- Incorrect Strike Price Selection: Choosing strike prices that are too close or too far from the current stock price can either limit protection or reduce profit potential.

- Poor Timing: Implementing the strategy during periods of low volatility may result in less favorable option premiums.

- Neglecting Transaction Costs: Failing to account for commissions and fees can erode the benefits of the strategy.

- Overlooking Tax Implications: Exercising options or having them assigned can have tax consequences that need to be considered.

The Collar Options Trading Strategy Explained in Simple Terms

The collar trading strategy, also known as the collar option strategy, is a popular investment approach that combines the use of both call and put options to manage risk while potentially enhancing returns. By employing this strategy, investors can protect against downside risk while still maintaining the upside potential of their underlying stock. This article will delve into the intricacies of the collar option strategy, breaking down its components, functionality, and implications in options trading.

Article navigation

- Understanding the Collar Option Strategy

- What is a Collar?

- Is a Collar Bullish or Bearish?

- Components of a Collar Option Strategy

- What Is the Difference Between a Collar and a Put Spread?

- How Collar Options Work in Options Trading

- What Is a 5% Collar?

- Pros and Cons of Collar Options

- Disadvantages and Risks of Collar Options

- Common Mistakes in Implementing Collar Strategies

- Expert Insights on Collar Trading

- Implementing Collar Strategies on Pocket Option

- Example: Applying a Collar Strategy on Pocket Option

- Using Collar Options in Your Trading Portfolio

- Final Thoughts

Understanding the Collar Option Strategy

The collar strategy is one of several risk-managed frameworks, with variants like the trading collar, synthetic collars, and short collar each offering specific tactical uses for different market conditions.

The collar option strategy is designed to provide a safety net for investors holding a long stock position. By utilizing both a short call option and a long put option, investors can effectively limit their potential losses while also capping their gains. This strategy is particularly useful when the stock price is expected to remain stable or experience moderate fluctuations. Understanding how to implement a collar involves recognizing the interplay between the components that make up this option strategy.

What is a Collar?

A collar is an options strategy that involves buying a put option while simultaneously selling a call option. This creates a protective mechanism for the investor, safeguarding their investment in the underlying stock. The strike price of the put option is usually set below the current stock price, while the strike price of the call option is set above it. This arrangement allows the investor to benefit from the appreciation of the stock price while limiting the downside if the stock price falls. The collar strategy is particularly effective in uncertain market conditions.

Is a Collar Bullish or Bearish?

A collar trading strategy is typically considered a neutral to slightly bullish approach. Investors employ this strategy when they have a positive long-term outlook on a stock but seek protection against short-term volatility. By setting a floor (via the put option) and a ceiling (via the call option), the strategy allows for limited participation in upward price movements while safeguarding against significant declines.

Components of a Collar Option Strategy

The primary components of a collar option strategy consist of the long stock position, the long put option, and the short call option. When an investor holds 100 shares of stock, they can buy a put option with a strike price that provides a safety net against potential losses. Concurrently, the investor sells a call option, which generates income that can offset the cost of the put option. The strike prices selected for both the put and call options are crucial, as they determine the range within which the stock price can fluctuate without triggering significant losses.

What Is the Difference Between a Collar and a Put Spread?

While both strategies involve options to manage risk, they differ in structure and intent:

| Feature | Collar Strategy | Put Spread Strategy |

|---|---|---|

| Composition | Long stock, long put, short call | Long put, short put (different strike prices) |

| Ownership of Stock | Yes | Not necessarily |

| Risk Management | Protects existing stock holdings | Profits from anticipated decline in stock price |

| Profit Potential | Limited to the upside cap set by the call option | Limited to the difference between strike prices |

| Cost | Can be low or zero-cost (premium from call offsets put) | Involves net premium outlay |

The collar trading strategy is primarily used for hedging existing positions, whereas a put spread is often employed as a speculative strategy anticipating a decline in the underlying asset’s price.

How Collar Options Work in Options Trading

In options trading, collar options function by creating a defined risk-reward profile for the investor. When the stock price rises, the short call option may expire worthless, allowing the investor to retain their stock position. Conversely, if the stock price falls, the long put option provides protection against losses, thus ensuring that the investment remains secure. This dual-layered approach allows traders to engage in investment strategies that capitalize on market movements without exposing themselves to excessive risk. By understanding how collar options work, investors can make informed decisions that align with their financial goals.

What Is a 5% Collar?

A 5% collar refers to setting the strike prices of the protective put and the covered call approximately 5% below and above the current market price of the underlying asset, respectively. This configuration creates a price band that limits potential losses and gains to a 5% range.

Pros and Cons of Collar Options

Advantages of Using the Collar Strategy

The collar strategy offers several advantages that appeal to investors seeking a balanced approach to risk management. One major benefit is the ability to limit downside risk while maintaining exposure to potential gains in the underlying stock. By buying a put option, investors secure protection against significant declines in the stock price, while the income generated from selling a call option helps offset the cost of the put. This dual mechanism allows traders to strategize effectively, especially during periods of market uncertainty.

Try Quick Trading on demo for free!

Disadvantages and Risks of Collar Options

Despite its benefits, the collar option strategy is not without its disadvantages and risks. One significant drawback is that while it protects against losses, it also caps the potential gains if the stock price rises substantially. This restriction can be frustrating for investors who miss out on significant profit opportunities. Additionally, the cost of the put option must be considered, as it can diminish overall returns, particularly if the market remains stable and the options expire worthless. Investors must weigh these factors carefully when evaluating a collar strategy.

Common Mistakes in Implementing Collar Strategies

Implementing a collar trading strategy requires careful consideration. Common pitfalls include:

Expert Insights on Collar Trading

“The collar strategy offers a balanced approach to risk management, allowing investors to protect gains while setting acceptable limits on potential losses.”

— Jane Smith, CFA, Senior Portfolio Manager

“In volatile markets, collars can be an effective tool to navigate uncertainty without liquidating positions.”

— John Doe, Options Strategist

Implementing Collar Strategies on Pocket Option

Pocket Option provides a user-friendly platform for executing various trading strategies, including the collar trading strategy.

Key Features:

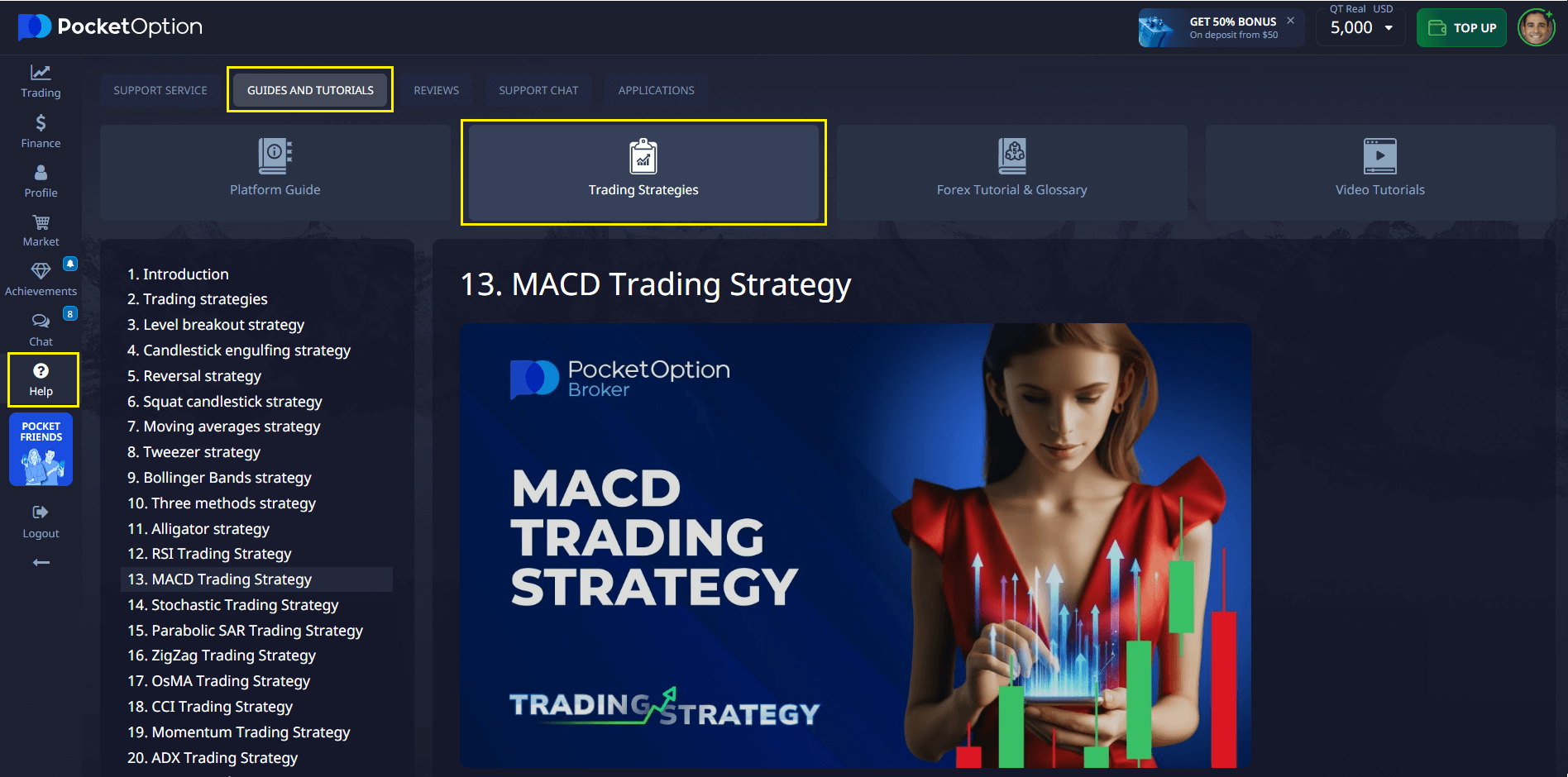

- Technical Indicators: Utilize tools like Moving Averages, RSI, and Bollinger Bands.

- Customizable Charts: Analyze price movements with candlestick or line charts.

- Educational Resources: Access tutorials and guides on strategy development.

Example: Applying a Collar Strategy on Pocket Option

While Pocket Option doesn’t support classic stock options trading, traders can emulate risk-managed strategies using its Quick Trading and tools like trend indicators and support/resistance levels.

For example:

- Asset Selection: Choose a stable asset and analyze recent volatility.

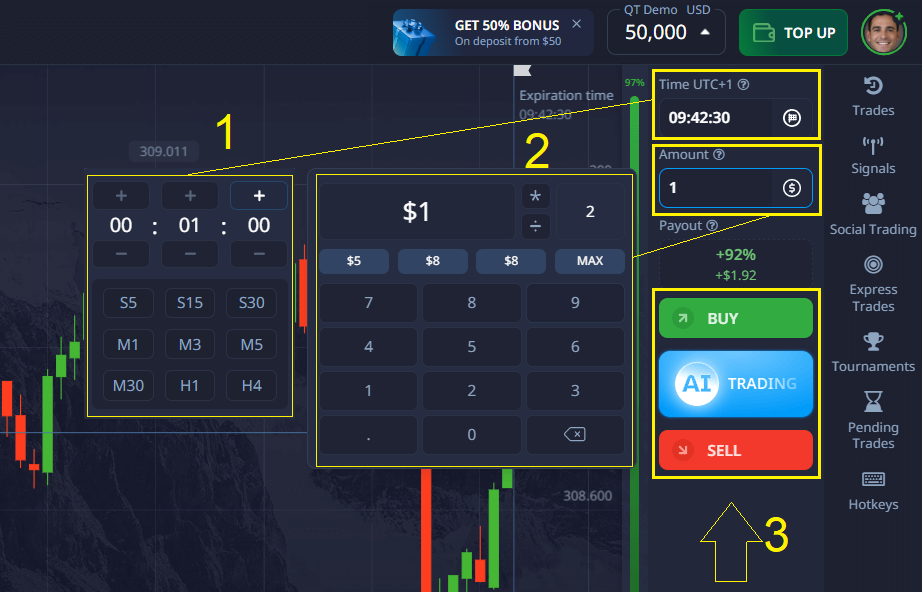

- Support/Resistance Setup: Identify visible support and resistance levels using Bollinger Bands and horizontal lines. To draw horizontal lines on Pocket Option, open a chart, choose the ‘Line’ or ‘Candlestick’ view, then click on the drawing tools icon. Select ‘Horizontal Line’ and place it at recent price levels where the asset frequently reverses direction—these points often indicate psychological price barriers traders react to.

Simulate a Collar:

- Open a short-term “Sell” trade near resistance.

- Simultaneously plan an opposite “Buy” trade from support.

- This setup mirrors a collar with a defined risk zone.

✔️ You can use the “Line” or “Candlestick” chart to adjust timing, and apply indicators like RSI and MACD for confirmation.

To reinforce this strategy, consider real trader insights:

“Using layered positions on Pocket Option helped me stay in the game when markets got tough. Managing risk visually with chart zones gave me more control.”

— Carlos M., independent trader

And don’t forget to review your sessions with the built-in trading journal to track success rates.

Imagine you’re monitoring a popular asset on Pocket Option. Anticipating potential short-term volatility, you decide to apply a collar-style setup:

- Open a Buy Trade: Enter a “Buy” position when the asset price approaches a strong support level, expecting a rebound.

- Set a Sell Trade: At the same time, plan a “Sell” position when the price nears a resistance level, managing your profit potential while mitigating risk.

This setup ensures a more controlled risk environment while mimicking the payoff structure of a traditional collar strategy. By executing this on Pocket Option, you can monitor your positions in real-time and adjust as market conditions evolve.

Using Collar Options in Your Trading Portfolio

Integrating Collar Strategies with Other Options

Investors can integrate collar strategies with tools like protective puts or covered calls. Combining multiple methods helps hedge portfolios and adapt to market conditions.

Evaluating the Effectiveness of Collar Options

To measure performance:

- Compare the cost of the put with income from the call.

- Use delta to analyze sensitivity to price changes.

- Track alignment with overall investment goals.

Common Mistakes to Avoid with Collar Strategies

Avoid:

- Selecting strike prices too close to the stock price.

- Overlooking transaction fees.

- Failing to monitor changing market dynamics.

Final Thoughts

The collar trading strategy helps investors limit downside risk while retaining upside opportunity. When thoughtfully executed—even via simulated approaches on Pocket Option—it empowers traders to remain disciplined. Discuss this and other topics in our community!

Note: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

FAQ

What is the primary purpose of collar trading?

Collar trading aims to protect an existing stock position while generating income through option premiums. It combines protective puts and covered calls to create a defined risk-reward profile.

How does volatility affect collar trading performance?

Market volatility directly impacts option premiums and strategy effectiveness. Higher volatility increases option premiums, potentially making the strategy more profitable but also more expensive to implement.

When should I adjust my collar positions?

Consider adjusting collar positions when the underlying stock price approaches either the put or call strike prices, when volatility significantly changes, or when approaching expiration dates.

What are the key components of a successful collar trading strategy?

Successful collar trading requires proper strike price selection, effective position sizing, regular monitoring, and strategic timing of adjustments based on market conditions.

How do I determine appropriate strike prices for my collar trades?

Strike prices should be selected based on your risk tolerance, desired protection level, and income goals. Consider factors such as implied volatility, time to expiration, and current market conditions.