- Pre-market and after-market hours: Times when fewer participants are active, but big moves often occur based on news or earnings.

- Overlap sessions: When multiple markets are open, leading to spikes in trading volume and opportunities.

- Time zone differences: Crucial when syncing trades across regions, especially if you’re located in North America, Europe, or Asia.

What Time Does the Stock Market Open and How to Trade It Wisely

Knowing what time does the stock market open is essential for traders and investors seeking to optimize their performance. Each minute of the trading day presents opportunities — and risks — that can define your results. This guide explores global stock market timings, practical strategies for each session, and how Pocket Option empowers users to act 24/7 on more than 100 tradable assets.

“Time is your most valuable trading resource. Markets reward precision and preparation, not guesswork.” — Nathan Collins, CFA

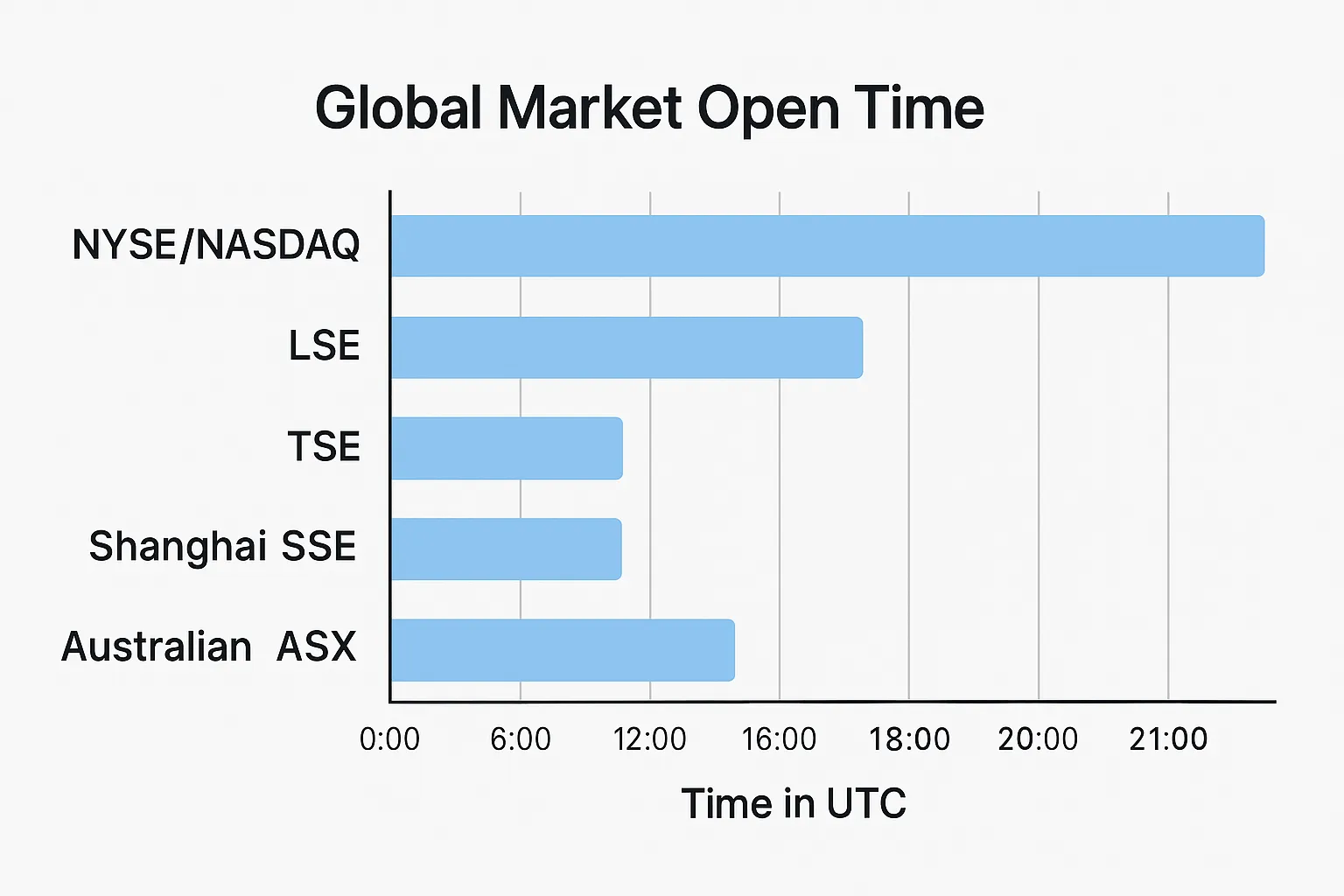

Understanding Global Market Open Time

Unlike a unified global start, market open time varies significantly across exchanges. Traders must account for time zones, local holidays, and daylight saving adjustments. Find out about the best time for day trading here.

| Exchange | Location | Opening Time (Local) | Opening Time (Central Time) | Closing Time (Local) |

|---|---|---|---|---|

| NYSE/NASDAQ | United States | 9:30 AM | 8:30 AM CT | 4:00 PM |

| LSE | United Kingdom | 8:00 AM | 2:00 AM CT | 4:30 PM |

| TSE | Japan | 9:00 AM | 6:00 PM CT (previous day) | 3:00 PM |

| SSE | China | 9:30 AM | 7:30 PM CT (previous day) | 3:00 PM |

| ASX | Australia | 10:00 AM | 7:00 PM CT (previous day) | 4:00 PM |

These stock market timings illustrate how global traders operate almost around the clock. Pocket Option users can benefit from this 24/7 flow using over-the-counter (OTC) assets even when traditional exchanges are closed.

Why Market Timings Matter

The timing of market sessions directly impacts volatility, liquidity, and trade success rates. Traders need to be especially aware of:

“Inconsistent timing leads to inconsistent results. Align your strategy with session behavior.” — Tara Kim, Market Analyst

Key Overlaps: When the Market Is Most Active

Overlapping market hours often bring the most volatility and volume:

- London/New York: 8:30 AM – 11:30 AM CT – High liquidity in forex and index markets

- Tokyo/London: 2:00 AM – 3:00 AM CT – Moderate overlap with Asian-European flows

These overlaps are crucial for planning your most active trading windows.

Pocket Option Advantage: 24/7 Access to Global Markets

Even outside regular stock market timings, Pocket Option users can trade 100+ assets across sectors — including tech giants, commodities, and currency pairs — any day of the week. Whether it’s Friday, today, or tomorrow, you’re never limited by traditional exchange hours.

Start trading now with Pocket Option to:

- Execute quick buy/sell strategies at any hour

- React instantly to market-moving news

- Access powerful charting tools for decision-making

When Do Stock Markets Open Today and Tomorrow?

Planning trades requires precise awareness of daily opening times:

- Today’s Open: Check your local equivalent of each major exchange start.

- Tomorrow’s Plan: Markets like the Tokyo Stock Exchange or ASX will open during your night (if you’re in the Americas).

What Time Does the Stock Market Open on Friday?

Most exchanges — including the NYSE and NASDAQ — follow normal hours on Friday, closing for the weekend at 4:00 PM (local). Be cautious in the final hour, as traders adjust positions before the two-day close.

“Fridays are where winners separate themselves. The close reveals sentiment going into the weekend.” — Elliot Ng, Senior Trader

How Time Zones and DST Affect Market Open Time

Daylight Saving Time (DST) can create discrepancies, especially in spring and autumn. For example:

- In the U.S., during DST, markets open at 8:30 AM CT instead of 9:30 AM EST.

- In Europe, transitions can affect the London-New York overlap.

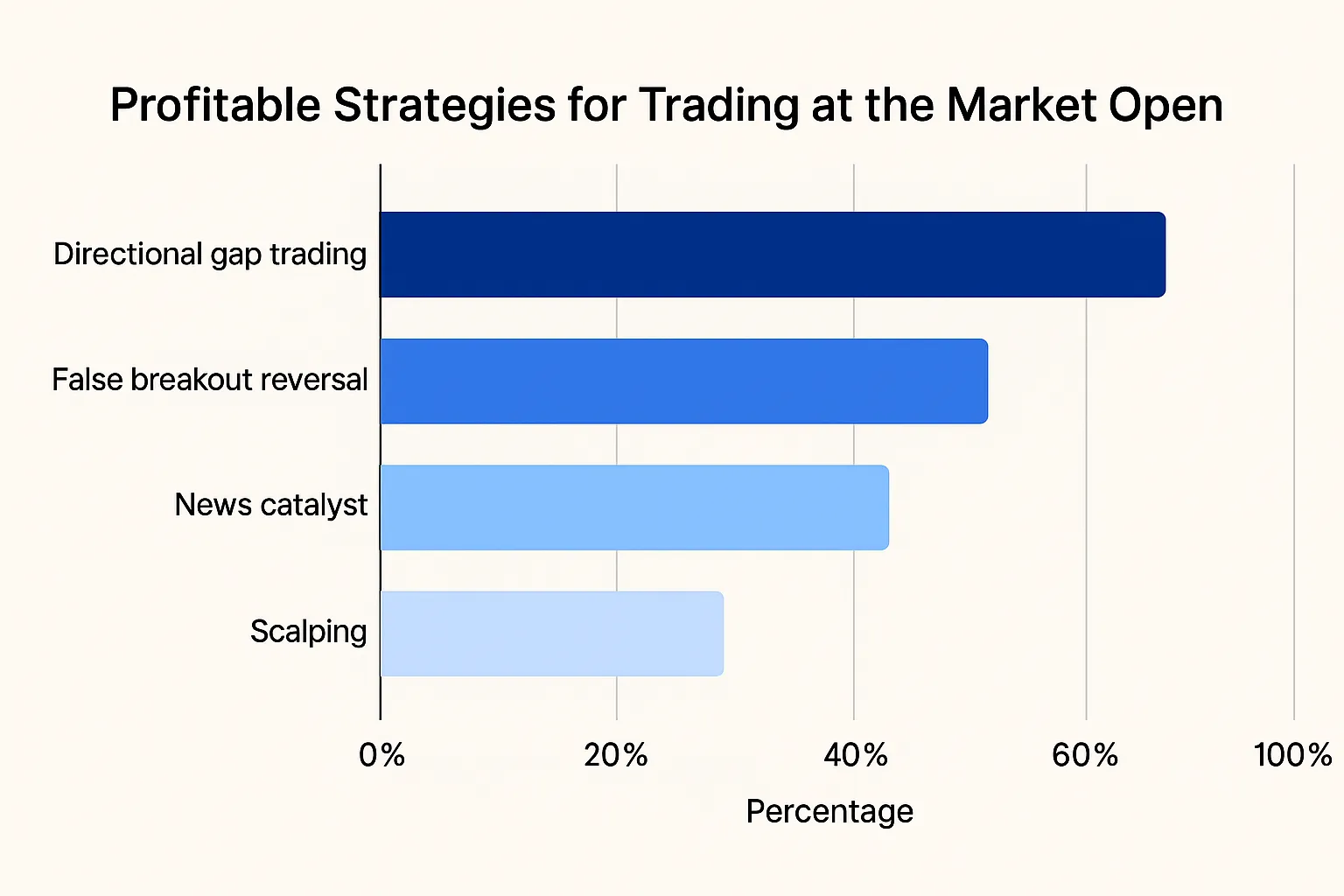

Strategic Use of Opening Sessions

The first 30–60 minutes after what time does the stock market open often sets the tone for the trading day:

- Gap Trading: Spot and act on overnight gaps based on news or earnings

- Momentum Trades: Ride early volume with trending assets

- Reversals: Look for failed breakouts or exhaustion patterns by mid-morning

Midday Consolidation and Afternoon Volatility

After the morning rush, many markets enter a lull (from around 11:30 AM to 1:30 PM local). Use this period to:

- Reassess active trades

- Adjust stop-losses

- Identify setups forming for afternoon breakouts

The last trading hour (especially on Friday) is another hotspot for directional movement and institutional volume.

After-Hours and Pre-Market: Extended Opportunities

Most exchanges also support extended trading:

- Pre-market (U.S.): 4:00 AM – 9:30 AM ET

- After-hours (U.S.): 4:00 PM – 8:00 PM ET

These times are ideal for reacting to:

- Earnings releases

- Global news (overnight events from Asia or Europe)

- Economic reports or company guidance

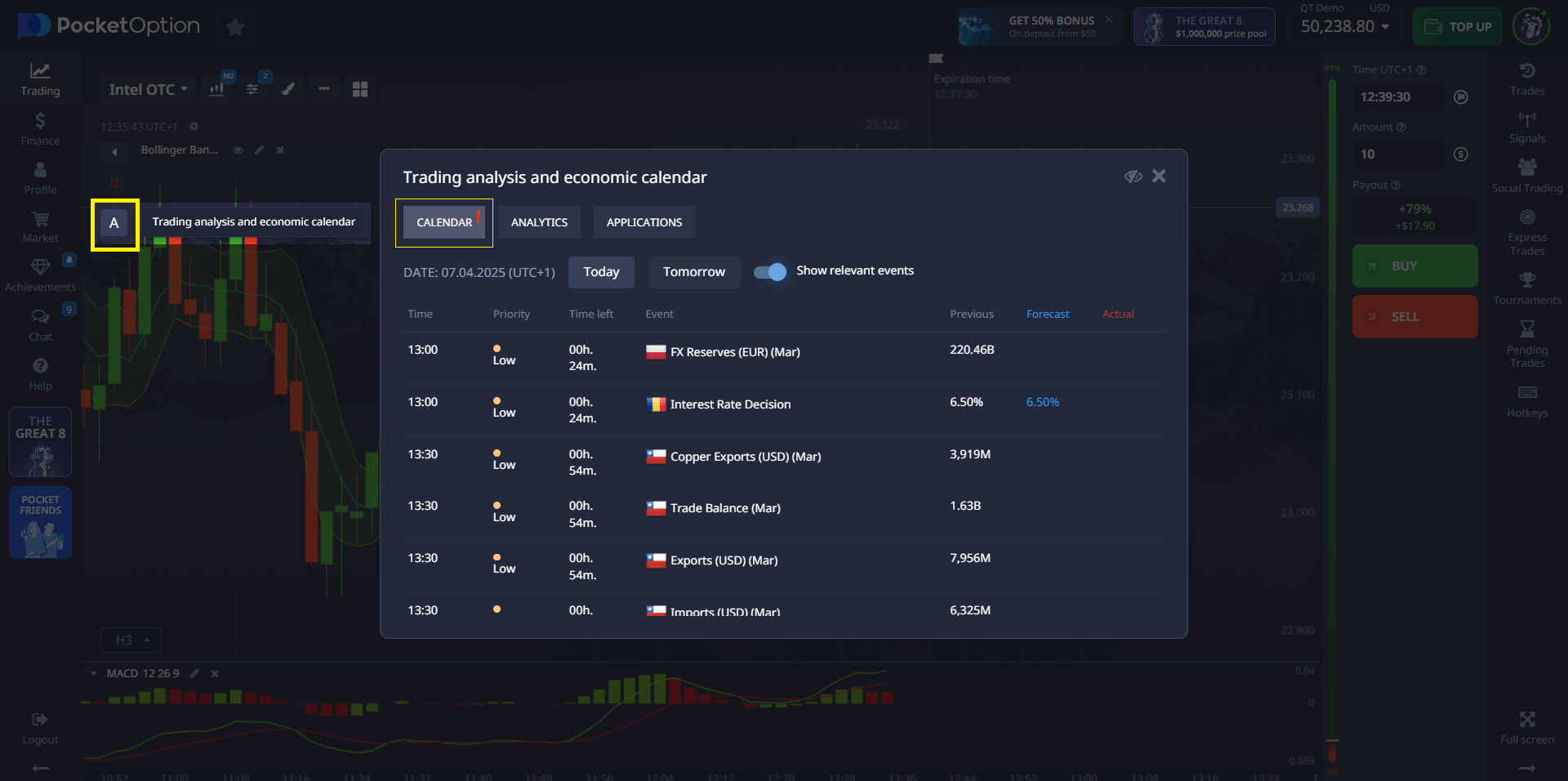

Automate for Time-Based Trading Success

Knowing when do stock markets open allows automation of key actions:

- Schedule limit orders for market open

- Automate alerts before market-moving news

- Use trailing stops based on session-specific volatility

Tools to Help You Monitor Market Schedules

Stay on top of multiple time zones with:

- Global Market Clocks

- Integrated Economic Calendars (filtered by impact and region)

- Custom Alerts for open/close and volatility events

Conclusion: Maximize Every Minute of the Trading Day

Mastering what time does the stock market open is more than a technical detail — it’s a gateway to strategic planning, disciplined execution, and consistent results. With modern platforms like Pocket Option, time zones are no longer a barrier. Whether you’re trading pre-market buzz, exploiting midday consolidations, or navigating Friday closes, understanding when do stock markets open gives you the upper hand. Start your day with clarity, execute with confidence, and finish with profits — Pocket Option makes it possible. Discuss this and other topics in our community!

FAQ

What is the 10 am rule in stock trading?

The 10 am rule suggests waiting until at least 10:00 AM (ET) to place trades. By then, early volatility from the open has often settled, revealing a more stable trend. Traders use this time to confirm breakout or reversal patterns before committing capital.

What is the 7% rule in stocks?

The 7% rule is a risk management principle, often used by swing traders and investors, advising to sell a stock if it falls more than 7–8% from your purchase price. This limits downside risk and prevents large losses.

Can I buy shares at 9 am?

Yes, but it depends on your broker and the exchange. The U.S. stock market pre-market session typically starts at 4:00 AM ET, so buying at 9:00 AM ET is possible. However, volume may be lower, and spreads wider compared to regular hours (9:30 AM – 4:00 PM ET).

What are the best times to trade for beginners?

Beginner traders often find success during the mid-morning (10:00–11:30 AM ET) and late afternoon (2:00–3:30 PM ET) sessions when volatility stabilizes. Avoid trading immediately at the open unless you have experience handling rapid price movements.

Is it better to trade at market open or close?

Both have advantages. The market open offers higher volatility and rapid movement, ideal for short-term setups. The close reflects institutional rebalancing and trend confirmations, useful for swing or end-of-day trades.