- Volatility: QUBT shares have been volatile, reflecting investor sensitivity to R&D costs and announcements.

- Earnings Reports: Mixed results; revenue is growing, but costs remain high.

- Sentiment: Some analysts see a bullish future if QUBT secures commercial success.

QUBT Stock Forecast 2030

Quantum computing is reshaping finance, and QUBT stands at the center. This article explores QUBT stock forecast 2030 with detailed price predictions and insights for investors.

Article navigation

Understanding Quantum Computing and QUBT

Quantum computing uses quantum bits (qubits), which can exist in multiple states at once, enabling computations far beyond the capabilities of traditional computers. QUBT is working to bring this power to practical use through software and hardware platforms targeting real-world problems across industries.

Why QUBT Matters

QUBT’s focus is on accessible quantum solutions for businesses. Strategic partnerships and R&D investments position it to benefit as demand grows. Analysts see this positioning as a core driver in any QUBT stock forecast 2030 scenario.

Why Forecasting is Essential

Given the speculative nature of the quantum sector, stock forecasts help manage risk and expectations. Tools like technical analysis and predictive modeling help investors identify trends and entry points.

Market Overview and Current Position

QUBT Stock: Historical and Projected Trends

Technical Insights

Historical chart patterns reveal frequent upswings on product news, followed by corrections. RSI indicators and moving averages show momentum opportunities.

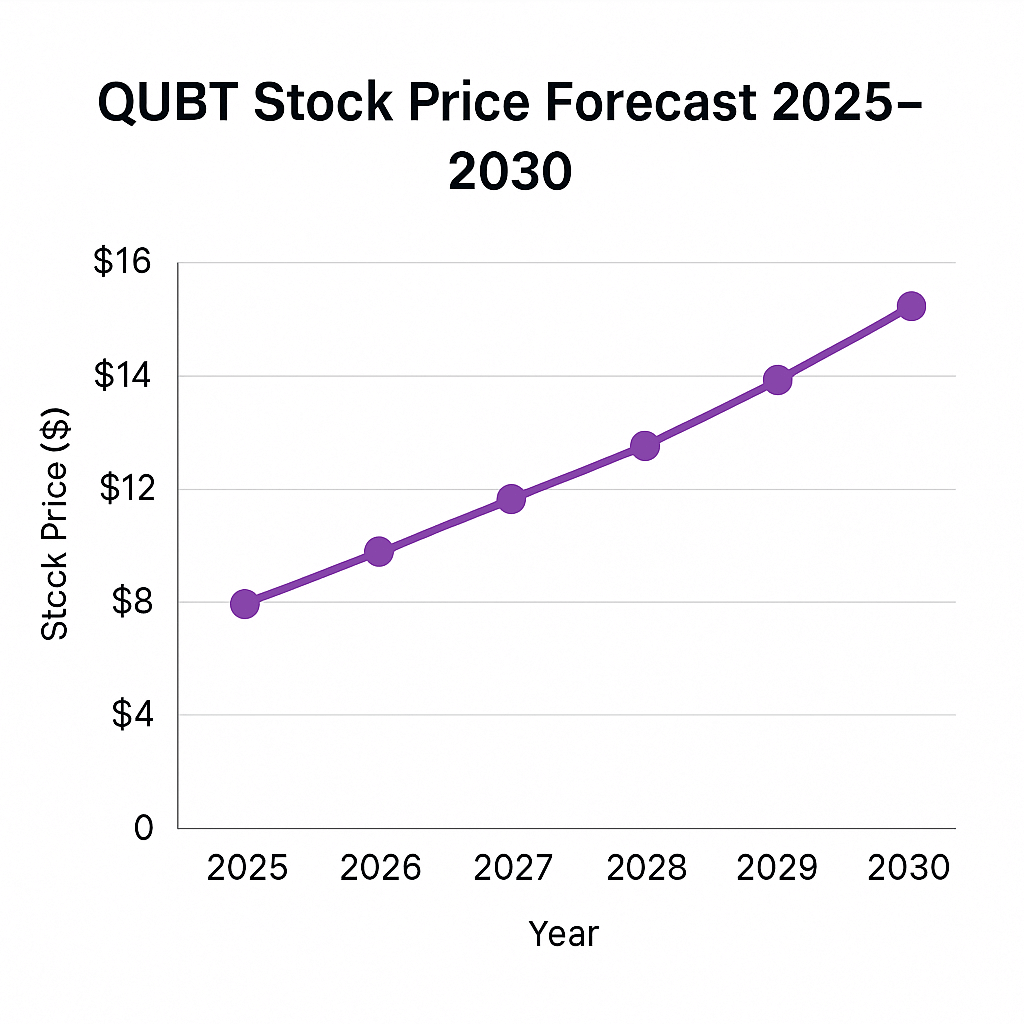

Forecast Table: QUBT Stock Price Projection

| Year | Forecast Price (USD) |

|---|---|

| 2025 | $8.50 |

| 2026 | $11.80 |

| 2027 | $12.60 |

| 2028 | $13.80 |

| 2029 | $15.00 |

| 2030 | $15.50 – $20.00 |

Expert Insight

“Investors often overlook the long gestation period of quantum technologies. Returns may be slow, but firms like QUBT are laying the foundation for disruptive applications.” — Dr. Evelyn Randle, MIT

What is the Future of QUBT Stock?

The QUBT stock forecast 2030 presents a mixed outlook. According to CoinCodex, projections for 2030 suggest a moderate decline, with expected fluctuations ranging from $8.37 to $11.33, indicating a potential ROI of 3.99%. Conversely, WalletInvestor forecasts a slight increase, predicting a price of $12.103 by 2030, translating to a 2.56% gain.

Dr. Evelyn Randle, a quantum finance researcher at MIT, notes: “Investors often overlook the long gestation period of quantum technologies. Returns may be slow, but firms like QUBT are laying the foundation for disruptive applications.”

These varied predictions highlight the inherent uncertainties in the quantum computing sector, emphasizing the need for investors to stay informed and cautious.

Pocket Option: No Long-Term Forecasts Needed

Unlike traditional investing platforms that depend on long-term stock forecasts like the qubt stock forecast 2030, Pocket Option offers a simpler, more flexible way to trade. Here, you don’t buy or sell assets — you simply predict whether the price will rise or fall within a short time frame. If your forecast is correct, you can earn up to 92% profit.

Currently, QUBT stock is not available on Pocket Option. However, the platform features over 100 other assets, including numerous stocks, which you can trade in just minutes. Whether you’re using a demo account or a real one, getting started takes only a quick registration — no downloads required.

QUBT Stock Price Predictions

Short-Term Price Forecast (2025-2026)

The short-term price forecast for QUBT stock between 2025 and 2026 appears optimistic, driven by increasing adoption of quantum computing technologies. Analysts predict that the stock price could rise significantly as the company solidifies its position in the market and continues to innovate. As investor interest peaks, the QUBT stock price may reach new highs, with projections estimating it could hover around $11.80 by late 2026, contingent on successful product launches and favorable market conditions.

Medium-Term Price Predictions (2027-2028)

Looking into the medium-term, from 2027 to 2028, QUBT Quantum Computing Inc is expected to experience continued growth as the quantum computing landscape matures. Price predictions during this period indicate that the QUBT stock price may stabilize, reflecting a more accurate valuation as the company achieves key performance milestones. If QUBT successfully expands its partnerships and market reach, a price target of $15 could be within reach, making it a critical time for investors to assess their positions in the stock market.

Long-Term Projections to 2030

Long-term projections for QUBT stock through 2030 suggest a promising outlook for investors interested in the quantum computing sector. By this time, analysts anticipate that quantum technologies will become more mainstream, significantly influencing the price of QUBT. If the company meets its strategic objectives, the stock price could soar, with some forecasts suggesting a potential value exceeding $20. This upward trajectory could be bolstered by advancements in AI and other technologies, making QUBT an attractive option for long-term investors aiming to capitalize on the future of computing.

Expert Perspectives and Strategic Insights

Unique Observations from Market Analysts:

- According to David Lin, equity strategist at Quantum Alpha Group: “We advise clients to allocate up to 2% of their portfolios to speculative tech like QUBT, balancing innovation exposure with stability.”

- Quantum computing ETFs, such as Defiance’s QTUM, may provide indirect exposure and mitigate volatility.

- A video presentation from the Quantum Economic Forum 2024 emphasized the strategic role of middleware software — an area where QUBT has active development.

Building a Portfolio with Quantum Computing Stocks

Incorporating QUBT into a diversified investment portfolio can offer exposure to the burgeoning quantum computing sector. As the landscape for quantum technologies expands, blending QUBT with other stocks like IonQ could mitigate risks associated with volatility. Investors should evaluate their risk tolerance and consider the long-term potential of quantum computing inc stock price forecasts. A well-rounded portfolio featuring QUBT can provide a strategic advantage, positioning investors to capitalize on future advancements in this innovative field.

Final Thoughts

The quantum computing industry presents both exciting opportunities and significant challenges. While the QUBT stock forecast 2030 offers varied predictions, investors should conduct thorough research and consider their risk appetite before making decisions. Engaging with platforms like Pocket Option can provide valuable exposure to emerging technologies and markets. Discuss this and other topics in our community!

FAQ

What is quantum computing and why is QUBT positioned as a potential growth investment?

Quantum computing uses quantum mechanical phenomena like superposition and entanglement to perform calculations exponentially faster than classical computers for specific problems. QUBT (Quantum Computing Inc.) represents a unique growth opportunity because it focuses on quantum software and accessibility rather than hardware development. This capital-efficient approach could allow QUBT to scale faster and with higher margins (targeting 70%+) than hardware competitors while avoiding the massive capital expenditures ($50M+ annually) required for quantum hardware development. Their Qatalyst™ platform specifically addresses the critical "quantum accessibility gap" that currently limits enterprise adoption.

What technological milestones will most significantly impact QUBT's stock performance by 2030?

The most critical technological milestones include: 1) Achievement of 1,000+ qubit systems with sufficient coherence times by 2026-2027, enabling practical advantage for commercial applications; 2) Error correction advances reaching 99.9% fault tolerance by 2027-2028, necessary for reliable business-critical calculations; 3) Standardization of quantum programming interfaces by 2026, facilitating wider software adoption; 4) Hybrid quantum-classical computing architectures that integrate with existing enterprise systems; and 5) Industry-specific quantum algorithms demonstrating 100x+ performance advantages over classical methods. QUBT's value proposition depends on these hardware advances materializing while their software platform makes them accessible to businesses.

How does QUBT compare to other quantum computing investment options in the public markets?

QUBT offers distinct characteristics compared to other quantum investments: Unlike larger tech companies (IBM, Google, Microsoft) where quantum represents a tiny fraction of their business, QUBT provides pure-play exposure to quantum software commercialization. Compared to hardware-focused companies (IonQ, Rigetti, D-Wave), QUBT requires significantly less capital expenditure ($18M in R&D vs. $50M+ for hardware) and potentially offers higher gross margins (targeting 70%+ vs. 40-50% for hardware). However, QUBT depends on third-party hardware advancement, while facing intensifying competition in the attractive software segment. This positioning creates both specific advantages (capital efficiency, flexibility) and unique risks (hardware dependency).

What are the most significant risks that could prevent QUBT from reaching optimistic 2030 valuations?

The most significant risks include: 1) Quantum hardware development delays extending beyond 2028 for fault-tolerant systems, which would postpone QUBT's value proposition; 2) Major cloud providers (Microsoft, Amazon, Google) leveraging their enterprise relationships to dominate quantum software access; 3) Financial sustainability challenges if cash burn exceeds $20M annually while revenue growth falls below 40%, potentially forcing dilutive financing; 4) Slower-than-expected enterprise adoption extending sales cycles and implementation timelines; and 5) Regulatory restrictions on quantum technologies limiting international market access. Investors should watch quarterly cash burn rates, client acquisition velocity, and quantum hardware milestones as early warning indicators.

What are the projected QUBT stock prices from 2025 to 2030?

According to compiled analyst forecasts, QUBT stock is projected to rise from approximately $8.50 in 2025 to a range of $15.50–$20.00 by 2030. These predictions are based on expected growth in quantum computing adoption, company performance, and broader market trends.