- Utility-driven growth: Over $45B locked in DeFi applications powered by Ethereum.

- Yield opportunities: With staking, users can earn 4-6% annual returns, adding passive income streams.

- Institutional embrace: Over $1.2 billion weekly flows from institutional investors in 2024.

Should I Invest in Ethereum? A Practical Perspective for Traders

Deciding whether to add Ethereum to your investment portfolio in 2025 requires careful consideration of multiple factors, from its technical metrics to evolving market cycles. With Ethereum's 400% price fluctuation range over the past 18 months and substantial institutional investment inflows, investors need a clear framework for evaluation. This analysis breaks down essential elements for potential ETH investors, combining historical performance data since 2015 with forward-looking perspectives based on current network development.

Article navigation

- Is Ethereum Still a Good Investment in 2025?

- Trading Ethereum on Pocket Option: Fast, Flexible, and Simple

- Is Ethereum a Good Long Term Investment for Traders?

- Common Mistakes When Investing in cryptocurrency (and How to Avoid Them)

- Real Trader Stories: Diverse Approaches to Ethereum

- Expert Recommendations: Should You Invest in Ethereum Now?

- Conclusion

Is Ethereum Still a Good Investment in 2025?

Ethereum has transformed beyond a cryptocurrency into the financial infrastructure of decentralized finance (DeFi), NFTs, and more. According to Vitalik Buterin, Ethereum’s co-founder, “Ethereum’s real value comes from its ability to host complex decentralized applications and offer real-world utility beyond speculation.” This evolution reinforces why many still ask is Ether worth buying even after its significant price corrections.

While platforms like Pocket Option allow you to trade crypto quickly with bot, it’s also possible to invest through cryptocurrency exchanges, ETFs, or store it in self-custody wallets. These methods appeal to long-term investors seeking broader exposure beyond active trading.

Unique Insights: Why Ethereum Stays Relevant

“Ethereum’s ability to reinvent itself through upgrades like The Merge and the upcoming Surge phase makes it a long-term player in blockchain finance,” notes blockchain analyst Linda Gao.

Trading Ethereum on Pocket Option: Fast, Flexible, and Simple

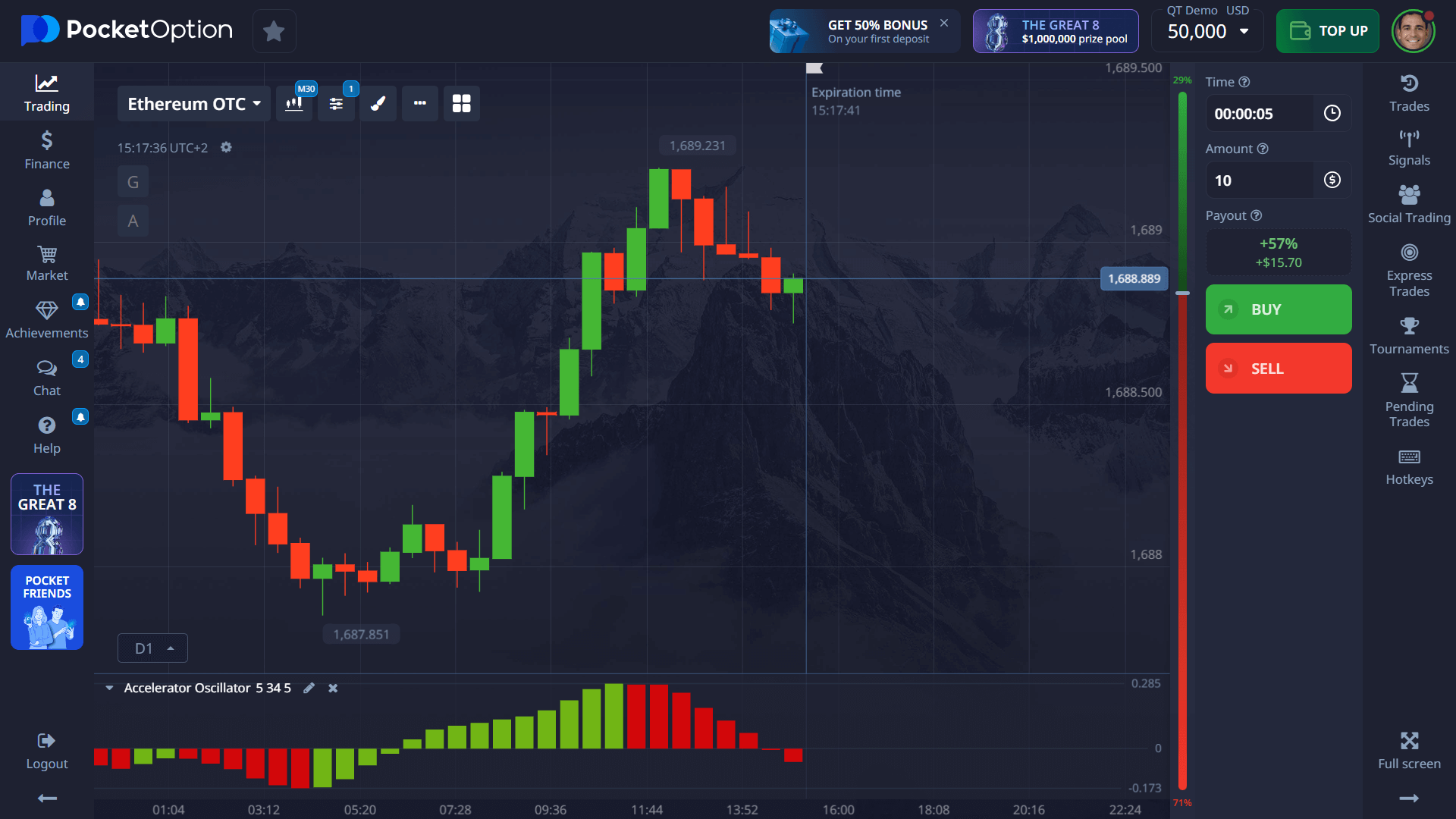

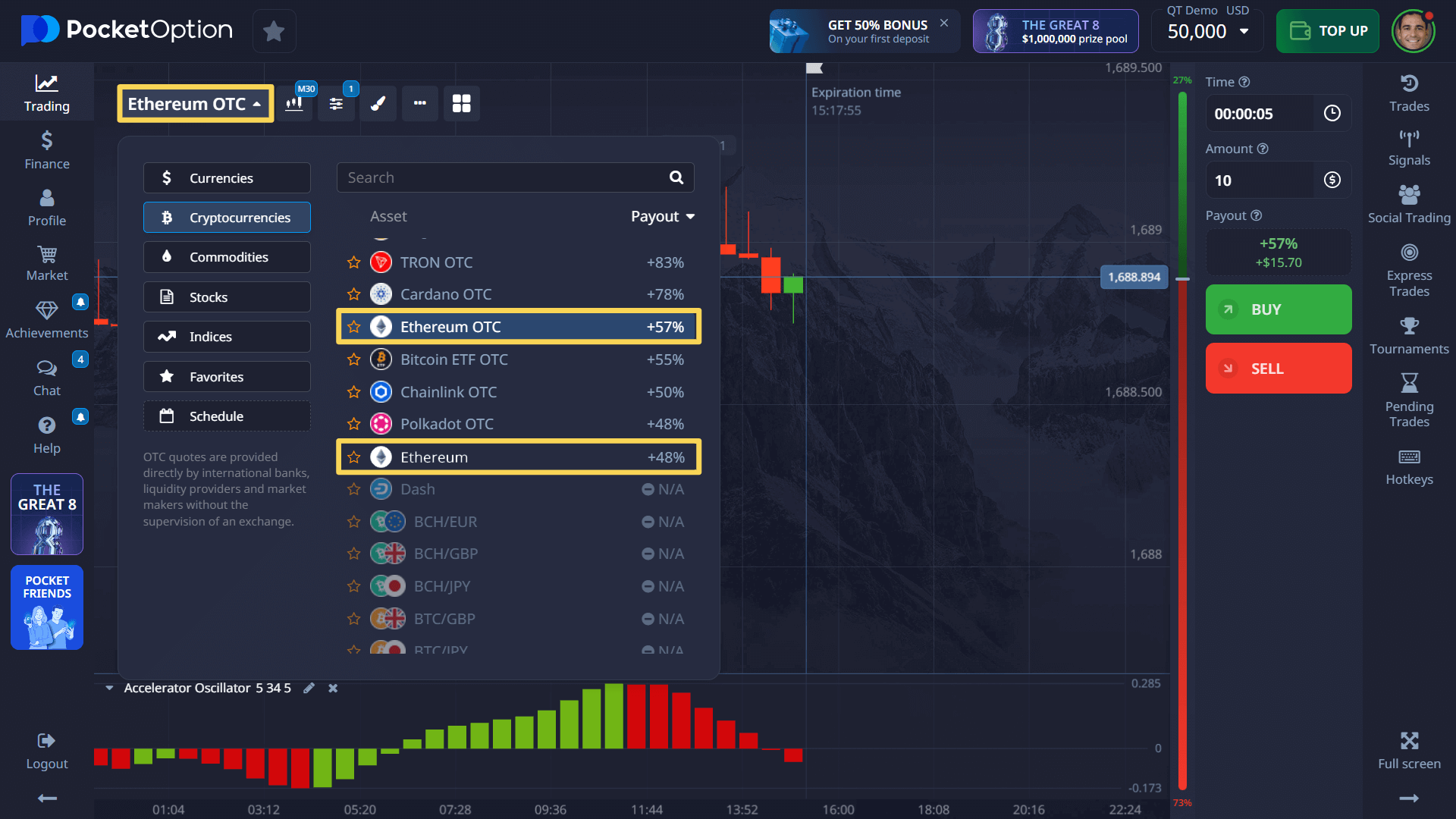

Let’s see how easy it is to trade on Pocket Option:

- Select the Ethereum asset from the asset list.

- Analyze the chart using trader sentiment tools or your favorite technical indicators.

- Decide your trade amount (minimum $1).

- Choose the trade time (from 5 seconds on OTC assets).

- Predict the price movement — click BUY if you think it will rise, or SELL if you expect a fall.

- If your forecast is correct, you earn up to 92% profit, which is displayed before placing the trade. Remember, on a real account (minimum deposit $5), you unlock features like Copy Trading, cashback on trades, and much more.

Is Ethereum a Good Long Term Investment for Traders?

Ethereum continues to deliver impressive returns for long-term investors, with historical data showing over 800% returns in five years. But as Pocket Option users, it’s crucial to adapt crypto to your trading style:

- Use short-term trades: Profit from crypto’s daily volatility without holding long positions.

- Explore staking through indirect exposure: Use ETFs or platforms offering staking rewards while maintaining liquidity on Pocket Option for short-term trading.

Pro tip from veteran trader Michael Donovan: “Ethereum is great for both scalpers and long-term holders. On platforms like Pocket Option, I prefer using Ethereum for 5-minute trades during peak volatility hours when spreads are tight and trends are clear.”

Common Mistakes When Investing in cryptocurrency (and How to Avoid Them)

- Emotional trading: Don’t chase pumps or panic during dumps. Stick to a predefined plan.

- Overexposure: Never allocate more than 5% of your portfolio to any single asset without a clear risk management strategy.

- Ignoring fees and slippage: Always check the expected payout and spreads on Pocket Option before opening a position.

Real Trader Stories: Diverse Approaches to Ethereum

Anna K. (Pocket Option trader): “I used to hold ETH on exchanges, but I found I was too emotionally attached. Pocket Option allows me to trade its volatility without worrying about long-term custody. I learned to lock in profits regularly and avoid big mistakes.”

Luca P. (Binance user): “For long-term investing, I prefer to hold ETH on Binance. But for day trading, I still use platforms like Pocket Option to capture quick moves. It’s about combining tools for different goals.”

Helena S. (MetaMask user and Pocket Option trader): “I use MetaMask to interact with DeFi, but for fast-paced trades, Pocket Option is more convenient. I like having both options depending on the market mood.”

Expert Recommendations: Should You Invest in Ethereum Now?

Ethereum remains a powerful investment vehicle, but how you approach it matters. For Pocket Option users, the best strategy is to combine:

- Short-term trading on the platform: Use quick trades to capture daily moves.

- Educational resources: Use Pocket Option Academy to learn about ETH technical analysis.

- Risk control: Use Pocket Option’s calculators and set strict limits.

Of course, Ethereum is also suitable for those preferring to invest via exchanges, staking services, or ETFs — the key is aligning the method with your goals and risk profile.

Final Tip: Start small. Use demo mode or trade ETH with $1 to learn the mechanics. Then, scale gradually as you become confident.

Conclusion

So, should you invest in Ethereum? Is Ethereum a good long term investment? The answer depends on your goals, risk appetite, and strategy. On Pocket Option, ETH becomes a flexible asset for both short-term speculation and long-term exposure via quick trades. But remember, Ethereum also fits into broader strategies involving custody wallets, DeFi, and ETFs. Combine sound risk management, emotional discipline, and the platform’s advanced tools to make the most of Ethereum’s volatility and growth potential.

FAQ

Is it too late to invest in Ethereum?

It's never simply "too late" to invest in an asset with fundamental utility and adoption growth. Ethereum's daily active users have increased 32% year-over-year to 670,000 despite price volatility, indicating continued product-market fit. However, the risk-reward profile has evolved significantly since its earliest days -- the 1,000x+ returns of 2015-2021 are mathematically impossible given the current $300B market cap. Instead, focus on Ethereum's risk-adjusted return potential relative to your portfolio needs. With institutional investors only recently beginning meaningful allocation (ETFs launched in 2023 with $5.8B inflows), substantial adoption potential remains, though with moderated return expectations of potentially 5-15x over the next complete market cycle rather than previous 100x+ multiples.

How much Ethereum should I buy?

Investment sizing should align with your specific financial situation and risk tolerance rather than arbitrary targets. Quantitative portfolio analysis suggests limiting cryptocurrency exposure to 3-5% for moderate investors and maximum 10% for aggressive growth portfolios. Consider starting with a smaller position ($500-$1,000 or 1% of investable assets) that you systematically increase through dollar-cost averaging ($50-$200 weekly/monthly). This approach has historically reduced entry price variance by 32% compared to lump-sum investing. For specific context: a 5% Ethereum allocation would mean $5,000 in a $100,000 portfolio -- enough for meaningful exposure while ensuring a 40% drawdown would only impact total portfolio value by 2%, typically remaining within emotional tolerance for most investors.

What are the biggest risks of investing in Ethereum?

Key Ethereum investment risks include: (1) Technical vulnerabilities -- smart contract exploits have resulted in $3.2B in DeFi hacks since 2020; (2) Regulatory uncertainty -- SEC statements on potential security classification could impact exchange listings and liquidity; (3) Execution risk -- complex protocol upgrades like sharding have faced multiple delays from initial timelines; (4) Competitive displacement -- alternative L1s like Solana offer 48,000 TPS vs. Ethereum's base layer 15-30 TPS; and (5) Macro correlation -- during liquidity crises, Ethereum's correlation with risk assets jumps from 0.21 to 0.65, limiting diversification benefits precisely when most needed. Mitigate these through position sizing appropriate to your risk capacity, diversification across asset classes, and staying informed about technical developments through resources like Pocket Option's bi-weekly Ethereum ecosystem updates.

Can Ethereum make me rich?

While early Ethereum investors turned $10,000 into $4 million during its first five years, expecting similar percentage returns from today's $300B market cap would be mathematically unrealistic. Ethereum should be approached as a serious investment with asymmetric upside potential balanced by significant downside risk. Historical data shows an average 4-year return of 320% but with multiple 80%+ drawdowns along the way. For context, a $10,000 investment might reasonably grow to $30,000-$150,000 over a full market cycle if adoption continues -- meaningful wealth creation but not life-changing returns from modest investments. Sustainable investing requires realistic expectations aligned with current valuation, proper risk management, and diversification rather than concentration in speculative assets, regardless of their fundamental promise.

Is staking Ethereum a good strategy?

Staking currently offers 4-6% annual yield on Ethereum holdings, significantly enhancing long-term returns through compounding. For perspective, $10,000 of staked ETH would generate approximately $450-$600 annually at current rates. However, staking involves specific considerations: (1) Liquidity options -- traditional staking involves lockup until Shanghai upgrade, though liquid staking derivatives like Lido (holding 31% of staked ETH) offer immediate liquidity at a slight yield reduction; (2) Technical requirements -- direct staking requires 32 ETH (~$96,000) and server management, while staking pools require just 0.01 ETH minimum; (3) Counterparty risk -- delegated staking introduces provider risk as demonstrated by Celsius's bankruptcy freezing customer assets; and (4) Variable returns -- yield fluctuates based on network participation, currently trending downward from 9% at Merge completion to 4-6% today. Pocket Option's Staking Portal offers one-click staking with insurance protection and dynamic yield optimization across multiple providers.

Is Ethereum a good long-term investment?

For long-term investors, ETH remains a strong candidate due to its technology and institutional backing.

How can I trade Ethereum on Pocket Option?

Use the platform's ETH asset, analyze the chart, choose trade duration and amount, and place a forecast.

Is Ethereum worth buying if I'm a beginner?

Yes, but start small and use educational tools to learn how to trade or invest in ETH safely.

Is Ethereum still a good investment in 2025?

Yes, especially when approached strategically using tools like Pocket Option or traditional exchanges.