- Trend following strategy

- Support and resistance trading

- Technical indicator combinations

- Price action analysis

How to make money on Pocket Option: Essential Methods for Financial Success

The world of online trading presents numerous opportunities for those interested in financial markets. This comprehensive analysis explores proven methods and strategies for trading on the Pocket Option platform, offering practical insights for both newcomers and experienced traders.

Understanding Pocket Option Trading

For those seeking information about how to make money on Pocket Option, understanding the fundamental principles and strategies is crucial. This comprehensive overview covers essential trading techniques, risk management, and practical approaches to trading on this platform.

Platform Overview

Pocket Option provides traders with various tools and features for market analysis and trading execution. The platform stands out for its user-friendly interface and comprehensive analytical capabilities.

| Feature | Description | Benefit |

|---|---|---|

| Trading Interface | Clean design | Easy navigation |

| Analysis Tools | Technical indicators | Informed decisions |

| Educational Resources | Video tutorials | Skill development |

Trading Strategies

Learning how to make money on Pocket Option requires understanding various trading strategies. Here are proven approaches:

| Strategy | Success Rate | Risk Level |

|---|---|---|

| Trend Following | 65-75% | Medium |

| Range Trading | 60-70% | Low |

| News Trading | 70-80% | High |

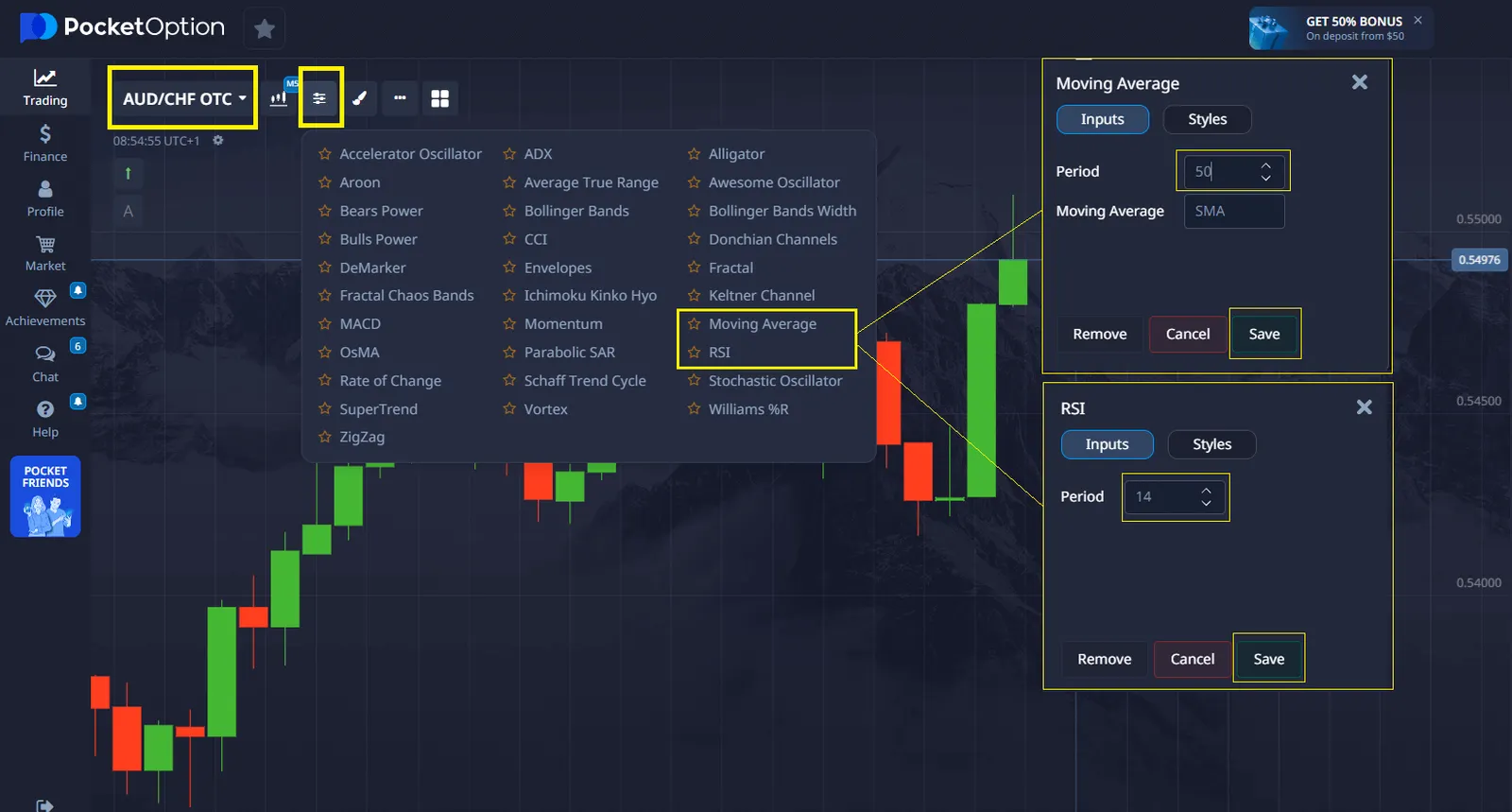

Example Trade Using the Trend Following Strategy

One of the most effective strategies on Pocket Option is the trend following strategy. Let’s go through a step-by-step example of a trade using this method.

- Asset: AUD/CHF

- Timeframe: 5 minutes

- Trade Amount: $5

Tools Used:

- Moving Average (MA) 50 indicator

- Relative Strength Index (RSI) indicator

Step 1: Identifying the Trend

Open the AUD/CHF chart and add the MA 50 indicator. If the price is above this line and moving upward, the trend is bullish. If the price is below the MA 50 and moving downward, the trend is bearish.

Step 2: Confirming the Signal

Add the RSI indicator and check its value:

- If RSI is above 50, it confirms an uptrend.

- If RSI is below 50, it confirms a downtrend.

In our example, the price is above the MA 50, and RSI is at 55, confirming an uptrend.

Step 3: Placing the Trade

Since the trend is bullish, we wait for a slight price pullback and then open a CALL (Buy) trade for 5 minutes with a $5 investment.

Step 4: Closing the Trade

After 5 minutes, the price continues to rise, and the trade closes in profit.

Result: By analyzing the trend and confirming signals with indicators, we executed a successful trade.

Risk Management

Effective risk management is essential when learning how to make money with Pocket Option. Consider these principles:

- Set stop-loss limits

- Use proper position sizing

- Monitor market conditions

- Maintain trading journal

| Risk Level | Position Size | Stop Loss |

|---|---|---|

| Conservative | 1-2% | 5-10 points |

| Moderate | 2-5% | 10-20 points |

| Aggressive | 5-10% | 20-30 points |

Market Analysis Techniques

Success in trading requires thorough market analysis and understanding of various indicators:

- Technical analysis tools

- Fundamental analysis methods

- Market sentiment indicators

- Economic calendar usage

| Analysis Type | Tools Used | Application |

|---|---|---|

| Technical | Charts, Indicators | Pattern recognition |

| Fundamental | News, Reports | Market impact |

| Sentiment | Volume, Momentum | Trend strength |

Real User Reviews & Success Stories

Many Pocket Option users have shared their success stories. Here are a few:

- James, 29 years old:”I started with a demo account, then tested strategies on real trades. Using the RSI indicator, I made three profitable trades in a row!”

- Sophia, 34 years old:”At first, I lost money, but when I started using technical indicators and keeping a trading journal, my profitability increased by 40%.”

- Daniel, 41 years old:”By using the trend-following strategy with Moving Average, I consistently make 10-15% returns on my deposit every week.”

These reviews prove that the right approach and discipline can lead to trading success.

Common Beginner Mistakes & How to Avoid Them

Many traders make the same mistakes when starting out. Here are the most common ones and how to prevent them:

1️⃣ Trading Without a Strategy – Avoid entering trades randomly. Stick to proven methods like trend following.

2️⃣ Ignoring Risk Management – Never risk your entire deposit. The optimal trade size is 1-2% of your balance.

3️⃣ Emotional Trading – After a losing trade, don’t try to recover losses immediately. Follow your plan.

4️⃣ Misusing Indicators – Before relying on any tool, test it on a demo account to fully understand how it works.

By avoiding these mistakes, you’ll significantly improve your chances of success!

FAQ

What is the minimum deposit on Pocket Option?

The minimum deposit is $5, making it accessible for new traders.

How long does it take to withdraw funds?

Withdrawals typically process within 1-3 business days, depending on the payment method.

Can I trade on mobile devices?

Yes, Pocket Option provides mobile applications for both iOS and Android platforms.

What are the most profitable trading hours?

Major market sessions (London, New York) typically offer better trading opportunities.

Is previous trading experience necessary?

While helpful, beginners can start with demo accounts and educational resources.

Conclusion

Success in trading requires a balanced approach combining technical knowledge, disciplined risk management, and continuous market analysis. The Pocket Option platform offers the necessary tools and features to implement various trading strategies effectively. By following the outlined methods, maintaining consistent practice, and adapting to market conditions, traders can work toward their financial objectives while managing potential risks.

Start trading