- Customizability: The ability to tailor trading strategies to your goals.

- Data Integration: Access to real-time market data and analysis.

- Risk Management: Built-in tools for setting stop-losses and managing exposure.

- Ease of Use: Intuitive interfaces for seamless integration into your trading routine.

Trading Bots for Stocks: Your Guide to Smarter Investments

In the fast-paced world of financial markets, traders need cutting-edge tools and strategies to stay ahead. This article delves into the transformative power of trading bots for stocks, their benefits, and how they can optimize your trading experience. We’ll also explore how platforms like Pocket Option make it easy to access these advanced tools, empowering traders to make informed decisions and achieve financial success.

What Are Stock Trading Bots?

A trading bot for stocks is an automated software designed to execute trades on your behalf. These bots analyze market conditions, identify opportunities, and execute trades based on pre-set parameters. Unlike human traders, bots operate 24/7, ensuring you never miss a market movement—even when you’re asleep.

Key Benefits of Stock Trading Bots

| Feature | Benefit | Implementation |

|---|---|---|

| Automated Analysis | Continuous market monitoring | Real-time data processing |

| Emotion-Free Trading | Eliminates human bias | Systematic decision-making |

| Speed Optimization | Executes trades faster than manual methods | Precise timing and efficiency |

| Risk Management | Reduces potential losses | Automated stop-loss and limits |

These advantages make trading bots for stocks indispensable for traders looking to optimize their strategies and maximize returns.

Choosing the Best Stock Trading Bot

With so many options available, selecting the best stock trading bot for your needs can be challenging. Here are some factors to consider:

Key Features to Look For

How to Evaluate Performance

- Return on Investment (ROI): Measure the bot’s profitability.

- Reliability: Ensure the system operates without glitches.

- Adaptability: Look for bots that can respond to changing market conditions.

By choosing the right bot for stock trading, traders can achieve consistent results and reduce the stress of manual trading.

Why Pocket Option is a Good Choice for Stock Trading

Pocket Option stands out as a platform that combines cutting-edge tools with a user-friendly experience. Whether you’re a beginner or an experienced trader, Pocket Option offers the perfect environment to leverage the power of automated trading.

Simplifying Stock Trading with Pocket Option

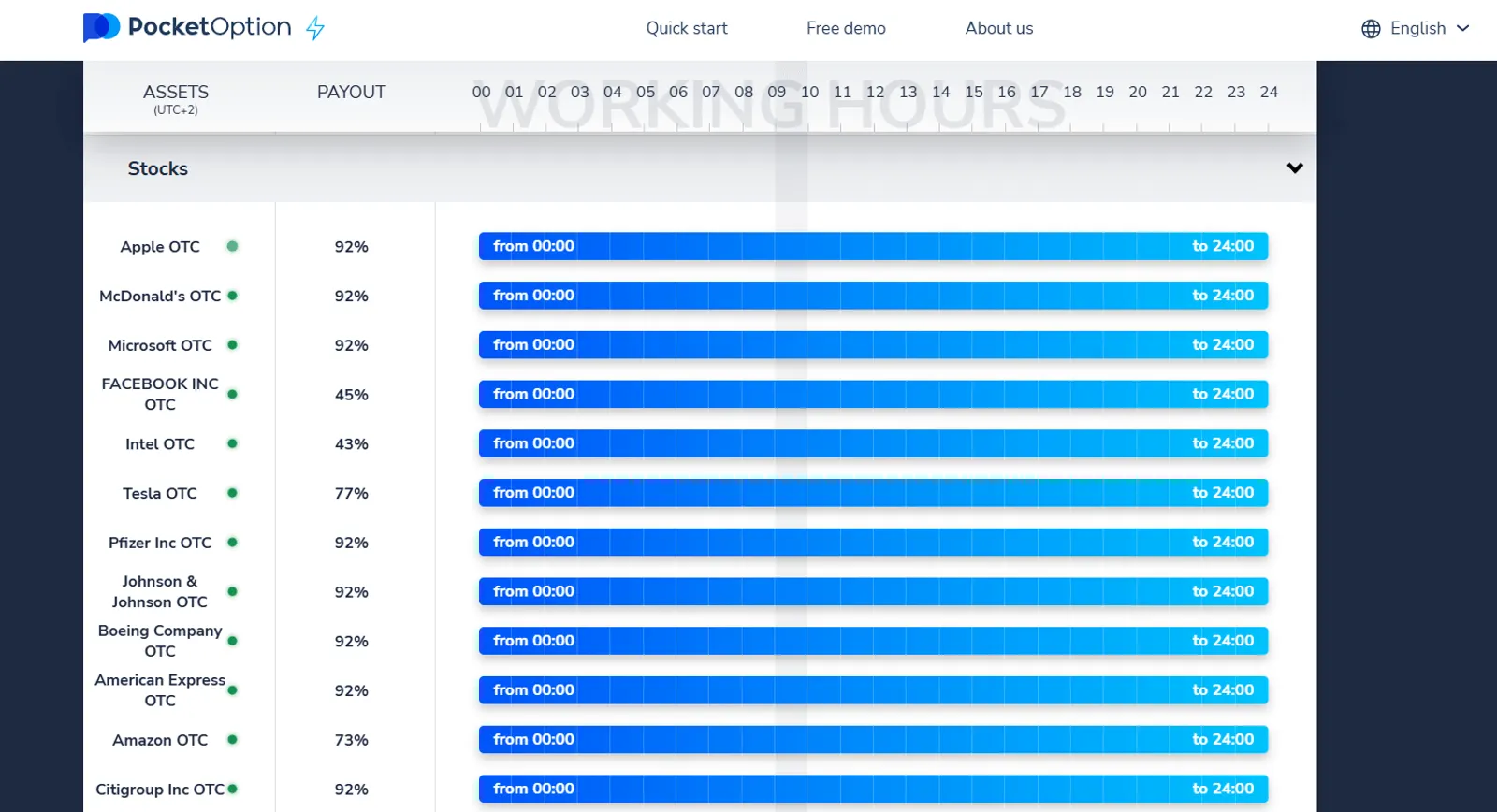

On Pocket Option, you can trade over 100+ assets, including popular stocks, cryptocurrencies, commodities, and forex pairs. With profit rates of up to 92%, the platform makes stock trading accessible and rewarding.

Key Features

- 24/7 Stock Trading: Trade stocks from leading companies anytime, anywhere.

- Profitability Up to 92%: Maximize your earnings with short-term trades.

- AI-Powered Trading Tools: Make data-driven decisions with advanced algorithms.

- Telegram Bot Integration: Receive real-time trading signals and automate trades directly from Telegram.

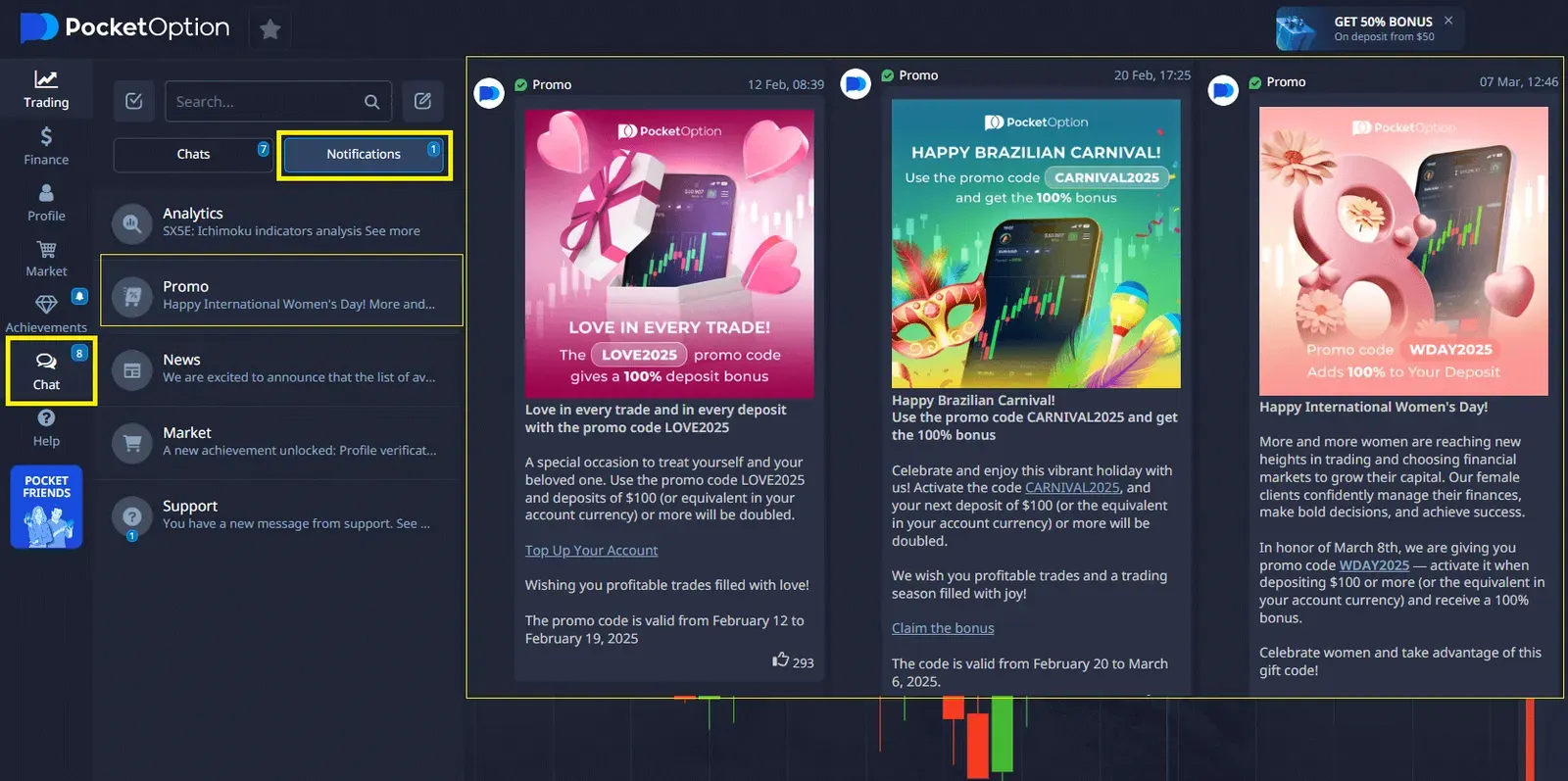

Exclusive Benefits

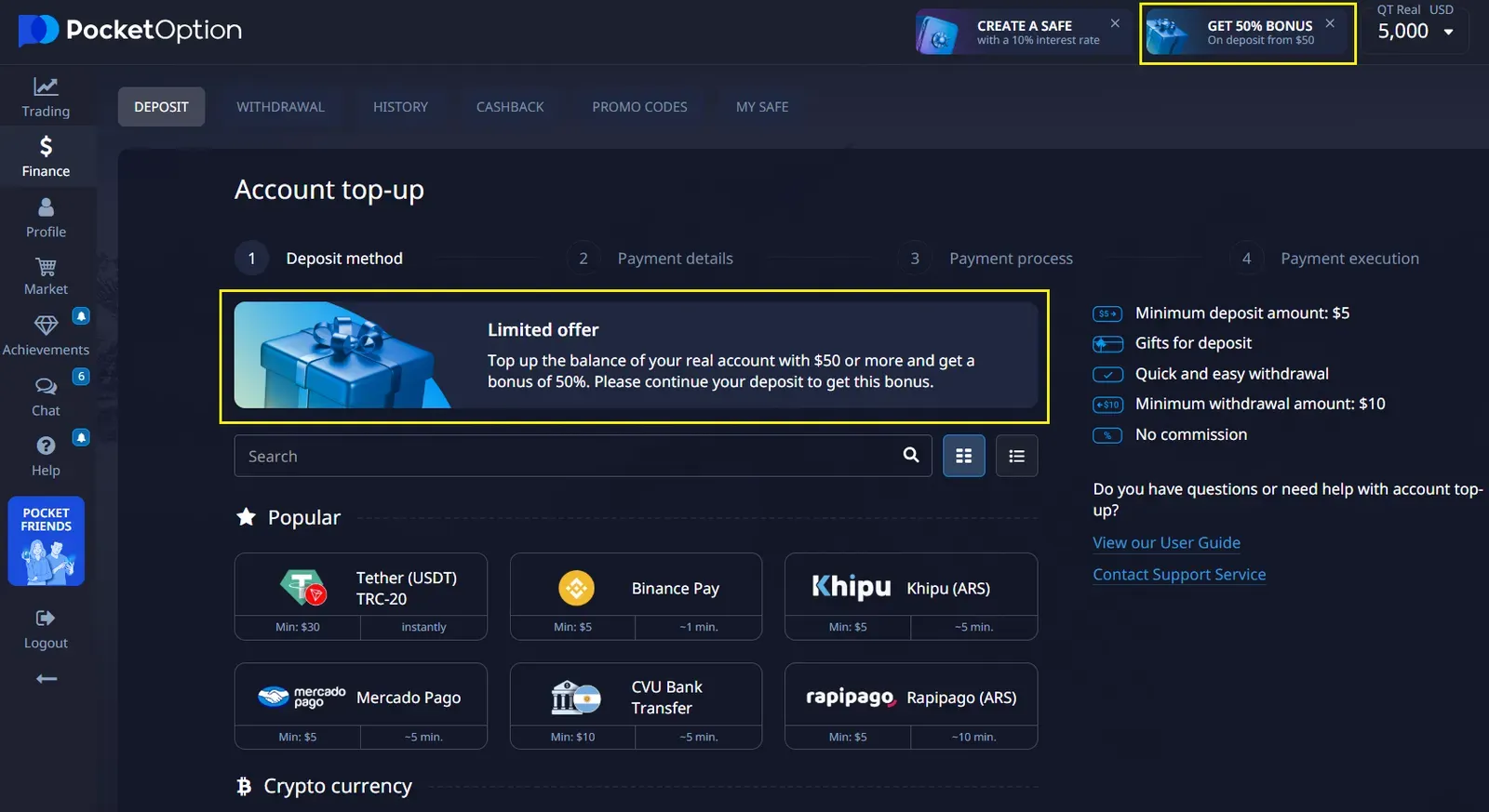

- $50,000 Demo Account: Practice risk-free before trading with real funds.

- Bonuses and promotions: Use code 50START to boost your initial deposit.

Pocket Option’s AI Trading and Telegram Bot

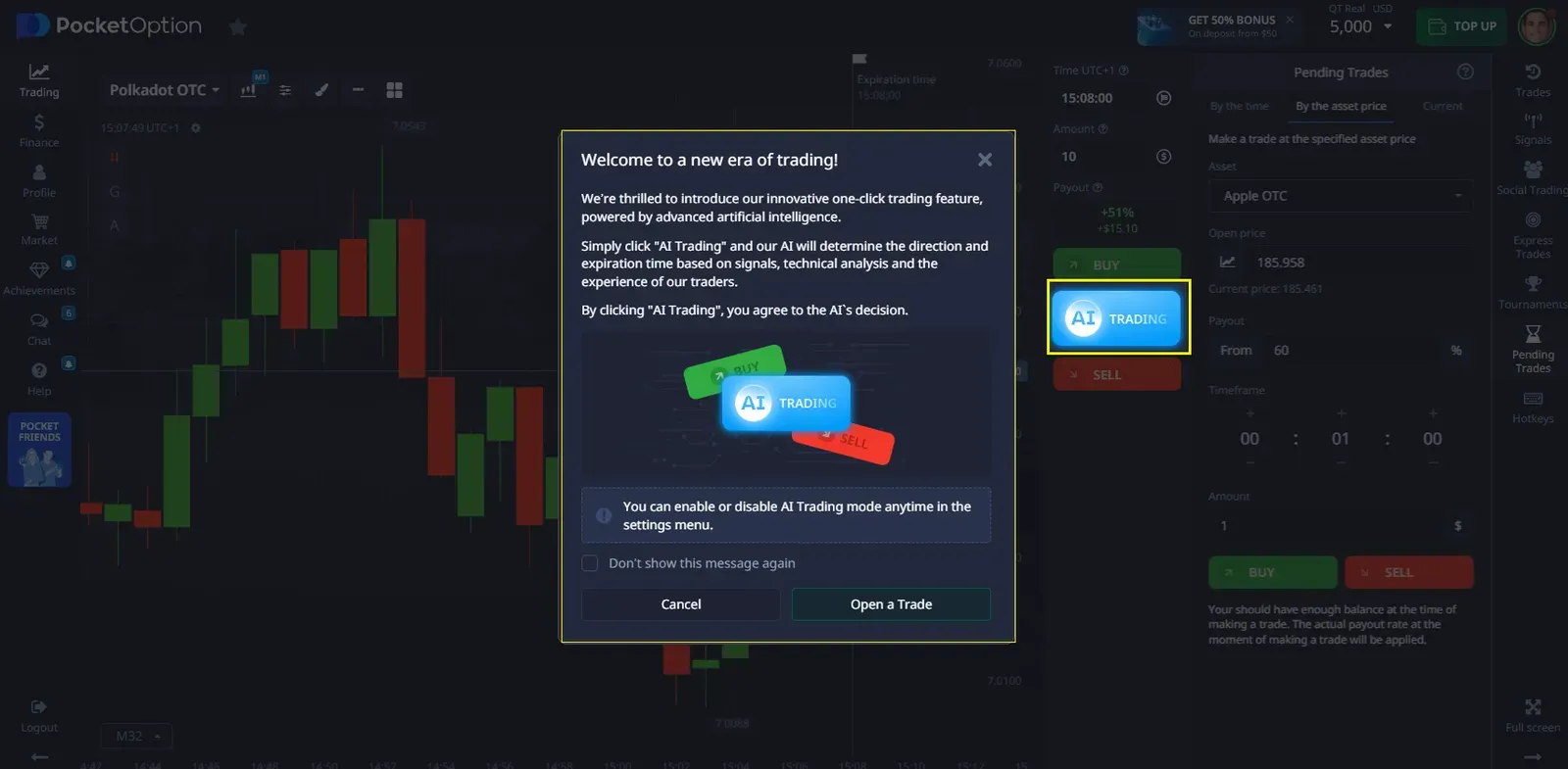

AI Trading: Smarter Decisions with Artificial Intelligence

Pocket Option’s AI Trading feature helps you simplify complex market analysis. With advanced algorithms, the AI evaluates trends, predicts market movements, and executes trades with precision.

How It Works:

- Enable AI Trading in your account settings.

- Let the AI analyze market trends and execute trades automatically.

- Monitor performance and adjust settings as needed.

Advantages:

- Data-driven decisions eliminate guesswork.

- Automated execution ensures optimal timing.

- Continuous updates improve performance over time.

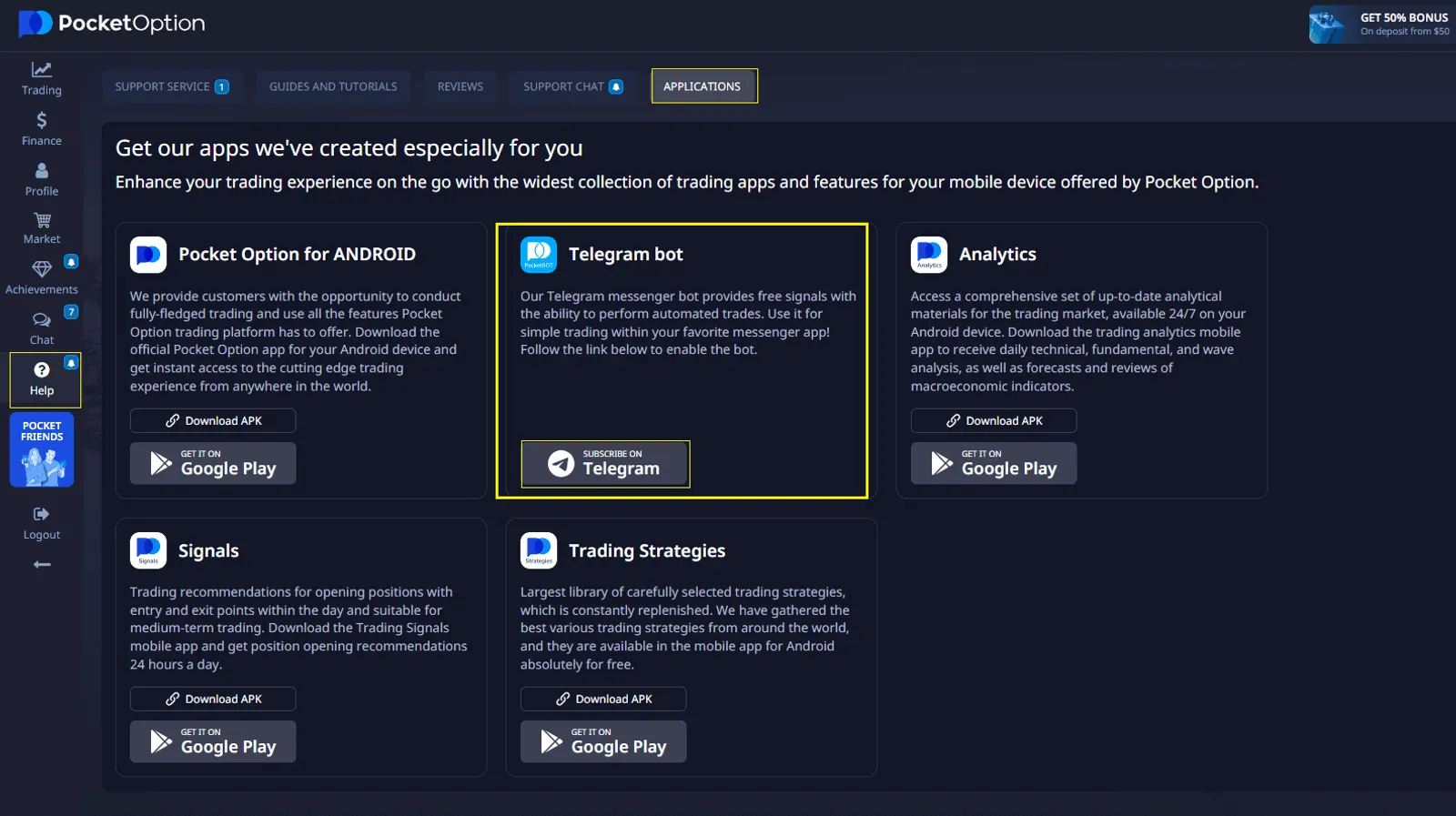

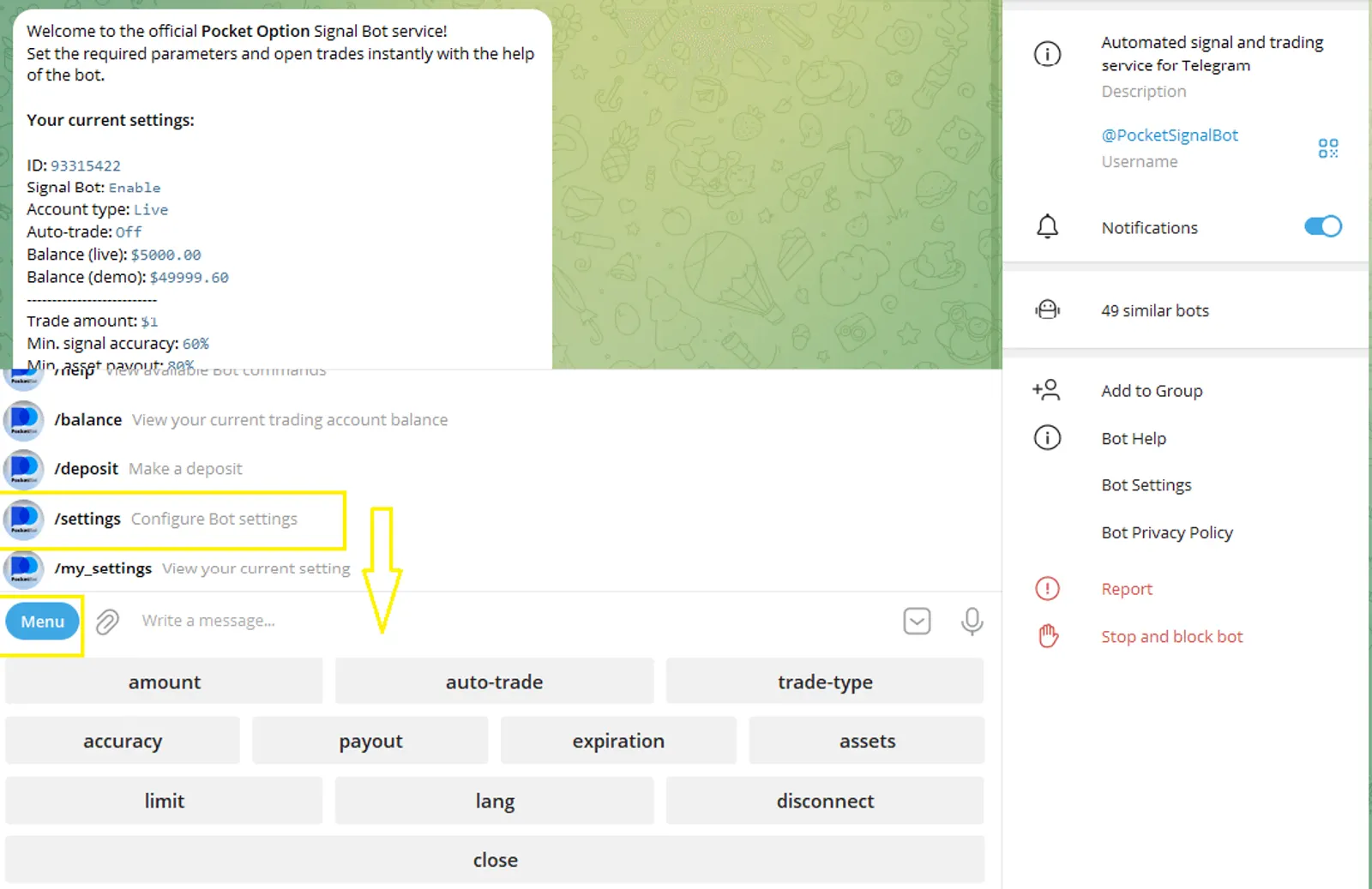

Telegram Bot: Trade On-the-Go

Stay connected to the markets with the Pocket Option Telegram Bot. This powerful tool delivers real-time trading signals and even allows you to automate trades directly within the Telegram app.

Features:

- Receive instant alerts on market movements.

- Set custom parameters for trades (e.g., trade value, signal accuracy).

- Enable auto-trading for hands-free execution.

Why Use the Telegram Bot?

- Convenience: Manage trades without logging into the platform.

- Flexibility: Adjust settings on the fly.

- Efficiency: Automate trades to save time and effort.

How to Get Started

Step 1: Create an Account

Sign up on Pocket Option in minutes and access your free $50,000 demo account to practice trading risk-free.

Step 2: Explore Trading Tools

Familiarize yourself with the platform’s features, including AI Trading and the Telegram Bot.

Step 3: Fund Your Account

Deposit funds to unlock the full potential of Pocket Option. Don’t forget to use the promo code “50START” for a 50% bonus on your first deposit!

Conclusion

Trading bots for stocks have revolutionized the way investors approach the market. By automating analysis, execution, and risk management, these tools help traders achieve better results with less effort. Platforms like Pocket Option take automation to the next level, offering cutting-edge AI tools, Telegram integration, and access to 100+ assets with profit rates of up to 92%.

Start your journey today with Pocket Option and experience the future of stock trading. Sign up now and unlock the power of automation!

FAQ

Are AI trading bots legit?

Yes, AI trading bots are legitimate tools used by traders to automate their strategies. However, their effectiveness depends on the platform, the quality of the algorithms, and the data available for analysis. Always choose reputable platforms like Pocket Option to ensure reliability and security.

Are trading bots profitable?

Trading bots can be profitable if they are configured correctly and aligned with effective strategies. They excel in markets with consistent trends and moderate volatility. However, profitability is not guaranteed and depends on market conditions, bot settings, and risk management.

Are trading bots worth it?

For many traders, trading bots are worth it because they automate repetitive tasks, eliminate emotional decision-making, and ensure 24/7 market monitoring. They’re especially beneficial for traders with well-defined strategies who want to scale their operations efficiently.

Are crypto trading bots profitable?

Crypto trading bots can be profitable, as they take advantage of the highly volatile cryptocurrency markets. They execute trades quickly and without emotions, which is crucial in fast-moving markets. However, success depends on the quality of the bot and the strategy it implements.

How do AI trading bots handle market volatility?

AI trading bots use dynamic risk management techniques, such as stop-loss orders, position sizing, and real-time data analysis, to adapt to volatile market conditions. This helps minimize losses and optimize trading opportunities during rapid market changes.

What are the main advantages of using AI trading bots?

Automation: Bots operate 24/7, ensuring you never miss market opportunities.

How do AI trading bots compare to traditional trading strategies?

AI trading bots outperform traditional strategies in terms of speed, consistency, and the ability to monitor multiple assets simultaneously. However, traditional trading offers more flexibility and human intuition, which can be advantageous in unpredictable markets. Combining both approaches can maximize results.