- Rosnące zapotrzebowanie na infrastrukturę AI i uczenia maszynowego

- Wzrost chmury obliczeniowej i centrów danych

- Wdrażanie 5G i edge computing

- Wysokomarżowe oprogramowanie dla przedsiębiorstw z przejęć

Prognoza Akcji Broadcom (AVGO) 2030: Strategiczne Spostrzeżenia dla Inwestorów Technologicznych

Prognoza akcji Broadcom 2030 staje się kluczowym tematem wśród inwestorów technologicznych poszukujących długoterminowych możliwości wzrostu. Jako lider w dziedzinie półprzewodników i oprogramowania dla przedsiębiorstw, Broadcom (NASDAQ: AVGO) działa na styku nowych technologii i globalnej infrastruktury. Ten artykuł analizuje, jak pozycjonowanie rynkowe, adopcja AI i strategiczne przejęcia mogą wpływać na prognozę akcji Broadcom 2030, pomagając inwestorom budować świadome strategie.

Article navigation

- Obecna Pozycja Rynkowa i Wyniki

- Kluczowe Czynniki Prognozy Akcji Broadcom na 2030 Rok

- Trendy Branżowe i Czynniki Zewnętrzne

- Najnowsze Aktualizacje i Informacje od Osób z Wewnątrz

- Prognozy Cen dla Akcji AVGO do 2030 Roku

- Dlaczego Polegać na Odległych Prognozach? Możliwości Handlowe Są Już Tutaj

- Narzędzia Wspierające Inteligentniejszy Handel na Pocket Option

- Ryzyka i Strategie Ograniczania Ryzyka

- Oś Czasu Inwestycji i Rozważania Strategiczne

- Podsumowanie

Obecna Pozycja Rynkowa i Wyniki

Broadcom od dawna jest uznawany za lidera w przestrzeni półprzewodników, ale jego przejście do oprogramowania dla przedsiębiorstw–podkreślone przejęciem VMware–wyznacza nową erę. Ta dywersyfikacja, wraz z silnymi fundamentami, ma kluczowe znaczenie dla zrozumienia prognozy ceny akcji AVGO na rok 2030.

| Wskaźnik | Obecna Wartość |

|---|---|

| Kapitalizacja Rynkowa | $550B+ |

| Roczny Wzrost Przychodów | ~10% |

| Marża Zysku Netto | ~42% |

| Stopa Dywidendy | ~2.2% |

Kluczowe Czynniki Prognozy Akcji Broadcom na 2030 Rok

Przewiduje się, że przejęcie VMware wygeneruje znaczące powtarzalne przychody, przesuwając AVGO w kierunku bardziej stabilnej bazy zysków. Ta transformacja znacząco wpływa na prognozę akcji AVGO na 2030 rok zarówno w modelach konserwatywnych, jak i optymistycznych.

Z Pocket Option nie musisz czekać do 2030 roku. Handluj ponad 100 aktywami już teraz z rentownością do 92%.

Trendy Branżowe i Czynniki Zewnętrzne

| Trend | Oczekiwany Wpływ |

|---|---|

| Popyt na Chipy AI i HPC | Wzrost przychodów dzięki niestandardowemu krzemowi |

| Wzrost Infrastruktury Chmurowej | Więcej kontraktów na sprzęt sieciowy Broadcom |

| Nadzór Regulacyjny | Opóźnienia w zatwierdzaniu fuzji i przejęć |

| Ryzyko Geopolityczne | Podatność łańcucha dostaw |

Najnowsze Aktualizacje i Informacje od Osób z Wewnątrz

Od I kwartału 2025 roku, Broadcom w pełni zintegrował operacje VMware, generując 10 miliardów dolarów rocznych przychodów z oprogramowania. Osoby z wewnątrz wskazały na odnowione skupienie na produktach wirtualizacyjnych opartych na AI. Podwyższenia rekomendacji analityków w marcu 2025 roku odzwierciedlają zwiększone zaufanie do zysków, wspierając od umiarkowanych do optymistycznych zakresów prognozy akcji Broadcom na 2030 rok.

Prognozy Cen dla Akcji AVGO do 2030 Roku

| Scenariusz | Cena Docelowa | Podstawa |

|---|---|---|

| Konserwatywny | $850 – $1,200 | Stabilny wzrost, umiarkowany wpływ oprogramowania |

| Umiarkowany | $1,300 – $1,900 | Przywództwo w AI, udana integracja |

| Optymistyczny | $2,000 – $3,200 | Dominacja w segmentach AI dla przedsiębiorstw i chipów |

Dlaczego Polegać na Odległych Prognozach? Możliwości Handlowe Są Już Tutaj

Czekanie latami na realizację długoterminowych prognoz może być niepewne i frustrujące. Zamiast czekać do 2030 roku, aby zobaczyć wyniki akcji takiej jak Broadcom (AVGO), traderzy mogą skorzystać z możliwości dostępnych w czasie rzeczywistym już dziś.

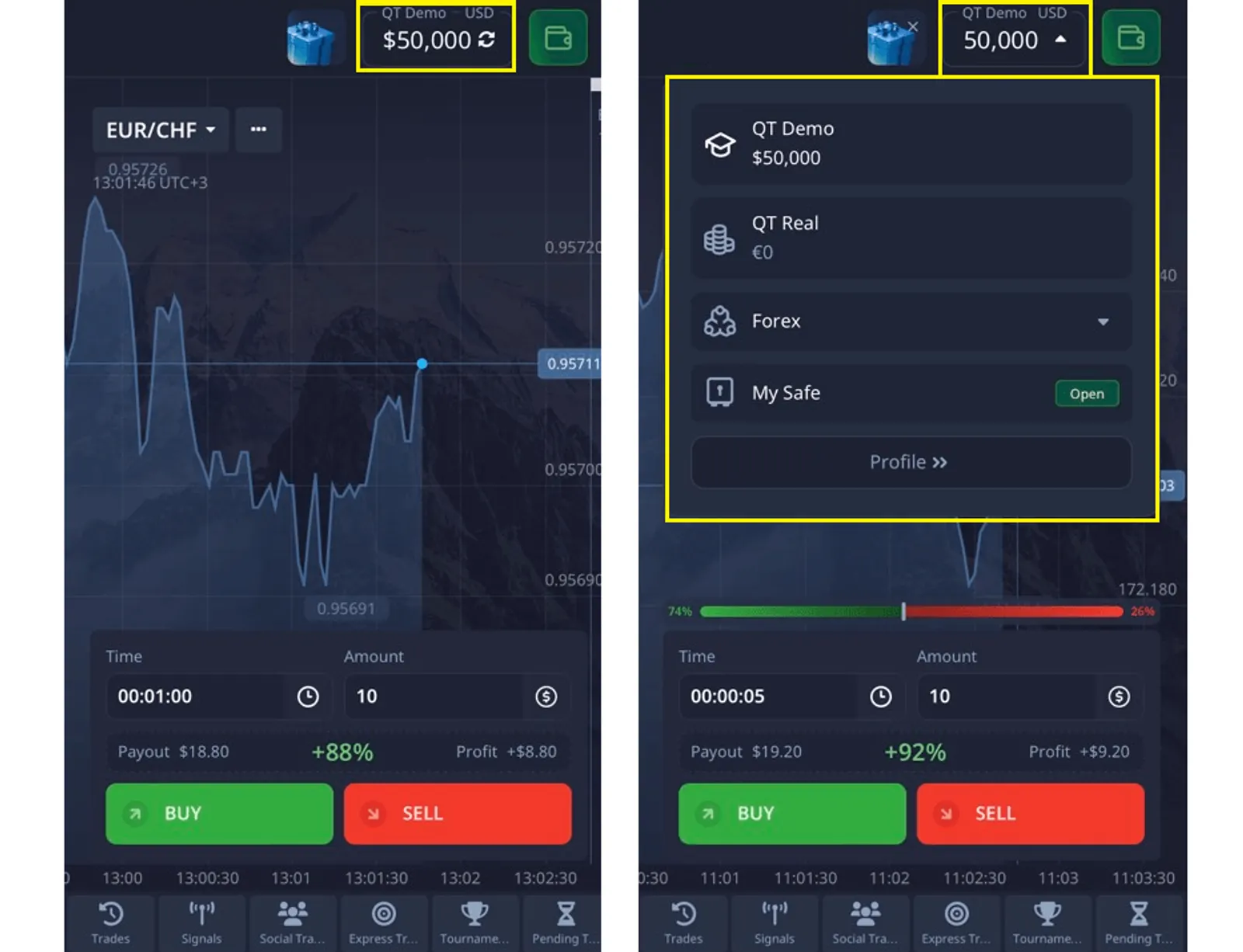

Pocket Option daje bezpośredni dostęp do ponad 100 instrumentów finansowych — w tym akcji, walut i kryptowalut — wszystko przez przeglądarkę lub urządzenie mobilne. Bez skomplikowanych konfiguracji, bez opóźnień.

✔️ Twórz krótkoterminowe prognozy w ciągu kilku sekund i zarabiaj do 92% zysku na transakcji, gdy Twój kierunek jest prawidłowy.

Oto dlaczego traderzy wybierają Pocket Option:

- Działaj Dziś: Reaguj na aktualne trendy cenowe zamiast czekać na scenariusze rozciągnięte na dekady.

- Najpierw Praktyka: Użyj konta demo o wartości $50,000, aby testować i udoskonalać swoje pomysły bez ryzyka finansowego.

- Zacznij od Małych Kwot: Rozpocznij handel z depozytem zaledwie $5– nie ma potrzeby dużego kapitału.

- Pełna Mobilność: Handluj w dowolnym momencie przez przeglądarkę lub aplikację z natychmiastowym wykonaniem.

Niezależnie od tego, czy badasz krótkoterminowe ruchy cen AVGO, czy dopiero zaczynasz przygodę z rynkami finansowymi, Pocket Option daje Ci elastyczność angażowania się, testowania i ulepszania swojej strategii już dziś — nie za 5 lat.

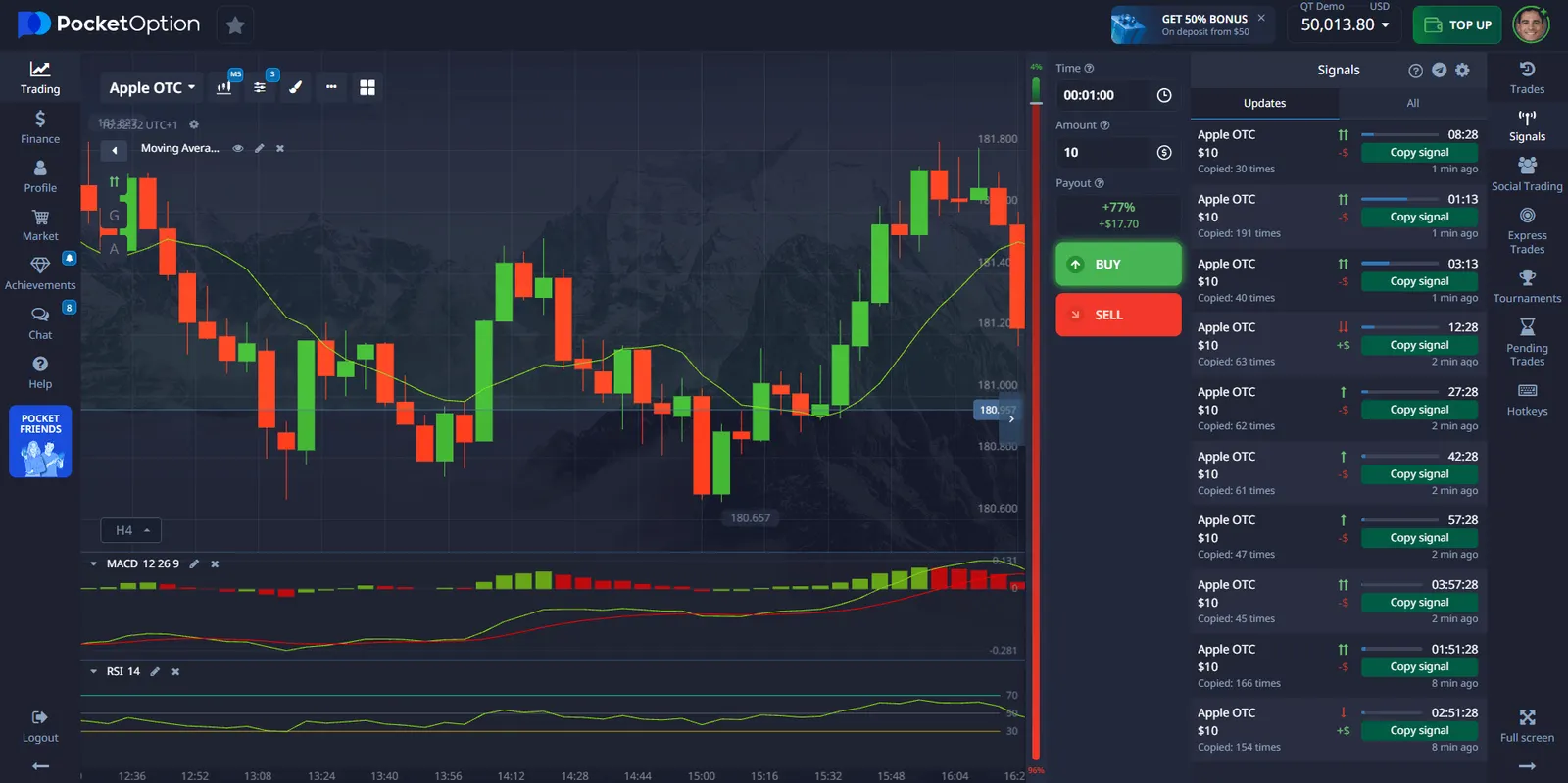

Narzędzia Wspierające Inteligentniejszy Handel na Pocket Option

Pocket Option dostarcza zestaw narzędzi handlowych zaprojektowanych, aby pomóc użytkownikom podejmować świadome decyzje i poprawiać realizację ich strategii. Te narzędzia są szczególnie cenne do analizowania krótkoterminowych trendów i szybkiego reagowania na zmiany rynkowe. Kluczowe funkcje obejmują:

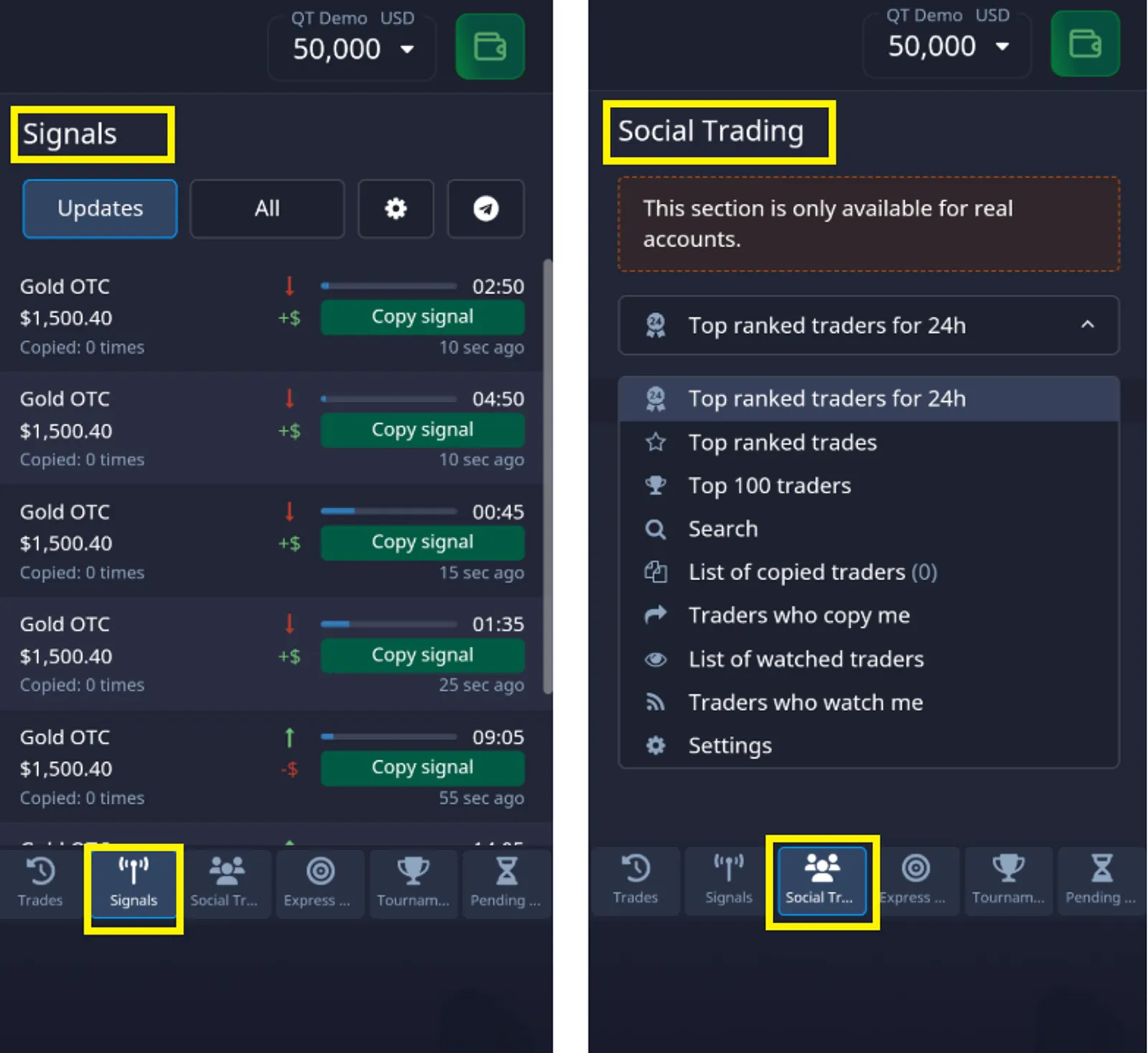

- Sygnały: Zautomatyzowane wskaźniki techniczne, które podkreślają potencjalny kierunek cen i punkty wejścia, pomagając traderom działać pewniej.

- Kalendarz Ekonomiczny: Śledzi nadchodzące globalne wydarzenia finansowe i ich potencjalny wpływ na rynek, umożliwiając planowanie strategiczne.

- Analityka Rynkowa: Oferuje wgląd i aktualizacje w czasie rzeczywistym, aby pomóc użytkownikom być na bieżąco z najnowszymi trendami i możliwościami.

- Narzędzia do Tworzenia Wykresów: Obejmuje szeroki zakres dostosowywanych wskaźników i narzędzi graficznych do analizy technicznej.

- Handel Społecznościowy: Pozwala użytkownikom śledzić i kopiować transakcje doświadczonych traderów — idealne dla początkujących, którzy chcą uczyć się na przykładach.

- Turnieje Handlowe: Wydarzenia konkurencyjne, w których użytkownicy mogą testować strategie, śledzić wyniki i wygrywać nagrody.

- Transakcje Bez Ryzyka: Symulowane transakcje, które pozwalają użytkownikom ćwiczyć i doskonalić strategie bez ryzyka finansowego.

Razem, te funkcje sprawiają, że Pocket Option to nie tylko platforma handlowa, ale także środowisko do nauki i analizy, które wspiera bardziej strategiczne podejmowanie decyzji.

Ryzyka i Strategie Ograniczania Ryzyka

- Zwiększona konkurencja w chipach AI ze strony Nvidia, AMD i startupów

- Nieprzewidywalne regulacje technologiczne i orzeczenia antymonopolowe

- Ryzyko realizacji badań i rozwoju w przestrzeni oprogramowania dla przedsiębiorstw

- Potencjalne spowolnienie globalnych wydatków na technologię

| Ryzyko | Ograniczanie |

|---|---|

| Nasycenie Rynku | Nowe pionowe segmenty produktów, fuzje i przejęcia |

| Zakłócenia Technologiczne | Wysokie wydatki na badania i rozwój, patenty |

| Obawy Dotyczące Wyceny | Wzrost dywidendy, skup akcji własnych |

| Ekspozycja Geopolityczna | Dywersyfikacja dostawców |

Oś Czasu Inwestycji i Rozważania Strategiczne

| Horyzont | Obszary Skupienia |

|---|---|

| Krótkoterminowy (1-2 lata) | Stabilizacja przychodów z oprogramowania, czynniki makro |

| Średnioterminowy (3-5 lat) | Ekspansja AI, pozycjonowanie konkurencyjne |

| Długoterminowy (6-10 lat) | Rola Broadcom w infrastrukturze cyfrowej |

Podsumowanie

Prognoza akcji Broadcom na 2030 rok odzwierciedla firmę w okresie przejściowym–od potentata sprzętowego do hybrydowego lidera technologicznego z ekspozycją na AI, sieci i oprogramowanie dla przedsiębiorstw. Podczas gdy cele cenowe znacznie się różnią, poinformowani inwestorzy powinni oceniać modele prognozy akcji Broadcom na 2030 rok względem ewoluujących trendów rynkowych i używać ustrukturyzowanych narzędzi oraz symulacji do wspierania decyzji opartych na danych.

FAQ

Jaka jest główna teza stojąca za prognozą akcji broadcom na rok 2030?

Teza koncentruje się na ewolucji Broadcom od lidera w dziedzinie półprzewodników do zróżnicowanej potęgi technologicznej z wysokomarżowym oprogramowaniem, silną obecnością w AI i znaczeniem dla globalnej infrastruktury.

Jak dokładne są modele prognozy akcji AVGO na rok 2030?

Chociaż żadna prognoza nie jest pewna, modele są coraz bardziej oparte na danych. Uwzględniają historyczne wyniki, prognozy zysków, popyt na AI i strategiczne przejęcia.

Co sprawia, że przejęcie VMware przez Broadcom jest ważne dla prognoz na rok 2030?

Umowa VMware oznacza przejście od cyklicznego sprzętu do powtarzalnych przychodów z oprogramowania, potencjalnie stabilizując zyski i zwiększając mnożniki wyceny do 2030 roku.

Czy ryzyka geopolityczne stanowią poważne zagrożenie dla prognozy akcji broadcom na rok 2030?

Tak, zwłaszcza biorąc pod uwagę ekspozycję łańcucha dostaw Broadcom i przeszkody regulacyjne. Łagodzenie tych ryzyk wymaga dywersyfikacji i zgodności z przepisami.

Jak długoterminowi traderzy mogą wykorzystywać platformy do modelowania strategii AVGO?

Platformy oferujące symulacje, narzędzia do tworzenia wykresów, alerty i dostęp do danych długoterminowych pomagają inwestorom testować i dostosowywać strategie zgodne z prognozą akcji broadcom na rok 2030.