- Technical Analysis Signals: These signals are based on historical price and volume data. They help traders identify patterns and trends using tools like Moving Averages, RSI (Relative Strength Index), Bollinger Bands, and trendline breakouts.

- Fundamental Analysis Signals: These signals rely on financial and economic data to assess a company’s performance or market conditions. Examples include earnings reports, price-to-earnings ratios, and industry trends.

- Sentiment Analysis Signals: These signals gauge market sentiment by analyzing data from social media, news outlets, or investor surveys to understand market optimism or fear.

- Algorithmic Trading Signals: Generated by computer algorithms, these signals analyze market data and execute trades automatically based on pre-set rules and criteria.

- Economic Indicator Signals: These signals use macroeconomic data such as GDP growth, inflation rates, or employment figures to provide insights into broader market trends.

- Volume-Based Signals: Using trading volume data, these signals highlight potential price movements. Common examples include On-Balance Volume (OBV) and Volume Weighted Average Price (VWAP).

- Volatility Signals: These signals measure market volatility to identify possible turning points. Indicators like the Volatility Index (VIX) or Average True Range (ATR) are often used.

Trading Signals in Finance

Unlock the potential of financial markets with actionable trading signals! Discover how technical, fundamental, and algorithmic tools guide decision-making, identify market trends, and manage risks effectively. In this article, we break down the types, applications, and challenges of trading signals, helping you navigate stocks, forex, crypto, and more with confidence.

Trading signals are powerful tools that help traders and investors navigate financial markets. They provide insights into potential price movements, making it easier to decide when to buy, sell, or hold an asset. Generated through methods like technical analysis, fundamental analysis, or algorithmic models, trading signals turn complex market data into clear, actionable information. Let’s explore how they work and why they matter.

Trading signals are fundamental elements for decision-making in today’s financial markets. Pocket Option implements advanced systems that process data in real-time, providing accurate indicators for over 100 financial assets. The platform uses state-of-the-art technology to analyze market patterns, trends, and potential turning points. Proprietary algorithms evaluate multiple variables simultaneously, from technical data to fundamental indicators. The system generates automated alerts when specific criteria predefined by the user are met. Traders receive instant notifications through the web platform or mobile application. The accuracy of the signals is maintained through continuous calibration of the algorithms.

Components of the Signal System:

| Component | Function | Accuracy |

|---|---|---|

| Proprietary Algorithms | Pattern Analysis | 92% |

| Technical Indicators | Trend Identification | 89% |

| Fundamental Analysis | Asset Evaluation | 87% |

| Real-Time Alerts | Immediate Notification | 99% |

| Filter System | Elimination of False Positives | 95% |

The technological infrastructure of Pocket Option processes more than 10 million data points per second. High-speed servers ensure latency lower than 0.001 seconds in the generation of signals. The system uses artificial neural networks to continuously improve the accuracy of predictions. Machine learning algorithms automatically adapt to the changing market conditions. The platform employs blockchain technology to ensure the integrity of historical data. Redundant backup systems ensure a service availability of 99.99%. The modular architecture allows for continuous updates without interrupting the service.

- Exponential Moving Average (EMA)

- Relative Strength Index (RSI)

- Moving Average Convergence/Divergence (MACD)

- Bollinger Bands

- Stochastic Oscillator

Registration on Pocket Option requires an identity document and verification of official residence.

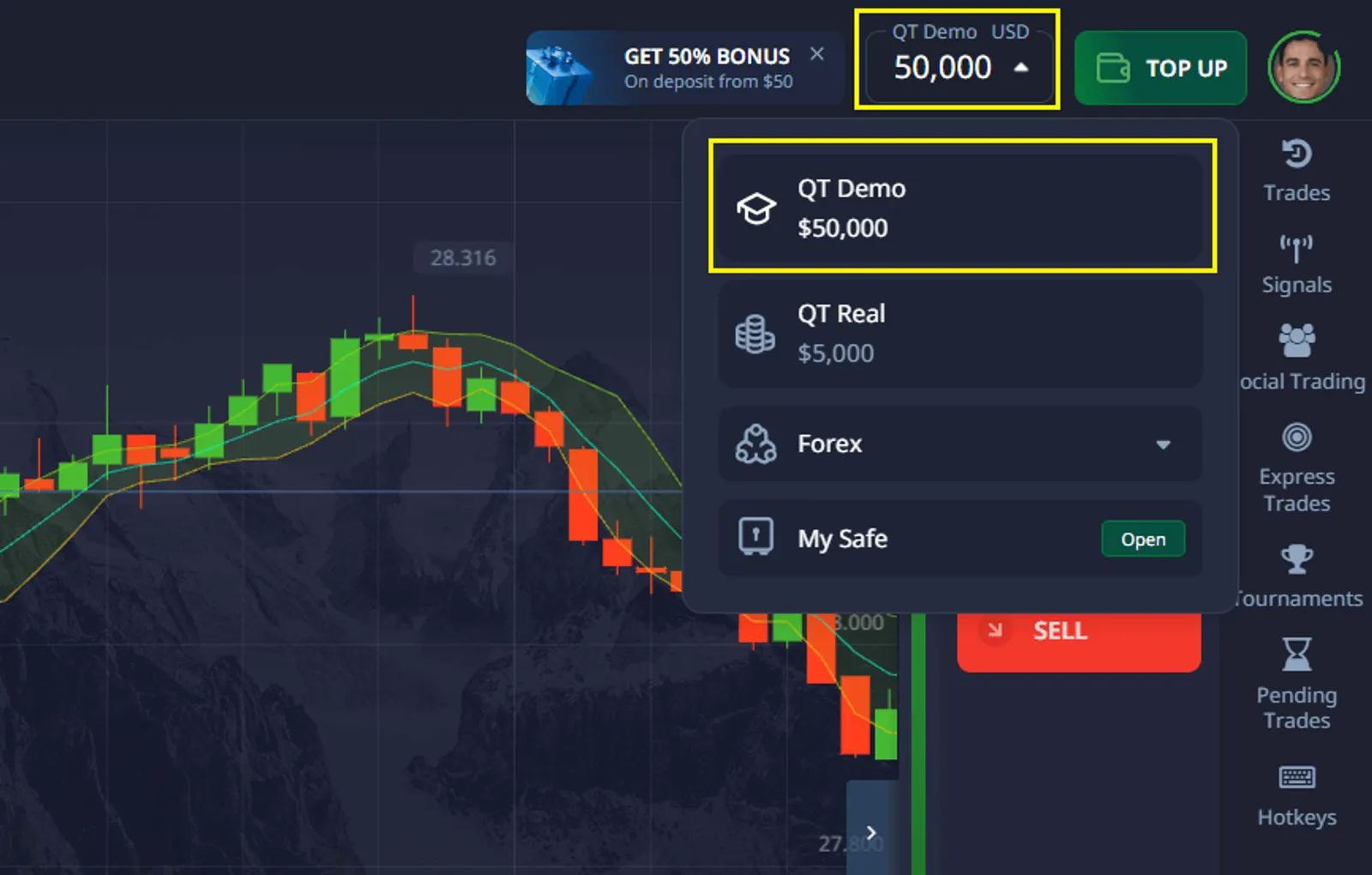

- Users have access to a demo account with $50,000 virtual funds for an unlimited period.

- Traders can operate with a minimum initial deposit of $5.

- The setup of custom signals is done from the main panel. New users receive personalized tutorials in multiple languages.

• 30+ technical indicators with adjustable parameters

• 7+ professional drawing tools

• Real-time charts

• Backtesting system with historical data

• Market sentiment analysis

Trading signals are widely used across different strategies and markets, making them valuable tools for traders, investors, and analysts. Here’s how they are applied in key areas:

- Stock Trading: Trading signals help stock traders identify when to enter or exit trades. For instance, technical signals like moving average crossovers or breakouts highlight trends, while fundamental signals based on earnings or valuation metrics point to long-term opportunities. Traders often combine these signals to validate trends and improve decision-making. Volume-based signals, such as On-Balance Volume (OBV), are also crucial for assessing price strength or detecting reversals.

- Forex Trading: The 24/7 forex market is a prime candidate for real-time trading signals. Forex traders rely on signals to track currency pair movements, often combining technical indicators, like support and resistance levels, with macroeconomic data. For example, a signal may be triggered when a currency pair breaks a key level, supported by favorable economic indicators like GDP growth or inflation data. The liquidity and volatility of forex make accurate, timely signals essential for short-term trading.

- Commodity Trading: In commodity markets, trading signals help analyze price trends influenced by supply and demand, geopolitical events, and weather patterns. Technical signals, such as trendlines and moving averages, are commonly used, alongside fundamental signals like inventory reports or production forecasts.

- Cryptocurrency Trading: Given the high volatility of crypto markets, trading signals are especially valuable. Signals often include technical patterns like breakouts, combined with sentiment analysis based on social media trends. Algorithmic signals also play a significant role in this rapidly evolving market.

- High-Frequency Trading: In high-frequency trading, algorithmic signals analyze large datasets in milliseconds to execute trades. These signals are tailored for speed and precision, using real-time data to capitalize on minute price fluctuations.

- Long-Term Investment Strategies: For long-term investors, trading signals provide insights into broader trends. Fundamental signals, like earnings growth or sector performance, are key in building and adjusting portfolios over time.

Trading signals are essential tools for making informed decisions in financial markets. They provide clear, actionable insights that help traders and investors navigate the complexities of market movements. Here’s why trading signals are so valuable:

- Provide Objective Market AnalysisTrading signals rely on data, not emotions, to assess market conditions. For example, a moving average crossover offers a straightforward, objective indication of when to buy or sell, bypassing subjective opinions. Signals like the RSI (Relative Strength Index) help identify whether an asset is overbought or oversold, keeping decisions grounded in facts rather than gut feelings.

- Identify Potential Trading OpportunitiesMarkets move fast, and it’s impossible to monitor everything manually. Trading signals scan massive amounts of data, alerting traders to opportunities they might otherwise overlook. For instance, a breakout signal highlights when an asset surpasses a key resistance level, potentially marking the start of a trend. Similarly, a volume spike signal can point to unusual activity that could lead to significant price changes.

- Manage RiskEffective trading signals don’t just identify opportunities—they also highlight potential risks. By using stop-loss levels, volatility measures, or other risk-based signals, traders can better protect their capital and minimize losses.

- Improve Timing of TradesMarkets often hinge on timing, and trading signals help refine it. For instance, signals based on technical indicators, such as MACD or Bollinger Bands, can guide traders on the best moments to enter or exit a position.

- Eliminate Emotional BiasFear, greed, or overconfidence can cloud judgment. Trading signals remove emotional bias by basing decisions on pre-determined criteria, ensuring a more disciplined approach to trading.

- Automate Trading StrategiesMany trading signals can be integrated into automated systems, allowing traders to execute strategies without constant manual intervention. This can save time and help maintain consistency, especially in volatile markets.

- Enhance Market UnderstandingUsing trading signals regularly improves a trader's understanding of market dynamics. They offer insights into trends, patterns, and behaviors, helping traders develop more refined strategies over time.

The platform integrates advanced risk management tools for Spanish traders. The system automatically calculates the optimal position size based on the balance. The signals include dynamic stop-loss and take-profit recommendations. The platform monitors total exposure to risk in real-time. The algorithms adjust parameters according to market volatility. The system allows setting personalized maximum loss limits. Traders receive alerts when approaching their set limits.

Risk Management Features

| Feature | Functionality | Benefit |

| Dynamic Stop-Loss | Automatic Adjustment | Capital Protection |

| Exposure Limits | Continuous Monitoring | Risk Control |

| Position Calculator | Size Optimization | Operational Efficiency |

| Risk Alerts | Instant Notifications | Loss Prevention |

| Anti-Martingale System | Strategy Control | Trading Discipline |

Pocket Option offers universal multi-platform access for all traders. The platform is compatible with Windows, Mac, and Linux systems. The signals are instantly synchronized between mobile and desktop devices. The system allows integration with MetaTrader 4/5 via API. The platform supports multiple languages with a localized interface. Users can customize the interface according to their preferences. Technical support is available 24/7 in various languages.

Trading signals are essential tools for traders and investors, offering clear metrics to guide decisions, uncover opportunities, and understand market dynamics. Whether in stock trading, forex, or cryptocurrency markets, trading signals play a vital role in shaping strategies and improving analysis.

However, effective use of trading signals requires more than just following them blindly. Traders must interpret them carefully, consider multiple factors, and remain aware of their limitations. As trading technologies evolve, the importance of trading signals will only grow, making them even more valuable for navigating financial markets.

By understanding their types, applications, and challenges, traders can leverage trading signals to make more informed decisions and improve their overall outcomes.

FAQ

What are the most commonly used technical Indicators for generating trading signals?

Common technical Indicators include Moving Averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

How often should I update my trading signals?

The frequency depends on your trading strategy and timeframe. Short-term traders might update signals constantly, while long-term investors might review signals weekly or monthly.

Can trading signals guarantee profitable trades?

No, trading signals cannot guarantee profits. They are tools to aid decision-making, but market unpredictability means there's always risk involved in trading.

How do I choose the right trading signals for my strategy?

Choose signals that align with your trading style, risk tolerance, and the assets you trade. Backtest different signals to see which perform best for your specific needs.

How do algorithmic trading systems use trading signals?

Algorithmic trading systems use predefined rules to automatically generate and act on trading signals, often executing trades without human intervention based on these signals.