- Entry: Buy at $450.25 on a breakout higher

- Stop: $449.80

- Target: $451.00

- Risk/Reward: about 1:1.6

Day Trading QQQ Market Analysis

QQQ ETF is one of the most traded ETFs in the world, ideal for day trading, swing strategies, and long-term exposure to the Nasdaq-100 index. Its liquidity and tech-heavy composition make it a favorite for traders seeking volatility and investors seeking growth.

What Is QQQ ETF

QQQ ETF replicates the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on Nasdaq — Apple, Microsoft, Amazon, Tesla, and more. Its focus on the tech sector makes it especially sensitive to earnings releases, Federal Reserve decisions, and macroeconomic data.

📊 Fact: According to Nasdaq, QQQ accounts for about 10% of all U.S. ETF trading volume daily, ensuring tight spreads and excellent price discovery for traders.

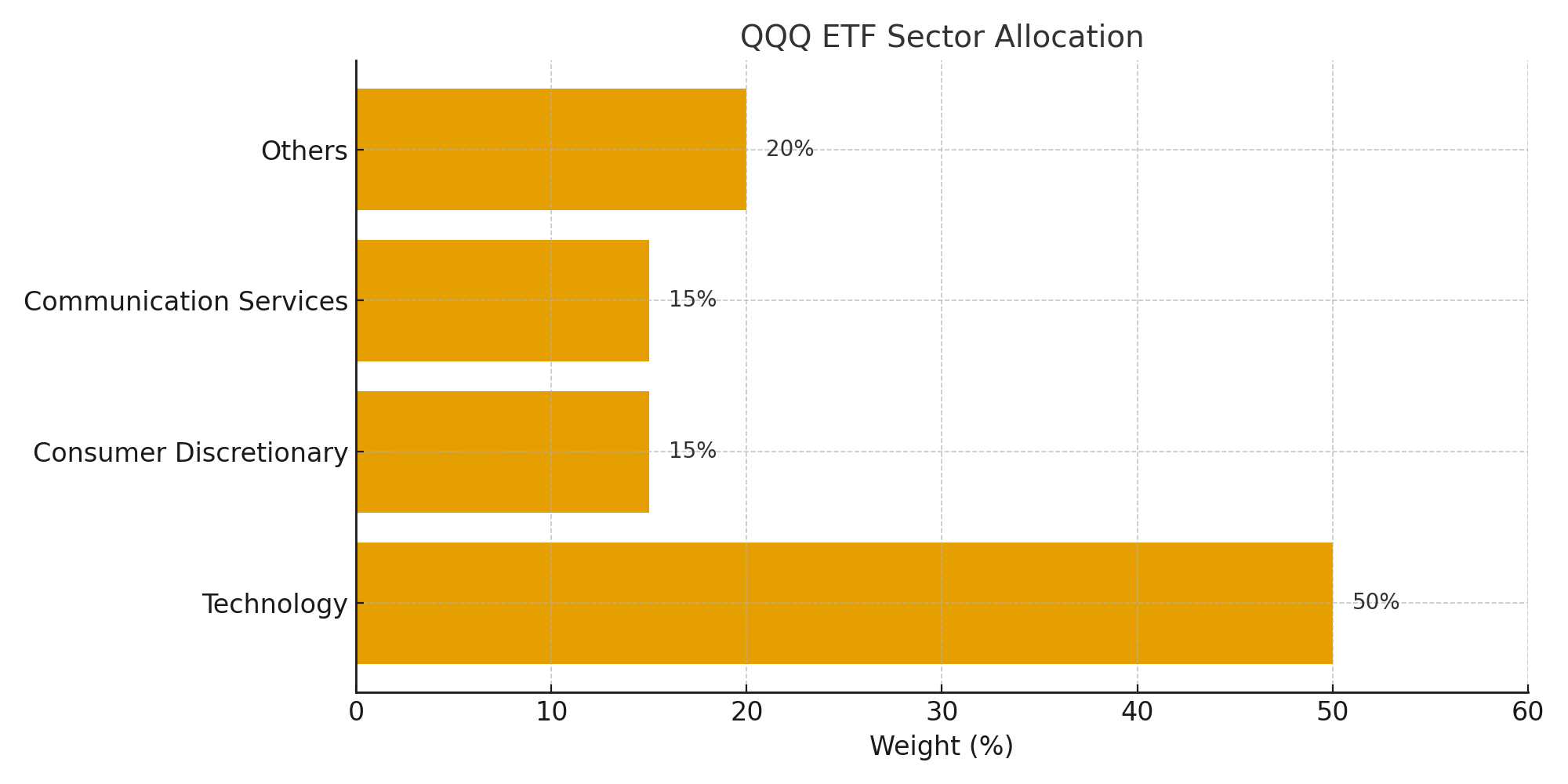

Composition and Market Behavior

| Sector | Top Holdings | Weight (%) |

|---|---|---|

| Technology | Apple, Microsoft | ~50% |

| Consumer Discretionary | Amazon, Tesla | ~15% |

| Communication Services | Meta | ~15% |

| Others | Healthcare, Industrials | ~20% |

Morgan Stanley analyst Sarah Lin calls QQQ “a leveraged play on innovation” — meaning rallies during bull markets tend to be stronger, while pullbacks can be sharper. This volatility is what attracts active traders.

Day Trading QQQ

Day trading QQQ ETF is about capturing short-term price movements within a single session. A common approach is to define the first 15-minute range after the market opens and trade the breakout.

Example: Intraday Breakout

If QQQ trades between $449.50 and $450.20 in the first minutes after open:

This setup is popular among scalpers because QQQ’s liquidity allows precise entries and exits.

💡 Fact: Bloomberg data shows that on Federal Reserve announcement days, QQQ averages about 2.4% intraday moves, creating great opportunities for disciplined day traders.

Swing Trading and Long-Term Investing

If you prefer holding positions for several days or weeks, swing trading QQQ can be ideal. A common strategy is buying pullbacks to the 20-day EMA during uptrends and setting a stop just below it, targeting previous highs.

Example: Buy at $445, set a stop at $440, and a target at $460 for a 3:1 reward-to-risk ratio.

For long-term investors, QQQ remains a solid diversification tool. According to Nasdaq data, for any 10-year rolling period since the ETF’s inception, returns were positive 96% of the time, making QQQ a powerful vehicle for wealth accumulation.

QQQ Options Strategies

Options allow traders to generate income and manage risk.

Example: If you hold 100 QQQ shares at $450, selling a $460 call for a $3.00 premium generates $300.

- If QQQ stays below $460 — you keep the premium.

- If QQQ rises above $460 — you sell shares at a profit and still keep the $300 premium.

This strategy is popular with investors looking for steady cash flow while remaining invested in QQQ ETF.

Making Money with QQQ

Scalping is one of the most common ways to profit from QQQ ETF. Three quick trades of 0.3–0.5% each can generate $50–100 on a small account — provided stop-losses are strictly respected.

💬 Trader Review: “Pocket Option helped me refine my timing — AI Trading and Telegram signals highlight entry points, and tournaments add a competitive edge.” — Elena P., day trader

📊 Example of Available Assets:

On Pocket Option, you can trade not only indices like QQQ but also individual stocks of the largest global companies — great if you want a QQQ-like strategy but focused on single names:

| Stock | Why It’s Interesting | What to Watch |

|---|---|---|

| AAPL (Apple) | Leader of Nasdaq-100, strong earnings reports | iPhone launches, revenue reports |

| MSFT (Microsoft) | Key driver of AI growth | Azure updates, OpenAI news |

| AMZN (Amazon) | Sensitive to retail trends | Holiday sales, Prime Day results |

| TSLA (Tesla) | High volatility, perfect for day trading | EV deliveries, quarterly results |

| META (Meta) | Reacts to ad market and metaverse news | Earnings reports, guidance |

💡 Tip: These stocks are available 24/7 as OTC assets, letting you test strategies even outside regular market hours.

FAQ

Can you day trade QQQ?

Yes — QQQ ETF is one of the most liquid ETFs in the market, making it perfect for day trading. Its high trading volume and tight spreads allow scalpers and intraday traders to enter and exit positions with minimal slippage.

What is the best QQQ trading strategy?

There’s no single “best” strategy, but breakout trading during the first 30 minutes, pullback entries near VWAP, and trading around economic events like CPI or Fed announcements are among the most popular. Swing traders often use the 20-day EMA to spot entries.

Is QQQ good for day trading?

Absolutely. QQQ’s tech-heavy composition means it moves more than the S&P 500 on most trading days. This volatility creates opportunities for intraday profits — just make sure to manage risk with stop-losses and proper position sizing.

Can beginners trade QQQ successfully?

While possible, beginners should start with paper trading and small positions while learning market dynamics and risk management.

What technical indicators work best for QQQ trading?

Moving averages, RSI, and MACD are commonly used, but their effectiveness depends on market conditions and trading style.

Conclusion

QQQ ETF is a flexible instrument for trading the technology sector. It’s liquid, volatile, and suitable for both day trading and long-term investing. Use clear strategies, manage your risk carefully, and start practicing on Pocket Option’s demo before moving to live trading with real capital.

Start trading