- Wybierz aktywo — Wybieraj spośród dostępnych aktywów, takich jak pary walutowe, kryptowaluty, akcje i wiele innych.

- Przeanalizuj wykres — Użyj narzędzi, takich jak wskaźnik sentymentu traderów i inne narzędzia analizy technicznej, aby ocenić trendy rynkowe.

- Ustaw kwotę transakcji — Zacznij handlować z minimalną kwotą zaledwie 1$.

- Wybierz czas trwania transakcji — Wybierz czas trwania transakcji, który Ci odpowiada, zaczynając od zaledwie 5 sekund.

- Dokonaj prognozy — Przewiduj, czy cena wzrośnie czy spadnie. Kliknij KUPUJ, jeśli uważasz, że wzrośnie, lub SPRZEDAJ, jeśli przewidujesz spadek.

- Zarabiaj zyski dzięki dokładnym prognozom — Jeśli Twoja prognoza jest prawidłowa, możesz zarobić do 92% zysku, widocznego przed złożeniem zlecenia.

Jak korzystać z konta demo Pocket Option: Przewodnik krok po kroku dla nowych traderów

Dla traderów, którzy chcą doskonalić swoje umiejętności bez ryzykowania prawdziwych pieniędzy, zrozumienie, jak efektywnie korzystać z kont demo Pocket Option, jest kluczowe. Te platformy treningowe z 50000 $ oferują bezpieczne środowisko do testowania strategii i zdobywania doświadczenia. Przyjrzyjmy się prawdziwym historiom sukcesu i praktycznym wskazówkom, jak maksymalnie wykorzystać korzyści płynące z handlu na demo.

Article navigation

- Czym jest konto demo?

- Jak złożyć zlecenie na koncie demo Pocket Option: Przewodnik krok po kroku

- Kluczowe strategie skutecznego tradingu demo

- Jak korzystać z demo Pocket Option: Przewodnik krok po kroku

- Analiza porównawcza: Trading demo vs. Trading na żywo

- Maksymalizacja nauki z tradingu demo

- Przejście z tradingu demo do tradingu na żywo

- Typowe pułapki do uniknięcia na koncie demo

- Podsumowanie

Czym jest konto demo?

Konto demo to darmowe konto udostępniane przez Pocket Option, które pozwala ćwiczyć trading bez używania prawdziwych pieniędzy. To doskonałe narzędzie dla początkujących, którzy chcą zrozumieć, jak działa trading, oraz dla doświadczonych traderów, którzy chcą testować nowe strategie w środowisku bez ryzyka.

Zalety kont demo:

✔️ Trading bez hamulców: możesz handlować bez obawy o utratę prawdziwych pieniędzy.

✔️ Praktyka i szkolenie: Pomaga początkującym zrozumieć platformę tradingową i dynamikę rynku.

✔️ Testowanie strategii: doświadczeni traderzy mogą testować i udoskonalać swoje strategie tradingowe.

✔️ Warunki rynkowe w czasie rzeczywistym: demo działa w czasie rzeczywistym, oferując realistyczne doświadczenie tradingowe.

✔️ Nieograniczone doładowanie: możesz doładować saldo swojego konta demo, gdy spadnie poniżej 50 000 USD.

Jak złożyć zlecenie na koncie demo Pocket Option: Przewodnik krok po kroku

Oto prosty przewodnik, jak złożyć zlecenie na koncie demo Pocket Option:

Kluczowe strategie skutecznego tradingu demo

Aby jak najlepiej wykorzystać swoje doświadczenie demo na Pocket Option, rozważ te sprawdzone strategie:

| Strategia | Opis | Korzyść |

|---|---|---|

| Traktuj jak prawdziwy trading | Podchodź do tradingu demo z taką samą powagą jak do tradingu na żywo | Rozwija dyscyplinę i realistyczne nawyki |

| Wyznacz konkretne cele | Określ jasne cele dla każdej sesji tradingowej | Zapewnia koncentrację i mierzalne postępy |

| Eksperymentuj z różnymi aktywami | Próbuj handlować na różnych rynkach i klasach aktywów | Poszerza wiedzę o tradingu i identyfikuje mocne strony |

| Prowadź dziennik tradingowy | Zapisuj wszystkie transakcje, strategie i wyniki | Ułatwia analizę i doskonalenie |

Wdrożenie tych strategii może znacząco poprawić Twoje doświadczenie edukacyjne i przygotować Cię do udanego tradingu na żywo.

Jak korzystać z demo Pocket Option: Przewodnik krok po kroku

Po zarejestrowaniu się możesz wypróbować darmowe konto demo. To doskonałe narzędzie, które pomoże Ci stawiać pierwsze kroki w tradingu, zobaczyć, jak to działa i nauczyć się handlować. Zaawansowani traderzy mogą ćwiczyć różne strategie tradingowe bez ryzykowania własnych pieniędzy. Wszystkie transakcje są realizowane przy użyciu środków wirtualnych. Jednak instrumenty handlowe, notowania i operacje są identyczne jak na koncie rzeczywistym.

Postępuj zgodnie z tymi krokami, aby skutecznie korzystać z konta demo Pocket Option:

- Zarejestruj się, aby uzyskać konto Pocket Option

- Przejdź do sekcji konta demo

- Zapoznaj się z interfejsem platformy

- Zacznij od małych transakcji, aby zrozumieć mechanikę

- Stopniowo zwiększaj rozmiar i złożoność transakcji

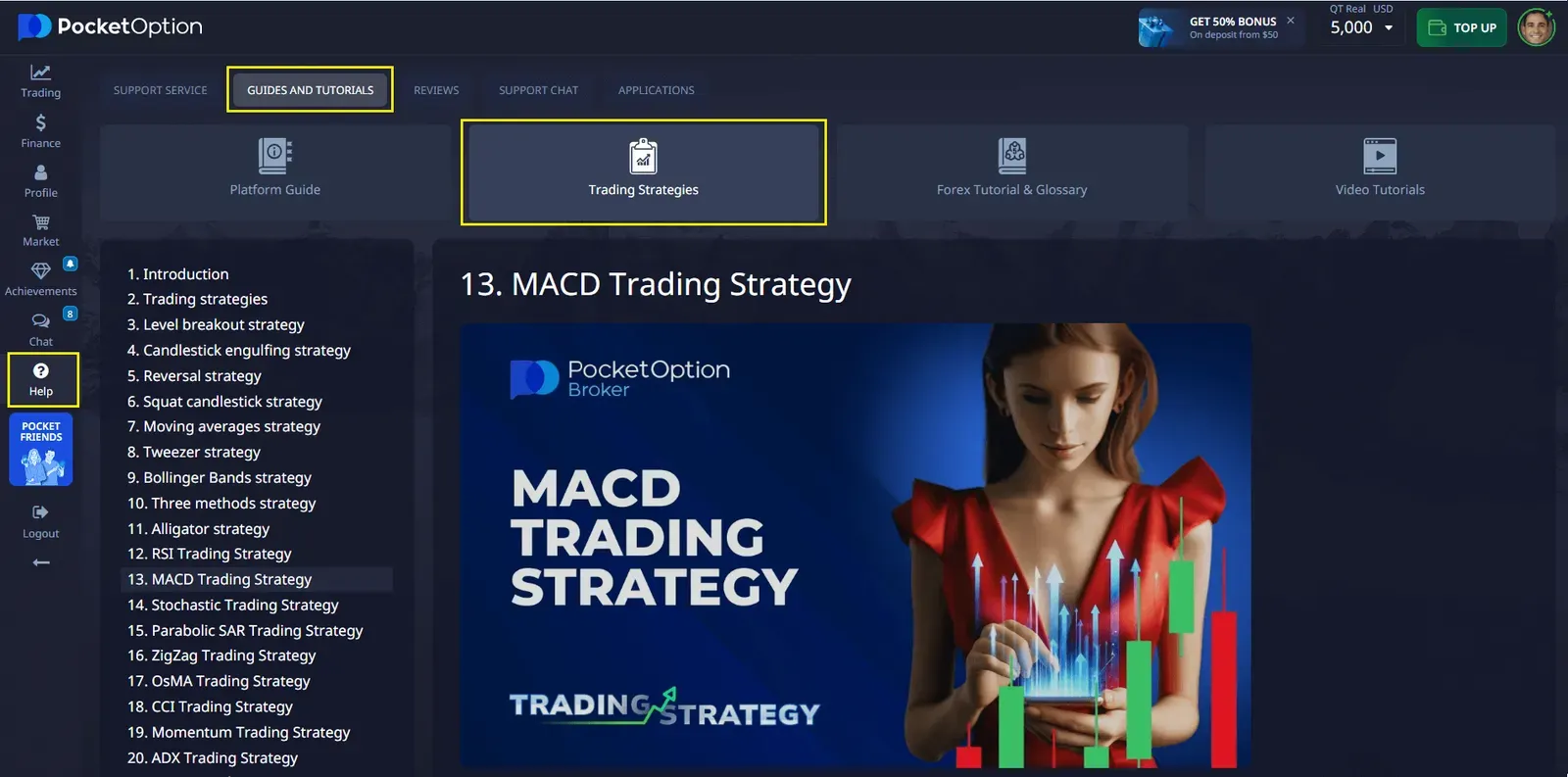

- Testuj różne strategie i horyzonty czasowe

- Regularnie analizuj swoje wyniki

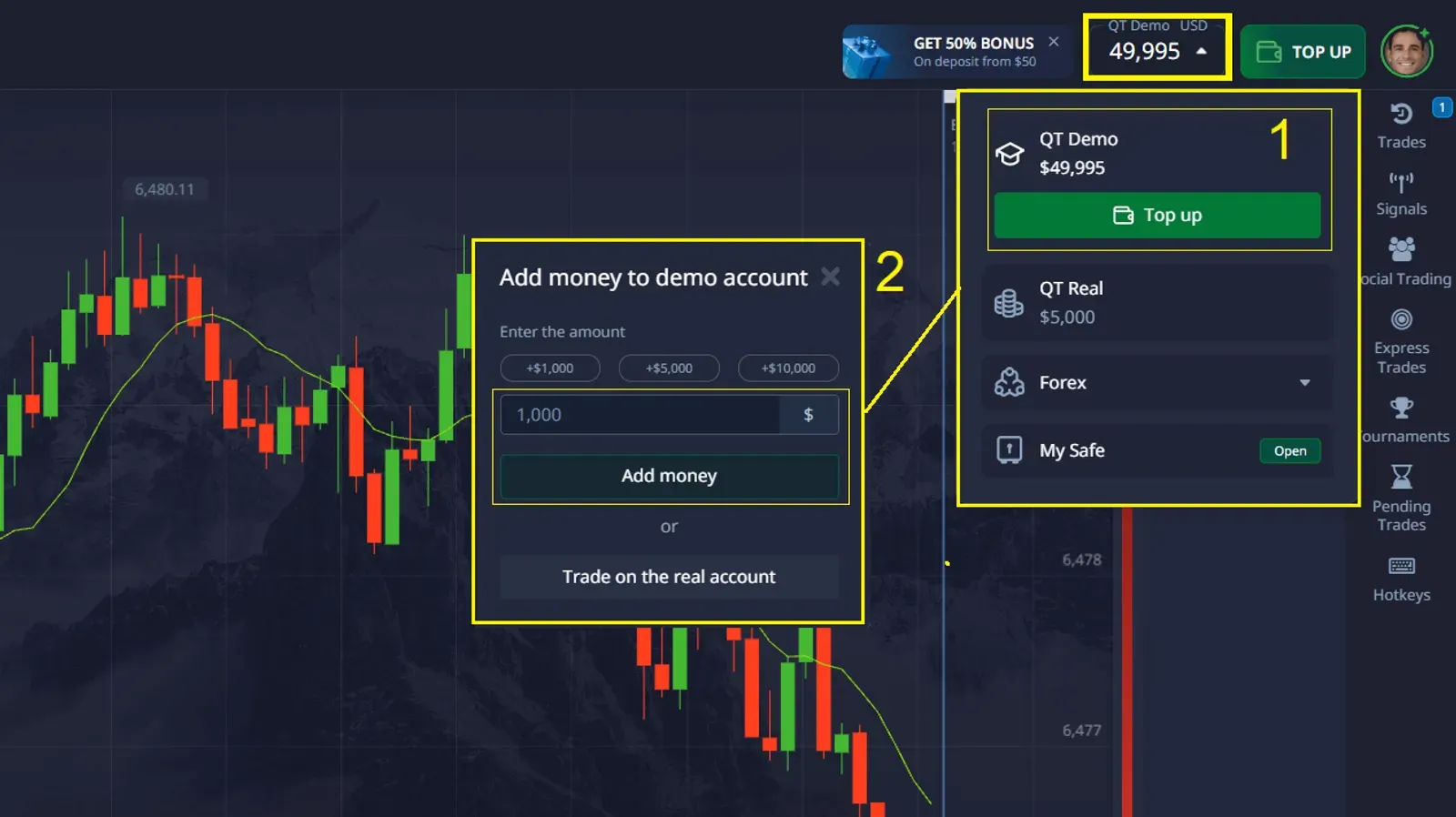

⚡Dobra wiadomość! Konto demo nie jest ograniczone czasowo ani kwotowo! Nawet jeśli wydasz swoje saldo, można je bezpłatnie doładować tyle razy, ile potrzeba! Aby to zrobić:

Aby doładować konto demo, po prostu kliknij saldo konta demo w górnym menu i wybierz przycisk „doładuj”. Pamiętaj, że saldo demo można doładować tylko wtedy, gdy jest poniżej 50 000 USD.

Analiza porównawcza: Trading demo vs. Trading na żywo

Zrozumienie różnic między tradingiem demo a tradingiem na żywo jest kluczowe dla płynnego przejścia. Oto porównanie:

| Aspekt | Demo | Na żywo |

|---|---|---|

| Ryzyko | Brak ryzyka finansowego | Prawdziwe pieniądze na szali |

| Emocje | Ograniczone zaangażowanie emocjonalne | Wysoki wpływ emocjonalny |

| Wykonanie | Często zidealizowane | Może podlegać poślizgom |

| Warunki rynkowe | Symulowane, mogą nie odzwierciedlać zmian w czasie rzeczywistym | Dynamiczne warunki rynkowe w czasie rzeczywistym |

Świadomość tych różnic pomaga rozwinąć bardziej realistyczne podejście do tradingu demo.

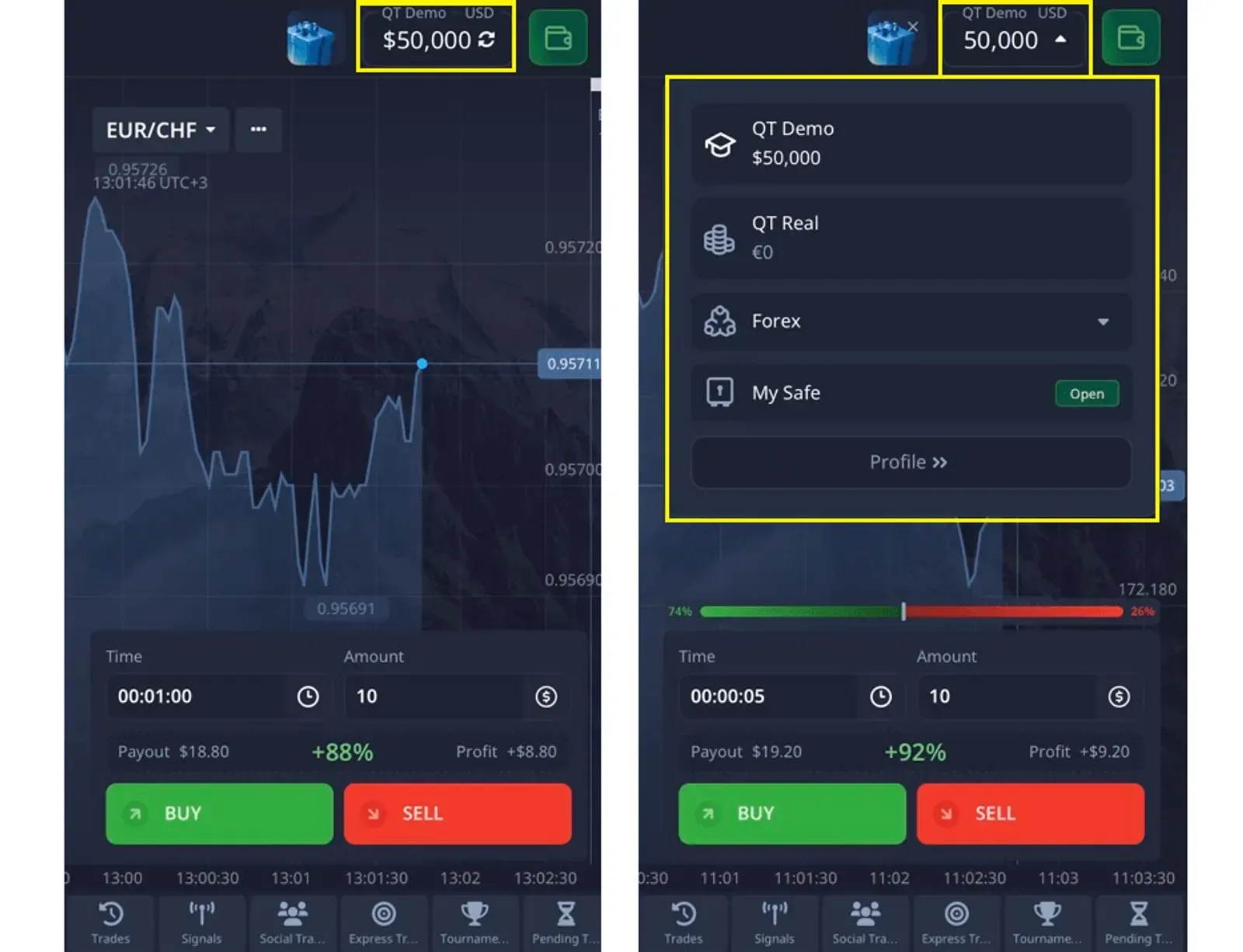

✅ A teraz — to, co najważniejsze: mobilność! Wypróbuj to bezpośrednio na swoim telefonie! Zarejestruj się, kliknij handluj teraz i ćwicz za darmo!

Maksymalizacja nauki z tradingu demo

Aby uzyskać maksymalną wartość z doświadczenia tradingu demo, rozważ te zaawansowane techniki:

- Symuluj różne warunki rynkowe

- Ćwicz strategie zarządzania ryzykiem

- Testuj dane historyczne

- Uczestniczy w konkursach tradingu demo

Techniki te mogą zapewnić bardziej kompleksowe doświadczenie edukacyjne i lepiej przygotować Cię do warunków rynku na żywo.

Przejście z tradingu demo do tradingu na żywo

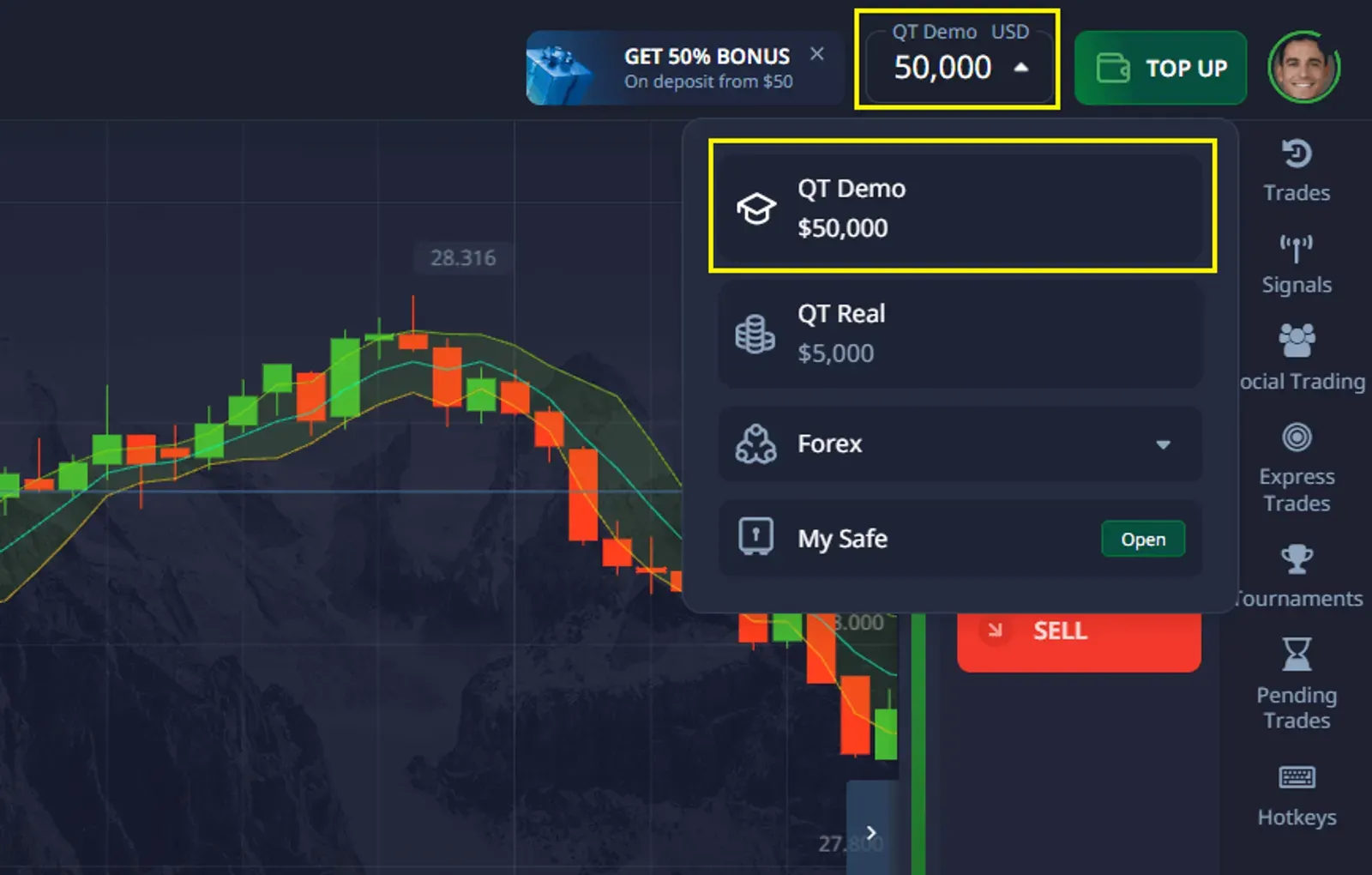

✅Aby przejść z konta demo na konto rzeczywiste i odwrotnie, po prostu kliknij swoje saldo u góry platformy i wybierz żądany typ konta.

Wiedza o tym, kiedy i jak przejść z tradingu demo do tradingu na żywo, jest kluczowa. Rozważ następujące czynniki:

| Czynnik | Wskaźnik gotowości |

|---|---|

| Stała rentowność | Rentowność przez co najmniej 3 kolejne miesiące |

| Kontrola emocjonalna | Zdolność do przestrzegania planu tradingowego bez impulsywnych decyzji |

| Zarządzanie ryzykiem | Systematyczne stosowanie odpowiedniego wymiarowania pozycji i stop-lossów |

| Zaufanie do strategii | Posiadanie dobrze przetestowanej i zrozumiałej strategii tradingowej |

Kiedy te czynniki się zbiegają, może być czas na rozważenie przejścia do tradingu na żywo z małym kontem.

Typowe pułapki do uniknięcia na koncie demo

Chociaż trading treningowy jest doskonałym narzędziem edukacyjnym, istnieje kilka powszechnych błędów, których należy być świadomym:

- Nadmierne handlowanie z powodu braku rzeczywistego ryzyka

- Zaniedbywanie odpowiedniego zarządzania ryzykiem

- Nieprowadzenie dokładnych rejestrów

- Nieprzechodzenie na trading na żywo, gdy jest się gotowym

Unikanie tych pułapek może zapewnić bardziej produktywne i realistyczne doświadczenie tradingu demo.

Podsumowanie

Nauka efektywnego korzystania z demo Pocket Option jest kluczowym krokiem w rozwijaniu umiejętności tradingowych. Traktując trading demo poważnie, wyznaczając jasne cele i stale analizując wyniki, traderzy mogą znacznie zwiększyć swoje szanse na sukces na rynkach na żywo. Pamiętaj, że kluczem do udanego tradingu jest ciągła nauka, praktyka i adaptacja. Wykorzystaj konto praktyczne jako potężne narzędzie do dopracowania swoich strategii i wzmocnienia pewności siebie przed zaryzykowaniem prawdziwego kapitału.

FAQ

Jak długo powinienem ćwiczyć na koncie demo przed przejściem na handel na żywo?

Czas trwania różni się w zależności od osoby, ale ogólnie powinieneś ćwiczyć, dopóki nie będziesz w stanie konsekwentnie wdrażać swojej strategii i wykazywać rentowność przez co najmniej 2-3 miesiące.

Czy mogę korzystać z automatycznych systemów handlowych na koncie demo Pocket Option?

Tak, Pocket Option umożliwia testowanie automatycznych systemów handlowych na swojej platformie demo, co może być cenne dla rozwoju strategii.

Czy warunki rynkowe na koncie demo są identyczne jak w handlu na żywo?

Chociaż konta demo starają się symulować rzeczywiste warunki rynkowe, mogą występować niewielkie różnice w szybkości realizacji i źródłach cen w porównaniu z handlem na żywo.

Ile wirtualnych pieniędzy jest zazwyczaj dostępnych na koncie demo Pocket Option?

Pocket Option zapewnia znaczną kwotę 50 000 USD wirtualnych środków

Czy mogę wrócić do handlu demo po rozpoczęciu handlu na żywo?

Tak, większość platform, w tym Pocket Option, pozwala traderom przełączać się między kontami demo i na żywo, co może być przydatne do testowania nowych strategii.