- To make shares more affordable for individual investors

- To increase liquidity in the stock

- To signal confidence in future growth

- To potentially boost investor interest

Tesla stock split history

Tesla, the innovative electric vehicle and clean energy company, has garnered significant attention from investors worldwide. One aspect of Tesla's financial history that has intrigued many is its stock split history. In this article, we'll delve into the Tesla stock split history, exploring its impact on investors and the company's growth trajectory.

Understanding Stock Splits

Before we dive into the specifics of Tesla’s stock splits, it’s essential to understand what a stock split is and why companies implement them. A stock split is a corporate action in which a company increases the number of its outstanding shares while proportionately decreasing the price per share. This action doesn’t change the overall value of an investor’s holdings or the company’s market capitalization.

Companies often implement stock splits for several reasons:

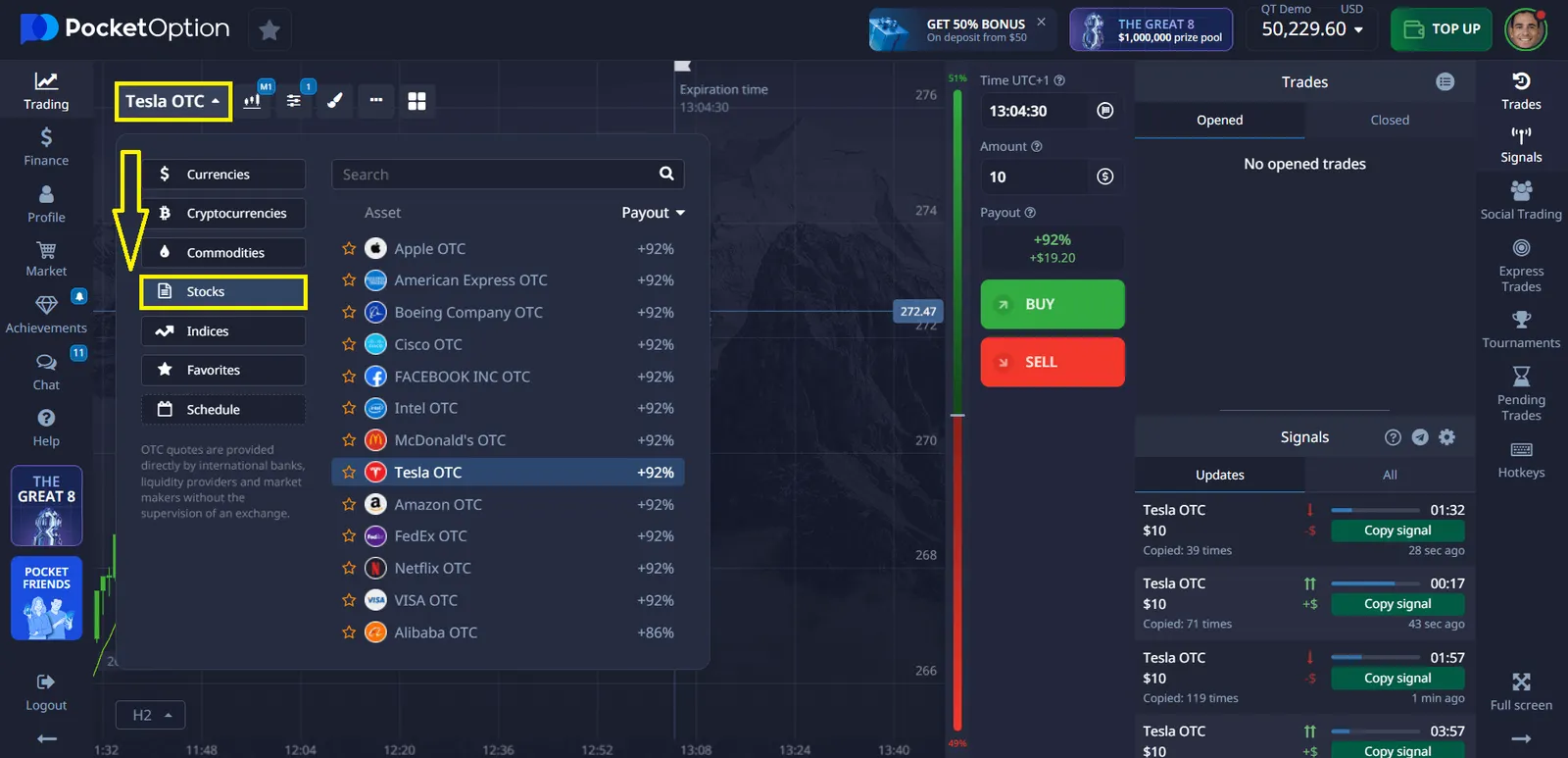

To see the tesla price chart, register on the Pocket Options platform:

To track stock prices on a chart in the Pocket Option platform, you can use the available charting tools. The chart displays real-time price changes for the selected asset. You can customize the chart as follows:

- Asset Selection: Select the stock or asset you want to track from the asset list.

- Chart Types: Switch between different chart types, such as line, candlestick or bar charts, depending on your preference.

- Timeframes: Customize timeframes to view price changes over different periods (e.g. 1 minute, 5 minutes, 1 hour).

- Indicators and tools: Add technical indicators and drawing tools to analyze price trends and patterns.

Tesla Stock Split History

Tesla’s stock split history is relatively recent, with the company having undergone two splits since its initial public offering (IPO) in 2010. Let’s examine each of these splits in detail:

1. August 2020 Stock Split

Tesla’s first stock split occurred on August 31, 2020. This was a 5-for-1 split, meaning that for each share an investor held before the split, they received five shares after the split.

| Pre-Split | Split Ratio | Post-Split |

|---|---|---|

| 1 share | 5-for-1 | 5 shares |

At the time of this split, Tesla’s stock was trading at around $2,213 per share. After the split, the price adjusted to approximately $442 per share. This split made Tesla shares more accessible to a broader range of investors, particularly retail investors who may have found the pre-split price prohibitively expensive.

2. August 2022 Stock Split

Tesla’s second stock split took place on August 25, 2022. This time, the company implemented a 3-for-1 split.

| Pre-Split | Split Ratio | Post-Split |

|---|---|---|

| 1 share | 3-for-1 | 3 shares |

Prior to this split, Tesla’s stock was trading at approximately $891 per share. After the split, the price adjusted to about $297 per share. This second split further increased the accessibility of Tesla’s stock to a wider range of investors.

Impact of Tesla Stock Splits

The Tesla stock split history has had several notable impacts on both the company and its investors:

- Increased accessibility for retail investors

- Enhanced liquidity in the stock

- Potential boost in investor sentiment

- Inclusion in major stock indices

One significant outcome of Tesla’s stock splits was its inclusion in the S&P 500 index in December 2020. This inclusion came after the first stock split and led to increased institutional investment in the company.

Comparing Tesla’s Stock Splits to Other Tech Giants

To put Tesla’s stock split history in context, let’s compare it to some other prominent tech companies:

| Company | Recent Split Date | Split Ratio |

|---|---|---|

| Tesla | August 2022 | 3-for-1 |

| Apple | August 2020 | 4-for-1 |

| Amazon | June 2022 | 20-for-1 |

| Alphabet (Google) | July 2022 | 20-for-1 |

As we can see, stock splits have been a common strategy among high-growth tech companies in recent years. Each company’s approach to stock splits can vary based on their specific circumstances and goals.

Pocket Options offers a wide variety of stocks to suit your tastes so you can diversify your portfolio, such as:

- Apple OTC

- McDonald’s OTC

- Intel OTC

- Tesla OTC

- American Express OTC

- Amazon OTC

- FedEx OTC

- VISA OTC

- Cisco OTC

- ExxonMobil OTC

- Pfizer Inc OTC

- FACEBOOK INC OTC

- Boeing Company OTC

- Alibaba OTC

- TWITTER OTC

- Microsoft OTC

- Johnson & Johnson OTC

- Citigroup Inc OTC

- Netflix OTC

To access today’s up-to-date list of stocks, register and log in to your personal account:

At Pocket Option, you can trade without buying the stock directly. Try quick trading, it’s easy!

Select a stock of your interest, analyze the market and place your trade based on your forecast:

The trade will close as soon as the time specified when opening the trade has passed. If the forecast is correct, you get a profit – up to 92%! This percentage can be seen in advance when choosing an asset for trading.

Potential Future Stock Splits

While it’s impossible to predict with certainty, many investors and analysts speculate about potential future stock splits for Tesla. The company’s decision to implement future splits would likely depend on several factors:

- Stock price performance

- Market conditions

- Company growth and financial health

- Investor demand

- Strategic goals of the company

It’s important to note that while stock splits can make shares more accessible, they do not directly impact the fundamental value of the company. Investors should always consider a company’s financial performance, growth prospects, and overall market conditions when making investment decisions.

Conclusion

The Tesla stock split history reflects the company’s rapid growth and its efforts to make its shares more accessible to a broader range of investors. With two splits in recent years, Tesla has demonstrated its commitment to increasing liquidity and potentially boosting investor interest. As the company continues to innovate and expand, investors will undoubtedly keep a close eye on any future stock split announcements and their potential impacts on the market.

Understanding the Tesla stock split history provides valuable insights into the company’s financial strategies and its relationship with investors. However, it’s crucial to remember that stock splits are just one aspect of a company’s financial picture. Investors should always conduct thorough research and consider multiple factors when making investment decisions.

FAQ

What is the Tesla stock split history?

Tesla has undergone two stock splits in its history. The first was a 5-for-1 split in August 2020, and the second was a 3-for-1 split in August 2022.

How do stock splits affect shareholders?

Stock splits increase the number of shares an investor owns while proportionately decreasing the price per share. The total value of an investor's holdings remains the same immediately after a split.

Why does Tesla implement stock splits?

Tesla implements stock splits to make its shares more affordable for individual investors, increase stock liquidity, and potentially boost investor interest in the company.

Do stock splits change the value of Tesla?

No, stock splits do not change the fundamental value of Tesla. They simply divide the existing value into more shares at a lower price per share.

Will Tesla have more stock splits in the future?

While it's impossible to predict with certainty, future stock splits would depend on factors such as stock price performance, market conditions, and the company's strategic goals.