- 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Option Trading Hours: Complete Schedule and Important Timeframes

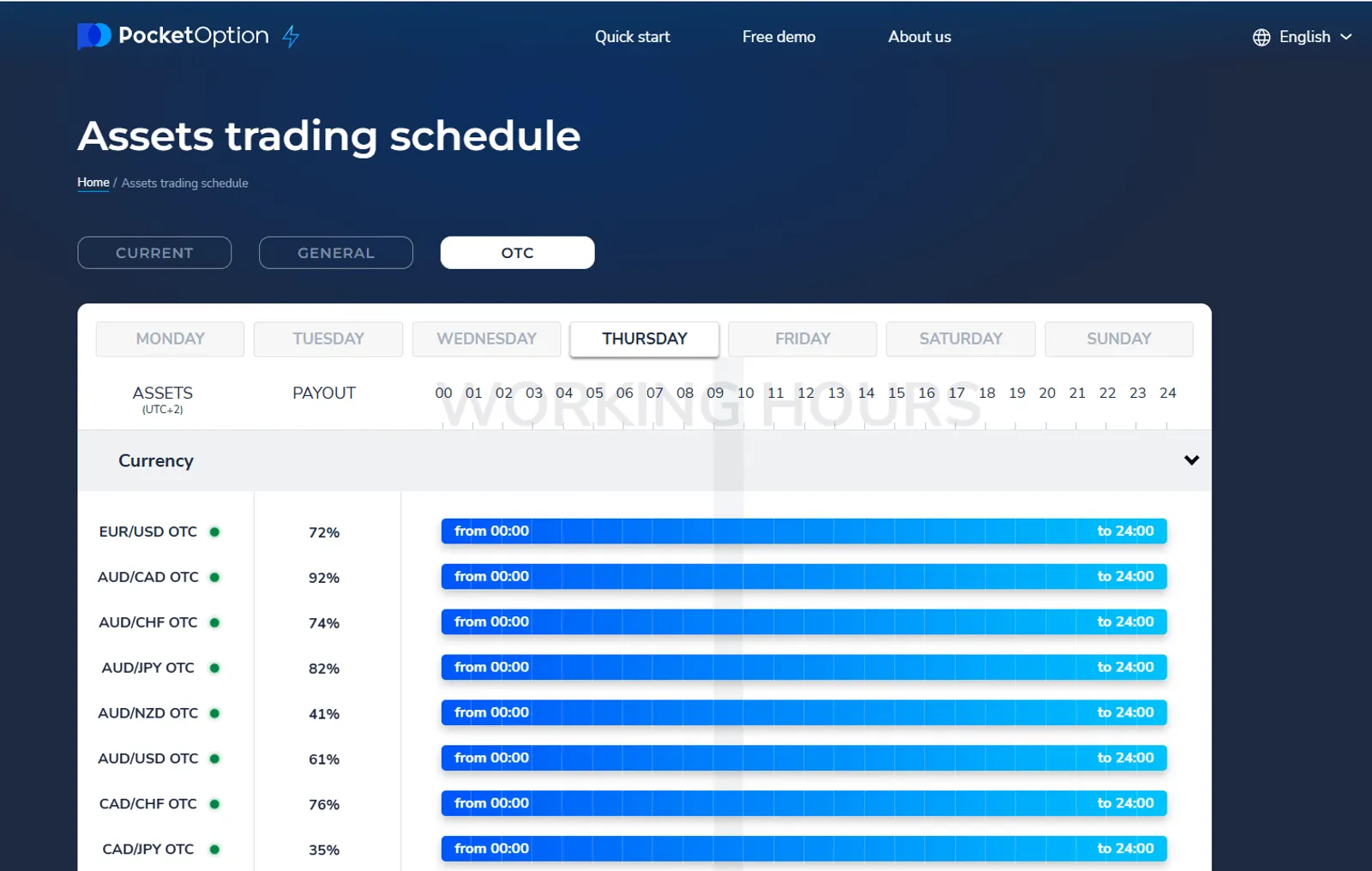

Understanding option trading hours is a key step to maximizing your potential in the options market. Each exchange operates on its own schedule, and knowing when you can trade helps you build more precise strategies. While many exchanges have fixed trading hours, platforms like Pocket Option offer the flexibility of 24/7 OTC (over-the-counter) trading. In this article, we’ll cover the standard trading hours, their impact on your strategy, and the best times for trading.

Option trading hours define the timeframes during which traders can buy or sell options contracts. Unlike the cryptocurrency market, which operates 24/7, options trading is restricted to specific hours that vary by exchange and the type of underlying asset.

For most U.S.-based exchanges, the standard trading time is:

Platforms like Pocket Option allow traders to access OTC assets 24/7, even if specific assets are unavailable during regular trading hours.

Different markets follow their own schedules for options trading. Below is a breakdown of the primary trading hours:

| Market Type | Trading Hours (ET) | Key Features |

|---|---|---|

| Stock Options (stock options trading hours) | 9:30 AM - 4:00 PM | Standard stock options |

| Index Options | 9:30 AM - 4:15 PM | Includes S&P 500, VIX |

| Weekly Options | 9:30 AM - 4:00 PM | Expire every Friday |

| ETF Options (etf trading hours) | 9:30 AM - 4:00 PM | Schedule matches regular stock trading hours |

Note: Index options like S&P 500 and VIX trade until 4:15 PM due to their high demand among institutional investors.

Extended trading sessions allow traders to adjust positions or react to news outside regular hours. However, these sessions come with specific risks:

- Lower liquidity, which can lead to wider spreads.

- Higher volatility, increasing trading risks.

- Not all options are available during extended hours.

| Session | Hours (ET) | Availability |

|---|---|---|

| Pre-Market | 8:00 AM - 9:30 AM | Limited assets available |

| After-Hours | 4:00 PM - 8:00 PM | Broad access but with limitations |

| Overnight (OTC) | 8:00 PM - 8:00 AM | Available on platforms like Pocket Option |

Example: OTC trading on Pocket Option is available 24/7 and is ideal for traders who need flexible schedules.

Pocket Option is a platform that offers the flexibility of 24/7 OTC trading, making it convenient for traders who cannot participate during regular trading hours.

OTC 24/7: Assets are available around the clock through OTC trading. If a specific asset is unavailable, you can still trade using OTC contracts.

If you are trading internationally, it’s important to consider time zones. For instance, U.S.-based traders must account for time differences when accessing European or Asian markets.

| Exchange | Location | Trading Hours (Local Time) |

| Eurex | Europe | 8:00 AM - 10:00 PM CET |

| HKEX | Hong Kong | 9:30 AM - 4:00 PM HKT |

| ASX | Australia | 10:00 AM - 4:30 PM AEST |

The timing of your trades directly affects your strategy. Here are some recommendations:

The best time for trading is during active market sessions with high liquidity:

- Overlap of European and American sessions (1:00 PM - 4:00 PM UTC) – High volumes for currency pairs and indices.

- Opening of the American session – Active movements in the stock and commodities markets.

Macroeconomic events can cause significant market movements:

- NFP Reports in the U.S. – Trigger sharp fluctuations in the forex market.

- Interest Rate Decisions – Have a major impact on forex trading.

- Quarterly Earnings Reports – Drive stock price trends.

Each financial instrument behaves differently depending on the time of day:

- Forex: Best time is during the overlap of European and American sessions for high liquidity.

- Stocks and Indices: Highest activity occurs in the first two hours after the market opens.

- Cryptocurrencies: Available 24/7, but activity peaks during the American session.

The timing of your trades determines key factors such as volatility, liquidity, and options time decay.

| Time Period | Characteristics | Recommendations |

| Market Open | High volatility, wider spreads | Avoid complex orders, wait for market stability |

| Midday | Lower volume, tighter ranges | Great for spread strategies |

| Market Close | Increased activity, price fluctuations | Close risky positions, avoid initiating complex trades |

Options markets observe holidays when they either close entirely or operate on reduced schedules. Major U.S. market holidays include:

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents Day

- Good Friday

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

Note: Markets often close early (usually at 1:00 PM ET) on the day before or after certain holidays.

Understanding option trading hours, whether through standard trading sessions or 24/7 OTC trading on Pocket Option, is critical to optimizing your strategies and minimizing risks.

Take advantage of market activity, economic events, and asset-specific characteristics to make well-informed decisions. Trading at the right time is the key to success in the options market!

FAQ

Can I trade options 24 hours a day?

No, option trading hours are limited. Most US options can be traded during regular market hours (9:30 AM to 4:00 PM Eastern Time), with some extended hours availability depending on your broker and the specific options. Unlike forex or cryptocurrency markets, options markets are not 24/7.

What are the best times to trade options within regular market hours?

Many experienced traders avoid the first 30 minutes after market open due to high volatility and wider spreads. The periods from 10:00 AM to 11:30 AM ET and 1:30 PM to 3:30 PM ET often provide good balances of liquidity and price stability for option trading.

Do option trading hours differ for weekly vs. monthly options?

The trading hours are generally the same for both weekly and monthly options, following standard market hours of 9:30 AM to 4:00 PM ET. However, be aware that weekly options expire every Friday, which can affect trading patterns and liquidity on expiration days.

How do option trading hours affect option prices?

Option prices can be more volatile at market open and close due to increased trading activity. Additionally, time decay (theta) operates continuously, including overnight and weekends, meaning options lose value even when markets are closed. This is particularly noticeable for options approaching expiration.

Are option trading hours the same globally?

No, option trading hours vary by exchange and country. US options markets operate from 9:30 AM to 4:00 PM ET, while European, Asian, and other international exchanges follow their own schedules. If you trade international options, you'll need to adjust to the specific hours of each market.