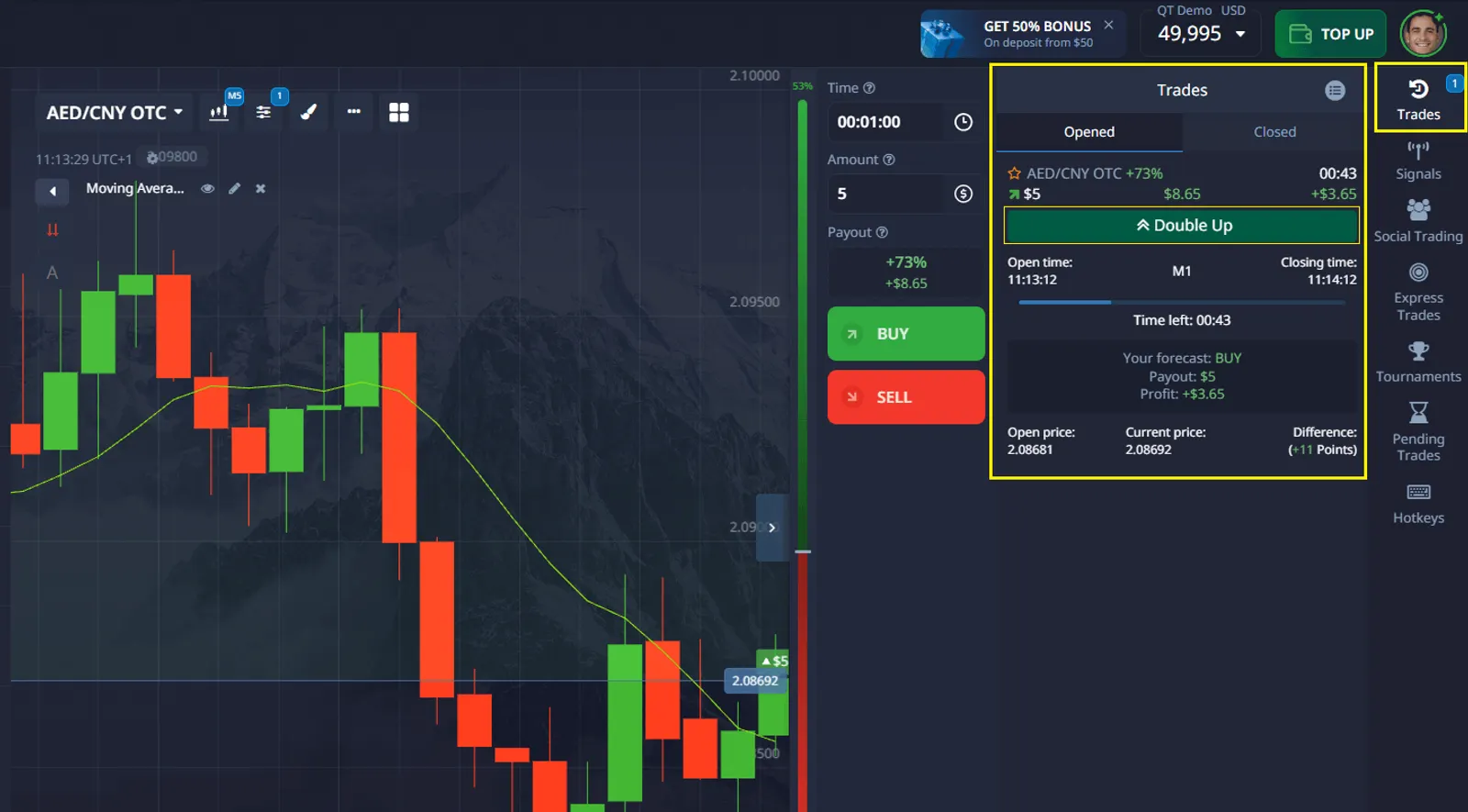

- Go to the "Trades" section in the right panel of the platform's interface.

- Select an active trade that you want to double.

- Click the green Double Up button.

What is Double Up on Pocket Option Trading Method

Understanding Double Up on Pocket Option requires a solid grasp of trading fundamentals and a strategic approach. This method allows traders to double their positions on active trades, creating an opportunity to maximize potential profits. However, using this feature demands careful market analysis and proper risk management.

Double Up is a feature that lets traders quickly duplicate an existing trade with the same parameters (price and expiration time). This can be especially useful in strong market trends. However, doubling your position also increases your risk exposure.

Key Characteristics of the Double Up Feature:

| Function | Description |

|---|---|

| Purpose | Doubling the current position |

| Availability | During an active trade |

| Risk Level | Increased market exposure |

Using Double Up requires close attention to market conditions. For example, if an asset’s price is moving in your favor, you can use the feature to increase your potential profit. However, keep in mind that if the trend reverses, your losses will also be doubled.

Here’s a step-by-step guide on how to use the Double Up feature:

After this, a new trade will open at the current market price but with the same parameters (entry price and expiration time) as the original trade. Both trades will close at the same time.

Example: If you are trading Bitcoin and the price is trending upwards, you can use Double Up to open a second trade with the same entry price. This allows you to increase your profit if the trend continues.

To successfully use the Double Up feature, it’s essential to consider several factors:

- Market Trend Analysis: Use technical indicators such as RSI, MACD, or Bollinger Bands to assess the strength of the current trend.

- Position Sizing Management: Doubling a position requires a clear understanding of how much you’re willing to increase your investment.

- Risk Assessment: Always consider market volatility and the possibility of trend reversals.

| Strategy Element | How to Implement |

|---|---|

| Analysis | Use technical indicators for forecasting |

| Execution | Choose the optimal timing for doubling up |

| Management | Continuously monitor your open positions |

Using the Double Up feature involves increased risk. Here are some tips for managing it effectively:

- Preserve Capital: Never risk more than you can afford to lose.

- Limit Position Size: Set strict limits on how much you’re willing to double.

- Use Stop-Loss Orders: These help minimize losses if the trend reverses.

| Risk Factor | Management Method |

| Market Volatility | Apply adaptive position sizing |

| Timing Risk | Open trades only when a clear signal is present |

- Increased Profit Potential: Successfully using the feature allows you to double your profit, especially during strong trends.

- Flexibility: You can adapt to market conditions by increasing your position when prices move in your favor.

- Control: The ability to duplicate trades gives traders more control over their positions.

To maximize the benefits of the Double Up feature, follow these best practices:

- Leverage Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can help you identify the best moments to double your position.

- Practice on a Demo Account: Test the strategy on a Pocket Option demo account before using it with real funds.

- Follow Risk Management Rules: Never double your position if market conditions are unclear.

The Double Up feature on Pocket Option is a powerful tool for increasing profits, but it requires a disciplined approach and a well-defined strategy. To succeed, traders should carefully analyze the market, use technical indicators, and adhere to risk management principles.

Start by practicing on a demo account to understand how this feature works, and ensure your decisions are based on data and analysis. Double Up is especially effective when trading volatile assets like Bitcoin in strong market trends.

FAQ

What are the main benefits of using double up feature?

Double up allows traders to increase position size during favorable market conditions, potentially enhancing returns on successful trades while maintaining initial entry points.

How does risk management work with double up?

Risk management involves setting strict position size limits, implementing stop-loss orders, and maintaining adequate capital reserves for potential market fluctuations.

When is the best time to use double up feature?

Optimal timing depends on clear trend confirmation, strong technical indicators, and proper market condition analysis showing continued momentum.

Can beginners use double up strategy?

Beginners should first master basic trading principles and risk management before implementing double up strategies due to increased complexity and risk exposure.

What technical indicators work best with double up?

Trend indicators like moving averages, momentum indicators, and volume analysis tools provide valuable data for double up decision-making.