- Full automation: Algorithms execute trades without manual input.

- Speed and efficiency: Systems analyze data and execute trades within milliseconds.

- Data-driven decisions: Algorithms rely on statistical models and historical data to predict market trends.

- Emotionless trading: Unlike human traders, these systems are not influenced by fear or greed.

Black Box Trading: Revolutionizing Modern Financial Markets

Modern financial markets have been transformed by technology, and black box trading has emerged as one of the most innovative and efficient approaches. This highly automated method allows traders to use proprietary algorithms that analyze data, identify opportunities, and execute trades — all without human intervention.

Black box trading, also known as "black-box trading," refers to a type of algorithmic trading where decisions are made by an automated system. The term "black box" highlights the fact that the system's internal workings and decision-making processes are not visible to the user. Instead, the trader interacts with a finished product that performs these tasks independently.

Key features of blackbox trading include:

The concept behind black box trading is simple yet powerful. The system processes vast amounts of market data, uses proprietary strategies to identify profitable opportunities, and executes trades autonomously. Here's how it works:

- Data Analysis: Algorithms scan real-time market data for patterns and trends.

- Strategy Implementation: The system applies pre-programmed trading strategies such as:

- Mean Reversion: Capitalizing on price movements returning to their historical average.

- Trend Following: Trading in the direction of the current market trend.

- Statistical Arbitrage: Exploiting temporary price discrepancies across markets.

- Execution: Once a profitable opportunity is identified, the system executes the trade instantly.

This level of automation enables traders to take advantage of high-frequency trading opportunities and efficiently manage large volumes of data.

While Pocket Option does not directly offer black box trading, the platform provides a range of tools and features that allow traders to automate and optimize their trading strategies. With Pocket Option, you don’t need to buy or sell assets directly. Simply predict the price movement, and if your prediction is correct, you earn high returns.

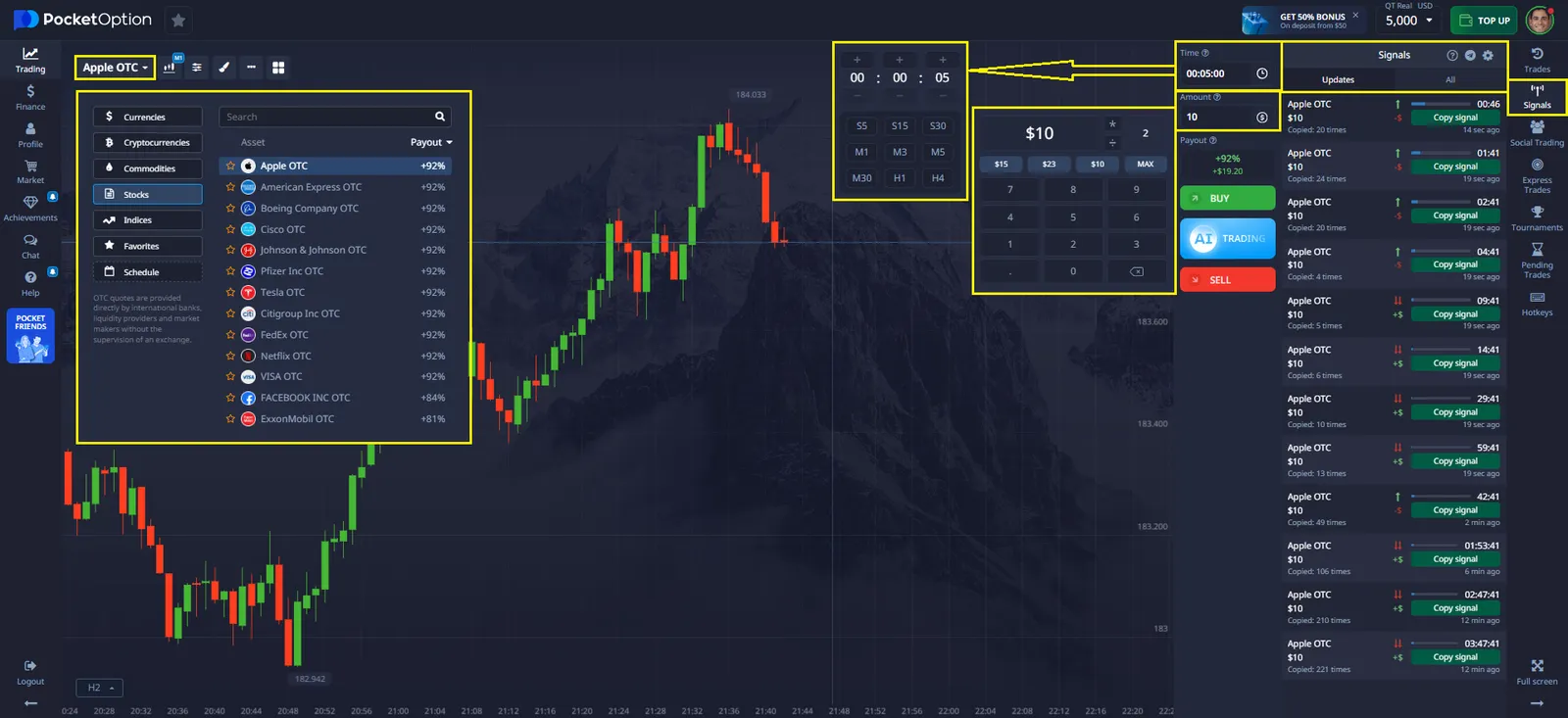

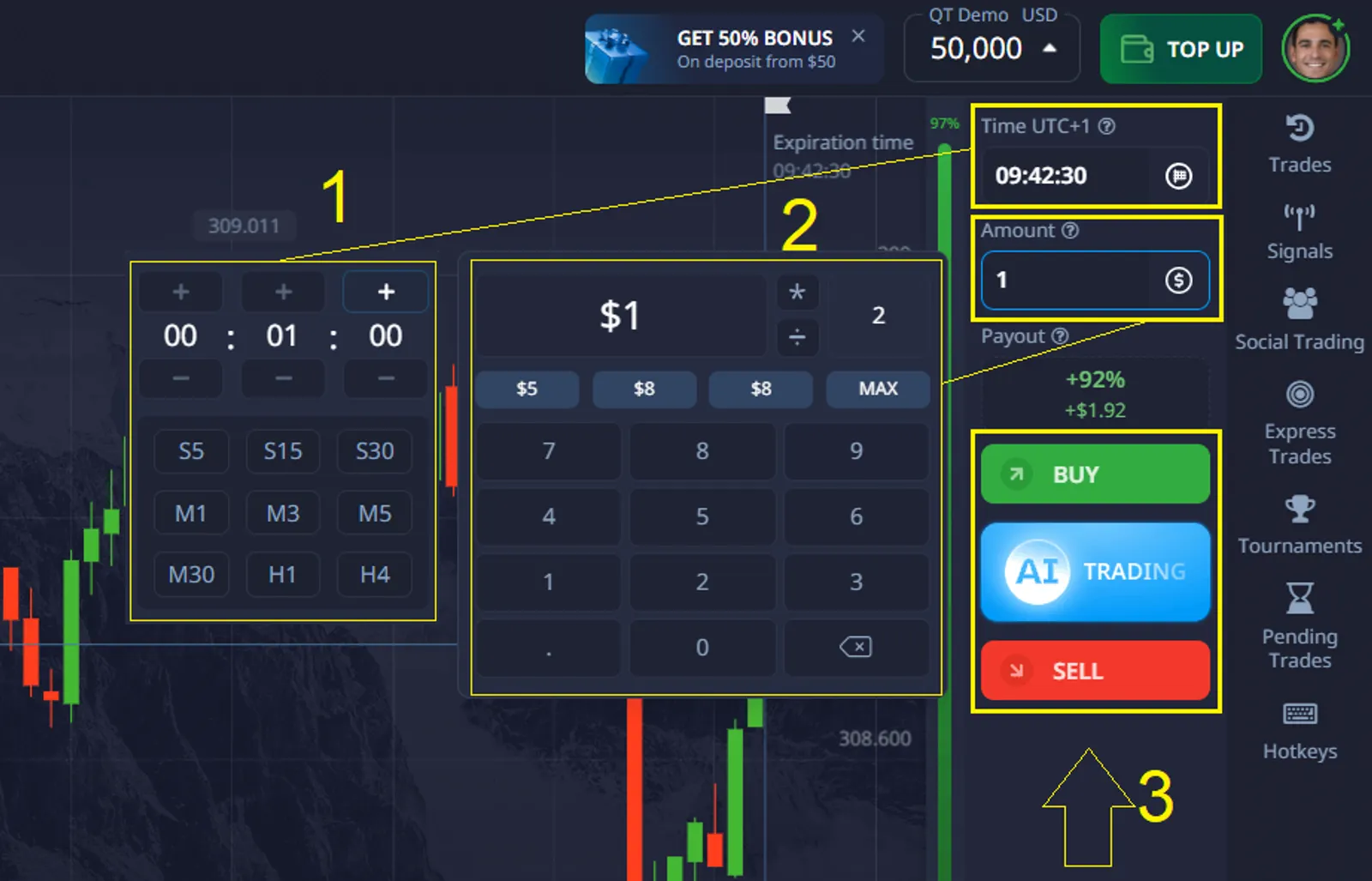

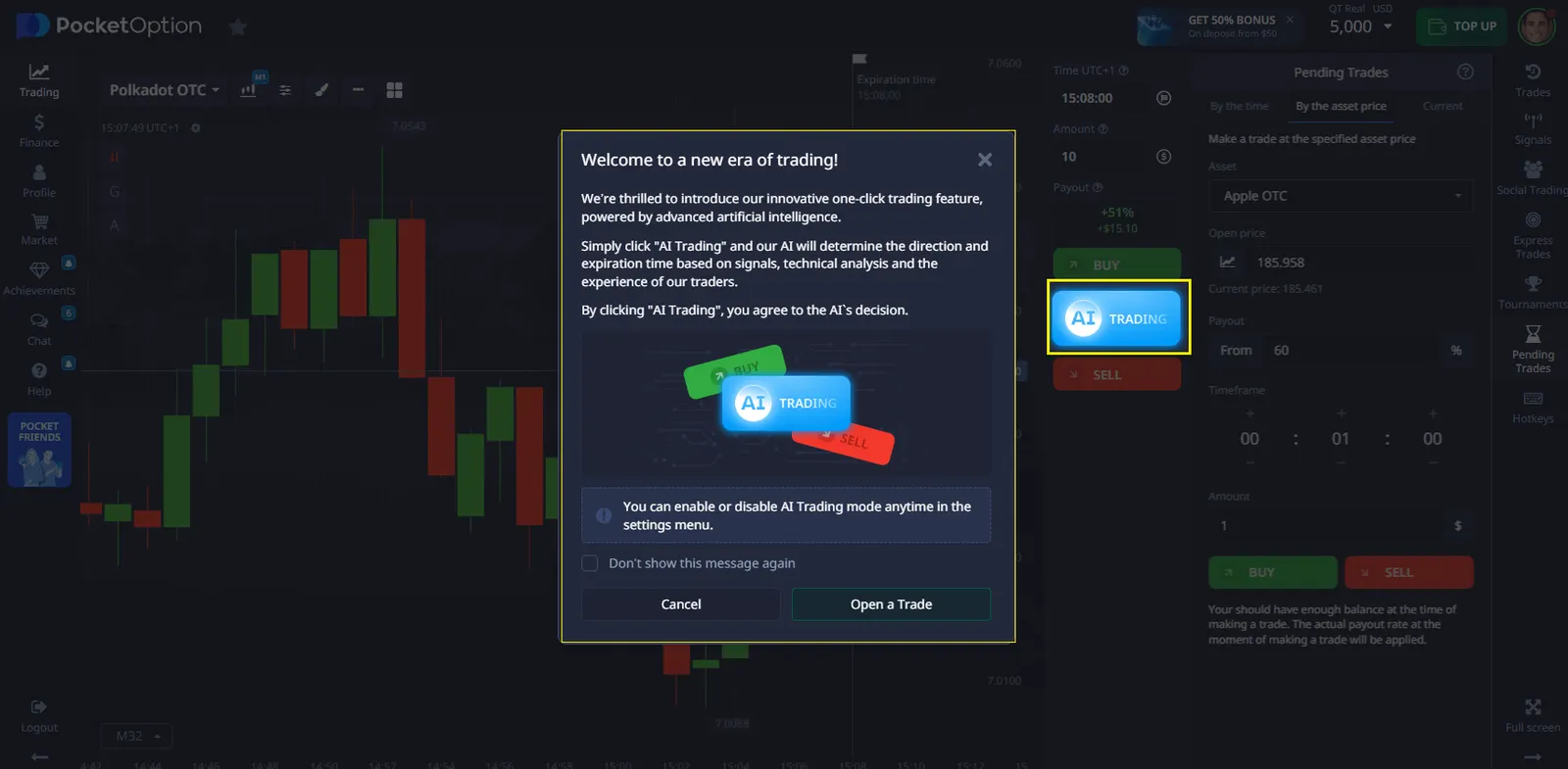

Trading Bots and Signals: Pocket Option offers trading bots and signal services to help automate aspects of your trading.

Simplified Forecast: On Pocket Option, you don’t need to buy or sell assets directly. Instead, you simply forecast whether the price will go up or down. If your prediction is correct, you can earn up to 92% profit in a single trade.

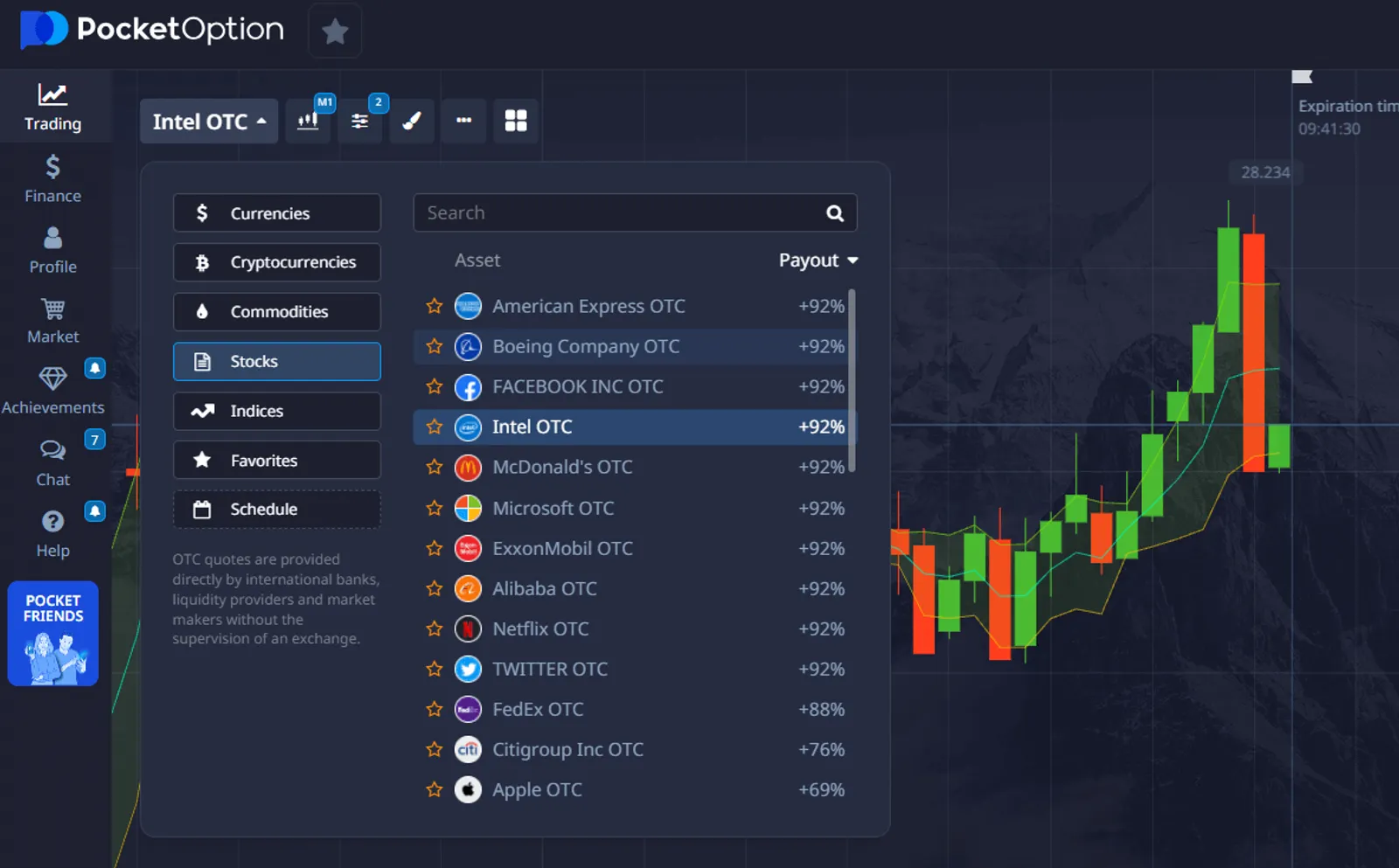

Wide Asset Selection: The platform offers access to over 100+ assets, including:

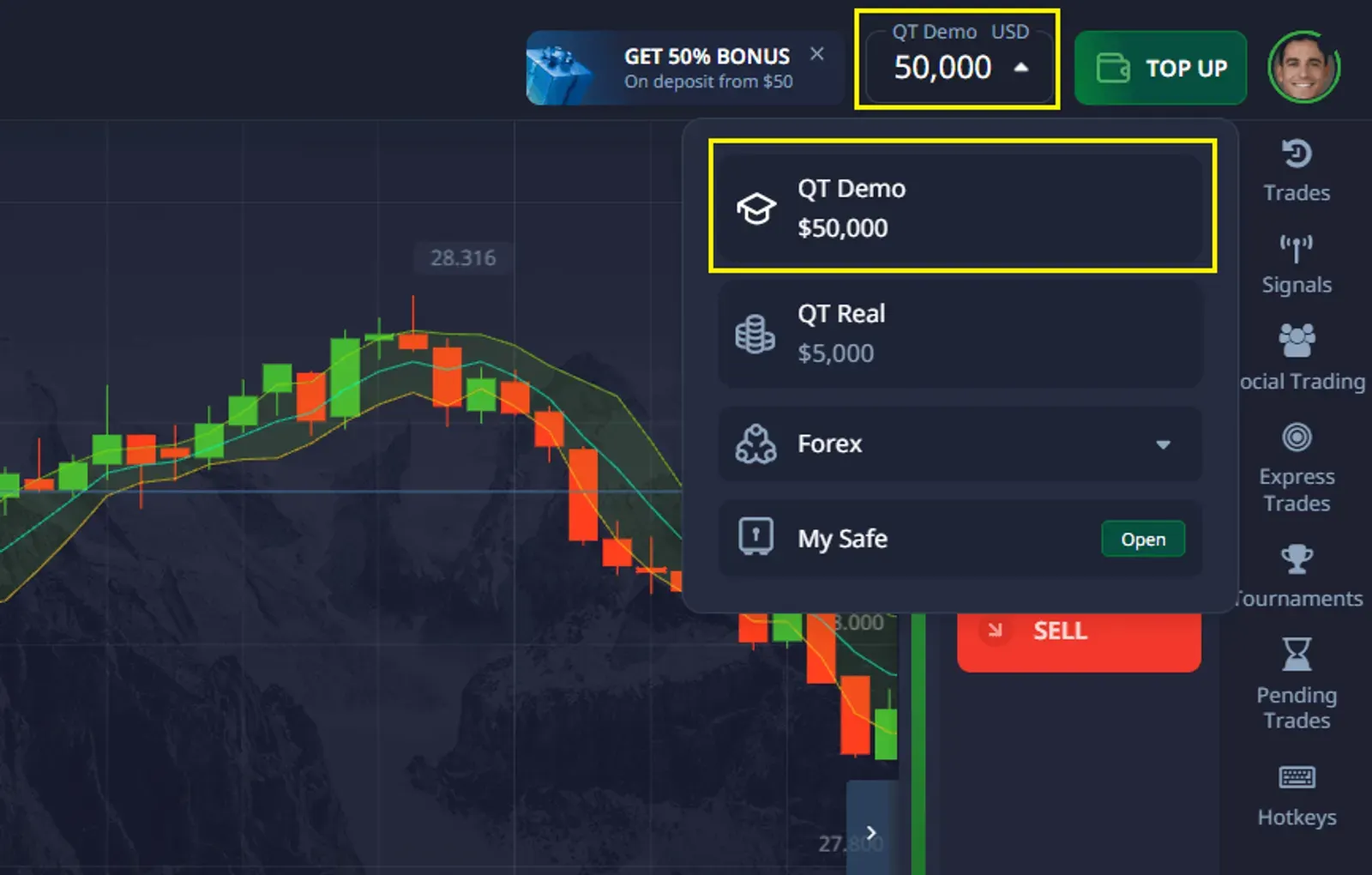

Demo Account: New users can practice trading with a $50,000 demo account, allowing you to test strategies risk-free.

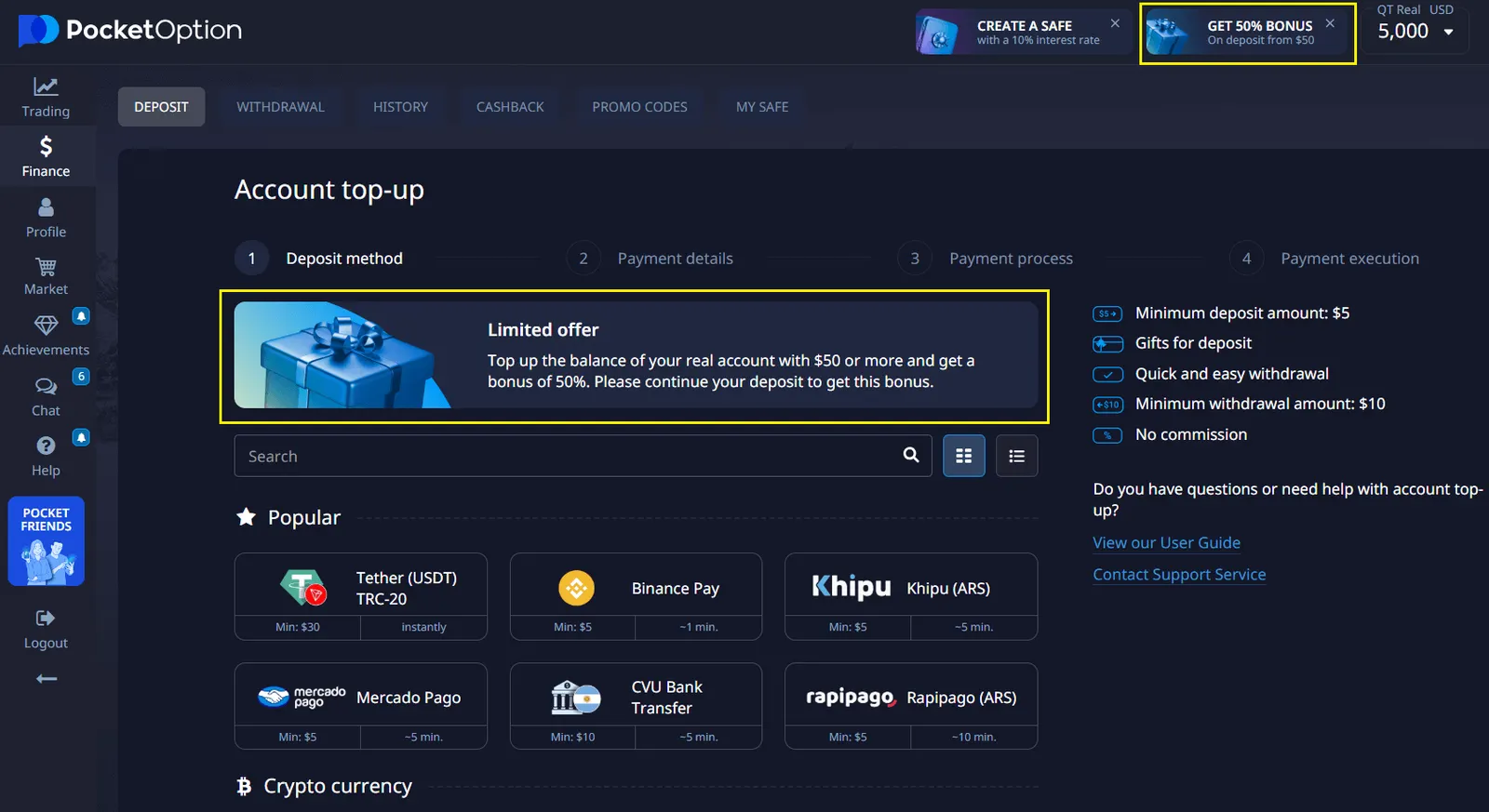

Promotions and Bonuses: Use the exclusive promo code "50START" to get a 50% bonus on your first deposit and start trading with a boost!

Pocket Option also provides:

- AI-Powered Trading Tools: Advanced algorithms to assist in data analysis and market predictions.

- 50+ Deposit and Withdrawal Methods: Flexible payment options for a seamless trading experience.

- Advanced Charting Tools: Analyze the market with technical indicators, trendlines, and other tools for precision trading.

- Social Trading: Mirror the strategies of successful traders and learn from their decisions.

Black box trading offers a range of benefits that make it appealing for traders and financial institutions alike:

- Unmatched Speed: Automated systems execute trades in microseconds, far faster than any human trader.

- Elimination of Emotions: Fear and greed, common pitfalls in manual trading, are entirely removed.

- Efficient Data Use: Algorithms process and analyze vast amounts of market data in real time.

- High Profit Potential: By capitalizing on small price movements, these systems can generate significant returns over time.

For traders using platforms like Pocket Option, tools such as trading bots and signals can mimic some of the principles of black-box trading, helping you make data-driven decisions and automate your strategies.

As technology continues to evolve, black-box trading is gaining momentum among professional traders and institutions. Its ability to process data, execute trades instantly, and remove human error makes it a powerful tool in modern financial markets.

For traders on platforms like Pocket Option, integrating automated tools and signals into your strategy can mimic some of the benefits of black box trading. With access to over 100 assets, AI analysis tools, and a $50,000 demo account, you can start trading smarter today.

Take advantage of the tools, bonuses, and flexibility that Pocket Option offers and step into the future of trading.

FAQ

Is Black Box Trading the Future?

Yes, as financial markets rely more on technology, black box trading is becoming a dominant strategy. It combines speed, precision, and automation, making it ideal for professional traders aiming for maximum efficiency.

Can You Use Pocket Option for Black Box Trading?

While Pocket Option does not offer full black box trading, it provides tools like trading signals, bots, and social trading to partially automate your strategies. You can predict price movements (up or down) and earn up to 92% profit per successful trade.

What are the Benefits of Black Box Trading?

Speed: Executes trades within milliseconds. Emotion-Free: Eliminates human bias and emotional trading. Data-Driven: Processes large datasets for highly accurate decisions.Scalability: Handles high volumes of trades efficiently.

How Does Black Box Trading Work?

It uses advanced algorithms and mathematical models to process vast amounts of market data in real-time. The system applies pre-defined strategies, such as trend following or statistical arbitrage, and executes trades automatically based on identified patterns.

What is Black Box Trading?

Black box trading is a type of algorithmic trading where a proprietary, automated system analyzes market data, identifies opportunities, and executes trades without human intervention. The system's internal processes are hidden ("black box"), making it efficient and emotion-free.