- ค่าเฉลี่ยเคลื่อนที่ (SMA, EMA, WMA)

- MACD (Moving Average Convergence Divergence)

- Parabolic SAR (Stop and Reverse)

- ADX (Average Directional Index)

ตัวชี้วัดสำหรับการเทรดรายวันและวิธีการใช้งาน

การเทรดรายวันเกี่ยวกับการตัดสินใจอย่างรวดเร็วจากการเคลื่อนไหวของราคาในระยะสั้น เพื่อตัดสินใจอย่างมีข้อมูลและปรับปรุงผลกำไร เทรดเดอร์ใช้ตัวชี้วัดทางเทคนิค--การคำนวณทางคณิตศาสตร์ที่ช่วยระบุแนวโน้ม จุดเข้าและออก และพฤติกรรมตลาดโดยรวม

เข้าใจเกี่ยวกับตัวบ่งชี้การเทรดรายวัน

ตัวบ่งชี้ทางเทคนิคเป็นเครื่องมือทางคณิตศาสตร์ที่นักเทรดใช้วิเคราะห์ข้อมูลราคา ปริมาณ และปัจจัยตลาดอื่นๆ ตัวบ่งชี้เหล่านี้ช่วยให้นักเทรดเห็นแนวโน้ม คาดการณ์การเคลื่อนไหวของราคา และจับจังหวะการเข้าและออกจากตลาด

สำหรับการเทรดรายวัน ตัวบ่งชี้มีความจำเป็นในการระบุโอกาสที่มีศักยภาพภายในเซสชั่นการเทรดเดียว กุญแจสู่ความสำเร็จคือการรู้ว่าตัวบ่งชี้ใดทำงานได้ดีที่สุดภายใต้สภาวะตลาดและรูปแบบการเทรดที่แตกต่างกัน

ประเภทตัวบ่งชี้ยอดนิยมสำหรับการเทรดรายวัน

| ประเภทตัวบ่งชี้ | หน้าที่ | ใช้ได้ดีที่สุดสำหรับ |

|---|---|---|

| แนวโน้ม | ระบุทิศทางของตลาด | ตลาดที่มีแนวโน้ม |

| โมเมนตัม | วัดความเร็วของการเปลี่ยนแปลงราคา | จังหวะการเข้า/ออก |

| ปริมาณ | ติดตามกิจกรรมการซื้อขาย | ยืนยันแนวโน้ม |

| ความผันผวน | วัดความผันผวนของราคา | การตั้งระดับ stop-loss |

ตัวบ่งชี้แนวโน้มที่จำเป็น

ตัวบ่งชี้แนวโน้มเป็นกระดูกสันหลังของกลยุทธ์การเทรดใดๆ เนื่องจากช่วยกำหนดว่าควรเข้าสถานะซื้อหรือขาย ตัวบ่งชี้แนวโน้มที่สำคัญประกอบด้วย:

ตัวอย่างเช่น ค่าเฉลี่ยเคลื่อนที่ 50 วันและ 200 วันถูกใช้อย่างแพร่หลายในการระบุแนวโน้มของตลาด เมื่อค่าเฉลี่ย 50 วันตัดขึ้นเหนือค่าเฉลี่ย 200 วัน (golden cross) มักจะเป็นสัญญาณของตลาดขาขึ้น ในทางกลับกัน เมื่อค่าเฉลี่ย 50 วันตัดลงต่ำกว่าค่าเฉลี่ย 200 วัน (death cross) จะบ่งชี้ถึงแนวโน้มขาลง

| ประเภทค่าเฉลี่ยเคลื่อนที่ | วิธีการคำนวณ | การตอบสนองต่อการเปลี่ยนแปลงราคา |

|---|---|---|

| แบบธรรมดา (SMA) | ค่าเฉลี่ยของราคาในช่วงเวลาหนึ่ง | ช้ากว่า เรียบกว่า |

| แบบเอ็กซ์โพเนนเชียล (EMA) | ถ่วงน้ำหนักไปที่ราคาล่าสุด | เร็วกว่า ตอบสนองมากกว่า |

| แบบถ่วงน้ำหนัก (WMA) | ถ่วงน้ำหนักแบบเชิงเส้นตามความล่าสุด | ความเร็วปานกลาง |

ตัวบ่งชี้โมเมนตัมสำหรับจังหวะการเข้า

ตัวบ่งชี้โมเมนตัมวัดความเร็วของการเปลี่ยนแปลงราคา ช่วยให้นักเทรดระบุจุดกลับตัวที่มีแนวโน้ม ตัวบ่งชี้เหล่านี้มีความสำคัญสำหรับจังหวะการเข้าและออกที่แม่นยำในการเทรดรายวัน

- RSI (Relative Strength Index)

- Stochastic Oscillator

- CCI (Commodity Channel Index)

- Williams %R

ตัวอย่างเช่น ค่า RSI ที่สูงกว่า 70 บ่งชี้ถึงตลาดที่ซื้อมากเกินไป ในขณะที่ค่าต่ำกว่า 30 บ่งชี้ถึงสภาวะขายมากเกินไป อย่างไรก็ตาม ในช่วงแนวโน้มที่แข็งแกร่ง เกณฑ์เหล่านี้อาจต้องมีการปรับเปลี่ยน เนื่องจากตลาดอาจยังคงอยู่ในสภาวะซื้อมากเกินไปหรือขายมากเกินไปเป็นระยะเวลานาน

| ตัวบ่งชี้ | ระดับซื้อมากเกินไป | ระดับขายมากเกินไป |

|---|---|---|

| RSI | 70+ | 30- |

| Stochastic | 80+ | 20- |

| CCI | 100+ | -100- |

| Williams %R | -20 ถึง 0 | -80 ถึง -100 |

ตัวบ่งชี้ที่อิงกับปริมาณสำหรับการยืนยัน

ตัวบ่งชี้ปริมาณวัดระดับกิจกรรมการซื้อขาย ช่วยให้นักเทรดยืนยันแนวโน้มและคาดการณ์การเคลื่อนไหวของตลาด ตัวบ่งชี้ที่อิงกับปริมาณที่พบบ่อยประกอบด้วย:

- On-Balance Volume (OBV)

- Volume Profile

- Chaikin Money Flow

ในการเทรดรายวัน ปริมาณช่วยยืนยันความแข็งแกร่งของแนวโน้ม เมื่อราคาเพิ่มขึ้นแต่ปริมาณลดลง อาจบ่งชี้ถึงความอ่อนแอที่อาจเกิดขึ้น ในทางกลับกัน ปริมาณที่เพิ่มขึ้นพร้อมกับการเพิ่มขึ้นของราคามักจะบ่งชี้ถึงแนวโน้มที่แข็งแกร่งขึ้น

| ประเภทสัญญาณ | การเคลื่อนไหวของราคา | ปริมาณ | การตีความ |

|---|---|---|---|

| การยืนยัน | เพิ่มขึ้น | เพิ่มขึ้น | สัญญาณขาขึ้นที่แข็งแกร่ง |

| การแยกตัว | เพิ่มขึ้น | ลดลง | มีแนวโน้มกลับตัวลง |

| การยืนยัน | ลดลง | เพิ่มขึ้น | สัญญาณขาลงที่แข็งแกร่ง |

| การแยกตัว | ลดลง | ลดลง | มีแนวโน้มกลับตัวขึ้น |

ตัวบ่งชี้ความผันผวนสำหรับการจัดการความเสี่ยง

ตัวบ่งชี้ความผันผวนวัดอัตราและขนาดของการเปลี่ยนแปลงราคา เครื่องมือเหล่านี้มีความสำคัญต่อการจัดการความเสี่ยงโดยการตั้งระดับ stop-loss และปรับขนาดของสถานะ

- Bollinger Bands

- Average True Range (ATR)

- Keltner Channels

ตัวอย่างเช่น Bollinger Bands ประกอบด้วยแถบกลาง (มักเป็นค่าเฉลี่ยเคลื่อนที่ 20 คาบ) และแถบบนและล่างที่ตั้งค่าห่างสองค่าเบี่ยงเบนมาตรฐาน เมื่อราคาเข้าใกล้หรือเกินแถบเหล่านี้ อาจบ่งชี้ถึงจุดกลับตัว

| สภาวะตลาด | รูปแบบ Bollinger Band | นัยสำคัญต่อการเทรด |

|---|---|---|

| ความผันผวนต่ำ | แถบหดตัว (บีบตัว) | การเตรียมพร้อมสำหรับการเบรกเอ้าท์ที่มีศักยภาพ |

| ความผันผวนสูง | แถบขยายตัว | แนวโน้มที่อาจต่อเนื่อง |

| สัญญาณการกลับตัว | ราคาสัมผัส/เกินแถบ | โอกาสเกิดการเคลื่อนไหวสวนแนวโน้ม |

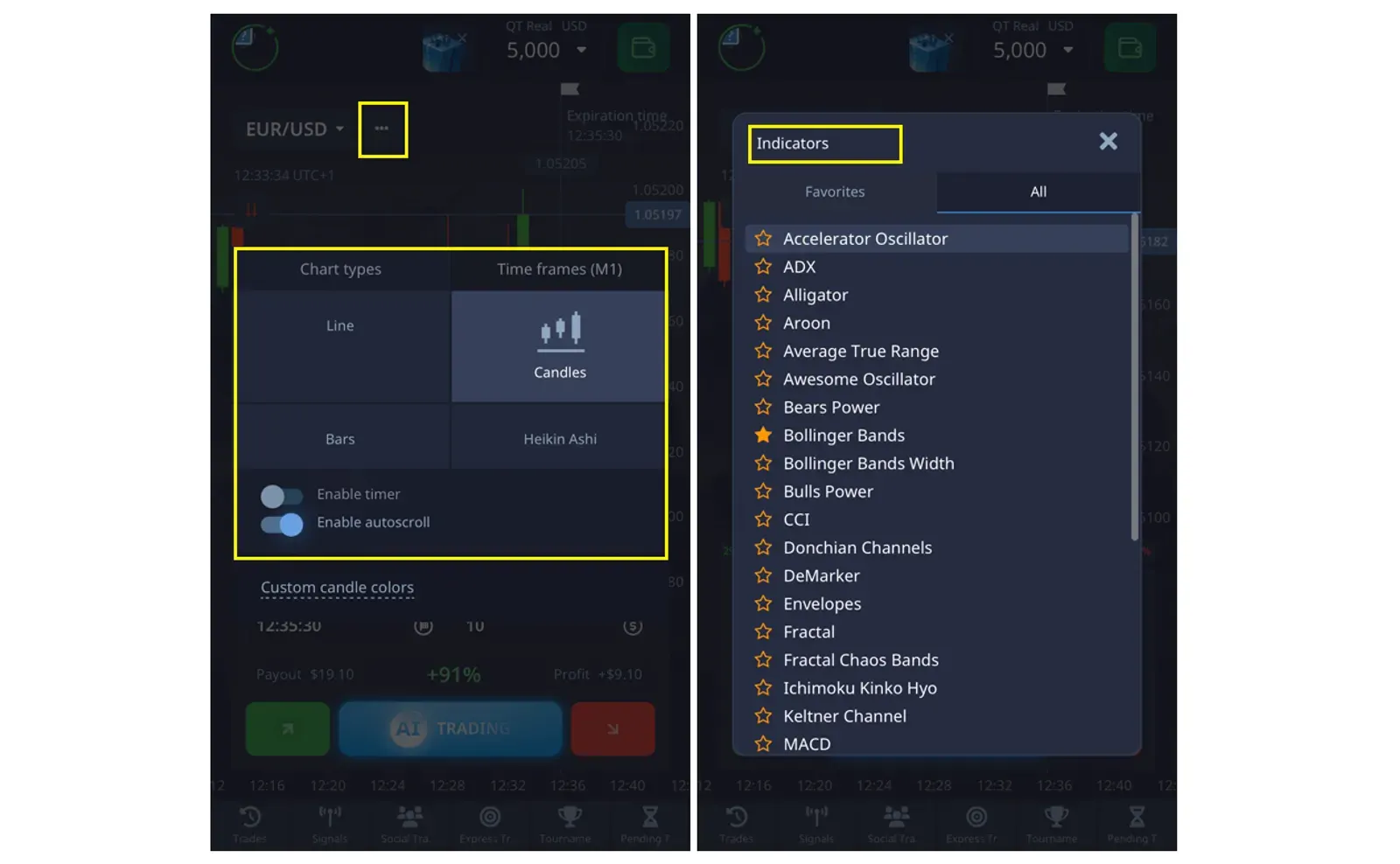

การปรับแต่งตัวบ่งชี้บน Pocket Option

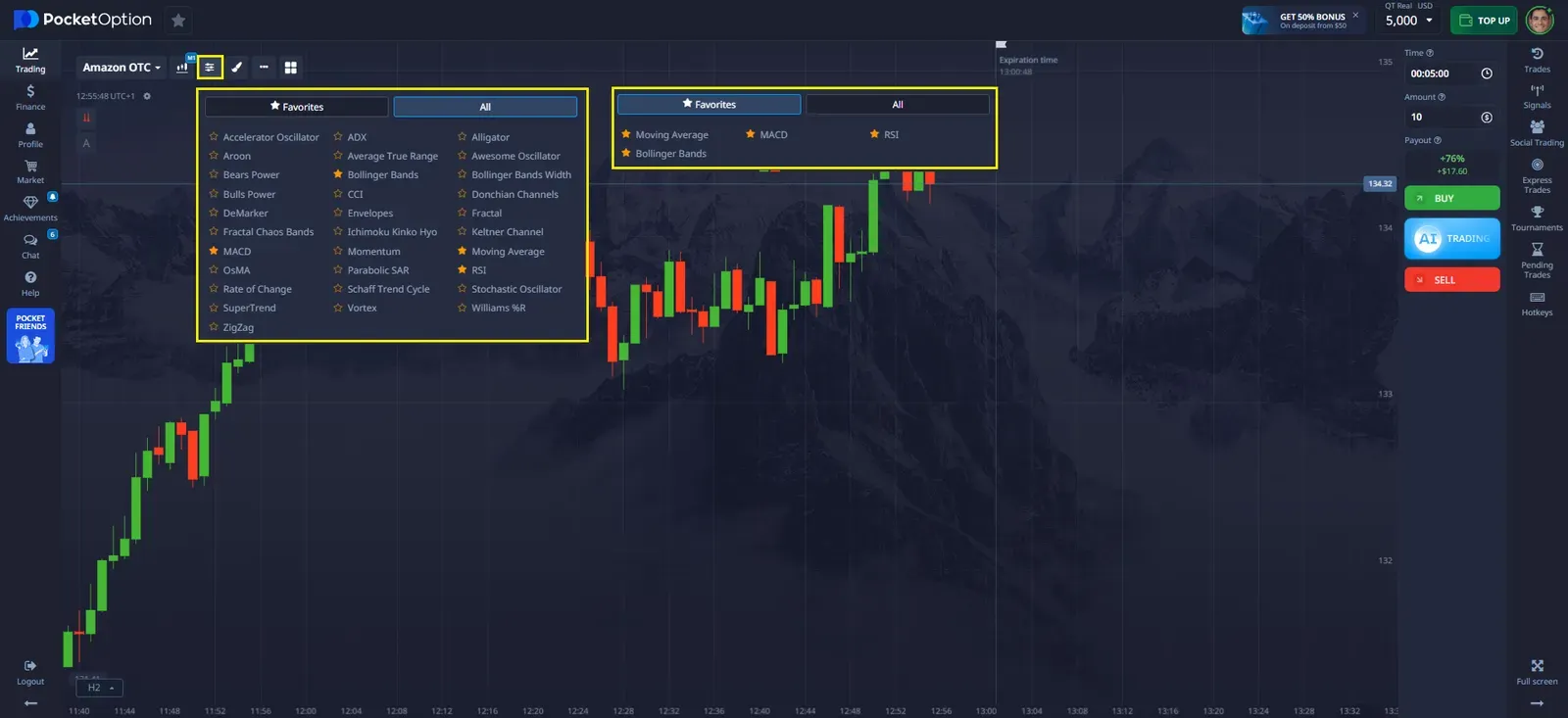

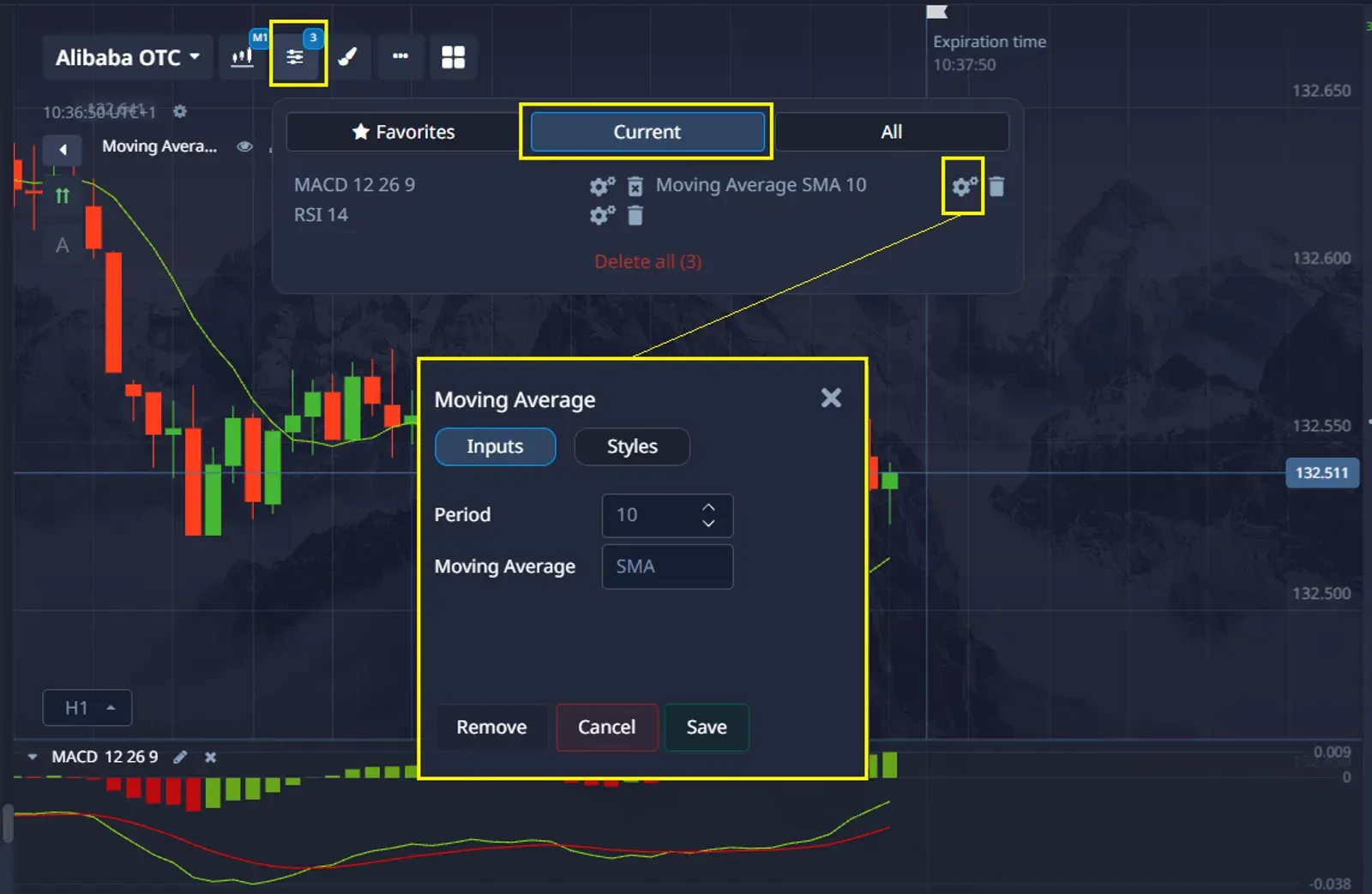

สำหรับการเทรดรายวันบนแพลตฟอร์ม Pocket Option คุณสามารถเลือกและเปิดใช้งานตัวบ่งชี้ผ่านส่วน ตัวบ่งชี้” ที่ตั้งอยู่ทางด้านซ้ายบนของอินเทอร์เฟซการเทรด ใกล้กับตัวเลือกประเภทกราฟ เครื่องมือเหล่านี้ถูกสร้างขึ้นทางคณิตศาสตร์และช่วยในการคาดการณ์การเคลื่อนไหวของราคาและแนวโน้มตลาด

Pocket Option อนุญาตให้นักเทรดเพิ่มตัวบ่งชี้เข้าสู่รายการโปรดเพื่อการเข้าถึงอย่างรวดเร็วโดยเพียงแค่คลิกที่ดาวข้างๆ คุณสามารถใช้ตัวบ่งชี้ได้ถึง 30 ตัวในกราฟทั้งหมด ดังนั้นหากคุณถึงขีดจำกัดนี้ คุณจะต้องลบบางตัวออกเพื่อเพิ่มตัวใหม่

✔️ เทรดได้ทุกที่ด้วยแอปมือถือ Pocket Option

พร้อมที่จะเทรดทุกที่ ทุกเวลาแล้วหรือยัง? แอปมือถือ Pocket Option ช่วยให้คุณควบคุมการเทรดของคุณไม่ว่าคุณจะอยู่ที่ไหน!

แต่นั่นยังไม่หมด — คุณยังสามารถเข้าถึงตัวบ่งชี้ที่หลากหลายเพื่อตัดสินใจเทรดอย่างชาญฉลาดยิ่งขึ้นในขณะเดินทาง ปรับกราฟของคุณอย่างรวดเร็ว ใช้ตัวบ่งชี้ที่คุณชื่นชอบ และดำเนินการเทรดในเพียงไม่กี่ปัด

“ฉันกำลังตรวจสอบตัวบ่งชี้ของฉันขณะรอกาแฟ — และการเทรดเสร็จสิ้นในเวลาไม่ถึงนาที”

“ฉันตั้งค่าการเทรดขณะเดินไปที่รถ ง่ายมาก — ปัด คาดการณ์ และดำเนินการ!”

การรวมตัวบ่งชี้สำหรับการเทรดรายวัน

วิธีที่ดีที่สุดในการใช้ตัวบ่งชี้ในการเทรดรายวันคือการรวมตัวบ่งชี้ประเภทต่างๆ เพื่อยืนยันสัญญาณและลดความเสี่ยงของสัญญาณหลอก ตัวอย่างเช่น ตัวบ่งชี้แนวโน้มเช่นค่าเฉลี่ยเคลื่อนที่สามารถระบุทิศทางตลาดโดยรวม ในขณะที่ตัวบ่งชี้โมเมนตัมช่วยในการจับจังหวะการเข้าและออกที่แม่นยำ

แนวทางที่สมดุลในการใช้ตัวบ่งชี้อาจรวมถึง:

- 1-2 ตัวบ่งชี้แนวโน้ม

- 1 ตัวบ่งชี้ความแกว่ง

- 1 ตัวบ่งชี้ปริมาณ

- 1 ตัวบ่งชี้ความผันผวน

การรวมกันนี้ให้มุมมองของตลาดที่ครอบคลุมโดยไม่ทำให้นักเทรดสับสนด้วยข้อมูลที่ซ้ำซ้อน

บทสรุป

การเลือกตัวบ่งชี้ที่เหมาะสมสำหรับการเทรดรายวันเป็นเรื่องของความเข้าใจว่าแต่ละตัวทำงานอย่างไรและพวกมันเสริมกันอย่างไร นักเทรดบนแพลตฟอร์มเช่น Pocket Option สามารถใช้เครื่องมือทางเทคนิคที่หลากหลาย เช่น ค่าเฉลี่ยเคลื่อนที่ RSI และ Bollinger Bands เพื่อเพิ่มประสิทธิภาพการวิเคราะห์และปรับปรุงผลลัพธ์การเทรดของพวกเขา โดยการปรับแต่งการตั้งค่าของคุณและใช้ประโยชน์จากแอปมือถือ คุณสามารถเชื่อมต่อกับตลาดได้ไม่ว่าคุณจะอยู่ที่ไหน

อย่าลืมว่า ไม่มีตัวบ่งชี้ใดที่แม่นยำเสมอไป และการวิเคราะห์ทางเทคนิคควรจับคู่กับกลยุทธ์การจัดการความเสี่ยงที่มั่นคงเสมอ รวมตัวบ่งชี้ที่ดีที่สุดสำหรับสไตล์การเทรดของคุณ และคุณจะอยู่บนเส้นทางสู่การเทรดรายวันที่ชาญฉลาดยิ่งขึ้น

FAQ

ตัวบ่งชี้ใดที่ทำงานได้ดีที่สุดสำหรับผู้เริ่มต้นในการเทรดรายวัน?

สำหรับผู้เริ่มต้น ค่าเฉลี่ยเคลื่อนที่อย่างง่าย (20 วันและ 50 วัน) RSI และปริมาณการซื้อขายเป็นจุดเริ่มต้นที่ดี สิ่งเหล่านี้ให้ข้อมูลพื้นฐานเกี่ยวกับแนวโน้มและโมเมนตัมโดยไม่ทำให้นักเทรดมือใหม่รู้สึกหนักเกินไป เมื่อคุ้นเคยกับพื้นฐานเหล่านี้แล้ว นักเทรดสามารถเพิ่มตัวบ่งชี้ที่เฉพาะเจาะจงมากขึ้นในการวิเคราะห์ของพวกเขาได้

ฉันควรใช้ตัวบ่งชี้กี่ตัวพร้อมกันสำหรับการเทรดรายวัน?

นักเทรดรายวันที่มีประสบการณ์ส่วนใหญ่ใช้ตัวบ่งชี้ที่เสริมกัน 3-5 ตัวเพื่อหลีกเลี่ยงข้อมูลที่มากเกินไปและสัญญาณที่ขัดแย้งกัน ควรเน้นที่การผสมผสานตัวบ่งชี้ประเภทต่างๆ (แนวโน้ม โมเมนตัม ปริมาณ) แทนที่จะใช้ตัวบ่งชี้หลายตัวที่ให้ข้อมูลคล้ายกัน

ตัวบ่งชี้สามารถคาดการณ์การกลับตัวของตลาดได้อย่างแม่นยำหรือไม่?

ไม่มีตัวบ่งชี้ใดสามารถคาดการณ์การกลับตัวได้อย่างแม่นยำ 100% ตัวบ่งชี้ได้ผลดีที่สุดเมื่อใช้เป็นเครื่องมือที่แสดงความน่าจะเป็นซึ่งบ่งชี้ถึงการกลับตัวที่อาจเกิดขึ้น ความแตกต่างระหว่างการเคลื่อนไหวของราคาและค่าที่อ่านได้จากตัวบ่งชี้มักให้สัญญาณเตือนล่วงหน้า แต่แนะนำให้ยืนยันก่อนทำการเทรดเสมอ

ฉันควรปรับตัวบ่งชี้สำหรับสภาวะตลาดที่แตกต่างกันอย่างไร?

ในตลาดที่ผันผวน คุณอาจต้องการปรับการตั้งค่าตัวบ่งชี้ - ตัวอย่างเช่น การขยายเกณฑ์ภาวะซื้อมากเกินไป/ขายมากเกินไปของ RSI จาก 70/30 เป็น 80/20 ในตลาดที่มีแนวโน้ม ช่วงเวลาของค่าเฉลี่ยเคลื่อนที่อาจถูกลดลงเพื่อเพิ่มการตอบสนอง การทดสอบย้อนหลังอย่างสม่ำเสมอช่วยกำหนดการตั้งค่าที่เหมาะสมที่สุดสำหรับสภาวะปัจจุบัน

ตัวบ่งชี้เดียวกันมีประสิทธิภาพในทุกตลาดการเงินหรือไม่?

แม้ว่าตัวบ่งชี้ทางเทคนิคส่วนใหญ่จะใช้ได้กับตลาดที่แตกต่างกัน แต่ประสิทธิภาพของมันอาจแตกต่างกัน ตัวบ่งชี้ปริมาณมักจะเชื่อถือได้มากกว่าในตลาดที่มีสภาพคล่องสูง เช่น คู่สกุลเงินหลักในตลาด forex หรือหุ้นที่มีมูลค่าตลาดสูง ตัวบ่งชี้เฉพาะทางบางตัวได้รับการออกแบบมาสำหรับตลาดเฉพาะ - ตัวอย่างเช่น ตัวบ่งชี้บางตัวที่เน้นสินค้าโภคภัณฑ์ซึ่งคำนึงถึงรูปแบบตามฤดูกาล