- ✅ ฟรีตลอดไป — ไม่มีค่าธรรมเนียมแอบแฝงหรือค่าสมัครสมาชิก

- ✅ การควบคุมความเสี่ยงในตัว — เทรดภายใต้เงื่อนไขของคุณเท่านั้น

- ✅ เหมาะสำหรับผู้เริ่มต้น — ไม่ต้องเขียนโค้ด ไม่มีความเครียดในการตั้งค่า

- ✅ โหมดอัตโนมัติหรือการอนุมัติด้วยตนเอง — ควบคุมได้หรืออัตโนมัติเต็มรูปแบบ

- ✅ ทำงาน 24/7 — อยู่ในตลาดแม้ในขณะที่คุณนอนหลับ

บอทสัญญาณการเทรด Pocket Option - ฉลาดและง่าย!

การทำงานอัตโนมัติกำลังปฏิวัติการเทรด ทำให้ทุกคน แม้แต่ผู้เริ่มต้น สามารถเทรดได้อย่างชาญฉลาดมากขึ้น ด้วยความเครียดน้อยลง หนึ่งในเครื่องมือที่ทรงพลังที่สุดที่คุณสามารถใช้ได้คือบอทสัญญาณการเทรด Pocket Option -- บอทเทเลแกรมฟรีที่ทำให้การเทรดเป็นอัตโนมัติ ส่งการแจ้งเตือนแบบเรียลไทม์ และช่วยให้คุณควบคุมความเสี่ยงได้ ไม่ว่าคุณต้องการลดข้อผิดพลาดหรือประหยัดเวลา คู่มือนี้จะแสดงให้คุณเห็นวิธีการตั้งค่าและใช้งานบอทอย่างละเอียด รวมถึงวิธีการจับคู่กับสัญญาณของแพลตฟอร์มเพื่อให้ได้กำไรสูงสุด!

Article navigation

- ทำไมเทรดเดอร์จึงเชื่อมั่นในบอท Telegram ของ Pocket Option

- วิธีการเข้าถึงบอท Telegram ของ Pocket Option

- ขั้นตอน: วิธีใช้บอท

- วิธีใช้สัญญาณในตัวของแพลตฟอร์ม

- นี่คือวิธีการเข้าถึงและใช้งาน:

- อะไรที่ทำให้บอทเทรดดิ้งน่าเชื่อถืออย่างแท้จริง?

- อย่าละเลยการจัดการความเสี่ยง

- ความคิดสุดท้าย: ระบบอัตโนมัติโดยไม่สูญเสียการควบคุม

ทำไมเทรดเดอร์จึงเชื่อมั่นในบอท Telegram ของ Pocket Option

บอทนี้ไม่ใช่แค่ตัวรับสัญญาณ — แต่เป็นผู้ช่วยที่ปรับแต่งได้อย่างเต็มที่ซึ่งสร้างขึ้นเพื่อรองรับเทรดเดอร์สมัยใหม่:

สำหรับเทรดเดอร์ที่ต้องจัดการระหว่างงานหรือสินทรัพย์หลายอย่าง เครื่องมือนี้ช่วยให้มั่นใจว่าไม่พลาดโอกาสใดๆ

วิธีการเข้าถึงบอท Telegram ของ Pocket Option

Pocket Option มีวิธีที่เชื่อถือได้สองวิธีในการเชื่อมต่อกับบอทสัญญาณ Pocket Option — ทั้งสองเป็นทางการ และคุณสามารถเลือกวิธีที่สะดวกกว่าสำหรับคุณ

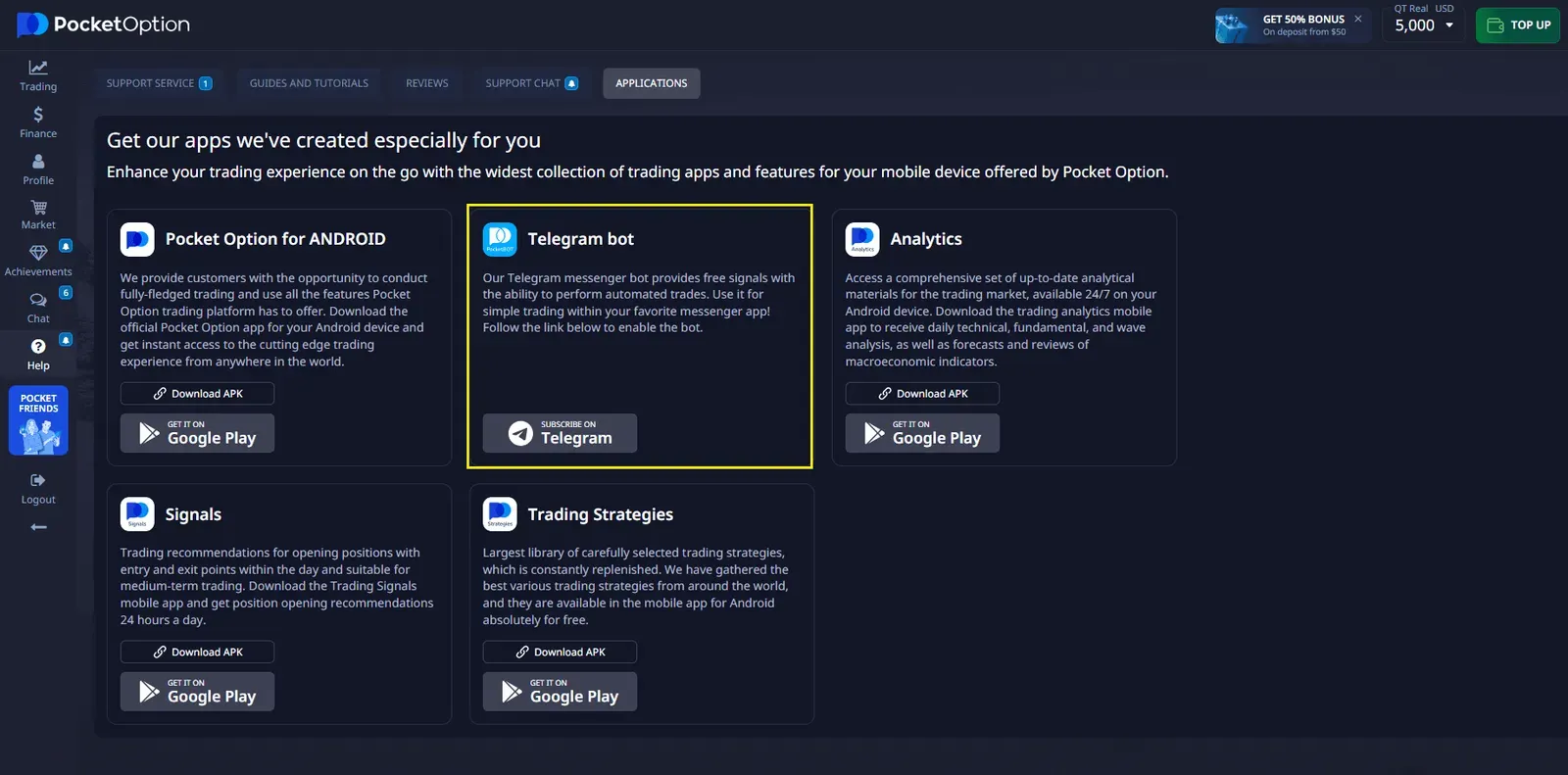

วิธีที่ 1: ใช้เมนู “ช่วยเหลือ” และ “แอปพลิเคชัน”

นี่เป็นเส้นทางแบบดั้งเดิมสำหรับการตั้งค่าบอท เหมาะอย่างยิ่งหากคุณกำลังเรียกดูอินเทอร์เฟซของแพลตฟอร์มอยู่แล้ว

- เข้าสู่ระบบบัญชีเทรดดิ้ง Pocket Option ของคุณ

- ที่แถบด้านซ้าย คลิกที่ “ช่วยเหลือ” — นี่จะเปิดเมนูทรัพยากร

- เลือก “แอปพลิเคชัน” จากรายการป๊อปอัพ

- ค้นหาบอท Telegram ของ Pocket Option คลิกที่มัน และทำตามคำแนะนำเพื่อเปิดใช้งาน

วิธีนี้รับประกันว่าคุณกำลังดาวน์โหลดเวอร์ชันที่เป็นทางการและอัปเดตโดยตรงจากแดชบอร์ดบัญชีของคุณ

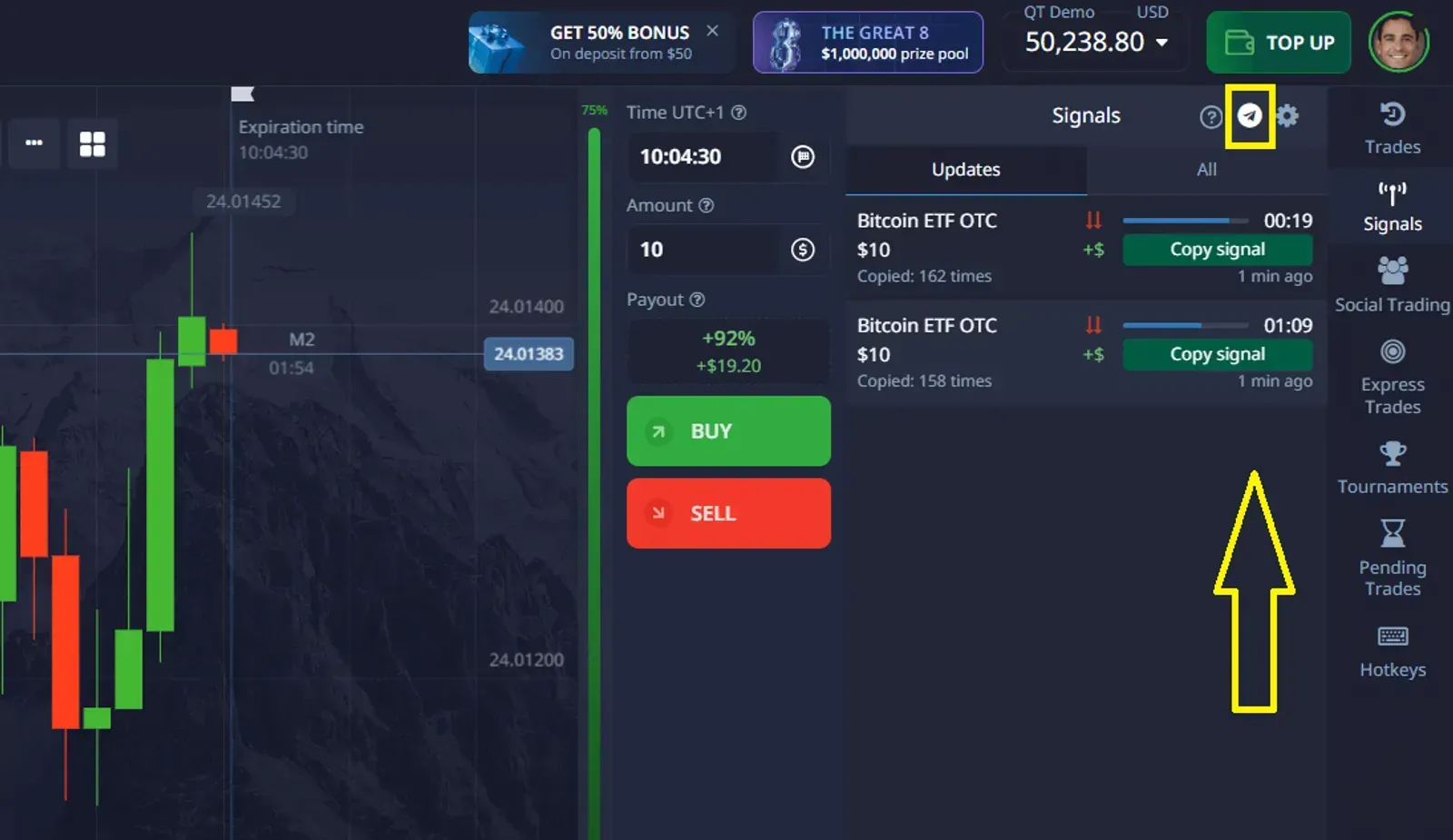

วิธีที่ 2: ใช้แท็บ “สัญญาณ”

นี่เป็นเส้นทางที่เร็วกว่า โดยเฉพาะอย่างยิ่งหากคุณกำลังดูอินเทอร์เฟซสัญญาณอยู่แล้ว

- เข้าสู่ระบบบัญชี Pocket Option ของคุณ

- นำทางไปยังแท็บ “สัญญาณ” ที่ด้านบนของเทอร์มินัลเทรดดิ้ง

- คุณจะเห็นคำแนะนำให้เปิดใช้งานบอท Telegram — คลิกและทำตามคำแนะนำ

- ภายในไม่กี่วินาที แอป Telegram ของคุณจะเปิดขึ้น และบอทจะพร้อมเริ่มต้น

ทั้งสองจุดเข้าถึงให้การควบคุมอย่างเต็มที่เหนือการตั้งค่า การรับสัญญาณ และคุณสมบัติการเทรดอัตโนมัติ

ขั้นตอน: วิธีใช้บอท

สำหรับคุณอย่างละเอียดแต่เข้าใจง่ายเกี่ยวกับวิธีใช้บอท:

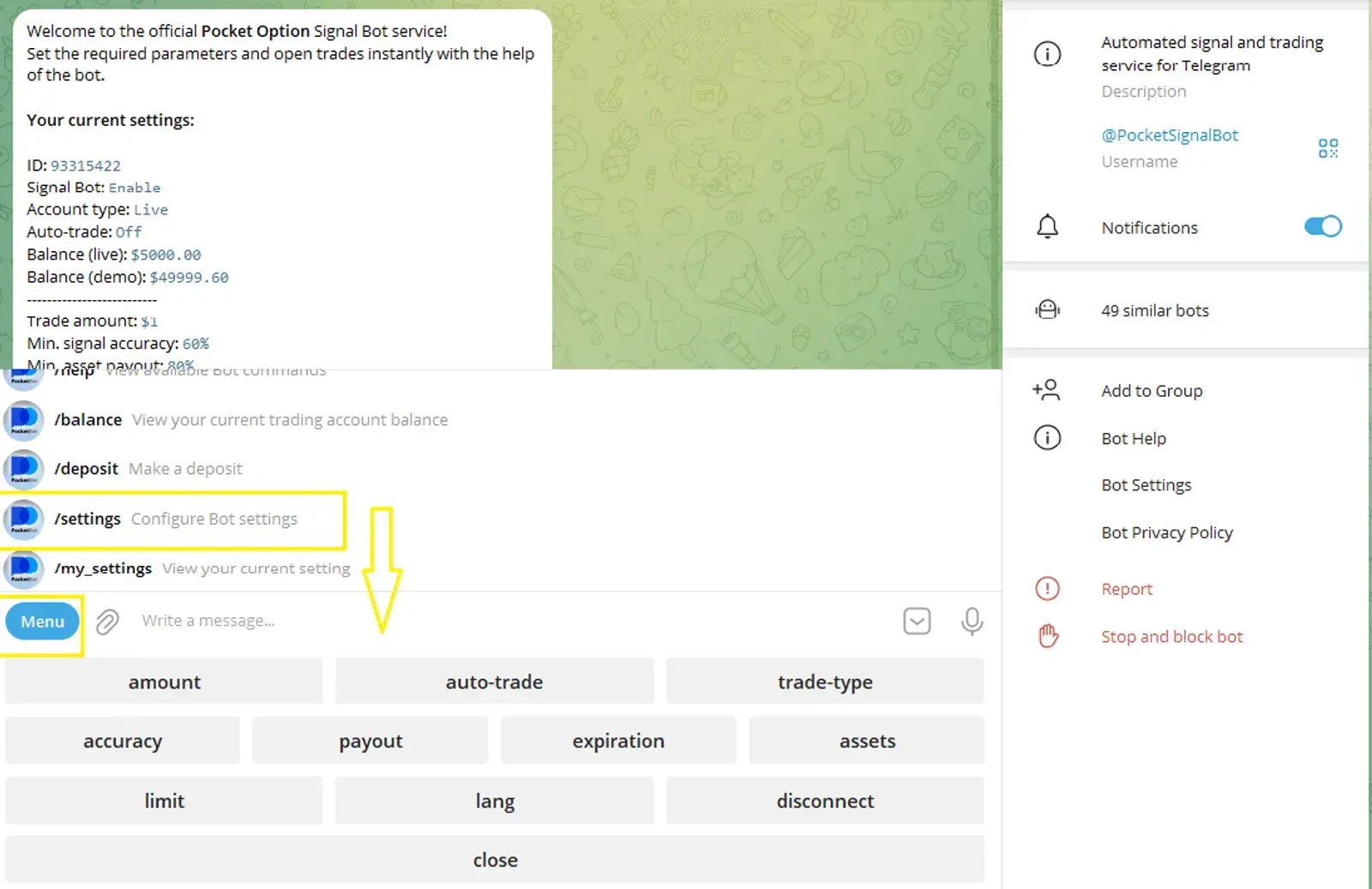

ขั้นตอนที่ 1: เชื่อมต่อบอทกับบัญชี Pocket Option ของคุณ

เมื่อคุณเปิดใช้บอท Telegram แล้ว ขั้นตอนแรกคือการเชื่อมต่ออย่างปลอดภัยกับบัญชีเทรดดิ้งของคุณ:

- แตะ “เริ่มต้น” ใน Telegram

- บอทจะขออนุญาต — ยืนยันเพื่ออนุญาตการเข้าถึงที่ปลอดภัย

- เมื่อตรวจสอบแล้ว บอทสามารถอ่านสัญญาณและหากได้รับอนุญาต วางการเทรดโดยอัตโนมัติในนามของคุณ

การเชื่อมต่อนี้ถูกเข้ารหัสและสามารถเพิกถอนได้ทุกเมื่อ ให้ทั้งความปลอดภัยและความยืดหยุ่นแก่คุณ

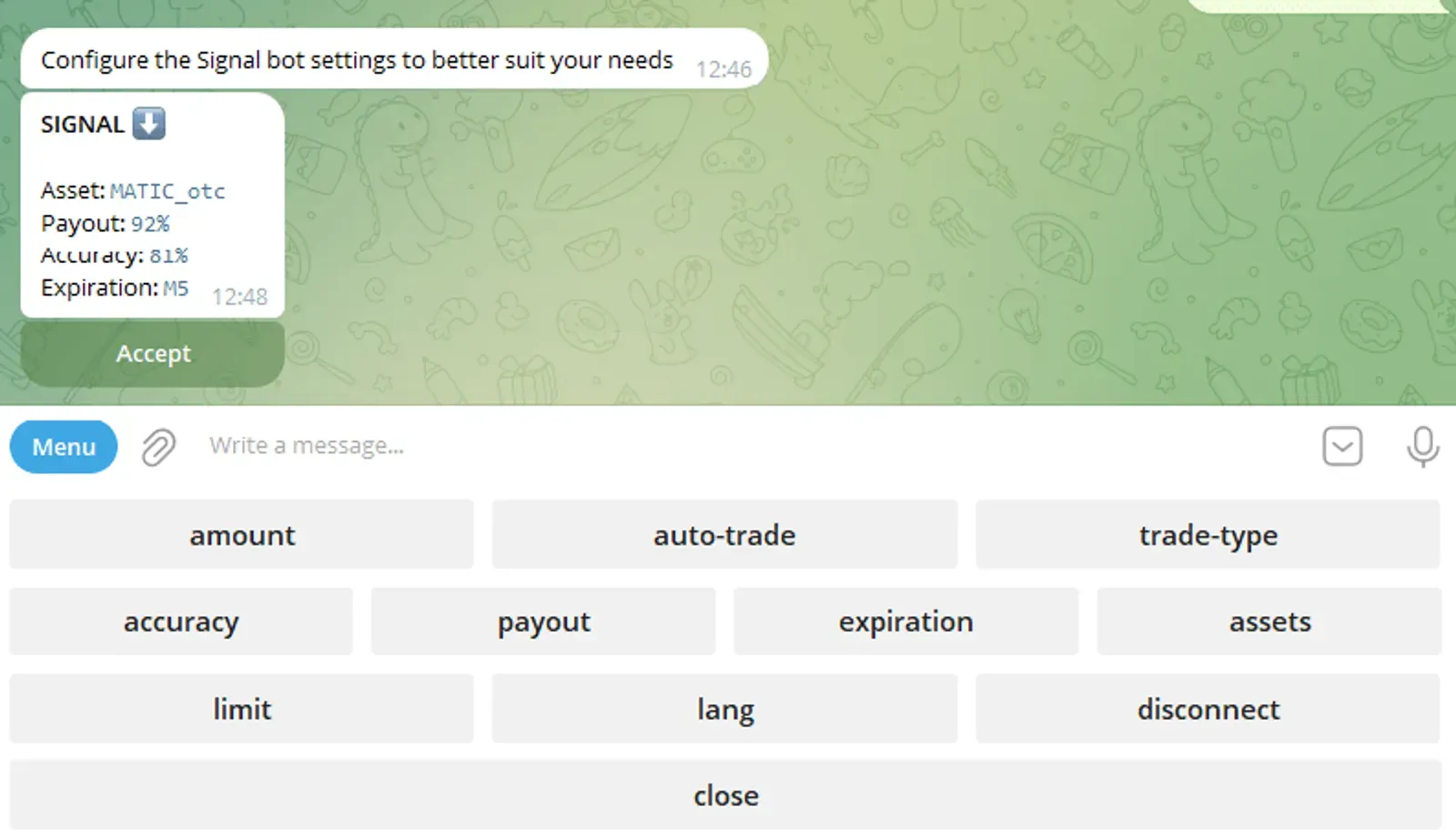

ขั้นตอนที่ 2: ปรับแต่งการตั้งค่าการเทรดของคุณ

ตอนนี้บอทสัญญาณ Pocket Option ได้เชื่อมต่อแล้ว — ถึงเวลาที่จะปรับให้เข้ากับสไตล์การเทรดของคุณ:

- บัญชีทดลองหรือบัญชีจริง: ฝึกโดยไม่มีความเสี่ยงหรือเทรดจริง — คุณเลือกได้

- จำนวนเงินเทรด: กำหนดจำนวนเงินที่แน่นอนเพื่อควบคุมความสม่ำเสมอและความเสี่ยง

- เกณฑ์การจ่ายเงินขั้นต่ำ: ตัวอย่างเช่น ดำเนินการเทรดที่มีศักยภาพในการคืนทุน 80%+ เท่านั้น

- จำนวนการเทรดที่เปิดสูงสุด: จำกัดจำนวนตำแหน่งที่สามารถเปิดได้พร้อมกัน

- เป้าหมายกำไร: หยุดเทรดหลังจากบรรลุเป้าหมายกำไรรายวัน

- ตัวบ่งชี้: เลือกเครื่องมือทางเทคนิคเช่น RSI, MACD หรือค่าเฉลี่ยเคลื่อนที่สำหรับจุดเข้าที่ฉลาดขึ้น

การตั้งค่าเหล่านี้ช่วยให้มั่นใจว่าบอทของคุณไม่ได้แค่เทรด — แต่เทรดตามเงื่อนไขของคุณ

ขั้นตอนที่ 3: ฝึกฝนด้วยบัญชีทดลอง

อย่ารีบเร่งเข้าสู่การเทรดจริง บอทมีโหมดทดลองที่ทำงานเต็มรูปแบบ ช่วยให้คุณทดสอบกลยุทธ์ การผสมผสานตัวบ่งชี้ และพฤติกรรมสัญญาณโดยไม่ต้องใช้เงินจริง

นี่คือวิธี:

- เลือก “บัญชีทดลอง” ในเมนูบอท

- เลือกจำนวนเงินเทรด (เช่น $1 หรือ $5)

- ยอมรับสัญญาณและปล่อยให้บอทวางการเทรด

- ตรวจสอบประสิทธิภาพในเทอร์มินัล Pocket Option ของคุณ

ขั้นตอนนี้ช่วยให้คุณเรียนรู้วิธีที่บอททำงานในสภาวะเวลาจริงและที่ไหนที่กลยุทธ์ของคุณอาจต้องการการปรับเปลี่ยน

ขั้นตอนที่ 4: ย้ายไปสู่การเทรดจริงด้วยความมั่นใจ

เมื่อคุณได้ตรวจสอบแนวทางของคุณแล้ว:

- สลับไปที่ “บัญชีจริง” ในการตั้งค่าของบอท

- ยืนยันจำนวนเงินเทรด ตัวกรองการจ่ายเงิน และขีดจำกัดการเทรดที่ใช้งานอีกครั้ง

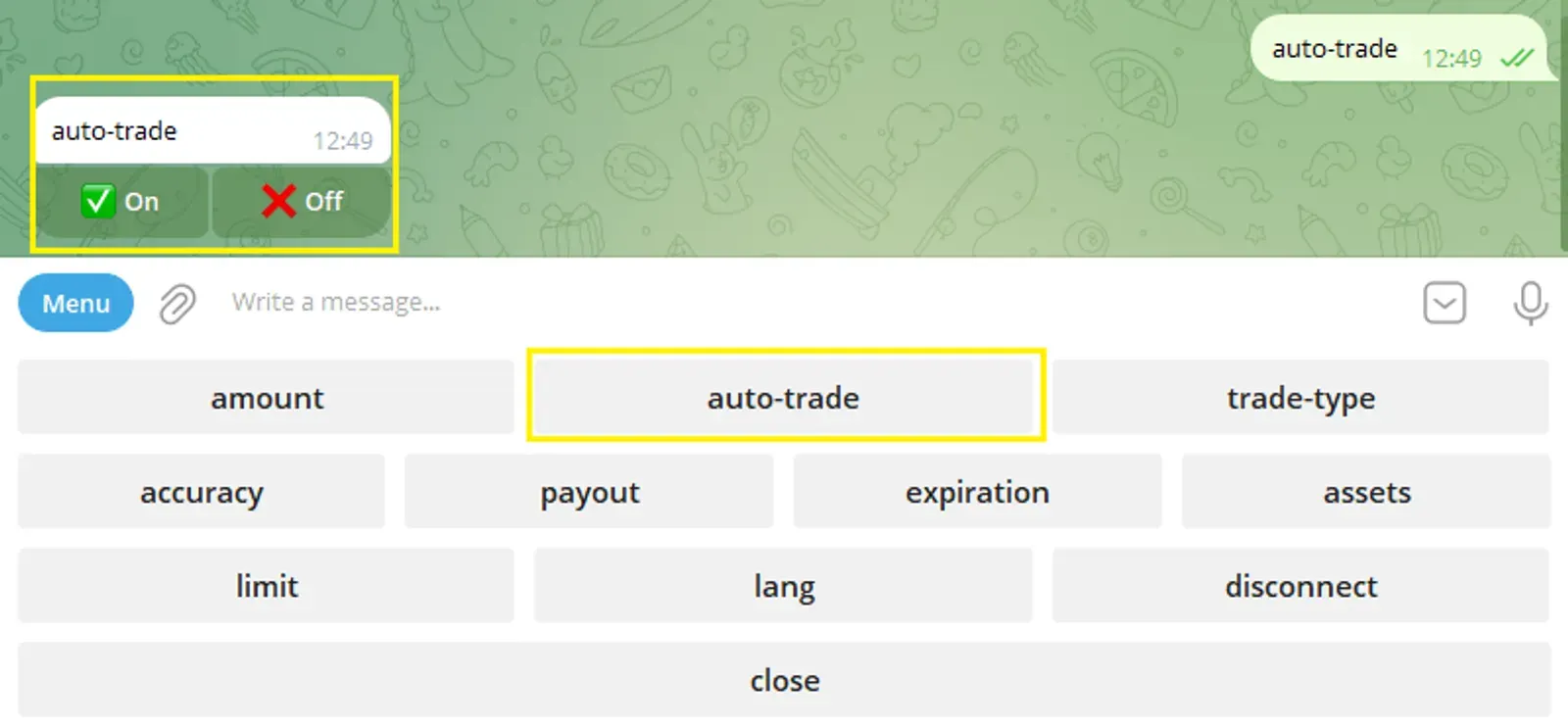

- เปิดใช้งานการเทรดอัตโนมัติหากคุณต้องการให้บอทเปิดตำแหน่งโดยไม่ต้องมีการยืนยันด้วยตนเอง

- กำหนดขีดจำกัด stop-balance เพื่อปกป้องเงินทุนของคุณในกรณีที่มีการเปลี่ยนแปลงของตลาดอย่างรวดเร็ว

จากจุดนี้ บอทสัญญาณฟรีของ Pocket Option จะเริ่มส่งและดำเนินการเทรด — ไม่ว่าจะเป็นแบบแมนนวล (คุณอนุมัติ) หรืออัตโนมัติ (แฮนด์ฟรี) ขึ้นอยู่กับการตั้งค่าของคุณ

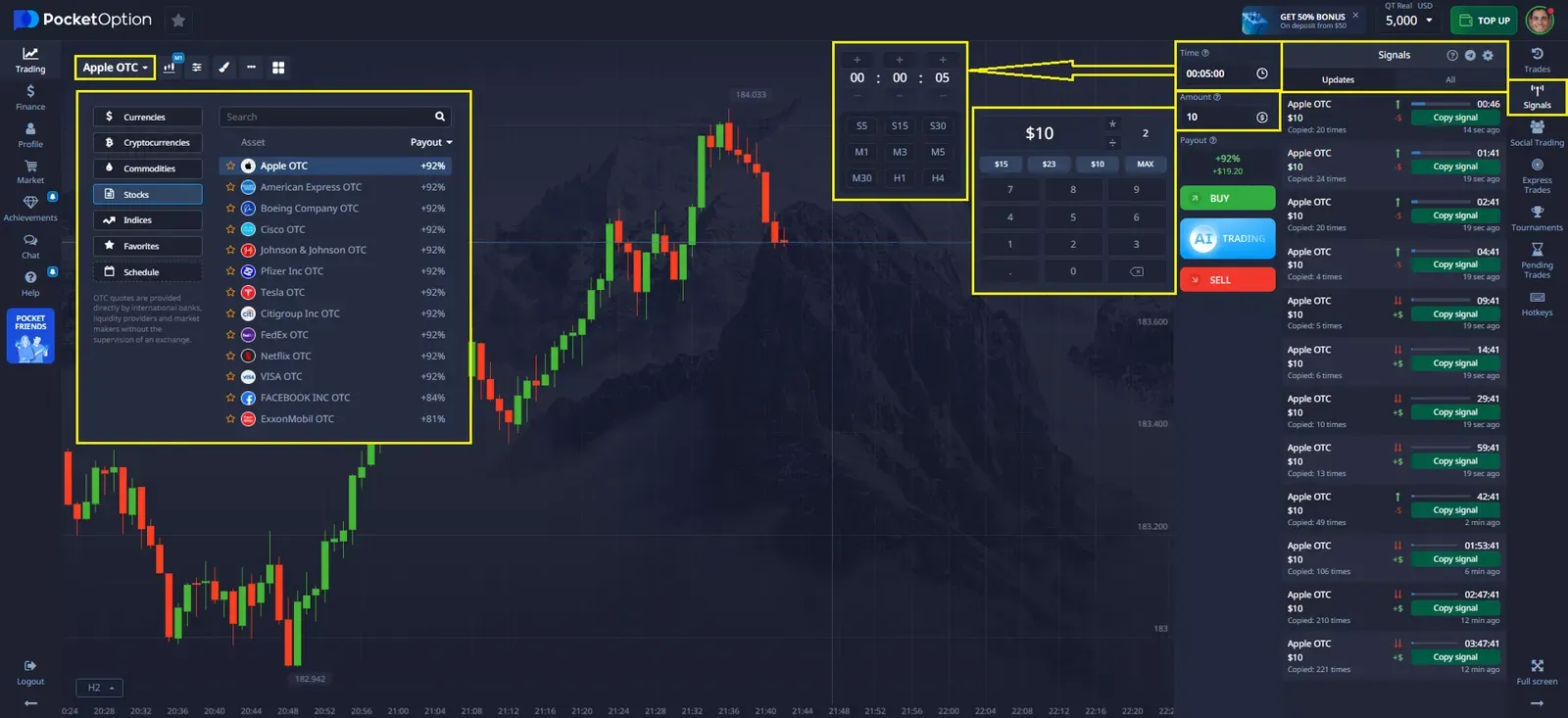

วิธีใช้สัญญาณในตัวของแพลตฟอร์ม

บอท Telegram มีประสิทธิภาพ แต่จะดียิ่งขึ้นเมื่อจับคู่กับเครื่องมือสัญญาณในตัวของ Pocket Option สิ่งเหล่านี้มองเห็นได้โดยตรงบนแพลตฟอร์มการซื้อขายและสามารถแนะนำทั้งการเทรดแบบแมนนวลและอัตโนมัติ

นี่คือวิธีการเข้าถึงและใช้งาน:

- นำทางไปยังแท็บสัญญาณในเทอร์มินัลเทรดดิ้งของคุณ

- เลือกกรอบเวลา — ตั้งแต่ 30 วินาที (S30) ถึง 4 ชั่วโมง (H4)

- เลือกประเภทของสินทรัพย์

- ดูลูกศรแนวโน้ม:

- ลูกศรหนึ่งดอก = ทิศทางตลาดทั่วไป

- ลูกศรสองดอก = สัญญาณแรงที่มีความน่าเชื่อถือสูงกว่า

- ใช้ข้อมูลเวลาจริงนี้เพื่อวางการเทรดของคุณ — หรือเพื่อให้สอดคล้องกับตรรกะของบอท

สัญญาณเหล่านี้ให้ความชัดเจนทางสายตาและสนับสนุนการตัดสินใจที่รวดเร็วและมีข้อมูล

อะไรที่ทำให้บอทเทรดดิ้งน่าเชื่อถืออย่างแท้จริง?

บอทจะดีเท่ากับความเสถียรและคุณสมบัติด้านความปลอดภัยของมัน นี่คือสิ่งที่คุณควรคาดหวังจากระบบระดับมืออาชีพ:

- การเชื่อมต่อแบบเรียลไทม์ที่รวดเร็วผ่าน WebSocket

- การเข้ารหัสเพื่อการแลกเปลี่ยนข้อมูลที่ปลอดภัย

- การจัดการข้อผิดพลาดในตัวเพื่อหลีกเลี่ยงการเทรดที่พลาดระหว่างการหยุดทำงาน

- กลไกการซิงค์ที่ยังคงสอดคล้องกับบัญชีของคุณ

- การติดตามประสิทธิภาพที่โปร่งใสเพื่อตรวจสอบการเคลื่อนไหวแต่ละครั้ง

บอท Pocket Option ตรงตามเงื่อนไขทั้งหมดนี้ — ให้ความเร็ว ความปลอดภัย และความสม่ำเสมอ

อย่าละเลยการจัดการความเสี่ยง

แม้แต่บอทที่ฉลาดที่สุดก็ยังต้องการขอบเขต โดยไม่มีข้อจำกัด ระบบอัตโนมัติสามารถขยายข้อผิดพลาด:

- จำกัดขนาดการเทรดของคุณ — หลีกเลี่ยงการเดิมพันเปอร์เซ็นต์ที่สูงของเงินทุนของคุณ

- กำหนดขีดจำกัดการขาดทุนรายวัน — เพื่อป้องกันวงจรอารมณ์

- หลีกเลี่ยงการเปิดรับมากเกินไป — อย่าให้บอทเทรดสินทรัพย์ที่คล้ายกันพร้อมกัน

- ตอบสนองต่อความผันผวน — หากสภาวะตลาดเปลี่ยนแปลงอย่างมาก หยุดชั่วคราวหรือปรับการตั้งค่า

ผู้ใช้บางรายยังใช้คุณสมบัติการปิดอัตโนมัติเมื่อความผันผวนเพิ่มขึ้นอย่างรวดเร็วหรือหากประสิทธิภาพลดลงต่ำกว่าระดับที่ยอมรับได้ นี่ช่วยรักษากลยุทธ์ระยะยาวให้คงอยู่

ความคิดสุดท้าย: ระบบอัตโนมัติโดยไม่สูญเสียการควบคุม

บอท Telegram ของ Pocket Option ไม่ใช่ปุ่มวิเศษ มันเป็นเครื่องมือเทรดดิ้งที่จริงจังที่ช่วยให้คุณทำงานได้อย่างชาญฉลาด หลีกเลี่ยงข้อผิดพลาดทางอารมณ์ และยังคงใช้งานได้ตลอด 24 ชั่วโมง โดยการรวมกลยุทธ์ของคุณเองกับการดำเนินการอัตโนมัติ ตัวกรองที่ปรับแต่งได้ และสัญญาณระดับแพลตฟอร์ม คุณสร้างระบบนิเวศที่สร้างขึ้นสำหรับการตัดสินใจที่ชาญฉลาดและปรับขนาดได้

เริ่มต้นด้วยโหมดทดลอง วิเคราะห์ผลลัพธ์ เริ่มใช้งานจริงเมื่อพร้อม และรักษาการควบคุมเสมอ — แม้ในขณะที่คุณใช้ระบบอัตโนมัติ

FAQ

ฉันจะเริ่มใช้บอท Telegram ของ Pocket Option ได้อย่างไร?

เพียงเข้าสู่ระบบบัญชี Pocket Option ของคุณ ไปที่ส่วน "ช่วยเหลือ" และเปิดใช้งานบอท Telegram ผ่านแท็บ "แอปพลิเคชัน"

ฉันสามารถทดสอบบอทก่อนใช้เงินจริงได้หรือไม่?

ใช่ คุณสามารถเริ่มต้นด้วยบัญชีทดลอง ซึ่งคุณสามารถฝึกการเทรดโดยไม่มีความเสี่ยงทางการเงิน

บอท Telegram ของ Pocket Option ใช้ฟรีหรือไม่?

ใช่ บอทนี้ใช้ฟรีโดยไม่มีค่าใช้จ่ายแฝง ให้คุณเข้าถึงคุณสมบัติการซื้อขายอัตโนมัติอย่างเต็มที่

ฉันจะรับสัญญาณการเทรดจากบอทได้อย่างไร?

บอทจะส่งสัญญาณการเทรดโดยตรงไปยัง Telegram ของคุณ ซึ่งคุณสามารถทำตามด้วยตนเองหรือให้บอททำงานโดยอัตโนมัติ

มีเครื่องมือจัดการความเสี่ยงอะไรบ้างในบอท?

บอทช่วยให้คุณตั้งค่าขีดจำกัดการขาดทุนรายวัน กำหนดจำนวนการเทรด และแม้แต่หยุดการเทรดโดยอัตโนมัติเมื่อถึงเป้าหมายกำไรของคุณ