- Nauka bez ryzyka: Nowi traderzy mogą eksplorować rynek bez obawy o utratę pieniędzy.

- Dane rynkowe w czasie rzeczywistym: Symulatory zapewniają dostęp do aktualizacji rynkowych na żywo, pozwalając użytkownikom handlować tak, jakby byli w rzeczywistych warunkach.

- Testowanie strategii: Idealne zarówno dla początkujących, jak i doświadczonych traderów do testowania nowych strategii.

- Dostępność: Dostępne online za darmo, ułatwiając rozpoczęcie w dowolnym momencie i miejscu.

Darmowy Symulator Handlu Opcjami: Ucz się Bez Ryzyka

Handel opcjami może być onieśmielający dla początkujących, ale darmowe symulatory handlu opcjami to doskonały sposób na zdobycie doświadczenia bez ryzykowania prawdziwych pieniędzy. Platformy te zapewniają realistyczne, pozbawione ryzyka środowisko do ćwiczenia strategii handlowych, zrozumienia dynamiki rynku i budowania pewności siebie przed przejściem do handlu na żywo.

Czym jest symulator handlu opcjami?

Symulator handlu opcjami to narzędzie online, które odtwarza rzeczywiste scenariusze handlowe przy użyciu wirtualnych środków. Pozwala użytkownikom ćwiczyć handel i testować strategie w rzeczywistych warunkach rynkowych bez ryzyka finansowego.

Korzyści z darmowego symulatora handlu opcjami:

Darmowe symulatory handlu opcjami

Oto niektóre z platform oferujących darmowe symulatory handlu opcjami:

- Thinkorswim od TD Ameritrade

- Oferuje realistyczne doświadczenie handlowe z wirtualnymi funduszami.

- Zawiera zaawansowane narzędzia handlowe i zasoby edukacyjne.

- Interactive Brokers Paper Trading

- Idealny do testowania strategii opcji z danymi rynkowymi w czasie rzeczywistym.

- Zapewnia płynne przejście do handlu na żywo, gdy będziesz gotowy.

- OptionsXpress Simulator

- Przyjazna dla użytkownika platforma z dostępem do wielu strategii.

- Idealna zarówno dla początkujących, jak i zaawansowanych traderów.

Dlaczego Pocket Option jest najlepszym wyborem

Jeśli szukasz niezawodnej platformy z darmowym symulatorem handlu, Pocket Option jest doskonałym wyborem. Łączy łatwość użytkowania, zaawansowane narzędzia i realistyczne warunki rynkowe, aby zapewnić najwyższej jakości doświadczenie edukacyjne.

Jak rozpocząć z Pocket Option

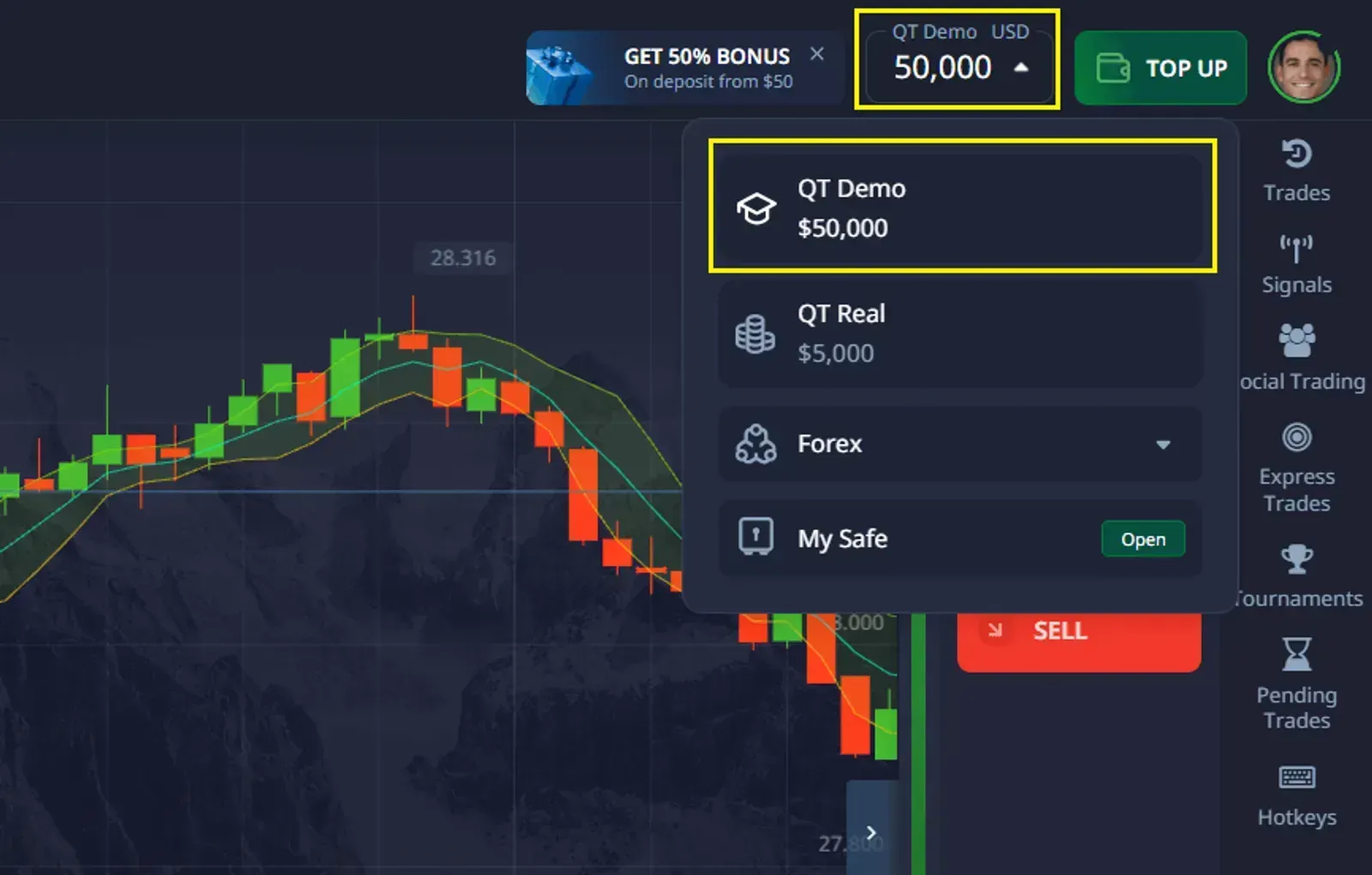

- Otwórz konto demo Rejestracja jest szybka i łatwa. Natychmiast uzyskasz dostęp do wirtualnych środków.

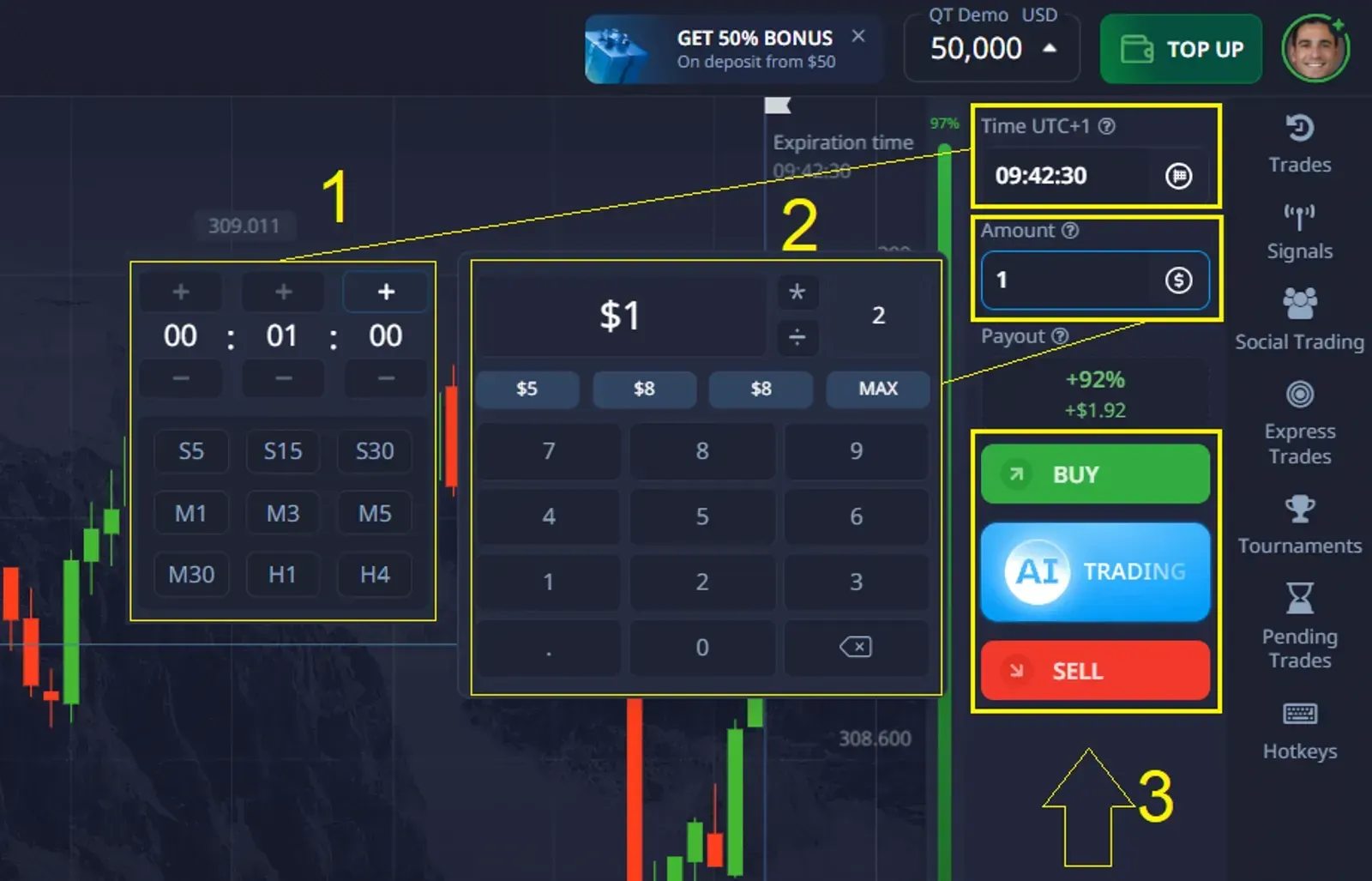

- Poznaj platformę Wypróbuj różne narzędzia, takie jak Szybki Handel i Ekspresowy Handel. Eksperymentuj z wskaźnikami i opcjami wykresów.

- Ćwicz i ucz się Używaj konta demo do ćwiczenia swoich strategii i zrozumienia rynku.

- Przejdź do handlu rzeczywistego Kiedy będziesz gotowy, przejdź na konto rzeczywiste i zacznij handlować prawdziwymi pieniędzmi.

Co wyróżnia Pocket Option?

- Handel bez ryzyka z $50000 Konto demo pozwala na handel z wirtualnymi środkami, dzięki czemu możesz ćwiczyć bez ryzyka utraty prawdziwych pieniędzy.

- Rzeczywiste warunki rynkowe Konto demo Pocket Option odzwierciedla dane rynkowe w czasie rzeczywistym, zapewniając autentyczne doświadczenie handlowe.

- Nieograniczony dostęp Ćwicz tyle, ile potrzebujesz, bez ograniczeń czasowych.

- Kompleksowe narzędzia Odkryj funkcje takie jak Szybki Handel, Ekspresowy Handel i różnorodne wskaźniki, aby ulepszyć swoje strategie handlowe.

- Płynne przejście do handlu rzeczywistego Kiedy poczujesz się pewnie, łatwo przejdź na konto rzeczywiste i zacznij zarabiać realne zyski.

Konto demo vs konto rzeczywiste

| Funkcje | Konto rzeczywiste | Konto demo |

|---|---|---|

| Zarabianie realnych zysków | ✅ Tak | ❌ Nie, tylko wirtualne środki |

| Praktyka bez ryzyka | ❌ Nie | ✅ Tak, handel bez żadnego ryzyka |

| Testowanie strategii | ❌ Tylko z realnymi środkami | ✅ Idealne do testowania strategii |

| Dostęp do funkcji | ✅ Pełny dostęp | ✅ Pełny dostęp |

| Bonusy i turnieje | ✅ Uczestnictwo w promocjach i turniejach | ❌ Niedostępne |

Twoje saldo $75 czeka! Chcesz mocnego startu w handlu? Pierwsza wpłata + kod promocyjny „50START” = $75 na Twoim koncie.

Podsumowanie

Jeśli szukasz darmowego symulatora handlu opcjami, platformy takie jak Thinkorswim, Interactive Brokers i OptionsXpress oferują doskonałe narzędzia dla początkujących i zaawansowanych traderów.

Jednak Pocket Option wyróżnia się bezpiecznym kontem demo, rzeczywistymi warunkami rynkowymi i zaawansowanymi funkcjami. Zacznij ćwiczyć już dziś i zrób pierwszy krok w kierunku zostania pewnym siebie i odnoszącym sukcesy traderem!

FAQ

Czy darmowe symulatory handlu opcjami są realistyczne?

Tak, większość darmowych symulatorów handlu opcjami, w tym oferowane przez platformy takie jak Pocket Option, dokładnie naśladuje rzeczywiste warunki rynkowe. Zapewniają dane rynkowe na żywo, realistyczne ruchy cen i dostęp do niezbędnych narzędzi handlowych, co czyni je doskonałymi do nauki.

Czym jest symulator handlu opcjami?

Symulator handlu opcjami to platforma internetowa, która umożliwia użytkownikom ćwiczenie handlu opcjami przy użyciu wirtualnych środków. Odwzorowuje rzeczywiste warunki rynkowe, zapewniając wolne od ryzyka środowisko do testowania strategii i doskonalenia umiejętności handlowych.

Dlaczego powinienem wybrać Pocket Option do handlu opcjami?

Pocket Option oferuje przyjazną dla użytkownika platformę z darmowym kontem demo, danymi rynkowymi w czasie rzeczywistym oraz zaawansowanymi narzędziami, takimi jak Szybki Handel i Handel Ekspresowy. Jest idealny dla początkujących, którzy chcą ćwiczyć bez ryzyka, oraz dla doświadczonych traderów, którzy chcą udoskonalić swoje strategie. Z nieograniczonym dostępem i płynnym przejściem do handlu rzeczywistego, Pocket Option wyróżnia się jako najlepszy wybór.

Jak przejść z konta demo do handlu rzeczywistego?

Gdy poczujesz się pewnie w swoich umiejętnościach handlowych, możesz łatwo przejść na prawdziwe konto handlowe na platformach takich jak Pocket Option. Po prostu wpłać środki, a uzyskasz dostęp do prawdziwych zysków, bonusów i dodatkowych funkcji, takich jak turnieje i cashback.

Czy mogę używać darmowego symulatora do testowania zaawansowanych strategii handlowych?

Absolutnie! Darmowe symulatory są idealne do testowania różnych strategii, od podstawowego handlu opcjami po bardziej zaawansowane techniki, takie jak spready, straddle i condory. Konto demo Pocket Option, na przykład, obsługuje narzędzia takie jak Szybki Handel i Handel Ekspresowy, które są idealne do testowania strategii.