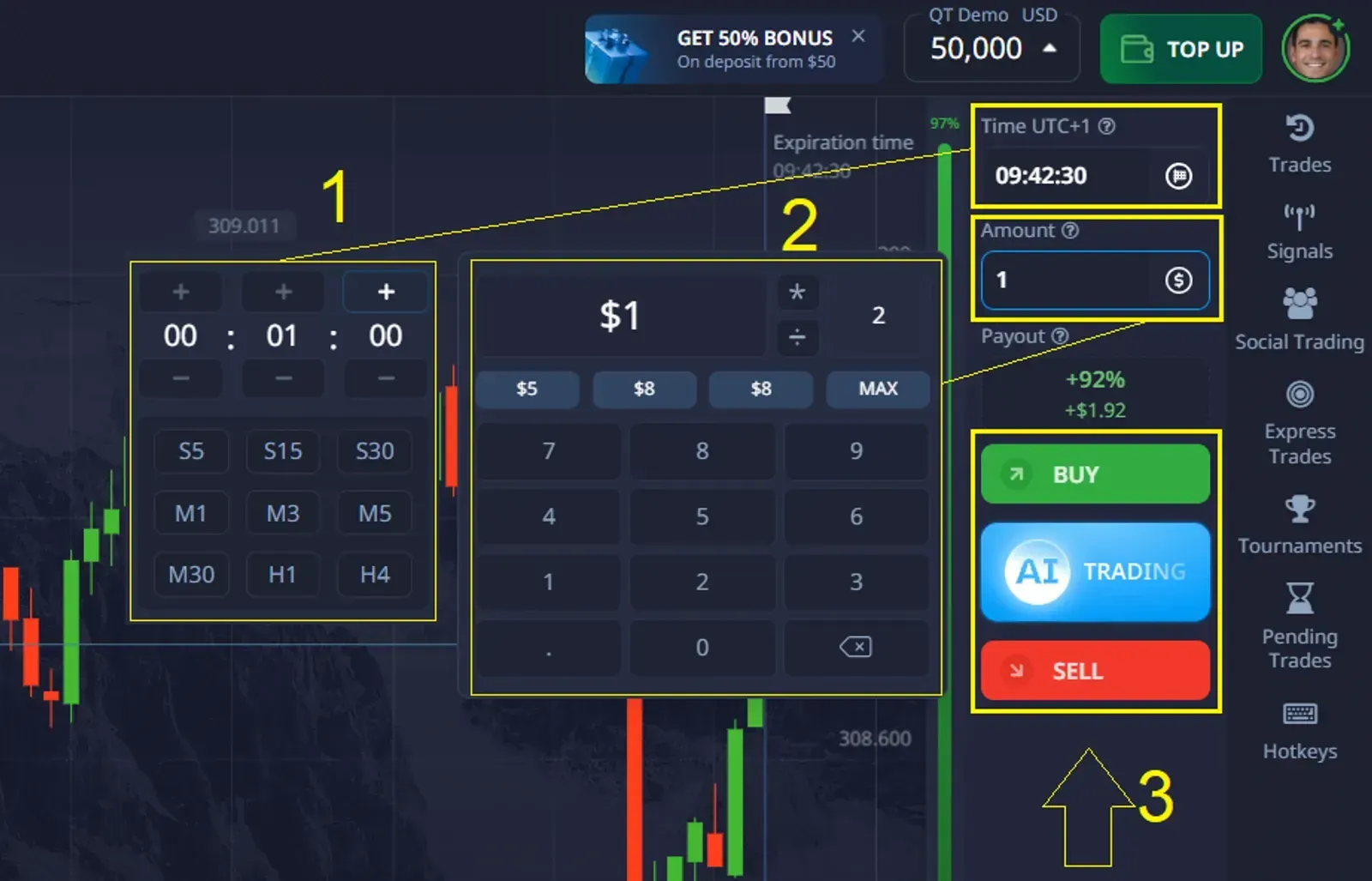

- Wybierz aktywo — handluj akcjami obiecujących firm AI lub innymi popularnymi instrumentami.

- Analizuj wykres — korzystaj ze wskaźników nastrojów traderów lub narzędzi analizy technicznej.

- Ustaw kwotę transakcji — zaczynając od zaledwie 1$.

- Wybierz czas trwania transakcji — od 5 sekund do kilku godzin.

- Dokonaj prognozy — jeśli uważasz, że cena wzrośnie, kliknij KUPUJ; jeśli spodziewasz się spadku, kliknij SPRZEDAJ.

Możliwości inwestycji w AI: Eksploracja fenomenu akcji AI za 3$

W ostatnich latach szum wokół sztucznej inteligencji (AI) osiągnął gorączkowy poziom, a inwestorzy prześcigają się w poszukiwaniu kolejnej wielkiej okazji. Jednym z tematów, który zyskał znaczącą uwagę, jest fenomen "akcji AI za 3$". Ten artykuł zagłębia się w rzeczywiste studia przypadków i historie sukcesu związane z tą intrygującą perspektywą inwestycyjną, badając, jak osoby i firmy osiągnęły sukces, zastosowane metody i uzyskane wyniki.

Article navigation

- Zrozumienie trendu Akcji AI za 3$”

- Studia przypadków: Historie sukcesu w inwestycjach w akcje AI

- Szybki handel akcjami AI na Pocket Option

- Jak Pocket Option pomaga Ci usprawnić swój trading

- Kluczowe strategie dla udanych inwestycji w akcje AI

- Identyfikowanie potencjalnych okazji „Cudownych akcji AI za 3$”

- Ryzyka i rozważania

- Opinie ekspertów na temat inwestycji w akcje AI

- Perspektywy przyszłości dla inwestycji w akcje AI

- Podsumowanie

Zrozumienie trendu Akcji AI za 3$”

Termin „akcje AI za 3$” odnosi się do kategorii tanich akcji w firmach, które są mocno zaangażowane w technologię sztucznej inteligencji. Akcje te wzbudziły zainteresowanie ze względu na ich znaczący potencjał wzrostu, ponieważ AI nadal rewolucjonizuje różne branże. Inwestorzy są przyciągani do tych akcji ze względu na ich przystępność cenową i możliwość znacznych zwrotów, jeśli firma odniesie sukces w swoich przedsięwzięciach związanych z AI.

Choć konkretna tożsamość „cudownej akcji AI za 3$” może się różnić w zależności od warunków rynkowych i indywidualnych perspektyw, koncepcja ta zdobyła wyobraźnię wielu inwestorów poszukujących kolejnej wielkiej okazji w sektorze AI.

Studia przypadków: Historie sukcesu w inwestycjach w akcje AI

Studium przypadku 1: Szybki wzrost startupu technologicznego

Godna uwagi historia sukcesu dotyczy małego startupu technologicznego, który skupił się na rozwoju rozwiązań cyberbezpieczeństwa opartych na AI. Początkowo notowana po nieco mniej niż 3$ za akcję, cena akcji firmy odnotowała dramatyczny wzrost w okresie dwóch lat, gdy jej innowacyjne produkty zyskiwały popularność na rynku.

| Rok | Cena akcji | Kapitalizacja rynkowa |

|---|---|---|

| 2022 | 2,95$ | 50 milionów $ |

| 2023 | 15,20$ | 280 milionów $ |

| 2024 | 42,75$ | 850 milionów $ |

Ten szybki wzrost demonstruje potencjał „akcji AI za 3$ gotowych do wzlotu” kiedy firma skutecznie wykorzystuje wschodzące technologie AI.

Studium przypadku 2: Innowacje w opiece zdrowotnej napędzane przez AI

Inny imponujący przypadek dotyczy firmy technologicznej z branży opieki zdrowotnej, która wykorzystała AI do opracowania przełomowych narzędzi diagnostycznych. Zaczynając jako „akcja AI za 3$”, cena akcji firmy znacznie wzrosła, gdy jej rozwiązania oparte na AI uzyskały zatwierdzenie regulacyjne i szerokie zastosowanie w szpitalach na całym świecie.

| Kamień milowy | Data | Cena akcji |

|---|---|---|

| Pierwsza oferta publiczna | Sty 2022 | 3,00$ |

| Zatwierdzenie FDA | Sie 2023 | 18,50$ |

| Ekspansja międzynarodowa | Mar 2024 | 37,25$ |

Szybki handel akcjami AI na Pocket Option

Chcesz odkryć trend AI bez długiego oczekiwania? Pocket Option to Twoja szansa! Tutaj możesz handlować akcjami związanymi z AI, otwierać transakcje zaczynając od zaledwie 1$, i zobaczyć wyniki w zaledwie 5 sekund!

Jak to działa?

Jeśli Twoja prognoza jest poprawna, możesz uzyskać do 92% zwrotu na swojej transakcji!

Jak Pocket Option pomaga Ci usprawnić swój trading

Pocket Option oferuje różnorodne narzędzia i funkcje, które pomogą Ci analizować i poprawiać wyniki handlowe, w tym śledzenie krzywej kapitału. Oto jak wspiera Twoją podróż handlową:

- Historia transakcji: Dostęp do szczegółowych zapisów rzeczywistych i demonstracyjnych transakcji, aby analizować wyniki i identyfikować trendy.

- Statystyki i analizy: Uzyskaj informacje o swoich wynikach, w tym wskaźnikach wygranych, zyskach i stratach.

- Bonusy i promocje: Zwiększ swój kapitał handlowy dzięki ekskluzywnym bonusom i ofertom.

- Trading społecznościowy: Kopiuj strategie odnoszących sukcesy traderów i ucz się z ich doświadczeń.

- Turnieje: Weź udział w turniejach, aby przetestować swoje umiejętności i wygrać nagrody.

- Zasoby edukacyjne: Naucz się strategii handlowych i analizy rynku za pomocą materiałów Pocket Option.

- Wsparcie: Uzyskaj pomoc od zespołu wsparcia w przypadku jakichkolwiek pytań lub problemów.

Akcje AI już transformują branże, a dzięki Pocket Option możesz nimi handlować już teraz.

Handluj łatwo i szybko, zaczynając od małych kwot!

Kluczowe strategie dla udanych inwestycji w akcje AI

Inwestorzy, którzy odnieśli sukces z okazjami z „akcjami AI za 3$”, często stosują określone strategie do identyfikacji i kapitalizacji tych inwestycji. Oto kilka kluczowych podejść:

- Dogłębne badania technologii AI firmy i jej potencjalnych zastosowań

- Analiza doświadczenia i historii zespołu zarządzającego w rozwoju AI

- Ocena kondycji finansowej firmy i źródeł finansowania

- Ocena krajobrazu konkurencyjnego i popytu rynkowego na rozwiązanie AI

- Monitorowanie zmian regulacyjnych, które mogą wpłynąć na adopcję AI w odpowiednich branżach

Identyfikowanie potencjalnych okazji „Cudownych akcji AI za 3$”

Dla inwestorów zastanawiających się „czym jest cudowna akcja AI za 3$”, która mogłaby potencjalnie przekształcić ich portfel, rozważ następujące czynniki przy ocenie firm:

| Czynnik | Ważność |

|---|---|

| Innowacyjna technologia AI | Wysoka |

| Silne portfolio własności intelektualnej | Wysoka |

| Partnerstwa z liderami branży | Średnia |

| Skalowalny model biznesowy | Wysoka |

| Pozytywne prognozy przepływów pieniężnych | Średnia |

Warto zauważyć, że choć „symbol cudownej akcji AI” może zmieniać się w czasie, podstawowe zasady dogłębnych badań i starannej analizy pozostają niezmienne.

Ryzyka i rozważania

Pocket Option rozumie, że chociaż potencjalne nagrody z inwestycji w okazje z „akcjami AI za 3$” mogą być znaczące, kluczowe jest zrozumienie związanych z nimi ryzyk:

- Wysoka zmienność ze względu na spekulacyjny charakter tanich akcji

- Potencjalne rozwodnienie poprzez dodatkowe emisje akcji

- Ryzyka regulacyjne związane z wschodzącymi technologiami AI

- Intensywna konkurencja w sektorze AI

- Dłuższe ramy czasowe dla osiągnięcia rentowności w firmach skoncentrowanych na AI

Opinie ekspertów na temat inwestycji w akcje AI

Aby uzyskać głębsze zrozumienie fenomenu „akcji AI za 3$”, rozmawialiśmy z kilkoma profesjonalistami inwestycyjnymi i ekspertami branży AI. Oto kilka kluczowych spostrzeżeń:

| Ekspert | Kluczowe spostrzeżenie |

|---|---|

| Dr Sarah Chen, Badaczka AI | „Szukaj firm z jasną ścieżką do komercjalizacji ich technologii AI.” |

| John Smith, Venture Capitalist | „Zdolność zespołu zarządzającego do wykonania jest często ważniejsza niż początkowy pomysł.” |

| Maria Rodriguez, Analityk finansowy | „Nie lekceważ znaczenia patentów i własności intelektualnej w przestrzeni AI.” |

Perspektywy przyszłości dla inwestycji w akcje AI

Patrząc w przyszłość, potencjał inwestycji w „akcje AI za 3$” pozostaje znaczący. Analitycy branżowi przewidują ciągły wzrost w różnych aplikacjach AI, w tym:

- Przetwarzanie języka naturalnego i konwersacyjna AI

- Widzenie komputerowe i rozpoznawanie obrazów

- Analityka predykcyjna i uczenie maszynowe

- Systemy autonomiczne i robotyka

- Rozwiązania cyberbezpieczeństwa wzmocnione przez AI

Te obszary reprezentują potencjalne możliwości dla inwestorów poszukujących kolejnej „cudownej akcji AI za 3$”, która mogłaby zapewnić znaczne zwroty.

Podsumowanie

Fenomen „akcji AI za 3$” przyciągnął uwagę inwestorów na całym świecie, oferując potencjał znaczących zwrotów w szybko rozwijającej się dziedzinie sztucznej inteligencji. Dzięki starannemu badaniu, analizie strategicznej i zrównoważonemu podejściu do zarządzania ryzykiem, inwestorzy mogą pozycjonować się, aby skorzystać z tych okazji. Gdy AI nadal przekształca branże i tworzy nowe rynki, potencjał odkrycia kolejnej cudownej akcji AI pozostaje ekscytującą perspektywą dla tych, którzy są gotowi nawigować przez złożoności tego dynamicznego sektora.

„

FAQ

Czym dokładnie jest "akcja AI za 3 dolary"?

Akcja AI za 3 dolary odnosi się do akcji firm zajmujących się technologią sztucznej inteligencji, których cena wynosi około 3 dolarów za akcję. Takie akcje są często uważane za spekulacyjne inwestycje o wysokim potencjale wzrostu.

Jak mogę zidentyfikować potencjalne okazje związane z "cudownymi akcjami AI za 3 dolary"?

Szukaj firm z innowacyjną technologią AI, silną własnością intelektualną, partnerstwami z liderami branży, skalowalnymi modelami biznesowymi i pozytywnymi prognozami przepływów pieniężnych. Dokładne badania i analiza branży są kluczowe.

Jakie są główne ryzyka związane z inwestowaniem w nisko wyceniane akcje AI?

Główne ryzyka obejmują wysoką zmienność, potencjalne rozwodnienie akcji, wyzwania regulacyjne, intensywną konkurencję i dłuższe ramy czasowe dla osiągnięcia rentowności. Ważne jest, aby dokładnie ocenić te czynniki przed zainwestowaniem.

Czy istnieją historie sukcesu "akcji AI za 3 dolary, które mają szansę gwałtownie wzrosnąć"?

Tak, zdarzały się przypadki firm skupionych na AI, które zaczynały jako akcje o niskiej cenie i doświadczały znaczącego wzrostu. Jednak ważne jest, aby pamiętać, że wyniki z przeszłości nie gwarantują przyszłych rezultatów.

Jak przyszłe perspektywy sektora AI wpływają na potencjalne inwestycje w akcje?

Oczekuje się, że sektor AI będzie nadal rósł, stwarzając możliwości w takich obszarach jak przetwarzanie języka naturalnego, widzenie komputerowe, analityka predykcyjna i systemy autonomiczne. Ten potencjał wzrostu może stworzyć nowe możliwości inwestycyjne w akcje AI.