- Algorithm complexity and effectiveness

- Data quality and quantity

- Market conditions and volatility

- Risk management capabilities

- Operational costs and fees

Pocket Option Solutions: Analyzing the Profitability of are AI Trading Bots

In recent years, the financial world has witnessed a surge in the use of artificial intelligence (AI) in various aspects of trading and investment. One of the most intriguing developments is the rise of AI trading bots. These automated systems promise to revolutionize the way we approach the markets, but a crucial question remains: are AI trading bots profitable?

To answer this question, we need to delve into the world of algorithmic trading, examine the potential benefits and drawbacks of AI-powered systems, and consider the factors that influence their profitability. Let's explore this topic in detail and try to understand whether AI trading bots can truly deliver on their promises.

AI trading bots are sophisticated computer programs that use artificial intelligence and machine learning algorithms to analyze market data, identify patterns, and execute trades automatically. These bots are designed to operate 24/7, process vast amounts of information, and make decisions faster than any human trader could.

The question of whether AI trading bots are profitable is complex and multifaceted. To gain a better understanding, let's break down the key components and considerations:

The profitability of AI trading bots depends on several factors, such as the quality of the AI analysis, market conditions, and the trading strategies used.

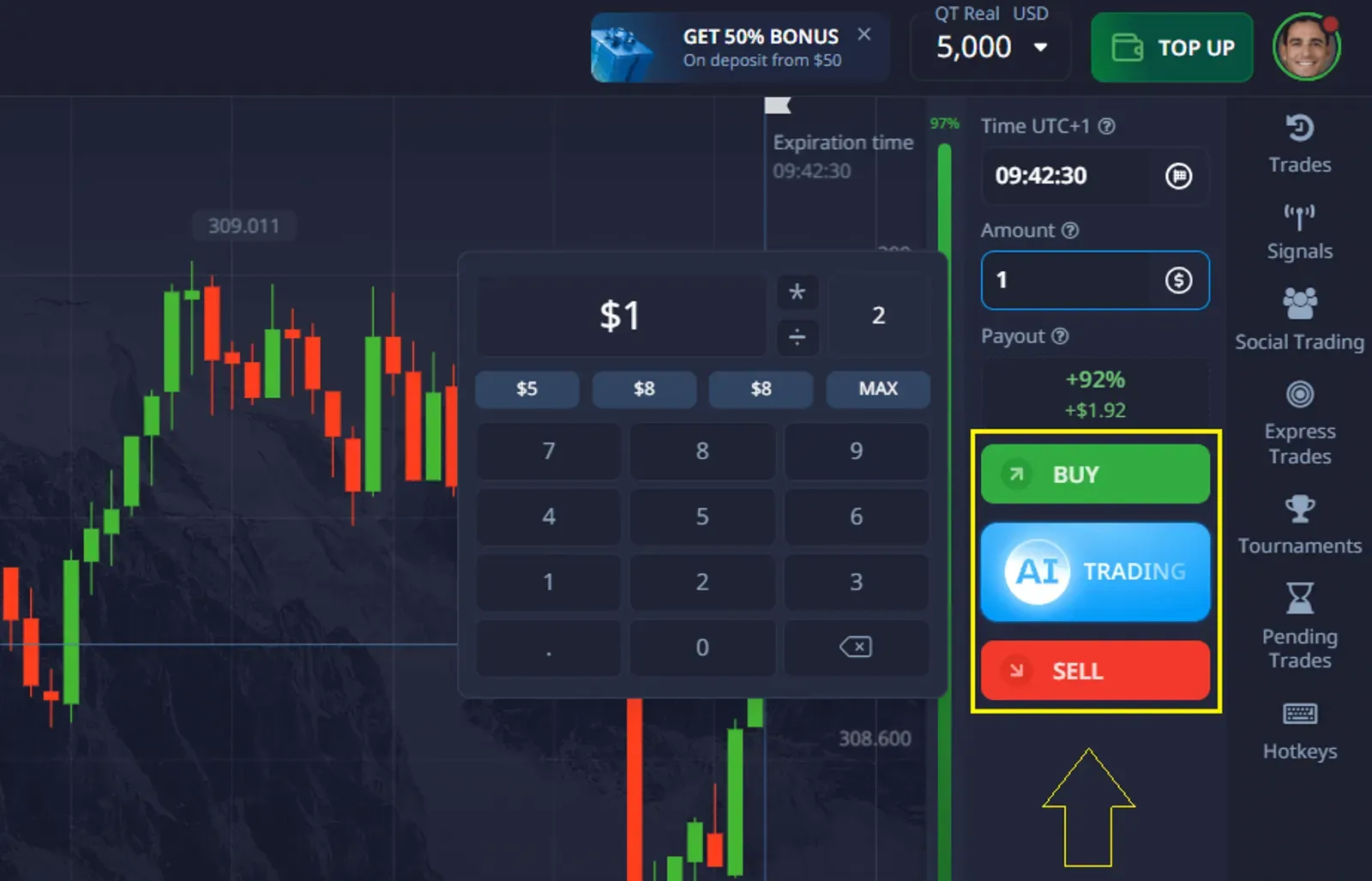

Pocket Option offers an AI trading feature that uses advanced artificial intelligence to determine the direction and expiration time of trades. This feature is based on signals, technical analysis, and traders’ experience.

The AI Trading feature on Pocket Option offers several benefits that enhance your trading experience:

- Advanced Analysis: The AI Trading feature uses sophisticated algorithms to analyze market trends, signals, and technical data, providing you with informed trading decisions.

- Time Saving: By automating the decision-making process, AI Trading saves you time and effort, allowing you to focus on other things while the system works for you.

- Enhanced Accuracy: The AI system is designed to minimize human error by relying on data and historical patterns.

- User Friendly: The feature can be easily enabled or disabled through the settings, making it accessible even for beginners.

- Increased Efficiency: AI Trading optimizes trade execution by determining the best direction and expiration time for trades, potentially increasing profitability.

- If you want to learn more or try AI trading, head over to the platform and give it a try today by enabling this feature in the settings!

How to enable:

To enable or disable the AI trading mode, you can go to the settings page by clicking on the avatar icon and enabling the AI trading option.

To start a trade with the AI on Pocket Option, simply click on the "AI Trading" option. By agreeing to this, you allow the AI to decide the direction of the trade and the expiration time.

Proponents of AI trading bots argue that these systems offer several advantages that can contribute to their profitability:

| Benefit | Description |

|---|---|

| Emotion-free trading | AI bots make decisions based on data and algorithms, eliminating emotional biases |

| 24/7 market monitoring | Bots can analyze and trade in markets around the clock without fatigue |

| High-speed execution | AI systems can process information and execute trades in milliseconds |

| Backtesting capabilities | Strategies can be tested on historical data to optimize performance |

These potential benefits have led many to ask: do AI stock trading bots work? The answer is not straightforward and depends on various factors.

While AI trading bots offer promising features, they also face several challenges that can impact their profitability:

- Overfitting: Bots may perform well on historical data but fail in live markets

- Market adaptability: Rapidly changing market conditions can render strategies obsolete

- Technical glitches: Software errors or network issues can lead to unexpected losses

- Regulatory concerns: Compliance with evolving financial regulations can be complex

These challenges highlight the importance of careful implementation and ongoing monitoring when using AI trading bots.

To determine whether AI trading bots are profitable, we need to consider several key factors:

| Factor | Impact on Profitability |

|---|---|

| Algorithm Quality | High-quality algorithms can identify more profitable opportunities |

| Market Conditions | Bots may perform differently in bull markets, bear markets, or sideways trends |

| Risk Management | Effective risk controls can protect against significant losses |

| Operational Costs | Lower costs can improve overall profitability |

| Execution Speed | Faster execution can capitalize on short-lived opportunities |

The interplay of these factors determines whether AI trading bots can generate consistent profits in real-world market conditions.

When examining whether AI trading bots are profitable, it's essential to look at real-world performance data. While individual results can vary widely, some studies and reports provide insights into the overall landscape:

- A study by the Journal of Financial Economics found that some AI-driven hedge funds outperformed traditional funds by 2-3% annually

- However, a report by Eurekahedge showed that AI/machine learning hedge funds had mixed results, with some years outperforming and others underperforming human-managed funds

- Retail-focused AI trading platforms have reported varying degrees of success, with some claiming annual returns of 10-20%, while others have struggled to beat market indices consistently

These mixed results suggest that while AI trading bots can be profitable, success is not guaranteed and depends on various factors.

For those considering using AI trading bots, here are some best practices to maximize the potential for profitability:

| Practice | Description |

|---|---|

| Thorough backtesting | Test strategies on diverse historical data sets |

| Start small | Begin with a small capital allocation to minimize risk |

| Continuous monitoring | Regularly review and adjust bot performance |

| Diversification | Use multiple strategies and asset classes to spread risk |

| Stay informed | Keep up with market trends and AI developments |

By following these practices, traders and investors can improve their chances of success with AI trading bots.

As we consider whether AI trading bots are profitable, it's important to look at the future of this technology. Several trends are likely to shape the landscape:

- Advancements in machine learning and natural language processing

- Integration of alternative data sources for more comprehensive analysis

- Improved explainability of AI decision-making processes

- Enhanced regulatory frameworks for AI-driven trading

These developments may further improve the profitability and reliability of AI trading bots in the coming years.

In conclusion, the question "Are AI trading bots profitable?" does not have a simple yes or no answer. The profitability of these systems depends on a complex interplay of factors, including algorithm quality, market conditions, risk management, and operational efficiency.

While some AI trading bots have demonstrated impressive results, others have struggled to consistently outperform traditional methods. The key to success lies in careful implementation, continuous monitoring, and a realistic understanding of both the potential and limitations of AI in trading.

As the technology continues to evolve, it's likely that AI trading bots will become more sophisticated and potentially more profitable. However, they are not a guaranteed path to riches, and investors should approach them with caution and due diligence.

Ultimately, the profitability of AI trading bots will depend on how well they are designed, implemented, and managed. As with any investment strategy, thorough research, careful testing, and ongoing evaluation are essential for those looking to leverage AI in their trading endeavors.

FAQ

Do stock trading bots work?

Stock trading bots can work effectively when properly designed and implemented. However, their success depends on various factors such as market conditions, algorithm quality, and risk management strategies. While some bots have shown promising results, others may underperform or even lead to losses.

What are the main advantages of using AI trading bots?

The main advantages of AI trading bots include 24/7 market monitoring, emotion-free decision-making, high-speed execution, and the ability to process vast amounts of data quickly. These features can potentially lead to more consistent and efficient trading strategies.

How do I choose the right AI trading bot for my investment goals?

To choose the right AI trading bot, consider factors such as your risk tolerance, investment goals, and preferred asset classes. Research different providers, examine their track records, and look for bots with transparent performance metrics and robust backtesting capabilities. It's also advisable to start with a demo account before committing real capital.

Are AI trading bots suitable for beginners?

AI trading bots can be suitable for beginners, but it's crucial to have a solid understanding of financial markets and trading principles before using them. Beginners should start with educational resources, practice with demo accounts, and gradually implement AI-assisted strategies as they gain experience and knowledge.

What are the potential risks associated with AI trading bots?

Potential risks of AI trading bots include overfitting (performing well on historical data but poorly in live markets), technical glitches, rapid market changes that render strategies obsolete, and the possibility of significant losses if risk management is inadequate. It's important to be aware of these risks and implement appropriate safeguards when using AI trading bots.