- Nâng cấp Ethereum 2.0 (chuyển đổi sang Proof-of-Stake)

- Giải pháp mở rộng Layer 2 như Arbitrum và Optimism

- Sử dụng DeFi tăng vọt và tích hợp NFT

- Sự chấp nhận Ethereum của các công ty và tổ chức

Dự đoán giá Ethereum 50000 đô la: Triển vọng dài hạn cho ETH

Khi việc chấp nhận tiền điện tử tiếp tục tăng tốc, Ethereum vẫn là một trong những tài sản được thảo luận nhiều nhất trong nền kinh tế kỹ thuật số. Với vai trò trung tâm trong hợp đồng thông minh, tài chính phi tập trung (DeFi) và NFT, nhiều người đang đặt câu hỏi: liệu Ethereum có đạt 50.000 đô la không? Bài viết này cung cấp một phân tích dự đoán giá Ethereum đạt 50.000 đô la, được hỗ trợ bởi dữ liệu thị trường, ý kiến chuyên gia và các phát triển quan trọng đến năm 2025, 2030 và 2050.

Article navigation

- Nhận Định Chuyên Gia

- Dự Đoán Giá Ethereum 50000 Đô la Hôm Nay: Tổng Quan Thị Trường

- Pocket Option và Giao Dịch ETH

- Hướng Dẫn Giao Dịch Nhanh Ethereum trên Pocket Option

- Dự Đoán Giá Ethereum 2025: Ethereum Có Thể Đạt 50K Không?

- Dự Đoán Giá Ethereum 2026: Ethereum Có Đạt 50K Không?

- Dự Đoán Giá Ethereum 2030: Đạt Đến Những Tầm Cao Mới

- Lời Chứng Thực Của Nhà Giao Dịch Thực

- Dự Đoán Giá Ethereum 2050: ETH Có Thể Đạt 100K hoặc 1 Triệu Đô La Không?

- Dự Đoán Giá Ethereum Hàng Ngày: Công Cụ Cho Các Nhà Giao Dịch Ngắn Hạn

- Những Điều Nhà Đầu Tư Nên Cân Nhắc

- Suy Nghĩ Cuối Cùng: Dự Đoán Giá Ethereum 50000 Đô la và Xa Hơn

Tại sao Dự đoán Giá Ethereum 50000 Đô la Đang Thu Hút Sự Chú Ý

Ethereum (ETH) đã chuyển từ một sự tò mò kỹ thuật thành một cường quốc tài chính, chỉ đứng sau Bitcoin về vốn hóa thị trường. Câu hỏi “Ethereum có thể đạt 50K không?” hiện đang thu hút sự phân tích nghiêm túc. Với sự quan tâm ngày càng tăng từ các tổ chức, cải tiến hệ sinh thái của ETH và vai trò ngày càng tăng trong các công nghệ phi tập trung, ý tưởng Ethereum đạt 50K không còn có vẻ xa vời.

Nhận Định Chuyên Gia

“Giá trị của Ethereum không chỉ nằm ở sự đầu cơ mà còn ở tính hữu dụng. Vị trí của nó như là nền tảng cho DeFi, NFT và Web3 mang lại cho nó một điểm tựa thực tế mà nhiều tài sản khác thiếu.” — Michael Sonnenshein, CEO của Grayscale

Dự Đoán Giá Ethereum 50000 Đô la Hôm Nay: Tổng Quan Thị Trường

Tính đến giữa năm 2025, Ethereum giao dịch trong khoảng từ 3,000 đến 4,000 đô la. Mặc dù có sự biến động định kỳ, ETH đã duy trì sự tăng trưởng ổn định trong năm năm qua. Các yếu tố chính bao gồm:

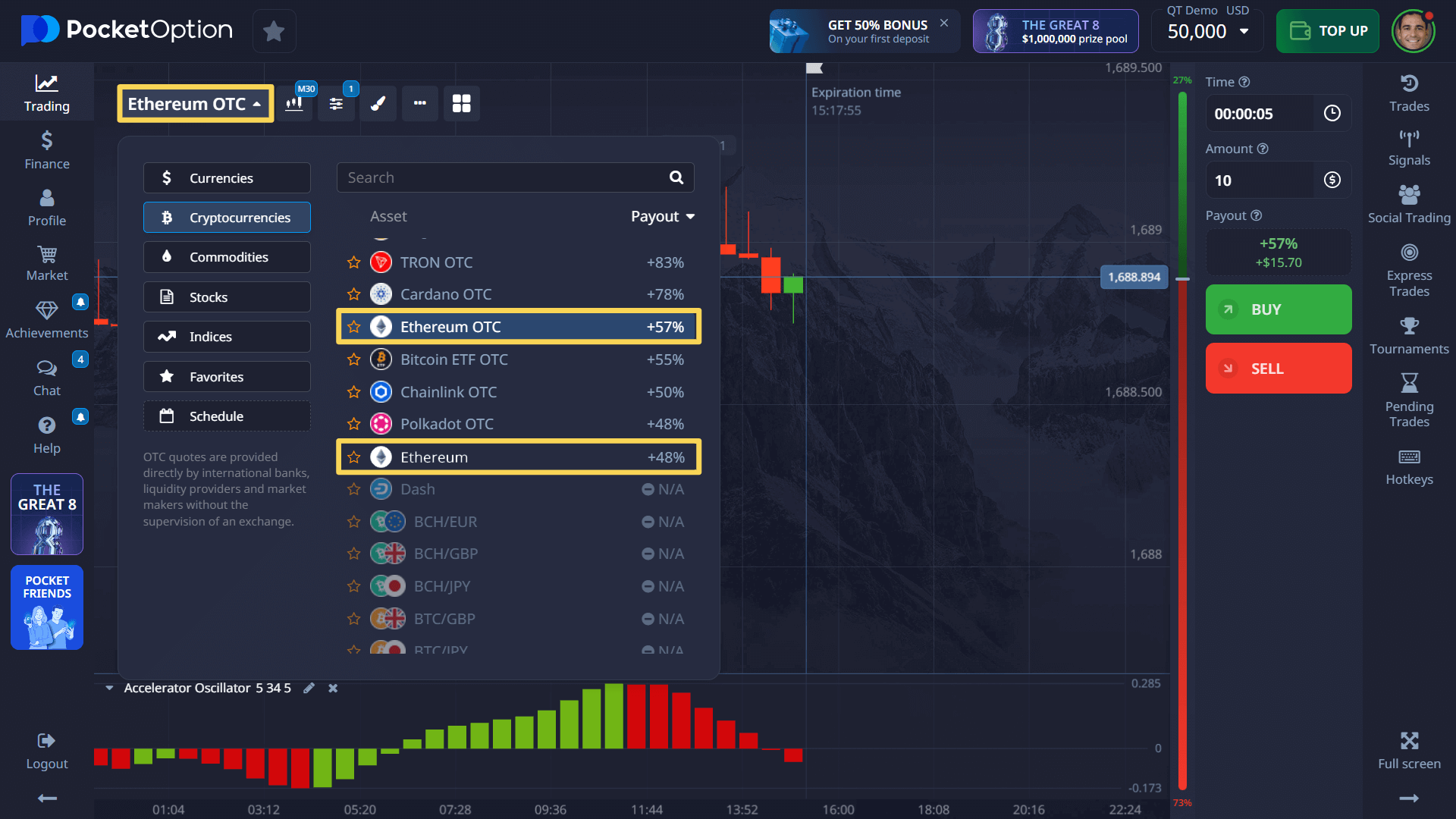

Pocket Option và Giao Dịch ETH

Pocket Option cung cấp một cách dễ dàng để giao dịch Ethereum mà không cần sở hữu tài sản. Trên nền tảng này, người dùng có thể tham gia Giao Dịch Nhanh 24/7 sử dụng ETH trong số hơn 100 tài sản có sẵn, bao gồm cổ phiếu và hàng hóa.

Hướng Dẫn Giao Dịch Nhanh Ethereum trên Pocket Option

- Chọn Tài Sản: Chọn “Ethereum” hoặc “Ethereum OTC”

- Phân Tích Biểu Đồ: Sử dụng RSI, Dải Bollinger, hoặc chỉ báo xu hướng

- Đặt Số Tiền Giao Dịch: Từ chỉ 1 đô la mỗi giao dịch

- Chọn Khung Thời Gian: Bắt đầu với khoảng thời gian 5 giây (cho OTC)

- Thực Hiện Dự Báo:

- Nhấp Mua/Lên nếu bạn dự đoán ETH sẽ tăng

- Nhấp Bán/Xuống nếu bạn dự đoán ETH sẽ giảm

- Kiếm Lợi Nhuận: Lên đến 92% cho các dự đoán đúng

Bắt đầu với tài khoản demo hoặc nạp tiền chỉ từ 5 đô la (tùy thuộc vào phương thức). Học hỏi không rủi ro trước khi giao dịch thực

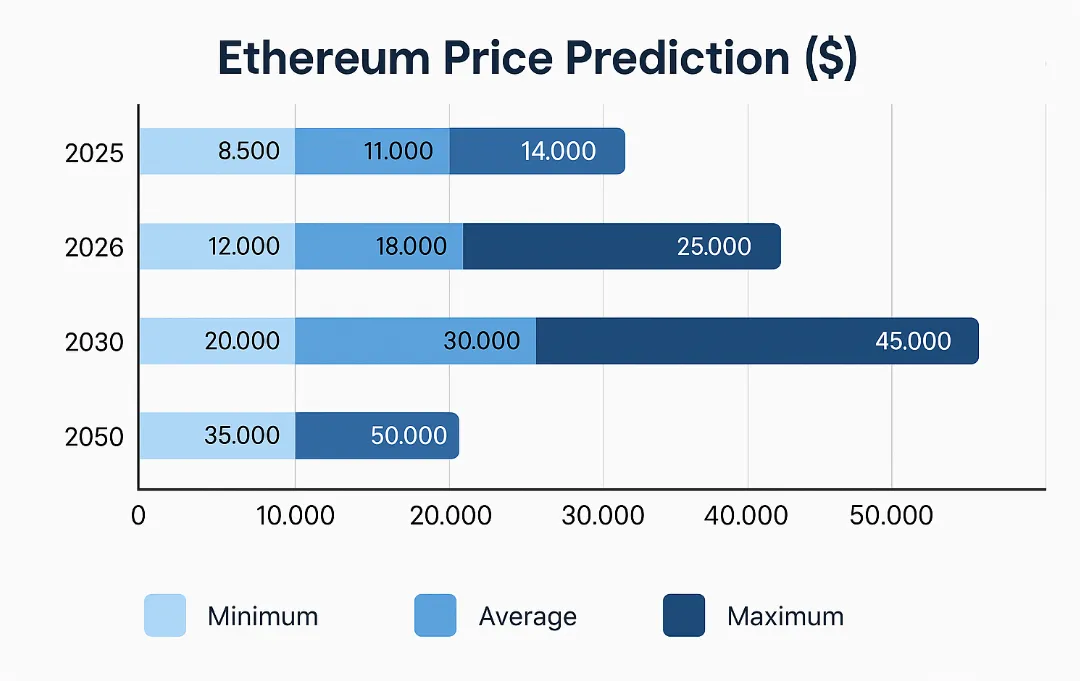

Dự Đoán Giá Ethereum 2025: Ethereum Có Thể Đạt 50K Không?

Dự Báo Của Các Nhà Phân Tích Về Dự Đoán Giá Ethereum 50000 Đô la 2025

| Nguồn | Dự Báo Giá ETH cho 2025 |

|---|---|

| Ark Invest | 20,000 – 50,000 đô la |

| Finder Panel (trung bình) | ~15,000 đô la |

| CoinPriceForecast | 8,500 – 12,000 đô la |

Mặc dù hầu hết các dự báo cho năm 2025 đều dưới 50,000 đô la, sự chấp nhận mạnh mẽ và phê duyệt Ethereum ETF có thể kích hoạt một đợt tăng giá.

Các Yếu Tố Hỗ Trợ Tăng Trưởng

- Sự thống trị của hệ sinh thái DeFi rộng lớn hơn

- Niêm yết Ethereum ETF tại Mỹ

- Tiếp cận bán lẻ thông qua các ứng dụng fintech

- Giảm cung sau hợp nhất (EIP-1559 đốt)

“Sức mạnh thực sự của Ethereum sẽ được thể hiện khi các tổ chức coi nó như một lớp tiện ích cho các nền kinh tế kỹ thuật số, không chỉ là một tài sản.” — Cathie Wood, ARK Invest

Điểm Nhấn Độc Đáo Cho Năm 2025

Một đợt tăng mạnh có thể xảy ra nhanh hơn dự kiến nếu sự phê duyệt quy định của Mỹ đẩy nhanh việc chấp nhận Ethereum ETF.

Dự Đoán Giá Ethereum 2026: Ethereum Có Đạt 50K Không?

Năm 2026, Ethereum có thể bước vào giai đoạn trưởng thành như một lớp hạ tầng blockchain thống trị.

Triển Vọng Thị Trường:

- Sự chấp nhận của các tổ chức tiếp tục

- Sự thống trị của Ethereum trên các nền tảng hợp đồng thông minh vẫn mạnh mẽ

- Ước tính giá dao động từ 10,000 đến 22,000 đô la

Nhận Định Chiến Lược

Các nhà phát triển và người dùng đang chuyển sang các giao thức tập trung vào ETH nhờ phí gas ổn định thông qua rollups — một xu hướng có thể làm tăng nhu cầu ETH vào năm 2026.

Dự Đoán Giá Ethereum 2030: Đạt Đến Những Tầm Cao Mới

Tiến Bộ Công Nghệ Ảnh Hưởng Đến Dự Đoán Giá Ethereum 50000 Đô la

Đến năm 2030, Ethereum có thể thực tế đạt ngưỡng 50K — hoặc thậm chí nhiều hơn.

| Năm | Ước Tính Bảo Thủ | Ước Tính Tăng Trưởng |

|---|---|---|

| 2030 | 25,000 đô la | 60,000+ đô la |

Động Lực Công Nghệ:

- Phân mảnh toàn diện và khả năng tương tác chuỗi chéo

- Chấp nhận Web3 chính thống

- Sự phát triển của tài sản thực được mã hóa (RWAs)

“Ethereum có thể trở thành lớp thanh toán của internet.” — Raoul Pal, CEO của Real Vision

Lời Chứng Thực Của Nhà Giao Dịch Thực

“Pocket Option cho phép tôi giao dịch ETH ngay cả vào cuối tuần. Tốc độ và công cụ là đẳng cấp.” — Diego M.

“Với Pocket Option, tôi cảm thấy kiểm soát. Giao Dịch Nhanh với ETH mang lại cho tôi kết quả nhanh chóng.” — Lisa K.

Dự Đoán Giá Ethereum 2050: ETH Có Thể Đạt 100K hoặc 1 Triệu Đô La Không?

Dự Báo Đầu Cơ Cho Dự Đoán Giá Ethereum 1 Triệu Đô La

| Năm | Kịch Bản Giá ETH |

|---|---|

| 2050 | 100,000 – 1,000,000+ đô la |

Giả Định Chính

- ETH trở thành xương sống của các ứng dụng tài chính toàn cầu

- Sự chấp nhận của chính phủ và tổ chức

- Phi đô la hóa thúc đẩy dự trữ tiền điện tử

“ETH triệu đô? Nếu tiền pháp định tiếp tục suy yếu và Web3 trưởng thành, điều đó không phải là không thể.” — Anthony Pompliano

Dự Đoán Giá Ethereum Hàng Ngày: Công Cụ Cho Các Nhà Giao Dịch Ngắn Hạn

Đối với các nhà giao dịch trong ngày, sự biến động của Ethereum mang lại cơ hội hấp dẫn. Sử dụng công cụ biểu đồ của Pocket Option, các nhà giao dịch phân tích:

- Phân kỳ RSI

- Giao cắt Trung bình Động

- Đường xu hướng và Vùng hỗ trợ

Những Điều Nhà Đầu Tư Nên Cân Nhắc

- Ethereum có đạt 50K không?: Có khả năng trong khoảng 2030–2040 dưới các điều kiện thị trường thuận lợi

- Dự đoán giá Ethereum 50,000 đô la: Đáng tin cậy trong dài hạn

- Dự đoán giá Ethereum 100,000 đô la: Có thể đạt được trong các kịch bản cực kỳ tăng trưởng

- Dự đoán giá Ethereum 2025: Phạm vi 8,000–25,000 đô la

- Dự đoán giá Ethereum 1 triệu đô la: Rất đầu cơ nhưng không phải là không thể

Suy Nghĩ Cuối Cùng: Dự Đoán Giá Ethereum 50000 Đô la và Xa Hơn

Luận điểm dự đoán giá Ethereum 50000 đô la được xây dựng trên các nền tảng vững chắc và các trường hợp sử dụng hướng tới tương lai. Mặc dù việc đạt 50K trong ngắn hạn vẫn chưa chắc chắn, sự phát triển của Ethereum hỗ trợ một quỹ đạo tăng trưởng dài hạn.

Dù bạn là một nhà giao dịch dày dạn hay chỉ đang khám phá, các nền tảng như Pocket Option cung cấp một cách trực quan để tham gia với ETH và hơn 100 tài sản khác — mà không cần sở hữu tiền điện tử trực tiếp.

FAQ

Ethereum có khả năng kỹ thuật để đạt $50,000 không?

Vâng, không có giới hạn kỹ thuật nào ngăn cản Ethereum đạt mức $50,000. Với khoảng 120 triệu ETH đang lưu hành, mức giá này sẽ định giá mạng lưới ở mức $6 nghìn tỷ - tương đương với vàng ($11-12T) hoặc tổng giá trị của các gã khổng lồ công nghệ như Apple, Microsoft và Amazon. Câu hỏi không phải là khả năng kỹ thuật mà là liệu Ethereum có thể thu hút đủ hoạt động kinh tế để biện minh cho mức định giá này hay không. Điều này sẽ yêu cầu Ethereum trở thành cơ sở hạ tầng thiết yếu cho tài chính toàn cầu và các ứng dụng kinh doanh.

Khung thời gian nào là thực tế để Ethereum đạt $50,000?

Khung thời gian có khả năng nhất để Ethereum có thể đạt $50,000 là từ năm 2030-2032, yêu cầu tăng trưởng hàng năm bền vững từ 40-60%. Trường hợp cơ bản này giả định sự tiến bộ công nghệ ổn định và sự chấp nhận ngày càng tăng của các tổ chức. Các kịch bản sớm hơn (2025-2029) sẽ đòi hỏi các chất xúc tác tăng trưởng bùng nổ và có vẻ ít khả năng hơn với xác suất 5-30%. Các mốc thời gian muộn hơn kéo dài đến sau năm 2035 với sự chấp nhận chậm hơn. Có một xác suất không nhỏ 15-20% rằng Ethereum không bao giờ đạt được cột mốc này do cạnh tranh hoặc hạn chế kỹ thuật.

Ethereum đạt mức $50,000 sẽ ảnh hưởng như thế nào đến thị trường tiền điện tử rộng lớn hơn?

Ethereum ở mức $50,000 sẽ biến đổi toàn bộ cảnh quan tài sản kỹ thuật số. Tổng thị trường tiền điện tử có thể vượt quá $20 nghìn tỷ, với Bitcoin có khả năng đạt $500,000+. Các dự án dựa trên Ethereum sẽ trải qua sự gia tăng định giá lớn của riêng mình, đặc biệt là những dự án cung cấp cơ sở hạ tầng quan trọng hoặc dịch vụ tài chính. Các giải pháp Layer 2 sẽ trở thành các hệ sinh thái trị giá hàng tỷ đô la. Tài chính truyền thống sẽ được tích hợp hoàn toàn với các hệ thống blockchain, và tiền điện tử sẽ trở thành một thành phần tiêu chuẩn trong danh mục đầu tư của các tổ chức trên toàn thế giới.

Những trở ngại lớn nhất để Ethereum đạt mức $50,000 là gì?

Một số trở ngại lớn có thể ngăn cản cột mốc $50,000: 1) Thách thức kỹ thuật về khả năng mở rộng nếu việc triển khai sharding không đạt được khả năng như đã hứa; 2) Các cuộc đàn áp quy định hạn chế sự tham gia của các tổ chức; 3) Cạnh tranh từ các blockchain thay thế chiếm lĩnh thị phần; 4) Lỗ hổng bảo mật hoặc lỗi nghiêm trọng làm tổn hại niềm tin; 5) Các yếu tố kinh tế vĩ mô hạn chế định giá tài sản rủi ro; và 6) Sự xuất hiện của các mô hình công nghệ vượt trội khiến các giải pháp blockchain trở nên lỗi thời. Mỗi yếu tố này đều là một trở ngại đáng kể cần phải vượt qua để Ethereum đạt được mức định giá đầy tham vọng này.

Các nhà đầu tư nên định vị bản thân như thế nào cho khả năng Ethereum đạt $50,000?

Định vị thông minh đòi hỏi một cách tiếp cận đa tầng: 1) Xây dựng vị thế cốt lõi thông qua trung bình giá trong các đợt điều chỉnh lớn của thị trường; 2) Tạo lợi nhuận thông qua staking hoặc cho vay để tăng tốc tích lũy; 3) Cân nhắc các sản phẩm phái sinh của Pocket Option để sử dụng đòn bẩy chiến lược trong các chu kỳ tăng giá đã được xác nhận; 4) Đa dạng hóa trong hệ sinh thái thông qua các token Layer 2 và các ứng dụng quan trọng; 5) Thực hiện kích thước vị thế nghiêm ngặt (1-15% danh mục đầu tư cho hầu hết các nhà đầu tư) để quản lý rủi ro giảm giá; và 6) Phát triển chiến lược thoát dựa trên các cột mốc rõ ràng để thu lợi nhuận trong các đỉnh điểm cảm xúc cực đoan. Hãy nhớ rằng ngay cả khi mục tiêu $50,000 không đạt được, những cơ hội đáng kể sẽ xuất hiện trong suốt quá trình phát triển của Ethereum.

Ethereum có thể tăng cao đến mức nào trong 5 năm tới?

Trong khoảng thời gian 5 năm (đến năm 2030), Ethereum có thể dao động từ $15,000 đến $50,000 tùy thuộc vào động lực thị trường. Nếu các xu hướng như DeFi, Web3 và sự tích hợp của các tổ chức tăng tốc, ETH có thể đạt mức cao nhất mọi thời đại mới và tiến gần đến ngưỡng $50K.

Giá của 1 Ethereum vào năm 2030 sẽ là bao nhiêu?

Dự đoán cho Ethereum vào năm 2030 rất khác nhau. Các ước tính bảo thủ đặt ETH trong khoảng từ $20,000 đến $30,000, trong khi các dự đoán lạc quan cho thấy giá trị trên $50,000. Các yếu tố như sự chấp nhận rộng rãi, việc triển khai đầy đủ Ethereum 2.0 và sự rõ ràng về quy định sẽ là chìa khóa.

ETH có thể đạt 40k không?

Mặc dù tham vọng, ETH đạt mức $40,000 không phải là điều không thể trong dài hạn. Kịch bản này có thể sẽ yêu cầu sự chấp nhận rộng rãi trên toàn cầu, Ethereum trở thành một lớp quan trọng trong tài chính toàn cầu, và các điều kiện kinh tế vĩ mô thuận lợi. Một số dự báo lạc quan cho giai đoạn 2040–2050 bao gồm khả năng này.