- Stock Underperformance. Northrop Grumman’s stock has declined by 3.6%, underperforming both the S&P 500 and other major players in the defense sector.

- Insider Stock Sales. The recent sale of 293 shares by Vice President Benjamin Davis has raised questions about the company’s future prospects. Insider sales often signal a lack of confidence from within the company.

- Cost Overruns on Key Projects. Several major defense programs have exceeded their budgets, further eroding confidence in the company’s ability to manage its operations efficiently.

- Stock Buyback Program. In response to the stock’s underperformance, Northrop Grumman has announced a buyback plan aimed at stabilizing its share price. However, this move is seen as a short-term fix rather than a long-term solution to the company’s challenges.

Why is Northrop Grumman stock going down?

The recent decline in Northrop Grumman's stock price has raised concerns among investors. While the defense industry is generally considered a stable sector, several factors have contributed to the company’s underperformance. Macroeconomic pressures, internal financial challenges, technological shifts, and changing market sentiment have all played a role. Below, we explore the primary reasons behind this downturn and what it could mean for investors.

Northrop Grumman, one of the largest defense contractors in the U.S., has recently seen its stock decline. Investors are concerned about various macroeconomic, financial, and industry-specific factors affecting the company's performance. Below, we analyze the key reasons behind this downward trend.

1. Macroeconomic and Geopolitical Factors

Why is Northrop grumman stock going down? Northrop Grumman operates in a sector that is heavily influenced by global geopolitical and economic trends. Recent developments have created significant challenges for the company:

| Factor | Impact on Northrop Grumman |

|---|---|

| U.S. Defense Budget Cuts | Plans to reduce the Pentagon’s budget by 8% over the next five years raise concerns about future revenue. |

| Geopolitical Stability | A decrease in global conflicts reduces demand for military contracts. |

| Rising Inflation | Increases production costs and lowers profitability. |

| European Competition | Companies like BAE Systems and Thales are gaining market share. |

| Currency Fluctuations | Affects international contracts and earnings. |

Cumulatively, these factors have weakened Northrop Grumman's position in the global defense market.

2. Financial Performance and Market Trends

Why is Northrop Grumman stock going down today? Northrop Grumman’s recent financial performance has also contributed to its declining stock price. A number of internal and external issues have undermined investor confidence:

3. Technological Shifts in the Defense Industry

The defense industry is undergoing rapid technological transformation, and Northrop Grumman faces challenges in adapting to these changes.

| Technological Change | Impact on Northrop Grumman |

|---|---|

| Rise of Unmanned Systems | Reduces demand for traditional fighter jets like the F-35, where Northrop Grumman plays a key role. |

| Elon Musk’s Criticism | Musk’s statements about the future of warfare favoring drones over fighter jets have negatively impacted defense stocks. |

These shifts highlight the need for Northrop Grumman to innovate and adapt to remain competitive in the evolving defense landscape.

4. Expert Opinions and Market Sentiment

The decline in Northrop Grumman’s stock price has sparked mixed reactions from analysts and investors alike:

- Analysts’ Recommendations. Citi analysts view the recent drop in stock price as a potential investment opportunity for long-term investors, citing the company’s strong fundamentals despite short-term challenges.

- Investor Discussions. Negative sentiment on platforms like Smart-Lab and Investing.com is influencing retail investors, further contributing to selling pressure.

- Regulatory Risks. Upcoming government regulations could increase operational costs for defense contractors, adding another layer of uncertainty for the company.

💡 Ready to Forecast Market Movements on demo account? Sign Up Now!

Did you know that you can make money not only when stocks rise but also when they fall? With Pocket Option, there’s no need to buy or sell the actual asset. Instead, you simply forecast whether the price will go up or down. If your forecast is correct, you can earn up to 92% profit in as little as 5 seconds!

- 100+ Tradable Assets. Choose from stocks, indices, cryptocurrencies, commodities, and currency pairs.

- Simple Forecast. No need to own the asset—just predict its price movement.

- Demo Account with $50,000. Practice trading risk-free before committing real money.

- Low Entry Barrier. Start trading with as little as $5, with trades starting from just $1.

- Welcome Bonus. Use promo code “50START” to get a 50% bonus on your first deposit.

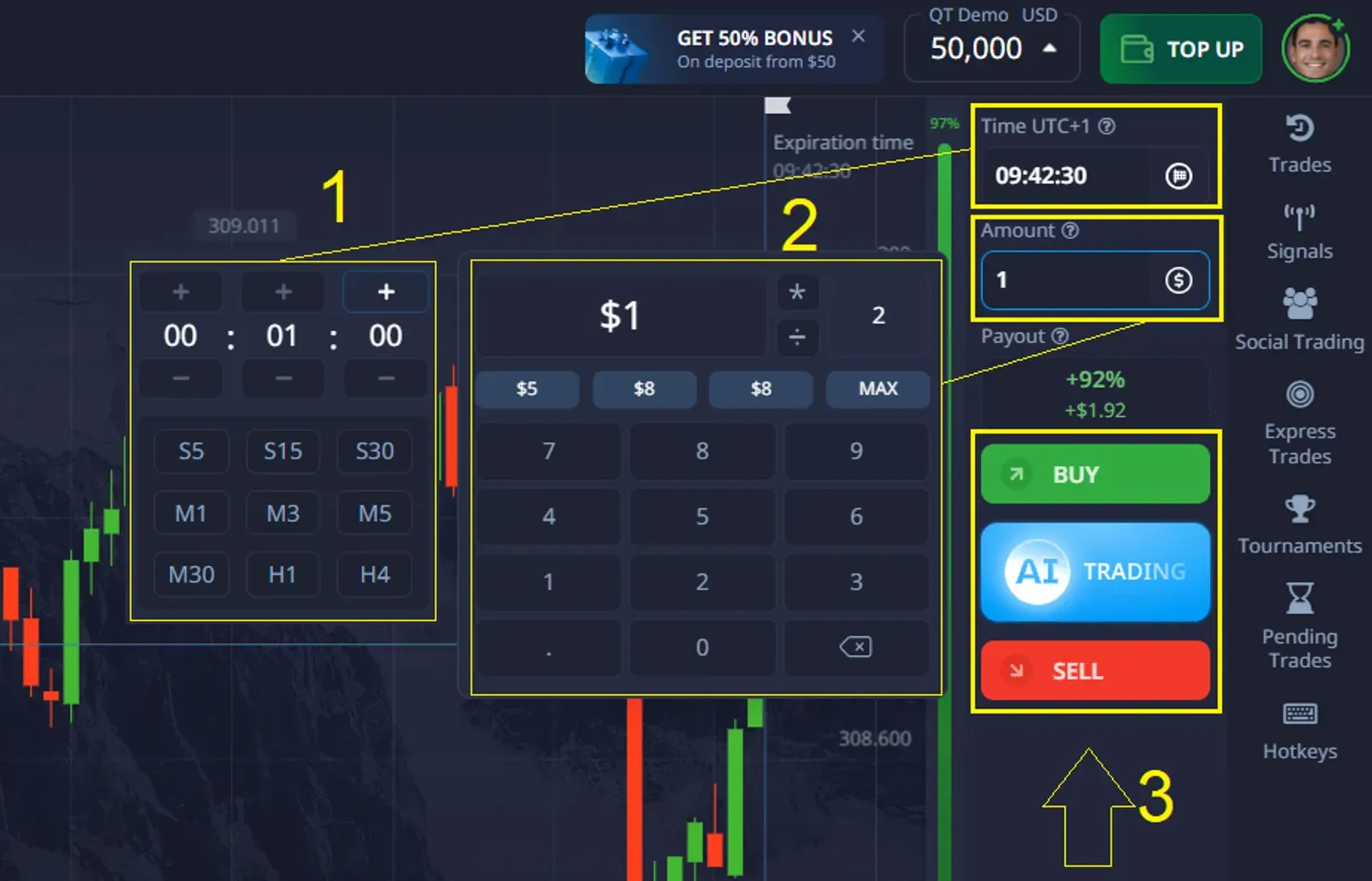

1. Choose an Asset. Select from over 100 assets, including stocks, indices, cryptocurrencies, commodities, and currencies.

2. Analyze the Chart. Use tools like the Trader Sentiment Indicator or technical analysis to identify trends.

3. Set Trade Amount & Time. Start with as little as $1 for trade durations as short as 5 seconds.

4. Make Your Forecast . If you think the price will go up, click "BUY." If you think it will go down, click "SELL."

If your forecast is correct, you can earn up to 92% profit. The potential payout percentage is displayed before placing a trade, so you always know what to expect.

💡 Additional Features on a Real Account (available from just $5):

- Copy Trading. Replicate the strategies of successful traders with ease.

- Cashback on Trades. Receive rewards based on your trading activity.

- Exclusive Benefits. Access bonuses, participate in tournaments, and enjoy premium features.

Northrop Grumman’s recent struggles are the result of a combination of macroeconomic pressures, financial challenges, and technological shifts in the defense industry. While the company faces significant hurdles, the current drop in its stock price may present an opportunity for long-term investors willing to take on some risk.

For those looking to profit from market fluctuations, Pocket Option provides a convenient and accessible platform for trading. Whether you’re new to trading or a seasoned investor, Pocket Option offers the tools and features you need to make informed decisions and succeed in the market.

FAQ

What are the main reasons for Northrop Grumman's stock decline?

The main reasons include market saturation, government budget constraints, increased competition, and technological shifts in the defense industry.

How has increased competition affected Northrop Grumman?

Increased competition has led to pressure on global contracts, loss of market share in specialized areas, and challenges in core markets.

What strategies can Northrop Grumman employ to recover its stock value?

Potential strategies include diversification, focusing on innovation, cost optimization, and forming strategic partnerships.

How do geopolitical factors impact Northrop Grumman's stock performance?

Geopolitical uncertainties can affect defense priorities and budgets, influencing investor sentiment and stock valuation.

What is the long-term outlook for the defense industry and Northrop Grumman?

The long-term outlook remains stable, with potential growth driven by emerging security threats, technological advancements, and possible increases in defense budgets.