robotics (Optimus), and the Cybertruck ramp-up. | Medium | Positive sentiment could drive the price higher, creating the conditions for a split. A split could also be used to generate excitement during a period of market consolidation. |

| CEO/Board Comments | No recent comments on a potential split. | Low | The company is currently focused on operational execution. A split is a financial tool, not an operational priority at this moment. |

Overall Probability (2024-2025): Low-to-Medium. A split is unlikely at current price levels but becomes a very real possibility if Tesla’s stock embarks on another significant bull run toward the $500-$1000 range. Investors should watch the price action closely.

Trading Tesla in the Modern Era: A Practical Guide with Pocket Option

Understanding the Tesla stock split history is fascinating, but the real question for many is: how can I act on this information? The modern brokerage landscape offers more tools and accessibility than ever before. Platforms like Pocket Option have democratized trading, allowing anyone to participate in the market with powerful features and a low barrier to entry. 📈

💬 “I work with several platforms, but Pocket Option is the only one where I can literally open Tesla trades with one tap using signals directly from Telegram,” says Jason Larsen, an active day trader with 8 years of experience.

A Practical Example: How to Open a Trade on Pocket Option

Trading on Pocket Option is designed to be intuitive and fast, perfect for a dynamic stock like Tesla. Here’s a simple example of how you could open a trade:

If your forecast is correct, you receive a payout of up to 92%! This percentage is clearly displayed before you even enter the trade, so you know your potential profit upfront. 💰

Unlock Your Full Potential with Pocket Option’s Features

Pocket Option is more than just a trading platform; it’s a comprehensive ecosystem designed to support traders of all levels. You can start with a real account deposit of just $5 or practice risk-free with an unlimited demo account.

Here are some of the standout features you can leverage:

- Social Trading: Don’t know where to start? Copy the trades of successful, experienced traders automatically to learn from their strategies and potentially profit faster.

- 🤖 AI Trading & Signals: Automate your trading using smart algorithms for improved efficiency. You can also use the Telegram Signal Bot to receive real-time trading ideas.

- Tournaments: Compete against other traders in regular tournaments to win prizes and showcase your trading skills.

- Bonuses and Promo Codes: Boost your trading capital with generous deposit bonuses and special promo codes.

- Flexible Payments: With over 50 deposit and withdrawal methods, managing your funds is easy and convenient, no matter where you are in the world.

- 📱 Mobile App: The powerful mobile app ensures you never miss an opportunity. Trade anytime, anywhere–whether you’re on your way to work or just have a spare minute.

FAQ

When did Tesla stock split?

Tesla split its stock on August 31, 2020 (5-for-1) and August 25, 2022 (3-for-1).

How many times has Tesla split its stock?

Tesla has split its stock twice—in 2020 and 2022.

What was Tesla's stock price before splits?

Before the 2020 split, TSLA traded around $2,213; before the 2022 split, around $891.

Will Tesla split its stock again?

There’s no official confirmation, but another split is possible if the price climbs above $500–$900.

How did Tesla splits affect the stock price?

Both splits led to increased interest and short-term rallies, especially from retail investors.

Should I buy Tesla before or after a split?

Buying before may capture pre-split momentum, while after offers more accessible prices. It depends on your strategy.

CONCLUSION

The Tesla stock split history is more than a series of financial footnotes; it is a core part of the company's narrative. The splits in 2020 and 2022 were masterstrokes of financial strategy that democratized share ownership, massively increased liquidity, and sent a powerful message of confidence to the market. They transformed Tesla from a high-priced stock accessible to a few into a household name owned by many. While a future split remains a topic of speculation, the conditions that would trigger it are clear. For now, investors and traders have unprecedented access to trade TSLA's price movements, using innovative platforms that provide sophisticated tools for everyone. By understanding the past, we can better navigate the present and anticipate the future of one of the world's most exciting companies. Whether you are a long-term investor or a short-term trader, Tesla's story is one you can be a part of.

Go to Free Demo