- SSI — large securities company, fast eKYC support

- VNDirect — user-friendly platform, low fees, online account opening.

- HSC — good customer service, secure electronic authentication.

- VCSC (Viet Capital Securities) — modern technology, fast account opening.

- Pocket Option — international platform, 15-minute eKYC, convenient trading.

Stock Trading Tips for Vietnamese Investors

Want to join the 4 million+ investors trading in the Vietnam stock market? This market with an average growth of 20% per year is waiting for you! This stock trading guide will provide you with practical knowledge, tools and investment strategies to start your profitable investment journey in Vietnam today.

Article navigation

- Guide to Effective Stock Trading in Vietnam

- Specific Features of the Vietnam Stock Market 2025

- 5 Simple Steps to Start Investing in Stocks in Vietnam

- Fundamental Analysis – The Key to Finding Valuable Stocks

- Technical Analysis and Indicators in Stock Trading

- Switch to Quick Trading with Pocket Option

- Types of Stocks and Assets Traded on Pocket Option

- Pocket Option App — Trade Anytime, Anywhere

- Risks When Investing in Stocks and How to Minimize Them

- Final Thoughts

Guide to Effective Stock Trading in Vietnam

Do you want to join more than 4 million investors trading on the Vietnam stock market? This market with an average growth rate of 20% per year is waiting for you! This article will provide you with practical knowledge, tools, and investment strategies to start your profitable investment journey in Vietnam today.

Specific Features of the Vietnam Stock Market 2025

The Vietnam stock market has particular characteristics that every investor needs to understand. In 2024, the market capitalization reached more than 210 billion USD, along with the goal of upgrading from a frontier market to an emerging market — this is the ideal time to start your investment journey.

💡 Register now to receive a free $50,000 demo account — practice risk-free trading and get familiar with the platform in just a few minutes!

| Stock Exchange | Characteristics | Investment Opportunities |

|---|---|---|

| HOSE (Ho Chi Minh City) | Largest capitalization, VN30-Index | VNM, VIC, VHM, FPT – stable bluechips |

| HNX (Hanoi) | Medium and small companies, higher volatility | SHS, PVS – good growth potential |

| UPCOM | Newly equitized companies, low liquidity | ACV, HVN – early investment opportunities |

One of the important indices is the VN-Index, considered the “thermometer” of the market, which has increased more than 500% since 2012, demonstrating long-term growth potential. VN30 focuses on 30 large-cap stocks, suitable for beginners.

According to analysts, in the past year, the VN-Index fluctuated between a low of 1,000 points and a high of 1,550 points, creating an ideal trading range for both long-term and short-term investors.

5 Simple Steps to Start Investing in Stocks in Vietnam

Are you ready? Here is a detailed roadmap to start your investment journey:

Step 1: Open a professional securities account

The starting point of stock trading is choosing a reputable trading platform. Vietnam has more than 70 securities companies with different strengths. Quick and transparent account registration with online eKYC support helps save time and effort.

Step 2: Deposit money into the account

Easy deposit via e-banking, e-wallets, or bank transfer. It is recommended to start with a capital amount suitable for your risk tolerance.

Step 3: Analyze and select stocks

Apply fundamental analysis to determine intrinsic value based on financial reports, P/E, P/B, ROE, ROA ratios, along with analysis of the impact of macroeconomic policies on the industry and companies.

Step 4: Use technical analysis to determine trading timing

Use popular technical indicators such as MACD, RSI, Bollinger Bands, Ichimoku to identify trends and appropriate buy/sell points.

Step 5: Monitor, manage risk, and optimize portfolio

Set stop-loss levels, diversify stocks in your portfolio to limit risk and increase profitability.

Fundamental Analysis – The Key to Finding Valuable Stocks

Fundamental analysis is an indispensable method for serious investors. In Vietnam, many enterprises are valued lower than in developed markets, creating attractive investment opportunities.

You should:

- Analyze the most recent quarterly financial report and compare with the same period last year.

- Evaluate P/E, P/B, ROE, ROA ratios compared to the industry and competitors.

- Research the 3-5 year business plan.

- Monitor leadership quality and changes in shareholder structure.

- Assess the impact of macroeconomic policies on businesses and industries.

Technical Analysis and Indicators in Stock Trading

Technical analysis helps you choose the precise buy and sell timing based on price trends and indicator signals. Some effective indicators widely used by traders:

- MACD (12,26,9)

- RSI (14)

- Bollinger Bands (20,2)

- Ichimoku (9,26,52)

Additionally, you can use multi-timeframe charts and volume analysis to improve accuracy.

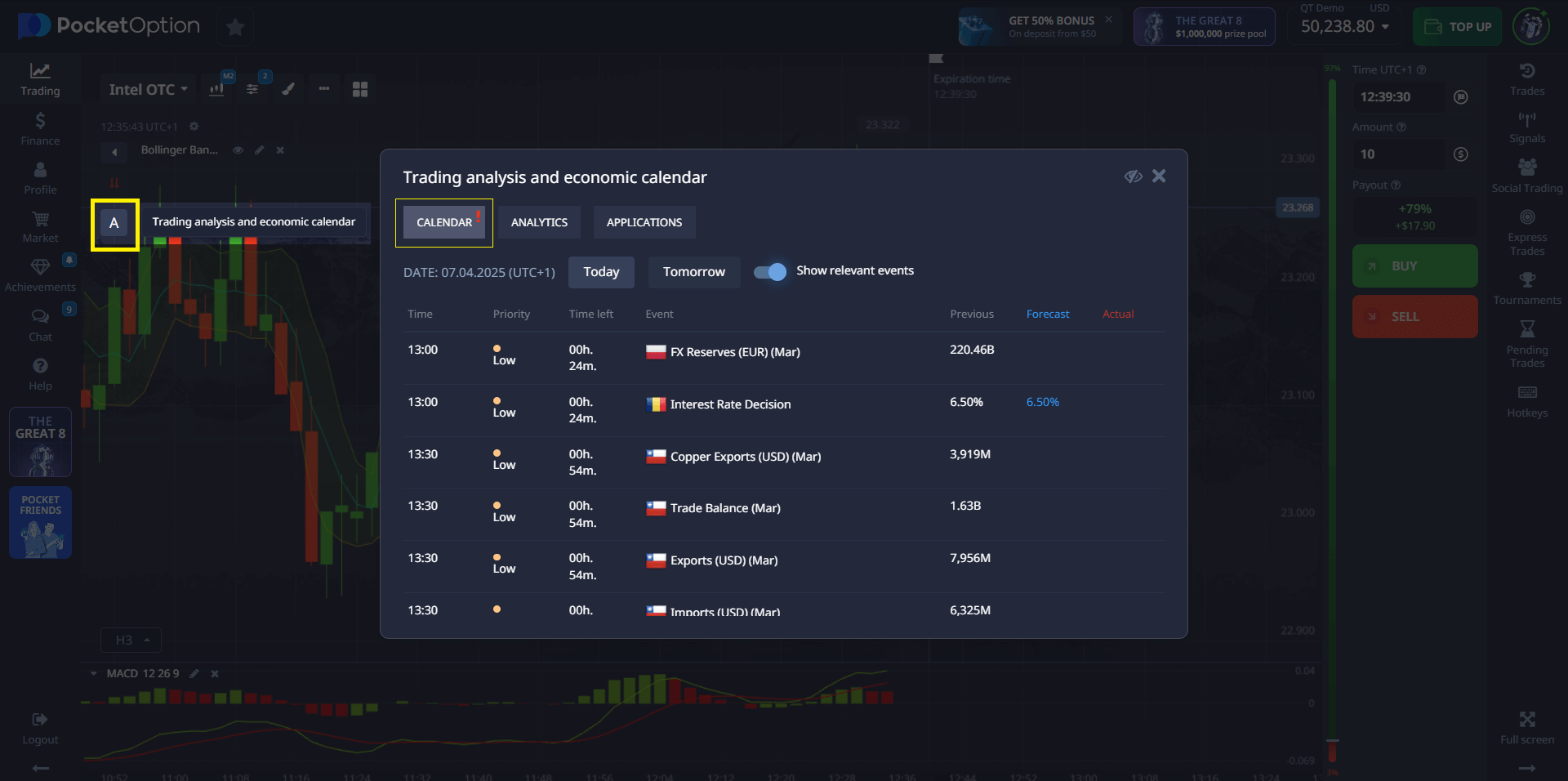

Switch to Quick Trading with Pocket Option

After mastering basic knowledge and techniques, you can try stock trading on the Pocket Option platform — a big difference compared to traditional investing.

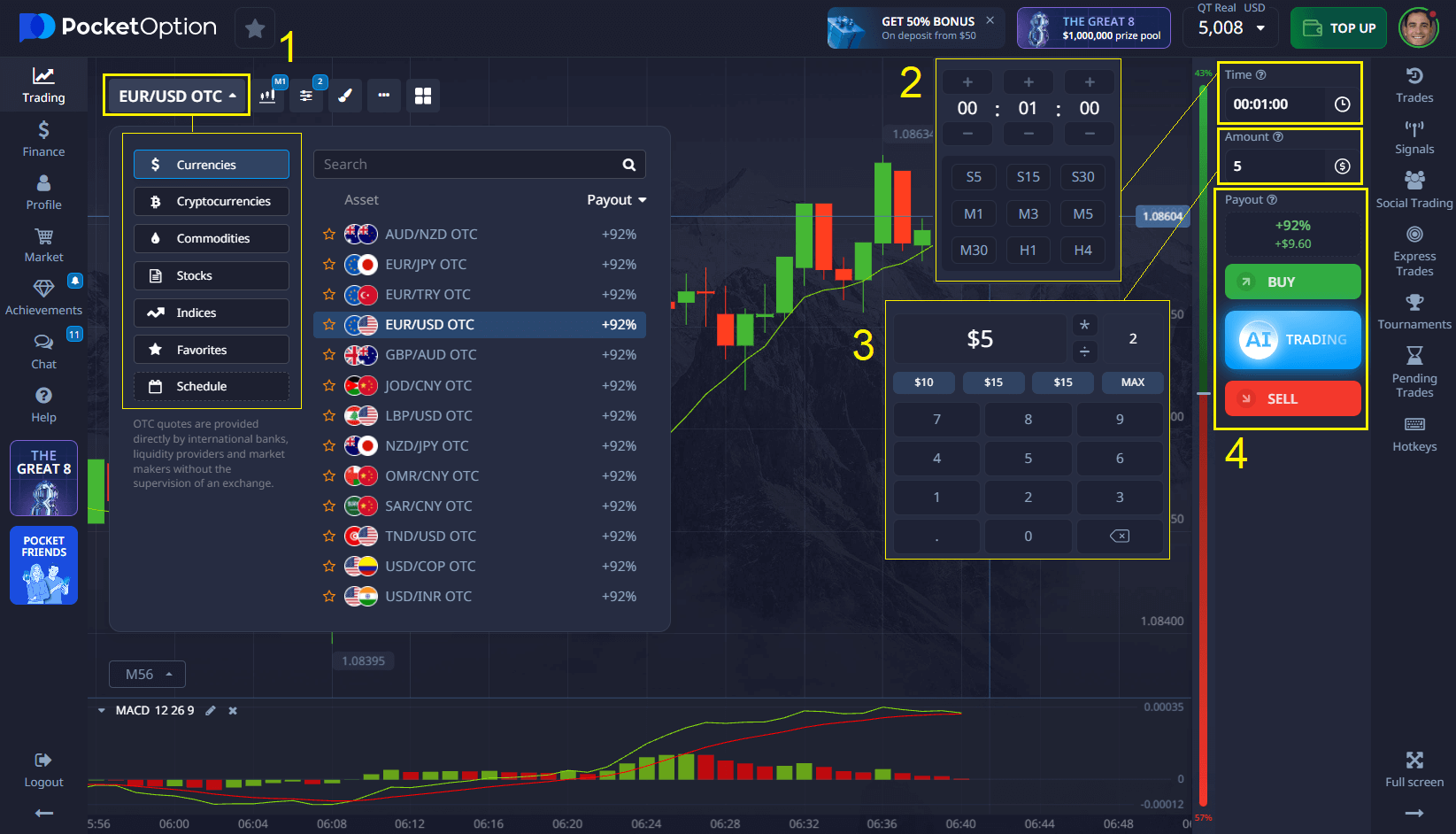

How does Pocket Option work?

- You do not need to buy or sell real stocks but only predict whether the asset price will go up or down within a fixed period.

- If the prediction is correct, you receive profits up to 92% of the amount wagered.

- The platform operates on browsers, no software download required.

- Open a real account from just $5 to start trading.

How to trade stocks on mobile with the Pocket Option app?

- Register an account on the Pocket Option homepage or via the official blog.

- Download the Pocket Option app to your phone from the homepage or the app store linked on the blog.

- Log in to the app with your registered account.

- Trade on a free demo account with a virtual balance of 50,000 USD to practice and get familiar with the platform.

- Open a real account with a minimum deposit starting from $5 (depending on your chosen payment method).

- Start trading stocks and other assets right on your phone, with full analysis tools and easy BUY/SELL order operation.

Example of opening a stock trade on Pocket Option:

- Choose your favorite stock asset (e.g., Tesla, Apple, Google).

- Analyze charts using built-in technical tools or trader sentiment indicators to evaluate trends.

- Select minimum trade amount $1.

- Choose trading time from 5 seconds (for OTC assets).

- Predict price direction: press BUY if price will rise, press SELL if price will fall.

- If prediction is correct, receive profits up to 92%.

Additionally, with a real account from $5, you can use special features:

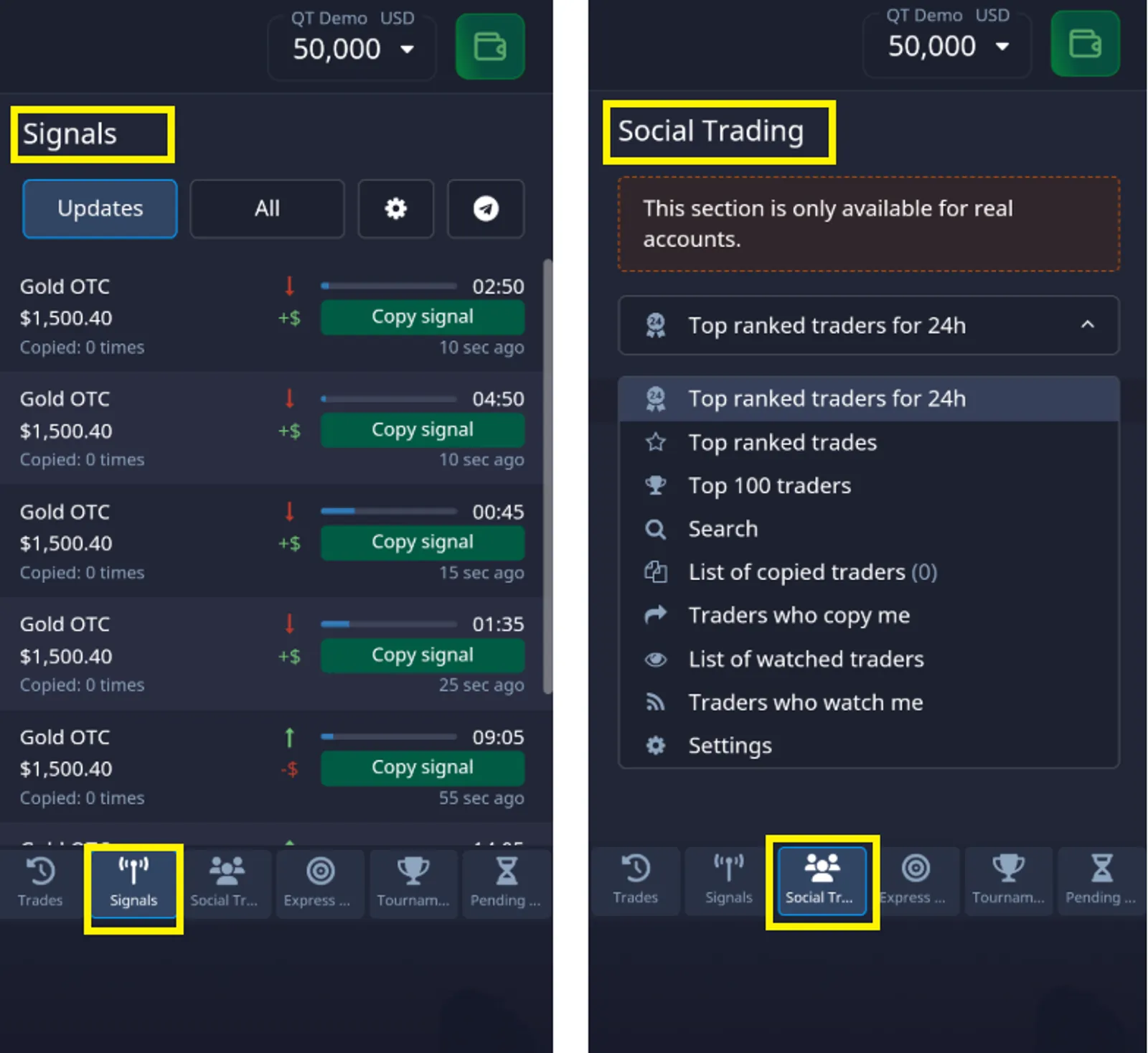

- Copy Trading — copy strategies from professional traders.

- Cashback — receive money back from trades.

- Participate in tournaments and attractive promotions.

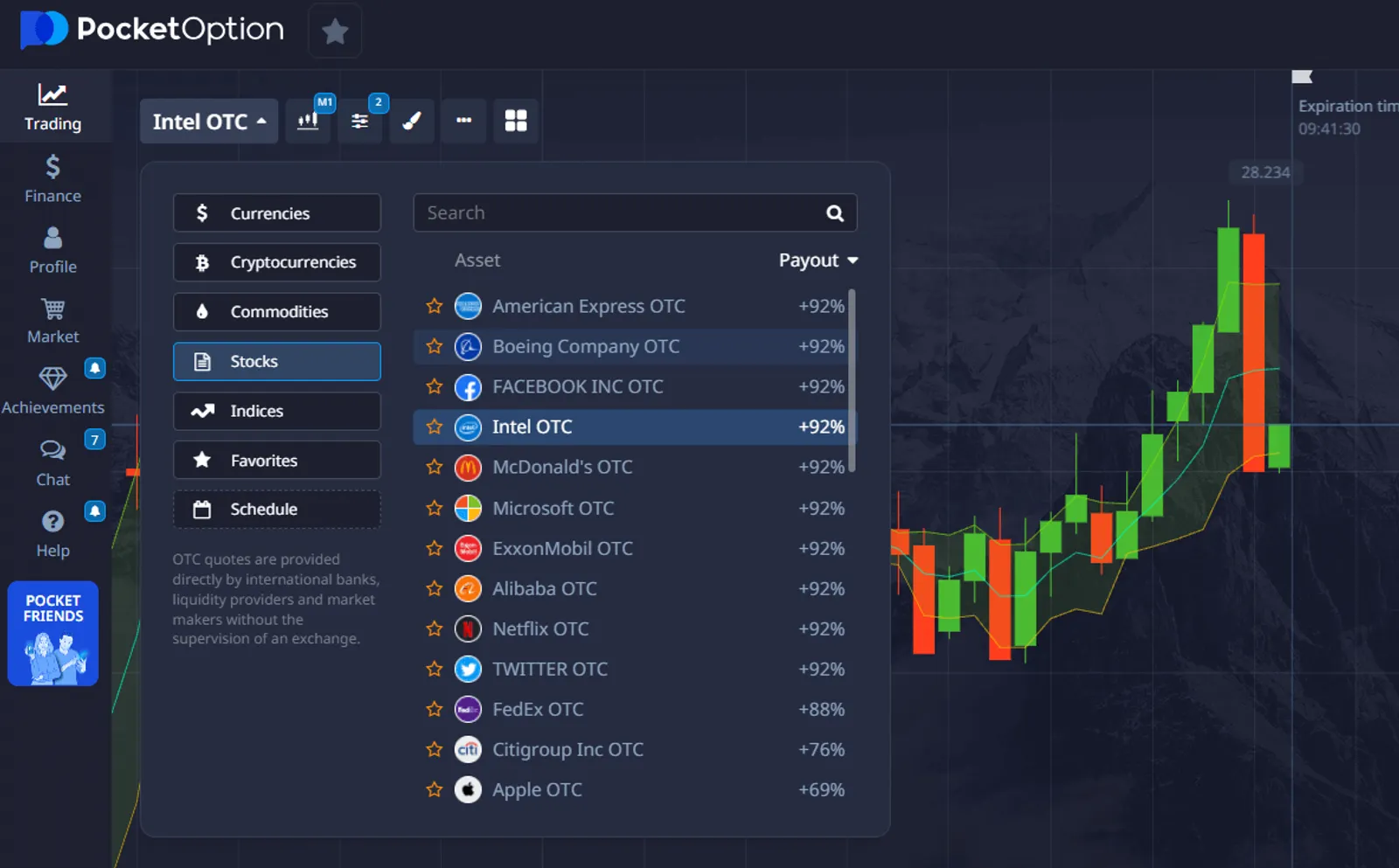

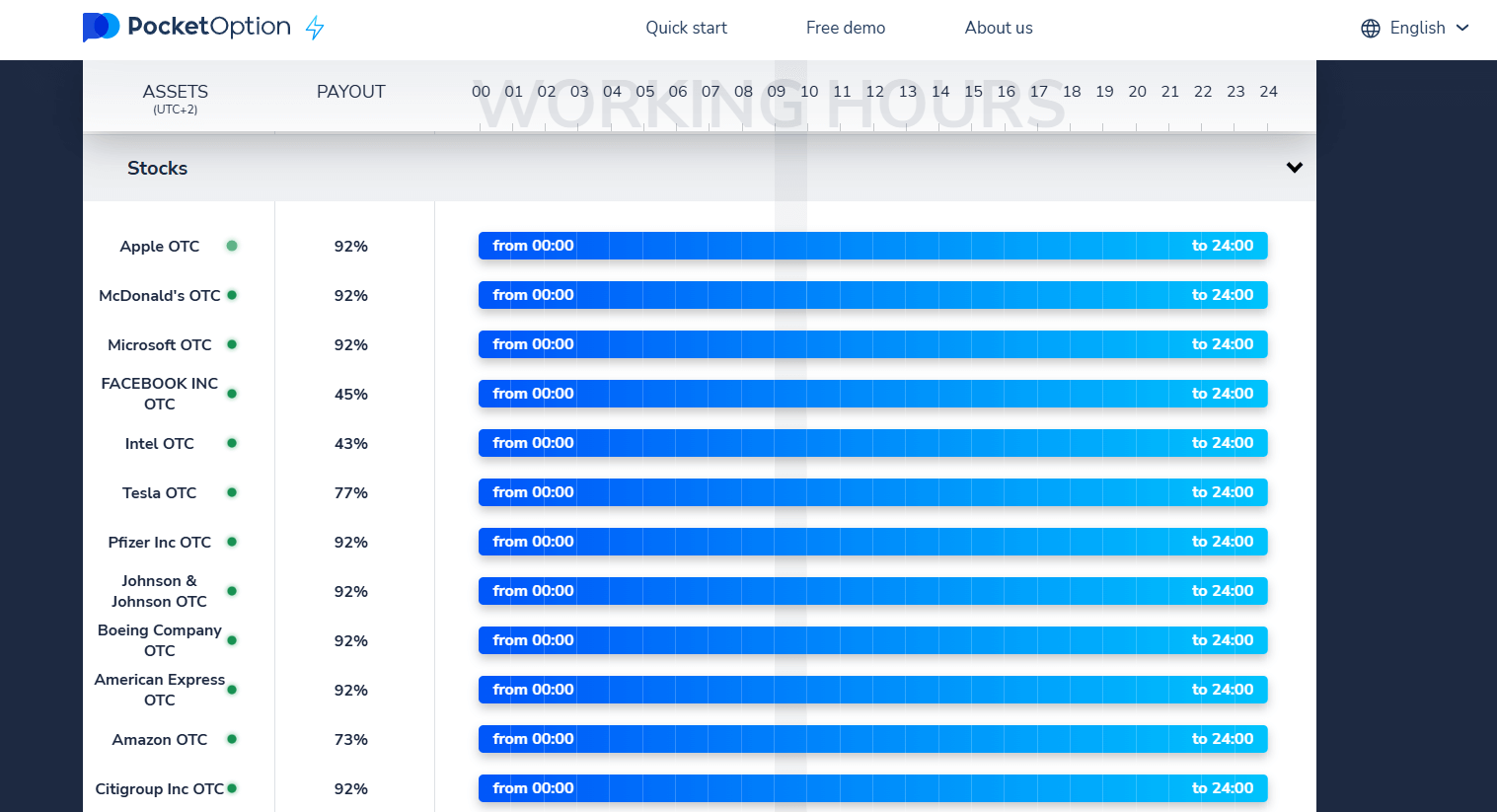

Types of Stocks and Assets Traded on Pocket Option

- Pocket Option offers many top international stocks such as: Tesla, Apple, Amazon, Google, Facebook, and many other bluechips.

- There are also other assets such as Forex, cryptocurrencies, commodities, and market indices.

- You can check the latest and full asset list on the Pocket Option homepage.

Pocket Option App — Trade Anytime, Anywhere

- The Pocket Option mobile app allows you to trade quickly, with full functionality as on desktop.

- Monitor charts, use analysis tools, and place BUY/SELL orders with just a few actions.

- Convenient trading anywhere: on the train, at a café, or even while resting.

- “I open trades while boiling water, it only takes 30 seconds” — a user shared.

- “Just swipe, predict, and done” — another trader commented.

Risks When Investing in Stocks and How to Minimize Them

Although there are great opportunities, the stock market also hides many risks such as:

- Strong price volatility

- Lack of transparent information

- Fluctuating investment psychology causing mistakes

To limit risks and avoid bankruptcy from stock trading, you should:

- Diversify your investment portfolio

- Set clear stop-loss levels

- Do not invest more money than you can afford to lose

- Always learn and update new knowledge

Final Thoughts

The Vietnam stock market is opening many great opportunities for investors. By mastering knowledge of fundamental and technical analysis, along with utilizing modern platforms like Pocket Option, you can completely optimize profits and minimize risks. Start your smart investment journey today!

FAQ

How much capital is needed to start investing in stocks in Vietnam?

To effectively start investing in stocks in Vietnam, you should have a minimum of 10-20 million VND. However, Pocket Option allows you to start with just 5 million VND and also offers a 100% bonus on your first deposit. With 50-100 million VND, you can already build a diverse investment portfolio with 5-7 stocks from different sectors, helping to effectively spread risk.

Which sectors have the best growth potential in Vietnam?

In 2025, the sectors with the strongest growth potential in Vietnam include: technology retail (MWG, FRT), banking (TCB, MBB, ACB), industrial real estate (KBC, SZC, NTC), renewable energy (PC1, REE, BCG) and logistics (GMD, VSC, STG). In particular, the retail sector is benefiting from the rapidly growing middle class, while industrial real estate benefits from the wave of manufacturing shifting to Vietnam.

How to recognize early signs of market trends in Vietnam?

To recognize early signs of Vietnam market trends, monitor three key factors: (1) Foreign investor activity - continuous net buying/selling for 10-15 sessions usually signals a new trend; (2) VN30 group movements - which precede the general market by 2-3 weeks; (3) Market liquidity changes - sudden 50% increase/decrease compared to the average of the last 20 sessions. Pocket Option provides a "Market Trend Indicator" tool that automatically analyzes 15 factors to forecast trends with accuracy up to 75%.

Should dividends or price appreciation be prioritized when investing in Vietnam?

Whether to prioritize dividends or price appreciation depends on your investment goals. For the Vietnamese market, balancing both factors usually yields the best results. Stocks in electricity, water, telecommunications sectors like POW, PC1, REE, TLH have stable dividend yields of 6-8%/year, suitable for passive income. Meanwhile, banking, technology, retail sectors like TCB, FPT, MWG have higher price appreciation rates. The optimal strategy is to allocate 40% of your portfolio to high-dividend stocks and 60% to growth stocks, adjusting the ratio according to your age and personal financial goals.

How to evaluate the performance of your stock investment portfolio?

To evaluate your stock investment performance, you should use the following metrics: (1) Risk-adjusted return (Sharpe Ratio) - ideally above 1.0; (2) Alpha - showing excess returns compared to the market; (3) Win/Loss ratio and Reward/Risk (R/R) ratio - should maintain a minimum R/R of 2:1; (4) Maximum drawdown - should not exceed 20% of investment capital. Pocket Option provides automatic performance reports by month/quarter/year, comparing with the VN-Index and sample portfolios, helping you objectively evaluate your investment results and adjust strategies in a timely manner.