- Accessible entry point for beginners without financial commitment

- Opportunity to test different teaching styles before deeper investment

- Continuous learning resources for experienced traders exploring new strategies

- Risk-free environment to develop fundamental skills

Pocket Option Free Stock Trading Courses: Your Path to Financial Market Mastery

Want to master stock trading without spending money on education? Pocket Option's free stock trading courses transform beginners into confident traders through structured learning and practical tools. These resources deliver professional-level training that previously required expensive seminars or business school education.

Why Choose Free Stock Trading Courses

Market volatility has driven millions of new retail traders to seek education. According to recent data, 65% of successful traders began with free online stock trading classes before considering paid options. Free stock trading courses offer several advantages:

Pocket Option’s Educational Ecosystem

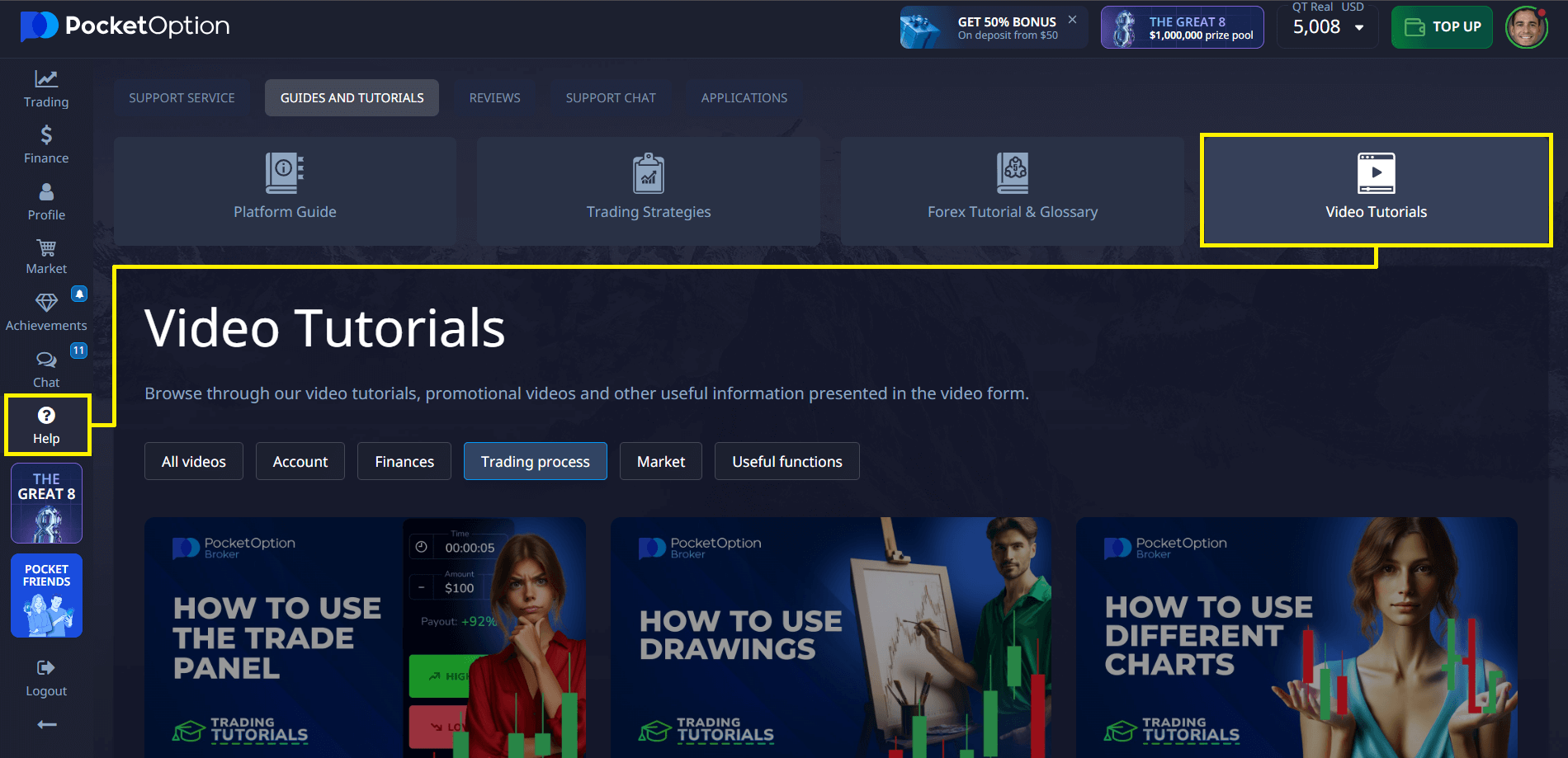

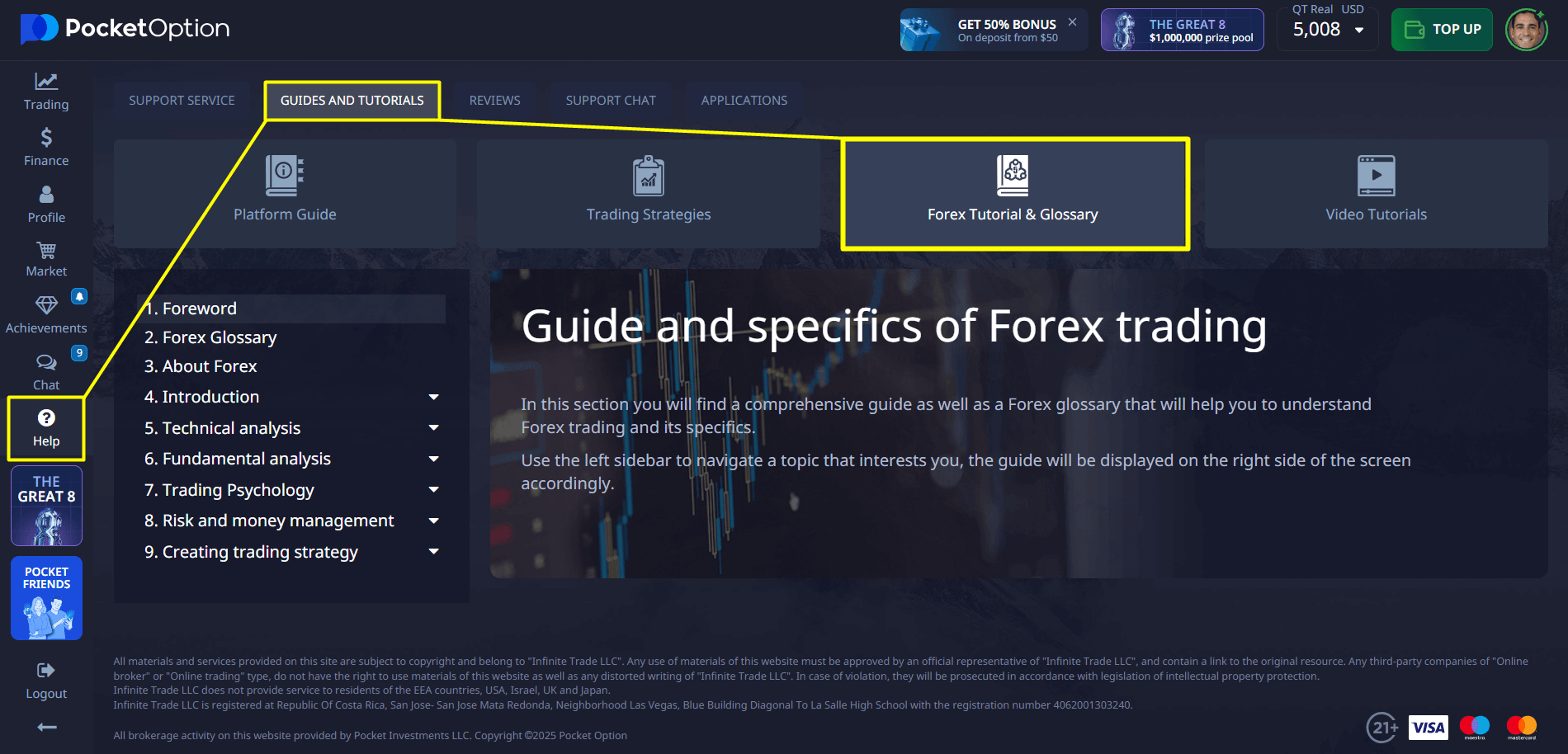

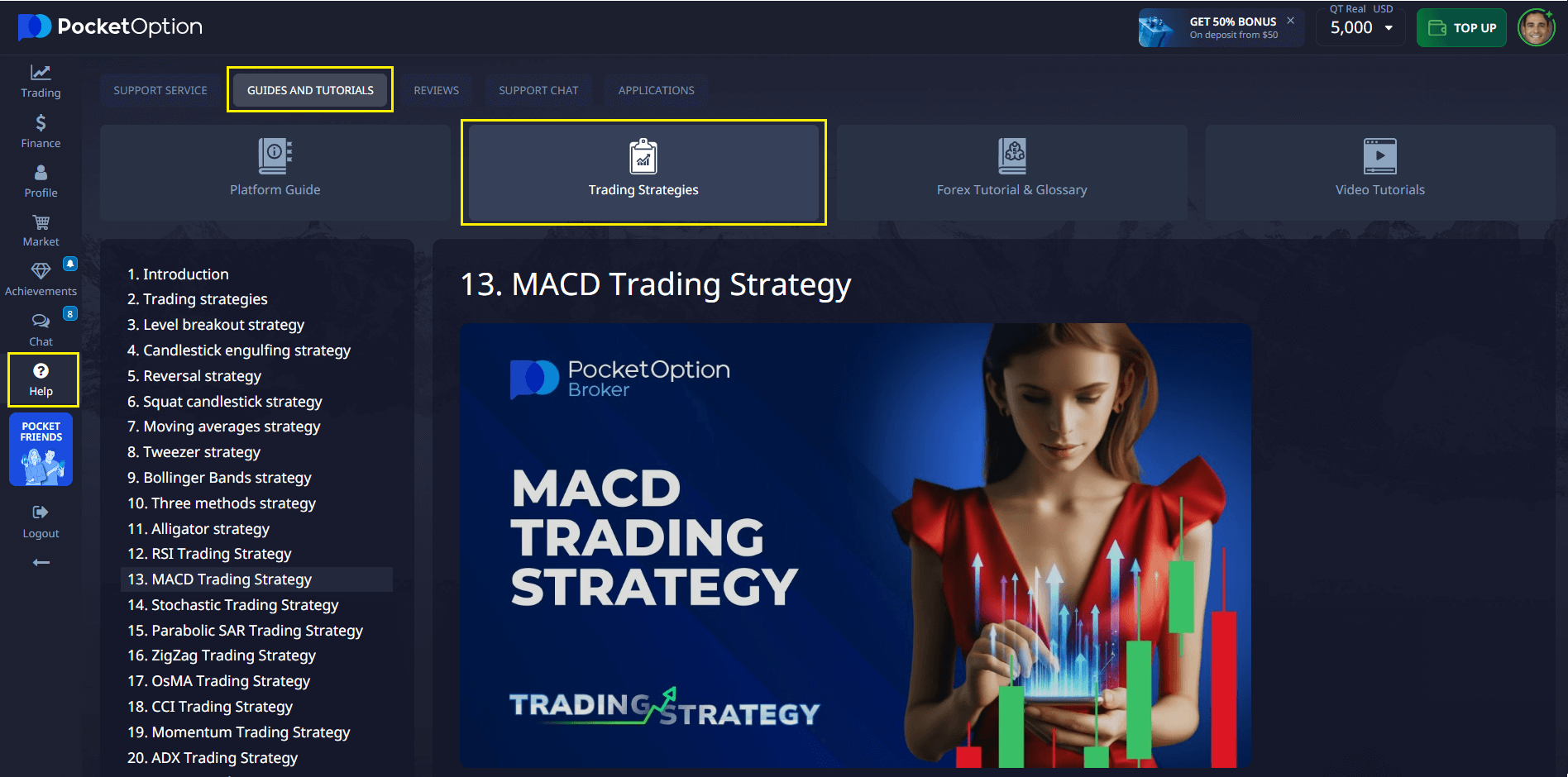

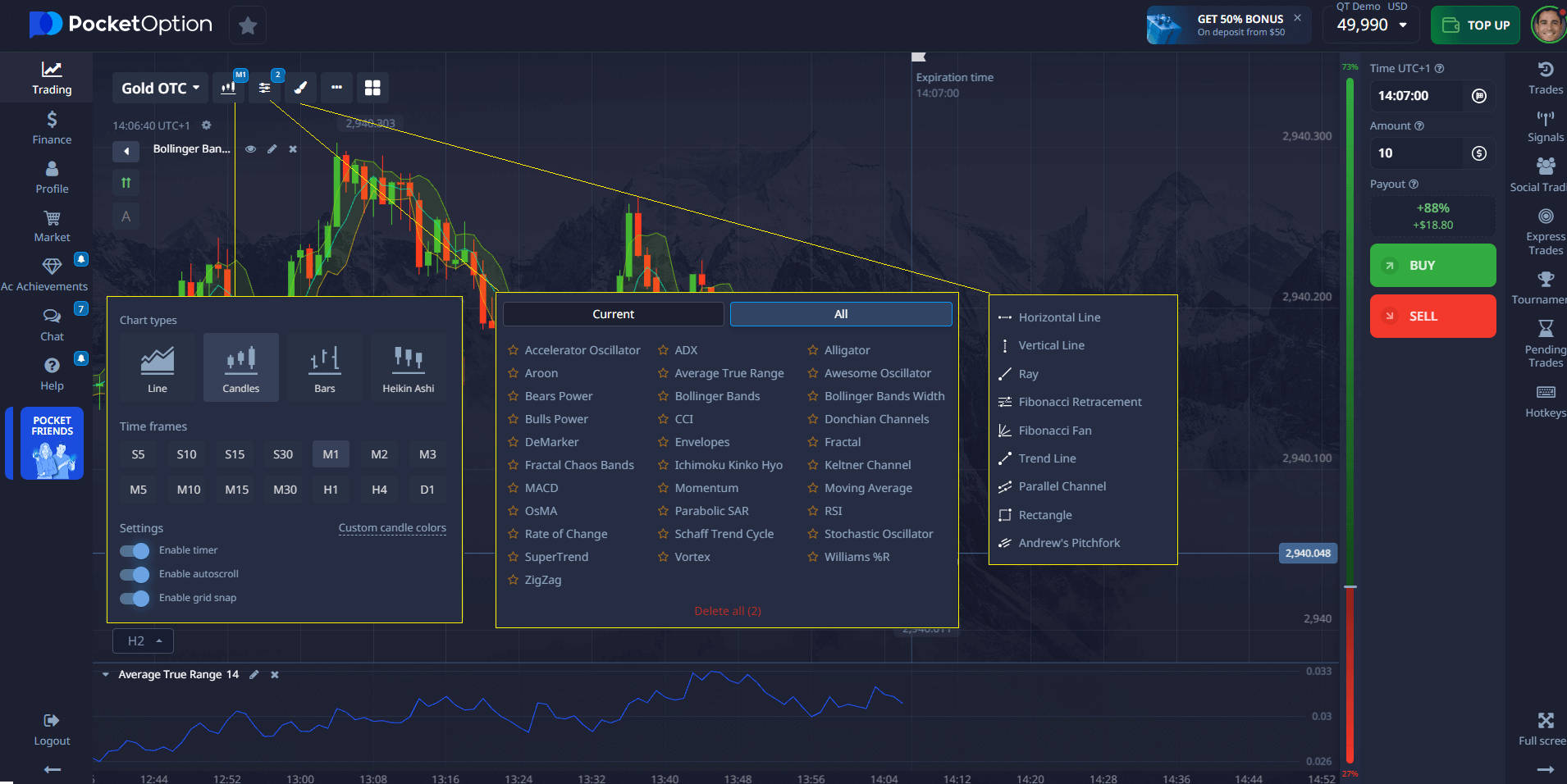

Pocket Option offers comprehensive free stock trading courses designed for both beginners and experienced traders. The educational platform includes:

- Video tutorials: Learning how to recognize chart patterns and use indicators. Ideal for visual learners.

- Forex Tutorial & Glossary: The Forex Tutorial helps traders understand the Forex market better. It covers essential topics ranging from basic market terminology and Forex mechanics to advanced strategies including technical and fundamental analysis.

- Trading Guides: Fundamental concepts and strategy development. Suitable for methodical students.

- Trading Simulator: Risk-free practice with Free Demo account in real market conditions. Suitable for those who are focused on practical application.

- 24/7 Chat Bot support: Helps traders to navigate the platform.

A distinctive feature of Pocket Option’s free online stock trading courses is their integration with the trading platform. This creates a seamless transition from learning to execution, where concepts are immediately transferred into practical application.

Core Components of Quality Stock Trading Education

Effective free stock trading courses, like those offered by Pocket Option, cover three essential elements:

1. Technical Analysis Fundamentals

- Chart pattern identification techniques

- Key indicator selection and interpretation

- Trend analysis and confirmation methods

2. Risk Management Principles

- Position sizing strategies tailored to account size

- Free Demo account with virtual $50,000 to practice your strategy before risking your real capital

- Portfolio diversification approaches

Building Your Trading Knowledge with Free Resources

Successful self-taught traders typically follow this approach with free stock trading course materials:

| Phase | Key Activities |

|---|---|

| Foundation Phase (2-4 weeks) | Master basic terminology, understand market structure, familiarize yourself with trading platforms |

| Strategy Development (4-8 weeks) | Practice technical analysis, develop and test trading plans, learn fundamental analysis basics. |

| Practice Implementation (Ongoing) | Use paper trading to apply concepts, implement journal tracking, review and refine performance. |

Supplementing Theory with Practice

Even the best free online stock trading course must be paired with practical experience. Pocket Option offers several ways to practice without risk:

- Demo Account Trading: Experience real market conditions without financial risk

- Historical Backtesting: Validate strategies against past market data

- Trading Competitions: Test skills against other traders in risk-free environments

- Micro-Position Trading: Start with minimal risk when moving to live trading

Common Pitfalls to Avoid

Even with quality stock trading courses free resources, traders often make these mistakes:

- Consuming too many resources simultaneously instead of mastering fundamentals

- Switching strategies before properly testing any single approach

- Focusing on complex techniques before understanding basics

- Neglecting risk management principles in favor of entry signals

- Trading with real money before demonstrating success in practice environments

FAQ

What distinguishes high-quality free stock trading courses from low-quality ones?

High-quality resources have verifiable instructor credentials, updated content, positive community feedback, minimal upselling, and structured learning progression.

How long does it typically take to learn trading through free online stock trading classes?

Most successful self-taught traders spend 3-6 months with free resources before developing consistency, though this varies with dedication and prior knowledge.

Can I really learn everything needed from free stock trading courses?

Yes, comprehensive free resources exist covering all essential aspects of trading, though you may need multiple sources for complete education.

Should beginners focus on technical or fundamental analysis first?

Most traders benefit from starting with basic technical analysis as it provides actionable signals, before gradually incorporating fundamentals.

How can I practice what I learn without risking real money?

Pocket Option's paper trading platform, backtesting tools, and trading simulators let you apply knowledge from free stock trading course materials without financial risk.