- Trendy branżowe w frekwencji kinowej

- Postępy technologiczne w doświadczeniach kinowych

- Konkurencja ze strony usług streamingowych

- Zdolność AMC do dywersyfikacji źródeł przychodu

- Warunki makroekonomiczne

Prognoza Ceny Akcji AMC 2030: Projekcja Przyszłej Wartości

Gdy inwestorzy patrzą w przyszłość, wielu jest ciekawych potencjalnej trajektorii akcji AMC Entertainment Holdings, Inc. (AMC). Ten artykuł zagłębia się w prognozę ceny akcji amc na rok 2030, badając różne czynniki, które mogą wpłynąć na wycenę firmy w ciągu następnej dekady.

Zrozumienie obecnej pozycji AMC

Zanim przejdziemy do prognozy ceny akcji AMC na rok 2030, istotne jest zrozumienie obecnej pozycji rynkowej AMC i jej ostatnich wyników. AMC Entertainment Holdings jest jedną z największych sieci kin na świecie, z istotną obecnością w Stanach Zjednoczonych i Europie.

| Wskaźnik | Wartość (stan na 2023 r.) |

|---|---|

| Kapitalizacja rynkowa | Około 2,5 miliarda dolarów |

| Przychody | 3,9 miliarda dolarów (2022) |

| Liczba kin | 950+ |

| Liczba ekranów | 10 500+ |

Firma w ostatnich latach borykała się ze znaczącymi wyzwaniami, w tym z wpływem pandemii COVID-19 i wzrostem popularności usług streamingowych. Jednak AMC wykazała się odpornością dzięki strategicznym inicjatywom i lojalnej bazie klientów.

Prognoza ceny akcji AMC na 2030 rok – Podsumowanie na podstawie ponad 30 źródeł

Prognozy ceny akcji AMC Entertainment Holdings, Inc. (AMC) na rok 2030 znacznie się różnią w zależności od źródła i zastosowanej metodologii. Poniżej przedstawiono porównanie prognoz z różnych renomowanych platform:

| Źródło | Cena minimalna | Cena średnia | Cena maksymalna | Uwagi |

|---|---|---|---|---|

| CoinCodex | 0,45$ | 1,39$ | 3,45$ | Przewiduje wzrost do 2029 r., po którym nastąpi spadek w 2030 r. |

| BTCC | 6,15$ | 7,07$ | 8,63$ | Oczekuje stopniowego wzrostu w czasie. |

| Skilling | 14,59$ | 223,36$ | 432,13$ | Ekstremalnie szeroki zakres pokazujący wysoką niepewność. |

| Stockscan.io | 8,55$ | 12,09$ | 15,63$ | Przewiduje znaczący wzrost ceny. |

| CoinPriceForecast (coinpriceforecast.com) | 12,22$ | 13,14$ | 14,05$ | Oczekuje stabilnego trendu wzrostowego. |

Czynniki wpływające na prognozę ceny akcji AMC na 2030 rok

Kilka kluczowych czynników prawdopodobnie odegra rolę w kształtowaniu prognozy ceny akcji AMC na 2030 rok:

Przyjrzyjmy się każdemu z tych czynników bardziej szczegółowo, aby lepiej zrozumieć ich potencjalny wpływ na długoterminowe wyniki akcji AMC.

1. Trendy frekwencji kinowej

Przyszłość frekwencji kinowej jest kluczowym czynnikiem w prognozach akcji AMC na 2030 rok. Chociaż usługi streamingowe zyskały na popularności, nadal istnieje duże zapotrzebowanie na doświadczenia kinowe.

| Rok | Globalne przychody z box office (miliardy USD) |

|---|---|

| 2019 (przed pandemią) | 42,5 |

| 2020 | 12,0 |

| 2021 | 21,3 |

| 2022 | 25,9 |

W miarę dalszego ożywienia branży, innowacje w produkcji i marketingu filmów mogłyby napędzać wzrost frekwencji, potencjalnie zwiększając przychody AMC i cenę akcji.

2. Postępy technologiczne

Inwestycje AMC w najnowocześniejszą technologię kinową mogą mieć znaczący wpływ na prognozę akcji AMC na 2030 rok. Ulepszone doświadczenia wizualne, takie jak IMAX, Dolby Cinema i 4DX, mogą przyciągnąć więcej widzów i uzasadnić wyższe ceny.

- Integracja wirtualnej rzeczywistości (VR) i rozszerzonej rzeczywistości (AR)

- Ulepszone systemy dźwiękowe i jakość ekranu

- Interaktywne elementy w kinach

Te postępy technologiczne mogą pomóc AMC wyróżnić się na tle opcji domowego oglądania i utrzymać przewagę konkurencyjną.

3. Konkurencja ze strony usług streamingowych

Wzrost platform streamingowych stanowi zarówno wyzwania, jak i możliwości dla AMC. Chociaż może to wpłynąć na tradycyjną frekwencję w kinach, AMC wykazała zdolność adaptacji, nawiązując współpracę z usługami streamingowymi w celu organizacji ekskluzywnych pokazów i wydarzeń.

| Strategia | Potencjalny wpływ |

|---|---|

| Wyłączne okna kinowe | Utrzymanie początkowej atrakcyjności box office |

| Partnerstwa z platformami streamingowymi | Nowe źródła przychodów i zaangażowanie widzów |

| Premium doświadczenia kinowe | Odróżnienie od domowego oglądania |

Zdolność AMC do poruszania się w tym zmieniającym się krajobrazie będzie kluczowa dla perspektyw akcji AMC w 2030 roku.

4. Dywersyfikacja przychodów

Aby osiągnąć pozytywną 5-letnią prognozę akcji AMC i na dalsze lata, firma może potrzebować eksploracji dodatkowych źródeł przychodów. Niektóre potencjalne obszary dywersyfikacji obejmują:

- Organizacja wydarzeń i rozrywka na żywo

- Turnieje e-sportowe i gamingowe

- Wynajem prywatnych kin na wydarzenia korporacyjne

- Rozszerzona oferta jedzenia i napojów

Pomyślne rozwijanie się w tych obszarach mogłoby zapewnić AMC bardziej stabilne i zróżnicowane źródła dochodów, potencjalnie poprawiając zaufanie inwestorów i wyniki akcji.

5. Czynniki makroekonomiczne

Szersze warunki ekonomiczne będą odgrywać znaczącą rolę w prognozie ceny akcji AMC na 2030 rok. Czynniki takie jak inflacja, nawyki wydatków konsumenckich i ogólny wzrost gospodarczy mogą wpływać na wyniki AMC i wycenę akcji.

| Czynnik ekonomiczny | Potencjalny wpływ na akcje AMC |

|---|---|

| Inflacja | Może wpływać na ceny biletów i koszty operacyjne |

| Wydatki konsumenckie na dobra dyskrecjonalne | Wpływa na frekwencję kinową i sprzedaż koncesji |

| Wzrost PKB | Może wpływać na ogólne nastroje rynkowe i wyceny akcji |

Inwestorzy rozważający długoterminowe pozycje w AMC powinni monitorować te trendy makroekonomiczne i ich potencjalny wpływ na kondycję finansową firmy.

Opinie ekspertów na temat prognozy ceny akcji AMC na 2030 rok

Choć trudno podać dokładną prognozę ceny akcji AMC na 2030 rok, analitycy finansowi i eksperci branżowi oferują różne perspektywy dotyczące długoterminowych perspektyw firmy.

| Nastawienie analityka | Kluczowe punkty |

|---|---|

| Bycze | – Powrót frekwencji kinowej- Udane wysiłki dywersyfikacyjne- Innowacje technologiczne napędzające wzrost |

| Neutralne | – Zrównoważony pogląd na wyzwania i możliwości- Nacisk na zdolność adaptacji do zmian rynkowych |

| Niedźwiedzie | – Obawy dotyczące długoterminowych trendów branży kinowej- Konkurencja ze strony usług streamingowych- Wyzwania w zarządzaniu zadłużeniem |

Warto zauważyć, że te prognozy są spekulacyjne i podlegają zmianom w oparciu o różne czynniki wpływające na firmę i szerszy rynek.

Strategie dla inwestorów długoterminowych

Dla tych, którzy rozważają AMC jako inwestycję długoterminową, mając na uwadze prognozę ceny akcji AMC na 2030 rok, warto rozważyć następujące strategie:

- Dywersyfikacja portfela w celu zarządzania ryzykiem

- Bieżące informacje o trendach branżowych i inicjatywach strategicznych AMC

- Monitorowanie kwartalnych raportów zysków i kluczowych wskaźników wydajności

- Rozważenie uśredniania kosztów w dolarach, aby złagodzić zmienność rynku

Dlaczego czekać do 2030 roku? Handluj na Pocket Option już dziś

Długoterminowe prognozy, takie jak przewidywania ceny akcji AMC na 2030 rok, wymagają lat cierpliwości, zmian rynkowych i ciągłej niepewności. Ale po co czekać dekadę na wyniki, skoro możesz handlować ruchami cenowymi już dziś i zarządzać swoim kapitałem w czasie rzeczywistym?

Pocket Option to globalna platforma tradingowa uruchomiona w 2017 roku. Daje natychmiastowy dostęp do ponad 100 instrumentów finansowych — w tym akcji takich jak AMC, walut i kryptowalut — wszystko bez pobierania czy skomplikowanych instalacji.

Przewiduj kierunek — w górę lub w dół — i zarabiaj do 92% zysku za transakcję, jeśli Twoja prognoza jest poprawna.

Co otrzymujesz z Pocket Option:

- Handluj teraz, nie później Zapomnij o dziesięcioletnich prognozach — działaj na trendach cenowych AMC już dziś.

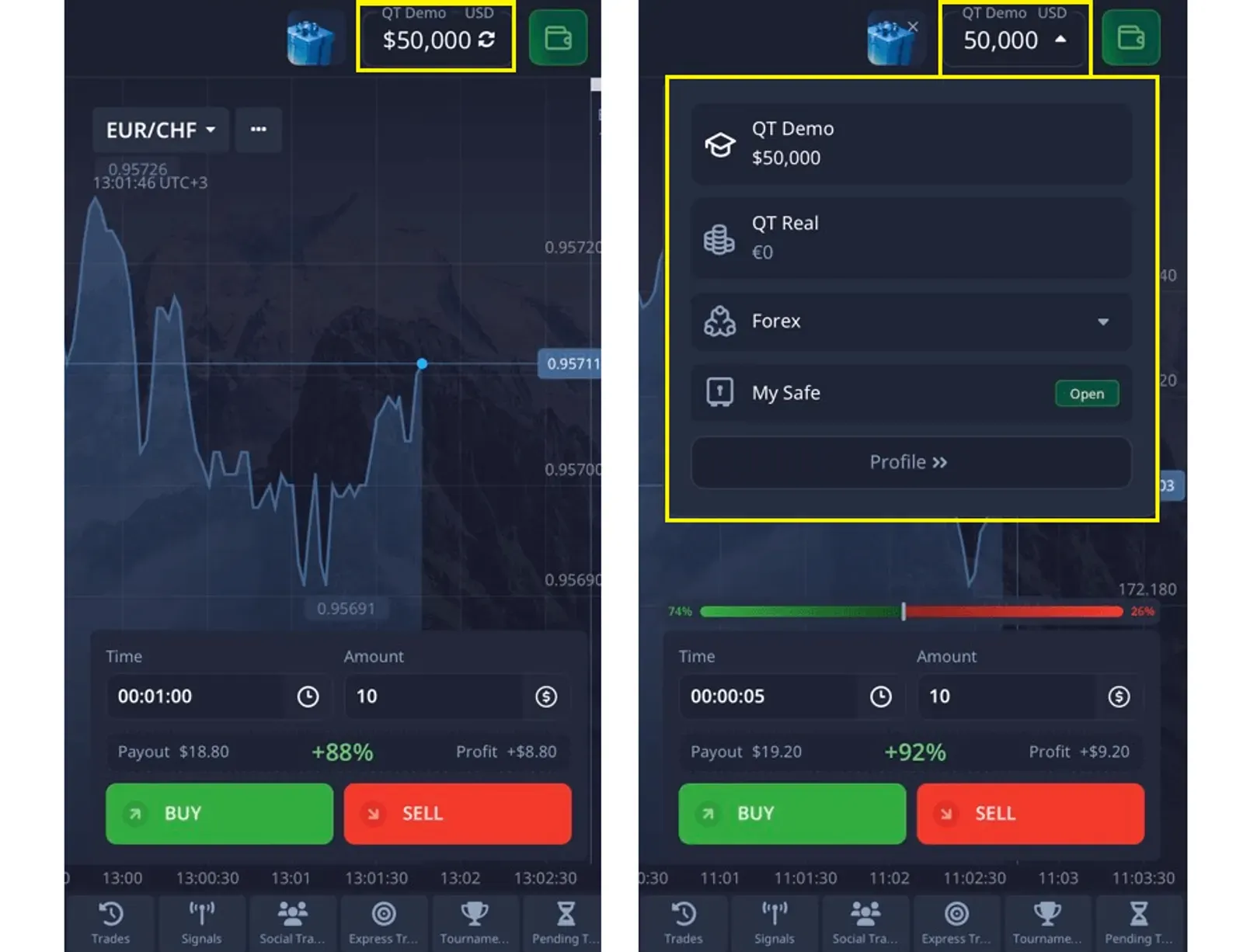

- Tryb demo 50 000$ Ucz się i ćwicz z wirtualnymi funduszami przed zainwestowaniem prawdziwych pieniędzy.

- Ponad 100 dostępnych aktywów Handluj akcjami, kryptowalutami, forex i więcej, zaczynając od zaledwie 5$.

- Bez potrzeby instalacji Dostęp bezpośrednio z przeglądarki lub aplikacji mobilnej.

Narzędzia stworzone do inteligentniejszego handlu:

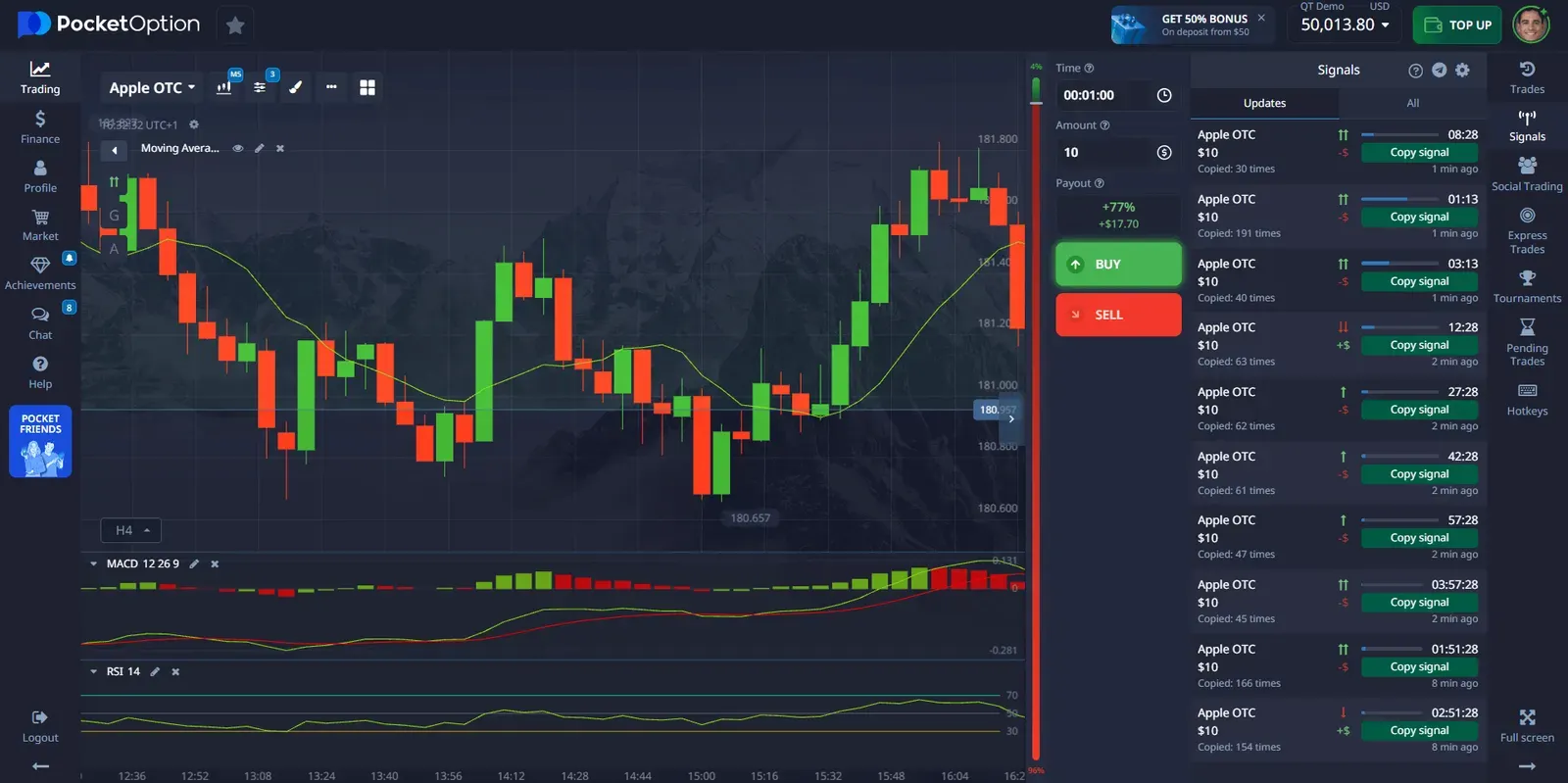

- Niestandardowe wykresy i wskaźniki Analizuj trendy akcji AMC za pomocą zaawansowanych narzędzi i wielu ram czasowych.

- AI i boty Automatyzuj swój handel za pomocą inteligentnych strategii i algorytmów.

- Copy Trading Śledź doświadczonych traderów i rozwijaj swoje konto podczas nauki.

- Turnieje tradingowe Rywalizuj, testuj swoje umiejętności i wygrywaj prawdziwe nagrody.

Dodatkowe korzyści dla każdego tradera:

- Bonusy i promocje Zwiększ swój kapitał dzięki sezonowym ofertom i zachętom.

- Elastyczne transakcje Wybieraj spośród ponad 50 metod wpłat i wypłat.

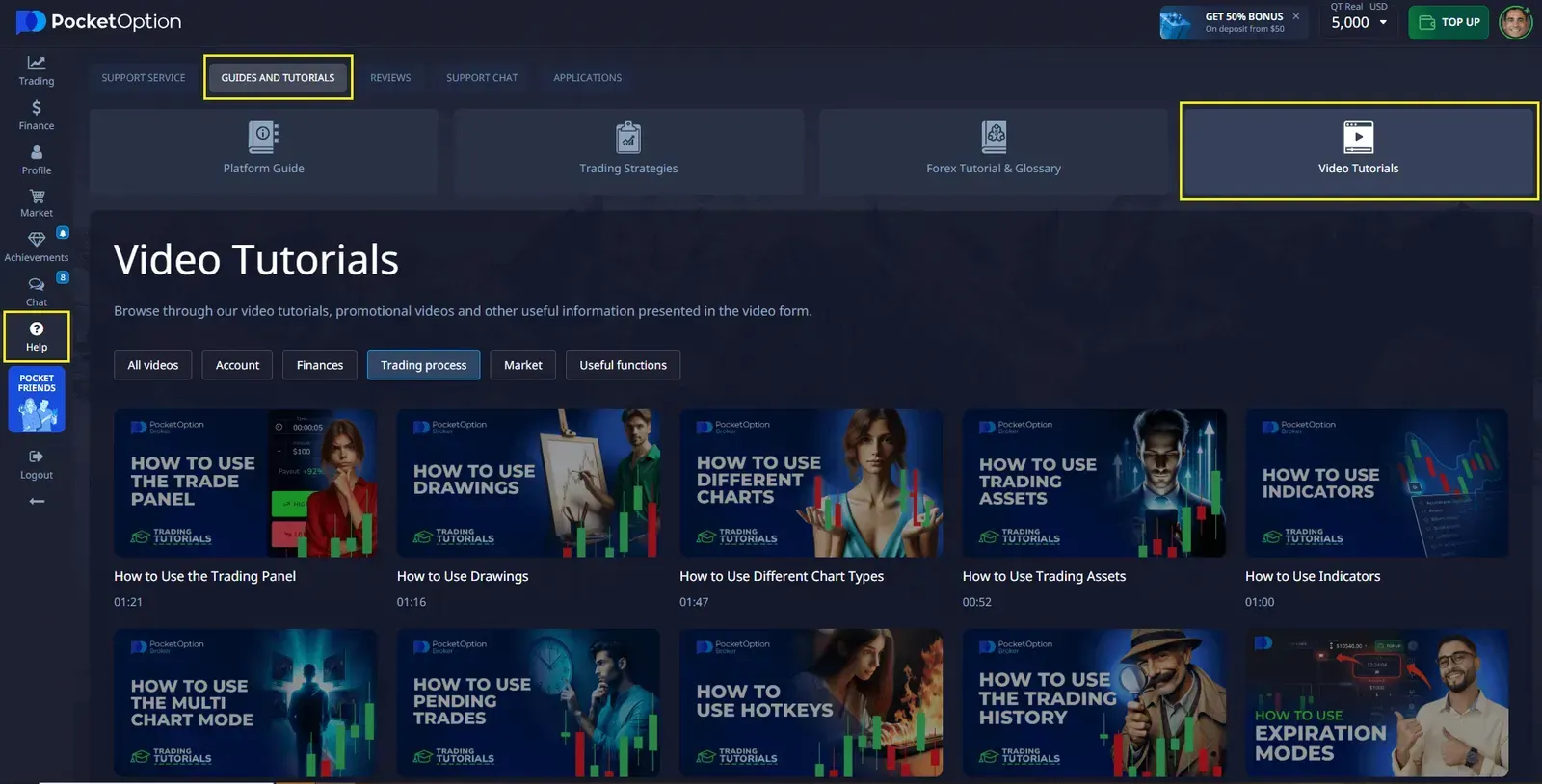

- Centrum edukacyjne Dostęp do strategii tradingowych, analiz trendów i filmów instruktażowych.

Handluj w ruchu:

Korzystaj z aplikacji mobilnej Pocket Option, aby pozostać na rynku z dowolnego miejsca — podczas przerwy na kawę lub w trakcie dojazdów. Otwieraj transakcje w zaledwie kilka sekund.

Praktykuj z 50 000$ w trybie demo lub zacznij na żywo z zaledwie 5$.

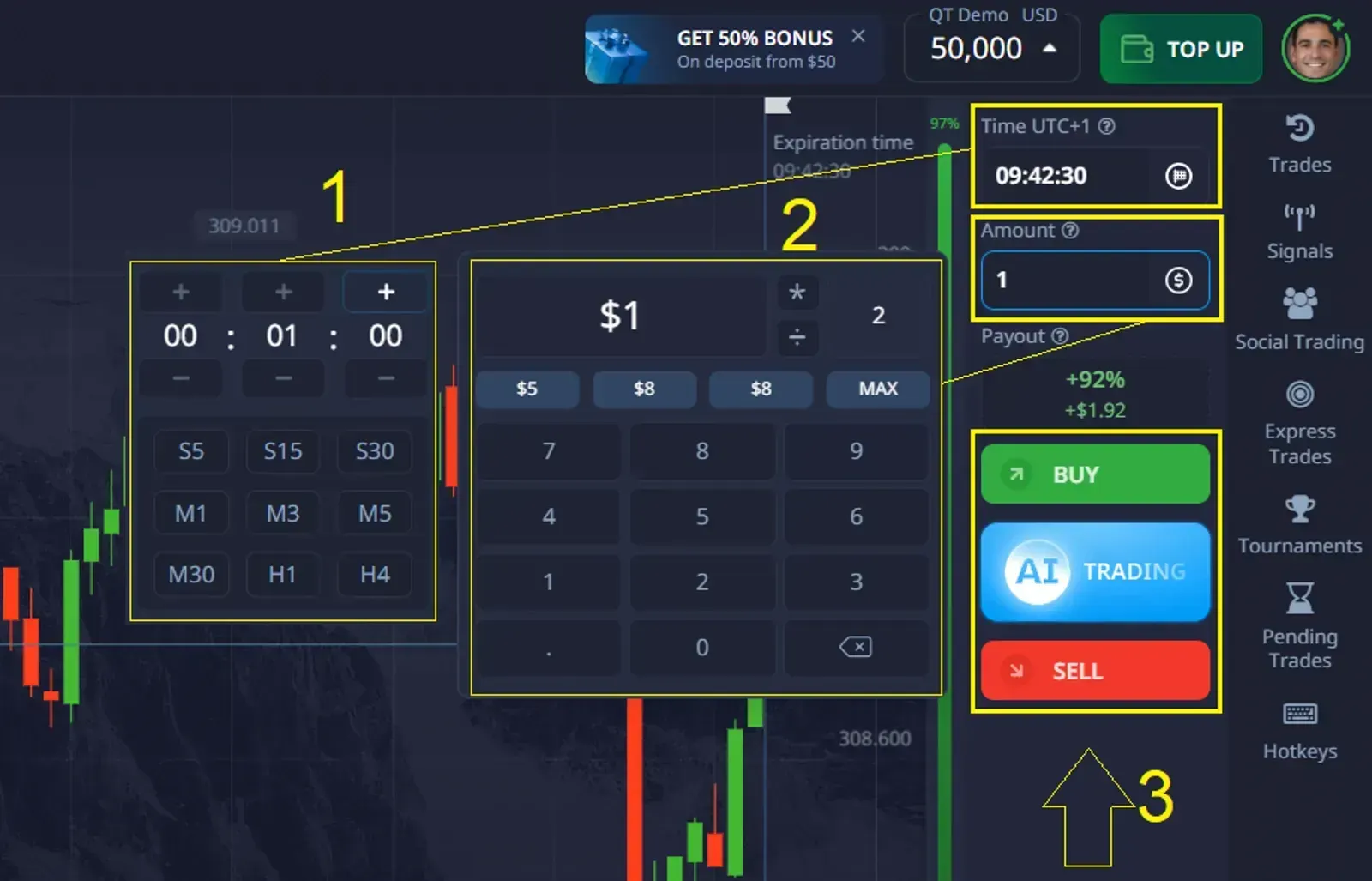

Jak otworzyć transakcję na Pocket Option:

- Wybierz swój aktyw spośród ponad 100 instrumentów

- Analizuj wykres za pomocą narzędzia obserwacji rynku lub wskaźników technicznych.

- Ustaw kwotę transakcji — od 1$.

- Wybierz czas trwania transakcji — od 5 sekund do kilku godzin.

- Dokonaj swojej prognozy:

- Jeśli uważasz, że cena wzrośnie, kliknij KUPUJ.

- Jeśli uważasz, że spadnie, kliknij SPRZEDAJ.

- Jeśli Twoja prognoza jest poprawna, zarobisz do 92% zysku, który jest pokazywany przed transakcją.

✔️ Z prawdziwym kontem zaczynającym się od zaledwie 5$, odblokujesz dodatkowe funkcje, takie jak copy trading, nagrody cashback i więcej.

Podsumowanie

Prognoza ceny akcji AMC na 2030 rok podlega licznym zmiennym i potencjalnym zmianom rynkowym. Choć firma stoi przed wyzwaniami związanymi ze zmieniającymi się nawykami konsumentów i zakłóceniami technologicznymi, ma również możliwości rozwoju poprzez innowacje i dywersyfikację. Inwestorzy powinni dokładnie rozważyć adaptacyjne strategie AMC, trendy branżowe i szersze czynniki ekonomiczne przy podejmowaniu długoterminowych decyzji inwestycyjnych. Jak w przypadku każdej inwestycji, zaleca się dokładne badanie i konsultacje z doradcami finansowymi przed dokonaniem znaczących alokacji portfelowych.

FAQ

Jakie czynniki będą miały największy wpływ na cenę akcji AMC w 2030 roku?

Kluczowe czynniki obejmują trendy w uczęszczaniu do kin, postęp technologiczny w doświadczeniach kinowych, konkurencję ze strony usług streamingowych, wysiłki AMC w zakresie dywersyfikacji przychodów oraz ogólne warunki makroekonomiczne.

Czy akcje AMC są dobrą inwestycją długoterminową?

Potencjał akcji AMC jako inwestycji długoterminowej zależy od zdolności firmy do dostosowania się do zmieniających się warunków rynkowych, zarządzania długiem i wykorzystywania nowych możliwości. Inwestorzy powinni dokładnie ocenić swoją tolerancję na ryzyko i przeprowadzić dokładne badania przed podjęciem decyzji inwestycyjnych.

Jak usługi streamingowe mogą wpłynąć na przyszłe wyniki akcji AMC?

Chociaż usługi streamingowe stanowią wyzwanie dla tradycyjnego kina, AMC wykazało się adaptacyjnością, współpracując z tymi platformami przy wyłącznych pokazach i wydarzeniach. Powodzenie firmy w poruszaniu się po tym zmieniającym się krajobrazie prawdopodobnie wpłynie na wyniki jej akcji.

Jakie nowe źródła przychodów może zbadać AMC, aby zwiększyć wartość swoich akcji do 2030 roku?

Potencjalne nowe źródła przychodów dla AMC obejmują organizację imprez, turnieje e-sportowe, wynajem prywatnych kin na imprezy firmowe oraz rozszerzoną ofertę żywności i napojów.

Jak mogę wykorzystać Pocket Option do kształtowania mojej strategii inwestycyjnej w akcje AMC?

Pocket Option oferuje różne narzędzia i zasoby, które mogą pomóc inwestorom analizować trendy rynkowe, uzyskiwać dostęp do danych w czasie rzeczywistym i podejmować świadome decyzje dotyczące akcji i innych papierów wartościowych. Jednakże, zawsze przeprowadzaj własne badania i rozważ konsultację z doradcą finansowym przed podjęciem decyzji inwestycyjnych.