- เปิดแท็บ “ปัจจุบัน” ในเมนูตัวบ่งชี้เดียวกันและคลิกที่ไอคอนปากกาเพื่อปรับการตั้งค่าต่างๆ เช่น สี ช่วงเวลา และความหนาของเส้น

- หรือแก้ไขโดยตรงจากแผนภูมิโดยคลิกที่ไอคอนดินสอถัดจากชื่อของตัวบ่งชี้

Pocket Option ตัวบ่งชี้ปริมาณ Pocket Option

ตัวบ่งชี้ปริมาณทำหน้าที่เป็นองค์ประกอบสำคัญในการวิเคราะห์ตลาด โดยเฉพาะอย่างยิ่งสำหรับการซื้อขาย บทความนี้สำรวจวิธีการเปิดใช้งานและใช้ตัวบ่งชี้ปริมาณอย่างมีประสิทธิภาพ ประเมินตัวบ่งชี้ที่คล้ายคลึงกัน และรวมตัวอย่างการซื้อขายเพื่อแสดงการประยุกต์ใช้งานจริง

ตัวบ่งชี้ที่อิงจากปริมาณบน Pocket Option

ตัวบ่งชี้ปริมาณใน Pocket Option แสดงเป็นฮิสโตแกรมใต้กราฟราคา โดยแต่ละแท่งแสดงถึงธุรกรรมทั้งหมดสำหรับแท่งเทียนราคาที่เกี่ยวข้อง แท่งที่สูงกว่าแสดงการมีส่วนร่วมที่สูงขึ้น ในขณะที่แท่งสั้นกว่าบ่งชี้ถึงกิจกรรมที่ลดลง ความแตกต่างของสีเน้นว่าปริมาณเกิดขึ้นระหว่างการเคลื่อนไหวของราคาขาขึ้นหรือขาลง

| ตัวบ่งชี้ | คำอธิบาย |

|---|---|

| Awesome Oscillator | วัดโมเมนตัมโดยเปรียบเทียบค่าเฉลี่ยเคลื่อนที่สองตัว ช่วยระบุความแข็งแกร่งของเทรนด์ |

| Bears Power | แสดงความแข็งแกร่งของผู้ขายเทียบกับค่าเฉลี่ยเคลื่อนที่ มีประโยชน์ในการยืนยันเทรนด์ขาลง |

| Bulls Power | สะท้อนความแข็งแกร่งของผู้ซื้อเหนือค่าเฉลี่ยเคลื่อนที่ มักใช้ในการตั้งค่าแบบขาขึ้น |

| MACD | รวมค่าเฉลี่ยเคลื่อนที่และฮิสโตแกรมเพื่อประเมินโมเมนตัมของตลาดและทิศทางแนวโน้ม |

| OsMA | แสดงความแตกต่างระหว่าง MACD และเส้นสัญญาณ เน้นการเปลี่ยนแปลงโมเมนตัม |

| Rate of Change (RoC) | คำนวณความเร็วของการเปลี่ยนแปลงราคาในช่วงเวลาหนึ่ง ส่งสัญญาณเพิ่มหรือลดความสนใจของตลาด |

วิธีเปิดใช้งานตัวบ่งชี้ปริมาณบน Pocket Option

บน Pocket Option นักเทรดสามารถเข้าถึงเครื่องมือที่เกี่ยวข้องกับปริมาณหลายตัวได้โดยตรงจากอินเทอร์เฟซการซื้อขาย

การเปิดใช้งานและการจัดการทีละขั้นตอน

👉ในการเพิ่มตัวบ่งชี้ปริมาณลงในแผนภูมิของคุณ ให้เปิดแท็บ “ตัวบ่งชี้” ที่ตั้งอยู่ที่มุมบนซ้ายของอินเทอร์เฟซ แล้วคลิกที่ตัวบ่งชี้ที่ต้องการจากรายการ

เมื่อใช้แล้ว สามารถปรับแต่งได้สองวิธี:

หากคุณวางแผนที่จะใช้เครื่องมือนี้เป็นประจำ ให้ทำเครื่องหมายดาวเพื่อย้ายไปยังส่วนรายการโปรดของคุณ

ในการลบตัวบ่งชี้ ให้ไปที่แท็บ “ปัจจุบัน” ในรายการตัวบ่งชี้และลบออกจากที่นั่น คุณยังสามารถลบออกจากแผนภูมิโดยคลิกที่ X ถัดจากชื่อของมัน

การใช้ตัวบ่งชี้ปริมาณในการซื้อขายแบบรวดเร็ว

ตัวบ่งชี้ปริมาณสะท้อนจำนวนการซื้อขายในช่วงเวลาที่กำหนด นี่ช่วยระบุกิจกรรมของตลาดและความสนใจในสินทรัพย์ ในการซื้อขายแบบรวดเร็ว การพุ่งขึ้นอย่างฉับพลันของปริมาณอาจบ่งชี้ถึงการเบรกเอาท์หรือการกลับตัวที่อาจเกิดขึ้น

ตัวอย่างการใช้งานจริง

มาดูสถานการณ์จริงโดยใช้ Awesome Oscillator บน Pocket Option ซึ่งสะท้อนโมเมนตัมของตลาดและมีความสัมพันธ์โดยอ้อมกับความแข็งแกร่งของปริมาณ

- เปิดสินทรัพย์ EUR/USD บนอินเทอร์เฟซการซื้อขายของ Pocket Option

- คลิกที่แท็บตัวบ่งชี้ที่มุมบนซ้ายและเลือก Awesome Oscillator

- สังเกตแท่งฮิสโตแกรมที่ด้านล่างของแผนภูมิ ช่วงของแท่งแบนหรือผสม (แดงและเขียวสลับกันใกล้ศูนย์) บ่งชี้ถึงความลังเลของตลาด

- รอสัญญาณที่ชัดเจน: แท่งสีเขียวติดต่อกันสองแท่งขึ้นไปที่เพิ่มขึ้นเหนือเส้นศูนย์แสดงถึงโมเมนตัมขาขึ้นที่กำลังเติบโต

- ในเวลาเดียวกัน ให้ติดตามการเคลื่อนไหวของราคาเพื่อหาแท่งเทียนเบรกเอาท์ ในอุดมคติคือแท่งเทียนขาขึ้นที่แข็งแกร่งหลังจากการรวมตัวระยะสั้น

เมื่อเงื่อนไขทั้งสองเป็นจริง:

- Awesome Oscillator เปลี่ยนเป็นสีเขียวและเพิ่มขึ้น

- ราคาทะลุเหนือโซนแนวต้านล่าสุด

→ วางการเทรด “ซื้อ” ด้วยระยะเวลาหมดอายุ 15 วินาที

เพื่อเพิ่มความแม่นยำ ให้ใช้ร่วมกับค่าเฉลี่ยเคลื่อนที่ (MA):

- เพิ่ม MA ระยะสั้น (เช่น 10) ลงในแผนภูมิของคุณ

- หากราคาข้ามเหนือ MA และ AO กำลังเพิ่มขึ้น นี่จะยืนยันความแข็งแกร่งของการเคลื่อนไหว

การยืนยันสองชั้นนี้ช่วยกรองการเคลื่อนไหวที่อ่อนแอและสนับสนุนการตัดสินใจที่มีโครงสร้าง

👉ในตัวอย่างของเรา โดยใช้ตัวบ่งชี้สองตัวและเลือกการซื้อขาย 15 วินาทีบน EUR/USD OTC เราได้รับผลตอบแทน 92% จากการลงทุน $10 — นั่นคือ +$9.2 ที่เครดิตเข้าบัญชี

วิธีรวมตัวบ่งชี้ปริมาณกับเครื่องมืออื่นๆ เพื่อหาจุดเข้าซื้อขาย

ตัวบ่งชี้ปริมาณแทบจะไม่ถูกใช้โดดๆ นักเทรดมักจะรวมมันกับเครื่องมือจากหมวดหมู่อื่นๆ เช่น ตัวบ่งชี้แนวโน้ม โมเมนตัม หรือความผันผวน ด้านล่างเป็นตารางเปรียบเทียบที่แสดงวิธีการจับคู่ตัวบ่งชี้ปริมาณเพื่อเพิ่มความน่าเชื่อถือของสัญญาณ:

| ตัวบ่งชี้ปริมาณ | ตัวบ่งชี้เพิ่มเติม | วิธีอ่านและหาจุดเข้าซื้อขาย |

|---|---|---|

| ปริมาณ | ค่าเฉลี่ยเคลื่อนที่ (MA) | เข้าซื้อขายเมื่อปริมาณพุ่งขึ้นเหนือค่าเฉลี่ยระหว่างแท่งเทียนที่ทะลุเหนือเส้น MA |

| Awesome Oscillator | RSI | เข้าซื้อขายเมื่อ AO แสดงแท่งสีเขียวหลังจากสีแดง และ RSI ข้ามเหนือ 30 จากภาวะขายมากเกินไป |

| Bulls Power | Fractal | เข้าซื้อขายเมื่อ Bulls Power กำลังเพิ่มขึ้น และ fractal ซื้อปรากฏใต้ราคา |

| Bears Power | Parabolic SAR | เข้าซื้อขายเมื่อ Bears Power เพิ่มขึ้น และจุด SAR พลิกไปอยู่เหนือราคา บ่งชี้การขาย |

| MACD | Bollinger Bands | เข้าซื้อขายเมื่อเส้น MACD ตัดกันขึ้น และแท่งเทียนทะลุเหนือแถบ Bollinger บน |

| Rate of Change (RoC) | ADX | เข้าซื้อขายเมื่อ RoC หันขึ้นอย่างรวดเร็ว และ ADX อยู่เหนือ 20 ยืนยันว่ากำลังเกิดเทรนด์ |

แต่ละเครื่องมือตีความปริมาณแตกต่างกัน ตัวอย่างเช่น Bulls/Bears Power แยกแยะแรงตามทิศทาง ในขณะที่ MACD ระบุรูปแบบการบรรจบกันตามค่าเฉลี่ยที่ได้รับผลกระทบจากปริมาณ

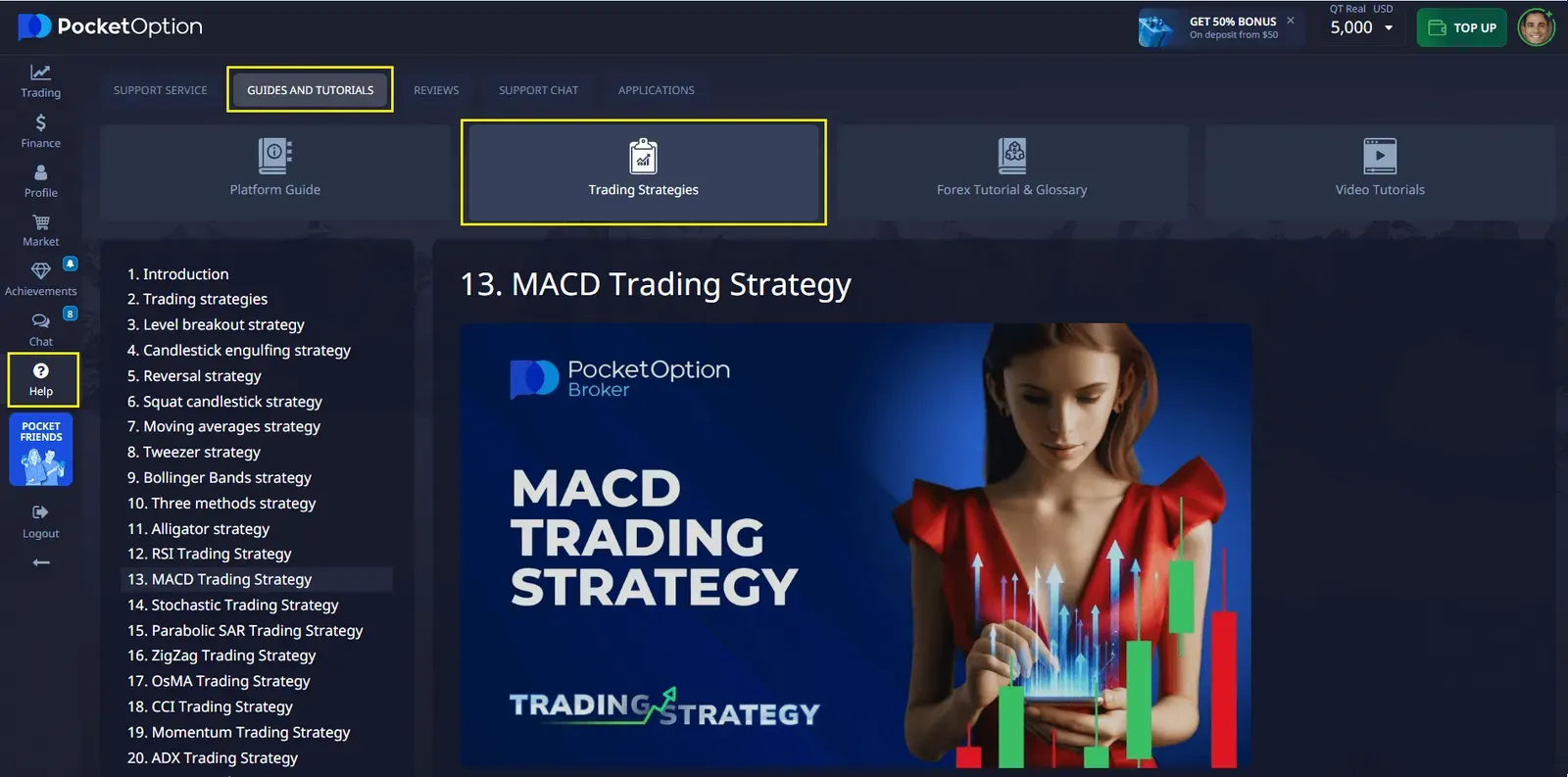

การเข้าถึงส่วนกลยุทธ์บน Pocket Option

Pocket Option มีแท็บกลยุทธ์เฉพาะที่ผู้ใช้สามารถสำรวจเทคนิคการซื้อขายที่กำหนดไว้ล่วงหน้า กลยุทธ์บางอย่างรวมตัวบ่งชี้ปริมาณ ให้วิธีการที่มีโครงสร้างเพื่อใช้งานอย่างมีประสิทธิภาพ

ไม่ว่าจะเป็นกลยุทธ์การยืนยันการเบรกเอาท์อย่างง่ายหรือการแยกของปริมาณขั้นสูง ผู้ใช้สามารถหาตัวอย่างที่เป็นประโยชน์ รวมถึงเงื่อนไขการเข้า/ออก และการตั้งค่าตัวบ่งชี้

ข้อจำกัดของตัวบ่งชี้ปริมาณ

ในขณะที่เครื่องมือที่ใช้ปริมาณให้ข้อมูลเชิงลึก แต่ก็มีข้อจำกัดเช่นกัน:

- ลักษณะล้าหลัง: ตัวบ่งชี้ปริมาณตอบสนองหลังจากราคาเปลี่ยนแปลง

- ขาดทิศทาง: ไม่ได้ทำนายแนวโน้มขาขึ้นหรือขาลงโดยธรรมชาติ

- การพึ่งพาสินทรัพย์: ข้อมูลปริมาณอาจแตกต่างกันในความน่าเชื่อถือระหว่างสินทรัพย์ OTC, forex และคริปโต

แง่มุมเหล่านี้ต้องการการตีความอย่างระมัดระวังและการรวมกับเครื่องมืออื่นๆ

ตัวบ่งชี้ปริมาณ เทียบกับ กลยุทธ์ที่ใช้แค่ราคา

นักเทรดบางคนพึ่งพาเพียงรูปแบบแท่งเทียนหรือค่าเฉลี่ยเคลื่อนที่ ตัวบ่งชี้ปริมาณให้บริบทเพิ่มเติมแต่ไม่ควรแทนที่การวิเคราะห์ราคา วิธีการแบบผสมผสานมักมีประสิทธิภาพมากกว่าในการระบุสัญญาณที่ถูกต้องและหลีกเลี่ยงการเบรกเอาท์ปลอม

สรุปและความคิดสุดท้าย

ตัวบ่งชี้ปริมาณเป็นส่วนประกอบที่มีประโยชน์ แม้จะไม่ถึงขั้นตัดสินใจขั้นสุดท้าย ของการวิเคราะห์การซื้อขาย บน Pocket Option นักเทรดสามารถเปิดใช้งานและปรับแต่งได้อย่างง่ายดาย อย่างไรก็ตาม การเข้าใจบริบท ข้อจำกัด และวิธีการรวมเข้ากับเครื่องมืออื่นๆ เป็นกุญแจสำคัญสู่การประยุกต์ใช้ที่มีความหมาย

FAQ

ตัวบ่งชี้ปริมาณมีให้ใช้งานบนมือถือหรือไม่?

ใช่ Pocket Option อนุญาตให้ใช้ตัวบ่งชี้ปริมาณบนแพลตฟอร์มทั้งเดสก์ท็อปและมือถือผ่านเมนู "ตัวบ่งชี้"

ฉันสามารถใช้ตัวบ่งชี้ปริมาณหลายตัวพร้อมกันได้หรือไม่?

ใช่ นักเทรดสามารถเปิดใช้งานเครื่องมือหลายอย่าง (เช่น ปริมาณ + MACD) เพื่อสร้างกลยุทธ์ที่สมบูรณ์ยิ่งขึ้น

ตัวบ่งชี้ปริมาณมีความแม่นยำเพียงใดสำหรับการเทรดแบบรวดเร็ว?

มันให้ข้อมูลสนับสนุนแต่ควรใช้ร่วมกับรูปแบบราคาหรือตัวบ่งชี้การยืนยันเพื่อผลลัพธ์ที่ดีขึ้น

ตัวบ่งชี้ปริมาณมีอยู่ในส่วนกลยุทธ์หรือไม่?

ใช่ ส่วนกลยุทธ์รวมวิธีการหลายวิธีที่พึ่งพาปริมาณหรือรวมกับสัญญาณแนวโน้ม

สินทรัพย์ใดแสดงข้อมูลปริมาณที่น่าเชื่อถือที่สุด?

คู่เงินฟอเร็กซ์หลักและหุ้นมักจะสะท้อนกิจกรรมปริมาณที่แม่นยำกว่าเมื่อเทียบกับเครื่องมือที่มีสภาพคล่องน้อยกว่าหรือเครื่องมือ OTC