- Highlight liquidity imbalances.

- Indicate possible retracement or continuation zones.

- Useful for price gap analysis and identifying high-probability entries.

FVG Trading: Understanding and Implementing Fair Value Gap Strategies

Fair value gaps represent important market inefficiencies that traders can identify and use in their decision-making process. FVG trading has gained popularity among technical analysts who look for objective entry and exit points in various financial markets.

Article navigation

- FVG Trading: Practical Approach for Market Analysis

- Understanding Fair Value Gaps

- Identifying Fair Value Gaps in Price Action

- Trading Strategies Involving FVGs

- How to Identify and Use Fair Value Gaps

- Expert Insight & Stats

- How FVG Works in Quick Trading on Pocket Option

- FVG as a “footprint of institutionalists”

- Analyzing Liquidity and Imbalance

- Bearish and Bullish Fair Value Gaps

- Risk Management in FVG Trading

- Smart Money Concepts in FVG Trading

- Why Pocket Option is Ideal for Practicing FVG Trading

FVG Trading: Practical Approach for Market Analysis

In today’s fast-moving financial markets, traders constantly seek tools and strategies that can help them anticipate market movements with higher precision. One such method is FVG trading, which focuses on recognizing Fair Value Gaps (FVGs) — specific imbalances in supply and demand that appear on charts as price gaps. Understanding and applying fair value gap trading can give traders an edge, whether in forex, stocks, or Quick Trading on Pocket Option.

👉 On Pocket Option, you can practice FVG trading on live charts, experiment risk-free with a demo account, and then apply strategies in real markets once you are confident.

Understanding Fair Value Gaps

Definition of Fair Value Gaps

A Fair Value Gap (FVG) is a market inefficiency that occurs when price moves rapidly, leaving behind a gap between candlesticks. This typically happens when liquidity is thin or institutional traders enter the market with strong buy or sell orders. In simple terms, FVGs show areas where supply and demand were not balanced, and the price often returns to “fill” these gaps before continuing its trend.

Key aspects:

Example: If EUR/USD jumps from 1.0850 to 1.0900 in a single candle with minimal pullback, the 1.0860–1.0890 zone could form an FVG. Traders anticipate that price may return to this gap before resuming the upward move.

Importance of Fair Value Gaps in Trading

Fair Value Gaps are not random. They reflect institutional trading gaps, often left by big players moving large volumes. Retail traders can use this knowledge to align with “smart money.”

Benefits of FVG trading:

- Pinpointing potential reversal or continuation zones.

- Enhancing accuracy of FVG strategy setups.

- Supporting better risk management.

- Helping traders recognize areas of market inefficiency.

According to Investopedia, gaps tend to be filled nearly 90% of the time in liquid markets, making them highly relevant for technical traders.

Identifying Fair Value Gaps in Price Action

Spotting FVGs requires careful observation of candlestick patterns:

Step-by-step identification:

- Look for a three-candle formation: The first candle creates momentum, the second shows strong movement, and the third leaves a visible gap.

- Switch between timeframes: Gaps on higher timeframes (H4, Daily) carry more weight than those on M1 or M5.

- Confirm with volume: A sudden surge in volume often signals institutional involvement.

| Step | What to Check | Why It Matters |

|---|---|---|

| 1 | Three-candle structure | Reveals imbalance |

| 2 | Timeframe | Higher TF = stronger signal |

| 3 | Volume | Confirms institutional moves |

Trading Strategies Involving FVGs

Gap Trading Strategy Explained

The classic gap fill strategy is simple yet effective:

- Wait for price to return to the FVG zone.

- Enter in the direction of the original move once confirmation forms.

- Place stop-loss below/above the gap zone to limit risk.

📌 Example: In GBP/USD, a bullish FVG forms after a breakout. When price pulls back to the gap area, traders enter long positions with stops just below the gap.

Using Fair Value Gaps in Forex Trading

In forex, market gaps trading helps identify imbalance zones created by global events or institutional flows. Traders can:

- Spot bullish gaps → potential long trades.

- Spot bearish gaps → potential short trades.

How to Identify and Use Fair Value Gaps

Steps to Identify Fair Value Gaps

- Analyze candlestick structures across multiple timeframes.

- Mark potential imbalance zones with rectangles.

- Wait for confirmation before entering a trade.

Utilizing the FVG Indicator

Modern platforms, including Pocket Option, allow traders to integrate FVG indicators that automatically mark imbalance zones. These tools save time and ensure you don’t miss critical setups.

Trading Plan Incorporating FVGs

A structured plan includes:

- Entry rules: Identify gaps and confirm with price action.

- Exit rules: Close trades once gaps are filled or trend weakens.

- Risk control: Always apply stop-loss orders.

| Element | Description |

|---|---|

| Entry | Price returns to FVG zone |

| Confirmation | Candlestick or volume support |

| Stop-loss | Just outside gap area |

| Take-profit | Gap fully filled or next key level |

Expert Insight & Stats

According to market analysis by Cory Mitchell (CMT), the S&P 500 fills its gaps about 60% of the time within six months, with smaller gaps showing even higher fill rates — 87–92% for gaps measuring 0–0.19%.

Market Rebellion adds that roughly 80% of gaps eventually fill, acting like magnets on price. Moreover, high trading volume at the opening (3× average) correlates with 70% fill rates, while low-volume gaps often fill at a rate of 85% within two trading sessions.

For short-term traders using Quick Trading, small gaps with these stats can form the basis of a high-probability trading plan.

👉 On Pocket Option, you can practice FVG trading on live charts, experiment risk-free with a demo account, and then apply strategies in real markets once you are confident.

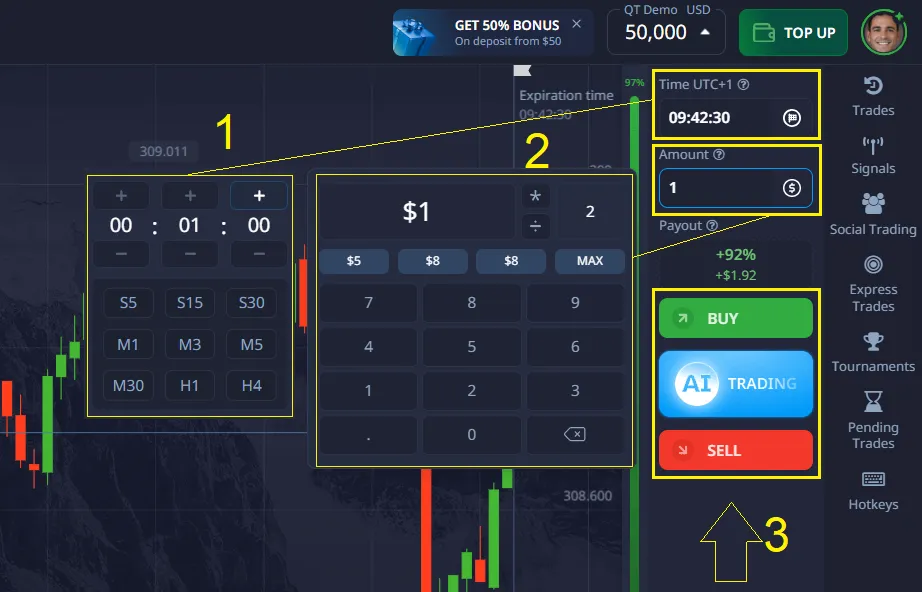

How FVG Works in Quick Trading on Pocket Option

Identifying FVGs:

In Quick Trading on Pocket Option, you can easily identify Fair Value Gaps (FVG) by tracking sharp price moves that leave gaps on the charts. These gaps — FVGs — become powerful signals for traders. When price moves quickly up or down, leaving behind a gap, it may indicate that the market will return to “fill” this gap. By using this approach, you can anticipate when the price will reverse.

Trading Strategy:

With FVG trading in Quick Trading, you have the unique opportunity to open trades for short durations — from 1 to 5 minutes. By utilizing these market inefficiency zones, you can predict when the price will return to the FVG and continue its movement. This gives you a high probability of successful trades throughout the day, especially in fast-moving volatile conditions.

Learn strategies at Pocket Option

Trading in the Direction of FVG:

Quick Trading on Pocket Option allows you to apply FVG for selecting entry points for Put (down) or Call (up) trades. For example, if a strong price rise forms a gap, you may expect the price to return to that zone, opening opportunities for a Put trade. This approach gives you a clear understanding of when and in which direction to act, enhancing your chances of success.

Key Points for Success:

To successfully apply FVG in Quick Trading, it’s not only important to correctly identify the gap, but also to consider key factors such as liquidity and market volatility. Additionally, it’s recommended to use other indicators like candlestick patterns and volume to increase the accuracy of your predictions and make smarter decisions at each step.

Bonus:

On Pocket Option, you can test these strategies on a free demo account before moving to real trades. This minimizes risks and allows you to confidently start using FVG for quick and profitable trading. 🚀

👉 Insight: In the context of Quick Trading (1-5 minutes), small gaps are ideal. But for longer-term strategies, it is reasonable to use statistics of gaps closing up to 45 days – this is more than 50% probability.

FVG as a “footprint of institutionalists”

Gaps are not just empty zones. They are markers of the movement of large players. It follows that trading in these zones is a strategy of alignment with large market forces.

Analyzing Liquidity and Imbalance

The Role of Liquidity in FVG Trading

Liquidity drives price efficiency. When liquidity is low, market inefficiency trading opportunities appear more often. Institutional players exploit these zones, leaving FVGs behind.

Understanding Imbalance in Price Action

Price imbalance means supply ≠ demand. Traders who learn to recognize imbalance zones can anticipate where institutional money is likely to react.

Example: During news releases, USD pairs often leave wide FVGs due to thin liquidity. Traders can plan entries once volatility settles.

Bearish and Bullish Fair Value Gaps

- Bearish FVG: Indicates strong selling pressure. Price often returns before continuing down.

- Bullish FVG: Suggests aggressive buying. Price usually retraces, then resumes upward.

| Type | Signal | Strategy |

|---|---|---|

| Bullish | Demand > Supply | Look for long entries |

| Bearish | Supply > Demand | Look for short entries |

Risk Management in FVG Trading

Implementing Effective Risk Management Strategies

No matter how strong an FVG strategy looks, risk control is essential:

- Use stop-loss orders to cap losses.

- Position sizing: Never risk more than 1–2% per trade.

- Diversification: Avoid overexposure to one asset.

Managing Trades with Fair Value Gap Patterns

Professional traders often manage positions dynamically:

- Partial exits once part of the gap is filled.

- Trailing stops to lock in profits.

As trading psychologist Brett Steenbarger notes, “Consistent profitability comes less from prediction and more from disciplined risk management.”

Smart Money Concepts in FVG Trading

Smart money concepts FVG analysis involves studying institutional flows. Large players leave footprints in the form of gaps, and aligning trades with them increases probability of success.

Practical tips:

- Combine FVG analysis with order blocks.

- Track high-impact economic events.

- Use Pocket Option’s advanced charting tools to mark institutional gaps.

Why Pocket Option is Ideal for Practicing FVG Trading

Pocket Option offers features tailored for traders experimenting with gap fill strategy and market imbalance setups:

- Free demo account with $50,000 virtual balance.

- Quick Trading mode with clear Buy/Sell options.

- Low minimum deposit starting from $5 (varies by region).

- Advanced charting tools to mark FVGs effectively.

Whether you’re a beginner or experienced trader, Pocket Option provides the perfect environment to test and refine your FVG strategy.

✅ Ready to test your FVG trading skills?

FAQ

What is FVG in trading?

A Fair Value Gap (FVG) is a price gap that shows market inefficiency when supply and demand are imbalanced. Traders use these zones to anticipate potential retracements and entries.

How to trade fair value gaps?

Identify the FVG on the chart, wait for the price to return to that zone, confirm with candlestick or volume signals, and then enter a trade in the original direction of the move.

Do FVG gaps always fill?

Not always, but research shows that up to 80–90% of gaps eventually get filled. Smaller gaps tend to fill faster, while larger ones may take days or even weeks.

What is FVG trading strategy?

It’s a method of trading that uses FVGs to spot entry and exit points. The core idea is to trade when the price returns to fill a gap, combining this with proper risk management and other indicators.

What exactly is an FVG in trading?

An FVG (Fair Value Gap) in trading is a price area where the market moved so quickly that it created an imbalance between buyers and sellers. Technically, it forms when three consecutive candles create a gap pattern, where the third candle doesn't overlap with the first candle's range. These gaps are considered areas where price hasn't been properly tested and often attract price to return and "fill" them.

How are FVGs different from regular price gaps?

Unlike regular price gaps that occur between trading sessions, FVGs form during continuous trading. Regular gaps appear between the close of one session and the open of another, while fair value gaps can form at any time when price moves rapidly. FVGs are specifically defined by a three-candle pattern and are more focused on order flow imbalances rather than just visual gaps on a chart.

Can FVG trading work in all market conditions?

FVG trading can work in various market conditions, but its effectiveness varies. In trending markets, FVGs tend to fill quickly as price retraces. In ranging markets, FVGs often mark the boundaries of the range. However, during extremely volatile conditions or news events, FVGs might be less reliable as normal market mechanics can be temporarily suspended.

What timeframes are best for identifying FVGs?

FVGs can be identified on any timeframe, from 1-minute charts to monthly charts. However, many traders find the most practical applications on the 15-minute, 1-hour, and 4-hour charts. Higher timeframe FVGs (daily, weekly) typically carry more significance but occur less frequently. The ideal approach is to align FVGs across multiple timeframes for higher probability setups.

Do I need special indicators to trade FVGs?

No special indicators are required to identify FVGs as they're based on basic candlestick patterns. However, some traders use custom indicators that automatically highlight these patterns. The core concept involves looking for three consecutive candles where the third candle doesn't overlap with the first candle's range. Many trading platforms, including Pocket Option, provide the charting capabilities needed to manually identify these patterns without additional indicators.

CONCLUSION

FVG trading is a practical and highly effective way to identify market inefficiencies and align with institutional flows. By learning how to spot, analyze, and trade Fair Value Gaps, traders can sharpen their market edge and improve decision-making. On Pocket Option, you can put theory into practice, starting with a risk-free demo account and gradually moving to real markets with a live account. Combining FVG analysis with strong risk management and smart money concepts equips you with the tools to navigate markets more confidently. 🚀

Start trading