- Złoto

- Ropa Brent

- Ropa WTI

- Srebro

- Gaz Ziemny

- Platyna spot

- Pallad spot

Świat handlu energią nieustannie ewoluuje wraz z postępem technologicznym i zmianami rynkowymi. Dla profesjonalistów dążących do poprawy wyników w handlu energią elektryczną, zrozumienie odpowiednich narzędzi i metodologii jest kluczowe. Ten artykuł analizuje najbardziej efektywne podejścia do uczestnictwa w rynku energii.

Zrozumienie Podstaw Handlu Energią

Handel energią obejmuje kupno i sprzedaż energii elektrycznej w różnych środowiskach rynkowych. Handlowcy analizują wzorce podaży i popytu, prognozy pogody oraz zmiany regulacyjne, aby podejmować świadome decyzje. Sukces w tej dziedzinie wymaga zarówno wiedzy technicznej, jak i praktycznego doświadczenia ze specjalistycznymi platformami.

| Rodzaj Handlu | Ramy Czasowe | Poziom Ryzyka | Wymagany Kapitał |

|---|---|---|---|

| Dzień naprzód | 24 godziny | Średni | Umiarkowany |

| Handel śróddzienny | Ten sam dzień | Wysoki | Umiarkowany-Wysoki |

| Kontrakty terminowe forward | Tygodnie do lat | Niski-Średni | Wysoki |

| Kontrakty futures | Miesiące do lat | Średni-Wysoki | Wysoki |

Handel Surowcami na Pocket Option

Pocket Option oferuje traderom dostęp do różnorodnej gamy rynków surowcowych, umożliwiając inwestorom dywersyfikację swoich portfeli poza tradycyjnymi aktywami forex i akcjami. Surowce reprezentują towary fizyczne i surowce, które są fundamentalne dla globalnej gospodarki, co czyni je atrakcyjnymi instrumentami inwestycyjnymi w różnych warunkach rynkowych. Te rynki surowcowe są dostępne poprzez intuicyjny terminal handlowy platformy, który zapewnia ceny w czasie rzeczywistym, narzędzia analizy technicznej i różne typy zleceń, aby pomóc traderom skutecznie realizować ich strategie handlu surowcami.

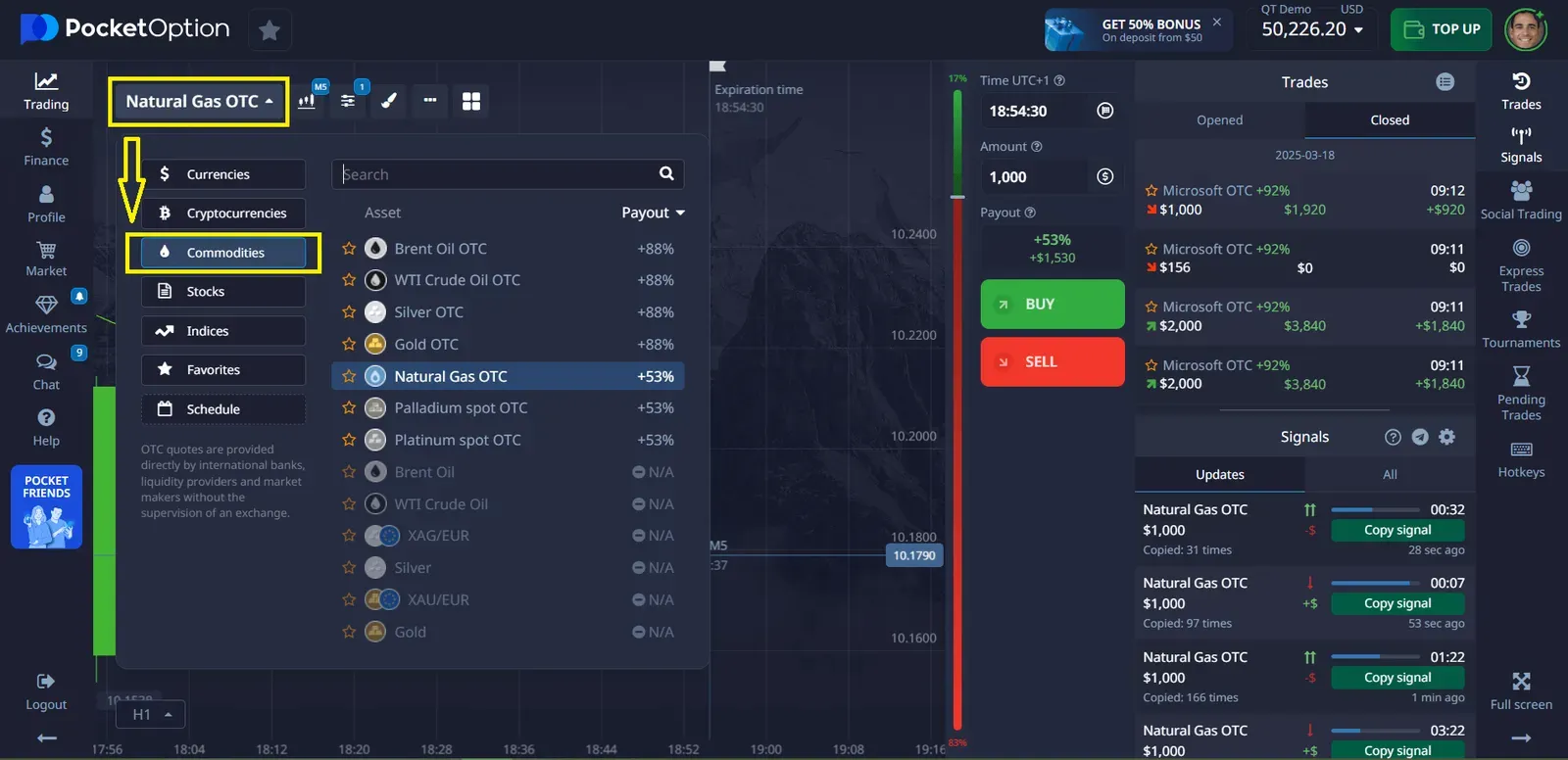

Surowce dostępne do handlu na Pocket Option obejmują:

Traderzy na Pocket Option mogą uzyskać dostęp do tych rynków surowcowych poprzez różne rodzaje kontraktów, w tym standardowe CFD i Szybki Handel, w zależności od ich preferencji handlowych.

Szybki Handel pozwala traderom czerpać zyski z ruchów cenowych bez posiadania jakichkolwiek aktywów bazowych! Musisz tylko dokonać prognozy, czy cena pójdzie w górę czy w dół. Jeśli Twoja prognoza jest poprawna, otrzymasz do 92% zysku✔️

Pocket Option zapewnia traderom:

- Szczegółową analizę rynku

- Kalendarze ekonomiczne i kanały informacyjne szczególnie istotne dla rynków surowcowych

- Pomoc traderom w byciu na bieżąco z czynnikami wpływającymi na ceny surowców (zjawiska pogodowe, napięcia geopolityczne)

- Raporty produkcyjne

- Dane o zapasach

Narzędzia Analizy Technicznej do Handlu na Rynku Energii Elektrycznej

Udany handel energią elektryczną opiera się na solidnych możliwościach analitycznych. Te narzędzia pomagają traderom identyfikować wzorce i dokonywać prognoz dotyczących ruchów rynkowych.

- Oprogramowanie do analizy wykresów cen do identyfikacji trendów

- Systemy integracji wzorców pogodowych

- Platformy monitorowania stanu sieci

- Aplikacje do modelowania podaży i popytu

| Narzędzie Analizy | Podstawowa Funkcja | Opcje Integracji | Źródła Danych |

|---|---|---|---|

| Genscape | Monitoring w czasie rzeczywistym | Dostępne API | Własne czujniki |

| PowerBI | Konfigurowalne dashboardy | Wiele konektorów | Różne bazy danych |

| Energy Exemplar | Symulacja rynku | Ograniczone | Historyczne i prognozowane |

| Bloomberg EMSX | Zarządzanie wykonaniem | Rozległe | Terminal Bloomberg |

Praktyczne Kroki do Efektywnego Handlu Energią

Aby handlować surowcami na Pocket Option, możesz wybrać je z listy dostępnych aktywów handlowych na platformie. Możesz przeglądać według kategorii lub skorzystać z funkcji natychmiastowego wyszukiwania, aby znaleźć konkretny surowiec:

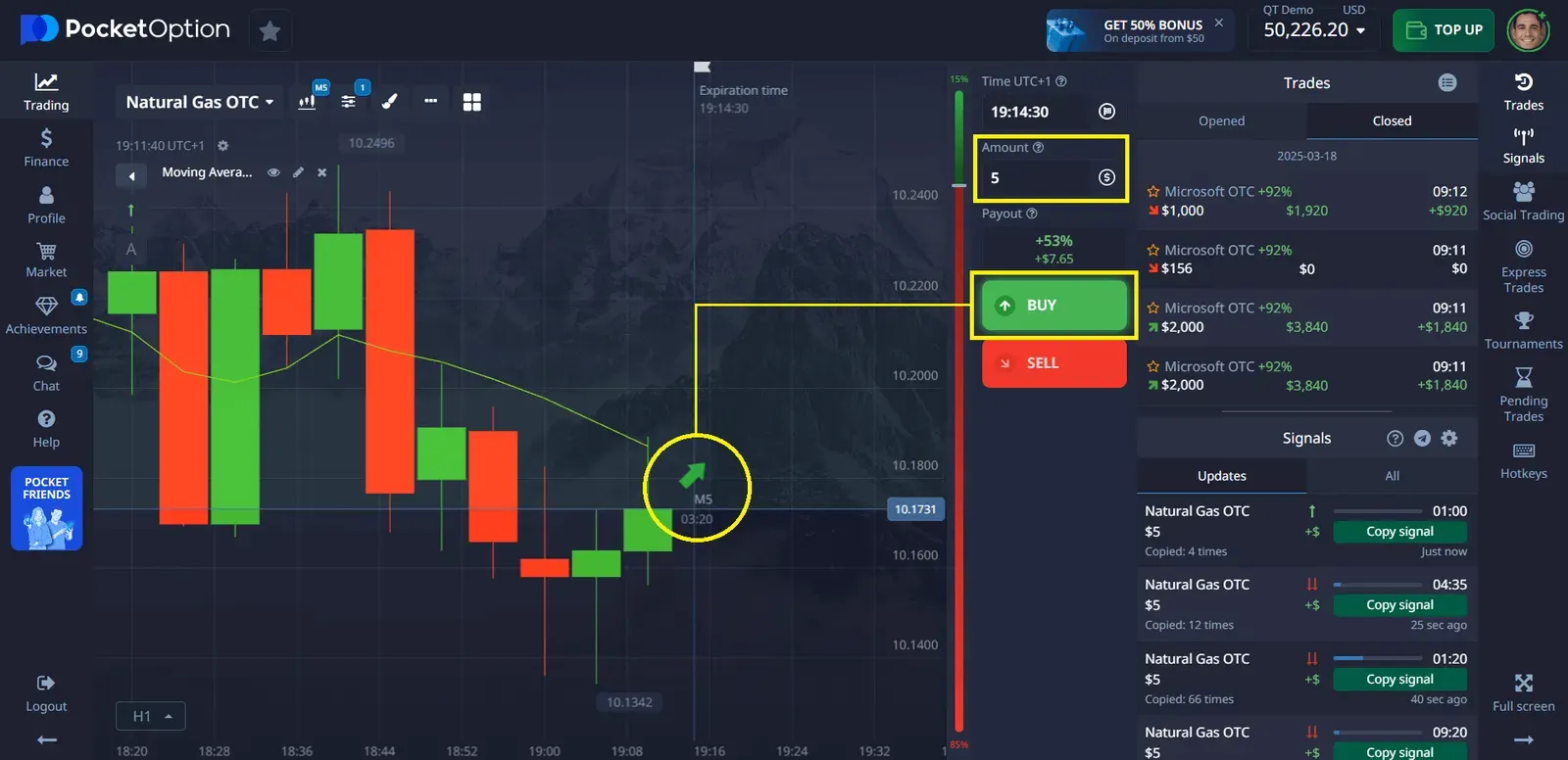

Po wybraniu surowca, przeanalizuj rynek i złóż transakcję na podstawie swojej prognozy:

Transakcja zostanie zamknięta, gdy upłynie czas określony przy jej otwieraniu. Jeśli prognoza jest poprawna, otrzymujesz zysk – do 92%. Ten procent można zobaczyć z wyprzedzeniem przy wyborze aktywa do handlu.

⚡Wskazówka: Ponadto, surowce mogą być również zawarte w transakcjach ekspresowych. Pozwala to na łączenie prognoz dotyczących wielu aktywów dla potencjalnie wyższych wypłat!

Zarządzanie ryzykiem:

Wdrożenie ustrukturyzowanego podejścia do handlu na rynku energii elektrycznej poprawia wydajność i zmniejsza ryzyko. Rozważ te praktyczne kroki:

- Ustalenie jasnych celów handlowych opartych na tolerancji ryzyka

- Opracowanie standardowych protokołów analizy

- Tworzenie zasad wielkości pozycji

- Wdrożenie ścisłych procedur zarządzania ryzykiem

| Faza Handlu | Kluczowe Działania | Wymagane Narzędzia |

|---|---|---|

| Analiza przedrynkowa | Przegląd pogody, wiadomości, poprzednich rozliczeń | Kanały informacyjne, serwisy pogodowe |

| Opracowanie strategii | Określenie punktów wejścia/wyjścia, wielkość pozycji | Oprogramowanie do analizy technicznej |

| Wykonanie | Składanie zleceń zgodnie z planem | Platforma handlowa |

| Przegląd po transakcji | Analiza wydajności, dostosowanie strategii | Dziennik, metryki wydajności |

Zarządzanie Ryzykiem w Handlu Energią Elektryczną

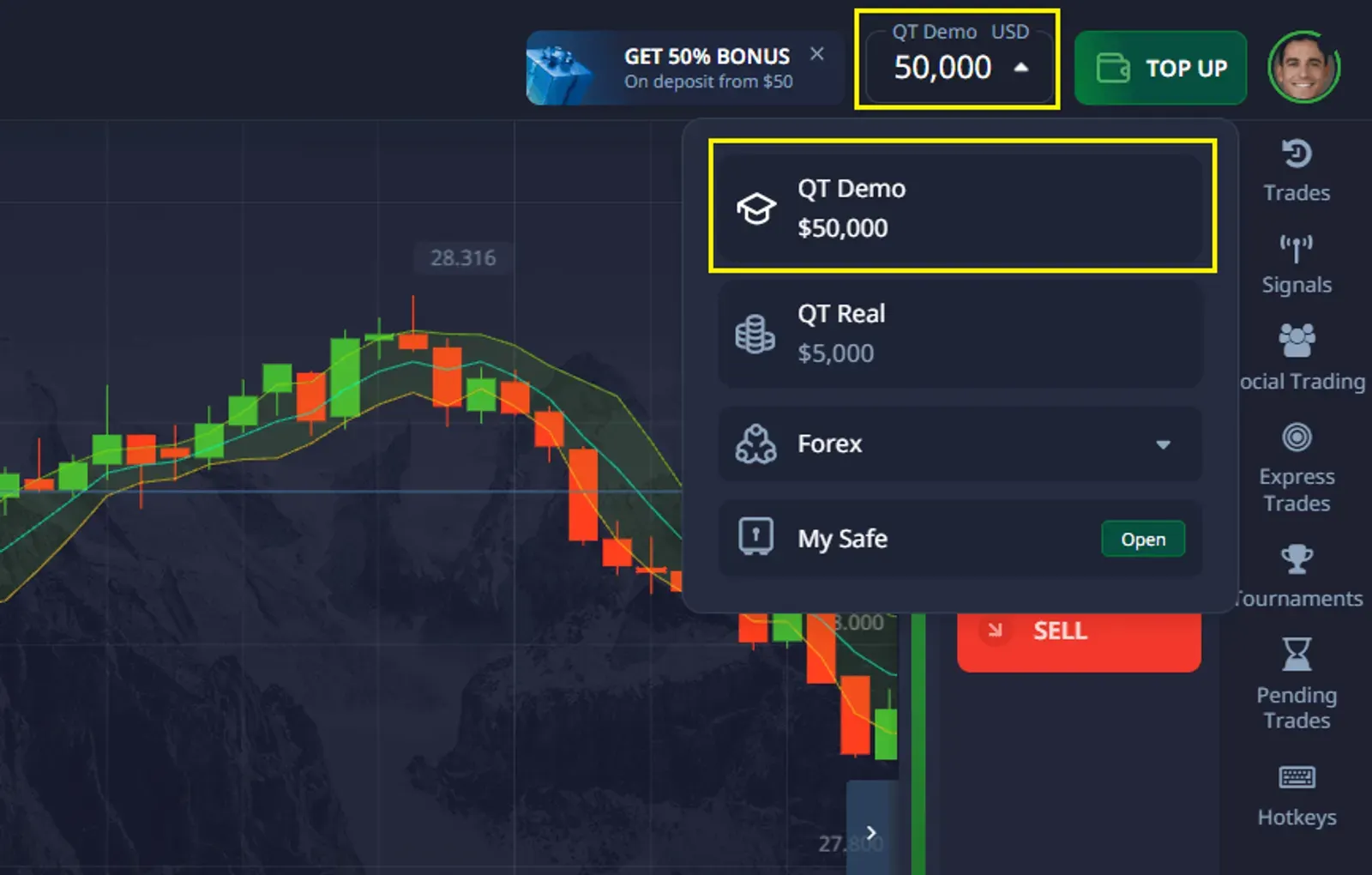

Z Pocket Option, traderzy uzyskują dostęp do bezpłatnego konta demo praktycznego, załadowanego 50 000 $ waluty wirtualnej, umożliwiającego eksperymentowanie z handlem bez ryzyka. Ta symulacja daje Ci praktykę przed przejściem do rzeczywistego środowiska handlowego. Konto demo Pocket Option zawiera podobne układy, instrumenty analityczne, wyświetlacze graficzne, sygnały rynkowe i możliwości operacyjne – niewiele różniące się od platformy z prawdziwymi pieniędzmi.

Unikalna zmienność rynków energii sprawia, że zarządzanie ryzykiem jest niezbędne w handlu energią. Skuteczni traderzy wdrażają kompleksowe ramy do ochrony kapitału.

- Limity pozycji oparte na warunkach rynkowych

- Dywersyfikacja w różnych okresach i regionach

- Techniki zabezpieczające wykorzystujące opcje i futures

- Regularne testy warunków skrajnych portfela

| Typ Ryzyka | Podejście do Łagodzenia | Metoda Monitorowania |

|---|---|---|

| Zmienność cen | Zlecenia stop-loss | Alerty cenowe |

| Ryzyko płynności | Analiza głębokości rynku | Wskaźniki wolumenu |

| Ryzyko kontrahenta | Kontrole kredytowe | Raporty ekspozycji |

| Ryzyko regulacyjne | Protokoły zgodności | Aktualizacje polityk |

Podsumowanie

Sukces w handlu energią wymaga połączenia wiedzy technicznej, myślenia strategicznego i odpowiednich narzędzi. Poprzez zrozumienie podstaw rynku, wykorzystanie solidnych platform i wdrożenie ustrukturyzowanego zarządzania ryzykiem, traderzy mogą skutecznie poruszać się po złożonościach handlu na rynku energii elektrycznej. Regularna ocena i adaptacja pozostają kluczowe dla długoterminowego sukcesu w tej dynamicznej dziedzinie.

FAQ

Jakie kwalifikacje są potrzebne, aby rozpocząć handel towarami elektrycznymi?

Większość profesjonalistów ma wykształcenie w dziedzinie ekonomii energetycznej, inżynierii lub finansów. Podczas gdy formalne kwalifikacje różnią się w zależności od pracodawcy, zrozumienie rynków energii, analiza techniczna i zarządzanie ryzykiem są niezbędne. Wielu traderów zdobywa również certyfikaty, takie jak Energy Risk Professional (ERP).

Ile kapitału potrzeba, aby rozpocząć handel energią?

Wymagania kapitałowe zależą od podejścia do handlu. Instytucjonalni traderzy mogą zarządzać portfelami wartymi miliony, podczas gdy indywidualni traderzy działający za pośrednictwem firm brokerskich mogą zacząć od 10 000-50 000 dolarów. Zawsze upewnij się, że masz wystarczający kapitał, aby wytrzymać zmienność rynku.

Która platforma do handlu energią jest najlepsza dla początkujących?

Początkujący często uważają Pocket Option za dostępną ze względu na przyjazny interfejs i zasoby edukacyjne. Inne platformy, takie jak EPEX Spot, oferują środowiska demonstracyjne, w których możesz ćwiczyć bez ryzyka finansowego.

Jak czynniki sezonowe wpływają na handel energią elektryczną?

Wzorce sezonowe znacząco wpływają na ceny energii elektrycznej poprzez zmieniające się zapotrzebowanie (ogrzewanie zimą, chłodzenie latem) i czynniki podażowe (dostępność energii wodnej, produkcja ze źródeł odnawialnych). Skuteczni traderzy włączają analizę sezonową do swoich strategii.

Czy handel algorytmiczny jest powszechny na rynkach energii elektrycznej?

Tak, handel algorytmiczny stał się coraz bardziej powszechny w handlu energią. Te systemy analizują dane rynkowe i wykonują transakcje w oparciu o z góry określone parametry, często uchwytując możliwości szybciej niż handel ręczny. Jednak wymagają one zaawansowanego rozwoju i stałego monitorowania.