- Extends the trade without changing the original opening time.

- Increases the investment amount, potentially boosting profit.

- Available only during the first half of the trade’s duration.

- Its availability depends on liquidity provider settings and the minimum expiration time.

What Does Rollover Mean in Pocket Option

In the world of online trading, understanding various terms and concepts is crucial for success. One such term that often confuses newcomers is "rollover." This article will explore what does rollover mean in Pocket Option and how it affects your trading experience. We'll delve into the mechanics of rollovers, their benefits, and potential risks, providing you with the knowledge to make informed decisions in your trading journey.

What Does Rollover Mean in Pocket Option?

The Rollover feature on the Pocket Option platform allows traders to extend an open trade for the same expiration period while increasing the investment amount. This function helps minimize losses and increase the probability of a profitable trade closure, especially when the market moves temporarily against the trader’s prediction.

Key Features of Rollover:

What Is Rollover in Pocket Option?

What is Rollover in Pocket Option? It is a trading tool designed to help traders manage risk and adjust their positions when market conditions do not align with their expectations. By using Rollover, traders can extend the expiration time of their trade while increasing the investment amount, providing additional flexibility and control over their trades.

How Does Rollover Work in Pocket Option?

The Rollover feature can be used when a trader sees that the price is temporarily moving in an unfavorable direction. Activating Rollover extends the trade duration, giving the market more time to reverse.

How to use Rollover

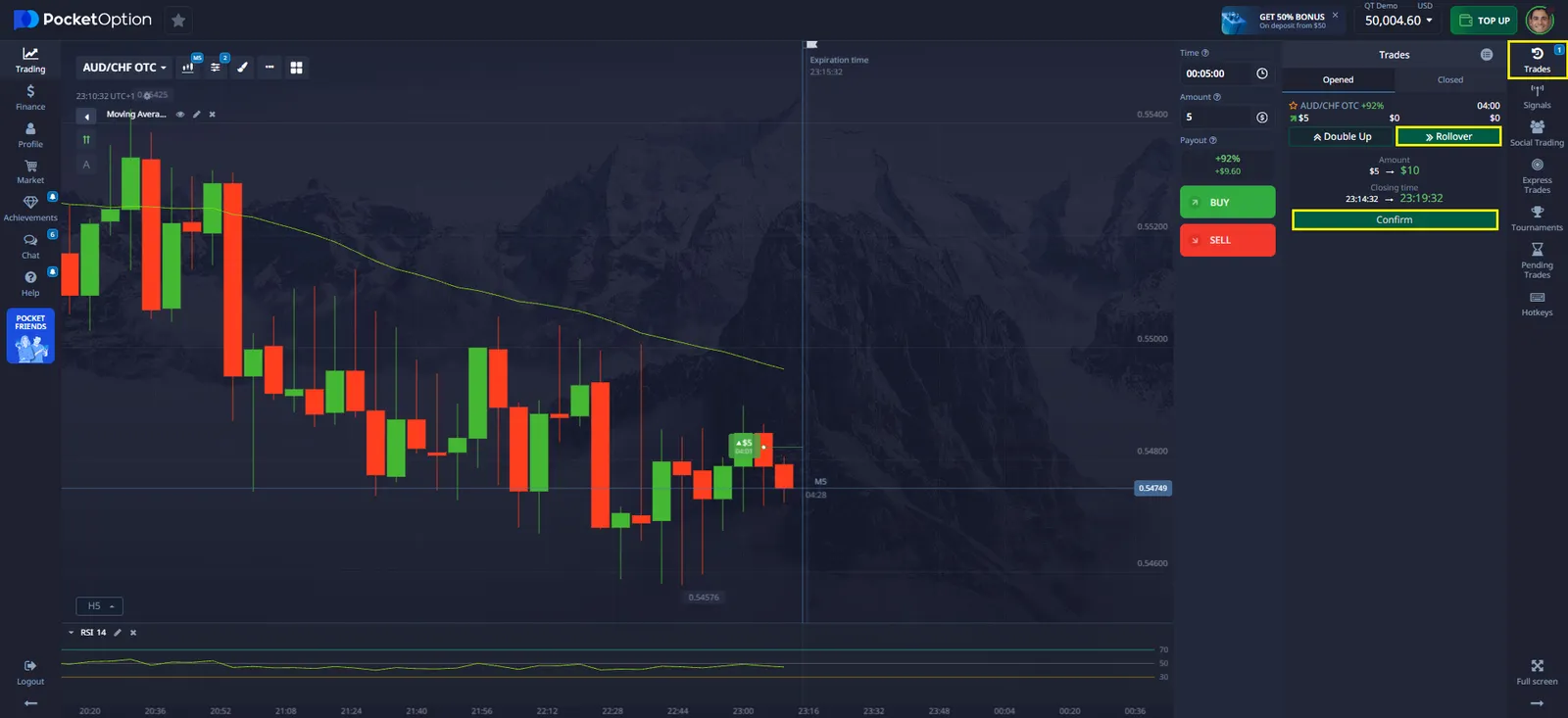

- Go to the “Trades” section in the right panel of the trading interface.

- Select an active trade that meets the Rollover conditions.

- Click the green Rollover button if it is active.

- Confirm the increased investment and the extended expiration time.

Important! The opening time remains unchanged after using Rollover. The function is available only during the first half of the trade duration.

Example of Using Rollover:

| Initial Parameters | Trader’s Action | Final Outcome |

|---|---|---|

| Investment: $100 | Uses Rollover | Trade duration extended |

| Expiration Time: 30 min | Increases investment by $20 | Trade extended by 30 min |

| Price moves against prediction | Waits for trend reversal | Potential profit increases |

When Should You Use Rollover?

The Rollover function is most effective in the following situations:

✅ Minor deviations from the expected trend – when the price moves against the trade temporarily, but a reversal is likely.

✅ Upcoming news or macroeconomic events – if factors affecting the asset price are expected soon.

✅ High market volatility – when sharp fluctuations might work in the trader’s favor if more time is given.

However, Rollover is NOT recommended in the following cases:

❌ A strong trend against the trade – when the price continues moving in the wrong direction.

❌ Insufficient funds – increasing investment requires a sufficient account balance.

❌ Trade has already been extended – Rollover can only be used once per trade.

Key Strategies for Effective Rollover Usage

To maximize the benefits of Rollover, follow these strategies:

- Analyze the market before using Rollover – monitor charts and economic news.

- Avoid extending trades without a solid reason – use Rollover only if you are confident in a price correction.

- Control your investments – do not overextend your trade amount unnecessarily.

- Combine Rollover with other strategies – it works best when used alongside technical analysis.

Advantages and Disadvantages of Rollover

Advantages:

✔️ Provides additional time for the trade.

✔️ Increases the potential for profit.

✔️ Serves as an alternative to closing a losing trade.

Disadvantages:

❌ Requires additional investment.

❌ Available only during the first half of the trade.

❌ Does not guarantee a positive outcome.

The Rollover feature in Pocket Option is a powerful tool for traders looking to enhance their chances of closing a trade successfully. However, it should be used strategically and with caution to avoid unnecessary financial risks.

FAQ

What is the primary purpose of a rollover in Pocket Option?

The primary purpose of a rollover in Pocket Option is to extend the expiration time of an open trade, allowing traders to keep their positions open for longer periods.

Are there any fees associated with rollovers in Pocket Option?

Yes, there are fees associated with rollovers in Pocket Option. These fees are typically a percentage of the initial investment and vary depending on the asset and market conditions.

Can I rollover any trade on Pocket Option?

While rollovers are available for most assets on Pocket Option, there may be some restrictions depending on the specific asset and market conditions. It's best to check the platform's guidelines for each asset.

How often can I rollover a trade on Pocket Option?

The frequency of rollovers may be limited by Pocket Option's policies and the available expiration times for each asset. It's important to use this feature judiciously and not rely on it excessively.

Does using rollovers guarantee profits in trading?

No, using rollovers does not guarantee profits. While rollovers can provide more time for a trade to potentially become profitable, they also come with additional costs and risks. Always use rollovers as part of a well-planned trading strategy.

Why is the Rollover button inactive?

The function is available only during the first half of the trade and requires a sufficient account balance. Its availability also depends on liquidity provider settings.

Can Rollover be used multiple times in one trade?

No, Rollover can only be used once per trade.

How much does the investment increase when using Rollover?

The amount increases by a percentage of the initial investment, with exact values depending on platform settings.