- AI and HPC Chip Demand: Growing at an estimated 35% annually, fueled by the build-out of “AI Factories.”

- Custom Silicon Partnerships: Deep collaborations with hyperscale cloud providers for tailor-made AI accelerators.

- Cloud Infrastructure Expansion: Steady demand for networking and connectivity components as enterprises move to hybrid cloud environments.

- VMware Software Synergies: Strong growth in the software division, with recurring revenue now forming a substantial portion of the company’s income.

- 5G and IoT Deployment: Continued global infrastructure upgrades providing a stable, long-term demand floor.

Broadcom (AVGO) Stock Forecast 2030: Strategic Insights for Tech Investors

Broadcom's AI chip dominance and VMware integration position it as a potential trillion-dollar company by 2030, according to latest market analysis.

Article navigation

- Broadcom Stock Prediction 2030: Complete AVGO Price Forecast Analysis

- Current Market Position and AI Strategy

- AVGO Stock Forecast 2030: Scenario Analysis

- How to Engage with Tech Market Trends on Pocket Option

- Key Growth Drivers Through 2030

- Risk Factors and Challenges

- Investment Strategies and Trading Opportunities

- Latest Updates and Insider Information

Broadcom Stock Prediction 2030: Complete AVGO Price Forecast Analysis

Broadcom (NASDAQ: AVGO) stands at the forefront of the semiconductor revolution, with artificial intelligence and cloud infrastructure driving unprecedented demand for its solutions. As we look toward 2030, investors are questioning whether this tech giant can maintain its impressive trajectory and what price targets are realistic for the next decade.

The company’s strategic positioning in AI-driven semiconductors, coupled with its successful VMware acquisition, creates a compelling investment narrative. However, understanding the various factors that will influence Broadcom stock prediction 2030 requires careful analysis of market trends, competitive dynamics, and technological evolution.

With Pocket Option, you don’t have to wait until 2030. Trade 100+ assets right now with profitability up to 92%.

Current Market Position and AI Strategy

Broadcom has established itself as a critical, if sometimes unseen, player in the AI infrastructure ecosystem. It supplies the essential high-speed networking components that act as the central nervous system for data centers and cloud computing platforms. To put this into a real-world context, imagine a massive AI data center built by a company like Google or Meta. It contains tens of thousands of powerful GPUs for processing AI models. For these GPUs to work together as a single, colossal brain, they need to communicate at lightning speed. Broadcom designs the market-leading Ethernet switches (like the Tomahawk and Jericho series) and custom chips (ASICs) that create this ultra-fast, low-latency network fabric, making large-scale AI possible.

The company’s revenue streams now span both its foundational semiconductor solutions and a robust enterprise software portfolio, providing a level of diversification that many pure-play chip companies lack.

Key Revenue Drivers:

“Broadcom’s transformation from a traditional semiconductor company to an AI-focused infrastructure powerhouse positions it perfectly for the next decade of growth.” – Sarah Chen, Tech Industry Analyst, 2025

📈 With Broadcom’s AI dominance shaping the market, Pocket Option provides the tools to analyze and trade on these powerful tech trends in real-time.

For traders looking to capitalize on Broadcom’s growth trajectory, platforms like Pocket Option offer opportunities to engage with AVGO movements through various trading strategy, allowing participation in both short-term fluctuations and longer-term trends.

AVGO Stock Forecast 2030: Scenario Analysis

Our comprehensive analysis presents three potential scenarios for Broadcom’s stock performance through 2030, considering various market conditions and execution outcomes. These forecasts reflect the inherent volatility and massive potential of the semiconductor sector.

| Scenario | 2025 Target | 2027 Target | 2030 Target | Key Assumptions |

|---|---|---|---|---|

| Bullish | $2,800 | $4,200 | $6,500 | Sustained AI boom, flawless VMware integration and cross-selling, continued leadership in networking, and expansion into new custom AI chip deals. |

| Base Case | $2,200 | $3,100 | $4,200 | Steady growth in line with market expansion, moderate software synergies, and consistent execution on product roadmaps. |

| Conservative | $1,800 | $2,400 | $2,800 | Macroeconomic headwinds, increased competition from rivals like Nvidia and Marvell, and slower-than-expected software adoption. |

“The semiconductor industry’s cyclical nature must be considered, but Broadcom’s diversification into software provides more stability than traditional chip companies enjoy.” – Michael Rodriguez, Investment Research Director, 2025

VMware Acquisition ImpactThe $69 billion VMware acquisition was a landmark strategic move, fundamentally altering Broadcom’s business model. This transaction has successfully transformed the company from a primarily hardware-focused entity to a balanced hardware-software giant with significant recurring revenue streams. The integration has progressed rapidly, with Broadcom streamlining VMware’s offerings and focusing on high-value enterprise customers.

- Immediate Revenue Impact: Added over $13 billion in annual software revenue, which now accounts for nearly half of Broadcom’s total income.

- Enhanced Customer Relationships: Deepened ties with thousands of enterprise clients, creating a captive audience for hardware and software solutions.

- Significant Cross-Selling Opportunities: Creating a powerful ecosystem where customers using VMware’s cloud stack are incentivized to use Broadcom’s networking hardware.

- Reduced Cyclicality: The stable, subscription-based software revenue provides a powerful buffer against the historical boom-and-bust cycles of the semiconductor industry.

💡 As Broadcom diversifies with software, your trading strategy can diversify too! Pocket Option offers over 100+ assets, from tech stocks to currencies, so you’re never limited to just one market.

How to Engage with Tech Market Trends on Pocket Option

While long-term investing in a stock like Broadcom is one path, the dynamic nature of the tech sector offers numerous trading opportunities. For those looking to actively participate, platforms like Pocket Option provide an accessible and feature-rich environment designed for both novice and experienced traders. It’s important to note that while a specific stock like AVGO may not always be available, you can trade the sector’s volatility through other instruments like tech-heavy indices, currency pairs, and other company stocks.

Here’s how Pocket Option empowers you to trade the trends:

- Accessible Starting Point: You can begin your trading journey with a minimum deposit of as little as $5, though this can vary by region and payment method.

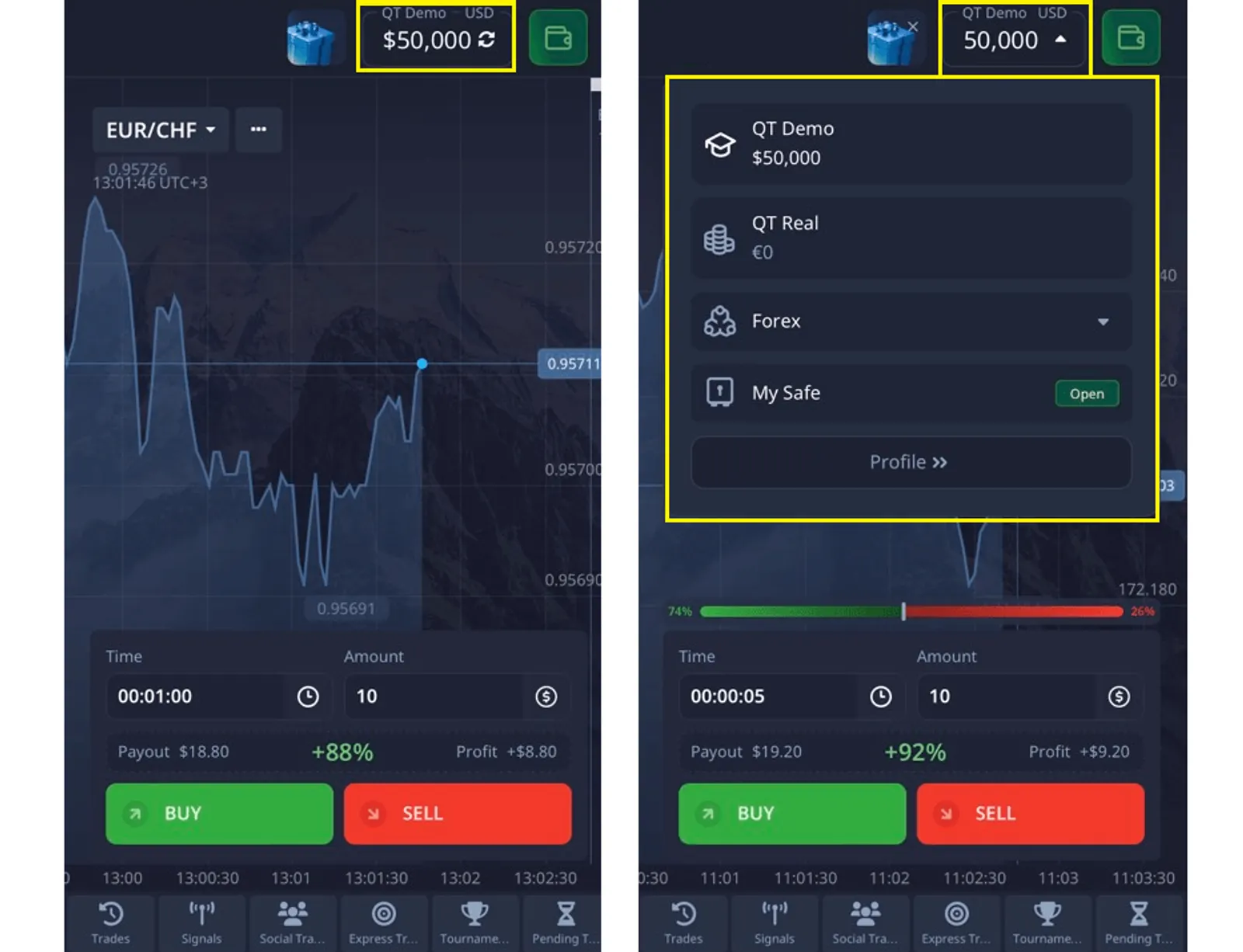

- Risk-Free Practice: Before committing real capital, you can hone your skills on a free demo account loaded with $50,000 in virtual funds. This allows you to test strategies in a real market environment without any financial risk.

- A World of Assets: With over 100 trading assets available, you can diversify your activities beyond a single company and trade on broader market movements.

- Free Education Hub: Pocket Option provides a comprehensive, free knowledge base filled with tutorials on trading strategies, forex, and market analysis. Educational videos help beginners understand the fundamentals and start their careers with confidence.

- Trade Anywhere, Anytime: The full-featured mobile app ensures you never miss a market move, while advanced tools like automated trading Bot can help execute your strategy.

- Compete and Win: Participate in regular trading tournaments to test your skills against others and win prizes.

✔️ Make short-term forecasts in seconds and earn up to 92% profit per trade when your direction is correct.

Key Growth Drivers Through 2030

Several macroeconomic and technological trends will shape Broadcom’s trajectory over the next decade, creating both opportunities and challenges for investors.

AI and Machine Learning Expansion

The artificial intelligence revolution continues accelerating, with enterprise AI adoption expected to reach 80% by 2027. Broadcom’s specialized chips and networking solutions are the bedrock for many AI training and inference workloads, positioning the company at the center of this transformation. The company’s ability to provide the complete Ethernet fabric for AI data centers is a key differentiator against competitors promoting proprietary solutions.

| AI Market Segment | 2024 Size | 2030 Projection | Broadcom’s Role |

|---|---|---|---|

| Data Center AI Chips | $45B | $180B | Key supplier for networking and custom training accelerators |

| Edge AI Processing | $12B | $65B | Specialized inference and connectivity solutions for devices |

| AI Software Infrastructure | $28B | $120B | VMware virtualization and private cloud platforms |

“Broadcom’s ability to provide both the silicon and software stack for AI workloads creates a competitive moat that will strengthen through 2030.” – Dr. Lisa Zhang, Semiconductor Research Institute, 2025

Cloud Infrastructure Evolution

The shift to hybrid and multi-cloud architectures directly benefits Broadcom’s networking and connectivity solutions. As enterprises modernize their IT infrastructure to handle AI workloads, the demand for high-performance, open-standard networking components continues to grow, playing directly into Broadcom’s strengths.

Risk Factors and Challenges

Despite strong growth prospects, several risk factors could impact Broadcom’s path to our 2030 price targets.

- Regulatory and Geopolitical Concerns: Ongoing US-China trade tensions could affect semiconductor exports and supply chains. Antitrust scrutiny of large technology companies remains a persistent threat.

- Competition and Market Dynamics: The semiconductor industry faces intense competition. Nvidia, with its dominant GPUs and Mellanox networking division (InfiniBand), is a formidable rival in the AI data center. Marvell Technology also competes directly in networking and custom silicon.

- Integration and Execution Risk: While the VMware integration has been strong so far, challenges in merging corporate cultures and aligning long-term product roadmaps could still arise.

- Technological Disruption: The rapid pace of AI chip innovation means constant vigilance and massive investment in R&D are essential to maintain a competitive edge.

“While Broadcom has strong competitive positions, the rapid pace of AI chip innovation means constant vigilance and investment in R&D is essential.” – James Park, Technology Investment Strategist, 2025

Investment Strategies and Trading Opportunities

Investors considering Broadcom exposure have multiple approaches, from long-term buy-and-hold strategies to more active trading approaches that capitalize on shorter-term volatility.

Long-term Investment Approach:

- Dollar-cost averaging into positions over 12-18 months.

- Dividend reinvestment to compound returns.

- Monitoring quarterly earnings for execution updates on software growth and AI chip demand.

- Position sizing based on risk tolerance and portfolio allocation.

Active Trading Strategies:

For traders seeking more frequent engagement with AVGO price movements and the tech sector at large, various strategies can be employed. For example, traders often apply technical analysis to identify optimal entry and exit points during earnings seasons or major product announcements.

🚀 Ready to put theory into practice? Pocket Option’s free demo account is your personal trading sandbox. Test strategies on real market data without risking a single dollar!

“The key to successful Broadcom investment is understanding both the technology cycles and the company’s execution capabilities across its diverse business units.” – Rachel Kim, Portfolio Manager, 2025

Latest Updates and Insider Information

As of Q1 2025, Broadcom has fully integrated VMware operations, generating $10B in software revenue annually. Insiders have pointed to a renewed focus on AI-powered virtualization products. Analyst upgrades in March 2025 reflect increased earnings confidence, supporting moderate-to-optimistic broadcom stock forecast 2030 ranges.

FAQ

What is the core thesis behind broadcom stock prediction 2030?

The thesis centers on Broadcom's evolution from a semiconductor leader to a diversified tech powerhouse with high-margin software, strong AI presence, and global infrastructure relevance.

How accurate are AVGO stock forecast 2030 models?

While no forecast is certain, models are increasingly data-driven. They incorporate historical performance, earnings guidance, AI demand, and strategic acquisitions.

What makes Broadcom's acquisition of VMware important for 2030 projections?

The VMware deal marks a shift from cyclical hardware to recurring software revenue, potentially stabilizing earnings and boosting valuation multipliers by 2030.

Are geopolitical risks a serious threat to broadcom stock forecast 2030?

Yes, especially considering Broadcom's supply chain exposure and regulatory hurdles. Mitigating these risks requires diversification and compliance.

How can long-term traders use platforms to model AVGO strategies?

Platforms offering simulations, charting tools, alerts, and long-term data access help investors test and adjust strategies that align with broadcom stock prediction 2030.

CONCLUSION

Broadcom stock prediction 2030 presents a compelling growth story built on AI infrastructure dominance, strategic diversification through VMware, and strong competitive positioning in critical technology markets. Our analysis suggests price targets ranging from $2,800 to $6,500 depending on execution and market conditions. The company's transformation into a balanced hardware-software entity reduces cyclical risks while maintaining exposure to high-growth AI markets. However, investors must consider regulatory challenges, competitive dynamics, and macroeconomic factors that could impact these projections. For those seeking immediate market participation, trading platforms offer opportunities to engage with Broadcom's price movements across various timeframes. Whether pursuing long-term investment strategies or active trading approaches, AVGO remains a cornerstone technology stock for the decade ahead. As artificial intelligence continues reshaping global technology infrastructure, companies like Broadcom that provide both the hardware foundation and software orchestration tools are positioned for sustained growth. The next five years will prove critical for validating these ambitious 2030 price projections.

Begin Trading Technology Stocks