- Discounted purchase price

- Potential stock value appreciation

- Dividend reinvestment opportunities

- Ownership and voting rights

Understanding the UPS Employee Stock Purchase Plan

The Employee Stock Purchase Plan at UPS is designed to allow employees to purchase shares of UPS stock at a discounted rate, enhancing their investment opportunities. This plan serves as a way for employees to invest in the company they work for and potentially benefit from long-term growth.

What is the Employee Stock Purchase Plan?

The Employee Stock Purchase Plan is a program offered by United Parcel Service that allows employees to buy UPS stock at a favorable price. This initiative encourages employees to become shareholders, thus fostering a sense of ownership and long-term investment in the company.

📌 Expert Insight: According to Charles W., a senior equity analyst, “ESPPs like the one at UPS align employee incentives with company performance, reinforcing productivity and loyalty.”

Benefits of Participating in the Stock Purchase Plan

Participating in the stock purchase plan offers numerous benefits, including purchasing stock at a discount, which can provide immediate value. Additionally, employees may benefit from the potential appreciation of UPS stock, which can lead to significant long-term gains in their investment portfolio.

Key Advantages:

Eligibility Requirements for Employees

To enroll in the Employee Stock Purchase Plan, employees must meet specific eligibility criteria, which often include being a full-time employee of UPS. Additionally, employees must have completed a designated period of service to take advantage of the plan’s benefits, ensuring commitment and investment in the company’s future.

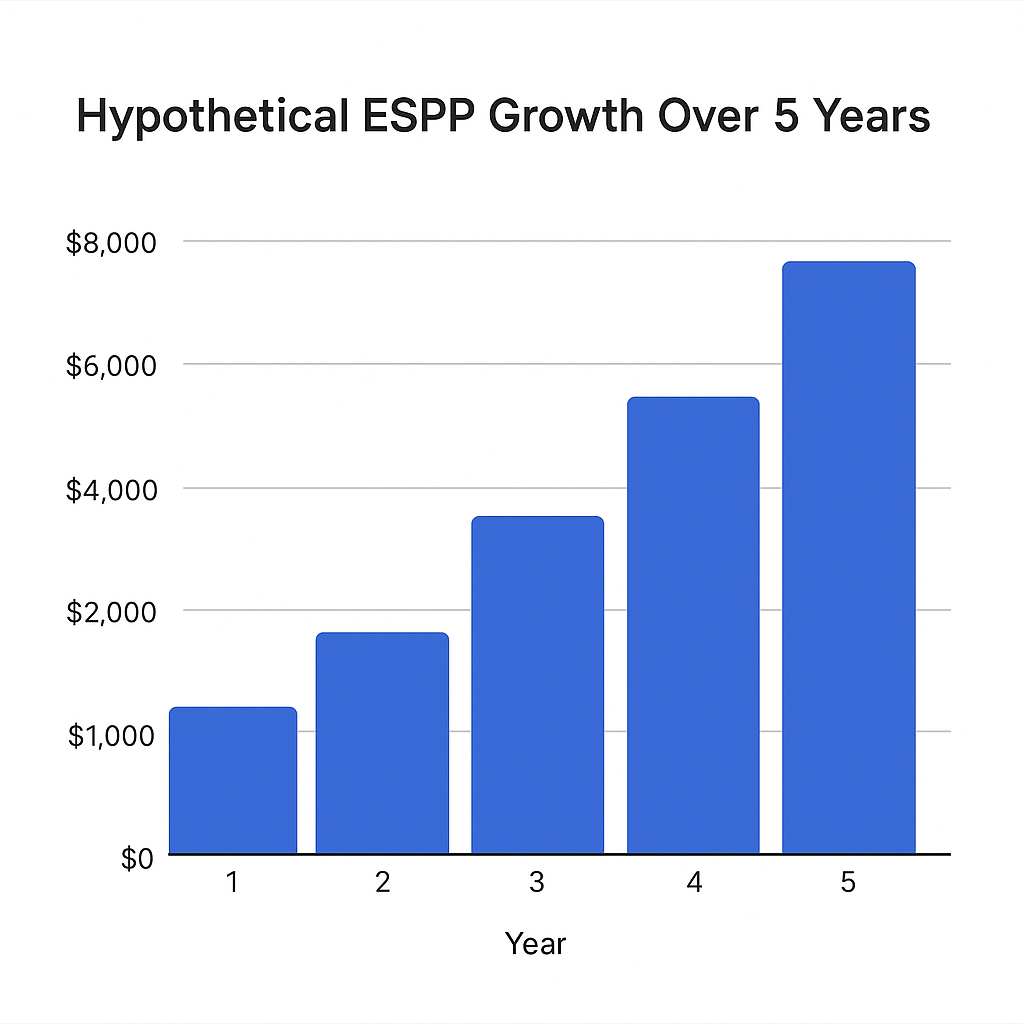

Real Example: ESPP Profit Potential

Let’s consider a hypothetical scenario: an employee contributes $200 monthly to purchase UPS stock at a 15% discount. Over 5 years, assuming a 6% annual stock growth rate and reinvested dividends:

- Total contributions: $12,000

- Discount value added: $1,800

- Growth on holdings: ~$2,300

- Estimated value after 5 years: ~$16,100

This simple example shows how disciplined investing through ESPP can significantly boost wealth.

How to Enroll in the Employee Stock Purchase Plan

Enrolling in the Employee Stock Purchase Plan is a straightforward process that requires employees to follow a few essential steps. By understanding the enrollment procedure, you can take the first step toward capitalizing on the investment potential offered by UPS.

Steps to Set Up Your Account

Understanding how to buy UPS stock as an employee is crucial when beginning your investment journey. Employees can use the internal platform provided by UPS to enroll in the program and select their contribution levels.

To set up your account for the Employee Stock Purchase Plan, employees need to access the plan online through Computershare. This involves providing personal information and selecting options for stock purchase, which facilitates smooth transactions and oversight of your investments.

Understanding the Purchase Process

Understanding the purchase process is key to maximizing your investment. Employees can buy shares at designated intervals, allowing for strategic investment decisions based on market conditions and personal financial goals.

Common Purchase Methods:

- Payroll deductions

- Scheduled purchase windows

- Automated dividend reinvestments

💡 Knowing how to sell UPS Class A stock is also essential. Employees can typically manage this through their brokerage or the transfer agent platform, depending on how shares were issued.

Key Deadlines to Remember

Staying aware of key deadlines is crucial for participation in the Employee Stock Purchase Plan. Employees must keep track of enrollment periods and purchase dates to ensure they do not miss opportunities to invest in UPS stock.

Maximizing Your Investment Through the Plan

Maximizing your investment through the Employee Stock Purchase Plan involves capitalizing on unique features such as discounts and dividend reinvestment options. These elements can significantly enhance your overall investment strategy and foster long-term financial growth.

Trade stocks without buying directly! Just make a forecast!

Utilizing Discounts and Offers

Utilizing discounts within the stock purchase program allows employees to acquire UPS stock at a reduced cost, which can lead to immediate equity gains. This strategic advantage positions employees favorably in the market and enhances their investment portfolio.

Dividend Reinvestment Options

UPS offers a dividend reinvestment plan that enables employees to reinvest dividends for additional shares. This approach can compound investments over time, providing a powerful strategy for long-term growth in your UPS stock holdings.

Strategies for Long-term Growth

Implementing effective strategies for long-term growth is crucial for anyone participating in the Employee Stock Purchase Plan. Employees should consider market trends, their financial goals, and the performance of UPS stock to optimize their investment over time.

- Diversify your investments

- Monitor UPS performance regularly

- Use tax-advantaged accounts when possible

Common Mistakes to Avoid in ESPP

Even well-intentioned investors can make mistakes that reduce their returns. Avoid these common errors:

- Selling shares immediately and forfeiting long-term gains

- Ignoring tax consequences, especially with qualified dispositions

- Overinvesting in employer stock, reducing diversification

- Missing enrollment deadlines and purchase opportunities

Tax Implications of the Employee Stock Purchase Plan

Understanding the tax implications associated with the Employee Stock Purchase Plan is essential for employees. Being informed about tax responsibilities can help in making well-rounded investment decisions and managing the financial aspects of stock ownership.

Tax Benefits of Investing in UPS Stock

Investing in UPS stock through the Employee Stock Purchase Plan may come with certain tax benefits, such as potential capital gains advantages. Employees should explore these benefits to enhance their overall investment returns and financial planning.

Understanding Tax Responsibilities

Employees need to understand their tax responsibilities when participating in the Employee Stock Purchase Plan. This includes reporting any gains and losses associated with stock transactions, which can impact their overall financial picture.

Consulting with a Tax Advisor

Consulting with a tax advisor can provide employees with tailored advice regarding their investments in UPS stock. Professional guidance can help navigate complex tax situations and optimize financial outcomes related to stock ownership.

ESPP vs. 401(k) vs. IRA: A Quick Comparison

| Feature | ESPP | 401(k) | IRA |

|---|---|---|---|

| Contribution Type | After-tax | Pre-tax or Roth | Pre-tax or Roth |

| Discounted Stock | Yes | No | No |

| Employer Match | No | Often | No |

| Tax Deferral | Limited | Yes | Yes |

| Investment Control | Limited to company stock | Broad | Broad |

Each plan has different objectives. A diversified approach often includes a mix of these accounts based on personal financial goals.

Shareowner Services and Stock Management

Effective stock management and access to shareowner services are vital for those investing in the Employee Stock Purchase Plan. Utilizing these resources can help employees stay informed and make strategic decisions about their UPS stock investments.

Tracking Your UPS Stock Investment

Tracking your UPS stock investment is essential for understanding its performance over time. Employees can utilize online tools to monitor stock prices, dividends, and overall portfolio growth, ensuring informed decision-making.

Using the Transfer Agent for Stock Transfers

Using Computershare as the transfer agent facilitates seamless stock transfers and transactions for employees. This service ensures that shareowners can manage their holdings efficiently and access necessary information regarding their investments.

Accessing Shareowner Services Online

Accessing shareowner services online provides employees with vital information related to their stock investments. By leveraging these resources, employees can manage their UPS stock accounts effectively and stay updated on company performance and offerings.

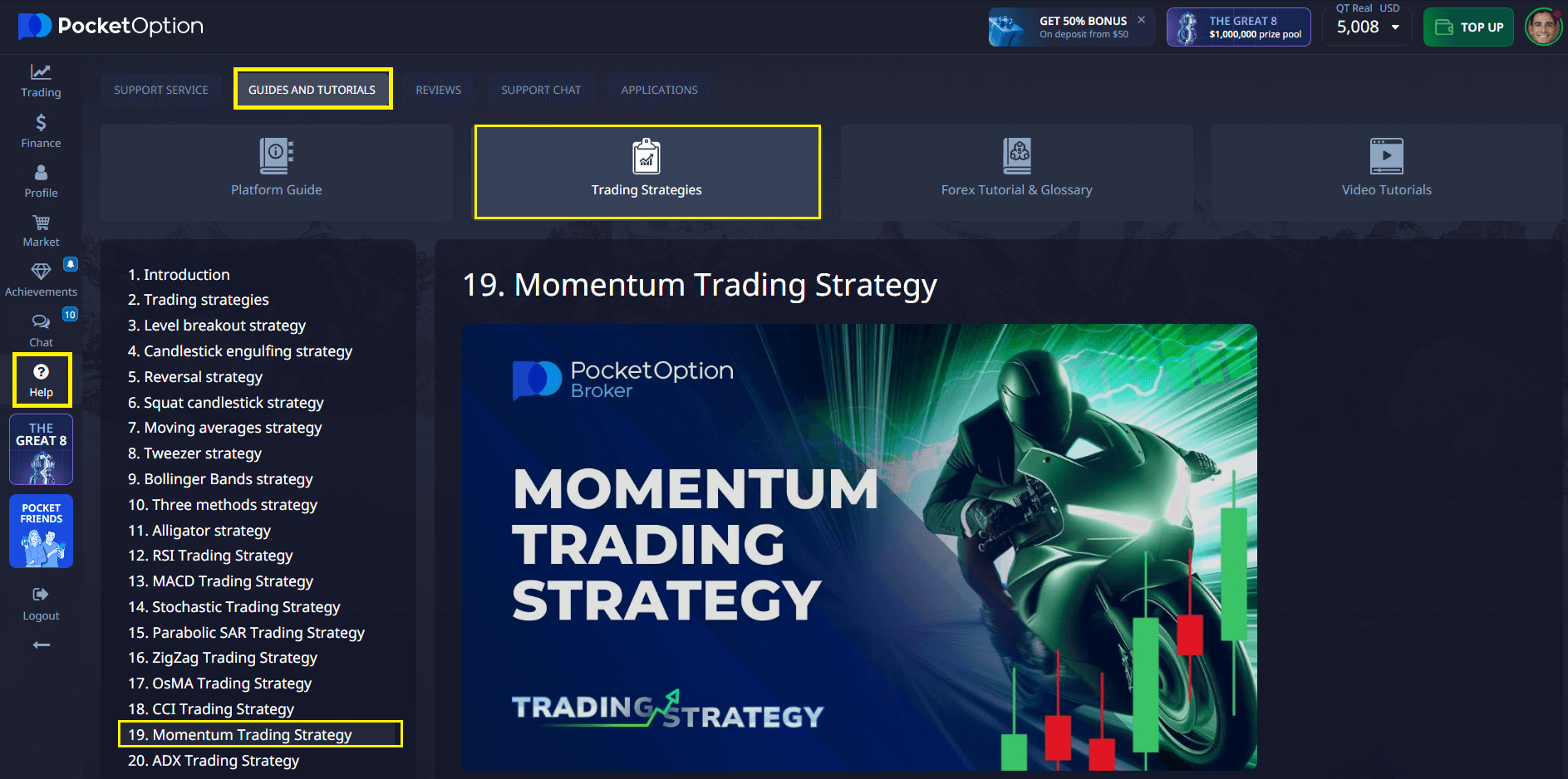

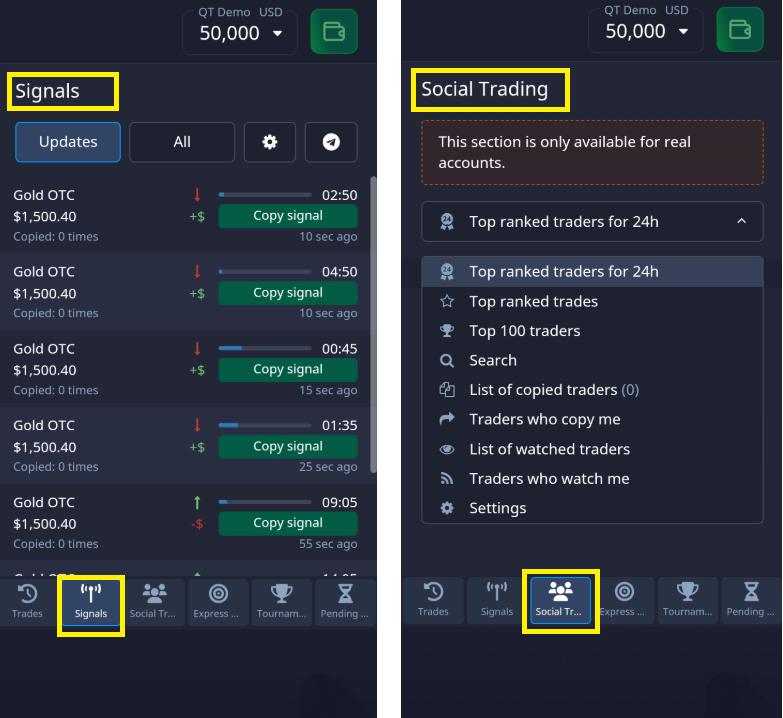

Integrating Pocket Option for Broader Investment Opportunities

For those looking to diversify beyond traditional stock purchases, platforms like Pocket Option provide an accessible way to explore short-term trading strategies. Whether you’re new to investing or seeking to optimize your existing portfolio, Pocket Option offers intuitive tools, demo accounts, and global market access.

Why Consider Pocket Option?

| Feature | Benefit |

|---|---|

| Demo Account | Practice with $10,000 virtual funds |

| Variety of Assets | Trade forex, stocks, commodities, and more |

| Copy Trading | Follow successful traders automatically |

Final Thoughts

Navigating the UPS Employee Stock Purchase Plan effectively requires awareness, strategy, and access to the right tools. By leveraging all available options—including innovative platforms like Pocket Option—you can build a more resilient and profitable investment approach.

💬 Join the conversation in our community and explore more investment insights!

FAQ

What is the UPS Employee Stock Purchase Plan?

The UPS Employee Stock Purchase Plan is a program that allows UPS employees to purchase company stock at a discounted price, typically through payroll deductions.

How do I calculate the potential return of the UPS Employee Stock Purchase Plan?

To calculate the potential return, use this formula: (Market Price - Discounted Price) / Discounted Price * 100. This gives you the percentage gain if you were to sell the shares immediately after purchase.

What factors should I consider before participating in the UPS Employee Stock Purchase Plan?

Consider factors such as your financial goals, risk tolerance, the company's financial health, market conditions, and how the plan fits into your overall investment strategy.

How can I buy UPS stock as an employee?

As a UPS employee, you can buy UPS stock through the Employee Stock Purchase Plan by enrolling during the designated enrollment period and specifying your contribution amount.

What are the tax implications of participating in the UPS Employee Stock Purchase Plan?

The tax implications can be complex and depend on various factors, including how long you hold the shares and the difference between the purchase price and fair market value. It's advisable to consult with a tax professional for personalized advice.