- Stratejik Düşünme — Şansa güvenmek yerine tekrarlanabilir sistemler oluşturun.

- Öz-Farkındalık — Kötü kararlara yol açan duygusal kalıpları tespit edin.

- Kalıp Tanıma — Kârlı düzenlemeleri ve tekrarlanan hataları tespit edin.

- Performans İncelemesi — Sadece ne olduğunu değil, neden olduğunu da anlayın.

- Disiplin — Dürtüsel değil, veri odaklı kararlar verin.

Opsiyon Ticaret Günlüğünde Ustalaşmak

Opsiyon ticaret günlüğü, performanslarını geliştirmek ve daha bilinçli kararlar almak isteyen tüccarlar için çok önemli bir araçtır. İşlemleri titizlikle kaydederek ve analiz ederek, tüccarlar stratejilerindeki kalıpları, güçlü yanları ve zayıflıkları belirleyebilirler.

Nedir?

Opsiyon işlem günlüğü geçmiş işlemlerin bir listesinden daha fazlasıdır — uzun vadeli başarı için bir temeldir. Sadece sonuçları değil, aynı zamanda her işlemin arkasındaki mantığı, duyguları ve piyasa bağlamını da takip eden yatırımcılar büyük bir avantaj elde ederler. Günlük, stratejileri geliştirmeye, duygusal kararları azaltmaya ve disiplin oluşturmaya yardımcı olur.

Pocket Option’da günlük tutma işlemi kolaylaştırılmıştır. Platform, derinlemesine analiz için İşlem Geçmişi bölümü ve canlı oturum takibi için İşlemler paneli gibi araçlar sunar. Bu özellikler, kapsamlı ve uygulanabilir bir işlem günlüğü oluşturmayı kolaylaştırır.

Neden Günlük Tutmalı?

Günlük tutmak, işlem yolculuğunuza yapı kazandırmaya yardımcı olur:

Pocket Option’da hızlı işlemler kullanıyorsanız — kısa vadeli fiyat hareketlerini tahmin etmek gibi — bir işlem günlüğü tutmak zorunlu hale gelir. Yüksek frekanslı işlemler çok fazla veri üretir ve sadece işlemlerinizi inceleyerek zamanla gelişebilirsiniz.

Günlüğünüze Ne Kaydetmelisiniz

| Öğe | Örnek |

|---|---|

| Varlık | EUR/USD |

| İşlem Zamanı | 14:05–14:10 |

| Yön | Yukarı |

| Giriş Nedeni | RSI aşırı satım |

| Duygu | Güvenli |

| Sonuç | Kâr |

| Piyasa Bağlamı | Haber kaynaklı oynaklık |

Pocket Option: Günlük Tutmak İçin Yerleşik Araçlar

Pocket Option klasik opsiyonlar sunmaz — bunun yerine, sadece fiyat yönünü tahmin ettiğiniz ve indirme gerekmeden çevrimiçi olarak %92’ye varan kâr elde edebileceğiniz ⚡ Hızlı İşlem özelliği sunar.

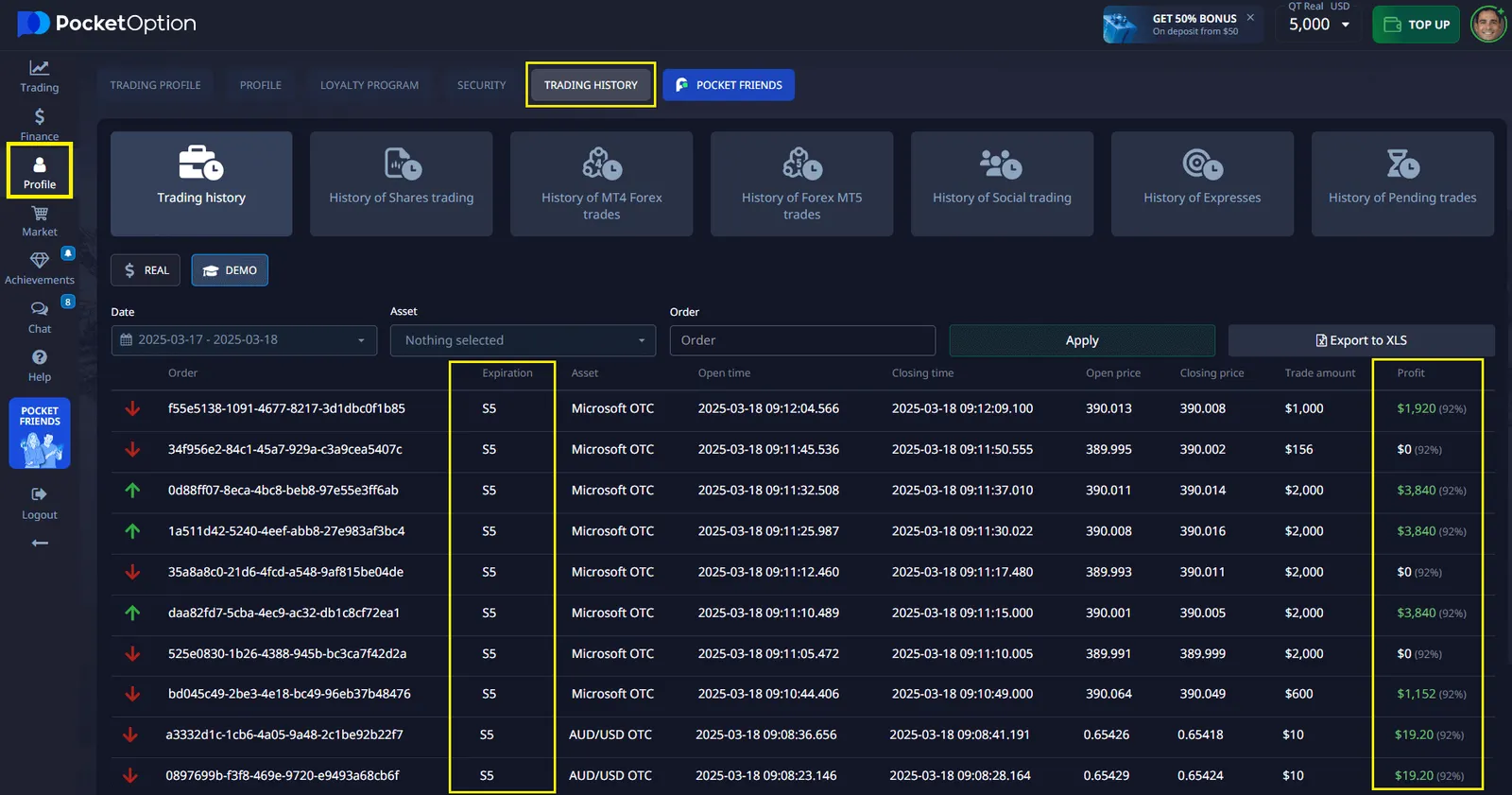

Pocket Option’da İşlem Geçmişi Bölümü

Pocket Option’daki İşlem Geçmişi sayfası, yatırımcılara geçmiş işlemleri hakkında tam erişim sağlar, dahil olanlar:

- Sipariş kimliği ve zaman damgaları

- Varlık ve işlem türü

- Giriş ve bitiş süreleri

- Kâr veya zarar sonucu

Bu bölüm, görsel bir sermaye eğrisi oluşturmanıza, kazanç/kayıp oranlarını izlemenize ve stratejinizin zaman içindeki performansını takip etmenize yardımcı olur. İster uzun vadeli büyümeyi ister kısa vadeli davranışı analiz ediyor olun, bu veriler tam resmi görmenize yardımcı olur.

Pocket Option size sadece işlem yapma imkanı değil, aynı zamanda her oturumda öğrenme ve gelişme imkanı sağlar. İşlem Geçmişi sayfası bu sürecin temelidir.

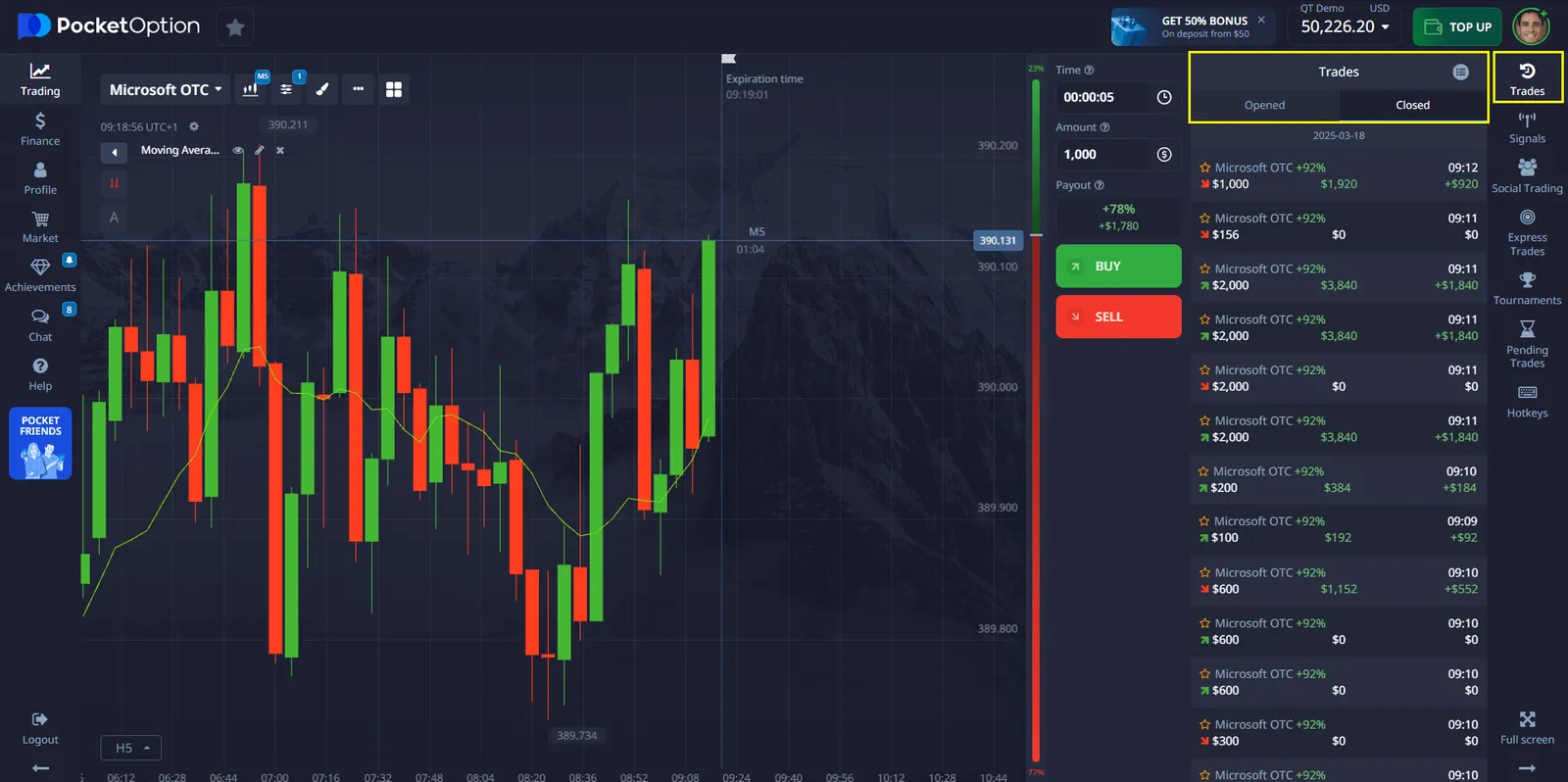

Gerçek Zamanlı İzleme İçin “”İşlemler”” Paneli

Aktif işlem oturumları sırasında, Pocket Option arayüzünün sağ tarafındaki “”İşlemler”” düğmesi şunları yapmanıza olanak tanır:

- Açık pozisyonları gerçek zamanlı görüntüleme

- İşlem detaylarını anında kontrol etme

- Aktif sona erme zamanlayıcılarını izleme

- Risk maruziyetinizden haberdar olma

Bu canlı izleme aracı, özellikle birden fazla işlem yaparken veya yüksek frekanslı oturumları yönetirken odaklanmanıza ve uyanık kalmanıza yardımcı olur. Ayrıca tutarlılığı artırmak için gerçek zamanlı eylemlerinizi günlük notlarınızla karşılaştırabilirsiniz.

Günlüğünüzü Nasıl Maksimize Edersiniz

- Şablon Oluşturun — Daha hızlı inceleme için girişlerinizi standartlaştırın.

- Duyguları Takip Edin — Her işlemden önce ve sonra nasıl hissettiğinizi kaydedin.

- Piyasa Bağlamı Ekleyin — Haberleri, trendleri veya teknik seviyeleri not edin.

- Haftalık İnceleme Yapın — Dürüst bir yansıma için zaman ayırın.

- Kararları Değerlendirin — Her işlemi disiplin ve uygulama açısından puanlayın.

- Görsel Araçlar Kullanın — Verileri grafiklere veya şemalara dönüştürün.

Sonuç

Opsiyon işlem günlüğü kişisel geri bildirim döngünüzdür — yansıtma, iyileştirme ve büyüme aracıdır. Pocket Option’ın İşlem Geçmişi ve gerçek zamanlı İşlemler izleme gibi özellikleriyle, aktivitenizi takip etmek sorunsuz ve anlamlı hale gelir.

İster stratejileri test ediyor, ister hızlı işlemleri yönetiyor, ister disiplini geliştiriyor olun, günlüğünüz deneyimi ölçülebilir ilerlemeye dönüştürür.

⚡ Sadece işlem yapmayın. İşlemlerinizi anlayın.

FAQ

Opsiyon işlem günlüğü nedir ve neden önemlidir?

Opsiyon işlem günlüğü, yatırımcıların işlemlerini, stratejilerini ve performanslarını belgelemek için kullandığı bir kayıt tutma aracıdır. Yatırımcıların kararlarını analiz etmelerine, kalıpları belirlemelerine ve zaman içinde işlem stratejilerini geliştirmelerine yardımcı olduğu için önemlidir.

Opsiyon işlem günlüğümü ne sıklıkla güncellemeliyim?

Opsiyon işlem günlüğünüzü tutarlı bir şekilde, ideal olarak her işlemden sonra veya her işlem gününün sonunda güncellemek en iyisidir. Bu, kayıtlarınızın doğru olmasını ve işlemleriniz hakkındaki önemli ayrıntıları unutmamanızı sağlar.

Opsiyon işlem günlüğüme hangi bilgileri dahil etmeliyim?

Opsiyon işlem günlüğünüz işlem detaylarını (giriş ve çıkış noktaları, pozisyon büyüklüğü, kâr/zarar), piyasa koşullarını, duygusal durumunuzu, işlemlere girme ve çıkma nedenlerinizi ve işlem sonrası analiz veya öğrenilen dersleri içermelidir.

Opsiyon işlem günlüğüm için elektronik tablo kullanabilir miyim?

Evet, elektronik tablo, opsiyon işlem günlüğü tutmak için etkili bir araç olabilir. Birçok yatırımcı, belirli ihtiyaçlarına ve işlem tarzlarına uygun özelleştirilmiş şablonlar oluşturmak için Excel veya Google Sheets kullanır.

Evet, elektronik tablOpsiyon işlem günlüğümü işlem performansımı geliştirmek için nasıl kullanabilirim?o, opsiyon işlem günlüğü tutmak için etkili bir araç olabilir. Birçok yatırımcı, belirli ihtiyaçlarına ve işlem tarzlarına uygun özelleştirilmiş şablonlar oluşturmak için Excel veya Google Sheets kullanır.

Düzenli olarak günlük girişlerinizi gözden geçirerek işlem davranışınızdaki kalıpları belirleyin, stratejilerinizin etkinliğini değerlendirin ve iyileştirme alanlarını tespit edin. Bu bilgileri yaklaşımınızı iyileştirmek, riski daha etkili bir şekilde yönetmek ve daha bilinçli işlem kararları vermek için kullanın.