- No Interest (Riba) – Trading is conducted without any interest charges.

- Transparent Conditions – All transactions are carried out with full clarity.

- Asset Restrictions – Certain assets, such as cryptocurrencies or specific currency pairs, may be unavailable.

- Profit and Loss Sharing – Transactions follow principles of fairness.

What is Islamic Halal Account in Pocket Option

Islamic Halal Accounts in Pocket Option help Muslim traders align trading with their faith. Learn key features, benefits, and considerations.

What is an Islamic Halal Account in Pocket Option?

The Islamic Halal Account in Pocket Option is designed for clients who adhere to the principles of Islamic finance. This type of account eliminates riba (interest), gharar (uncertainty), and ensures transparent transactions in compliance with Shariah law.

Key Features of the Islamic Account

Comparison of Islamic Halal Account and Standard Account

| Feature | Islamic Halal Account | Standard Account |

|---|---|---|

| Shariah Compliance | Yes | No |

| Riba (Interest) | Excluded | Present |

| Gharar (Uncertainty) | Excluded | Possible |

| Asset Restrictions | Yes | No |

| Access to Cryptocurrencies | Possible restrictions | No restrictions |

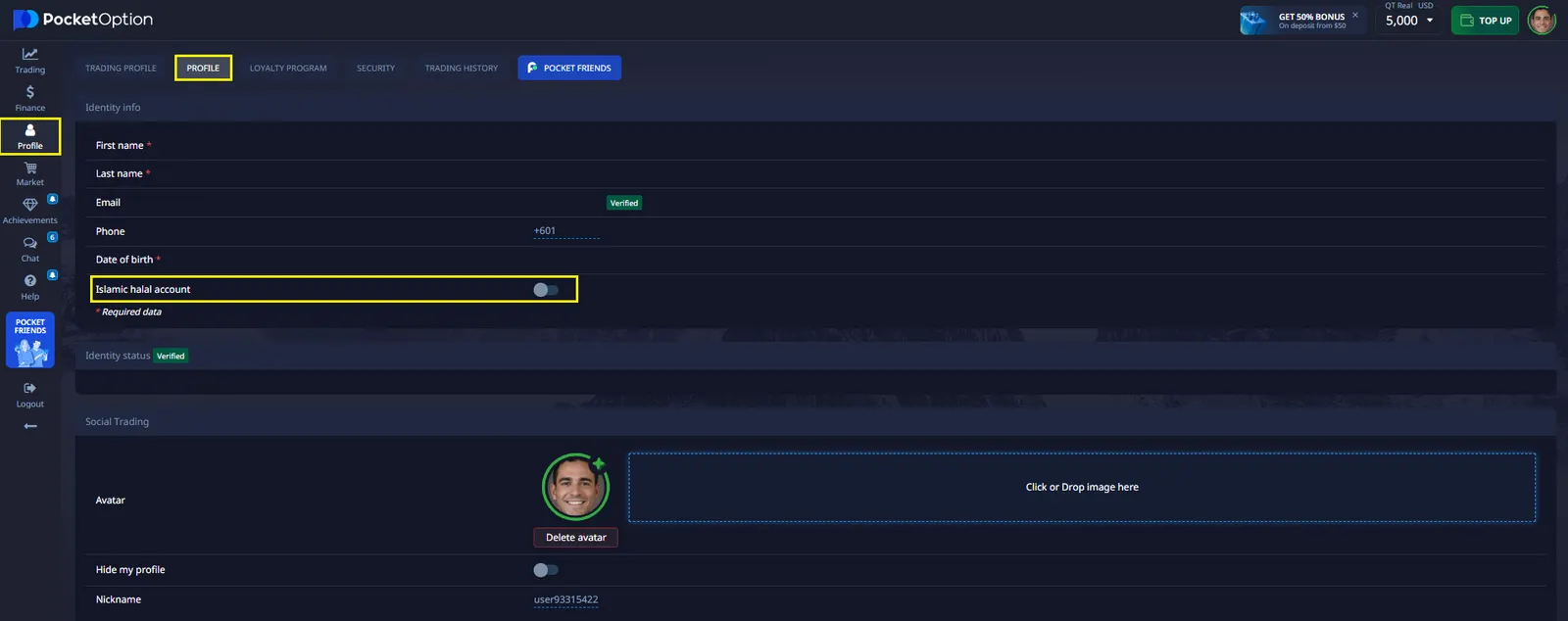

How to Open an Islamic Halal Account?

If you are wondering what is Islamic Halal Account in Pocket Option and how to open it, the process involves a few straightforward steps:

- Registration – Create an account in Pocket Option.

- Account Selection – Choose the “Islamic Account” option in settings.

- Start Trading – Once activated, you can begin trading.

Tips for Successful Islamic Trading

To maximize the efficiency of your Islamic Halal Account on Pocket Option, consider the following recommendations:

- Understand the principles of Islamic finance – Learn the fundamentals of trading without riba and gharar.

- Monitor market trends – Stay informed about economic news that may affect your trades.

- Apply risk management strategies – Set loss limits and use capital protection strategies.

- Utilize educational materials – Explore analytical tools and learning resources provided by the platform.

- Start with a demo account – Test trading mechanics before switching to a real account.

FAQ

What exactly is an Islamic Halal Account in Pocket Option?

An Islamic Halal Account in Pocket Option is a specialized trading account that complies with Islamic finance principles. It operates without interest charges or overnight fees, making it suitable for Muslim traders who wish to follow Sharia law while engaging in financial markets.

How does an Islamic Halal Account differ from a standard trading account?

The main differences are that Islamic Halal Accounts do not charge or pay interest, do not have overnight fees, and may have slightly different fee structures. They also might have limitations on certain trading instruments to ensure compliance with Islamic finance principles.

Can non-Muslims open an Islamic Halal Account on Pocket Option?

Yes, non-Muslims can open Islamic Halal Accounts. However, these accounts are specifically designed to meet Islamic finance requirements and may have different terms compared to standard accounts.

Are there any limitations to trading with an Islamic Halal Account?

Yes, there may be limitations on certain trading instruments or strategies. Additionally, some accounts might have wider spreads to compensate for the lack of overnight fees.

How can I verify if Pocket Option's Islamic Halal Account truly complies with Sharia law?

It's advisable to review Pocket Option's detailed account terms and conditions. You may also want to consult with an Islamic finance expert or scholar to ensure the account aligns with your interpretation of Sharia law.

What is the main difference between an Islamic account and a standard account?

The main difference is the exclusion of riba (interest) and gharar (uncertainty), as well as possible asset restrictions.

Can I switch from a standard account to an Islamic account?

Yes, you can select the Islamic account in your account settings. In some cases, additional verification may be required.

What assets may be unavailable in an Islamic account?

Some cryptocurrencies and currency pairs may be excluded if they do not comply with Islamic financial principles.

CONCLUSION

With no interest charges, clear trading conditions, and the ability to switch between account types, the Islamic account in Pocket Option provides a convenient trading environment. However, users should be aware of potential asset restrictions. To achieve successful trading, it is crucial not only to follow Islamic financial principles but also to apply risk management strategies, study the market, and make use of educational resources. This approach will help traders effectively utilize the Halal account and achieve stable results.

Start trading